Navigating the complexities of student loan debt can feel overwhelming, but understanding the intricacies of federal student loan direct programs is crucial for securing a brighter financial future. This guide provides a clear and concise overview of the various programs, application processes, repayment options, and strategies for managing and reducing your student loan burden. We’ll explore the different loan types, eligibility requirements, and the potential long-term financial implications of your choices, empowering you to make informed decisions.

From understanding the nuances of subsidized and unsubsidized loans to exploring loan forgiveness and deferment options, we aim to demystify the process. We will also address common scams and misinformation, ensuring you’re equipped to navigate this crucial financial landscape with confidence and avoid potential pitfalls.

Understanding Student Loan Direct Programs

Federal student loan programs offer crucial financial assistance to students pursuing higher education. Understanding the different types of loans and their associated terms is essential for responsible borrowing and effective financial planning. This section details the key features of the Direct Loan program, enabling you to make informed decisions about financing your education.

Types of Federal Student Loan Direct Programs

The federal government offers several types of Direct Loans, each with specific eligibility requirements and repayment terms. These programs are designed to meet the diverse financial needs of students at various stages of their academic journey. The main categories include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans for Graduate Students and Parents, and Direct Consolidation Loans.

Eligibility Requirements for Direct Loan Programs

Eligibility for each Direct Loan program varies. Generally, students must be enrolled at least half-time in a degree or certificate program at an eligible institution. They must also demonstrate financial need for subsidized loans and meet specific credit requirements for unsubsidized and PLUS loans. Specific requirements, including citizenship status and satisfactory academic progress, are detailed on the Federal Student Aid website.

Interest Rates and Repayment Options for Direct Loan Programs

Interest rates for federal student loans are set annually by the government and are generally lower than private loan options. Interest rates vary depending on the loan type and the loan disbursement date. Repayment options include standard repayment plans, graduated repayment plans, extended repayment plans, and income-driven repayment plans. Borrowers can choose the plan that best fits their financial circumstances and repayment capabilities. Income-driven repayment plans, for example, tie monthly payments to a percentage of the borrower’s discretionary income.

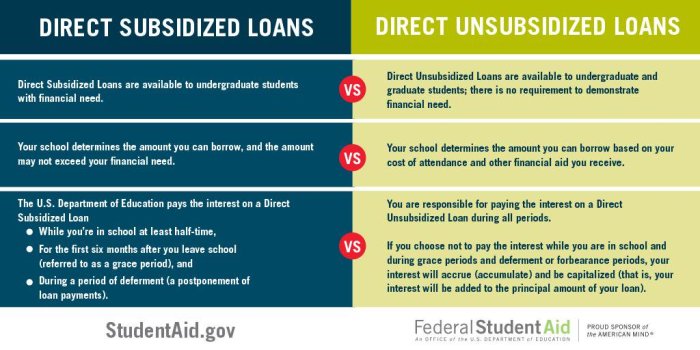

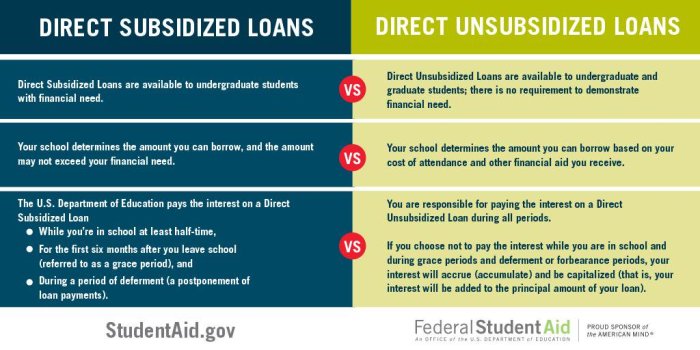

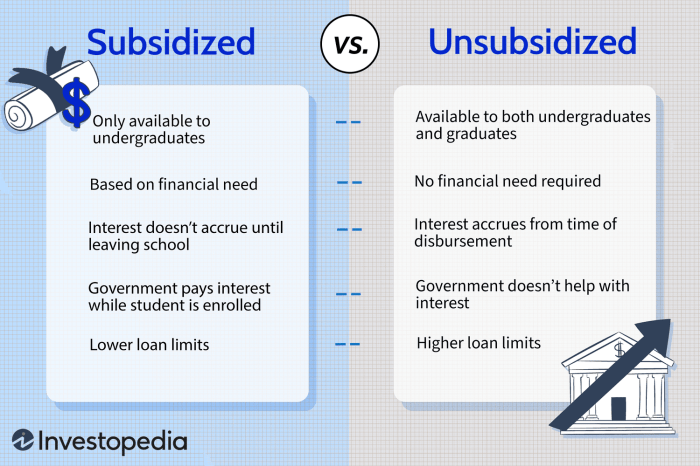

Comparison of Direct Subsidized and Unsubsidized Loans

The key differences between Direct Subsidized and Unsubsidized Loans lie in interest accrual and eligibility criteria. Subsidized loans only accrue interest while the borrower is in school at least half-time, during grace periods, and during deferment periods. Unsubsidized loans accrue interest throughout the loan’s life, regardless of the borrower’s enrollment status. The table below summarizes these differences:

| Feature | Direct Subsidized Loan | Direct Unsubsidized Loan |

|---|---|---|

| Interest Accrual While in School | No | Yes |

| Financial Need Requirement | Yes | No |

| Credit Check | No | No |

| Maximum Loan Amount | Varies by year and school | Varies by year and school, generally higher than subsidized |

Applying for Student Loan Direct Programs

Securing federal student loans through the Direct Loan program involves a straightforward yet crucial process. Understanding each step ensures a smooth application and timely access to funds for your education. Careful preparation and attention to detail are key to a successful application.

The application process begins with completing the Free Application for Federal Student Aid (FAFSA). This form gathers necessary financial information to determine your eligibility for federal student aid, including Direct Loans. After submitting the FAFSA, you’ll receive a Student Aid Report (SAR) summarizing your information and outlining your eligibility for various types of aid. Based on this report, your school will determine your financial aid package, which may include Direct Loans.

Completing the FAFSA

Accurate and efficient completion of the FAFSA is paramount. The FAFSA requires information about both the student and their family’s financial situation, including income, assets, and tax information. Gathering this information beforehand significantly streamlines the process. Using the IRS Data Retrieval Tool (DRT) can help prevent errors by automatically transferring your tax information directly into the FAFSA. Reviewing your completed FAFSA carefully before submitting it is crucial to ensure accuracy and avoid delays in processing.

The FAFSA Verification Process

After submitting your FAFSA, you may be selected for verification. Verification involves providing additional documentation to confirm the accuracy of the information you provided. Common documents requested include tax returns, W-2s, and proof of untaxed income. Responding promptly to verification requests is essential to avoid delays in receiving your financial aid. Failure to respond can result in the suspension of your aid eligibility.

The Student Loan Application and Approval Process Flowchart

The following describes a flowchart illustrating the application and approval process. Imagine a diagram with boxes and arrows. The first box would be “Complete the FAFSA”. An arrow points to the next box, “FAFSA Submitted”. This is followed by a decision box: “Selected for Verification?”. If yes, an arrow leads to “Provide Verification Documents”, then back to “FAFSA Submitted”. If no, the arrow goes to “School Processes FAFSA”. This leads to “Financial Aid Award Notification”, which then leads to “Accept Loan Offer” and finally “Loan Funds Disbursed”. Each step is clearly linked, showing the progression of the application. Any delays, such as those caused by verification, would be indicated by loops in the flowchart.

Repayment Options for Student Loan Direct Programs

Choosing the right repayment plan for your federal student loans is crucial for managing your debt effectively and minimizing long-term financial burden. Several repayment plans are available, each with its own set of advantages and disadvantages, catering to different financial situations and income levels. Understanding these options allows borrowers to make informed decisions that align with their individual circumstances.

Understanding the nuances of each plan is vital to avoid unexpected financial strain and ensure a smoother repayment journey. The following sections detail the various options and their implications.

Standard Repayment Plan

The Standard Repayment Plan is the default option for most federal student loan borrowers. It involves fixed monthly payments spread over a 10-year period. This plan offers predictability and a relatively short repayment timeline.

- Fixed Monthly Payment: A consistent monthly payment amount throughout the loan’s life.

- Repayment Period: 10 years (120 months).

- Advantages: Predictable payments, relatively short repayment period, lower overall interest paid compared to longer-term plans.

- Disadvantages: Higher monthly payments than income-driven plans, may be challenging for borrowers with limited income.

Graduated Repayment Plan

The Graduated Repayment Plan starts with lower monthly payments that gradually increase every two years. This option can be beneficial for borrowers anticipating income growth.

- Variable Monthly Payment: Payments increase every two years.

- Repayment Period: 10 years (120 months).

- Advantages: Lower initial payments, suitable for borrowers expecting increased income.

- Disadvantages: Payments become significantly higher later in the repayment period, potentially creating financial hardship later on. Total interest paid is generally higher than the Standard Repayment Plan.

Extended Repayment Plan

The Extended Repayment Plan offers a longer repayment period, resulting in lower monthly payments. This option is suitable for borrowers who need more time to manage their debt.

- Fixed Monthly Payment: A consistent monthly payment amount.

- Repayment Period: Up to 25 years, depending on the loan amount.

- Advantages: Lower monthly payments than the Standard Repayment Plan, more manageable for borrowers with lower income.

- Disadvantages: Significantly higher total interest paid over the life of the loan, longer repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans (IDR) base monthly payments on your discretionary income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans offer lower monthly payments, but the repayment period can extend beyond 20 years. After a set period (often 20 or 25 years), any remaining loan balance may be forgiven, though this forgiveness is considered taxable income.

- Variable Monthly Payment: Payments are adjusted annually based on income and family size.

- Repayment Period: Typically 20-25 years, with potential for loan forgiveness after that time.

- Advantages: Lower monthly payments, more manageable for borrowers with low income.

- Disadvantages: Longer repayment period, potential for higher total interest paid, forgiven amount is considered taxable income.

Long-Term Financial Implications

The long-term financial implications of each repayment plan are significant. Choosing a plan with lower monthly payments (like an IDR plan) might seem appealing initially, but it can lead to paying substantially more interest over the life of the loan. Conversely, a Standard Repayment Plan with higher monthly payments will result in less interest paid overall but may be more challenging to manage in the short term. Borrowers should carefully weigh their current financial situation and long-term goals when selecting a repayment plan. For example, a borrower prioritizing early debt payoff might choose the Standard Repayment Plan, while a borrower with limited current income might opt for an IDR plan. Careful budgeting and financial planning are crucial regardless of the chosen plan.

Managing and Reducing Student Loan Debt

Successfully navigating student loan repayment requires proactive planning and a strategic approach. Understanding your repayment options and employing effective budgeting techniques are crucial for minimizing debt and achieving financial stability. This section provides practical strategies and resources to help you manage your student loans effectively.

Budgeting and Managing Student Loan Payments

Effective budgeting is paramount to managing student loan payments. Begin by creating a detailed budget that Artikels your monthly income and expenses. Categorize your expenses to identify areas where you can reduce spending. Prioritize your student loan payments and allocate sufficient funds each month to ensure timely payments and avoid late fees. Consider using budgeting apps or spreadsheets to track your income and expenses, and to project future cash flow. Regularly review and adjust your budget as needed to reflect changes in your income or expenses. For example, if you receive a raise, you could allocate a larger portion of your income towards your student loans to accelerate repayment. Conversely, if faced with unexpected expenses, adjusting your budget might involve temporarily reducing discretionary spending.

Resources for Borrowers Facing Financial Hardship

Borrowers experiencing financial hardship may qualify for several federal programs designed to provide temporary relief. The Department of Education offers income-driven repayment plans, which adjust your monthly payments based on your income and family size. These plans can significantly reduce your monthly payments, making them more manageable during periods of financial difficulty. Furthermore, borrowers may be eligible for deferment or forbearance, which temporarily suspends or reduces their loan payments. These options provide crucial breathing room, allowing borrowers to address immediate financial challenges before resuming regular payments. It is important to contact your loan servicer to explore available options and understand the implications of each program. For example, deferment and forbearance can impact your overall loan repayment timeline and potentially increase the total interest paid.

Loan Consolidation and Refinancing Options

Loan consolidation and refinancing can simplify repayment and potentially lower your monthly payments. Consolidation combines multiple federal student loans into a single loan with a new repayment plan. This simplifies the repayment process by reducing the number of payments and potentially lowering your monthly payment, although the total interest paid over the life of the loan might increase. Refinancing involves replacing your existing student loans with a new loan from a private lender. This option might offer a lower interest rate, resulting in lower monthly payments and potentially saving you money over the long term. However, refinancing federal student loans with a private lender means losing access to federal loan benefits such as income-driven repayment plans and forgiveness programs. Carefully weigh the pros and cons of each option before making a decision. For example, a borrower with excellent credit might qualify for a significantly lower interest rate through refinancing, while a borrower with less-than-perfect credit might find consolidation a more suitable option.

Calculating Monthly Payments Using Different Repayment Plans

The monthly payment amount varies depending on the repayment plan chosen. Standard repayment plans typically require fixed monthly payments over a 10-year period. However, income-driven repayment plans, such as the Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE) plans, adjust your monthly payments based on your income and family size. The extended repayment periods for income-driven plans result in lower monthly payments but can lead to higher overall interest paid. To calculate monthly payments under different plans, you can use the loan servicer’s online calculators or consult a financial advisor. For example, a $50,000 loan with a 5% interest rate would have a monthly payment of approximately $537 under a standard 10-year repayment plan. However, under an income-driven repayment plan, the monthly payment might be significantly lower, depending on the borrower’s income. It’s crucial to understand the implications of each repayment plan to make an informed decision.

The Impact of Student Loan Direct Programs

Student loan direct programs have profoundly reshaped the landscape of higher education, significantly impacting both individual borrowers and the broader economy. Their influence extends far beyond the immediate act of financing education, affecting access to higher learning, long-term financial stability, and national economic trends. Understanding these impacts is crucial for both policymakers and prospective students.

Student loan direct programs have undeniably increased access to higher education for many. By providing a readily available source of funding, these programs allow individuals from diverse socioeconomic backgrounds to pursue post-secondary education who might otherwise be financially excluded. This increased access can lead to greater social mobility and a more skilled workforce. However, this expansion of access comes with inherent complexities and potential drawbacks.

The Benefits and Drawbacks of Student Loan Debt

Student loan debt, while enabling educational opportunities, presents both advantages and disadvantages for borrowers. A key benefit is the potential for increased earning power. Individuals with higher education degrees often command higher salaries, allowing them to repay their loans and enjoy a better standard of living over their lifetime. However, the substantial debt incurred can also limit financial flexibility immediately after graduation. Borrowers may face challenges in saving for a down payment on a house, starting a family, or investing in other long-term goals. The weight of loan repayments can significantly impact a borrower’s overall financial health and well-being, potentially delaying major life decisions. Furthermore, defaulting on student loans can lead to severe consequences, including damage to credit scores and wage garnishment.

The Effect of Student Loan Debt on Long-Term Financial Planning

The presence of significant student loan debt can fundamentally alter long-term financial planning. Borrowers often find that debt repayment consumes a substantial portion of their monthly income, reducing the amount available for saving, investing, and other financial priorities. This can delay retirement planning, homeownership, and other significant life goals. For example, a borrower burdened with $50,000 in student loans might delay saving for retirement by several years, potentially impacting their long-term financial security. Similarly, the monthly loan payments might make it challenging to save for a down payment on a house, potentially postponing homeownership indefinitely. Careful budgeting and financial planning are essential to navigate these challenges and mitigate the long-term effects of student loan debt.

Visual Representation of Student Loan Debt Growth

Imagine a graph charting the growth of student loan debt over time. The x-axis represents years, starting from, say, 1990, and extending to the present. The y-axis represents the total amount of outstanding student loan debt in trillions of dollars. The line graph would show a relatively slow, steady incline in the early years, gradually steepening into a dramatic upward curve in recent decades. The visual would clearly illustrate the exponential growth of student loan debt, highlighting the increasing financial burden on borrowers and the national economy. The graph might include markers indicating key economic events or policy changes that correlate with periods of rapid debt growth.

Understanding Loan Forgiveness and Deferment Options

Navigating the complexities of student loan repayment often involves exploring options for loan forgiveness and deferment. These programs can provide temporary or permanent relief, but it’s crucial to understand the conditions and long-term implications before applying. This section will clarify the eligibility requirements, application processes, and potential consequences associated with these options.

Loan Forgiveness Program Conditions

Several federal loan forgiveness programs exist, each with specific eligibility criteria. For instance, the Public Service Loan Forgiveness (PSLF) program requires 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Teacher Loan Forgiveness offers partial loan forgiveness to teachers who meet certain requirements, such as teaching in a low-income school for a specified number of years. Other programs, like the Income-Driven Repayment (IDR) plans, don’t offer complete forgiveness but can significantly reduce monthly payments and potentially lead to loan forgiveness after a set period. Eligibility for each program depends on factors such as loan type, employment history, and income. It is imperative to carefully review the specific requirements of each program before applying.

Applying for Loan Deferment or Forbearance

The process for applying for deferment or forbearance typically involves submitting an application to your loan servicer. You’ll need to provide documentation to support your request, such as proof of unemployment or enrollment in school. Deferment and forbearance differ; deferment postpones payments and may or may not accrue interest depending on the type of loan and reason for deferment, while forbearance temporarily suspends payments but usually accrues interest. The application process and required documentation may vary slightly depending on your loan servicer and the specific type of deferment or forbearance you are requesting. It is advisable to contact your loan servicer directly for detailed instructions and to ensure you meet all eligibility requirements.

Implications of Deferment or Forbearance on Long-Term Loan Repayment

While deferment and forbearance can offer short-term financial relief, they can significantly impact long-term repayment. Interest typically continues to accrue during forbearance, increasing the total amount owed. Deferment may or may not accrue interest depending on the loan type and reason for deferment. The added interest can lead to a larger total loan balance and extend the repayment period, ultimately costing more in the long run. For example, a borrower who defers their loans for several years may find their total debt significantly higher by the time repayment begins, even if they were not accruing interest during the deferment period. Careful consideration of the long-term financial consequences is essential before opting for deferment or forbearance.

Common Reasons for Loan Forgiveness or Deferment

Several situations might justify applying for loan forgiveness or deferment.

- Unemployment: Job loss can make loan repayment challenging, making deferment or forbearance a viable option.

- Economic Hardship: Significant financial difficulties, such as medical emergencies or unexpected expenses, can qualify for deferment or forbearance.

- Enrollment in School: Returning to school often necessitates a temporary suspension of loan payments.

- Military Service: Active duty military service frequently qualifies for deferment.

- Public Service Employment: Working in qualifying public service roles may lead to loan forgiveness under specific programs.

Scams and Misinformation Related to Student Loans

Navigating the world of student loans can be complex, and unfortunately, this complexity makes borrowers vulnerable to scams and misleading information. Understanding common tactics used by fraudsters and learning how to identify red flags is crucial for protecting your financial well-being. This section will Artikel common scams, provide strategies for avoiding them, and highlight examples of misleading information circulating about student loan repayment.

Common Student Loan Scams

Scammers often prey on borrowers’ anxieties about repayment or their lack of familiarity with loan programs. Common tactics include promising loan forgiveness or consolidation for a fee, offering assistance with loan applications in exchange for personal information, and posing as government representatives to solicit sensitive data. These scams can result in significant financial losses and identity theft. One example is a scheme where individuals claim to be able to quickly discharge your student loans through a little-known government program—this is often completely fabricated. Another common scam involves promising reduced interest rates or monthly payments in exchange for upfront fees.

Avoiding Student Loan Scams and Fraudulent Activities

Protecting yourself from student loan scams requires vigilance and a healthy dose of skepticism. Never share your personal information, including your Social Security number, student loan details, or bank account information, unless you are absolutely certain you are interacting with a legitimate organization. Always verify the identity of anyone contacting you regarding your student loans by contacting the official lender or loan servicer directly using contact information found on their official website, not a link provided by a third party. Be wary of unsolicited offers that seem too good to be true, as these are often indicative of fraudulent activity. Before engaging with any service promising assistance with your student loans, thoroughly research the company’s reputation and legitimacy. Check for online reviews and complaints.

Examples of Misleading Information About Student Loan Repayment

Misinformation about student loan repayment often centers around unrealistic promises or misleading interpretations of loan forgiveness programs. For example, some sources may exaggerate the eligibility criteria for loan forgiveness programs, leading borrowers to believe they qualify when they don’t. Others might misrepresent the amount of debt that can be forgiven, creating false expectations. Similarly, some individuals might promote quick fixes or shortcuts to loan repayment that don’t exist, leading borrowers to waste time and money on ineffective strategies. It’s crucial to rely on official government sources and reputable financial institutions for accurate information about repayment options.

Warning Signs of Student Loan Scams

It is vital to be aware of the warning signs that might indicate a student loan scam. Being alert and informed can significantly reduce your risk.

- Unsolicited calls, emails, or text messages offering loan forgiveness or consolidation services.

- Requests for upfront fees or payments to access loan forgiveness programs.

- Promises of guaranteed loan forgiveness or significantly reduced payments that seem too good to be true.

- Pressure to act quickly or provide personal information without verification.

- Websites or organizations that lack clear contact information or credible credentials.

- Communication that uses unprofessional language or contains grammatical errors.

- Claims of secret or little-known government programs for loan forgiveness.

Last Word

Securing a higher education shouldn’t come at the cost of long-term financial instability. By understanding the intricacies of federal student loan direct programs, you can effectively manage your debt, explore available repayment options, and plan for a secure financial future. Remember, proactive planning and informed decision-making are key to successfully navigating the student loan repayment process. Utilize the resources and strategies Artikeld in this guide to confidently manage your debt and achieve your financial goals.

Frequently Asked Questions

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during certain deferment periods. Unsubsidized loans accrue interest from the time the loan is disbursed.

What happens if I can’t make my loan payments?

Contact your loan servicer immediately. They can help you explore options like deferment, forbearance, or income-driven repayment plans to avoid default.

Can I refinance my student loans?

Yes, but be aware that refinancing federal loans with a private lender may mean losing access to federal repayment assistance programs.

How do I find my loan servicer?

You can usually find your servicer’s contact information on the National Student Loan Data System (NSLDS) website.