Navigating the complexities of student loan debt is a significant challenge for many. Understanding your student loan debt-to-income ratio (DTI) is crucial for making informed financial decisions. This ratio, a simple yet powerful indicator, reveals how much of your monthly income is dedicated to repaying student loans. A high DTI can significantly impact your ability to secure mortgages, save for retirement, and even obtain other loans. This guide delves into the intricacies of calculating and managing your student loan DTI, offering strategies for effective debt management and highlighting the long-term implications of your choices.

We will explore the calculation of this key ratio, providing clear examples and illustrating how different income levels affect acceptable DTI percentages. We’ll examine the impact of high DTI on major life decisions like homeownership and retirement planning, and discuss various strategies to reduce your debt burden, including refinancing, income-driven repayment plans, and debt consolidation. Government policies, the role of financial literacy, and illustrative case studies will further illuminate the path to responsible debt management.

Defining Student Loan Debt to Income Ratio

Understanding your student loan debt-to-income ratio (DTI) is crucial for managing your finances and securing future opportunities. This ratio provides a clear picture of your ability to repay your student loans relative to your earnings. A high DTI can indicate potential financial strain, while a low DTI suggests greater financial stability.

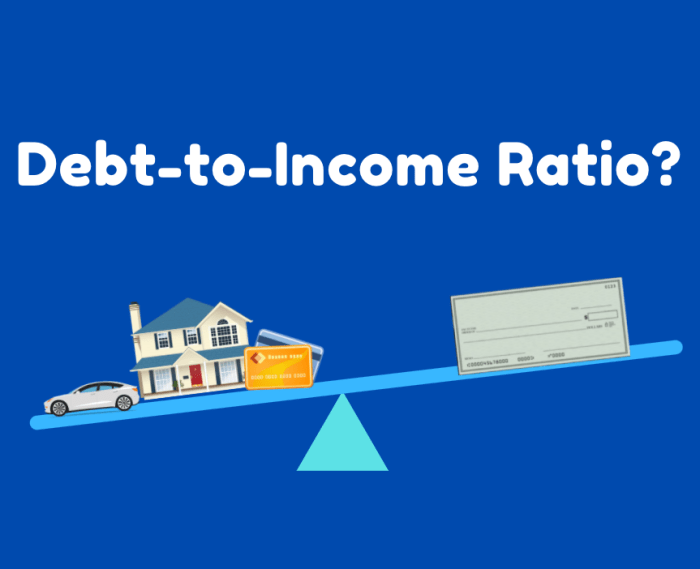

The student loan debt-to-income ratio is calculated by dividing your total monthly student loan payments by your gross monthly income. Gross income refers to your income before taxes and other deductions. The result is expressed as a percentage. For example, if your total monthly student loan payments are $500 and your gross monthly income is $3000, your student loan DTI is (500/3000) * 100% = 16.7%.

Student Loan Debt-to-Income Ratio Examples and Implications

Different debt-to-income ratios carry varying implications for your financial health. A low DTI, generally below 10%, indicates a strong capacity to manage your student loan repayments. This often leads to better credit scores and improved access to financial products like mortgages or auto loans. Conversely, a high DTI, typically above 43%, might suggest financial difficulties. Lenders may view this as a higher risk, potentially impacting your approval for loans or credit cards. A DTI between 10% and 43% falls within a moderate range, requiring careful monitoring and budgeting.

Acceptable Student Loan Debt-to-Income Ratios Based on Income

The acceptable DTI varies depending on individual circumstances and lender policies. However, a general guideline can provide a useful framework. Lower income levels generally require lower DTIs to ensure manageable repayments. Higher income levels afford more flexibility.

| Gross Monthly Income | Acceptable DTI Range (%) | Implications | Example |

|---|---|---|---|

| $2,000 | 5-10% | Strong financial position; easier loan approvals. | $100-$200 monthly student loan payments |

| $4,000 | 10-20% | Good financial standing; manageable repayments. | $400-$800 monthly student loan payments |

| $6,000 | 15-30% | Moderate financial standing; requires careful budgeting. | $900-$1800 monthly student loan payments |

| $8,000 | 20-35% | Higher repayment capacity; still requires financial awareness. | $1600-$2800 monthly student loan payments |

Note: These are general guidelines. Individual circumstances and lender requirements may vary. It’s always advisable to consult with a financial advisor for personalized advice.

Impact of Student Loan Debt on Financial Decisions

A high student loan debt-to-income ratio significantly impacts major life decisions, often forcing borrowers to make difficult choices and delaying or forgoing opportunities available to those with less debt. The weight of monthly payments and the overall debt burden can severely restrict financial flexibility and limit future prospects.

The impact extends far beyond simply managing monthly payments; it profoundly shapes long-term financial planning and overall well-being.

Impact on Homeownership

A substantial student loan debt burden can make homeownership a distant dream for many. Lenders assess an applicant’s debt-to-income ratio (DTI) carefully when considering mortgage applications. A high DTI, heavily influenced by student loan payments, can result in loan denial or necessitate a smaller, less desirable mortgage. For example, someone with a high student loan debt may only qualify for a smaller home than they could afford otherwise, or may need to delay home purchase for several years to reduce their DTI. This delay can lead to missed opportunities in the real estate market and the loss of potential equity growth. Furthermore, higher interest rates may be applied to those with high DTI ratios, increasing the overall cost of the mortgage.

Impact on Retirement Savings

Student loan repayments often compete directly with retirement savings. Individuals burdened with substantial debt may find it challenging to contribute meaningfully to retirement accounts, especially in the early years of their careers when compounding returns are most impactful. This can lead to a significant shortfall in retirement funds, potentially impacting their quality of life in later years. Consider the scenario of two individuals earning the same salary: one with significant student loan debt, and another with minimal debt. The individual with the debt may have to prioritize loan repayments over retirement contributions, significantly reducing their retirement nest egg compared to their debt-free counterpart.

Impact on Securing Other Loans

Securing loans for other purposes, such as purchasing a car or starting a business, becomes considerably more difficult with a high student loan debt-to-income ratio. Lenders view this ratio as a key indicator of creditworthiness and repayment ability. A high ratio signals increased risk, potentially leading to loan denials or less favorable loan terms, such as higher interest rates or stricter repayment schedules. This can create a vicious cycle, limiting access to credit needed for further financial advancement and hindering opportunities for wealth building. For instance, someone seeking a small business loan might be rejected due to a high student loan debt burden, despite a strong business plan, because the lender perceives a high risk of default.

Strategies for Managing Student Loan Debt

Managing student loan debt effectively requires a proactive approach and a thorough understanding of available options. The right strategy depends on individual circumstances, including loan type, interest rates, and income. This section Artikels several key strategies to help borrowers navigate their repayment journey and achieve financial freedom.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a private lender, often at a lower interest rate. This can significantly reduce the total amount you pay over the life of the loan. However, refinancing typically requires a good credit score and stable income. It’s crucial to compare offers from multiple lenders before making a decision, ensuring you understand all the terms and conditions. For example, a borrower with federal loans at 6% interest could potentially refinance to a private loan with a 4% interest rate, saving hundreds or even thousands of dollars over the repayment period. The process usually involves applying online, providing financial documentation, and undergoing a credit check.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payments based on your income and family size. These plans are offered by the federal government and can significantly lower your monthly payments, making them more manageable, especially during periods of lower income. Several IDR plans exist, each with different eligibility requirements and repayment terms. For instance, the Revised Pay As You Earn (REPAYE) plan caps monthly payments at 10% of discretionary income, while the Income-Based Repayment (IBR) plan offers similar benefits. Choosing the right IDR plan requires careful consideration of long-term repayment costs and potential forgiveness after a certain number of years. It is important to note that IDR plans may result in a longer repayment period and higher total interest paid over the life of the loan.

Debt Consolidation

Debt consolidation involves combining multiple student loans into a single loan. This can simplify repayment by reducing the number of payments and potentially lowering your monthly payment amount. Consolidation can be done through either federal or private lenders. Federal consolidation offers the advantage of maintaining federal loan benefits, such as income-driven repayment plans and potential loan forgiveness programs. Private consolidation, on the other hand, may offer lower interest rates but could sacrifice these federal benefits. For example, a borrower with five different federal loans could consolidate them into one, streamlining their repayment process and potentially reducing administrative burden. Careful consideration should be given to the interest rate offered and the terms of the consolidated loan.

Sample Repayment Plan

Let’s consider a hypothetical scenario: A borrower has $50,000 in student loan debt with a 6% interest rate. Here’s a comparison of repayment under different strategies:

| Strategy | Monthly Payment (Estimate) | Total Interest Paid (Estimate) | Repayment Period (Years) |

|---|---|---|---|

| Standard 10-year repayment | $550 | $16,000 | 10 |

| Refinancing to 4% interest | $480 | $10,000 | 10 |

| Income-Driven Repayment (Example) | $300 | $25,000 | 25 |

| Debt Consolidation (to 5% interest) | $520 | $14,000 | 10 |

Note: These are simplified estimations. Actual payments and interest paid will vary based on individual loan terms and chosen repayment plan. Consult a financial advisor for personalized guidance.

Government Policies and Student Loan Debt

Government policies play a significant role in shaping the student loan landscape and, consequently, the student loan debt-to-income ratio for borrowers. These policies range from direct loan programs and repayment assistance to initiatives aimed at reducing the overall cost of higher education. Understanding the nuances of these policies is crucial to comprehending the complexities of student loan debt.

Different government policies have been implemented to address the rising student loan debt crisis. These approaches vary significantly in their design, implementation, and impact on borrowers. Some focus on making repayment more manageable, while others aim to prevent debt accumulation in the first place. The effectiveness of each approach is a subject of ongoing debate.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust monthly student loan payments based on a borrower’s income and family size. Several IDR plans exist, each with its own eligibility criteria and payment calculation method. These plans typically offer lower monthly payments than standard repayment plans, but they often extend the repayment period, potentially leading to higher total interest paid over the life of the loan. The impact on the debt-to-income ratio is a reduction in the monthly debt burden, making it easier for borrowers to manage their finances, though the overall debt may take longer to eliminate. For example, a borrower with a high debt-to-income ratio might see this ratio significantly improve under an IDR plan, even though the total debt remains unchanged.

Loan Forgiveness Programs

Several government programs offer partial or complete loan forgiveness based on specific criteria, such as working in public service (Public Service Loan Forgiveness or PSLF) or teaching in underserved areas. These programs aim to incentivize individuals to pursue careers in public service or address workforce shortages. The potential benefit is a significant reduction or elimination of student loan debt, dramatically improving the debt-to-income ratio. However, drawbacks include stringent eligibility requirements and the potential for program changes or delays in forgiveness. For instance, the PSLF program has faced criticism for its complex application process and high rejection rate, limiting its effectiveness for many borrowers.

Changes to Interest Rates and Fees

Government policies also influence the cost of student loans through adjustments to interest rates and fees. Lower interest rates reduce the total amount borrowers pay over the life of the loan, improving their ability to manage their debt. Conversely, higher interest rates increase the overall cost and can negatively impact the debt-to-income ratio. For example, a decrease in interest rates on federal student loans could potentially lower the monthly payment and thus improve the debt-to-income ratio for many borrowers. Similarly, eliminating or reducing loan origination fees could provide immediate savings and positively impact the debt-to-income ratio.

Investment in Higher Education Affordability

Government policies that aim to increase the affordability of higher education, such as increased funding for grants and scholarships, can indirectly reduce student loan debt. By lowering the reliance on loans, these policies help to mitigate the accumulation of debt and improve the debt-to-income ratio for future graduates. Increased funding for Pell Grants, for example, can make college more accessible to low-income students, reducing their need to borrow large sums of money. This preventative approach aims to address the root cause of high student loan debt, rather than focusing solely on repayment solutions.

Long-Term Effects of Student Loan Debt

The weight of student loan debt can extend far beyond graduation, significantly impacting various aspects of an individual’s financial well-being for years, even decades to come. The long-term implications are multifaceted, affecting major life decisions and potentially hindering the achievement of long-term financial goals. Understanding these effects is crucial for effective debt management and planning for a secure future.

High student loan debt can impose significant constraints on long-term financial planning. The substantial monthly payments required can severely limit disposable income, leaving less money available for saving, investing, and other crucial financial priorities. This can delay major life milestones such as homeownership, starting a family, and retirement planning. Furthermore, the persistent pressure of debt can lead to increased stress and anxiety, negatively impacting overall well-being.

Impact on Homeownership

The dream of homeownership can become a distant reality for many burdened by substantial student loan debt. High monthly loan payments reduce the amount of money available for a down payment and ongoing mortgage expenses. Lenders also carefully scrutinize debt-to-income ratios, and high student loan debt can significantly lower credit scores, making it more difficult to qualify for a mortgage or secure favorable interest rates. This can lead to delays in homeownership, potentially resulting in missed opportunities for building equity and wealth. For example, a young professional with $100,000 in student loan debt might struggle to save for a down payment, even with a stable income, leading to a delayed home purchase compared to a peer with minimal debt.

Delayed Retirement Planning

Student loan debt can significantly impact retirement savings. The need to prioritize loan repayment often leaves little room for contributing to retirement accounts like 401(k)s or IRAs. This delay in saving can severely impact the size of a retirement nest egg, potentially leading to a less comfortable retirement or the need to work longer than planned. The compounding effect of lost investment opportunities over decades can be substantial. For instance, delaying retirement savings by five years due to student loan repayments could result in a significantly smaller retirement fund compared to someone who started saving earlier, even with the same annual contribution amount.

Impact on Family Formation

The financial strain of high student loan debt can also affect decisions related to starting a family. The costs associated with raising children are substantial, and the added burden of loan payments can make it difficult to manage household finances effectively. Couples might delay having children or choose to have fewer children than they would have otherwise preferred due to financial constraints. This illustrates the ripple effect of student loan debt, extending beyond individual finances to influence significant life choices. For example, a couple with significant combined student loan debt may choose to delay having children until their debt is significantly reduced, impacting their family planning timeline.

Hypothetical Scenario: Two Graduates

Consider two graduates, both with the same starting salary. Graduate A aggressively tackles their $50,000 student loan debt through refinancing and disciplined budgeting, paying it off within five years. Graduate B makes minimum payments on their $50,000 loan, stretching repayments over the maximum loan term. After ten years, Graduate A has significantly more disposable income, a higher credit score, and a substantial head start on saving for a house and retirement. Graduate B, on the other hand, still faces significant monthly payments, limiting their ability to save and potentially impacting their long-term financial stability. This scenario highlights the importance of proactive debt management strategies in mitigating the long-term consequences of student loans.

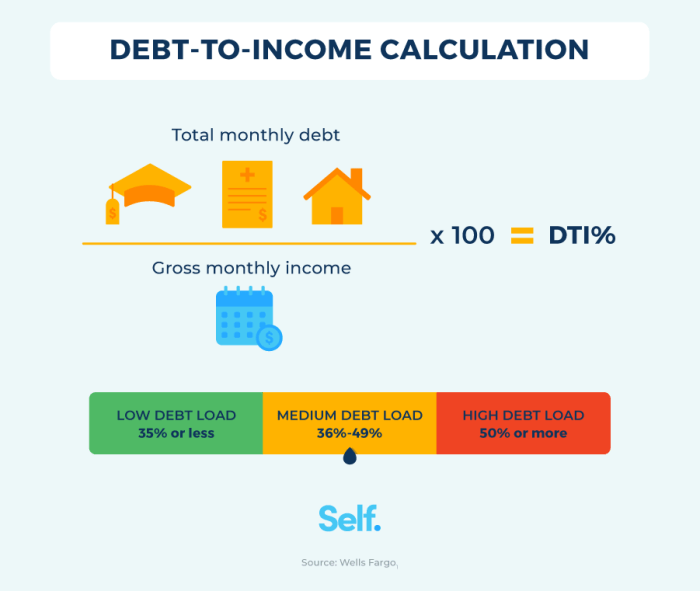

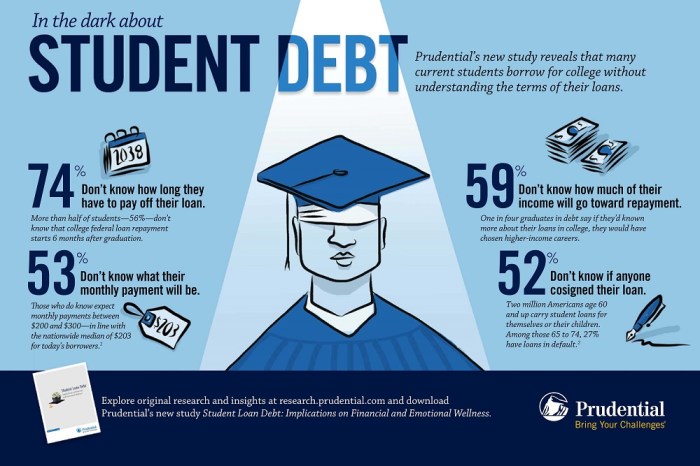

The Role of Financial Literacy

Navigating the complexities of student loan debt requires a strong foundation in financial literacy. Understanding key financial concepts empowers individuals to make informed decisions, effectively manage their debt, and ultimately achieve their financial goals. Without this knowledge, borrowers may struggle to understand their repayment options, leading to potentially detrimental consequences such as default.

Financial education significantly enhances an individual’s ability to comprehend their debt-to-income ratio (DTI). A clear understanding of DTI allows borrowers to assess their financial health accurately, identify potential risks, and develop appropriate strategies for debt management. For example, someone with a high DTI might explore options like income-driven repayment plans or debt consolidation to lower their monthly payments and improve their overall financial stability. This understanding is crucial for long-term financial planning and avoiding financial distress.

Understanding Debt-to-Income Ratio Calculation and Interpretation

Calculating and interpreting the DTI is a fundamental aspect of financial literacy. The DTI is calculated by dividing total monthly debt payments (including student loans, credit cards, and other loans) by gross monthly income. A lower DTI indicates better financial health. For instance, a DTI of 36% or less is generally considered manageable, while a higher DTI might signal potential financial strain. Understanding this ratio allows borrowers to proactively address potential issues and make informed decisions regarding their student loan repayment strategies. Understanding the impact of different repayment plans on their DTI further empowers them to choose the best option for their individual circumstances.

Key Financial Literacy Concepts for Managing Student Loan Debt

A solid grasp of several key financial concepts is crucial for effectively managing student loan debt. These concepts provide the framework for making sound financial decisions and avoiding common pitfalls.

- Budgeting and Expense Tracking: Creating a realistic budget and meticulously tracking expenses are essential for understanding cash flow and identifying areas where spending can be reduced to allocate more funds towards loan repayment.

- Understanding Interest Rates and Loan Amortization: Knowing how interest accrues and the impact of different interest rates on total repayment costs is vital. Understanding loan amortization schedules helps borrowers visualize their repayment journey and plan accordingly.

- Repayment Plan Options: Familiarizing oneself with various repayment plans (standard, graduated, income-driven, etc.) is crucial for selecting the most suitable option based on individual income and financial circumstances. Understanding the pros and cons of each plan is critical.

- Credit Scores and Their Impact: Understanding how credit scores are calculated and their influence on future borrowing opportunities is crucial. Maintaining a good credit score can significantly impact access to favorable loan terms in the future.

- Debt Consolidation and Refinancing: Knowing when and how to consolidate or refinance student loans can potentially lower interest rates and simplify repayment. However, it’s crucial to understand the associated fees and implications before making such decisions.

Illustrative Case Studies

Examining real-world examples of individuals navigating student loan debt offers valuable insights into effective management strategies and potential pitfalls. These case studies illustrate the diverse experiences and outcomes associated with different approaches to loan repayment.

Successful Student Loan Debt Management: The Case of Sarah Miller

Sarah Miller, a 30-year-old marketing professional, graduated with $40,000 in student loan debt. She immediately began aggressively paying down her loans, prioritizing high-interest loans first using the avalanche method. She meticulously tracked her spending, identified areas for savings, and created a realistic budget that incorporated her loan payments. Sarah also actively explored options for loan forgiveness programs applicable to her profession and actively sought opportunities for professional development that would increase her earning potential. Her proactive approach, coupled with financial discipline, allowed her to pay off her student loans within five years, significantly improving her financial well-being. This demonstrates the power of early repayment, strategic budgeting, and proactive career planning.

Struggling with High Student Loan Debt: The Case of David Lee

David Lee, a 35-year-old teacher, accumulated $100,000 in student loan debt pursuing a graduate degree. He initially struggled to manage his payments, often deferring or forbearing his loans, leading to accumulating interest. David’s income did not keep pace with his debt, and he faced challenges prioritizing loan payments over other essential expenses. He lacked a comprehensive financial plan and failed to actively explore options like income-driven repayment plans or loan refinancing. His situation highlights the potential consequences of insufficient planning, inadequate income, and a lack of proactive debt management strategies. The accumulation of interest significantly extended his repayment timeline and impacted his overall financial stability.

Comparison of Case Studies: Best Practices and Pitfalls

Sarah’s success stems from her proactive approach to debt management, including aggressive repayment strategies, meticulous budgeting, and career planning. Conversely, David’s struggles underscore the importance of comprehensive financial planning, considering income-driven repayment options, and proactively seeking solutions when facing financial challenges. The contrast between these two case studies clearly illustrates the significant impact of early intervention, financial literacy, and the utilization of available resources in successfully navigating student loan debt. Sarah’s story exemplifies the benefits of prioritizing debt repayment and actively managing finances, while David’s experience serves as a cautionary tale of the consequences of neglecting these crucial aspects.

Final Conclusion

Successfully managing student loan debt requires a proactive and informed approach. By understanding your student loan debt-to-income ratio and employing effective strategies, you can navigate the complexities of repayment and build a secure financial future. Remember, financial literacy is key – equipping yourself with the knowledge to understand your DTI and implement appropriate strategies empowers you to take control of your financial well-being and achieve long-term financial stability. Don’t hesitate to seek professional financial advice if needed; it’s an investment in your future.

Query Resolution

What happens if my student loan debt-to-income ratio is too high?

A high DTI can make it difficult to qualify for mortgages, auto loans, and other forms of credit. It can also limit your ability to save for retirement and other long-term goals.

How often should I check my student loan debt-to-income ratio?

It’s beneficial to review your DTI at least annually, or more frequently if your income or debt levels change significantly.

Can I improve my student loan debt-to-income ratio?

Yes, through strategies like refinancing to lower your interest rate, consolidating loans, or increasing your income.

What resources are available to help me manage my student loan debt?

Many non-profit organizations and government agencies offer free resources and counseling to help manage student loan debt. Your loan servicer can also provide information and support.