Navigating the complexities of student loan disbursement can feel overwhelming. Understanding when and how you receive your funds is crucial for effective financial planning during your education. This guide provides a comprehensive overview of student loan disbursement schedules, covering various loan types, influencing factors, and best practices for managing your funds effectively. We’ll explore potential issues, solutions, and different disbursement methods to ensure a smooth and stress-free process.

From understanding the components of a typical disbursement schedule to mastering effective budgeting strategies, we aim to empower you with the knowledge needed to confidently manage your student loan funds. We will also address common questions and concerns to help you navigate this important aspect of higher education financing.

Understanding Disbursement Schedules

Student loan disbursement schedules Artikel when and how your loan funds will be released to you or your educational institution. Understanding this schedule is crucial for effective financial planning during your studies. A clear understanding ensures you can budget effectively and avoid potential financial surprises.

Disbursement schedules typically include key information about your loan(s).

Components of a Disbursement Schedule

A typical disbursement schedule will detail the date(s) funds will be released, the amount disbursed on each date, the loan type(s) involved, and the remaining balance after each disbursement. It might also include information regarding any fees associated with the loan disbursement. The level of detail provided can vary depending on the lender and the type of loan.

Differences in Disbursement Schedules Across Loan Types

Federal student loans often have disbursement schedules tied to academic terms or semesters. Funds are usually disbursed directly to the educational institution to cover tuition and fees, with any remaining amount sent to the student. The disbursement schedule is usually provided by the school’s financial aid office. Private student loans, conversely, may have more flexible disbursement schedules, sometimes allowing for direct disbursement to the student or a more customized payment plan. They may also have different disbursement processes, requiring more direct interaction with the lender.

Examples of Disbursement Schedules

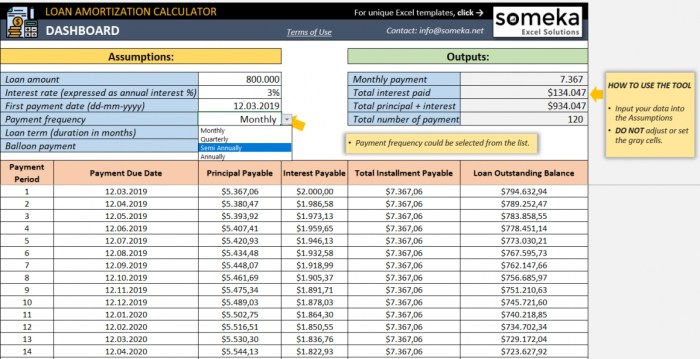

Disbursement schedules are commonly presented in tabular format. Below is a sample schedule illustrating how this information might be presented. Note that this is a simplified example, and actual schedules may contain more details.

| Disbursement Date | Loan Type | Amount Disbursed | Remaining Balance |

|---|---|---|---|

| August 15, 2024 | Federal Direct Subsidized Loan | $3,500 | $10,500 |

| October 1, 2024 | Federal Direct Unsubsidized Loan | $4,000 | $6,500 |

| December 15, 2024 | Federal Direct Subsidized Loan | $3,000 | $3,500 |

| February 1, 2025 | Federal Direct Unsubsidized Loan | $3,500 | $0 |

Factors Affecting Disbursement Timing

Receiving your student loan funds is a crucial step in financing your education, and understanding the factors that influence the disbursement timeline is essential for effective financial planning. Several interconnected elements contribute to the timing of your loan disbursement, ranging from your own actions to institutional processes.

Several key factors influence when your student loan funds are released. These factors often interact, creating a complex process that requires careful attention to detail from both the student and the institution. Understanding these factors can help you manage expectations and avoid potential delays.

The Role of the Institution’s Financial Aid Office

The institution’s financial aid office plays a central role in the disbursement process. They are responsible for verifying your enrollment, confirming your eligibility for financial aid, and processing your loan application. This involves checking for accuracy and completeness in your application, ensuring you meet all the necessary requirements, and coordinating with the loan provider to initiate the disbursement. Any issues or delays within the financial aid office, such as high application volume or staff shortages, can directly impact the speed of disbursement. For instance, a university experiencing a surge in applications during a busy enrollment period might experience a backlog in processing, leading to slight delays in loan disbursement.

Impact of Delayed or Incomplete Documentation

Submitting incomplete or delayed documentation can significantly delay the disbursement of your student loan funds. Required documents often include enrollment verification, loan applications, and any supporting documentation related to your financial situation or academic standing. Failure to provide these documents promptly can lead to a hold on your loan processing. For example, a missing transcript or an incomplete loan application form can result in delays ranging from a few days to several weeks. The institution’s financial aid office will typically notify students of any missing documentation and provide instructions on how to submit the necessary materials. Prompt action is key to minimizing delays.

Managing Funds After Disbursement

Receiving your student loan disbursement marks a significant step, but effective management is crucial for ensuring your funds last throughout your studies. Careful planning and consistent tracking are key to avoiding financial stress and making the most of your educational investment. This section Artikels strategies for responsible fund management.

Successful management of your loan disbursement requires a proactive approach. It’s not just about spending; it’s about strategic allocation to meet your educational and living needs while keeping your long-term financial health in mind. Understanding your budget and consistently monitoring your spending habits are critical components of this process.

Budgeting Strategies

Creating a detailed budget is paramount to successful financial management. This involves carefully estimating your income (your loan disbursement) and expenses (tuition, housing, food, transportation, etc.). Regularly reviewing and adjusting your budget ensures you stay on track and identify potential areas for savings. Consider using budgeting apps or spreadsheets to simplify the process.

- Prioritize Essential Expenses: Focus on allocating funds first to essential expenses such as tuition, rent or mortgage payments, utilities, and groceries.

- Track Spending Habits: Monitor your spending regularly using budgeting apps, spreadsheets, or even a simple notebook. This helps identify areas where you can cut back.

- Create an Emergency Fund: Aim to set aside a small portion of your loan for unexpected expenses. This can prevent you from falling behind on payments or taking on additional debt.

- Avoid Impulse Purchases: Resist the temptation to make unnecessary purchases. Consider the long-term implications before spending.

- Regularly Review and Adjust: Your budget isn’t static. Review it at least monthly to account for changes in expenses or income.

Hypothetical Student Budget

Let’s consider a hypothetical student, Sarah, receiving a $10,000 loan disbursement for a semester. This budget example demonstrates a practical allocation strategy. Note that these figures are estimates and may vary based on individual circumstances and location.

| Category | Amount |

|---|---|

| Tuition | $4,000 |

| Housing (Rent/Dorm) | $2,500 |

| Food | $1,500 |

| Transportation | $500 |

| Books & Supplies | $500 |

| Personal Expenses | $500 |

| Emergency Fund | $500 |

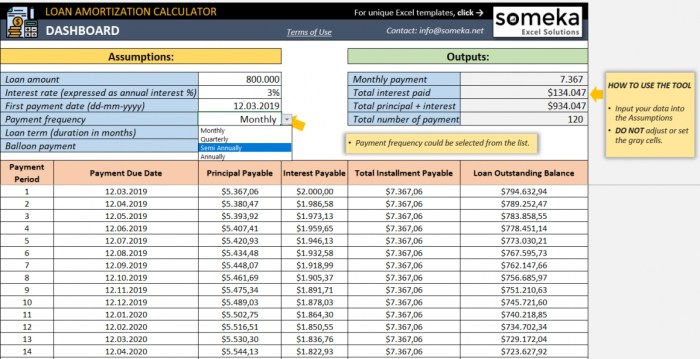

Loan Payment Tracking

Tracking your loan payments is crucial to avoid late payments and potential penalties. Many lenders provide online portals to monitor your account and payment history.

- Utilize Lender Portals: Most lenders offer online portals where you can track your loan balance, payment history, and upcoming due dates.

- Set Reminders: Set reminders on your phone or calendar to ensure you make your payments on time.

- Automate Payments: Consider setting up automatic payments to avoid missed payments.

- Keep Records: Maintain a record of all your loan payments for your personal records.

Potential Issues and Resolutions

Student loan disbursement can sometimes present unforeseen challenges. Understanding potential problems and knowing how to address them proactively can significantly reduce stress and ensure you receive your funds in a timely manner. This section Artikels common issues and provides practical solutions for resolving them.

Delays and discrepancies are among the most frequently encountered problems. Late disbursements can disrupt educational plans and create financial hardship, while discrepancies in funding amounts can leave students short of the necessary funds. Effective communication and a methodical approach are key to resolving these issues.

Late Disbursements

Late disbursement of student loan funds can stem from various factors, including incomplete application forms, missing documentation, processing delays by the lender or institution, or verification issues. Addressing these problems requires prompt action and clear communication.

If your loan disbursement is delayed, the first step is to check your loan portal for updates or any requests for additional information. Many institutions provide online portals where you can track your loan’s progress. If you find no updates, contact your lender or financial aid office directly. Explain the situation clearly, providing your student ID number and any relevant details. Keep a record of all communication, including dates, times, and the names of the individuals you spoke with.

Discrepancies in Funding Amounts

Sometimes, the disbursed amount may differ from the expected amount. This could be due to errors in calculating the loan amount, changes in enrollment status, or outstanding balances on your account.

If you notice a discrepancy, carefully review your loan documents and your student account statement. Compare the disbursed amount with your initial loan offer and any subsequent changes. If the discrepancy persists, contact your lender or financial aid office immediately. Provide them with all relevant documentation, including your loan offer letter and your account statement. They can investigate the discrepancy and provide a resolution.

Step-by-Step Guide to Resolving Disbursement Issues

A systematic approach can help you resolve disbursement-related problems efficiently. This guide Artikels a clear path to follow.

- Check your loan portal: Log in to your student loan portal and review the status of your disbursement. Look for any messages or notifications indicating potential issues or requests for additional information.

- Gather necessary documentation: Collect all relevant documents, such as your loan offer letter, student account statement, and any communication you’ve had with your lender or financial aid office.

- Contact your lender or financial aid office: If you identify a problem, contact your lender or financial aid office immediately. Explain the situation clearly and provide them with the necessary documentation.

- Follow up: After contacting your lender or financial aid office, follow up on your case within a reasonable timeframe. If you don’t receive a response, reach out again.

- Keep records: Maintain a record of all communication, including dates, times, and the names of the individuals you spoke with. This documentation will be useful if you need to escalate the issue.

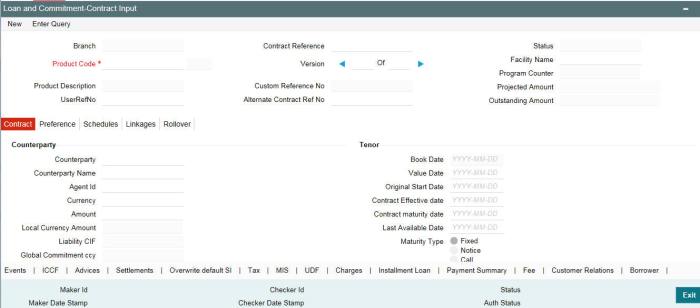

Comparison of Different Disbursement Methods

Student loan disbursement methods directly impact how quickly and easily you access your funds. Understanding the differences between available options is crucial for efficient financial planning. This section compares direct deposit and check disbursement, highlighting their respective advantages and disadvantages, and outlining the process of setting up direct deposit.

Direct Deposit versus Check Disbursement

Direct deposit and check disbursement represent the two primary methods for receiving student loan funds. Each offers distinct benefits and drawbacks that students should consider when choosing their preferred method.

Advantages and Disadvantages of Direct Deposit

Direct deposit, the electronic transfer of funds directly into a designated bank account, offers several advantages. It’s generally faster, safer, and more convenient than receiving a check. Funds are typically available within a few business days, eliminating the need to physically deposit a check and wait for processing. The risk of lost or stolen checks is also eliminated. However, it requires having an active bank account. If a student doesn’t have a bank account, this method is not feasible. Furthermore, incorrect account information can lead to delays or failed transactions.

Advantages and Disadvantages of Check Disbursement

Check disbursement, while a traditional method, presents some drawbacks. The primary disadvantage is the time it takes for the check to arrive and be processed. This can significantly delay access to funds. Additionally, checks can be lost, stolen, or damaged during transit, creating potential complications. On the positive side, check disbursement doesn’t require a bank account, providing an alternative for students without one. However, this convenience comes at the cost of speed and security.

Setting Up Direct Deposit for Student Loan Disbursements

Setting up direct deposit typically involves providing your financial institution’s name, your account number, and your routing number to your loan servicer. This information is usually requested through your student loan portal or during the loan application process. Accurate information is paramount to ensure successful disbursement. Many servicers offer online forms or allow you to upload images of your bank statement to verify your account details. Double-checking all entered information before submitting is crucial to prevent delays or issues with receiving your funds. Contacting your loan servicer directly if you encounter any problems is recommended. They can provide specific instructions and address any questions you might have regarding the process.

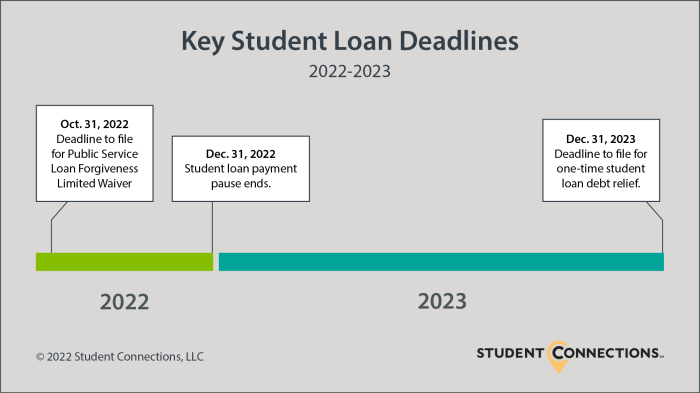

Visual Representation of Disbursement Information

Understanding the timeline and process of student loan disbursement is crucial for effective financial planning. Visual aids significantly improve comprehension by presenting complex information in a clear and accessible format. This section provides visual representations to illustrate the disbursement process and potential delays.

Visual representations, such as timelines and flowcharts, offer a concise and easily digestible overview of the often intricate student loan disbursement process. These tools allow students to anticipate key milestones, identify potential delays, and proactively manage their funds.

Student Loan Disbursement Timeline

A horizontal timeline would effectively illustrate the key stages of the disbursement process. The timeline would begin with the loan application submission and progress through various stages, including application processing, credit check, loan approval, disbursement scheduling, and finally, the receipt of funds. Each stage would be represented by a labeled marker along the timeline. Crucially, the timeline would also incorporate potential delays, such as incomplete application forms represented by a branching path showing the delay and the steps to correct the issue, or a delay caused by verification of income represented by a different branching path. The length of each segment could visually represent the typical duration of each stage. Different colors could be used to differentiate between the standard process and potential delays, with delays highlighted in a contrasting color like red or orange to draw attention to them. Key milestones, such as the disbursement date, would be clearly marked with larger, bolder text or symbols. This visual representation would provide a clear and concise overview of the expected timeline, highlighting potential points of delay and the overall process duration.

Student Loan Disbursement Flowchart

A flowchart would effectively illustrate the step-by-step process of student loan disbursement. The flowchart would use standard flowchart symbols, such as rectangles for processes, diamonds for decisions, and parallelograms for input/output. The process would begin with the student submitting a loan application. Subsequent steps would include application review, credit check, loan approval or denial (represented by a decision diamond), disbursement scheduling, and finally, the release of funds to the student’s account. Each step would be clearly labeled, and the flowchart would show the flow of information and actions throughout the process. Potential delays or issues, such as missing documentation or verification requirements, could be included as separate branches in the flowchart, illustrating how these issues can impact the overall timeline. For example, a branch might show a loop back to a previous step if additional documentation is required. This visual representation would provide a clear and concise step-by-step overview of the entire disbursement process.

Final Review

Successfully managing your student loan disbursement requires proactive planning and a clear understanding of the process. By familiarizing yourself with the key factors influencing disbursement timing, employing effective budgeting strategies, and knowing how to address potential issues, you can significantly reduce stress and ensure a smoother financial journey throughout your academic years. Remember, seeking assistance from your financial aid office or lender is always an option if you encounter difficulties.

Q&A

What happens if my disbursement is delayed?

Contact your financial aid office or lender immediately to inquire about the delay and identify the cause. They can provide information on the expected timeline and any necessary actions.

Can I change my disbursement method after it’s been set up?

Generally, yes. However, the process and timeframe may vary depending on your lender and institution. Contact them to inquire about changing your disbursement method (e.g., from direct deposit to check).

What if I receive a disbursement amount that’s incorrect?

Immediately contact your lender or financial aid office to report the discrepancy. Provide documentation such as your loan agreement and disbursement schedule to facilitate a quick resolution.

How can I track my loan disbursement progress?

Most lenders and institutions provide online portals or account access where you can track the status of your disbursement. Check your account regularly for updates.