Navigating the complexities of student loan repayment can be daunting, and the promise of consolidation often seems like a lifeline. However, lurking beneath the surface are predatory schemes designed to exploit vulnerable borrowers. Student loan consolidation scams prey on individuals struggling with debt, offering false hope of lower payments and manageable repayment plans. Understanding the tactics employed by these scammers is crucial to protecting yourself from financial ruin.

These scams often involve deceptive marketing, high-pressure sales tactics, and hidden fees that quickly escalate the borrower’s debt burden. The consequences of falling victim to such a scheme can be devastating, leading to significant financial hardship, damaged credit, and considerable emotional distress. This guide will equip you with the knowledge and tools to identify and avoid these fraudulent practices, ensuring a safe and responsible path towards debt management.

Understanding Student Loan Consolidation Scams

Student loan consolidation can seem like a lifeline for borrowers struggling with multiple loans, promising lower monthly payments and simplified repayment. However, this process also attracts scammers who prey on vulnerable individuals facing financial hardship. Understanding the tactics employed by these fraudulent schemes is crucial to protect yourself from becoming a victim.

Common Tactics Used in Student Loan Consolidation Scams

Scammers often employ deceptive marketing strategies to lure unsuspecting borrowers. These tactics frequently involve high-pressure sales techniques, promising unrealistically low interest rates or immediate debt relief. They may claim to be affiliated with the government or a legitimate lending institution, using official-sounding names and logos to build trust. Unsolicited phone calls, emails, and text messages are common channels used to reach potential victims. They often emphasize the urgency of the situation, creating a sense of panic to pressure borrowers into making quick decisions without proper research.

Types of Fraudulent Student Loan Consolidation Schemes

Several fraudulent schemes target student loan borrowers. One common type involves upfront fees. Scammers demand significant fees for services they never deliver, leaving borrowers with no consolidation and a loss of money. Another scheme involves falsified paperwork. Fraudsters create fake documents that appear legitimate, deceiving borrowers into believing they are enrolled in a genuine consolidation program. A third type involves identity theft. Scammers may obtain borrowers’ personal information to apply for fraudulent loans in their names, resulting in significant debt accumulation and damage to credit scores.

Examples of Deceptive Marketing Materials

Deceptive marketing materials often mimic official government communications or reputable lending institutions. For example, a scammer might send an email with a forged government seal, claiming to offer a special government-backed consolidation program with extremely low interest rates. Another example is a website designed to look like a legitimate lender’s site, but with subtly altered contact information or disclaimers hidden in fine print. These materials may also include testimonials from fake individuals, creating a false sense of security and credibility.

Comparison of Legitimate and Fraudulent Consolidation Options

| Company Name | Services Offered | Fees | Contact Information |

|---|---|---|---|

| Federal Student Aid (FSA) | Direct Consolidation Loan Program | None (for federal loans) | StudentAid.gov |

| Private Lender (e.g., Sallie Mae, Discover) | Private Loan Consolidation | Variable, depending on the lender and borrower’s creditworthiness | Contact the specific lender directly |

| Fraudulent Scheme | Promises of immediate debt relief, unrealistically low interest rates, or guaranteed approval | High upfront fees, often with no service rendered | Often uses fake contact information or spoofed numbers |

| Another Fraudulent Scheme | Claims of government affiliation or exclusive access to special programs | May involve hidden fees or ongoing payments | May use misleading website addresses or untraceable email addresses |

Identifying Red Flags of a Scam

Student loan consolidation can offer significant financial relief, but navigating the process requires caution. Understanding the hallmarks of legitimate programs and the warning signs of scams is crucial to protect yourself from fraud. This section Artikels key characteristics to look for and helps you identify potential red flags.

Legitimate student loan consolidation programs typically involve established lenders or government-backed programs. They provide transparent information about fees, interest rates, and repayment terms. The application process is usually straightforward and doesn’t require upfront payments or excessive personal information beyond what’s necessary for loan verification and credit checks.

Characteristics of Legitimate Student Loan Consolidation Programs

Legitimate programs operate with transparency and adhere to strict regulatory guidelines. They clearly Artikel all associated costs, including fees and interest rates. You should easily find contact information and be able to verify their legitimacy through official government websites or reputable financial institutions. The application process is typically handled through secure online portals or via mail, with no pressure to make immediate decisions.

Warning Signs Indicating a Potential Scam

Several warning signs can indicate a fraudulent student loan consolidation scheme. High-pressure sales tactics, promises of unrealistic interest rate reductions, requests for upfront fees, and vague or misleading information are all major red flags. Scammers often use aggressive marketing strategies to prey on borrowers facing financial distress.

How Scammers Pressure Victims into Quick Decisions

Scammers employ various tactics to pressure victims into making hasty decisions. They may create a sense of urgency by claiming limited-time offers or emphasizing immediate financial benefits. They might also use emotional appeals, playing on the borrowers’ financial anxieties to manipulate them into acting quickly without fully considering the implications. For example, a scammer might claim that unless the borrower acts immediately, their credit score will be severely damaged or they will lose the opportunity to consolidate their loans at a favorable rate. This pressure prevents borrowers from thoroughly researching the offer and seeking independent advice.

Flowchart for Evaluating Suspicious Offers

The following flowchart illustrates the steps to take when you encounter a suspicious student loan consolidation offer:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Suspicious Student Loan Consolidation Offer?”. A “yes” branch would lead to a series of boxes: “Is the lender/company reputable and verifiable?”, “Are fees and interest rates clearly stated?”, “Is there high-pressure sales tactics?”, “Do they request upfront payments?”. Each “yes” answer to the last three questions would lead to a final box labeled “Potentially a Scam – Seek Independent Advice.” A “no” answer to any of the questions would lead to a box labeled “Proceed with Caution – Verify independently before committing.” A “no” branch from the initial box would lead directly to a box labeled “Proceed with Due Diligence.” ]

The flowchart visually guides individuals through a decision-making process, encouraging them to carefully assess each aspect of a student loan consolidation offer before committing. It emphasizes the importance of independent verification and seeking advice from trusted sources.

The Impact of Student Loan Consolidation Scams

Falling victim to a student loan consolidation scam can have devastating and long-lasting consequences, extending far beyond the immediate financial losses. The impact encompasses significant financial hardship, profound emotional distress, and a stark contrast to the positive outcomes achievable through legitimate consolidation. Understanding these ramifications is crucial for preventing future victimization and mitigating the damage for those already affected.

The financial consequences of these scams are severe. Victims often face increased debt burdens due to inflated interest rates, hidden fees, and the accumulation of additional charges. They may lose their savings as scam operators drain their bank accounts under false pretenses. Credit scores plummet, making it incredibly difficult to secure loans, rent apartments, or even obtain employment in the future. The financial instability can lead to a cascade of problems, including difficulty paying essential bills, potential home foreclosure, and even bankruptcy.

Financial Ramifications of Student Loan Consolidation Scams

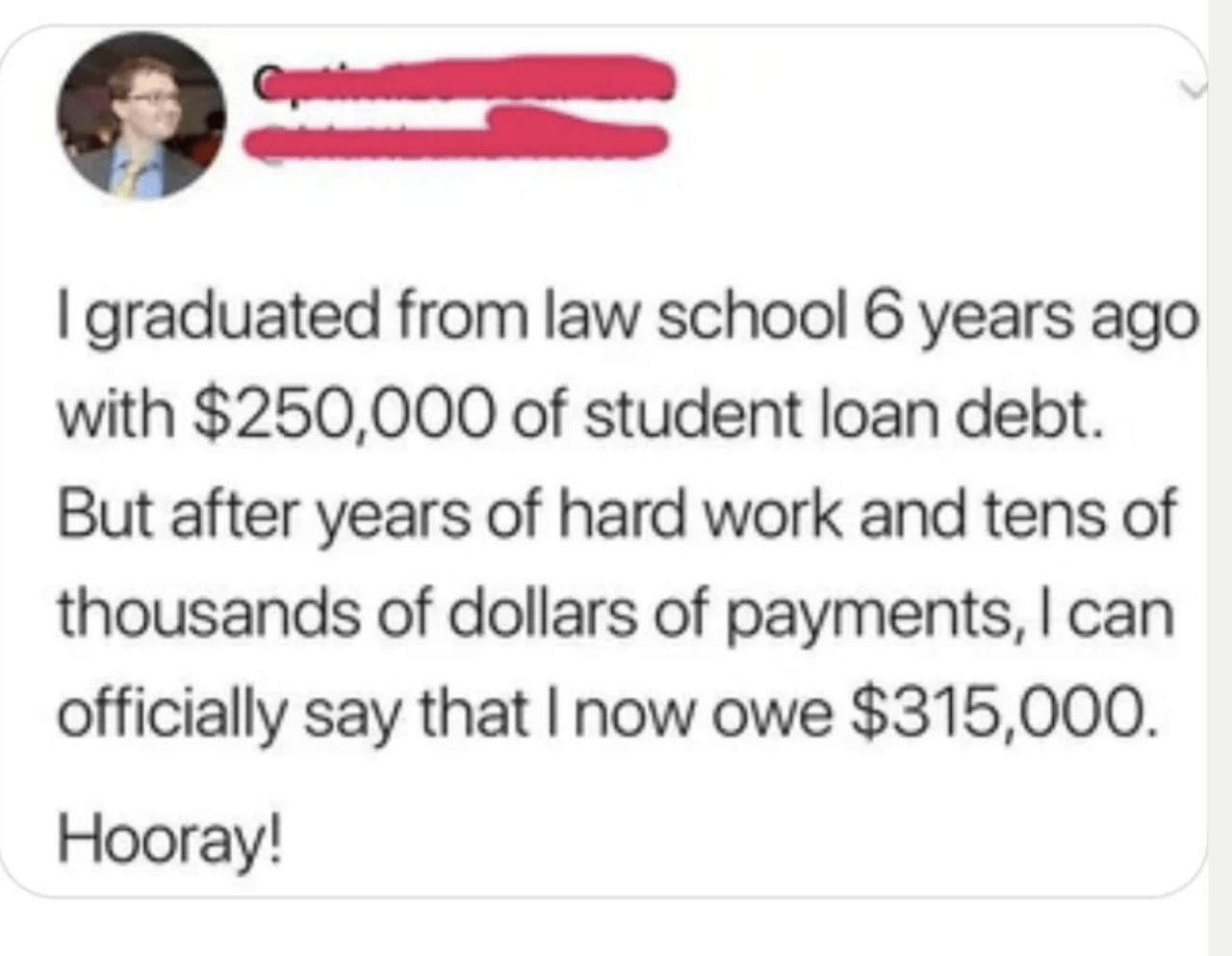

The financial damage inflicted by these scams is multifaceted. Increased debt loads are a common outcome, with victims often finding themselves owing significantly more than their original loan amount. This is primarily due to predatory interest rates far exceeding those offered by legitimate consolidation programs. Furthermore, hidden fees and charges, often disguised within complex contracts, further exacerbate the debt burden. Many victims also report unauthorized withdrawals from their bank accounts, depleting their savings and creating additional financial strain. The damage extends beyond immediate losses; a severely damaged credit score can hinder future financial opportunities for years to come. For example, a person might find themselves unable to purchase a home or secure a car loan, even years after the scam has been uncovered.

Emotional and Psychological Toll on Victims

Beyond the financial repercussions, student loan consolidation scams inflict significant emotional and psychological damage. Victims often experience feelings of shame, guilt, and helplessness. The betrayal of trust, coupled with the financial devastation, can lead to depression, anxiety, and even post-traumatic stress. The constant worry about debt and the struggle to regain financial stability can significantly impact mental well-being, leading to strained relationships and a decline in overall quality of life. The feeling of being trapped in a cycle of debt can be incredibly overwhelming and isolating.

Comparison of Fraudulent and Legitimate Consolidation

Legitimate student loan consolidation offers a streamlined approach to managing multiple loans, often resulting in a single monthly payment with a potentially lower interest rate. This simplifies repayment and provides a clear path towards debt elimination. In contrast, fraudulent consolidation schemes often involve inflated interest rates, hidden fees, and deceptive marketing tactics. These schemes leave victims with a significantly higher debt burden, damaged credit scores, and severe emotional distress. The long-term effects of fraudulent consolidation can be devastating, potentially hindering career prospects and financial stability for years to come. A legitimate consolidation program, on the other hand, empowers borrowers to regain control of their finances and work towards a debt-free future.

Real-World Case Studies and Outcomes

Numerous real-world cases highlight the devastating impact of these scams. One example involves a recent graduate who fell victim to a scheme promising significantly reduced interest rates. Instead, the scam resulted in a substantial increase in their debt and a severely damaged credit score. The victim experienced significant emotional distress, requiring professional counseling to cope with the financial and emotional fallout. Another case involved a group of students who were lured by promises of quick and easy debt relief. They subsequently lost thousands of dollars and faced years of financial hardship as a result. These cases underscore the importance of vigilance and careful research when considering student loan consolidation options.

Protecting Yourself from Scams

Navigating the world of student loan consolidation can be complex, making you vulnerable to scams. However, by taking proactive steps and exercising due diligence, you can significantly reduce your risk of falling victim to fraudulent schemes. This section Artikels key preventative measures and resources to safeguard your financial well-being.

Protecting yourself from student loan consolidation scams requires a multi-pronged approach. It involves understanding how these scams operate, recognizing warning signs, and knowing where to turn for reliable information and assistance. By being informed and vigilant, you can significantly minimize your vulnerability.

Reputable Sources for Student Loan Information

Reliable information is your first line of defense. Relying on official sources ensures you’re making informed decisions based on accurate data, not misleading promises.

Seeking information from untrusted sources can lead to disastrous consequences. Always verify the legitimacy of any information you receive before taking any action. A reputable source will provide clear and concise information, avoiding vague or overly promising statements.

- Federal Student Aid (FSA): The official U.S. government website for student aid information. This site provides comprehensive details on federal student loans, repayment plans, and consolidation options.

- National Student Loan Data System (NSLDS): A central database that allows you to view your federal student loan information from various lenders.

- Your Loan Servicer(s): Contact your current loan servicer(s) directly for information about your loans and consolidation options. Their contact information should be readily available on your loan statements.

- Consumer Financial Protection Bureau (CFPB): The CFPB offers resources and guidance on avoiding student loan scams and other financial fraud.

Verifying the Legitimacy of a Loan Consolidation Company

Before engaging with any loan consolidation company, thoroughly investigate their legitimacy. Don’t be swayed by flashy advertisements or aggressive sales tactics.

Legitimate companies will readily provide you with verifiable information. They will not pressure you into making quick decisions or demand upfront fees. Always remember that you should never pay a fee to consolidate your federal student loans.

- Check for Licensing and Accreditation: Verify that the company is properly licensed and accredited in your state. You can usually find this information on their website or by contacting your state’s attorney general’s office.

- Research Online Reviews: Look for independent reviews from past clients. Be wary of companies with overwhelmingly positive reviews, as these may be fabricated.

- Confirm Their Contact Information: Ensure their contact information is readily available and accurate. Avoid companies that are difficult to reach or have inconsistent contact details.

- Verify Their Claims: Independently verify any claims the company makes about interest rates, repayment terms, and fees. Don’t rely solely on their marketing materials.

Reporting Suspected Scams

If you suspect you’ve encountered a student loan consolidation scam, report it immediately to the appropriate authorities. Quick action can help prevent others from becoming victims.

Reporting suspected scams is crucial to protecting yourself and others. The information you provide can help law enforcement investigate and prosecute fraudulent activities.

- Federal Trade Commission (FTC): The FTC is the primary federal agency responsible for investigating consumer fraud, including student loan scams. You can file a complaint online at FTC.gov.

- Your State Attorney General’s Office: Your state’s attorney general’s office also handles consumer complaints and may be able to assist you.

- Consumer Financial Protection Bureau (CFPB): The CFPB accepts complaints about student loan servicers and other financial institutions.

- Local Law Enforcement: If you believe you’ve been a victim of a crime, contact your local law enforcement agency.

Legal and Regulatory Aspects

Student loan consolidation scams carry significant legal ramifications for both the perpetrators and the victims. Understanding the legal framework surrounding these scams is crucial for borrowers to protect themselves and for authorities to effectively combat fraudulent activities. This section will Artikel the legal implications and the role of regulatory bodies in preventing and addressing these crimes.

The legal ramifications for individuals and companies involved in student loan consolidation scams are severe. These scams often violate multiple federal and state laws, leading to a range of potential penalties. Companies found guilty of deceptive practices can face hefty fines, cease-and-desist orders, and even criminal charges, depending on the severity and scale of the fraud. Individuals who fall victim to these scams may experience significant financial hardship, but legal recourse may be available to recover losses.

Legal Ramifications for Perpetrators

Companies orchestrating student loan consolidation scams can face charges under various statutes, including the Truth in Lending Act (TILA), the Fair Debt Collection Practices Act (FDCPA), and state consumer protection laws. Violations of TILA can result in significant fines for misleading disclosures about interest rates, fees, and repayment terms. Similarly, FDCPA violations can lead to penalties for harassing or deceptive debt collection practices often employed by scam artists. Criminal charges, such as wire fraud or mail fraud, are also possible for particularly egregious cases involving large-scale schemes or significant financial losses. For example, in 2019, a company was fined millions of dollars and its owners faced prison time for running a student loan consolidation scam that defrauded thousands of borrowers. The severity of penalties often depends on the number of victims, the amount of money stolen, and the sophistication of the scam.

Role of Regulatory Bodies

Several federal and state regulatory bodies play a crucial role in preventing and addressing student loan consolidation scams. The Consumer Financial Protection Bureau (CFPB) is a key player, actively investigating and taking enforcement actions against companies engaged in deceptive lending practices. State attorneys general also have significant authority to pursue legal action against scam operators within their jurisdictions. These agencies work to monitor the student loan industry, investigate complaints, and take enforcement actions, including issuing cease-and-desist orders, imposing fines, and pursuing criminal charges. Their efforts aim to protect borrowers from predatory practices and hold perpetrators accountable. Furthermore, they often collaborate to share information and coordinate investigations across state lines, effectively targeting large-scale scams.

Laws and Regulations Protecting Borrowers

Several laws and regulations are designed to protect borrowers from student loan consolidation scams. The Truth in Lending Act (TILA) mandates clear and accurate disclosure of loan terms, protecting borrowers from misleading information about interest rates and fees. The Fair Credit Reporting Act (FCRA) safeguards the accuracy of credit reports, preventing fraudulent information from impacting borrowers’ credit scores. Additionally, various state consumer protection laws provide further recourse for victims of deceptive lending practices. These laws often empower state attorneys general to pursue legal action against companies engaging in fraudulent activities, providing avenues for redress for affected borrowers. For example, many states have laws specifically targeting deceptive business practices, allowing victims to sue for damages and recover their losses.

Examples of Successful Legal Actions

Numerous successful legal actions have been taken against perpetrators of student loan consolidation scams. Several high-profile cases have resulted in significant fines, restitution for victims, and even prison sentences for those involved. For instance, in a recent case, a company was ordered to pay millions of dollars in restitution to borrowers who were misled into consolidating their loans through deceptive marketing tactics. These legal victories demonstrate the effectiveness of regulatory action and the potential for victims to recover their losses through legal channels. The details of specific cases are often publicly available through the websites of the CFPB, state attorneys general offices, and court records. These cases serve as a deterrent to future fraudulent activities and highlight the importance of consumer awareness and reporting of suspicious activity.

Resources and Support for Victims

Falling victim to a student loan consolidation scam can be devastating, leaving individuals with financial burdens and emotional distress. However, numerous resources exist to help those who have been scammed navigate the recovery process and rebuild their financial stability. Understanding these resources and taking proactive steps is crucial for regaining control of your financial future.

It’s important to remember that you are not alone. Many organizations and government agencies are dedicated to assisting victims of financial fraud, offering support and guidance through the difficult process of recovery.

Government Agencies Offering Assistance

Several government agencies play a vital role in assisting victims of student loan scams. The Federal Trade Commission (FTC) is a primary resource, offering tools and resources to report scams and obtain information on fraud prevention. The Consumer Financial Protection Bureau (CFPB) also provides valuable resources and guidance on resolving financial disputes, including those related to student loan scams. Additionally, state attorney general offices often have dedicated units to investigate and prosecute financial fraud, offering assistance to victims within their jurisdiction. Contacting these agencies is the first step in the recovery process, as they can provide advice, guidance, and in some cases, direct assistance in pursuing legal action against the perpetrators.

Non-Profit Organizations Providing Support

Beyond government agencies, numerous non-profit organizations specialize in assisting victims of financial scams. These organizations often provide free or low-cost counseling, legal aid, and financial literacy programs. Many focus on assisting vulnerable populations, such as low-income individuals and students, who may be disproportionately targeted by scams. These organizations can offer invaluable support and guidance during the recovery process, helping victims navigate complex legal and financial challenges. Examples include the National Foundation for Credit Counseling (NFCC) and local consumer protection agencies.

Steps to Recover from a Student Loan Consolidation Scam

Recovering from a student loan consolidation scam requires a multi-faceted approach. First, report the scam to the appropriate authorities, including the FTC, CFPB, and your state attorney general’s office. Gather all relevant documentation, such as loan agreements, communication records, and bank statements. This documentation will be crucial in proving the fraudulent nature of the scam and pursuing legal recourse. Next, contact your loan servicers and lenders to explain the situation and explore options for addressing any unauthorized actions or fraudulent charges. Consider seeking legal counsel to understand your legal options and pursue any available legal remedies. Finally, focus on rebuilding your credit by diligently paying your bills and monitoring your credit reports regularly.

Credit Repair and Financial Counseling Resources

Credit repair and financial counseling are vital components of the recovery process. Credit repair services can help to improve your credit score by addressing negative marks resulting from the scam. However, it is important to choose reputable credit repair companies and avoid those that make unrealistic promises. Financial counseling services can help you create a budget, manage debt, and develop a plan for long-term financial stability. These services can provide invaluable support in navigating the financial challenges following a scam. The NFCC is a valuable resource for locating reputable credit counselors in your area.

End of Discussion

Protecting yourself from student loan consolidation scams requires vigilance and informed decision-making. By understanding the red flags, verifying the legitimacy of companies, and utilizing reputable resources, you can navigate the consolidation process with confidence. Remember, legitimate consolidation options provide transparency, clear terms, and readily available contact information. Don’t hesitate to seek assistance from trusted sources if you encounter suspicious offers; your financial well-being is paramount.

Essential Questionnaire

What are the typical fees associated with legitimate student loan consolidation?

Legitimate consolidation programs may have minimal upfront fees or government-mandated fees, but these are typically transparent and clearly Artikeld. Avoid programs with excessive or hidden fees.

How can I verify the legitimacy of a loan consolidation company?

Check the company’s registration with relevant authorities, search for online reviews and complaints, and contact the Federal Trade Commission (FTC) or your state’s attorney general’s office to verify their legitimacy.

What should I do if I believe I’ve been a victim of a student loan consolidation scam?

Immediately contact the FTC and your state’s attorney general’s office to report the scam. Gather all documentation related to the fraudulent transaction and seek legal advice.

Can I consolidate my private and federal student loans together?

While some private lenders offer consolidation options, federal student loans can generally only be consolidated through the federal government’s programs. Carefully research options and avoid companies promising to consolidate both types of loans without clear federal government backing.