Navigating the complexities of student loan repayment can feel overwhelming. Understanding your monthly student loan cost is crucial for effective financial planning and avoiding future debt struggles. This guide provides a clear and concise overview of the factors influencing your monthly payments, helping you budget effectively and make informed decisions about your repayment strategy.

From understanding average monthly payments across various loan amounts and interest rates to exploring different repayment plan options and their long-term implications, we’ll cover all the essential aspects. We’ll also delve into practical budgeting strategies and address common questions surrounding student loan repayment, empowering you to take control of your financial future.

Understanding Average Monthly Payments

Calculating your average monthly student loan payment can seem daunting, but understanding the key factors involved simplifies the process. This section will explore the typical range of monthly payments, considering various loan amounts, interest rates, and repayment plans. We will also examine other factors that influence your final monthly cost.

Several factors determine your monthly student loan payment. The most significant are the loan amount and the interest rate. Higher loan amounts and higher interest rates naturally lead to larger monthly payments. However, the repayment plan you choose significantly impacts your monthly payment amount and the overall cost of your loan.

Average Monthly Payment Examples

The following table illustrates a range of average monthly payments for different loan amounts and interest rates, using common repayment plans. These are examples and your actual payments may vary depending on your specific loan terms and lender.

| Loan Amount | Interest Rate | Repayment Plan | Average Monthly Payment (Estimate) |

|---|---|---|---|

| $20,000 | 5% | Standard 10-year | $212 |

| $20,000 | 7% | Standard 10-year | $228 |

| $40,000 | 5% | Standard 10-year | $424 |

| $40,000 | 7% | Standard 10-year | $456 |

| $20,000 | 5% | Extended 20-year | $127 |

| $20,000 | 5% | Income-Driven (Example) | $100 – $200 (Variable based on income) |

Note: These are estimated average monthly payments. Actual payments may vary based on individual loan terms and lender policies. Income-driven repayment plans are particularly variable, depending on income and family size.

Factors Influencing Monthly Payments

Beyond loan amount and interest rate, several other factors can influence your monthly student loan payment. Understanding these factors can help you better manage your repayment strategy.

Loan type plays a significant role. Federal loans often offer more flexible repayment options, including income-driven plans, than private loans. The grace period, the time between graduation and the start of repayment, also impacts the total amount paid over the life of the loan, although it doesn’t directly affect the monthly payment amount during repayment. Finally, capitalization of interest, where unpaid interest is added to the principal balance, can significantly increase the loan amount and subsequent monthly payments. Careful consideration of these factors ensures a well-informed approach to repayment.

Factors Affecting Monthly Costs

Understanding the total cost of your student loans and your monthly payments involves more than just the principal loan amount. Several key factors significantly influence these figures, impacting your overall repayment experience. These factors interact in complex ways, so it’s crucial to understand each one individually to effectively manage your student loan debt.

Interest Rates and Their Impact

Interest rates are a cornerstone of student loan repayment. They represent the cost of borrowing money, and higher interest rates translate directly into higher monthly payments and a greater total amount paid over the life of the loan. For example, consider a $20,000 student loan with a 10-year repayment term. At a 5% interest rate, the monthly payment would be approximately $212, resulting in a total repayment of around $25,440. However, if the interest rate were to increase to 7%, the monthly payment would jump to roughly $238, leading to a total repayment of approximately $28,560. This illustrates how even a seemingly small change in interest rate can significantly increase both monthly payments and the total cost of the loan over time. This difference becomes even more pronounced over longer repayment periods or with larger loan amounts.

Loan Repayment Plans and Their Effects on Monthly Payments

Various repayment plans are available to borrowers, each designed to suit different financial situations and repayment preferences. The Standard Repayment Plan, for instance, typically involves fixed monthly payments over 10 years. While straightforward, this plan can result in higher monthly payments compared to other options. In contrast, the Income-Driven Repayment (IDR) plans, such as the Income-Based Repayment (IBR) plan or the Pay As You Earn (PAYE) plan, calculate monthly payments based on your income and family size. These plans generally result in lower monthly payments initially but may extend the repayment period significantly, leading to higher overall interest costs. Extended repayment plans offer lower monthly payments but usually increase the total interest paid. The best plan depends on individual circumstances and financial goals; careful consideration is needed to weigh the short-term benefits of lower monthly payments against the long-term consequences of higher overall costs.

Additional Fees Associated with Student Loans

Beyond interest, several fees can add to the total cost of student loans and impact monthly payments. Origination fees, charged by the lender upon loan disbursement, are a common example. These fees are typically a small percentage of the loan amount and are factored into the overall loan balance. Late payment fees are incurred when payments are not made on time, increasing the total amount owed and potentially affecting your credit score. Understanding these additional fees is vital for accurately budgeting and managing your student loan repayments. Failing to account for these fees can lead to unexpected increases in monthly payments and overall debt.

Repayment Plan Options and Their Implications

Choosing the right student loan repayment plan is a crucial decision that significantly impacts your monthly budget and long-term financial health. Understanding the various options available and their potential consequences is essential for effective financial planning. This section will compare different repayment plans, outlining the application process for income-driven plans, and exploring the long-term financial ramifications of each choice.

Several repayment plans cater to different financial situations and priorities. The key differences lie in monthly payment amounts, repayment periods, and the total interest paid over the life of the loan. Careful consideration of these factors is vital in selecting the most suitable plan.

Comparison of Repayment Plan Types

The three primary types of federal student loan repayment plans – Standard, Extended, and Income-Driven – offer varying degrees of flexibility and long-term implications. The optimal choice depends heavily on individual circumstances and financial projections.

- Standard Repayment Plan: This plan features fixed monthly payments over a 10-year period. It results in the lowest total interest paid but may involve higher monthly payments compared to other options. This plan is best suited for borrowers with stable incomes and a strong capacity for higher monthly payments.

- Extended Repayment Plan: Offering more manageable monthly payments, this plan extends the repayment period to up to 25 years. While it reduces the monthly burden, it leads to significantly higher total interest payments over the loan’s lifetime. This is a viable option for borrowers who need lower monthly payments but are prepared for a longer repayment term.

- Income-Driven Repayment Plans (IDR): These plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR), base monthly payments on your discretionary income and family size. Payments are typically lower than under standard or extended plans, but the repayment period can be extended to 20 or 25 years. Potential loan forgiveness after 20 or 25 years is a key advantage, but the overall interest paid will likely be higher than with the standard plan. This is an ideal option for borrowers with lower incomes or fluctuating financial situations.

Applying for an Income-Driven Repayment Plan

The application process for an income-driven repayment plan involves several steps and requires specific documentation. Accurate and timely submission of the necessary information is crucial for a smooth transition.

- Determine Eligibility: Confirm your eligibility for an IDR plan based on your loan type and income. Not all federal student loans qualify for all IDR plans.

- Gather Required Documents: Collect necessary documentation, including tax returns (IRS Form 1040), W-2 forms, and proof of family size (if applicable).

- Complete the Application: Submit the application through the Federal Student Aid website (StudentAid.gov). This typically involves completing an online form and uploading the required documents.

- Monitor Your Account: Regularly monitor your student loan account to ensure the application has been processed correctly and your payments are accurately calculated based on your income.

Long-Term Financial Implications of Repayment Plan Choices

The long-term financial implications of each repayment plan are significant, impacting both the total amount repaid and the time it takes to become debt-free. Consider the following when making your decision:

Choosing a Standard Repayment Plan, while resulting in the lowest total interest paid, demands higher monthly payments. For example, a $50,000 loan at 5% interest would require approximately $537 monthly payments under the standard plan, resulting in approximately $16,440 in interest over 10 years. However, an Extended Repayment Plan for the same loan could lower monthly payments to around $268 but extend the repayment period to 25 years, accumulating approximately $35,000 in interest. Conversely, an IDR plan might offer significantly lower monthly payments initially, but the total interest paid and repayment period could be considerably longer, potentially leading to higher overall costs. Loan forgiveness possibilities under IDR plans offer a significant benefit, but only after meeting specific requirements, such as 20 or 25 years of payments. For example, a borrower who qualifies for Public Service Loan Forgiveness (PSLF) under an IDR plan could potentially have their remaining loan balance forgiven after 120 qualifying payments.

Budgeting and Financial Planning for Loan Repayment

Successfully managing student loan debt requires careful budgeting and proactive financial planning. Integrating loan payments into your monthly budget is crucial to avoid default and build a strong financial foundation. This involves understanding your income, expenses, and developing strategies to allocate funds effectively.

Creating a realistic budget allows you to visualize your financial situation and make informed decisions about your spending habits. This process helps prioritize essential expenses, identify areas for potential savings, and ensures consistent student loan payments. Without a well-defined budget, managing debt effectively becomes significantly more challenging.

Sample Monthly Budget Incorporating Student Loan Payments

A sample monthly budget should be personalized to reflect individual circumstances. However, a typical budget might include the following categories:

The following example illustrates a potential monthly budget for an individual with a $500 monthly student loan payment. Note that these figures are illustrative and may vary greatly depending on location, lifestyle, and individual circumstances. Adjust these numbers to reflect your own personal income and expenses.

| Category | Amount |

|---|---|

| Housing (Rent/Mortgage) | $1200 |

| Transportation (Car Payment, Gas, Public Transit) | $300 |

| Food (Groceries, Eating Out) | $400 |

| Student Loan Payment | $500 |

| Utilities (Electricity, Water, Internet) | $200 |

| Entertainment | $100 |

| Savings | $100 |

| Other Expenses (Clothing, Healthcare, etc.) | $200 |

| Total Expenses | $3000 |

Strategies for Managing Student Loan Debt While Balancing Other Financial Obligations

Effective debt management involves prioritizing payments, exploring repayment options, and consistently tracking progress. This requires discipline and a proactive approach to financial planning.

Several strategies can assist in balancing student loan payments with other financial obligations. These include creating a detailed budget, automating loan payments, exploring income-driven repayment plans, and actively seeking ways to increase income or reduce expenses. For example, setting up automatic payments ensures consistent repayments and prevents late fees. Additionally, exploring options like income-driven repayment plans can lower monthly payments, making them more manageable.

The Importance of Financial Planning to Avoid Default and Manage Debt Effectively

Proactive financial planning is essential to avoid loan default and effectively manage debt. A comprehensive financial plan considers long-term goals, income projections, and potential financial emergencies.

Failing to plan for student loan repayments can lead to significant financial consequences, including damaged credit scores, wage garnishment, and potential legal action. A well-structured financial plan incorporates strategies for budgeting, saving, and investing, ensuring consistent loan payments and minimizing financial stress. Regularly reviewing and adjusting your financial plan based on changing circumstances is crucial for long-term success. For example, unforeseen events such as job loss can disrupt repayment plans, making it important to have contingency plans in place.

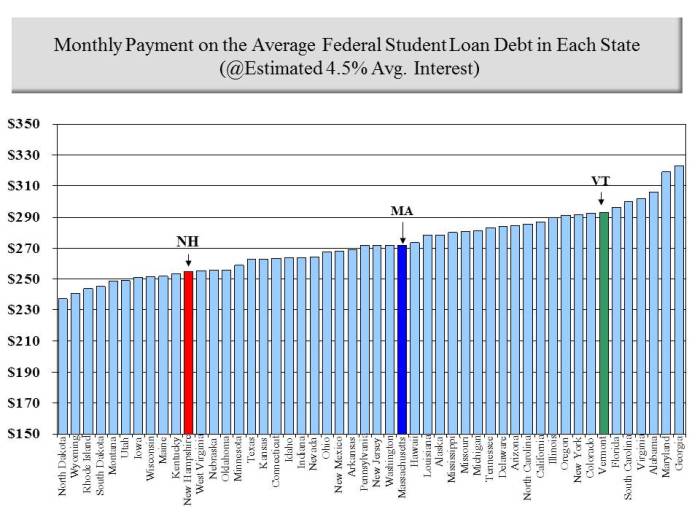

Visual Representation of Monthly Payment Variations

Understanding how monthly student loan payments fluctuate based on loan amount and interest rate is crucial for effective financial planning. Visual aids significantly enhance this understanding, allowing for quick comparisons and informed decision-making. The following descriptions illustrate how different visual representations can effectively convey this complex information.

Monthly Payment Variation by Loan Amount and Interest Rate

A well-designed chart, ideally an interactive one, would effectively illustrate the relationship between loan amount, interest rate, and resulting monthly payment. This chart could utilize a scatter plot, where the x-axis represents the loan amount (e.g., ranging from $10,000 to $100,000), the y-axis represents the monthly payment, and different colored lines represent various interest rates (e.g., 4%, 6%, 8%). Each point on the chart would represent a specific loan amount and its corresponding monthly payment at a given interest rate. A legend clearly identifying the color-coded interest rates would be essential. The visual would clearly show how monthly payments increase significantly with both higher loan amounts and higher interest rates. For instance, a $50,000 loan at 4% interest might result in a monthly payment of approximately $200 (hypothetical example), while the same loan at 8% interest would yield a significantly higher monthly payment, perhaps around $350 (hypothetical example). The steeper slope of the lines at higher interest rates would visually demonstrate the accelerated impact of interest on monthly payments.

Cumulative Interest Paid Under Different Repayment Plans

A bar chart effectively displays the total cumulative interest paid over the loan’s lifespan under different repayment plans. Each bar would represent a specific repayment plan (e.g., Standard, Extended, Income-Driven). The height of each bar would represent the total interest paid, allowing for immediate visual comparison. For example, a bar chart could show that a Standard repayment plan (faster repayment) results in lower cumulative interest compared to an Extended repayment plan (slower repayment), even though the latter might have lower monthly payments. The chart would need a clear title and labels for each bar, specifying the repayment plan and the corresponding total interest paid. Adding data labels directly to each bar, showing the exact amount of interest paid, would further enhance clarity. For instance, a hypothetical comparison might show that a $50,000 loan under a standard plan incurs $10,000 in interest, while the same loan under an extended plan incurs $20,000 in interest. This visual clearly demonstrates the long-term financial implications of different repayment choices.

End of Discussion

Successfully managing student loan debt requires a proactive and informed approach. By understanding the factors influencing your monthly payments, exploring various repayment options, and implementing effective budgeting strategies, you can navigate the repayment process with confidence. Remember, proactive planning and informed decision-making are key to achieving long-term financial stability and minimizing the overall cost of your student loans.

Helpful Answers

What happens if I miss a student loan payment?

Missing a payment can result in late fees, damage to your credit score, and potentially lead to loan default. Contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment.

Can I refinance my student loans to lower my monthly payment?

Refinancing might lower your monthly payment, but it depends on your credit score and interest rates at the time of refinancing. Carefully compare offers and consider the potential long-term implications before refinancing.

How do I choose the best repayment plan for my situation?

Consider your income, expenses, and long-term financial goals. Compare standard, extended, and income-driven repayment plans to determine which best aligns with your individual circumstances. A financial advisor can provide personalized guidance.

What is loan forgiveness, and am I eligible?

Loan forgiveness programs, such as Public Service Loan Forgiveness (PSLF), can eliminate remaining student loan debt after meeting specific requirements. Eligibility criteria vary depending on the program. Check the eligibility requirements on the official government websites.