Navigating the complexities of student loan repayment can feel overwhelming. Understanding your options, especially the potential benefits and drawbacks of deferment, is crucial for long-term financial health. A student loan deferment calculator provides a powerful tool to visualize the impact of deferring your payments, allowing you to make informed decisions about your repayment strategy. This guide explores the intricacies of student loan deferment, offering a comprehensive overview of available programs, eligibility criteria, and the long-term financial implications.

We will delve into the mechanics of a student loan deferment calculator, explaining its functionality and demonstrating how input parameters such as loan amount, interest rate, and deferment period influence the calculated outcomes. We’ll also compare deferment to alternative repayment strategies, such as forbearance and income-driven repayment plans, helping you determine the best approach for your unique circumstances. Real-world examples will illustrate the potential cost of deferment and highlight the importance of careful planning.

Understanding Student Loan Deferment

Student loan deferment allows you to temporarily postpone your student loan payments without penalty. This can provide crucial financial relief during periods of hardship or career transitions. Understanding the different types of deferment available and their eligibility requirements is key to effectively managing your student loans.

Types of Student Loan Deferment Programs

Several types of deferment programs exist, each with specific eligibility criteria. The availability of these programs depends on your loan type (federal or private) and your circumstances. Federal student loans generally offer more deferment options than private loans.

Eligibility Criteria for Deferment

Eligibility for student loan deferment varies depending on the type of deferment sought. Generally, you’ll need to demonstrate financial hardship or meet specific qualifying circumstances. Documentation will be required to support your application. Examples of qualifying circumstances might include unemployment, economic hardship, or enrollment in a graduate program. Specific requirements are Artikeld by the loan servicer.

Applying for Student Loan Deferment

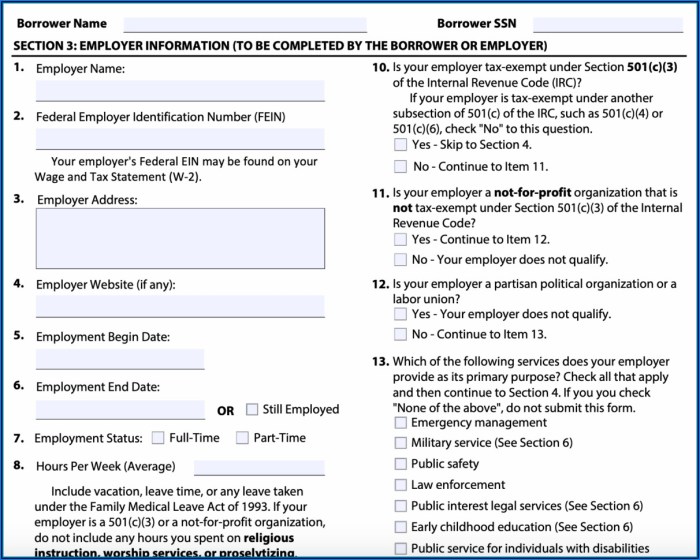

The application process typically involves contacting your loan servicer directly. You will need to complete an application form and provide supporting documentation to verify your eligibility. The specific documents required will depend on the type of deferment you are applying for. Processing times vary, so it’s essential to apply well in advance of when you need the deferment to begin. A step-by-step guide would generally involve: 1. Contacting your loan servicer; 2. Obtaining the necessary application forms; 3. Gathering supporting documentation; 4. Submitting the completed application; 5. Monitoring the status of your application.

Comparison of Deferment Options

The following table compares the benefits and drawbacks of various deferment options. Note that the availability and specifics of these options can change, so it is crucial to check with your loan servicer for the most up-to-date information.

| Deferment Type | Benefits | Drawbacks | Eligibility |

|---|---|---|---|

| Economic Hardship Deferment | Temporary suspension of payments; avoids late fees | Interest may continue to accrue; may negatively impact credit score if not managed carefully | Demonstrable financial hardship, such as unemployment or significantly reduced income. |

| Unemployment Deferment | Payment suspension during unemployment | Interest may accrue; requires proof of unemployment | Documentation of unemployment status, typically through official unemployment documentation. |

| In-School Deferment | Payment suspension while enrolled at least half-time in an eligible educational program | Interest may accrue on unsubsidized loans | Enrollment verification from the educational institution. |

| Postponement for Military Service | Payment suspension while serving in the military | Interest may accrue on unsubsidized loans | Verification of active duty military service. |

Using a Student Loan Deferment Calculator

Student loan deferment calculators are valuable tools for understanding the financial implications of temporarily postponing your loan payments. They help you visualize how deferment affects your loan balance, interest accrual, and ultimately, your total repayment cost. By inputting key information about your loan, you can generate projections that inform your decision-making process.

A typical student loan deferment calculator requires several key pieces of information to provide accurate estimations. The accuracy of the calculations hinges on the completeness and correctness of the input data. Incorrect data will lead to inaccurate predictions, potentially leading to misinformed financial decisions.

Input Parameters for Accurate Calculations

The necessary inputs typically include the total loan amount, the current annual interest rate, and the length of the deferment period. For instance, if you have a $20,000 loan at a 5% annual interest rate, and you are considering a six-month deferment, these would be the inputs you would provide to the calculator. Additional information, such as the type of loan (federal or private) and whether interest accrues during the deferment period (which is common), may also be requested. The calculator might also ask for the current monthly payment amount, although this may be calculated internally.

User Interface Flow for a Hypothetical Student Loan Deferment Calculator

A user-friendly calculator would likely present a simple form. First, the user would input their loan amount. Next, they would enter their annual interest rate. Following this, the user would specify the length of the deferment period, perhaps using a dropdown menu or a numerical input field (allowing for both months and years). After inputting all necessary data, the user would click a “Calculate” button. The calculator would then process this information and display the projected results in a clear and concise manner. The results screen would display the total interest accrued during the deferment period, the new loan balance at the end of the deferment period, and potentially an estimate of the new monthly payment amount once the deferment period ends.

Impact of Deferment on Total Loan Repayment Amount

Deferring student loan payments can significantly increase the total amount you ultimately repay. While it provides temporary relief from payments, interest continues to accrue during the deferment period. This means that your loan balance will grow larger than if you were making regular payments. For example, a $20,000 loan at 5% interest over a six-month deferment would accumulate approximately $500 in interest (assuming simple interest for ease of understanding). This $500 is added to the principal, increasing the total amount you owe. This additional interest will extend the repayment period or increase the monthly payments needed to repay the loan within the original timeframe, ultimately leading to a higher total repayment amount. The longer the deferment period, the greater the impact on the overall cost of the loan.

The Impact of Deferment on Loan Repayment

Deferring student loan payments might seem like a helpful solution during financial hardship, but it’s crucial to understand its long-term implications. While it provides temporary relief from monthly payments, deferment allows interest to continue accruing on your loan balance, ultimately increasing the total cost of your education. This section explores how deferment affects your loan repayment and offers strategies for managing your debt effectively after the deferment period ends.

Interest accrual during a deferment period significantly impacts the total loan cost. Because you’re not making payments, the interest charges accumulate and are added to your principal balance. This means that when your deferment ends, you’ll owe a larger amount than you originally borrowed. The longer the deferment period, the greater the increase in your overall debt. This phenomenon, known as capitalization of interest, can substantially increase the total interest paid over the life of the loan.

Interest Accrual’s Effect on Total Loan Cost

Let’s consider an example. Suppose you have a $20,000 student loan with a 6% annual interest rate. If you defer payments for one year, the interest accrued during that year would be $1,200 ($20,000 x 0.06). This $1,200 is added to your principal balance, meaning you now owe $21,200. If you continue deferring for another year, the interest calculation will be based on the new, higher principal. This compounding effect significantly increases the total amount you will eventually need to repay. A longer deferment period leads to exponentially higher interest charges, ultimately increasing the total cost of your loan. For example, a three-year deferment could result in a significantly larger increase than a one-year deferment.

Long-Term Financial Implications of Deferment

Deferring versus not deferring student loans presents a clear financial trade-off. While deferment offers short-term relief, it leads to a higher total loan cost over the long term due to accumulated interest. Not deferring, while demanding immediate financial commitment, results in a lower overall cost. Consider the previous example: deferring for even a short period significantly increases the final amount owed. The choice depends on an individual’s immediate financial situation and their ability to manage the increased repayment burden later. Careful consideration of both short-term and long-term consequences is crucial.

Effect of Different Deferment Lengths on Total Interest Paid

The following table illustrates the impact of different deferment lengths on the total interest paid for a $20,000 loan with a 6% annual interest rate. These figures assume no additional payments are made during the deferment period and that the interest is capitalized at the end of each deferment year.

| Deferment Length (Years) | Total Interest Paid (Approximate) |

|---|---|

| 1 | $1,200 + additional interest on the increased principal |

| 2 | Significantly higher than a one-year deferment |

| 3 | Substantially higher than both one and two-year deferments |

Note: The exact figures will vary depending on the loan’s interest rate and capitalization methods. This table provides a general illustration of the compounding effect of interest.

Strategies for Managing Student Loan Debt After Deferment

After a deferment period, it’s crucial to develop a robust repayment strategy to minimize the long-term impact of the accrued interest.

- Create a Realistic Budget: Assess your income and expenses to determine an affordable monthly payment amount.

- Explore Repayment Plans: Investigate different repayment plans offered by your loan servicer, such as income-driven repayment plans, which can adjust your monthly payment based on your income.

- Prioritize High-Interest Loans: If you have multiple loans, focus on repaying those with the highest interest rates first to reduce overall interest costs.

- Consider Refinancing: Explore refinancing options to potentially lower your interest rate and monthly payment, although this may not be suitable for all borrowers.

- Increase Payments When Possible: Make extra payments whenever possible to accelerate your repayment and reduce the total interest paid.

Alternatives to Deferment

Deferment, while offering temporary relief from student loan payments, isn’t always the best solution. Understanding alternative options is crucial for making informed decisions about your student loan repayment strategy. These alternatives offer varying degrees of flexibility and may be more beneficial depending on your individual financial circumstances.

Exploring options like forbearance and income-driven repayment plans allows borrowers to tailor their repayment strategy to their current financial situation. Careful consideration of the long-term implications of each option is essential to ensure you choose the path that best aligns with your financial goals.

Forbearance Compared to Deferment

Forbearance and deferment both temporarily suspend or reduce your student loan payments. However, they differ significantly. Deferment typically requires demonstrating financial hardship or returning to school, and interest may or may not accrue depending on the loan type. Forbearance, on the other hand, is generally granted for a shorter period and is often available for reasons not qualifying for deferment, such as temporary unemployment. Interest typically accrues during forbearance, leading to a larger overall loan balance upon repayment resumption. Choosing between them depends on your specific situation and the terms of your loan. If you qualify for deferment and your loan type allows for non-accruing interest, this is often the preferable option. Otherwise, a careful assessment of the potential interest accrual during forbearance is crucial.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans calculate your monthly payments based on your income and family size. Several IDR plans exist, each with its own eligibility criteria and payment calculation methods. These plans typically offer lower monthly payments than standard repayment plans, potentially making them more manageable during periods of financial strain. However, IDR plans usually extend the repayment period, resulting in higher total interest paid over the life of the loan. This trade-off between lower monthly payments and increased total interest should be carefully weighed against the benefits of manageable monthly payments. For example, an individual with a low income immediately after graduation might find an IDR plan more beneficial than a standard repayment plan, even though it will ultimately cost more in interest.

Choosing Between Deferment and Alternatives: A Decision Flowchart

The decision of whether to pursue deferment or an alternative repayment strategy depends heavily on individual circumstances. A flowchart can help visualize this process.

Imagine a flowchart with a starting point labeled “Facing Student Loan Payment Difficulty?”. From there, a “Yes” branch leads to a decision point: “Do you meet the criteria for deferment (financial hardship, return to school, etc.)?”. A “Yes” answer leads to “Consider Deferment (Check interest accrual rules)”. A “No” answer leads to another decision point: “Is your income significantly low?”. A “Yes” answer leads to “Consider Income-Driven Repayment Plan”. A “No” answer leads to “Consider Forbearance (Note: Interest usually accrues)”. All paths eventually lead to a final box: “Implement Chosen Strategy and Monitor Progress”. This visual representation simplifies the decision-making process by outlining the key questions and their respective outcomes. This approach helps borrowers systematically evaluate their options and choose the most appropriate path.

Illustrative Examples of Deferment Scenarios

Understanding how a student loan deferment calculator works is best done through practical examples. The following scenarios demonstrate how different loan amounts, interest rates, and deferment periods affect the total repayment cost. Remember that these are simplified examples and real-world scenarios may involve additional factors.

Scenario 1: Low Loan Amount, Low Interest Rate, Short Deferment

This scenario involves a $10,000 loan with a 4% annual interest rate, deferred for 1 year. Using a student loan deferment calculator, we can see that the interest accrued during the deferment period would be approximately $400. After the deferment, the loan balance would be $10,400. The visual representation would show a flat line for the loan balance at $10,000 for one year (the deferment period), followed by a steadily increasing line reflecting the loan balance with regular payments, gradually decreasing until it reaches zero. A second line on the same graph would show the loan balance without deferment, indicating a steeper initial decline due to the immediate commencement of repayments. The difference between the two lines would visually represent the additional cost incurred due to the deferment.

Scenario 2: High Loan Amount, High Interest Rate, Long Deferment

This scenario explores a $50,000 loan with an 8% annual interest rate, deferred for 3 years. The calculator would show a significantly higher interest accrual during the deferment period – approximately $12,000. This would result in a loan balance of $62,000 at the end of the deferment. The visual representation would show a flat line at $50,000 for three years, then a much slower decline in the loan balance compared to the no-deferment scenario. The graph would highlight the substantial difference in the total repayment amount and the significantly longer repayment period required due to the deferment. The no-deferment line would show a more rapid decrease in the loan balance over time.

Scenario 3: Moderate Loan Amount, Moderate Interest Rate, Moderate Deferment

Let’s consider a $25,000 loan with a 6% annual interest rate deferred for 2 years. The deferment calculator would illustrate an interest accrual of approximately $3,000 during the deferment period. The loan balance at the end of the deferment would be $28,000. The visual representation would show a flat line for two years at $25,000, followed by a gradual decrease in the loan balance. The comparison with the no-deferment scenario would show a noticeable difference in the total repayment cost and the time taken to repay the loan. The no-deferment line would demonstrate a quicker repayment timeline and a lower overall cost.

Outcome Summary

Ultimately, responsible student loan management requires a thorough understanding of available options and their potential consequences. While a student loan deferment calculator can be an invaluable tool for projecting future costs, it’s essential to weigh the short-term benefits against the long-term financial implications. By carefully considering your individual circumstances and exploring all available repayment strategies, you can create a plan that aligns with your financial goals and ensures a path towards successful debt repayment. Remember to seek professional financial advice if needed to ensure you make the best decision for your situation.

Answers to Common Questions

What happens to my interest during a deferment period?

Interest typically continues to accrue on your loan balance during a deferment period, increasing your total loan amount. The exact terms vary depending on your loan type and deferment program.

Can I defer my student loans indefinitely?

No, deferment periods are typically limited in length. The maximum deferment period varies depending on the loan type and program.

What if I can’t afford my student loan payments even after deferment?

Explore other options such as forbearance, income-driven repayment plans, or contact your loan servicer to discuss potential hardship options.

How accurate are student loan deferment calculators?

Calculators provide estimates based on the input data. Actual results may vary slightly due to factors not included in the calculation.