Navigating the complex landscape of student loan interest rates can feel overwhelming. Understanding the current rates is crucial for both current borrowers and those planning future education financing. This guide delves into the factors influencing these rates, exploring the differences between federal and private loans, fixed versus variable options, and the impact of economic shifts. We’ll also examine repayment strategies and resources to help you make informed decisions about your student loan debt.

From understanding the interplay between inflation and interest rates to exploring various repayment plans and loan forgiveness programs, we aim to provide a clear and comprehensive overview. We’ll also analyze the potential effects of economic events like recessions and offer practical strategies for managing and minimizing your student loan burden. By the end, you’ll have a clearer understanding of how to navigate this crucial aspect of higher education financing.

Understanding Current Student Loan Interest Rates

Navigating the world of student loans requires a solid understanding of interest rates, as these directly impact the total cost of your education. Understanding the factors that influence these rates, the differences between federal and private loans, and the implications of fixed versus variable rates is crucial for making informed borrowing decisions.

Factors Influencing Student Loan Interest Rates

Several key factors determine the interest rate you’ll receive on your student loans. These include your creditworthiness (for private loans), the type of loan (federal subsidized vs. unsubsidized, or private), the loan’s repayment plan, and prevailing market interest rates. Generally, a stronger credit history and a federal loan will result in a lower interest rate. The current economic climate also plays a significant role; higher inflation tends to lead to higher interest rates. For federal loans, the interest rate is often set annually by Congress and can vary based on the loan type and the student’s borrowing history.

Federal vs. Private Student Loan Rates

Federal student loans typically offer lower interest rates than private loans. This is because the federal government subsidizes these loans, reducing the risk for lenders. Furthermore, federal loans often come with more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Private student loans, on the other hand, are offered by banks and credit unions and are subject to credit checks and other eligibility requirements. As a result, individuals with less-than-perfect credit may face higher interest rates or even be denied a loan.

Fixed vs. Variable Interest Rates for Student Loans

Student loans can have either fixed or variable interest rates. A fixed interest rate remains the same for the life of the loan, providing predictability in your monthly payments. A variable interest rate fluctuates based on an index, such as the prime rate or LIBOR. While variable rates might start lower, they can increase over time, potentially leading to higher total repayment costs. Choosing between a fixed and variable rate depends on your risk tolerance and financial outlook. If you prefer stability and predictability, a fixed rate is generally recommended.

Current Average Interest Rates for Various Student Loan Types

| Lender | Loan Type | Interest Rate | Repayment Plan |

|---|---|---|---|

| Federal Government | Subsidized Federal Stafford Loan (Undergraduate) | 4.99% (Example – rates change annually) | Standard, Income-Driven |

| Federal Government | Unsubsidized Federal Stafford Loan (Graduate) | 6.54% (Example – rates change annually) | Standard, Income-Driven |

| Private Lender (Example) | Private Student Loan (Variable) | 7.00% – 12.00% (Variable, depending on creditworthiness) | Various options offered by lender |

| Private Lender (Example) | Private Student Loan (Fixed) | 8.00% – 13.00% (Fixed, depending on creditworthiness) | Various options offered by lender |

*Note: Interest rates are subject to change and are examples only. Always check with the lender for the most current rates.*

Impact of Economic Factors on Student Loan Rates

Student loan interest rates are not set in isolation; they are significantly influenced by broader economic conditions. Understanding these influences is crucial for both borrowers and lenders, as it allows for better prediction of future rate movements and informed financial planning. The interplay between inflation, Federal Reserve policy, and overall economic health directly shapes the cost of borrowing for higher education.

Inflation and Interest Rates have a strong correlation. When inflation rises, the Federal Reserve often increases interest rates to cool down the economy and curb rising prices. This increase in the federal funds rate typically leads to higher interest rates across the board, including student loan rates. Conversely, during periods of low inflation, interest rates tend to be lower, potentially resulting in more affordable student loans. The relationship isn’t always perfectly linear, however, as other economic factors can also play a role.

Inflation’s Influence on Student Loan Rates

Inflation, the rate at which the general level of prices for goods and services is rising, directly impacts student loan interest rates. High inflation erodes the purchasing power of money, making borrowing more expensive. To combat inflation, the Federal Reserve typically raises interest rates, which in turn increases the cost of borrowing for students. For example, during periods of high inflation, like the late 1970s and early 1980s, student loan interest rates were significantly higher than they are in periods of low inflation. Conversely, during periods of low or even negative inflation (deflation), the cost of borrowing can decrease, leading to lower student loan rates. The relationship is complex and influenced by other economic factors, but the general trend holds true.

Federal Reserve Monetary Policy’s Impact

The Federal Reserve (the Fed), the central bank of the United States, plays a pivotal role in setting interest rates through its monetary policy. The Fed’s primary tool is the federal funds rate, the target rate that banks charge each other for overnight loans. Changes to the federal funds rate ripple through the financial system, affecting various interest rates, including those on student loans. When the Fed raises the federal funds rate (a contractionary monetary policy), it becomes more expensive for banks to borrow money, leading them to increase interest rates on loans they offer, including student loans. Conversely, when the Fed lowers the federal funds rate (an expansionary monetary policy), borrowing becomes cheaper, potentially leading to lower student loan rates. This mechanism helps the Fed manage inflation and overall economic growth.

Economic Events Affecting Future Student Loan Rates

Several economic events can significantly impact future student loan rates. Recessions, for instance, often lead to lower interest rates as the Fed attempts to stimulate economic activity. Conversely, periods of rapid economic growth might lead to higher rates as the Fed works to curb inflation. Geopolitical events, such as wars or trade disputes, can also introduce uncertainty into the market, influencing interest rates. Changes in government fiscal policy, such as increased government spending or tax cuts, can also affect inflation and, consequently, student loan rates. Furthermore, shifts in investor sentiment and market expectations can influence the cost of borrowing.

Hypothetical Recession Scenario and its Effect

Let’s imagine a hypothetical scenario where a significant recession hits the US economy. To counter the economic downturn, the Federal Reserve would likely implement expansionary monetary policy, lowering the federal funds rate. This would, in turn, decrease the cost of borrowing for banks, potentially leading to lower student loan interest rates. In this scenario, the government might also introduce stimulus packages or other interventions, potentially impacting the overall cost of borrowing and the availability of student loan funds. A real-world example that mirrors this would be the response to the 2008 financial crisis, where the Fed dramatically lowered interest rates to stimulate the economy, which indirectly impacted student loan rates as well, although the effects weren’t immediate or uniform across all loan types.

Student Loan Repayment Options and Interest Rates

Choosing the right student loan repayment plan significantly impacts your overall cost. Different plans offer varying monthly payments and repayment timelines, directly influencing the total interest you’ll pay over the life of your loan. Understanding these options is crucial for effective financial planning.

Understanding the nuances of each repayment plan is vital for minimizing your long-term debt burden. The optimal plan depends on your individual financial circumstances, income, and long-term financial goals. Factors such as your expected income growth and career trajectory should be considered when making your decision.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loans. It involves fixed monthly payments over a 10-year period. While this plan offers predictable payments, it often results in higher total interest paid compared to income-driven plans due to its shorter repayment timeframe.

- Pros: Predictable monthly payments, relatively short repayment period.

- Cons: Higher total interest paid, potentially higher monthly payments than income-driven plans.

Graduated Repayment Plan

With the Graduated Repayment Plan, your monthly payments start low and gradually increase every two years for the life of the loan. This plan can be appealing initially, but the increasing payments can become burdensome later on. The total interest paid is generally higher than with the Extended Repayment Plan due to the longer repayment period.

- Pros: Lower initial payments.

- Cons: Payments increase over time, potentially leading to financial strain later; higher total interest paid than extended repayment.

Extended Repayment Plan

The Extended Repayment Plan stretches your repayment period to up to 25 years, leading to lower monthly payments. However, this longer repayment period results in significantly higher total interest paid over the loan’s lifetime.

- Pros: Lower monthly payments.

- Cons: Significantly higher total interest paid, longer repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) link your monthly payments to your income and family size. These plans typically offer lower monthly payments than standard plans, but they often extend the repayment period beyond 10 years, potentially leading to higher overall interest paid. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

For example, consider an individual with $40,000 in student loan debt and an annual income of $35,000. Under a standard repayment plan, their monthly payment might be around $400. However, under an IDR plan, their monthly payment could be significantly lower, perhaps $200 or less, depending on the specific plan and their family size. This lower payment reduces immediate financial strain but extends the repayment period, leading to more interest accumulating over time.

- Pros: Lower monthly payments, manageable for lower-income borrowers.

- Cons: Longer repayment periods, potentially significantly higher total interest paid.

Loan Forgiveness Programs

Several loan forgiveness programs exist, offering the potential to have remaining loan balances forgiven after a certain number of qualifying payments. These programs often require participation in income-driven repayment plans for a specified period, typically 20 or 25 years. While loan forgiveness eliminates the remaining balance, it’s crucial to understand that you will have paid a substantial amount of interest over the extended repayment period.

For instance, a teacher who works in a low-income school district for 10 years might qualify for loan forgiveness under the Public Service Loan Forgiveness (PSLF) program. While this forgives their remaining debt, they would have still accumulated significant interest during the 10 years of repayment. The amount of interest paid will depend on factors like the initial loan amount, interest rate, and the specific IDR plan used.

- Pros: Potential for complete loan forgiveness after meeting specific requirements.

- Cons: Often requires a lengthy repayment period, resulting in substantial interest paid even with forgiveness.

Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a proactive approach. Understanding your repayment options and employing smart strategies can significantly reduce the overall cost and time it takes to become debt-free. This section Artikels several key strategies to help you navigate your student loan journey successfully.

Reducing Total Interest Paid on Student Loans

Minimizing interest payments is crucial for faster debt repayment. Several strategies can achieve this. High-interest loans should be prioritized for repayment. Consider making extra payments whenever possible, even small amounts can add up over time. Explore income-driven repayment plans, which may lower your monthly payments but extend the repayment period. However, remember that this might increase the total interest paid over the loan’s lifetime. Finally, diligently track your payments and ensure you are on track to meet your goals. Consistent monitoring allows for early identification and correction of any potential issues.

Refinancing Student Loans to Lower Interest Rates

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and the total interest paid over the life of the loan. For example, someone with multiple federal loans at 7% interest might refinance to a single private loan at 4%, saving thousands of dollars over the repayment period. However, it’s important to carefully weigh the pros and cons before proceeding.

Potential Risks Associated with Refinancing Student Loans

While refinancing can be beneficial, it also presents potential risks. Losing access to federal loan benefits, such as income-driven repayment plans and loan forgiveness programs, is a significant consideration. Furthermore, refinancing might lock you into a longer repayment term, potentially increasing the total interest paid if the interest rate savings aren’t substantial enough. A thorough comparison of your current loan terms and the offered refinance terms is essential before making a decision. It’s also wise to check your credit score before applying for refinancing, as a higher score can lead to more favorable interest rates.

A Step-by-Step Guide to Managing and Reducing Student Loan Debt

Effective student loan management involves a structured approach. First, consolidate your loans if you have multiple lenders to simplify repayment. Next, create a realistic budget that includes your student loan payments. Then, explore different repayment plans and choose the one that best aligns with your financial situation. Prioritize high-interest loans for repayment. Regularly review your progress and make adjustments as needed. Finally, consider seeking professional financial advice if you need assistance in developing a personalized repayment strategy. This structured approach ensures a well-defined path to efficiently manage and reduce your student loan debt.

Resources for Finding Current Student Loan Rate Information

Staying informed about current student loan interest rates is crucial for borrowers to make informed decisions about repayment strategies and overall financial planning. Understanding where to find reliable and up-to-date information is the first step in effectively managing your student loan debt. This section Artikels key resources and highlights important factors to consider when evaluating the information presented.

Finding accurate and current information on student loan interest rates requires careful selection of sources. Government websites and reputable financial institutions are generally the most reliable options, offering transparency and avoiding misleading marketing tactics often found on less credible platforms. Always cross-reference information from multiple sources to ensure accuracy and consistency.

Reliable Sources for Student Loan Interest Rate Information

Locating current student loan interest rate information involves accessing trustworthy sources. These sources offer detailed information and avoid misleading or incomplete data, providing a solid foundation for informed decision-making.

- Federal Student Aid (FSA): The U.S. Department of Education’s website, studentaid.gov, provides comprehensive information on federal student loan programs, including current interest rates for various loan types (Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, etc.). This site is the primary source for official information on federal student loans.

- National Education Association (NEA): The NEA, a prominent teachers’ union, often publishes articles and resources related to student loans, including updates on interest rates and repayment options. While not a direct source of rate information, it offers valuable context and analysis.

- Major Financial Institutions: Large banks and financial institutions such as Bank of America, Wells Fargo, and Chase often provide information on private student loans and their associated interest rates. However, it’s crucial to compare rates from multiple institutions, as they vary significantly.

Key Features to Consider When Evaluating Information

Evaluating the credibility and accuracy of information on student loan rates is crucial. Several key features should be considered to ensure you are receiving reliable data that accurately reflects the current market conditions.

- Source Credibility: Verify the source’s reputation and authority. Government websites and established financial institutions are generally more reliable than less-known or commercial sites.

- Date of Publication: Interest rates change frequently. Ensure the information is current and reflects the most recent rates. Look for clearly stated publication or last-updated dates.

- Transparency and Detail: Reliable sources provide clear explanations of the interest rates, including the type of loan, terms, and any associated fees. Be wary of sources that lack transparency or are vague in their descriptions.

- Consistency Across Sources: Compare information from multiple reputable sources to verify accuracy and consistency. Significant discrepancies may indicate unreliable data.

Visual Representation of Student Loan Interest Rate Trends

Understanding the historical and projected trends of student loan interest rates is crucial for borrowers to make informed decisions about their education financing and repayment strategies. Analyzing these trends allows for a better understanding of the interplay between economic factors and the cost of borrowing for higher education.

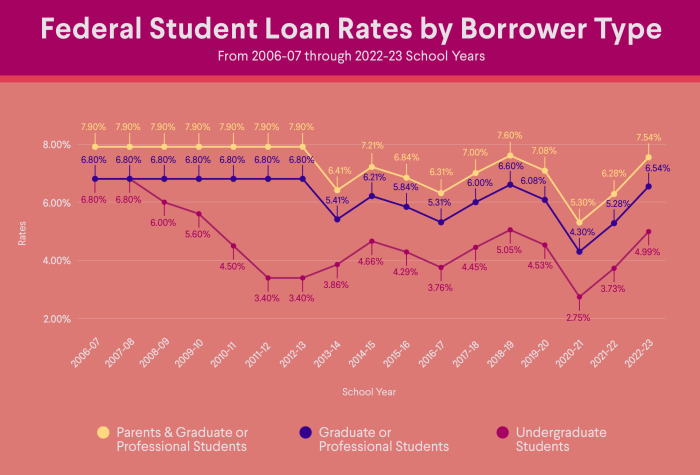

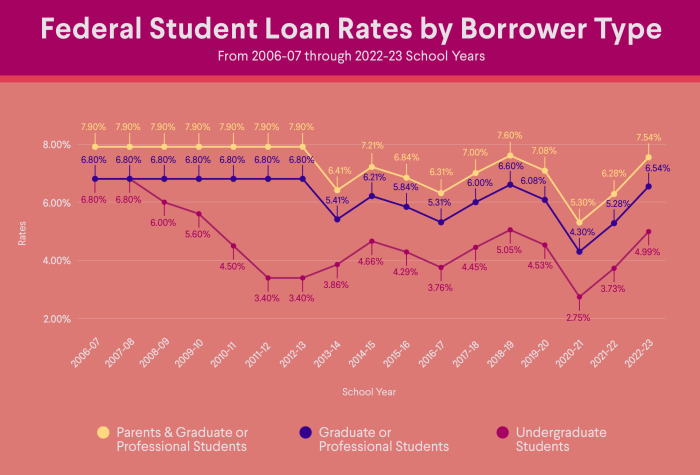

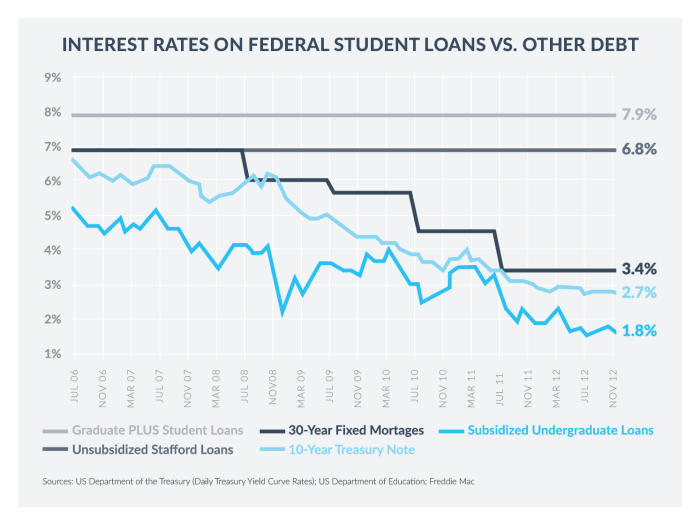

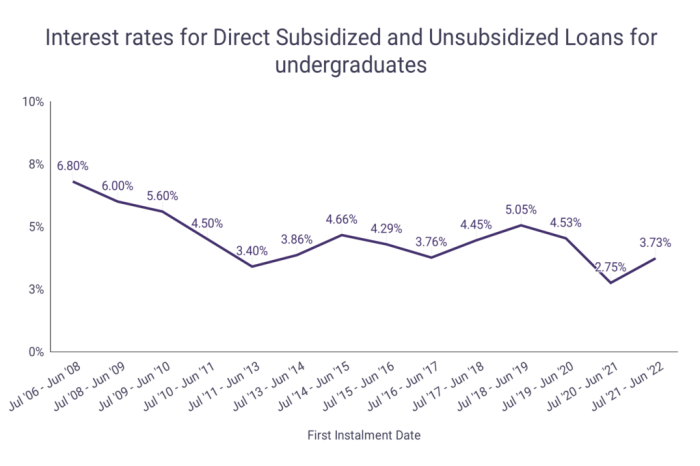

A graph depicting historical student loan interest rates would typically have “Year” on the horizontal (x) axis and “Interest Rate (Percentage)” on the vertical (y) axis. Data points would represent the average interest rate for federal student loans for each year, possibly broken down by loan type (e.g., subsidized and unsubsidized). The graph might show a generally upward trend over several decades, with periods of fluctuation reflecting changes in the overall economic climate. For instance, a sharp increase might be observed during periods of high inflation or increased government borrowing, while decreases might correspond to periods of economic expansion and lower interest rates across the board. Specific data points would need to be sourced from government financial reports and would vary depending on the time period examined. The line connecting the data points would illustrate the overall trend, clearly showing periods of growth and decline in interest rates.

Factors Contributing to Observed Trends

Several interconnected factors influence student loan interest rates. Government fiscal policy plays a significant role; changes in government spending and borrowing directly affect interest rates. The Federal Reserve’s monetary policy, particularly its actions to manage inflation, also has a profound impact. Economic growth and recessionary periods influence the overall cost of borrowing, impacting student loan rates as well. Market forces, such as the supply and demand for loanable funds, also contribute to rate fluctuations. Finally, changes in government regulations and legislation pertaining to student loan programs can directly alter interest rates. For example, a change in the government’s subsidy program for student loans might lead to a change in the overall interest rate.

Projected Future Trends of Student Loan Interest Rates

Projecting future student loan interest rates requires making several assumptions about the future economic climate. If, for example, inflation remains elevated and the Federal Reserve continues to raise interest rates to combat it, then student loan rates are likely to rise. Conversely, if inflation falls and economic growth slows, rates might stabilize or even decline. A projected graph would again utilize “Year” on the x-axis and “Interest Rate (Percentage)” on the y-axis. However, this graph would show a projected line, rather than a historical one, based on a model that incorporates assumptions about future inflation, economic growth, and government policy. The projection might show a range of possible outcomes, reflecting uncertainty about future economic conditions. For example, one scenario might show a continued upward trend in rates, while another scenario might show a stabilization or even a slight decline, depending on the assumed economic environment. The model used to create this projection would be based on existing economic models and historical data, but it would necessarily involve a degree of uncertainty due to the unpredictable nature of future economic events.

Ending Remarks

Successfully managing student loan debt requires proactive planning and a thorough understanding of the current interest rate environment. By utilizing the resources and strategies Artikeld in this guide, you can effectively navigate the complexities of repayment, minimize your overall interest costs, and pave the way for a financially secure future. Remember to regularly review your loan details and explore all available options to find the best repayment plan for your individual circumstances. Proactive management empowers you to take control of your financial future.

Key Questions Answered

What is the difference between a fixed and variable interest rate on a student loan?

A fixed interest rate remains constant throughout the loan’s life, providing predictable monthly payments. A variable interest rate fluctuates based on market conditions, leading to potentially lower initial payments but higher payments if rates rise.

How can I find my current student loan interest rate?

Your loan servicer’s website or monthly statement will clearly state your current interest rate. You can also contact your servicer directly for clarification.

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, which has serious financial consequences.

Are there any penalties for paying off my student loans early?

Most federal student loans do not have prepayment penalties. However, it’s always advisable to check your loan documents to be certain.