Navigating the complexities of student loan repayment can feel overwhelming, but understanding direct deposit is a crucial step towards financial clarity. This guide provides a comprehensive overview of how direct deposit works for student loans, covering everything from setup and security to troubleshooting potential problems and incorporating this method into your long-term financial plan. We’ll explore the advantages and disadvantages compared to other disbursement methods, helping you make informed decisions about managing your student loan funds.

From understanding the process of setting up direct deposit to learning how to mitigate security risks and troubleshoot common issues, this guide aims to empower you with the knowledge and tools needed to confidently manage your student loan payments. We will delve into the specifics of different loan types, repayment plans, and the overall impact on your financial well-being, ensuring you’re well-equipped to handle your student loan finances effectively.

Understanding Direct Deposit for Student Loans

Receiving your student loan disbursement via direct deposit is a convenient and efficient method. This process electronically transfers funds directly into your designated bank account, eliminating the need for paper checks and potentially speeding up the receipt of your funds. Understanding how direct deposit works and its advantages can significantly simplify the financial aspects of your education.

Direct Deposit Setup and Benefits

Setting up direct deposit for your student loan payments typically involves providing your bank account information to your loan servicer. This usually includes your account number, routing number, and bank name. Your loan servicer will then use this information to electronically deposit your loan funds into your account on the disbursement date. The benefits of using direct deposit are numerous. It’s a secure and reliable method, minimizing the risk of lost or stolen checks. Funds are typically available much faster than with traditional paper checks, allowing you to access them immediately for tuition payments, books, or living expenses. Direct deposit also offers increased convenience, as you don’t have to worry about physically cashing a check or dealing with potential delays associated with mail delivery.

Direct Deposit Compared to Other Disbursement Methods

Direct deposit offers significant advantages compared to other disbursement methods. While paper checks were once the standard, they present risks like loss or theft, and the processing time is considerably longer. Receiving your loan via mail can delay access to your funds, causing potential financial strain. Other methods, if available, might involve additional fees or complicated processes. For example, some institutions might offer disbursement to prepaid debit cards, but these often come with associated fees and potential limitations on usage. While there aren’t inherent disadvantages to direct deposit beyond the need to initially set up the account information, the primary disadvantage of other methods lies in the potential for delays, fees, and security risks.

Updating Direct Deposit Information with Your Loan Servicer

Updating your direct deposit information is a straightforward process, but the specific steps might vary slightly depending on your loan servicer. Generally, you’ll need to log in to your loan servicer’s online account portal. Look for a section related to “payment information,” “account details,” or a similar designation. Within this section, you should find an option to update your banking information. You’ll likely need to provide your new account number, routing number, and bank name. Double-check all information for accuracy before submitting the update. Some servicers may require you to verify your identity through additional security measures. After submitting the updated information, it’s advisable to contact your loan servicer to confirm that the changes have been successfully processed and to inquire about the effective date of the update. This ensures a smooth and timely disbursement of your future loan payments.

Security and Fraud Prevention Related to Direct Deposit

Choosing direct deposit for your student loan repayments offers convenience, but it’s crucial to understand the associated security risks and take proactive steps to protect yourself from fraud. This section details common threats, preventative measures, and the safeguards implemented by loan servicers.

Direct deposit, while efficient, introduces vulnerabilities if not handled carefully. Phishing scams, identity theft, and compromised banking information are all potential threats that could lead to unauthorized access to your student loan funds or even result in fraudulent payments being made from your account. Understanding these risks and implementing appropriate safeguards is essential for protecting your financial well-being.

Common Security Risks and Mitigation Strategies

Several security risks are associated with student loan direct deposit. These include phishing emails attempting to steal banking details, malware infecting computers to capture sensitive information, and unauthorized access to online accounts through weak passwords or compromised credentials. To mitigate these risks, borrowers should be vigilant about suspicious emails, regularly update their anti-virus software, and use strong, unique passwords for all online accounts. They should also enable two-factor authentication wherever possible, adding an extra layer of security to their accounts. Regularly reviewing bank statements for any unauthorized transactions is also crucial.

Identifying Red Flags Indicating Fraudulent Activity

Recognizing fraudulent activity is paramount to preventing financial loss. Red flags can include unexpected changes to your direct deposit information, emails or calls requesting personal banking details, or discrepancies between your loan repayment schedule and your bank statements. Unusual account activity, such as unexpected debits or credits, should also raise concerns. If you notice any of these red flags, immediately contact your loan servicer and your bank to report the suspicious activity.

Loan Servicer Safeguards Against Fraudulent Direct Deposit Attempts

Loan servicers employ various measures to protect borrowers from fraudulent direct deposit attempts. These include advanced fraud detection systems that monitor transactions for suspicious patterns, secure data encryption to protect sensitive information, and robust authentication protocols to verify borrower identity before processing any changes to direct deposit details. Many servicers also provide educational resources and alerts to help borrowers recognize and avoid common scams. They frequently verify changes to direct deposit information with the borrower through secondary channels, such as phone calls or secure messaging, to ensure the request is legitimate.

Best Practices for Securing Direct Deposit Information

Protecting your direct deposit information requires proactive measures. Never share your banking details via email or unsecured websites. Use strong, unique passwords for your online banking and loan servicer accounts. Regularly review your bank statements for any unauthorized transactions. Report any suspicious activity immediately to your loan servicer and your bank. Consider enrolling in your bank’s fraud alert system for an added layer of protection. Finally, be wary of unsolicited emails or phone calls requesting personal financial information; legitimate institutions will never request such sensitive data through these channels.

Managing Student Loan Direct Deposits

Effectively managing your student loan direct deposits is crucial for responsible financial planning. Understanding how to track payments, budget accordingly, and troubleshoot potential issues will help you navigate the repayment process smoothly and avoid unnecessary stress. This section provides practical guidance to help you achieve this.

Sample Student Loan Direct Deposit Payment Schedule

A well-organized schedule helps you stay on top of your payments. Consider creating a spreadsheet or using a budgeting app to track your payments. The following is an example of a simple schedule you can adapt to your needs:

| Date | Payment Amount | Payment Method | Notes |

|---|---|---|---|

| October 26, 2024 | $500 | Direct Deposit | On time |

| November 26, 2024 | $500 | Direct Deposit | On time |

| December 26, 2024 | $500 | Direct Deposit | On time |

Tips for Budgeting with Student Loan Direct Deposits

Receiving your student loan funds via direct deposit provides an opportunity to implement effective budgeting strategies. Prioritize creating a realistic budget that allocates funds for essential expenses, loan repayments, and savings.

- Create a Detailed Budget: List all your monthly expenses (rent, utilities, groceries, transportation, etc.) and allocate funds accordingly.

- Prioritize Loan Repayments: Treat your student loan payments as a non-negotiable expense and ensure you allocate sufficient funds to meet your repayment obligations.

- Build an Emergency Fund: Aim to save at least 3-6 months’ worth of living expenses in an emergency fund to cover unexpected costs.

- Track Spending: Regularly monitor your spending habits to identify areas where you can cut back and reallocate funds.

- Automate Savings: Set up automatic transfers from your checking account to your savings account to ensure consistent savings.

Potential Problems and Solutions for Student Loan Direct Deposits

While direct deposit offers convenience, several potential problems might arise. Being prepared for these issues can help minimize disruptions.

- Incorrect Bank Account Information: Ensure your bank account information is accurately updated with your loan servicer. If the deposit fails due to incorrect information, contact your servicer immediately to rectify the issue.

- Delayed Deposits: Deposits may be delayed due to technical glitches or bank processing times. If your deposit is significantly late, contact your loan servicer to investigate.

- Insufficient Funds: If your account doesn’t have enough funds to cover fees or other charges, it could lead to payment failures. Maintain sufficient funds in your account.

- Account Closure: Closing your bank account without updating your loan servicer will result in failed deposits. Always update your account information with your servicer.

Reconciling Bank Statements with Student Loan Direct Deposits

Regularly reconciling your bank statements with your student loan payment records ensures accurate tracking of your payments and helps identify any discrepancies promptly.

- Gather Documents: Collect your bank statement and your student loan payment confirmation or schedule.

- Compare Transactions: Compare the deposit amounts and dates on your bank statement with the information from your loan servicer.

- Identify Discrepancies: If any discrepancies exist, investigate the cause. This might involve contacting your bank or loan servicer for clarification.

- Record Reconciliation: Document your reconciliation process, noting any discrepancies and their resolutions.

Direct Deposit and Different Loan Types

Direct deposit offers a convenient and efficient way to receive your student loan funds, but the process and disbursement schedule can vary depending on the type of loan you have – federal or private – and the repayment plan you select. Understanding these differences is crucial for effective financial planning. This section will explore how loan type and repayment plan influence the direct deposit process.

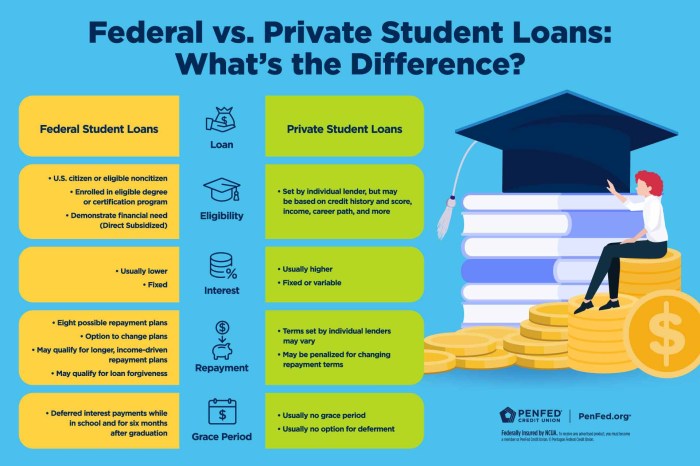

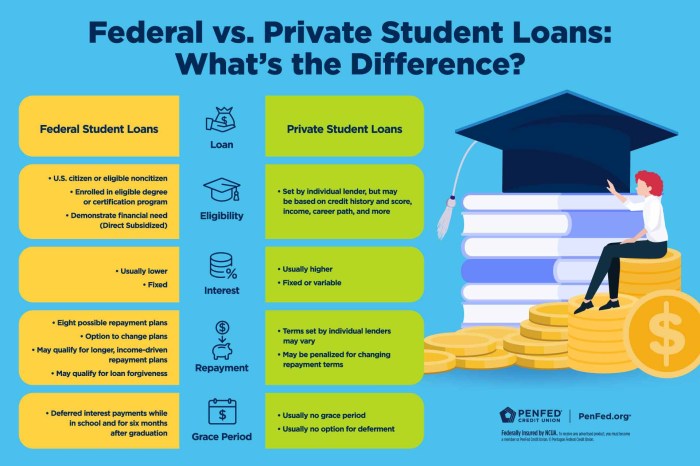

Federal and private student loans utilize similar direct deposit mechanisms, requiring you to provide your bank account information to the lender. However, significant differences exist in disbursement timelines and overall loan management.

Federal and Private Loan Disbursement Differences

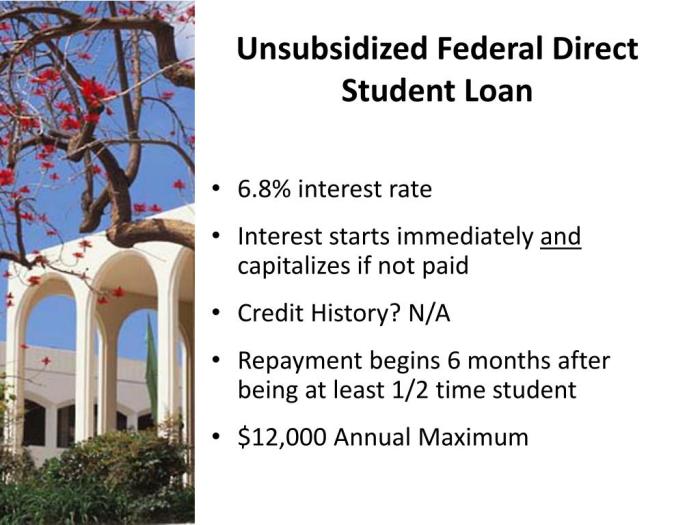

Federal student loans generally follow a standardized disbursement schedule, often tied to academic terms. Funds are typically released directly to the educational institution to cover tuition and fees, with any remaining amount disbursed to the student. Private loan disbursement schedules are more variable and depend on the lender’s policies and the loan agreement. Some private lenders may release funds directly to the student, while others might follow a similar process to federal loans, sending funds to the institution first. This variability necessitates careful review of the individual loan agreements. For example, a federal Stafford loan might be disbursed in two installments per semester, while a private loan from a specific bank might be disbursed as a single lump sum at the beginning of the academic year.

Repayment Plan Impact on Direct Deposit

The choice of repayment plan significantly affects how your direct deposit functions during repayment. For example, under an income-driven repayment plan, your monthly payment amount will fluctuate based on your income, resulting in variable direct deposit debits from your account. Standard repayment plans, on the other hand, will involve consistent monthly payments, leading to predictable direct debits. Failure to maintain sufficient funds in your account could lead to returned payments and potential penalties. Let’s consider a scenario where a borrower is on an income-driven repayment plan and experiences a temporary reduction in income. Their monthly payment amount will decrease, leading to a smaller direct debit from their account during that period. Conversely, if they receive a raise, their monthly payment, and therefore the direct debit amount, will increase.

Loan Type and Direct Deposit Timing Examples

Consider a student with both federal subsidized and unsubsidized Stafford loans, and a private loan from a credit union. The subsidized Stafford loan might be disbursed directly to the university at the start of each semester. The unsubsidized Stafford loan might be disbursed similarly. The private loan, however, might be disbursed as a single payment to the student at the beginning of the academic year, allowing for more flexibility in managing expenses. If this student also has a federal loan in repayment, the monthly payments would be automatically debited via direct deposit, according to their chosen repayment plan schedule. The credit union loan might have a separate repayment schedule and direct debit process. This highlights how different loan types interact with direct deposit and how their timings can differ significantly.

Troubleshooting Direct Deposit Issues

Student loan direct deposit is generally a smooth process, but occasionally, issues can arise causing delays or preventing funds from reaching your account. Understanding the potential problems and their solutions can significantly reduce stress and ensure timely receipt of your loan disbursement. This section will address common issues, their causes, and how to resolve them.

Common Causes of Direct Deposit Delays

Delays in receiving your student loan funds via direct deposit can stem from several sources. These range from simple errors in your banking information to more complex problems with the loan processor or your financial institution. Identifying the root cause is the first step towards a quick resolution.

Troubleshooting Student Loan Direct Deposit Problems

Below is a table outlining potential problems, their causes, and recommended solutions. Remember to always keep your banking information up-to-date and carefully review your loan documents.

| Problem | Possible Cause | Solution | Contact Information |

|---|---|---|---|

| Funds not received by expected date | Incorrect account or routing number; Bank processing delays; Loan disbursement delay; Insufficient funds in the lender’s account | Verify banking information with your bank and loan servicer; Check with your bank for processing delays; Contact your loan servicer for disbursement status; Check your loan servicer’s website for any announcements or delays | Your loan servicer’s customer service number; Your bank’s customer service number |

| Partial deposit | Error in the amount processed; Multiple disbursements combined; A portion of the loan was held due to outstanding fees or other issues. | Contact your loan servicer to inquire about the discrepancy and review your loan account statement for any outstanding balances or fees. | Your loan servicer’s customer service number |

| Funds deposited into the wrong account | Incorrect banking information provided to the loan servicer; Accidental duplication of direct deposit information. | Immediately contact your loan servicer to report the error and provide the correct account information. You may also need to contact your bank to report the incorrect deposit. | Your loan servicer’s customer service number; Your bank’s customer service number |

| Returned payment | Insufficient funds in your account; Account closed; Account frozen; Incorrect account information. | Contact your bank to address the reason for the returned payment and update your account information with your loan servicer. | Your bank’s customer service number; Your loan servicer’s customer service number |

Available Resources for Borrowers

Numerous resources are available to assist borrowers facing direct deposit problems. Your loan servicer’s website usually contains a FAQ section addressing common issues and contact information. You can also find helpful information through the U.S. Department of Education’s website or by contacting your financial institution directly. Remember to keep records of all communication with your loan servicer and bank.

Steps to Take if You Suspect an Error

If you suspect an error in your student loan direct deposit, promptly contact your loan servicer. Document the discrepancy – note the expected amount, the amount received (if any), and the date. Gather any relevant documentation, such as your loan disbursement schedule and bank statements. Be prepared to provide your loan servicer with your full name, student ID number, and loan details. Following these steps ensures a faster resolution.

Impact of Direct Deposit on Financial Planning

Direct deposit of student loan funds significantly impacts long-term financial planning, offering both advantages and challenges. Understanding how to effectively manage these funds through direct deposit is crucial for responsible financial management and achieving long-term financial goals. Proper planning can help avoid debt accumulation and facilitate timely repayment.

Direct deposit streamlines the process of receiving student loan funds, making them readily available for immediate use. However, this ease of access can also lead to impulsive spending if not carefully managed. Therefore, a well-structured budget is essential to ensure funds are allocated effectively towards educational expenses and other necessary costs.

Incorporating Student Loan Repayments into a Personal Budget

Creating a comprehensive budget that accounts for student loan repayments is vital for successful financial planning. This involves carefully tracking income and expenses, allocating a specific amount for loan repayment, and adhering to this plan consistently. Failure to budget adequately for loan repayments can lead to missed payments, impacting credit scores and potentially incurring late fees. Consider using budgeting apps or spreadsheets to monitor income, expenses, and loan repayment progress. Prioritize essential expenses such as housing, food, and transportation before allocating funds for discretionary spending. Regularly review and adjust the budget as needed to reflect changes in income or expenses.

Automating Student Loan Payments via Direct Deposit

Automating student loan payments through direct deposit offers a convenient and reliable method of repayment. Many loan servicers offer online portals where borrowers can set up automatic payments from their checking or savings accounts. This ensures timely payments, avoiding late fees and negative impacts on credit scores. Scheduling automatic payments also eliminates the risk of forgetting payment deadlines, a common issue that can lead to financial difficulties. By setting up automatic payments, borrowers can free up mental space and focus on other aspects of their financial planning. For example, a borrower could schedule a recurring transfer from their checking account to their loan servicer’s account on the 1st of each month.

Understanding the Total Cost of Borrowing

Understanding the total cost of borrowing is crucial when using direct deposit for student loan disbursement. This involves considering not only the principal loan amount but also interest rates, fees, and the overall repayment period. A longer repayment period might seem appealing, but it often leads to paying significantly more in interest over time. Using loan repayment calculators can help estimate the total cost of borrowing under different scenarios. For example, a $20,000 loan with a 5% interest rate over 10 years will cost considerably more than the same loan repaid over 5 years. Understanding this total cost allows borrowers to make informed decisions about loan selection and repayment strategies. This also aids in prioritizing debt reduction and achieving financial stability faster.

Conclusion

Successfully managing your student loan payments through direct deposit requires proactive planning and a keen awareness of potential pitfalls. By understanding the process, prioritizing security, and actively monitoring your transactions, you can significantly streamline your repayment journey and build a strong foundation for your financial future. Remember to utilize the resources available and don’t hesitate to contact your loan servicer if you encounter any issues. Proactive management of your student loan direct deposit will lead to a more efficient and less stressful repayment experience.

Common Queries

What happens if my bank account information changes?

You must update your bank account information with your loan servicer immediately to avoid payment delays or returned payments. Failure to do so may result in late fees.

Can I use a joint account for direct deposit?

This depends on your loan servicer’s policies. Some servicers allow it, while others may require the account to be in the borrower’s name only. Check with your servicer for their specific requirements.

What if my direct deposit is delayed or doesn’t arrive?

Contact your loan servicer immediately to investigate the issue. They can track the payment and determine the cause of the delay. Keep records of all communication.

Are there any fees associated with student loan direct deposit?

Generally, there are no fees charged by the loan servicer for using direct deposit. However, your bank may charge fees for insufficient funds or other account-related issues. Check with your bank for details.