Navigating the complex world of student loans can feel overwhelming, especially for students facing the prospect of significant debt. This guide provides a clear and concise path to understanding the various loan options available, the application process, and effective repayment strategies. From understanding federal and private loans to utilizing online tools and resources, we’ll equip you with the knowledge to make informed decisions about your financial future.

We will explore the current student loan landscape in the US, highlighting key features and challenges. We’ll delve into the specifics of different loan types, application procedures, and the importance of thoroughly understanding loan terms before committing. Practical tools and resources will be presented to aid in comparison shopping and informed decision-making. Finally, we will cover post-approval management, including repayment plans and strategies to avoid default.

Understanding the Student Loan Landscape

Navigating the US student loan system can be complex, with a multitude of loan types, repayment plans, and potential challenges. This section provides a foundational understanding of the current landscape to help you make informed decisions. The high cost of higher education in the US has led to a significant increase in student loan debt, impacting millions of borrowers.

The Current US Student Loan Market

The US student loan market is characterized by a significant amount of outstanding debt, held by both the federal government and private lenders. Federal student loans, offered by the government, generally offer more favorable terms and repayment options than private loans. However, the sheer volume of federal student loan debt presents challenges for both borrowers and the government. Delinquency and default rates fluctuate, impacting the overall economic stability of borrowers and the financial health of the lending institutions. Furthermore, the rising cost of tuition continues to fuel the growth of the student loan market, creating a cycle of increasing debt for many students. The market is also influenced by fluctuating interest rates, impacting repayment costs and the overall affordability of higher education.

Types of Student Loans

Students can access two primary types of student loans: federal and private. Federal student loans are offered by the government and are generally preferred due to their borrower protections and flexible repayment plans. These include subsidized and unsubsidized loans, as well as PLUS loans for parents and graduate students. Private student loans, on the other hand, are offered by banks and other financial institutions. They often have higher interest rates and fewer repayment options than federal loans, but they may be necessary for students who don’t qualify for sufficient federal aid.

Applying for Federal and Private Student Loans

The application process for federal student loans typically involves completing the Free Application for Federal Student Aid (FAFSA). This form collects information about your financial situation and is used to determine your eligibility for federal student aid, including grants, scholarships, and loans. Once approved, the funds are disbursed directly to your educational institution. Applying for private student loans usually involves a more rigorous application process, including a credit check (often requiring a co-signer if the student lacks a credit history). Private lenders assess your creditworthiness and financial history to determine your eligibility and loan terms. You will typically need to shop around and compare offers from multiple lenders before selecting a loan.

Comparison of Student Loan Options

| Loan Type | Interest Rate | Repayment Terms | Eligibility Requirements |

|---|---|---|---|

| Federal Subsidized Loan | Variable, set by the government | Various repayment plans available, including income-driven repayment | US citizenship or eligible non-citizen status, enrollment in an eligible educational program, demonstration of financial need (for subsidized loans) |

| Federal Unsubsidized Loan | Variable, set by the government | Various repayment plans available | US citizenship or eligible non-citizen status, enrollment in an eligible educational program |

| Federal PLUS Loan (Parent/Grad) | Variable, set by the government | Various repayment plans available | US citizenship or eligible non-citizen status, enrollment in an eligible educational program, credit check (for parents) |

| Private Student Loan | Variable, set by the lender; generally higher than federal loans | Varies by lender; typically fixed terms | Creditworthiness (often requiring a co-signer), enrollment in an eligible educational program |

The Discovery Process

Navigating the world of student loans can feel overwhelming, but a systematic approach to research can significantly simplify the process. Understanding your options and the terms involved is crucial for making informed decisions that align with your financial goals and future prospects. This section Artikels a step-by-step guide to effectively research student loan options and make sound financial choices.

Effective research involves a multi-pronged approach, combining exploration of various resources with careful consideration of your individual circumstances. This will enable you to compare loan options and select the one that best suits your needs. Remember, taking your time and thoroughly understanding the terms is key to avoiding potential pitfalls.

Reliable Sources of Information for Student Loans

Finding trustworthy information is paramount when researching student loans. Relying on unreliable sources can lead to misinformation and potentially costly mistakes. Therefore, it is vital to focus on credible and verified sources.

Several reliable sources can provide comprehensive and accurate information. These include government websites offering official details on federal student loan programs, and reputable financial institutions offering private student loans. Each source provides different types of information, ensuring a well-rounded understanding of the options available.

- Federal Government Websites: The U.S. Department of Education’s website (studentaid.gov) is an excellent starting point. It provides details on federal loan programs, eligibility requirements, repayment plans, and more. This is a crucial source for understanding government-backed loans.

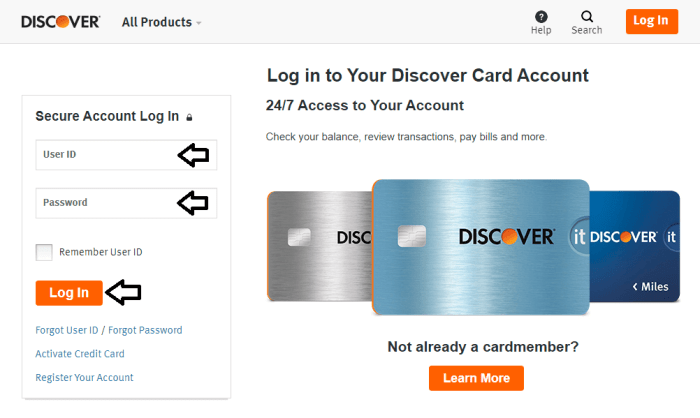

- Reputable Financial Institutions: Banks and credit unions often offer private student loans. Reviewing their websites and comparing interest rates, fees, and repayment terms is essential. It is important to check the institution’s reputation and financial stability before considering a loan from them.

- Independent Financial Aid Advisors: Independent, fee-based financial aid advisors can offer personalized guidance. However, it is crucial to verify their credentials and experience to ensure you are receiving accurate and unbiased advice. Their services are usually best suited for complex financial situations.

A Step-by-Step Guide to Researching Student Loan Options

A structured approach ensures you cover all essential aspects when exploring student loan options. This methodical process helps avoid overlooking critical details and facilitates a more informed decision.

- Determine your financial need: Calculate the total cost of your education, including tuition, fees, room, and board, and subtract any financial aid you’ve already received (grants, scholarships). This will reveal how much you need to borrow.

- Explore federal loan options first: Federal student loans often offer lower interest rates and more flexible repayment options than private loans. Understand the different types of federal loans (subsidized, unsubsidized, PLUS loans) and their eligibility requirements.

- Compare private loan offers: If you need to borrow more than federal loans cover, research private loan options from multiple lenders. Compare interest rates, fees, repayment terms, and any additional benefits offered.

- Read the fine print: Carefully review all loan documents before signing. Pay close attention to interest rates, fees, repayment terms, and any penalties for late payments or default.

- Consider your repayment plan: Understand the different repayment options available (standard, graduated, income-driven) and choose the plan that best fits your post-graduation financial expectations.

Decision-Making Flowchart for Choosing a Student Loan

A visual representation can simplify the decision-making process. The flowchart below illustrates a structured approach to choosing the right student loan. It emphasizes a step-by-step process, leading to an informed and suitable choice.

[Imagine a flowchart here. The flowchart would start with “Determine Financial Need,” branching to “Explore Federal Loans” (Yes/No). If “Yes,” it would lead to “Compare Federal Loan Options,” then to “Apply for Federal Loans.” If “No” from “Explore Federal Loans,” it would go to “Explore Private Loans,” then to “Compare Private Loan Offers,” then to “Apply for Private Loans.” Both “Apply for Federal Loans” and “Apply for Private Loans” would converge to “Review Loan Documents and Terms,” and finally, “Select Loan and Sign Agreement.”]

Understanding Loan Terms and Conditions

Thoroughly understanding the loan terms and conditions is paramount before signing any agreements. Overlooking crucial details can lead to unforeseen financial burdens and difficulties. Therefore, careful review is vital.

Loan agreements typically include details on interest rates (fixed or variable), fees (origination fees, late payment fees), repayment terms (length of repayment, monthly payments), and default consequences. Understanding these aspects allows for informed decision-making and avoids future complications. It’s recommended to seek clarification on any unclear points before committing to a loan.

“Failing to understand the terms and conditions of a student loan can have significant long-term financial implications.”

Tools and Resources for Student Loan Discovery

Navigating the complex world of student loans can feel overwhelming, but thankfully, numerous online tools and resources are available to simplify the process. These resources empower students to compare loan options effectively, understand repayment terms, and make informed financial decisions. Utilizing these tools can significantly reduce stress and improve the overall loan selection experience.

Online Tools and Resources for Student Loan Comparison

Several websites and apps provide comprehensive tools to compare student loan options. These platforms typically allow users to input their financial information and educational goals to receive personalized loan recommendations. Key features often include interest rate comparisons, repayment schedule projections, and eligibility requirements for various loan types. Effective use of these tools can save borrowers significant amounts of money over the life of their loans.

Student Loan Calculators and Repayment Planning Tools

Access to accurate and reliable student loan calculators is crucial for effective financial planning. These calculators help estimate monthly payments, total interest paid, and the overall cost of borrowing. Many also allow users to explore different repayment scenarios, such as adjusting loan terms or making extra payments, to understand their impact on the total cost. Using a calculator before committing to a loan can prevent financial surprises and allow for informed decision-making. Examples include calculators provided by the federal government (like the one on studentaid.gov) and many reputable financial institutions.

Comparison of Student Loan Comparison Websites

The following table compares the features and benefits of several popular student loan comparison websites. Note that features and availability may change over time, so it’s always best to check the websites directly for the most up-to-date information.

| Website | Features | Benefits | Limitations |

|---|---|---|---|

| Example Website A (replace with actual website) | Loan comparison, interest rate information, repayment calculators, eligibility checks | Comprehensive comparison tools, easy-to-use interface | May not include all lenders, limited personalized advice |

| Example Website B (replace with actual website) | Loan comparison, repayment plan options, prequalification, financial literacy resources | Focus on personalized recommendations, access to educational resources | May require personal information upfront |

| Example Website C (replace with actual website) | Loan comparison, refinancing options, debt management tools | Strong focus on refinancing, helpful for existing borrowers | May not be suitable for first-time borrowers |

Using a Student Loan Calculator

Let’s illustrate how a student loan calculator works. Imagine a student borrows $20,000 at a 5% interest rate over 10 years. Using a standard amortization calculator (many are freely available online), we can determine the monthly payment. For this example, the approximate monthly payment would be around $212. The total interest paid over the 10-year period would be approximately $4,260. By adjusting the loan term or interest rate, the calculator allows users to see how these changes affect their monthly payments and the overall cost of the loan. For instance, extending the loan term to 15 years would lower the monthly payment but increase the total interest paid. This demonstrates the importance of carefully considering all repayment options before finalizing a loan agreement. Remember to always use a reputable calculator from a trusted source to ensure accuracy.

Navigating the Application Process

Securing student loans involves a multi-step application process that requires careful attention to detail and thorough preparation. Understanding the requirements and potential pitfalls can significantly improve your chances of a successful application and favorable loan terms. This section Artikels the key steps, potential challenges, and best practices for navigating this crucial stage.

The student loan application process generally follows a similar pattern across various lenders, though specific requirements may vary. It’s crucial to carefully review the lender’s specific instructions and guidelines.

Required Documentation and Verification

Completing a student loan application requires providing various documents to verify your identity, financial situation, and enrollment status. Commonly requested documents include a completed application form, proof of identity (such as a driver’s license or passport), social security number, proof of enrollment (acceptance letter or transcript from your educational institution), and tax returns or other financial documentation to demonstrate your ability to repay the loan. Lenders may also request bank statements or pay stubs to assess your financial stability. The verification process typically involves the lender contacting your educational institution and potentially your employer to confirm the information you have provided. Failure to provide accurate and complete documentation can delay the application process or lead to rejection.

Co-Signer Roles and Types

In many cases, especially for students with limited credit history, a co-signer is required to increase the likelihood of loan approval. A co-signer is an individual with established credit who agrees to share responsibility for repaying the loan if the student defaults. There are different types of co-signers, including parents, relatives, or even close friends with strong credit. The co-signer’s credit score and financial stability significantly influence the loan approval and interest rate offered. The co-signer’s role is to mitigate the lender’s risk, providing a safety net in case the student is unable to meet their repayment obligations. Choosing a reliable co-signer with a good credit history is essential for a successful application.

Negotiating Loan Terms and Interest Rates

While lenders generally set interest rates based on creditworthiness and market conditions, there’s often room for negotiation, particularly for larger loan amounts or when comparing offers from multiple lenders. Students can improve their negotiating position by demonstrating a strong credit history, securing a co-signer with excellent credit, and shopping around for the best rates from different lenders. Comparing loan terms, including interest rates, fees, and repayment schedules, is crucial before committing to a loan. It’s advisable to clearly articulate your financial situation and repayment capacity during negotiations, highlighting any factors that could strengthen your application.

Common Application Mistakes and Avoidance Strategies

Several common mistakes can hinder the student loan application process. One frequent error is submitting incomplete or inaccurate information on the application. Carefully reviewing the application form and providing accurate details is crucial. Another common mistake is failing to compare loan offers from different lenders. Shopping around and comparing interest rates, fees, and repayment terms can save significant money over the life of the loan. Finally, neglecting to understand the loan terms and conditions before signing the agreement is a significant oversight. Thoroughly reading and understanding all aspects of the loan agreement is essential before committing to the loan. By avoiding these common pitfalls and diligently preparing for the application process, students can significantly increase their chances of securing favorable loan terms.

Post-Approval

Congratulations! Securing your student loans marks a significant step towards your educational goals. However, the journey doesn’t end with approval. Understanding and effectively managing your student loans post-approval is crucial for your long-term financial well-being. This section Artikels key aspects of post-approval loan management, including repayment options, the consequences of default, and strategies for successful repayment.

Repayment Plan Options

After graduation or leaving school, you’ll need to begin repaying your student loans. Several repayment plans are available, each with its own terms and conditions. Choosing the right plan depends on your individual financial circumstances and income. Common plans include standard repayment (fixed monthly payments over 10 years), graduated repayment (payments increase over time), extended repayment (longer repayment period, resulting in lower monthly payments but higher overall interest), and income-driven repayment (payments based on your income and family size). It’s important to carefully compare these options to determine the best fit for your situation. The federal government offers several income-driven repayment plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). These plans can significantly reduce monthly payments, but they often result in a longer repayment period and potentially higher total interest paid.

Consequences of Student Loan Default

Defaulting on your student loans—failing to make payments for a specified period—has serious consequences. These consequences can significantly impact your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future. Furthermore, the government can garnish your wages, tax refunds, and even Social Security benefits to recover the debt. Default can also lead to the loss of professional licenses in certain fields and limit your ability to obtain future federal student aid. The severity of the consequences varies depending on the loan type and the amount owed, but the potential financial and personal ramifications are substantial. For example, a defaulted loan could lead to a significant drop in your credit score, potentially impacting your ability to buy a house or car in the future.

Strategies for Effective Student Loan Repayment

Effective student loan repayment requires careful planning and budgeting. Creating a realistic budget that accounts for all income and expenses is crucial. This budget should prioritize loan payments alongside essential living expenses such as housing, food, and transportation. Exploring options for increasing income, such as a part-time job or freelance work, can help accelerate repayment. Additionally, consider automating your loan payments to ensure timely payments and avoid late fees. Regularly reviewing your budget and adjusting it as needed will ensure you stay on track. Finally, consistently making extra payments, even small ones, can significantly reduce the total interest paid and shorten the repayment period. For instance, paying even an extra $50 per month can save thousands of dollars in interest over the life of the loan.

Resources for Borrowers Experiencing Financial Hardship

If you’re facing financial hardship and struggling to make your student loan payments, several resources can provide assistance.

- Deferment or Forbearance: These programs temporarily postpone or reduce your payments. Eligibility requirements vary depending on the loan type and your circumstances.

- Income-Driven Repayment Plans: As mentioned earlier, these plans base your monthly payments on your income and family size.

- Student Loan Counseling: Non-profit credit counseling agencies can provide guidance on managing your student loans and exploring repayment options.

- Federal Student Aid Website: The official website (studentaid.gov) offers comprehensive information on repayment plans, hardship options, and other resources.

Illustrative Scenarios

Understanding the student loan process can be significantly improved by examining real-world examples. These scenarios highlight both successful navigation and the challenges that can arise, offering valuable insights for prospective borrowers.

Successful Student Loan Discovery and Application

Sarah, a diligent pre-med student, began researching student loan options early in her junior year. She meticulously compared interest rates, repayment plans, and loan terms from various lenders, including federal and private options. Sarah utilized online loan comparison tools and attended a financial aid workshop at her university. This allowed her to identify a combination of federal subsidized and unsubsidized loans that minimized her overall borrowing and matched her expected need. She carefully reviewed all loan documents, ensuring she understood the terms and conditions before signing. Her proactive approach resulted in a streamlined application process and a manageable loan burden upon graduation. She secured the best loan options for her needs and circumstances, resulting in a lower overall cost.

Challenging Student Loan Discovery and Application

Mark, a first-generation college student, felt overwhelmed by the student loan process. He lacked awareness of the different loan types available and did not seek guidance from his university’s financial aid office. He rushed the application process, failing to compare loan terms thoroughly. He ended up with a higher interest rate and less favorable repayment terms than were available. Mark’s initial challenges were compounded by a lack of understanding of the terms of his loans and available repayment options. However, after realizing his mistake, he sought assistance from a financial aid counselor, who helped him refinance his loans at a lower interest rate. This experience taught him the importance of careful planning and seeking professional guidance.

Successful Student Loan Repayment Plan

Upon graduation, Jessica implemented a robust student loan repayment strategy. She immediately created a detailed budget, allocating a significant portion of her income towards loan repayment. She opted for an income-driven repayment plan that adjusted her monthly payments based on her income and family size. Jessica diligently tracked her payments and explored options to accelerate repayment, such as making extra payments whenever possible. She also prioritized high-interest loans to reduce the overall cost of borrowing. Her proactive approach ensured that her loan payments were manageable and she remained on track to repay her loans efficiently. By utilizing budgeting tools and keeping a close eye on her progress, she successfully managed her loan repayments without compromising her financial stability.

Ending Remarks

Successfully navigating the student loan process requires careful planning, research, and a proactive approach. By understanding the different loan types, utilizing available resources, and carefully managing your repayment plan, you can minimize the financial burden of higher education and pave the way for a secure financial future. Remember that seeking professional financial advice can be invaluable in making informed decisions tailored to your specific circumstances. Take control of your financial journey and make the most of your educational investment.

Commonly Asked Questions

What is the difference between federal and private student loans?

Federal loans are offered by the government and typically have more favorable terms and repayment options. Private loans are offered by banks and credit unions, often with higher interest rates and stricter eligibility requirements.

What happens if I default on my student loans?

Defaulting on student loans can have severe consequences, including damage to your credit score, wage garnishment, and tax refund offset. It can also make it difficult to obtain future loans or credit.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments. However, refinancing federal loans into private loans may mean losing certain benefits like income-driven repayment plans.

What is a co-signer, and why would I need one?

A co-signer is someone who agrees to repay your loan if you default. Lenders often require co-signers for borrowers with limited credit history or low credit scores.