Navigating the world of student loan direct loans can feel overwhelming, a labyrinth of subsidized and unsubsidized options, repayment plans, and forgiveness programs. This guide aims to illuminate this often-confusing process, providing a clear and concise understanding of federal direct student loans, from application to repayment and beyond. We will explore the various loan types, interest rates, repayment strategies, and potential avenues for loan forgiveness or deferment, empowering you to make informed decisions about your financial future.

Understanding the nuances of direct student loans is crucial for responsible financial planning. This guide offers a structured approach, breaking down complex information into digestible segments, allowing you to confidently manage your student loan debt and achieve your long-term financial goals. Whether you are a prospective borrower or already managing student loan debt, this resource provides the knowledge necessary for effective financial stewardship.

Understanding Direct Student Loans

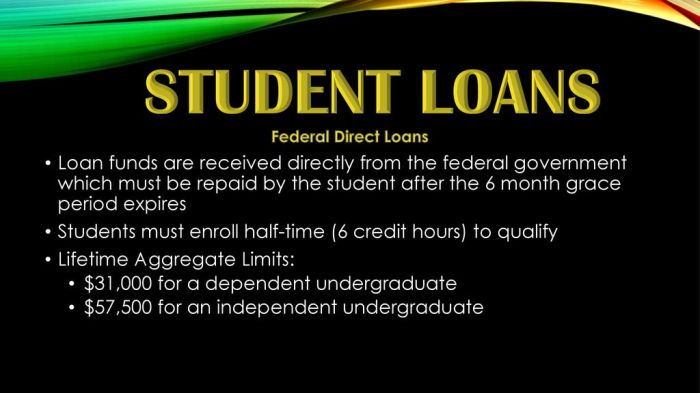

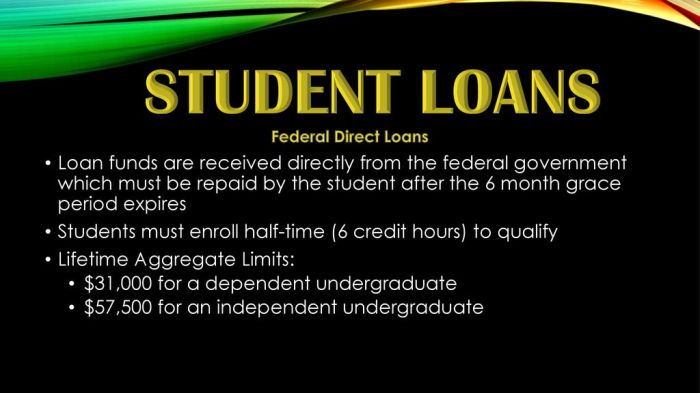

Federal Direct Student Loans are a crucial funding source for many students pursuing higher education. Understanding the different types of loans and the application process is essential for securing the financial support you need. This section will provide a clear overview of Direct Student Loans, outlining eligibility requirements and the application procedure.

Types of Federal Direct Student Loans

There are three main types of federal direct student loans: Subsidized Loans, Unsubsidized Loans, and PLUS Loans. Each loan type has distinct characteristics regarding interest accrual, eligibility, and repayment.

Subsidized Loans

Subsidized loans are need-based loans. The government pays the interest on the loan while you’re in school at least half-time, during a grace period, and during periods of deferment. Eligibility is determined by your demonstrated financial need as assessed through the Free Application for Federal Student Aid (FAFSA). This means your eligibility depends on factors such as your family’s income and assets. You must be enrolled at least half-time in an eligible degree or certificate program to qualify.

Unsubsidized Loans

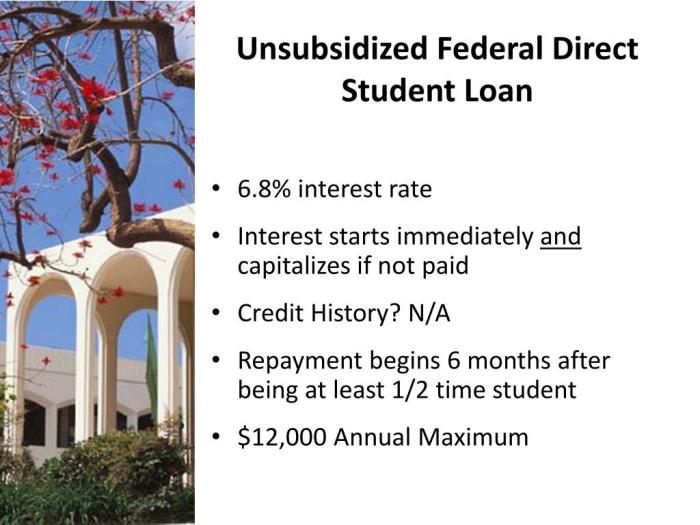

Unsubsidized loans are not need-based. Interest begins to accrue from the time the loan is disbursed, regardless of your enrollment status or deferment. This means the loan balance will grow even while you are still in school. Eligibility requirements are generally less stringent than for subsidized loans; you simply need to be enrolled at least half-time in an eligible program and meet the federal student aid requirements.

PLUS Loans

PLUS Loans are loans available to parents of dependent undergraduate students or to graduate students. These loans have a credit check requirement; borrowers must pass a credit check to be eligible. Interest accrues from the time the loan is disbursed. Parents are responsible for repaying PLUS loans, while graduate students are responsible for their own PLUS loans. The credit check is performed to assess creditworthiness and determine whether the parent or graduate student can responsibly manage the loan.

Applying for a Direct Student Loan

Applying for a Direct Student Loan involves several key steps. First, complete the Free Application for Federal Student Aid (FAFSA). The FAFSA determines your eligibility for federal student aid, including Direct Loans. Next, your school will receive your FAFSA information and will use it to determine your financial aid package. This package will include your eligibility for federal student loans. After receiving your financial aid offer, you will accept the loan terms through your school’s financial aid portal. Finally, the loan funds will be disbursed directly to your school to cover tuition and fees, and any remaining amount will be sent to you.

Subsidized vs. Unsubsidized Loan Comparison

| Loan Type | Interest Rate | Repayment Options | Eligibility Criteria |

|---|---|---|---|

| Subsidized | Variable, set annually by the government. | Standard, graduated, extended, and income-driven repayment plans. | Demonstrated financial need, enrolled at least half-time. |

| Unsubsidized | Variable, set annually by the government. | Standard, graduated, extended, and income-driven repayment plans. | Enrolled at least half-time. |

Interest Rates and Repayment Plans

Understanding the interest rates and repayment options for your Direct Student Loans is crucial for effective financial planning and responsible debt management. This section will clarify how interest rates are determined and Artikel the various repayment plans available to borrowers.

Direct Student Loan Interest Rate Determination

The interest rate applied to your Direct Student Loan depends on several factors, primarily the loan type (subsidized or unsubsidized) and the loan disbursement date. Federal regulations set the interest rate for each loan period, which typically runs from July 1st to June 30th. These rates are fixed for the life of the loan, meaning they won’t change after the loan is disbursed. For subsidized loans, the government pays the interest while you’re in school (under certain conditions), during grace periods, and during deferment periods. Unsubsidized loans accrue interest from the time the loan is disbursed, regardless of your enrollment status. You can find the specific interest rate for your loan on your loan documents and the National Student Loan Data System (NSLDS) website.

Repayment Plan Options

Several repayment plans cater to different financial situations and repayment preferences. Choosing the right plan can significantly impact your monthly payments and the total amount you pay over the life of the loan. The key plans include:

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s the most common plan and often results in the lowest total interest paid, but monthly payments can be higher.

- Graduated Repayment Plan: This plan starts with lower monthly payments that gradually increase over a 10-year period. This can be beneficial for borrowers expecting an increase in income over time.

- Extended Repayment Plan: This plan allows for longer repayment periods (up to 25 years), resulting in lower monthly payments but potentially higher total interest paid. This option is generally available for loans totaling more than $30,000.

Interest Capitalization

Interest capitalization occurs when accrued but unpaid interest is added to the principal loan balance. This increases the principal amount on which future interest is calculated, leading to a larger total loan amount over time. For example, if you have unpaid interest at the end of a grace period or deferment, this interest will be capitalized, resulting in higher monthly payments and a larger total repayment amount. Understanding and minimizing capitalization is key to keeping your total loan cost down.

Sample Repayment Schedule

The following table illustrates a sample repayment schedule for a $20,000 loan under different repayment plans. These are illustrative examples only and actual payments may vary slightly based on the specific interest rate and loan terms.

| Repayment Plan | Loan Amount | Monthly Payment | Total Paid (approx.) |

|---|---|---|---|

| Standard (10 years) | $20,000 | $212 (assuming 5% interest) | $25,440 |

| Graduated (10 years) | $20,000 | Starts lower, increases gradually (assuming 5% interest) | $25,440 (approximately same as Standard) |

| Extended (25 years) | $20,000 | $110 (assuming 5% interest) | $33,000 (approximately) |

Managing Student Loan Debt

Successfully navigating student loan debt requires a proactive and organized approach. Understanding your repayment options and developing a robust budget are crucial steps towards minimizing the long-term financial impact of your loans. This section provides practical strategies and tools to help you manage your student loan debt effectively.

Budgeting and Managing Student Loan Debt

Effective budget management is paramount when dealing with student loan repayments. A well-structured budget ensures that loan payments are prioritized alongside other essential expenses, preventing missed payments and potential penalties. Creating a budget involves carefully tracking income and expenses to identify areas where savings can be made and allocated towards loan repayment. This process empowers you to make informed financial decisions and gain control over your finances.

Strategies for Minimizing the Overall Cost of Student Loans

Several strategies can significantly reduce the total cost of your student loans over their lifespan. These strategies include exploring different repayment plans (such as income-driven repayment), making extra payments when possible to reduce the principal balance faster, and refinancing your loans if interest rates fall. Careful consideration of these options can lead to substantial savings. For example, refinancing a loan with a higher interest rate to one with a lower rate can save thousands of dollars over the life of the loan.

Creating a Personal Budget Incorporating Student Loan Payments

A step-by-step guide to creating a personal budget that includes student loan payments is as follows:

- Track your income: Record all sources of income, including your salary, part-time job earnings, or any other financial inflows.

- List your expenses: Categorize your expenses (housing, food, transportation, entertainment, etc.). Be as detailed as possible. Use bank statements and receipts to help with this.

- Calculate your net income: Subtract your total expenses from your total income. This is the amount of money you have left after covering your expenses.

- Allocate funds for student loan payments: Determine the amount you can realistically allocate towards your student loan payments each month. This amount should be consistent with your net income and leave enough for other necessities.

- Review and adjust: Regularly review your budget to ensure it remains accurate and reflects any changes in your income or expenses. Adjust your spending habits as needed to maintain a healthy financial balance.

Calculating the Total Cost of a Student Loan

Calculating the total cost of a student loan involves determining the total interest accrued over the loan’s repayment period. This can be done using online loan calculators or by applying the following formula:

Total Cost = Principal + Total Interest

For example, a $20,000 loan with a 5% annual interest rate over 10 years might result in a total interest payment of approximately $5,000, bringing the total cost to $25,000. The exact amount will depend on the loan’s terms and repayment plan. It’s crucial to understand this total cost before accepting any loan.

The Impact of Direct Loans on Future Finances

Successfully navigating student loan debt requires understanding its long-term consequences. Borrowing for education offers significant opportunities, but failing to plan for repayment can severely impact your financial future. This section explores the relationship between student loans and your overall financial well-being.

Student loan debt can significantly influence your credit score. Lenders report your loan repayment activity to credit bureaus. Consistent on-time payments build positive credit history, while missed or late payments negatively affect your score. A lower credit score can limit your access to credit in the future, resulting in higher interest rates on mortgages, auto loans, and credit cards. This translates to paying significantly more over the life of those loans. For example, a lower credit score might increase the interest rate on a mortgage by a full percentage point, adding thousands of dollars to the total cost.

Credit Score Impact

Consistent, on-time payments on your student loans are crucial for building a strong credit history. Conversely, late or missed payments can drastically lower your credit score, potentially impacting your ability to secure favorable terms on future loans and credit lines. The impact of a low credit score extends beyond interest rates; it can also affect your ability to rent an apartment, get certain jobs, and even secure insurance policies.

Long-Term Financial Implications

Significant student loan debt can constrain future financial goals. Large monthly payments can limit the amount you can save for a down payment on a house, retirement, or an emergency fund. This can lead to delayed milestones and reduced financial flexibility. For instance, someone burdened with substantial student loan payments might postpone starting a family or purchasing a home, significantly altering their life trajectory. It is crucial to create a realistic budget that accounts for student loan repayment alongside other essential financial priorities.

Balancing Repayment with Other Goals

Balancing student loan repayment with other financial goals requires careful planning and budgeting. Prioritizing high-interest debt while simultaneously saving for retirement and other long-term goals requires a strategic approach. Creating a comprehensive budget that allocates funds for loan repayment, emergency savings, retirement contributions, and other essential expenses is vital. Consider exploring different repayment plans to find one that aligns with your current financial situation and long-term objectives. For example, income-driven repayment plans can lower monthly payments, providing more financial breathing room for other savings goals.

Consequences of Default

Defaulting on student loans has severe consequences. This includes damage to your credit score, wage garnishment, tax refund offset, and difficulty obtaining future federal loans or financial aid. Defaulting can make it extremely challenging to secure a mortgage, rent an apartment, or obtain employment in certain fields. The financial repercussions of defaulting can be long-lasting and significantly impact your ability to achieve your financial goals. For example, the government can seize a portion of your tax refund each year until the debt is repaid. Furthermore, the debt can be passed on to your heirs after your death.

Resources and Further Assistance

Navigating the complexities of student loan repayment can feel overwhelming, but numerous resources are available to provide guidance and support. Understanding where to find reliable information and assistance is crucial for successful debt management and long-term financial well-being. This section Artikels key resources and explains how they can help you effectively manage your student loans.

Reputable Organizations Offering Guidance and Support

Several non-profit and government-affiliated organizations offer valuable assistance to student loan borrowers. These organizations provide a range of services, from financial counseling to debt management strategies. Accessing these resources can significantly improve your understanding of repayment options and help you develop a personalized plan to tackle your student loan debt.

- The National Foundation for Credit Counseling (NFCC): The NFCC is a non-profit organization that connects individuals with certified credit counselors who can provide personalized guidance on debt management, including student loans. Counselors can help you create a budget, explore repayment options, and develop strategies for reducing your debt.

- The Consumer Financial Protection Bureau (CFPB): The CFPB is a U.S. government agency that provides resources and information on a wide range of financial topics, including student loans. They offer educational materials and tools to help borrowers understand their rights and responsibilities. Their website provides access to complaints processes and resources for resolving issues with lenders.

- Sallie Mae: While a private lender, Sallie Mae offers resources and tools beyond just loan servicing. They provide educational materials on student loan repayment and financial planning, although it’s important to remember their primary business is lending. It’s recommended to compare their advice with information from independent sources.

Official Government Websites Related to Federal Student Aid

The federal government maintains several websites dedicated to providing information about federal student aid programs. These websites offer comprehensive resources on loan repayment plans, interest rates, and other crucial details. They are invaluable sources of accurate and up-to-date information.

- Federal Student Aid Website: This website is the primary source for information about federal student loans, including eligibility criteria, application procedures, and repayment options. It offers detailed explanations of different loan programs and provides tools for tracking loan balances and managing payments.

- National Student Loan Data System (NSLDS): This website allows borrowers to access their federal student loan information, including loan balances, repayment history, and servicer contact information. It’s a centralized system for managing and tracking federal student loans.

The Role of Student Loan Counselors in Assisting Borrowers

Student loan counselors play a vital role in guiding borrowers through the complexities of loan repayment. They provide personalized advice based on individual financial circumstances, helping borrowers choose the most suitable repayment plan and develop effective debt management strategies. Counselors can also advocate on behalf of borrowers who are facing difficulties with their loan servicer. They can offer support and guidance to help borrowers navigate the challenges of managing student loan debt and avoid default.

Final Conclusion

Securing a higher education often requires navigating the complexities of student loan financing. This guide has provided a framework for understanding federal direct student loans, encompassing the various loan types, repayment options, and strategies for managing debt effectively. By understanding the implications of interest rates, repayment plans, and potential forgiveness programs, you can make informed choices to minimize the long-term financial burden of student loans. Remember, proactive planning and informed decision-making are key to successfully managing your student loan debt and achieving your financial aspirations.

Question & Answer Hub

What happens if I can’t make my student loan payments?

Contact your loan servicer immediately. They can discuss options like deferment, forbearance, or income-driven repayment plans to help you manage your payments.

Can I refinance my student loans?

Yes, you can refinance federal student loans with private lenders. However, be aware that refinancing may lose federal protections and benefits.

How do I find my loan servicer?

You can usually find your loan servicer’s contact information on the National Student Loan Data System (NSLDS) website (information available on government websites related to federal student aid).

What is the difference between deferment and forbearance?

Deferment temporarily suspends payments and may or may not accrue interest, depending on the type of loan. Forbearance temporarily suspends or reduces payments but usually accrues interest.