Navigating the complex world of student loan debt can feel overwhelming, but Reddit offers a wealth of firsthand experiences and advice. This guide delves into the vibrant discussions surrounding student loan consolidation on Reddit, examining the common themes, concerns, and strategies shared by users. We’ll explore the various consolidation options, their potential benefits and drawbacks, and the crucial factors to consider before making such a significant financial decision.

From federal and private loan consolidation programs to alternative debt management strategies, we’ll analyze the pros and cons based on real-world Reddit experiences. We’ll also address common pitfalls to avoid and offer insights into how consolidation can impact credit scores and overall financial health. This comprehensive overview aims to equip you with the knowledge needed to make informed choices about your student loan debt.

Specific Consolidation Programs Mentioned

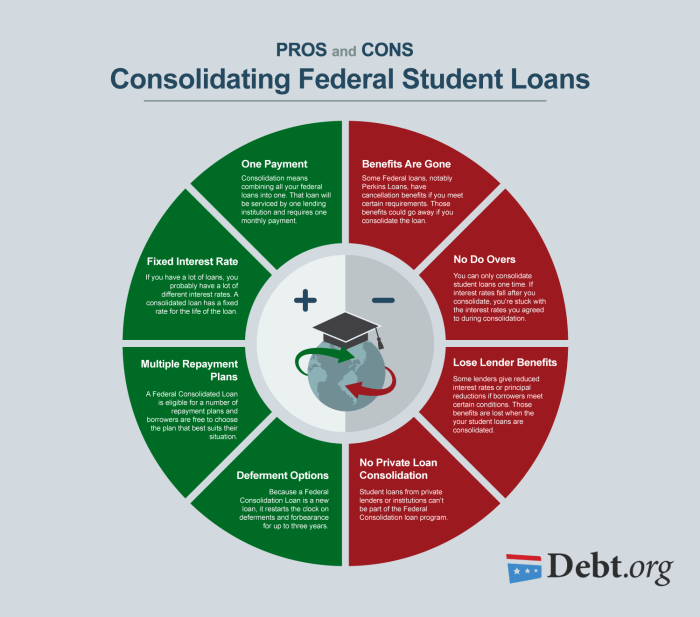

Student loan consolidation can significantly impact your repayment strategy, interest rates, and overall financial well-being. Understanding the nuances of different programs is crucial before making a decision. This section will delve into the commonly discussed federal and private consolidation programs, highlighting their advantages and disadvantages based on Reddit user experiences.

Federal Student Loan Consolidation

Federal student loan consolidation combines multiple federal student loans into a single, new loan. This simplifies repayment by reducing the number of monthly payments and potentially lowering your monthly payment amount. However, it’s important to carefully consider the long-term implications.

Reddit users frequently discuss the benefits of streamlined repayment and the convenience of dealing with a single servicer. For example, one user reported a significant reduction in their monthly payment after consolidating their federal loans, allowing them to allocate more funds towards other financial goals. Conversely, some users express concern about the potential for increased overall interest costs if the new loan’s interest rate is higher than the weighted average of their previous loans. Another user noted that while their monthly payment decreased, the overall loan term lengthened, leading to higher total interest paid over the life of the loan. This highlights the importance of comparing interest rates before consolidating.

Private Student Loan Consolidation

Private student loan consolidation programs, offered by various lenders, consolidate multiple private student loans into a single loan. Unlike federal consolidation, these programs often offer additional benefits such as balance transfers from credit cards or other high-interest debts. However, these programs typically come with stricter eligibility requirements and potentially higher interest rates compared to federal options.

Reddit discussions on private consolidation often focus on the potential for lower interest rates, but this is not always guaranteed. Some users report successful experiences with lower interest rates and more manageable monthly payments. One user described successfully consolidating high-interest private loans with a lender offering a lower interest rate and a longer repayment term, providing them with much-needed financial breathing room. Conversely, other users have shared negative experiences with hidden fees, inflexible repayment terms, and difficulties navigating the application process. One user highlighted a situation where the promised lower interest rate was not reflected in their final loan agreement, leading to significant disappointment.

Impact on Credit Score and Financial Health

Consolidating student loans is a significant financial decision, and Reddit discussions reveal a range of experiences regarding its impact on credit scores and overall financial well-being. While the potential benefits are attractive, understanding the nuances is crucial before proceeding. The perceived effects vary greatly depending on individual circumstances and the chosen consolidation method.

The impact on credit scores is a frequently debated topic. Many Reddit users report a temporary dip in their credit score immediately following consolidation, primarily due to the opening of a new loan account and the associated hard inquiry. However, this drop is usually temporary and often followed by a gradual improvement, especially if the borrower maintains responsible repayment habits. The long-term effect largely depends on the individual’s credit history and how the consolidation plan affects their credit utilization ratio. A lower credit utilization ratio (the percentage of available credit used) generally results in a higher credit score. Conversely, those who already had poor credit management may not see immediate or significant improvements.

Credit Score Changes After Consolidation

The change in credit score after consolidation is not uniform. Some Reddit users report a slight decrease initially, followed by a slow climb as they consistently make on-time payments on their consolidated loan. Others, particularly those with already excellent credit, experience minimal change or even a slight increase due to the simplification of their credit profile. A common thread is the importance of maintaining a good payment history throughout the consolidation process. For instance, one user described having a score of 720 before consolidation and experiencing a temporary drop to 700, but seeing it climb back up to 740 within a year due to consistent on-time payments on the consolidated loan. Another user with a lower initial score reported a more gradual increase after consolidation, highlighting the importance of responsible financial behavior.

Impact on Overall Financial Health

Reddit discussions frequently highlight the positive impact of student loan consolidation on overall financial health. Many users cite improved budgeting and reduced stress as major benefits. The simplification of having a single monthly payment, rather than multiple payments to different lenders, contributes significantly to this improved financial well-being. This ease of management allows for better tracking of expenses and facilitates better financial planning. For example, a user described struggling to manage multiple loans with varying interest rates and due dates before consolidation. After consolidation, they were able to create a more manageable budget, leading to increased savings and reduced financial anxiety. Another user mentioned that consolidation allowed them to free up cash flow, enabling them to invest in other areas, such as retirement savings or paying down other debts. However, it’s important to remember that consolidation alone doesn’t solve underlying financial problems. Effective budgeting and responsible spending habits are crucial for long-term financial success.

Alternatives to Consolidation

Student loan consolidation isn’t the only path to managing your debt. Many Reddit users discuss alternative strategies offering potentially better outcomes depending on individual circumstances. Understanding these options and their nuances is crucial before making any decisions. This section explores popular alternatives, comparing their advantages and disadvantages to help you determine the best approach for your unique financial situation.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a private lender, typically at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. However, refinancing often means losing access to federal loan benefits like income-driven repayment plans or loan forgiveness programs.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. Several federal IDR plans exist, each with different eligibility requirements and payment calculation methods. While these plans result in lower monthly payments, you may end up paying more in interest over the long term, and the remaining balance might be forgiven after 20 or 25 years, depending on the plan. Forgiveness is taxable income, however.

Student Loan Forgiveness Programs

Certain professions, such as teaching or working in public service, may qualify for loan forgiveness programs. These programs typically require a set number of years of service in a qualifying role before a portion or all of your loans are forgiven. Eligibility criteria and forgiveness amounts vary significantly depending on the specific program. It is crucial to carefully research specific programs to determine eligibility and understand the requirements.

| Alternative | Description | Advantages | Disadvantages |

|---|---|---|---|

| Refinancing | Replacing existing student loans with a new private loan, usually at a lower interest rate. | Lower monthly payments, reduced total interest paid, potentially shorter repayment period. | Loss of federal loan benefits (IDR plans, forgiveness programs), potential for higher interest rates if credit score is poor, risk of predatory lending. |

| Income-Driven Repayment (IDR) Plans | Federal plans adjusting monthly payments based on income and family size. | Lower monthly payments, affordability for low-income borrowers. | Higher total interest paid over the life of the loan, potential for loan forgiveness that is taxable income, complex application process. |

| Student Loan Forgiveness Programs | Programs forgiving loans for those working in specific public service professions. | Potential for complete or partial loan forgiveness. | Strict eligibility requirements, long commitment periods (e.g., 10 years of service), limited availability, forgiveness is taxable income. |

Illustrative Examples from Reddit Threads

Reddit offers a wealth of anecdotal evidence regarding student loan consolidation, showcasing both successful and unsuccessful experiences. Analyzing these accounts provides valuable insights into the factors influencing the outcome of consolidation efforts. While individual circumstances vary significantly, common themes emerge, highlighting the importance of careful planning and understanding of personal financial situations.

Successful Consolidation Scenario

One Reddit user, let’s call him “FinanciallyFree,” described a situation where consolidation dramatically improved their financial well-being. FinanciallyFree initially had multiple federal student loans with varying interest rates, ranging from 4% to 7%. Managing these loans individually was proving challenging, leading to missed payments and accumulating late fees. By consolidating their loans into a Direct Consolidation Loan, they secured a fixed, lower interest rate of 5.5%. This simplification reduced their monthly payment and provided a clearer path to repayment. The fixed interest rate eliminated the uncertainty associated with fluctuating rates, and the reduced monthly payment allowed them to allocate more funds towards other financial goals, like saving for a down payment on a house. The improved payment management also helped to boost their credit score, opening doors to better financial opportunities.

Unsuccessful Consolidation Scenario

Conversely, another Reddit user, “DebtDrowning,” shared a negative experience with consolidation. DebtDrowning consolidated their private student loans, believing they were securing a lower interest rate. However, the new loan came with a significantly longer repayment term and hidden fees. While the monthly payment appeared lower initially, the extended repayment period resulted in a much higher total interest paid over the life of the loan. Furthermore, the hidden fees and additional charges quickly eroded any initial savings. This led to a longer period of debt and a feeling of being further behind financially, despite the initial perceived benefit of a lower monthly payment. DebtDrowning’s credit score also suffered due to the increased debt burden and the extended repayment timeline.

Key Differences and Contributing Factors

The key difference between FinanciallyFree’s and DebtDrowning’s experiences lies in their understanding of the terms and conditions of their consolidation loans. FinanciallyFree meticulously researched their options, carefully comparing interest rates, fees, and repayment terms before choosing a federal consolidation loan that aligned with their financial goals. DebtDrowning, on the other hand, rushed into consolidation without fully understanding the implications of the extended repayment period and hidden fees associated with their private loan. The type of loan consolidated (federal vs. private) also played a crucial role. Federal consolidation loans generally offer more borrower protections and simpler terms, while private loans can be more complex and potentially less favorable. Ultimately, thorough research, understanding of loan terms, and a clear financial plan are essential for a successful student loan consolidation.

Final Summary

Ultimately, the decision to consolidate student loans is a deeply personal one, heavily dependent on individual circumstances and financial goals. While Reddit provides valuable perspectives and shared experiences, it’s crucial to conduct thorough research and, ideally, seek professional financial advice before proceeding. By understanding the potential benefits and risks, as well as the available alternatives, you can navigate the student loan consolidation process with greater confidence and clarity, making informed choices that align with your long-term financial well-being.

Essential Questionnaire

What is the general sentiment towards student loan consolidation on Reddit?

Reddit sentiment is mixed. While many find consolidation beneficial for simplification and potentially lower interest rates, others caution against potential drawbacks like extending repayment terms.

Can I consolidate private and federal student loans together?

Generally, no. Federal and private loans are typically consolidated separately. However, private loan refinancing options may consolidate multiple loans, including federal ones, into a single private loan.

How does consolidation affect my credit score?

The immediate impact is usually minimal. However, responsible repayment after consolidation can positively affect your credit score over time. Conversely, missed payments can negatively impact it.

What are some common mistakes people make when consolidating student loans?

Common mistakes include failing to compare interest rates and fees across different lenders, not understanding the terms of the new loan, and neglecting to factor in potential long-term costs.