Navigating the world of student loans can feel overwhelming, especially when it comes to understanding disbursement dates. These dates, marking when funds are released to your account, are crucial for effective financial planning throughout your academic journey. This guide unravels the complexities of student loan disbursement, offering insights into the process, influencing factors, and strategies for managing your finances effectively.

From understanding the steps involved in the disbursement process to identifying potential delays and utilizing available resources, we’ll equip you with the knowledge to confidently manage your student loan funds. We will cover both federal and private loans, highlighting key differences and providing practical advice to ensure a smooth financial experience.

Understanding Student Loan Disbursement Processes

Student loan disbursement is the process by which the funds you’ve been approved for are actually transferred to your account. Understanding this process is crucial for ensuring you receive your funds on time and can cover your educational expenses. The steps involved, timelines, and disbursement methods vary depending on the type of loan and the lender.

Typical Steps in Student Loan Disbursement

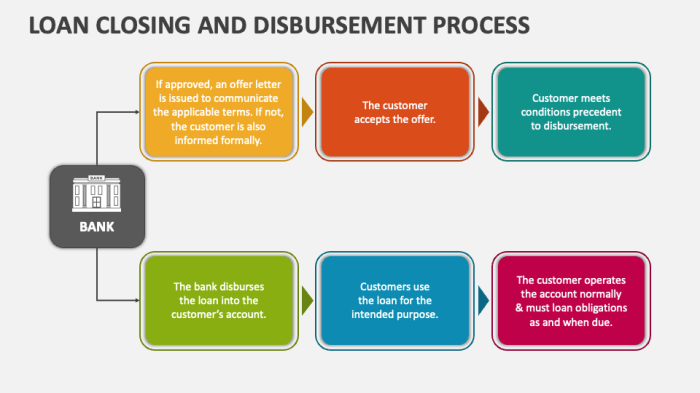

The disbursement process generally begins after you’ve completed your Free Application for Federal Student Aid (FAFSA) or a private loan application and have been approved for funding. Your school then certifies your enrollment, confirming that you are actively pursuing your degree. The lender then verifies your information and prepares the disbursement. Finally, the funds are released and credited to your student account. This can be a direct deposit into your bank account, a paper check mailed to your address, or, less commonly, a credit to your school’s account to cover tuition and fees. The exact timing of each step depends on several factors, including the lender’s processing speed and any required verifications.

Federal vs. Private Student Loan Disbursement Timelines

Federal student loans typically have a more standardized disbursement process and timeline. Disbursements are often made in installments, usually one for each semester or academic term. These installments are often scheduled to coincide with the start of the academic term. Private student loans, on the other hand, can have more variable timelines. The disbursement schedule depends on the lender’s policies and may be subject to additional verification steps, potentially delaying the process. Private loan lenders may also disburse funds in a single lump sum or multiple installments, depending on the loan terms.

Student Loan Disbursement Methods and Processing Times

The most common disbursement methods are direct deposit and paper checks. Direct deposit is generally the fastest method, with funds typically credited to your account within a few business days. Paper checks can take longer, potentially up to 1-2 weeks, due to mailing times and processing delays. The choice of disbursement method is often made during the loan application process. Some lenders may offer electronic fund transfers or other methods as well. Faster methods generally reduce the overall processing time, ensuring quicker access to funds.

Comparison of Disbursement Processes Across Major Student Loan Providers

| Loan Provider | Disbursement Methods | Typical Processing Time | Installment Schedule |

|---|---|---|---|

| Sallie Mae | Direct Deposit, Check | 3-7 business days (direct deposit); 7-14 business days (check) | Per semester/term |

| Navient | Direct Deposit, Check | 3-5 business days (direct deposit); 7-10 business days (check) | Per semester/term |

| Nelnet | Direct Deposit, Check | 2-5 business days (direct deposit); 10-14 business days (check) | Per semester/term |

Factors Affecting Disbursement Dates

Student loan disbursement, while seemingly straightforward, can be subject to delays influenced by various factors. Understanding these potential delays allows students to proactively address any issues and ensure timely access to their funds. This section will explore the key factors contributing to variations in disbursement timelines.

Missing Documentation or Verification Issues

Incomplete or inaccurate application materials are a primary cause of disbursement delays. Lenders require specific documentation to verify a student’s eligibility and identity. This typically includes transcripts, enrollment verification, and proof of identity. Missing or flawed documents trigger a verification process, delaying the release of funds until all required information is received and validated. For instance, a missing tax transcript could halt the process until the student provides it. Similarly, discrepancies between the information provided on the application and official documents will necessitate further verification, adding time to the disbursement timeline.

The Role of the Student’s Institution in the Disbursement Process

The student’s educational institution plays a crucial role in the disbursement process, acting as an intermediary between the lender and the student. The institution verifies the student’s enrollment, confirms their financial aid eligibility, and forwards the disbursement information to the lender. Delays can occur if the institution’s processing systems are slow, if there are errors in the student’s financial aid file, or if the institution experiences internal administrative delays. For example, a backlog of financial aid applications at a university could lead to a delay in disbursement for all students involved.

Impact of Academic Terms on Disbursement Schedules

The timing of disbursement is also affected by the academic term. Fall and spring semesters usually have established disbursement schedules, often aligned with the start of classes. Summer terms, however, frequently have shorter durations and may have different, often more compressed, disbursement timelines. This difference stems from the shorter enrollment periods and the varying needs of students attending summer courses. Disbursements for summer sessions might be released closer to the start of the term compared to the fall and spring semesters.

Flowchart Illustrating Potential Delays in Student Loan Disbursement

Imagine a flowchart with the following steps:

Start: Application Submitted

Step 1: Institution receives application. A delay here could be due to postal delays or application processing backlog at the institution.

Step 2: Institution verifies student enrollment and financial aid eligibility. Delays could arise from incomplete student information or system errors within the institution’s system.

Step 3: Lender receives verification. Delays may result from communication issues between the institution and the lender.

Step 4: Lender verifies student identity and financial information. Delays could be caused by missing documents or discrepancies in the information provided.

Step 5: Funds are disbursed.

Possible Delay Points: Each step contains a potential delay point as detailed above. The flowchart would visually represent the sequential steps and the points where delays can occur, leading to the final disbursement of funds. Any delay at any point would push back the final disbursement date.

Accessing Disbursement Information

Knowing when and how to access your student loan disbursement information is crucial for effective financial planning. This section details the various methods available to track your loan disbursement status and understand the key information provided in official notifications. Staying informed allows you to budget effectively and avoid potential issues.

Understanding the process of accessing disbursement information is vital for timely repayment and avoiding late payment fees. Several resources and methods are available to help students monitor their loan funds and understand their disbursement schedule.

Student Loan Portal Access

Most lenders provide online student loan portals offering a centralized view of your account. These portals usually display disbursement dates, loan amounts, and the status of your loan. To locate this information, log in to your portal and navigate to the section displaying your loan details or transaction history. You’ll typically find a summary table or timeline showing past and upcoming disbursements. For example, many portals use a visual calendar interface where each disbursement is represented as an event on the calendar, indicating the date and amount disbursed. Look for terms like “disbursement date,” “payment date,” or “credit date” to identify the relevant information.

Interpreting Disbursement Notifications

Official disbursement notifications, typically sent via email or mail, contain crucial information. These notifications usually include the disbursement date, the amount disbursed, and the account where the funds were deposited. They might also include details about any fees deducted from the disbursement. For example, a notification might state: “Disbursement of $5,000 on October 26th, 2024, has been deposited into your designated bank account ending in XXXX.” Carefully review all details to ensure accuracy and promptly report any discrepancies. Pay close attention to the specific date, amount, and account information to confirm that the disbursement aligns with your expectations.

Common Resources for Disbursement Information

Accessing accurate and timely information about your student loan disbursement is essential for responsible financial management. Below is a list of reliable resources that can assist you in finding answers to your questions:

- Your Lender’s Website: Most lenders have comprehensive FAQs and support sections on their websites addressing common disbursement questions.

- Your School’s Financial Aid Office: Your school’s financial aid office is a valuable resource for questions regarding disbursement timelines and procedures specific to your institution.

- Your Student Loan Servicer: Once your loans are disbursed, a servicer will manage your account. Their website and customer service lines are excellent resources for questions about your loans.

- The National Student Loan Data System (NSLDS): NSLDS provides a centralized view of your federal student loans, though disbursement details may be limited.

Planning Around Disbursement Dates

Effective financial planning is crucial for students, especially when relying on student loan disbursements. Understanding the timing of these disbursements allows for proactive budgeting and prevents potential financial hardship. By anticipating these dates and creating a realistic budget, students can avoid accumulating debt and manage their finances responsibly.

Knowing when your loan funds will be available allows you to plan your spending accordingly. This proactive approach minimizes the risk of unexpected financial shortfalls and promotes responsible financial management throughout your academic journey. Failing to plan can lead to unnecessary stress and potential financial difficulties.

Budgeting Based on Anticipated Disbursement Dates

Creating a budget that aligns with your expected disbursement dates is key to responsible financial management. Begin by identifying all your anticipated expenses for the semester or academic year, including tuition, fees, housing, food, books, transportation, and personal expenses. Then, compare these expenses to your expected loan disbursement amounts. If the loan amount doesn’t cover all expenses, explore options like part-time employment, scholarships, or grants to bridge the gap. Regularly review and adjust your budget as needed.

Managing Expenses Before Disbursement

The period before loan disbursement can be challenging. To manage expenses effectively during this time, carefully track your spending, prioritize essential expenses (like rent and groceries), and avoid unnecessary purchases. Consider using savings if available or exploring temporary solutions such as reduced spending or seeking short-term financial assistance from family or friends. Accurate expense tracking will help you understand your spending habits and identify areas where you can cut back.

Sample Student Loan Disbursement Budget

The following table illustrates a sample budget for a student receiving a $5,000 student loan disbursement. Remember that this is just an example, and your individual budget will vary based on your personal circumstances and expenses.

| Category | Amount | Category | Amount |

|---|---|---|---|

| Tuition | $2000 | Books & Supplies | $500 |

| Housing | $1500 | Food | $800 |

| Transportation | $200 | Personal Expenses | $0 |

Financial Resources for Disbursement Delays

Unexpected delays in loan disbursements can create financial strain. Fortunately, several resources can provide temporary assistance. These include contacting your university’s financial aid office for guidance and potential short-term solutions, exploring emergency loan options from credit unions or banks, and reaching out to family or friends for support. Many universities also offer emergency funds or hardship grants for students facing unforeseen financial difficulties. Proactive communication with your financial aid office is crucial in addressing any disbursement issues promptly.

Student Loan Disbursement and Financial Aid

Understanding how student loan disbursements interact with other forms of financial aid is crucial for effective financial planning during your education. The timing and amounts of different aid types significantly influence a student’s overall financial picture, potentially impacting budgeting, expenses, and overall financial well-being.

The Interplay of Student Loans and Other Financial Aid

Student loan disbursements often work in conjunction with other financial aid, such as grants and scholarships. Grants, typically awarded based on financial need, and scholarships, often merit-based, directly reduce the overall cost of tuition and fees. These funds frequently arrive earlier than loan disbursements, providing a crucial buffer for initial expenses. A student might receive a grant covering their first semester’s tuition before their loan funds are released, helping to cover immediate costs. The remaining balance would then be covered by the student loan disbursement, which may be disbursed in installments throughout the academic year. This staggered approach ensures that funds are available when needed, rather than all at once.

The Impact of Disbursement Timing on Financial Planning

The timing of various financial aid disbursements significantly impacts a student’s financial planning. For example, a student relying on a combination of grants, scholarships, and loans needs to meticulously track the expected arrival dates of each. If a grant is disbursed early, it can be used to cover immediate expenses like housing and textbooks. However, if loan disbursements are delayed, the student needs a contingency plan to bridge the gap until the funds arrive. Careful budgeting and tracking are essential to avoid potential shortfalls. A student might create a detailed budget, anticipating the arrival of each type of aid, and factoring in potential delays.

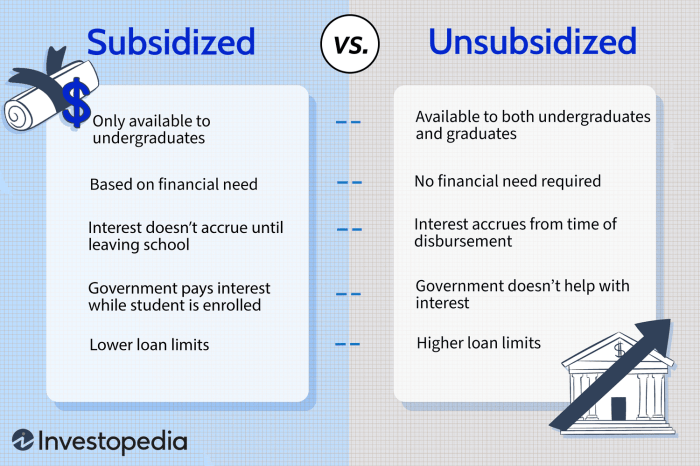

Federal vs. Private Student Loan Disbursement Processes

Federal and private student loan disbursement processes differ. Federal loans generally follow a more standardized procedure, often tied to academic progress and the institution’s disbursement schedule. The school’s financial aid office typically handles the disbursement directly to the student’s account or to cover tuition and fees. Private loans, conversely, have more variable disbursement schedules, and the funds may be directly deposited into the student’s bank account. This can create complexities when coordinating with other aid sources, especially if the private loan disbursement is delayed or doesn’t align with the academic calendar. For instance, a student might receive their federal loan funds promptly, covering tuition, but face delays with their private loan, requiring them to temporarily use credit cards to cover living expenses.

Discrepancies Between Expected and Actual Disbursement Amounts

Discrepancies between expected and actual disbursement amounts can arise from various factors. Changes in enrollment status, incomplete financial aid forms, or issues with verification of information can delay or reduce disbursement amounts. For instance, a student who drops below full-time enrollment might see a reduction in their loan disbursement, while a student whose financial aid application contains errors may experience a delay in receiving funds. Furthermore, unexpected fees or changes in tuition costs could create a shortfall, even if the disbursement amount matches the initial estimate. A student expecting a specific loan amount may find the actual amount lower due to a change in their enrollment status, leaving them with a gap in funding. This highlights the importance of regular communication with the financial aid office to stay informed of any changes.

Last Recap

Successfully managing your student loan disbursement requires proactive planning and a clear understanding of the process. By understanding the factors that influence disbursement dates, utilizing available resources to track your funds, and developing effective budgeting strategies, you can navigate this crucial aspect of your education with confidence. Remember, proactive planning and resourcefulness are key to a successful financial journey.

Key Questions Answered

What happens if my disbursement is delayed?

Contact your loan provider immediately to investigate the cause of the delay. Many institutions offer financial assistance programs for students facing unexpected delays.

Can I change my disbursement method after applying for a loan?

This depends on your loan provider and the stage of the application process. Contact your lender to inquire about changing your disbursement method.

How often are student loan disbursements made?

Disbursements are typically made per academic term (fall, spring, summer) and are often split into installments.

What if I receive less money than expected in my disbursement?

Review your loan documents and contact your lender to reconcile any discrepancies. There might be adjustments for fees or other factors.