Navigating the complexities of student loan debt is a significant financial undertaking for many. Understanding how these loans impact your credit report is crucial for long-term financial health. This guide explores the multifaceted relationship between student loans and your credit score, offering insights into responsible management and strategies for mitigating potential negative consequences.

From the initial disbursement of funds to eventual repayment, your student loans leave a traceable footprint on your credit history. This footprint influences your creditworthiness, impacting your ability to secure future loans, mortgages, or even rental agreements. This detailed analysis will equip you with the knowledge to navigate this process effectively and build a strong credit profile despite the presence of student loan debt.

Understanding Student Loan Impacts on Credit Reports

Student loans significantly impact your credit report and score, influencing your ability to secure loans, credit cards, and even rental agreements in the future. Understanding how these loans are reported and how your payment history affects your credit is crucial for long-term financial health. This section will detail the relationship between student loans and your creditworthiness.

Student Loan Payment Impacts on Credit Scores

On-time student loan payments contribute positively to your credit score. Each payment demonstrates responsible credit management, building a positive payment history which is a major factor in credit scoring models. Conversely, late or missed payments negatively impact your credit score, potentially lowering it significantly. The severity of the negative impact depends on the frequency and length of the delinquency. For example, a single late payment might cause a minor dip, but consistently late payments can severely damage your credit. Furthermore, the impact of late payments can linger on your credit report for several years, affecting your creditworthiness for an extended period.

Types of Student Loans and Credit Reporting

Several types of student loans exist, each reported differently on credit reports. Federal student loans, such as subsidized and unsubsidized Stafford Loans and PLUS Loans, are generally reported to credit bureaus. Private student loans also appear on credit reports. The reporting of these loans is generally consistent, focusing on the loan amount, payment history, and current status (e.g., current, delinquent, in default). However, the specific details reported may vary slightly depending on the lender and the servicer.

Income-Driven Repayment Plans and Credit Reports

Income-driven repayment (IDR) plans, such as Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE), adjust your monthly payments based on your income and family size. While these plans can make payments more manageable, they are still reported to credit bureaus. Consistent payments under an IDR plan will positively affect your credit score, similar to payments on a standard repayment plan. However, it’s important to note that any missed payments, even under an IDR plan, will negatively impact your credit score. For instance, if you consistently make on-time payments under an IBR plan, your credit score will improve, but if you miss payments even under an IDR plan, your score will be negatively affected.

Credit Utilization Ratio and Credit Scores with Student Loans

Credit utilization ratio, the percentage of available credit you’re using, significantly influences your credit score. High utilization ratios generally indicate higher risk, negatively impacting scores. The impact of student loans on credit utilization is significant because they often represent a substantial portion of a borrower’s total debt.

| Credit Utilization Ratio | Credit Score Impact (General) | Impact with High Student Loan Debt | Example |

|---|---|---|---|

| Below 30% | Positive; Shows responsible credit management | Positive; Helps mitigate negative impact of high debt | $10,000 credit limit, $2,000 used |

| 30-50% | Neutral to slightly negative | Negative; High student loan debt amplifies negative impact | $10,000 credit limit, $4,000 used |

| 50-70% | Negative; Indicates higher risk | Significantly negative; High debt makes this very risky | $10,000 credit limit, $6,000 used |

| Above 70% | Very negative; Suggests potential financial instability | Extremely negative; High risk of default on both loans and credit | $10,000 credit limit, $8,000 used |

Student Loan Delinquency and its Credit Consequences

Falling behind on student loan payments can have significant and long-lasting consequences for your credit score and financial well-being. Understanding the stages of delinquency and the steps to avoid them is crucial for maintaining a healthy financial future. This section details the process, potential impacts, and strategies for responsible student loan management.

Stages of Student Loan Delinquency and Their Credit Impacts

Student loan delinquency is typically categorized into stages based on the number of missed payments. Each stage results in increasingly negative impacts on your credit report and score. The specific timeline for each stage may vary slightly depending on your lender, but the general progression is consistent. A missed payment typically results in a delinquency being reported to the credit bureaus after 30 days.

- 30-59 Days Delinquent: Your account is considered delinquent, and this information is reported to credit bureaus. Your credit score will likely begin to decline. You’ll also receive notices from your lender urging you to make a payment.

- 60-89 Days Delinquent: The delinquency remains on your credit report, and the negative impact on your score intensifies. Collection efforts from the lender may become more aggressive.

- 90+ Days Delinquent: This is considered a serious delinquency. Your credit score will suffer significantly, making it harder to obtain credit in the future. The lender may refer your account to collections.

Student Loan Default and Long-Term Effects

Defaulting on a student loan occurs when you fail to make payments for an extended period, typically 270 days or more. This is a serious event with severe consequences.

- Negative Credit Report Impact: A default will remain on your credit report for seven years, significantly harming your credit score and making it difficult to obtain loans, credit cards, or even rent an apartment.

- Wage Garnishment: The government can garnish your wages to recover the defaulted loan amount.

- Tax Refund Offset: Your federal tax refund can be seized to repay the debt.

- Difficulty Obtaining Future Loans: Securing future loans, including mortgages, auto loans, and even personal loans, will become extremely challenging.

- Potential Legal Action: In some cases, legal action may be taken to recover the debt.

Strategies for Avoiding Student Loan Delinquency

Proactive planning and responsible management are key to avoiding delinquency.

- Budgeting and Financial Planning: Create a realistic budget that includes your student loan payments. Track your income and expenses carefully.

- Exploring Repayment Options: Investigate different repayment plans offered by your lender, such as income-driven repayment plans, to find one that fits your budget.

- Communicating with Your Lender: If you anticipate difficulty making payments, contact your lender immediately to discuss options like deferment or forbearance. Early communication is crucial.

- Seeking Financial Counseling: Consider seeking professional financial counseling to develop a personalized plan for managing your student loans and overall finances.

Flowchart Illustrating Lender Actions During Student Loan Delinquency

Imagine a flowchart with these steps:

Start: Missed Payment

Step 1: 30-day grace period. Notice sent to borrower.

Step 2: Delinquency reported to credit bureaus (after 30 days). Further notices and calls to borrower.

Step 3: 60-day delinquency. More aggressive collection attempts.

Step 4: 90-day delinquency. Account referred to collections agency.

Step 5: 270-day delinquency. Loan defaults. Wage garnishment and tax refund offset initiated.

End: Resolution of debt (through repayment or other means).

Strategies for Managing Student Loan Debt and Credit

Managing student loan debt effectively is crucial for building a strong financial future. This involves understanding various repayment strategies and their impact on your credit score. Choosing the right approach depends on your individual financial situation and long-term goals. Careful planning and consistent effort are key to successfully navigating this process.

Refinancing and Consolidation: A Comparison

Refinancing and consolidation are two common strategies for managing student loans, each with its own set of advantages and disadvantages. Refinancing involves replacing your existing loans with a new loan, often at a lower interest rate. Consolidation, on the other hand, combines multiple loans into a single loan, simplifying repayment. The choice between these options depends heavily on individual circumstances such as credit score, interest rates, and loan types.

Refinancing: Benefits and Drawbacks

Refinancing can significantly lower your monthly payments and reduce the total interest paid over the life of the loan, especially if you qualify for a lower interest rate. However, refinancing may extend the repayment period, leading to higher overall interest payments if you don’t pay extra towards the principal. Furthermore, refinancing might not be suitable for all loan types, and it could potentially result in the loss of certain benefits associated with federal student loans, such as income-driven repayment plans.

Consolidation: Benefits and Drawbacks

Consolidation simplifies repayment by combining multiple loans into a single monthly payment. This makes budgeting easier and reduces the administrative burden of managing multiple accounts. However, consolidation might not always lower your interest rate, and you could end up paying more interest overall if the new interest rate is higher or the repayment term is longer. Additionally, consolidating federal loans into a private loan could result in the loss of federal loan benefits.

Improving Credit Scores While Managing Student Loans

A step-by-step approach to improving your credit score while managing student loans involves several key actions. First, make consistent, on-time payments. This is the single most important factor influencing your credit score. Second, keep your credit utilization low. This means using only a small percentage of your available credit. Third, maintain a diverse credit history, including other types of credit like credit cards, if managed responsibly. Fourth, regularly monitor your credit reports for any errors and take steps to correct them promptly. Fifth, consider seeking professional financial advice if needed to create a personalized strategy.

Budgeting and Prioritizing Student Loan Payments

Effective budgeting is essential for managing student loan payments alongside other financial obligations. Start by creating a detailed budget that lists all your income and expenses. Prioritize essential expenses like housing, food, and transportation. Then, allocate a specific amount towards your student loan payments each month. Consider using budgeting apps or spreadsheets to track your spending and ensure you stay on track. If you face financial hardship, explore options like deferment or forbearance, but be aware of the potential long-term consequences. Remember to regularly review and adjust your budget as needed to accommodate changes in your income or expenses.

Impact of Student Loan Debt on Other Financial Decisions

Student loan debt significantly impacts your financial future, extending far beyond monthly payments. The presence of this debt influences lenders’ assessments of your creditworthiness when applying for mortgages, auto loans, and other forms of credit. Understanding this influence is crucial for making informed financial decisions and planning for the future.

The weight of student loan debt affects your debt-to-income ratio (DTI), a key factor lenders consider. Your DTI is calculated by dividing your total monthly debt payments (including student loans) by your gross monthly income. A higher DTI suggests a greater financial burden, potentially reducing your chances of loan approval or resulting in less favorable loan terms, such as higher interest rates.

Mortgage Loan Applications

Lenders scrutinize your DTI when evaluating mortgage applications. A high DTI, largely influenced by substantial student loan payments, can make it challenging to qualify for a mortgage, particularly for larger loans. For example, if your student loan payments consume a significant portion of your income, lenders might perceive you as a higher-risk borrower, potentially leading to loan rejection or the necessity of a larger down payment to compensate for the perceived risk. Some lenders might offer mortgages with higher interest rates to mitigate their risk, increasing your overall borrowing costs.

Auto Loan Applications

Similar to mortgage applications, auto loan lenders carefully assess your DTI. High student loan payments can limit your borrowing power for auto loans. This might restrict your choice of vehicles or necessitate a larger down payment to secure financing. Furthermore, a higher DTI might result in higher interest rates on your auto loan, increasing the total cost of the vehicle over time. Consider a scenario where an individual with significant student loan debt applies for a car loan. The lender, considering the existing debt burden, might offer a loan with a higher interest rate or require a substantial down payment, thereby making the purchase less affordable.

Strategies for Minimizing the Impact

Effectively managing student loan debt is crucial for improving your creditworthiness and securing favorable loan terms. Several strategies can help minimize the impact of student loan debt on future financial decisions. These include exploring income-driven repayment plans, which adjust your monthly payments based on your income, refinancing your loans to secure a lower interest rate, and diligently making on-time payments to maintain a good credit score. Building a strong credit history, independent of student loans, by responsibly managing credit cards and other lines of credit, also strengthens your financial profile and demonstrates responsible financial behavior to potential lenders.

Resources for Student Loan Management

Understanding the resources available is vital for effective student loan management. Many organizations offer guidance and support to borrowers navigating the complexities of student loan repayment.

- The National Foundation for Credit Counseling (NFCC): Offers free and low-cost credit counseling services, including assistance with student loan debt management.

- StudentAid.gov: The official website for the U.S. Department of Education, providing information on federal student loan programs, repayment options, and loan forgiveness programs.

- Your Loan Servicer: Your loan servicer can provide personalized information about your loans, repayment plans, and available assistance programs.

- Nonprofit Credit Counseling Agencies: Many reputable nonprofit organizations offer free or low-cost credit counseling and debt management services.

Credit Reporting Errors Related to Student Loans

Student loan information is a significant part of your credit report, impacting your credit score and future borrowing opportunities. Inaccuracies on your report can have serious consequences, potentially hindering your ability to secure loans, rent an apartment, or even get a job. Understanding how to identify and correct these errors is crucial for maintaining a healthy financial standing.

Identifying Potential Errors on Credit Reports

Regularly reviewing your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion) is essential. Compare the information reported with your own records of student loan accounts, including loan amounts, interest rates, payment histories, and account statuses. Discrepancies, such as incorrect loan amounts, inaccurate payment dates, or misreported account statuses (e.g., showing delinquency when payments are current), should be investigated immediately. Pay close attention to the lender’s name and the loan’s unique identifier, ensuring they accurately reflect your loans.

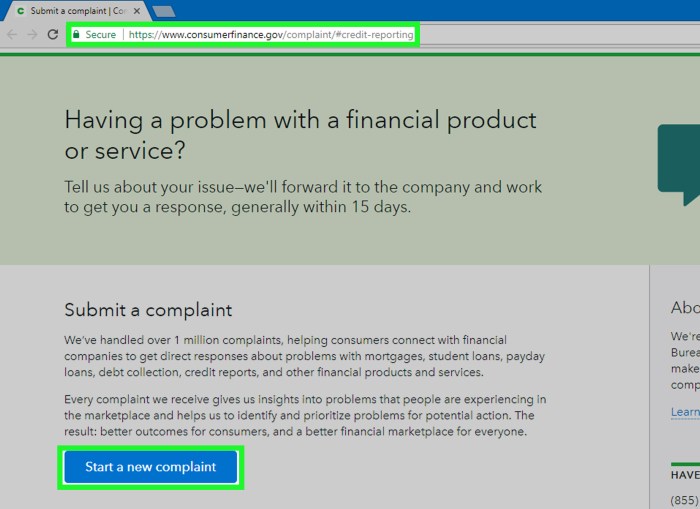

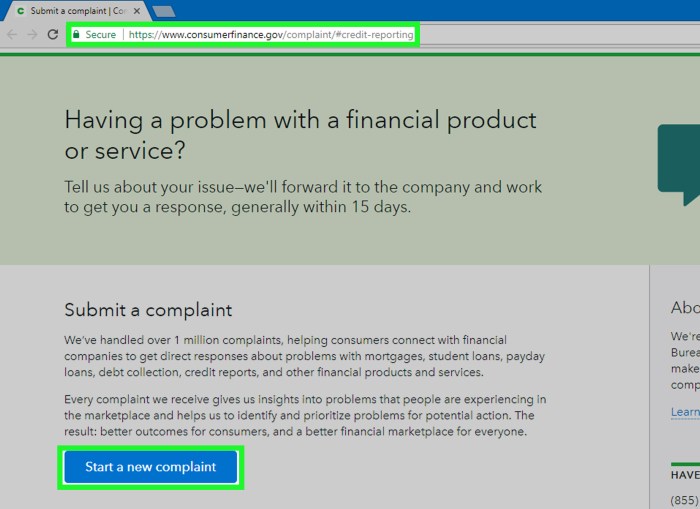

Disputing Inaccurate Student Loan Information

The process of disputing inaccurate information involves contacting both the credit bureaus and your loan servicer. Begin by gathering all relevant documentation, including your loan agreements, payment confirmations, and any other evidence that contradicts the inaccurate information on your report. Then, submit a dispute to each credit bureau using their online dispute portals or by mail. Simultaneously, contact your loan servicer to inform them of the error and request a correction of their records. Keep detailed records of all communication and correspondence.

Examples of Common Errors and Their Consequences

Several common errors can occur in student loan reporting. For example, a loan might be reported as delinquent when payments are up-to-date, negatively impacting your credit score. Another common error is an incorrect loan balance, which could lead to an inaccurate debt-to-income ratio calculation, potentially affecting your eligibility for other loans or credit products. In some cases, a loan might be reported under the wrong name or with an incorrect social security number, leading to serious credit reporting issues. The consequences of these errors can include lower credit scores, difficulty securing loans or credit cards, and even potential denial of employment opportunities.

Contacting Credit Bureaus and Loan Servicers to Resolve Inaccuracies

Each credit bureau has its own dispute process, typically involving completing an online form or sending a letter with supporting documentation. Provide specific details about the error, including the account number, the inaccurate information, and the correct information supported by evidence. Your loan servicer should be contacted concurrently, providing them with the same information and requesting a correction to their records. Expect a response from the credit bureaus within 30-45 days, and continue to follow up if you do not receive a resolution. Persistent communication and clear documentation are vital for successful dispute resolution. Remember to retain copies of all correspondence and documentation for your records.

Visual Representation of Student Loan Impact on Credit

Understanding how student loans affect your credit score requires looking beyond the simple number. A credit report provides a visual representation of your borrowing and repayment history, offering a detailed picture of your creditworthiness. This visual representation, though not a literal image, is conveyed through various data points and their arrangement within the report.

A hypothetical student, let’s call her Sarah, has a credit report reflecting both the positive and negative aspects of managing her student loans. Her report shows several student loan accounts, each with a detailed history of payments. Some accounts show a consistent record of on-time payments, represented by consistently positive payment notations. These are visually indicated as sequential entries, all marked with “paid as agreed” or similar positive indicators. This consistent positive payment history contributes to a higher credit score. However, other accounts show a period of missed payments, represented by late payment notations or even potential delinquencies. These entries would appear as negative marks, perhaps with specific dates indicating the missed payments. These negative marks are detrimental to her overall credit score. The report would also show the balances of each loan, their interest rates, and the total amount of debt she carries. The length of her credit history, incorporating the student loans, would also be visible, indicating how long she has been managing credit accounts.

Student Loan Payment Behavior and Credit Report Representation

Consistent on-time payments are visually represented as a series of positive payment notations within each student loan account’s history. These positive entries typically show as “paid as agreed” or similar phrasing, and consistently appear without any gaps or negative marks. This unbroken string of positive entries indicates responsible credit management and significantly boosts the credit score. In contrast, missed payments appear as negative entries, often with specific dates indicating the missed payment. These negative entries are typically flagged with notations like “late payment,” “30 days past due,” “60 days past due,” or similar, depending on the severity of the delinquency. The more frequent and severe these negative notations, the more negatively they impact the credit score. The visual impact of these negative entries is a disruption to the otherwise positive payment history, clearly indicating periods of financial difficulty. The number of missed payments and the length of time the account was delinquent are crucial factors influencing the overall score. A pattern of consistent late payments will be more damaging than a single isolated incident.

Conclusion

Successfully managing student loan debt requires proactive planning and a thorough understanding of its impact on your credit. By consistently making on-time payments, actively monitoring your credit report for errors, and exploring available repayment options, you can minimize negative consequences and build a positive credit history. Remember, responsible financial management is key to achieving long-term financial well-being.

FAQ

What if I can’t make a student loan payment?

Contact your loan servicer immediately. They can discuss options like forbearance or deferment to temporarily suspend payments, preventing default.

How long does a student loan stay on my credit report?

Generally, positive and negative information remains on your credit report for seven years from the date of the last activity (e.g., missed payment). Accounts in collections may remain longer.

Can I improve my credit score after a student loan default?

Yes, but it takes time and effort. Repaying the defaulted loan, establishing a consistent positive payment history on other accounts, and maintaining low credit utilization are crucial steps.

How often should I check my credit report?

It’s recommended to check your credit report at least annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion) to monitor for accuracy and identify potential errors.