Navigating the complexities of student loan repayment can be daunting, and the allure of consolidation offers often seems too good to be true. Unfortunately, this allure frequently masks predatory schemes designed to exploit vulnerable borrowers. Understanding the tactics employed by fraudulent consolidation companies is crucial to protecting your financial future and avoiding the devastating consequences of falling victim to these scams. This guide will equip you with the knowledge and tools necessary to make informed decisions and safeguard your finances.

Student loan consolidation fraud encompasses a range of deceptive practices, from companies promising unrealistically low interest rates to those demanding upfront fees for services they never deliver. These schemes often target individuals struggling with their loan payments, preying on their desperation for relief. The financial and emotional toll of such fraud can be significant, leading to damaged credit scores, increased debt, and profound feelings of stress and anxiety. By understanding the red flags and employing effective protective measures, borrowers can significantly reduce their risk of becoming victims.

Defining Student Loan Consolidation Fraud

Student loan consolidation, while offering the potential for simplified repayment, unfortunately presents opportunities for fraudulent schemes. These schemes prey on borrowers facing financial hardship or overwhelmed by the complexity of managing multiple loans. Understanding the various tactics employed by fraudsters is crucial for protecting yourself from becoming a victim.

Types of Student Loan Consolidation Fraud Schemes

Several fraudulent schemes exist within the student loan consolidation landscape. These schemes often involve deceptive marketing, inflated fees, and the promise of unrealistic benefits. One common type involves companies falsely claiming affiliation with the government or legitimate lenders. Another involves charging exorbitant upfront fees for services that are either unnecessary or already available for free through the government. Finally, some schemes involve identity theft, where fraudsters use borrowers’ information to consolidate loans without their knowledge or consent.

Tactics Used by Fraudsters

Fraudsters employ various tactics to lure unsuspecting borrowers. High-pressure sales tactics, promising quick solutions to debt problems, and misleading advertising are frequently used. They may target borrowers through unsolicited phone calls, emails, or even social media advertisements. These communications often contain exaggerated claims about interest rate reductions and simplified repayment plans that are too good to be true. The urgency created by these tactics can prevent borrowers from thoroughly researching the company and its services before committing.

Examples of Fraudulent Consolidation Companies and Their Deceptive Practices

While naming specific companies is difficult due to the constantly evolving nature of these schemes and legal ramifications, it’s important to understand the common deceptive practices. Fraudulent companies may use fake testimonials, fabricated success stories, and misleading website content to create a false sense of legitimacy. They might also obscure crucial details about fees, interest rates, and the terms of the consolidation agreement within complex legal jargon. These companies often operate outside of regulatory oversight, making it challenging for borrowers to seek redress if they become victims of fraud.

Comparison of Legitimate and Fraudulent Consolidation Options

| Feature | Legitimate Consolidation | Fraudulent Consolidation |

|---|---|---|

| Fees | Minimal or no upfront fees; transparent fee structure. | High upfront fees; hidden fees; unclear fee structure. |

| Interest Rates | May offer a weighted average interest rate based on existing loans; clearly stated interest rate. | Promises unrealistically low interest rates; interest rates significantly higher than advertised. |

| Government Affiliation | May be offered through the federal government (Direct Consolidation Loan) or a reputable lender; clear disclosure of affiliation. | Falsely claims affiliation with the government or reputable lenders; lacks transparency about affiliation. |

| Transparency | Provides clear and concise information about the terms and conditions; readily available contact information. | Uses confusing jargon; avoids clear communication; difficult to contact. |

Identifying Red Flags and Warning Signs

Student loan consolidation can offer significant benefits, such as simplifying repayment and potentially lowering interest rates. However, the process also attracts fraudulent schemes designed to exploit borrowers facing financial hardship. Recognizing the warning signs of a student loan consolidation scam is crucial to protecting your financial well-being. Understanding these red flags can help you avoid becoming a victim.

It’s vital to remember that legitimate consolidation companies operate transparently and will never pressure you into making hasty decisions. They will provide clear and concise information about their services, fees, and the terms of your new loan. Conversely, fraudulent schemes often rely on deceptive tactics to lure in unsuspecting borrowers.

Verifying the Legitimacy of Consolidation Companies

Before engaging with any student loan consolidation company, thorough verification is paramount. This involves checking the company’s registration with relevant authorities and reviewing online reviews and complaints. Legitimate companies will readily provide this information and will not hesitate to answer your questions. Conversely, scams often involve unregistered entities operating under false pretenses. You can cross-reference company information with the Federal Trade Commission (FTC) website and your state’s attorney general’s office to confirm legitimacy. Checking the Better Business Bureau (BBB) website for complaints and ratings can also provide valuable insight.

A Checklist of Questions Borrowers Should Ask

Prospective borrowers should approach student loan consolidation with a critical eye. Asking the right questions before signing any agreements can help prevent fraud. This proactive approach ensures that you understand the terms and conditions fully before committing to a consolidation plan.

- What are the fees associated with your services, and how are they calculated?

- What is the interest rate on the consolidated loan, and how is it determined?

- What is the repayment term, and what are the monthly payment amounts?

- What is your company’s registration status with relevant authorities?

- Can you provide references from previous clients?

- What happens if I miss a payment?

- Is there a prepayment penalty?

- What is your company’s complaint resolution process?

Common Red Flags in Student Loan Consolidation Scams

Several warning signs consistently appear in fraudulent student loan consolidation schemes. Being aware of these red flags can significantly reduce your risk of becoming a victim. These indicators often involve high-pressure tactics, unrealistic promises, and a lack of transparency.

- High-pressure sales tactics: Companies that aggressively push you to consolidate your loans without allowing time for careful consideration are highly suspicious.

- Guaranteed loan approval: No legitimate lender can guarantee loan approval. All lenders assess creditworthiness.

- Upfront fees: Legitimate consolidation companies rarely charge upfront fees. Beware of companies demanding payment before services are rendered.

- Unrealistic promises: Promises of drastically reduced interest rates or immediate debt forgiveness should be treated with extreme skepticism.

- Lack of transparency: A lack of clear information about fees, interest rates, and repayment terms is a major red flag.

- Requests for personal information before verification: Never provide sensitive personal information to a company before verifying its legitimacy.

- Poor communication: Difficulty contacting the company or receiving unclear responses to your questions is a significant warning sign.

- Websites with poor design or unprofessional appearance: Legitimate companies invest in professional-looking websites.

The Role of Government Agencies and Regulatory Bodies

Government agencies play a crucial role in safeguarding student loan borrowers from consolidation fraud. Their involvement encompasses preventative measures, investigative actions, and the prosecution of perpetrators. These agencies utilize various legal tools and resources to protect consumers and maintain the integrity of the student loan system.

Federal agencies like the Federal Trade Commission (FTC), the Consumer Financial Protection Bureau (CFPB), and the Department of Education (ED) are primarily responsible for overseeing the student loan industry and addressing fraudulent activities. These agencies collaborate to investigate complaints, enforce regulations, and educate borrowers about potential risks. Their combined efforts are essential in combating this type of financial crime.

Federal Agency Responsibilities in Combating Student Loan Consolidation Fraud

The FTC investigates deceptive practices related to student loan consolidation, including false advertising and misrepresentation of services. The CFPB focuses on ensuring fair lending practices and protecting borrowers from abusive or predatory lending behaviors within the consolidation process. The Department of Education’s role involves overseeing the federal student loan programs and taking action against institutions or individuals who violate program rules or engage in fraudulent activities. These agencies utilize a range of tools, including investigations, civil penalties, and referrals for criminal prosecution.

Legal Repercussions for Individuals and Companies Involved in Fraudulent Schemes

Individuals and companies found guilty of student loan consolidation fraud face severe legal consequences. These can include hefty civil penalties imposed by regulatory agencies, such as the FTC or CFPB. Additionally, criminal charges, including wire fraud, mail fraud, or conspiracy to commit fraud, can result in significant prison sentences and substantial fines. The severity of the penalties depends on the scale and nature of the fraudulent activities, as well as the extent of harm caused to borrowers. For example, a large-scale operation involving multiple victims might lead to more substantial penalties compared to a smaller, isolated incident.

Reporting Suspected Student Loan Consolidation Fraud

Borrowers who suspect they have been victims of student loan consolidation fraud should immediately report the incident to the appropriate agencies. The FTC offers an online complaint form for reporting fraudulent activities. The CFPB also provides multiple channels for reporting complaints, including a website and a toll-free hotline. Furthermore, borrowers can report suspected fraud directly to their loan servicer or to the Department of Education. Providing detailed information, including documentation such as contracts, communication records, and financial statements, is crucial in facilitating a thorough investigation.

Examples of Successful Prosecutions of Student Loan Consolidation Fraud Cases

Several high-profile cases demonstrate the effectiveness of government agencies in prosecuting student loan consolidation fraud. For instance, in [Year], the FTC successfully prosecuted [Company Name], a company that falsely advertised its student loan consolidation services, resulting in [Outcome, e.g., significant fines and restitution to victims]. Another example involves [Individual Name], who was convicted of [Crime] related to student loan consolidation fraud and sentenced to [Sentence]. These cases highlight the commitment of government agencies to holding perpetrators accountable and protecting borrowers from financial harm. Publicly available court documents and press releases from the involved agencies often detail these successful prosecutions.

Protecting Yourself from Student Loan Consolidation Fraud

Protecting yourself from student loan consolidation fraud requires vigilance and a proactive approach. Understanding how these schemes operate and employing effective strategies to verify offers are crucial steps in safeguarding your financial well-being. This section Artikels practical methods to ensure you are making safe and informed decisions regarding your student loan consolidation.

Verifying the Legitimacy of Loan Consolidation Offers

Before engaging with any loan consolidation offer, thoroughly investigate the entity making the offer. Check if the company is licensed and registered with relevant state and federal authorities. You can verify this information through official government websites and online databases dedicated to financial institutions. Look for evidence of positive customer reviews and testimonials from reliable sources. Be wary of unsolicited offers promising unrealistically low interest rates or quick approvals, as these can be indicative of fraudulent activities. Always independently confirm any information provided by the company through official channels. For example, contact your current loan servicer directly to verify the legitimacy of any consolidation offer before proceeding.

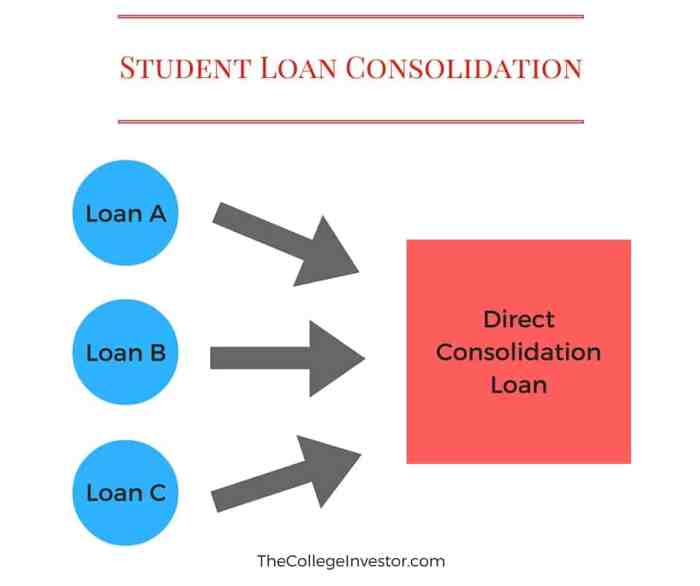

A Step-by-Step Guide to Safely Consolidating Student Loans

Consolidating your student loans should be a carefully considered process. First, gather all your student loan information, including loan balances, interest rates, and servicers. Next, research and compare different loan consolidation programs offered by reputable lenders, including the federal government’s Direct Consolidation Loan program. Third, carefully review the terms and conditions of each program, paying close attention to interest rates, fees, and repayment terms. Fourth, only work with established and reputable lenders. Fifth, never provide sensitive personal information until you have verified the lender’s legitimacy. Finally, obtain all loan documents in writing and thoroughly review them before signing. This methodical approach minimizes the risk of falling prey to fraudulent schemes.

Identifying and Avoiding Phishing Scams Related to Loan Consolidation

Phishing scams often mimic legitimate communication from loan servicers or government agencies. Be cautious of unsolicited emails, text messages, or phone calls that request personal information, such as your Social Security number, bank account details, or student loan information. Legitimate institutions will rarely request such sensitive data through these channels. Always verify the sender’s identity by independently contacting the purported organization through official channels. Never click on links or open attachments from unknown or suspicious sources. Look for red flags such as poor grammar, generic greetings, and urgent requests for information. Remember, legitimate institutions will never pressure you to act quickly or make decisions without providing ample time for review.

The Importance of Regularly Reviewing Loan Documents and Statements

Regularly reviewing your student loan documents and statements is essential for detecting any unauthorized activity or discrepancies. This includes checking for unexpected changes in your loan balance, interest rate, or payment schedule. Any inconsistencies should be reported immediately to your loan servicer and the relevant authorities. Keeping accurate records of all your loan-related correspondence, including emails and payment confirmations, can be invaluable in the event of a dispute or fraud investigation. By actively monitoring your accounts and promptly addressing any irregularities, you can significantly reduce your risk of becoming a victim of student loan consolidation fraud.

The Impact of Student Loan Consolidation Fraud on Borrowers

Falling victim to student loan consolidation fraud carries devastating financial and emotional consequences for borrowers. The immediate impact can be severe, leading to significant debt increases and long-term damage to creditworthiness and financial stability. Understanding the scope of these consequences is crucial for both preventing fraud and supporting those who have already been affected.

The financial ramifications of fraudulent consolidation are multifaceted. Victims often find themselves saddled with higher interest rates, increased loan balances, and extended repayment periods compared to their original loan terms. This translates to paying significantly more over the life of the loan, diverting funds that could have been used for other essential needs like housing, healthcare, or saving for the future. The emotional toll is equally significant, causing stress, anxiety, and feelings of helplessness and betrayal. Many victims report experiencing significant sleep disturbances, relationship problems, and even depression as a result of their financial predicament.

Financial Consequences of Student Loan Consolidation Fraud

Fraudulent consolidation schemes often involve hidden fees, inflated interest rates, and the addition of unnecessary insurance or other products, all of which increase the overall cost of the loan. Borrowers may also unknowingly agree to terms that drastically extend their repayment period, leading to substantially higher total interest payments. For example, a borrower who consolidates a $50,000 loan at a 7% interest rate into a new loan with a 12% interest rate and a longer repayment term could end up paying tens of thousands of dollars more over the life of the loan. This unexpected financial burden can have a ripple effect, impacting the borrower’s ability to save, invest, and plan for the future. The financial instability can also lead to missed payments on other debts, further damaging their credit score and overall financial well-being.

Long-Term Effects on Credit Scores and Financial Stability

The impact of fraudulent consolidation extends far beyond the immediate financial consequences. Late or missed payments resulting from the increased debt burden can severely damage a borrower’s credit score, making it difficult to obtain future loans, rent an apartment, or even secure certain jobs. This negative impact on credit can persist for years, hindering their ability to achieve long-term financial stability and potentially impacting their ability to purchase a home or secure other financial opportunities. Furthermore, the emotional stress associated with managing overwhelming debt can lead to poor financial decision-making, exacerbating the problem and creating a vicious cycle of debt.

Comparison of Borrower Experiences

The experiences of borrowers who have fallen victim to student loan consolidation fraud vary, but a common thread is the sense of betrayal and vulnerability. Some victims may have been targeted through sophisticated phishing scams or predatory marketing tactics, while others may have been misled by seemingly legitimate companies. Regardless of the specific method, the consequences are often equally devastating. One borrower might experience a modest increase in their monthly payment, while another might face a doubling or tripling of their debt. The emotional impact is similarly varied, with some individuals experiencing mild anxiety while others struggle with severe depression and financial ruin. However, the shared experience of financial hardship and the sense of having been taken advantage of creates a sense of community and shared struggle among victims.

Examples of Financial Burden and Stress

Consider the case of Sarah, a recent college graduate who consolidated her student loans with a company promising lower interest rates. Instead, she was unknowingly enrolled in a loan with significantly higher interest rates and fees, leading to a substantial increase in her monthly payments. The added financial burden caused immense stress, forcing her to cut back on essential expenses and impacting her ability to save for a down payment on a house. Another example is John, who, due to the fraudulent consolidation, experienced multiple late payments, severely damaging his credit score. This resulted in him being denied a mortgage and facing challenges securing a new apartment. These are just two examples of the numerous real-life cases highlighting the significant financial burden and emotional distress faced by victims of student loan consolidation fraud.

Resources and Support for Victims

Falling victim to student loan consolidation fraud can be a devastating experience, leaving borrowers feeling lost and overwhelmed. Fortunately, several resources are available to help those who have been defrauded navigate the complex process of recovering from this financial crime. Understanding these resources and taking proactive steps is crucial for regaining control of your financial situation.

Reporting Student Loan Consolidation Fraud

Reporting the fraud is the first critical step. Victims should promptly contact the relevant authorities and their loan servicers. This involves filing a formal complaint with the Federal Trade Commission (FTC), the Consumer Financial Protection Bureau (CFPB), and potentially state attorneys general’s offices. Simultaneously, contacting the loan servicer to dispute any fraudulent activity on the account is equally important. Detailed documentation, including contracts, communication records, and financial statements, should be gathered and submitted as evidence. Failure to report the fraud promptly can hinder the investigation and recovery process.

Government Agencies and Non-Profit Organizations Offering Support

Several government agencies and non-profit organizations provide vital support to victims of student loan consolidation fraud. These organizations offer guidance on reporting fraud, navigating the legal process, and accessing financial assistance.

- Federal Trade Commission (FTC): The FTC is the primary federal agency responsible for investigating and addressing consumer fraud, including student loan scams. They offer resources, complaint filing mechanisms, and guidance on recovering losses.

- Consumer Financial Protection Bureau (CFPB): The CFPB focuses on protecting consumers in the financial marketplace. They can provide assistance with complaints related to student loans and predatory lending practices.

- State Attorneys General Offices: Each state has an attorney general’s office that can investigate consumer fraud within their jurisdiction. Contacting the state attorney general’s office is beneficial for local-level support and enforcement.

- National Consumer Law Center (NCLC): The NCLC is a non-profit organization that advocates for consumer rights and provides legal assistance and resources to low-income individuals.

- Student Loan Borrower Assistance (SLBA): Numerous non-profit organizations specialize in assisting student loan borrowers, providing advice, and advocacy. These organizations can provide crucial support in navigating complex loan issues.

Obtaining Legal Assistance and Financial Counseling

Seeking legal counsel and financial guidance is often necessary to fully recover from student loan consolidation fraud. An attorney specializing in consumer fraud or student loan law can advise on legal options, such as filing lawsuits against perpetrators, and guide the process of recovering financial losses. Financial counselors can provide assistance in developing a budget, managing debt, and exploring options for debt relief. Many non-profit credit counseling agencies offer free or low-cost financial counseling services. The National Foundation for Credit Counseling (NFCC) is a reputable organization that can connect individuals with certified credit counselors.

Illustrative Examples of Fraudulent Schemes

Understanding the mechanics of student loan consolidation fraud requires examining real-world examples. These cases highlight the diverse tactics employed by perpetrators and the devastating consequences for victims. The following examples are illustrative and should not be considered exhaustive of all possible schemes.

Advance Fee Fraud

This scheme typically involves a fraudulent company promising to consolidate student loans at significantly lower interest rates or with more favorable repayment terms. However, to initiate the “consolidation,” victims are required to pay an upfront fee—often a substantial sum—for services that are never delivered. The perpetrators, often operating through sophisticated websites and marketing materials, disappear after receiving the payment, leaving victims with their original loans and a significant financial loss. For example, imagine a company advertising “guaranteed” loan consolidation with a 5% interest rate reduction. They request a $1,500 processing fee upfront, promising to handle all the paperwork. Once the fee is paid, the company becomes unreachable, and the victim discovers no consolidation occurred, leaving them with the original loan and $1,500 less. The impact on the victim is twofold: the loss of the advance fee and the continued burden of their original high-interest student loans.

Fake Consolidation Companies

These fraudulent operations mimic legitimate student loan consolidation companies. They create websites and marketing materials that closely resemble those of reputable organizations, often using similar names or logos to deceive potential victims. They may even provide false documentation or claim to be affiliated with government agencies. Once victims provide their personal and financial information, the perpetrators use it for identity theft, opening fraudulent accounts or taking out loans in the victim’s name. One example might involve a company calling itself “National Student Loan Consolidation,” using a website and phone number that appear professional. They persuade victims to provide sensitive information, including social security numbers and bank details, under the guise of processing the consolidation. This information is then used to open fraudulent credit accounts or obtain loans, resulting in significant debt and damage to the victim’s credit score. The impact extends beyond financial loss; victims face the lengthy and stressful process of repairing their credit and clearing their names.

Debt Relief Scams Targeting Federal Loans

This type of fraud preys on borrowers struggling with federal student loans. The perpetrators promise to negotiate lower payments or even forgiveness of the debt, often falsely claiming special government programs or loopholes. They charge high fees for their “services,” but in reality, they offer little to no assistance. They may even actively prevent victims from accessing legitimate government programs or repayment options. A scenario might involve a company promising to eliminate a borrower’s federal student loan debt through a “secret” program. They charge a hefty monthly fee for their “services,” but the borrower’s loan balance remains unchanged. Meanwhile, the company’s actions delay or prevent the borrower from exploring legitimate options such as income-driven repayment plans. The impact is significant, involving financial losses from the fees paid, delayed repayment plan options, and potential damage to credit scores due to missed payments or collection efforts.

Concluding Remarks

Protecting yourself from student loan consolidation fraud requires vigilance and a proactive approach. By carefully vetting companies, understanding the warning signs, and utilizing available resources, you can navigate the consolidation process safely and securely. Remember, legitimate consolidation options exist, offering genuine pathways to manageable repayment plans. Don’t let the fear of debt overwhelm you; empower yourself with knowledge and take control of your financial future.

FAQ Summary

What are the legal consequences of committing student loan consolidation fraud?

Severe penalties, including hefty fines and imprisonment, await individuals and companies found guilty of student loan consolidation fraud. The specific consequences vary depending on the severity and nature of the fraudulent activities.

Can I consolidate my federal and private student loans together?

While some private lenders may offer consolidation options encompassing both federal and private loans, it’s generally advisable to consolidate federal loans through the government’s direct consolidation program and address private loans separately. This approach often provides better protection and more favorable terms.

How long does the student loan consolidation process typically take?

The timeframe for student loan consolidation varies depending on the lender and the complexity of the application. It can range from a few weeks to several months. Expect delays if additional documentation is required.

What should I do if I suspect I’ve been a victim of student loan consolidation fraud?

Immediately contact the relevant government agencies (such as the Federal Trade Commission or your state’s attorney general’s office) to report the suspected fraud. Gather all relevant documentation, including contracts, communications, and financial records. Seek legal counsel to explore your options for redress.