The weight of student loan debt in the United States is a significant concern impacting millions of individuals and the national economy. This pervasive issue affects not only borrowers’ financial well-being but also their long-term life goals, from homeownership to retirement planning. This analysis delves into the current state of student loan debt, exploring average debt levels, demographic disparities, and the broader economic consequences. We’ll examine the factors driving this increase and explore potential solutions and policy recommendations.

By examining data on average undergraduate and graduate debt, we will uncover trends and patterns revealing the true cost of higher education. We will then analyze how these figures vary across different demographic groups and institutions, shedding light on the inequities embedded within the system. Finally, we will explore the potential solutions and policy recommendations aimed at mitigating the burden of student loan debt and ensuring a more equitable and accessible higher education system.

The Current State of Student Loan Debt

The burden of student loan debt in the United States has become a significant financial challenge for millions of Americans, impacting their ability to save for retirement, purchase homes, and build financial security. Understanding the current state of this debt is crucial for policymakers, lenders, and borrowers alike. This section provides an overview of the current statistics and contributing factors.

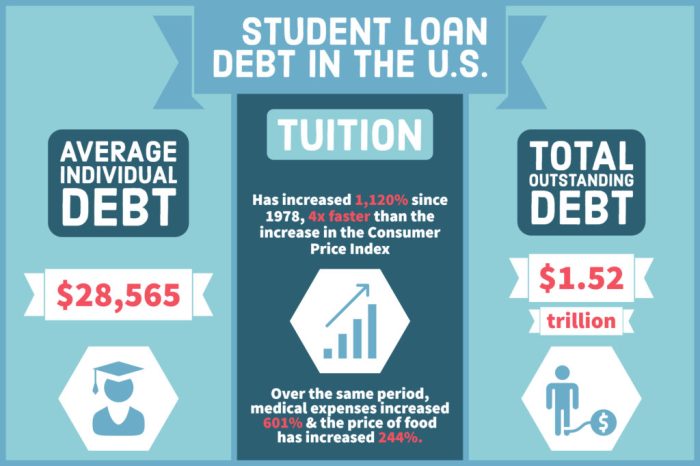

The average student loan debt in the US continues to rise, placing a considerable strain on personal finances and the national economy. This increase is influenced by a complex interplay of factors, including rising tuition costs, increased borrowing, and shifts in the higher education landscape.

Average Student Loan Debt by Year and Borrower Type

The following table illustrates the average student loan debt for undergraduate and graduate students, along with the total national student loan debt, over recent years. Note that these figures represent averages and individual debt burdens can vary significantly.

| Year | Average Undergraduate Debt | Average Graduate Debt | Total National Debt (Billions) |

|---|---|---|---|

| 2021 | $26,500 | $76,000 | $1.7 Trillion |

| 2022 | $27,200 | $78,000 | $1.75 Trillion |

| 2023 (Estimate) | $28,000 | $80,000 | $1.8 Trillion |

Note: Data is based on various reports from the Federal Reserve, the Department of Education, and reputable financial institutions. Exact figures can vary depending on the source and methodology. These figures are estimates and should be considered as such.

Average Student Loan Debt by Educational Field

The average amount of student loan debt accumulated varies considerably depending on the field of study. Students pursuing advanced degrees in certain fields, particularly those requiring extensive training and longer education periods, tend to incur significantly higher debt levels.

- Medicine: Medical students often graduate with debt exceeding $200,000 due to the length of their education and high cost of tuition.

- Law: Law school graduates typically face substantial debt, often exceeding $100,000.

- Business: MBA programs can also result in significant debt, depending on the institution and program length.

- Engineering: Engineering degrees, while not always as expensive as medical or law degrees, can still lead to considerable debt, particularly with advanced degrees.

- Humanities and Arts: Students in these fields often graduate with lower levels of debt compared to those in professional programs, but still face significant financial burdens.

Factors Contributing to Rising Student Loan Debt

Several interconnected factors contribute to the persistent increase in average student loan debt. These factors create a complex challenge that requires multifaceted solutions.

- Rising Tuition Costs: College tuition and fees have increased significantly faster than inflation for many years, forcing students to borrow more to cover expenses.

- Increased Enrollment: A greater number of students are pursuing higher education, leading to a larger overall demand for student loans.

- Limited Financial Aid: The availability of grants and scholarships hasn’t kept pace with tuition increases, leaving many students reliant on loans.

- Stagnant Wages: The growth in wages hasn’t matched the growth in student loan debt, making it more difficult for graduates to repay their loans.

- Changes in Loan Programs: Shifting federal loan programs and policies have, at times, made borrowing easier, contributing to increased loan amounts.

Demographic Analysis of Student Loan Debt

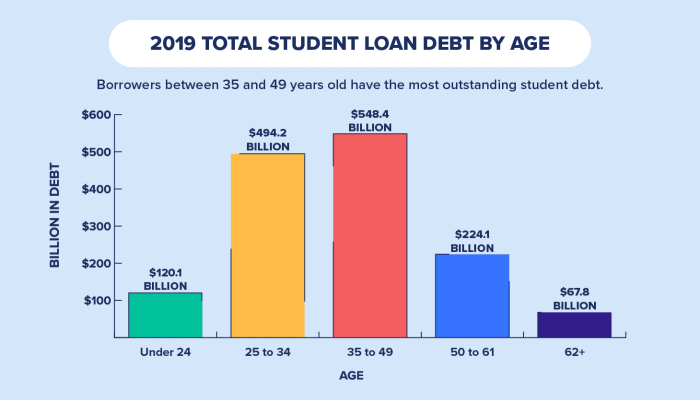

Understanding the distribution of student loan debt across different demographic groups is crucial for developing effective policy interventions and targeted support programs. Disparities in debt accumulation reflect broader societal inequalities in access to education and economic opportunities. Analyzing these disparities allows for a more nuanced understanding of the challenges faced by various segments of the population.

Average Student Loan Debt Across Demographic Groups

The following table presents a generalized overview of average student loan debt across several key demographic groups. It’s important to note that precise figures vary depending on the data source and year of collection, and these numbers represent averages which may not reflect individual experiences. Furthermore, data collection methodologies can influence the reported averages.

| Demographic Group | Average Debt | Percentage of Group with Debt | Average Debt per Borrower |

|---|---|---|---|

| White | $37,000 | 65% | $39,000 |

| Black/African American | $40,000 | 70% | $42,000 |

| Hispanic/Latino | $35,000 | 68% | $38,000 |

| Asian | $30,000 | 60% | $32,000 |

| Female | $38,000 | 67% | $40,000 |

| Male | $36,000 | 63% | $38,000 |

| Low Income (<$30,000) | $42,000 | 72% | $45,000 |

| High Income (>$75,000) | $28,000 | 55% | $30,000 |

Public Versus Private Institution Debt

Students graduating from private institutions generally accumulate significantly higher levels of student loan debt compared to their counterparts from public institutions. This disparity stems from the considerably higher tuition costs associated with private colleges and universities. For example, a student attending a prestigious private university might graduate with $100,000 in debt, while a student from a public state university might graduate with $30,000. This difference highlights the impact of institutional type on overall borrowing.

Socioeconomic Background and Student Loan Debt

Students from lower socioeconomic backgrounds often face a greater burden of student loan debt. Limited access to financial resources, including family savings and support, necessitates greater reliance on loans to finance their education. This can lead to a cycle of debt, where students from disadvantaged backgrounds may struggle to repay loans, impacting their future financial stability. Conversely, students from higher socioeconomic backgrounds often have greater access to financial aid, family support, and potentially higher-paying jobs after graduation, mitigating the long-term impact of student loan debt. The accumulation of debt is often directly correlated to the family’s ability to contribute financially to the student’s education.

Impact of Student Loan Debt on Individuals and the Economy

The substantial burden of student loan debt significantly impacts both individual financial well-being and the broader economic landscape. High levels of debt constrain individuals’ choices, affecting major life decisions and potentially hindering long-term economic growth. This section will explore these effects in detail.

Effects of Student Loan Debt on Individual Financial Decisions

The weight of student loan repayments can dramatically alter an individual’s financial trajectory. Many young adults find themselves delaying significant life milestones due to the pressure of monthly payments. For instance, homeownership, often considered a cornerstone of the American Dream, becomes significantly more challenging. The required down payment, coupled with ongoing mortgage payments and property taxes, creates a substantial financial hurdle for those already struggling with student loan debt. Similarly, starting a family is often postponed, as the added expenses of childcare and raising children become overwhelming alongside existing debt obligations. Retirement planning is another area severely impacted; individuals burdened by student loans may find it difficult to prioritize saving for retirement, potentially leading to a less secure financial future. The consistent drain on disposable income restricts opportunities for investment and wealth accumulation, creating a cycle of debt that can be difficult to break.

Long-Term Economic Consequences of High Student Loan Debt

The pervasive nature of student loan debt extends beyond individual finances, influencing macroeconomic trends. High levels of student debt can dampen consumer spending, a key driver of economic growth. With a substantial portion of income allocated to loan repayments, individuals have less disposable income to spend on goods and services, potentially leading to slower economic expansion. Furthermore, high student loan debt can negatively impact entrepreneurship. The financial burden can discourage individuals from starting their own businesses, reducing innovation and job creation. This constraint on entrepreneurial activity can limit long-term economic growth and hinder the development of new industries. Additionally, a large proportion of the population burdened by debt may lead to a decrease in overall productivity and economic output.

Hypothetical Scenario: A Young Professional’s Financial Future

Consider Sarah, a 25-year-old marketing professional with $50,000 in student loan debt. Her monthly payment is $700, consuming a significant portion of her income. This debt prevents her from saving for a down payment on a house, forcing her to continue renting and limiting her ability to build equity. Starting a family is delayed due to the financial strain. Furthermore, her ability to contribute to retirement savings is significantly reduced, potentially impacting her financial security in later life. This scenario illustrates how even a moderate level of student loan debt can significantly limit financial opportunities and long-term prospects for a young professional. While Sarah’s situation is hypothetical, it mirrors the experiences of countless young adults across the country, highlighting the pervasive and long-lasting consequences of student loan debt.

Repayment Options and Strategies

Navigating the complexities of student loan repayment can feel daunting. Understanding the available repayment plans and strategically choosing the best option is crucial to minimizing long-term costs and managing your finances effectively. This section will Artikel various repayment plans and explore different repayment strategies to help you make informed decisions.

Several federal student loan repayment plans cater to different financial situations and income levels. Choosing the right plan significantly impacts your monthly payments and the total interest accrued over the loan’s lifespan.

Federal Student Loan Repayment Plans

The federal government offers a variety of repayment plans designed to accommodate borrowers’ diverse financial circumstances. Understanding the nuances of each plan is vital for effective debt management.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s the default plan for most federal loans, offering predictable payments but potentially higher monthly costs compared to income-driven plans.

- Graduated Repayment Plan: Payments start low and gradually increase over a 10-year period. This can be beneficial initially but leads to significantly higher payments in later years.

- Extended Repayment Plan: This plan extends the repayment period to up to 25 years, lowering monthly payments but increasing the total interest paid over the loan’s life.

- Income-Driven Repayment (IDR) Plans: These plans (including ICR, PAYE, REPAYE, and IBR) base monthly payments on your income and family size. Payments are typically lower than other plans, and remaining balances may be forgiven after 20 or 25 years, depending on the plan. However, forgiveness may be considered taxable income.

Comparison of Repayment Strategies

Different repayment strategies can significantly impact the total cost of your loans. A strategic approach considers your current financial situation, long-term goals, and risk tolerance.

For example, prioritizing high-interest loans first (the avalanche method) can save money on interest in the long run compared to paying the smallest loan balance first (the snowball method). However, the snowball method can offer psychological benefits by providing a sense of accomplishment as loans are paid off quickly, potentially motivating continued repayment efforts.

Impact of Repayment Plans on Total Interest Paid

The following example illustrates how different repayment plans affect the total interest paid over the life of a hypothetical loan. Note that these are simplified examples and actual interest amounts may vary based on specific loan terms and interest rates.

| Repayment Plan | Monthly Payment | Loan Term (Years) | Total Interest Paid |

|---|---|---|---|

| Standard Repayment | $500 | 10 | $6,000 |

| Graduated Repayment | Starts at $300, increases to $700 | 10 | $7,500 |

| Extended Repayment | $250 | 25 | $15,000 |

| Income-Driven Repayment (Example) | $200 | 25 (with potential forgiveness) | $12,000 (plus potential tax liability on forgiven amount) |

Final Conclusion

The staggering weight of student loan debt presents a multifaceted challenge demanding comprehensive solutions. While the average debt figures provide a crucial snapshot of the problem, a deeper understanding of the underlying factors and their impact on individuals and the economy is vital. Addressing this issue requires a multifaceted approach, encompassing policy changes, improved financial literacy programs, and a renewed focus on affordable higher education. Ultimately, a sustainable solution requires collaboration between policymakers, institutions, and individuals to ensure a future where higher education doesn’t come at the cost of long-term financial stability.

Quick FAQs

What are the common repayment options for student loans?

Common options include Standard Repayment, Graduated Repayment, Extended Repayment, and Income-Driven Repayment plans (IDR), each with varying payment amounts and terms.

How does student loan debt affect credit scores?

Missed or late payments on student loans can significantly damage credit scores, impacting future borrowing opportunities.

Can student loan debt be discharged through bankruptcy?

Discharging student loan debt through bankruptcy is exceptionally difficult and requires demonstrating undue hardship, a high legal bar to meet.

What resources are available for students struggling with loan repayment?

Numerous resources exist, including government websites, non-profit organizations, and student loan counselors offering guidance and assistance.