Navigating the complexities of student loan debt can feel overwhelming, but understanding your options is the first step towards financial freedom. Student loan consolidation offers a potential pathway to simplify repayment, potentially lowering monthly payments and streamlining the process. This guide explores the intricacies of consolidation, empowering you to make informed decisions about your financial future.

From understanding the various types of consolidation programs available – federal versus private – to assessing the impact on your credit score and long-term financial health, we’ll cover the essential aspects to consider. We’ll delve into the advantages and disadvantages, providing practical examples and a decision-making framework to help you choose the best path for your circumstances.

Understanding Student Loan Consolidation

Student loan consolidation simplifies your repayment by combining multiple federal student loans into a single, new loan. This can lead to a more manageable monthly payment, but it’s crucial to understand the process and its implications before making a decision. The process involves applying through a designated government program or, in some cases, a private lender.

The Student Loan Consolidation Process

The process of consolidating federal student loans typically begins with gathering all necessary information about your existing loans, including loan servicers, loan amounts, and interest rates. Next, you’ll apply through the designated government program, typically the Federal Student Aid website. This involves completing an application form and providing supporting documentation. Once approved, your new consolidated loan will be issued, and your old loans will be paid off. The new loan will have a single monthly payment, interest rate, and repayment schedule. For private loans, the process is similar but involves applying through the private lender directly.

Applying for Student Loan Consolidation

Applying for federal student loan consolidation is a straightforward process. First, gather all your loan information. Then, visit the Federal Student Aid website (StudentAid.gov) and complete the Direct Consolidation Loan application. You’ll need to provide details about your existing loans, your Social Security number, and other personal information. Once submitted, the application will be processed, and you’ll receive notification of approval or denial. If approved, your new loan will be disbursed, and your previous loans will be paid off. Remember to carefully review all terms and conditions before signing any documents.

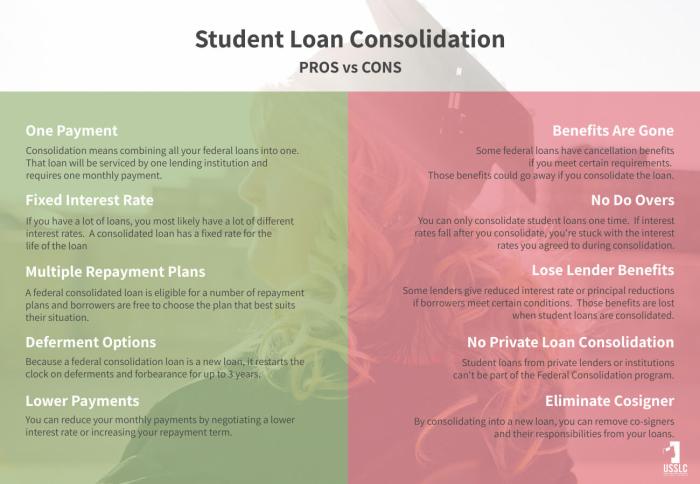

Advantages and Disadvantages of Student Loan Consolidation

Consolidating student loans offers several potential benefits. A simplified repayment plan with a single monthly payment can improve financial organization. A potentially lower monthly payment can ease short-term budget constraints. However, consolidation may not always be the best option. A longer repayment term can lead to paying more interest overall. The interest rate on the consolidated loan may be higher than the weighted average of your existing loans, increasing the total amount repaid. Additionally, consolidating federal loans into a private loan can result in the loss of federal loan benefits such as income-driven repayment plans.

Comparison of Student Loan Consolidation Programs

The primary program for federal student loan consolidation is the Direct Consolidation Loan program offered by the Department of Education. This program allows borrowers to consolidate multiple federal student loans into a single Direct Consolidation Loan. Private lenders also offer consolidation options, but these loans generally come with less favorable terms and may lack the benefits of federal loans. The key difference lies in the eligibility requirements, interest rates, and repayment options available. Federal programs often offer income-driven repayment plans, which private lenders typically do not.

Eligibility Criteria for Student Loan Consolidation Programs

Eligibility for federal student loan consolidation generally requires that you have multiple federal student loans. You must also be in good standing with your existing lenders, meaning you are not currently in default. Private loan consolidation eligibility varies by lender but often requires a good credit score and stable income. Specific requirements will depend on the lender’s criteria. It is essential to check the individual lender’s requirements before applying.

Types of Consolidation Programs

Student loan consolidation offers a way to simplify your repayment process by combining multiple loans into a single one. However, understanding the differences between federal and private consolidation programs is crucial to making an informed decision. Choosing the right path depends heavily on the types of loans you currently hold and your overall financial situation.

Federal Student Loan Consolidation

Federal student loan consolidation combines your eligible federal student loans (Direct Loans, Federal Family Education Loans, etc.) into a single Direct Consolidation Loan. This simplifies repayment by reducing the number of monthly payments and potentially providing access to income-driven repayment plans. The primary benefit lies in streamlining the repayment process and potentially lowering your monthly payment amount through extended repayment terms. However, it’s important to note that while your monthly payment might decrease, the overall interest paid might increase due to a longer repayment period. Additionally, you might lose access to certain benefits associated with specific loan types, such as loan forgiveness programs.

Private Student Loan Consolidation

Private student loan consolidation involves combining multiple private student loans from different lenders into a single loan with a new lender. This process can offer similar benefits to federal consolidation, such as simplifying repayment and potentially securing a lower interest rate, depending on your creditworthiness. However, private consolidation programs typically require a credit check and good credit history to qualify. Unlike federal consolidation, private options often lack the same government-backed protections and flexible repayment plans. The terms and conditions, including interest rates and fees, will vary significantly based on the lender and your credit profile. It’s essential to shop around and compare offers before committing to a private consolidation plan.

Comparison of Consolidation Options

The following table summarizes the key differences between federal and private student loan consolidation programs. Keep in mind that specific details, such as interest rates and fees, can vary greatly depending on individual circumstances and lender policies.

| Program Name | Interest Rate | Fees | Eligibility |

|---|---|---|---|

| Federal Direct Consolidation Loan | Weighted average of your existing federal loan interest rates, fixed for the life of the loan. | Typically no fees. | Must have eligible federal student loans. |

| Private Student Loan Consolidation | Variable or fixed, depending on the lender and borrower’s creditworthiness. Typically higher than federal rates. | Origination fees and other potential fees may apply. | Good to excellent credit history typically required. May require a co-signer. |

Credit Score and Financial Implications

Consolidating your student loans can have a significant impact on your credit score and overall financial health. Understanding these potential effects is crucial before making a decision. While consolidation can offer benefits, it’s essential to weigh them against the potential drawbacks to ensure it aligns with your long-term financial goals.

Consolidation affects your credit score primarily by altering your credit history. The impact is multifaceted and depends on several factors, including your current credit profile and how you manage your consolidated loan. A well-managed consolidated loan can improve your credit score, while mismanagement can lead to negative consequences.

Credit Score Changes After Consolidation

The immediate effect of consolidation on your credit score is often a slight dip. This is because opening a new loan, even a consolidation loan, introduces a new account to your credit report, and temporarily lowers your average account age. However, this dip is usually temporary and often overshadowed by the long-term positive effects, provided the loan is managed responsibly. For instance, if you previously had several loans with varying payment due dates, consolidating them into a single loan simplifies your repayment schedule, reducing the risk of missed payments. This improved payment history positively influences your credit score over time. Conversely, failing to make timely payments on the consolidated loan will negatively impact your credit score significantly more than missing payments on multiple smaller loans.

Positive Impacts on Credit History

Responsible management of a consolidated student loan can lead to several positive impacts on your credit history. These include improved payment history (due to simplified repayment), a higher credit utilization ratio (if the consolidation reduces your overall debt), and a potential increase in your average credit age over time (as the consolidated loan adds to your credit history). These factors can cumulatively contribute to a higher credit score. For example, a person with several delinquent loans who consolidates and diligently makes payments on time will likely see a substantial improvement in their credit score over several months.

Negative Impacts on Credit History

Conversely, irresponsible management of a consolidated loan can severely damage your credit history. Missing payments, exceeding credit limits (if applicable), or incurring additional debt while consolidating can negatively impact your score. The severity of the negative impact depends on the extent of the mismanagement and the length of time it persists. For instance, a missed payment on a consolidated loan results in a negative mark on your credit report, which can remain for several years. Similarly, repeatedly exceeding credit limits (if your consolidation includes a credit card component) can also negatively impact your score.

Long-Term Financial Implications

The long-term financial implications of student loan consolidation depend on the terms of the loan and your ability to manage your finances effectively. A lower interest rate achieved through consolidation can lead to significant savings over the life of the loan, freeing up money for other financial goals. However, extending the repayment period, a common feature of consolidation, might increase the total interest paid. Careful consideration of the total interest paid versus the monthly payment savings is crucial. For example, while a longer repayment term lowers monthly payments, it also leads to a higher total interest paid over the loan’s lifetime. This requires a careful cost-benefit analysis.

Outcome Summary

Ultimately, the decision to consolidate student loans is a deeply personal one. Weighing the potential benefits against the risks, and carefully considering your individual financial situation, is crucial. This guide provides the information necessary to make an informed choice. Remember, seeking professional financial advice can provide invaluable support in navigating this complex process and ensuring you select the most suitable option for your unique needs.

Essential FAQs

What is the impact of consolidation on my credit score?

Consolidation itself doesn’t directly improve or hurt your credit score. However, consistent on-time payments after consolidation can positively impact your credit history, while missed payments can negatively affect it.

Can I consolidate private and federal loans together?

Generally, you cannot consolidate federal and private student loans into a single federal loan. However, some private lenders offer consolidation options for both federal and private loans.

What if I’m already struggling to make payments?

If you’re having trouble making payments, explore income-driven repayment plans or contact your loan servicer to discuss options like forbearance or deferment before considering consolidation. Consolidation may not be the best solution if you are already behind on payments.

Are there fees associated with consolidation?

Fees vary depending on the program. Federal consolidation typically has minimal or no fees, while private consolidation may involve origination fees or other charges.