Facing a delayed student loan disbursement can be incredibly stressful. The anticipated funds, crucial for tuition, housing, and living expenses, fail to materialize, leaving students scrambling to manage their finances. This situation, unfortunately, is more common than many realize, stemming from a variety of factors ranging from simple administrative oversights to more complex documentation issues. Understanding the reasons behind these delays, and proactively addressing potential problems, is key to ensuring a smooth financial path through your education.

This guide explores the common causes of student loan disbursement delays, offering practical advice and solutions. We’ll delve into the verification process, effective communication strategies with loan providers and financial aid offices, and even explore alternative funding options to bridge the gap. By understanding the system and taking proactive steps, you can minimize the risk of facing financial hardship due to delayed loan payments.

Reasons for Student Loan Non-Advancement

Student loan disbursement delays can be frustrating and disruptive to a student’s academic and financial planning. Understanding the reasons behind these delays can help students proactively address potential issues and ensure a smoother process. Several factors, both on the student’s side and within the administrative processes of the lending institution, can contribute to non-advancement of student loan funds.

Administrative Processes and Potential Points of Failure

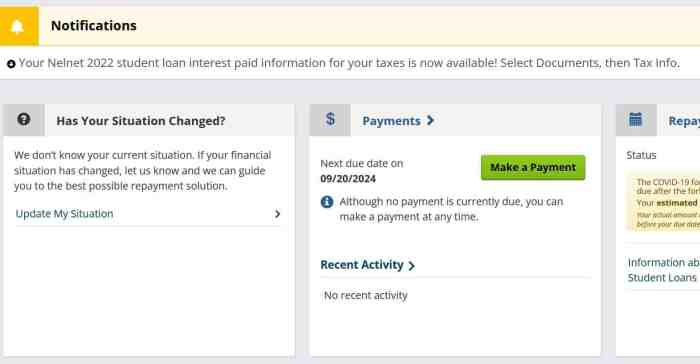

The process of student loan disbursement involves several steps, each presenting a potential point of failure. First, the student’s application must be completed accurately and submitted on time. Then, the application undergoes verification, which involves checking the student’s eligibility, academic standing, and financial information. This often includes confirming enrollment with the educational institution and verifying the student’s identity. Next, the loan is processed by the lender, which involves internal review and approval. Finally, the funds are disbursed to the student’s account, typically through direct deposit or a check. Delays can occur at any stage of this process.

Examples of Delayed or Rejected Loan Applications

Several scenarios can lead to delays or rejection of a student loan application. For example, incomplete or inaccurate application forms, discrepancies in the information provided, failure to meet the lender’s eligibility criteria (such as minimum GPA or credit score requirements), or late submission of required documentation can all cause delays. Another common issue is a problem with the student’s financial aid package, such as missing documentation or discrepancies between the student’s reported information and the institution’s records. Furthermore, issues with the student’s banking information, such as incorrect account numbers or closed accounts, can prevent successful disbursement. In some cases, the lender might identify potential fraud or inconsistencies, leading to a thorough investigation and potential rejection of the application.

Best Practices for Avoiding Delays in Receiving Loan Funds

To minimize the risk of delays, students should meticulously complete their loan applications, ensuring all information is accurate and up-to-date. This includes carefully reviewing all forms, providing accurate banking details, and promptly submitting all required documentation. Students should also maintain open communication with their financial aid office and the lender to address any questions or concerns promptly. Proactive monitoring of the application status and timely responses to requests for additional information can significantly reduce the chances of delays. Finally, students should familiarize themselves with the lender’s policies and procedures to understand the timelines and requirements for loan disbursement.

Reasons for Delays and Their Solutions

| Reason | Impact | Solution | Prevention |

|---|---|---|---|

| Incomplete Application | Delayed processing, potential rejection | Correct and resubmit application with all required documents | Thoroughly review application before submission |

| Incorrect Information | Delayed processing, potential rejection | Contact lender to correct information | Double-check all information for accuracy |

| Missing Documentation | Delayed processing | Provide missing documentation promptly | Maintain organized records and submit all documents on time |

| Issues with Financial Aid Package | Delayed disbursement | Resolve discrepancies with the financial aid office | Regularly check financial aid status and address issues promptly |

| Banking Information Errors | Funds cannot be disbursed | Update banking information with the lender | Verify banking details before submission |

Verification and Documentation Requirements

Securing a student loan often requires verification of your identity and financial circumstances to ensure you meet the lender’s eligibility criteria. This process involves submitting various documents that support your application and demonstrate your ability to repay the loan. Providing accurate and complete documentation is crucial for a timely loan disbursement.

Providing incomplete or inaccurate documentation can significantly delay the loan disbursement process, or even lead to the denial of your application. It is therefore essential to understand the specific requirements and ensure you submit all necessary materials accurately.

Required Documents for Student Loan Verification

The specific documents required can vary depending on the lender and your individual circumstances. However, some common documents include proof of identity (such as a driver’s license or passport), proof of enrollment (an acceptance letter or enrollment verification from your educational institution), and proof of income (tax returns, pay stubs, or bank statements). Additionally, lenders may request information regarding your existing debts and credit history. Providing these documents allows the lender to assess your creditworthiness and ensure you can manage the loan repayment.

Consequences of Incomplete or Inaccurate Documentation

Submitting incomplete or inaccurate documentation can result in significant delays in processing your loan application. Lenders may request additional information, causing delays that can impact your ability to pay for tuition, housing, or other educational expenses on time. In some cases, inaccurate information may lead to the denial of your loan application altogether. Furthermore, providing false information is considered fraud and can have serious legal consequences.

Student Loan Application Document Checklist

To streamline the application process, it is recommended to compile the following documents before submitting your application:

- Government-issued photo identification (e.g., driver’s license, passport)

- Social Security number

- Proof of enrollment (acceptance letter, enrollment verification from your institution)

- Federal Student Aid (FAFSA) data confirmation

- Tax returns (for you and your parents/guardians, if applicable)

- Bank statements (showing sufficient funds for living expenses, if applicable)

- Pay stubs or employment verification (if employed)

- Completed loan application form

This checklist helps ensure you have all the necessary documents prepared, reducing the risk of delays and application rejections.

Resolving Discrepancies in Documentation

Discrepancies in your provided documentation can arise from various reasons, including simple typographical errors or inconsistencies between different documents. For example, a mismatch between your stated income on the application and the income reflected in your tax returns could trigger a review. If discrepancies are identified, the lender will typically contact you to clarify the issue. It’s crucial to respond promptly and provide any supporting documentation needed to resolve the discrepancy. This may involve submitting corrected documents or providing additional explanations.

Verifying Student Information and Loan Eligibility

The verification process involves a multi-step procedure. First, the lender verifies your identity using the provided documentation. Next, they confirm your enrollment status with your educational institution. Then, they assess your financial situation based on the provided income and debt information. Finally, they determine your eligibility for the loan based on their lending criteria, including your creditworthiness and repayment capacity. This process ensures the lender is lending responsibly and minimizes the risk of default.

Communication with Loan Providers

Effective communication is crucial for resolving issues and ensuring a smooth process when dealing with student loan applications. Maintaining a professional and persistent approach will significantly improve your chances of a positive outcome, whether it’s a timely loan disbursement or a clear understanding of any delays or rejections. This section Artikels strategies for contacting your loan provider and interpreting their responses.

Proactive and well-structured communication is key to navigating the complexities of student loan applications. Understanding the appropriate channels, crafting clear inquiries, and interpreting responses correctly are all essential components of successful interaction with your loan provider.

Appropriate Communication Channels and Inquiry Content

Several channels are typically available for contacting loan providers. These might include phone calls, email, secure online messaging portals, or even postal mail. The preferred method is often indicated on the loan provider’s website or application materials. Regardless of the channel chosen, your inquiry should always be polite, professional, and include specific details. Always reference your application number or any other relevant identification information. Include the specific reason for your contact and any supporting documentation you may have.

Examples of Polite and Professional Communication

When contacting your loan provider, maintaining a respectful and professional tone is essential. Avoid accusatory language or emotional outbursts. Instead, focus on clearly stating your needs and expressing your understanding of the process.

For example, instead of saying, “Why is my loan taking so long?”, a more effective approach would be, “I am writing to inquire about the status of my student loan application, application number [Your Application Number]. I understand processing times can vary, but I would appreciate an update on the expected disbursement date.”

Interpreting Provider Responses

Loan providers’ responses can range from confirmations to explanations of delays or rejections. Understanding the nuances of these responses is crucial. Delays may be due to incomplete documentation, verification processes, or simply high application volumes. Rejections, on the other hand, typically involve specific reasons, such as insufficient credit history or failure to meet eligibility criteria. Always carefully review the provider’s response for specific details and next steps. If the response is unclear, don’t hesitate to request further clarification.

Sample Email Template for Loan Status Inquiry

Subject: Inquiry Regarding Student Loan Application – [Your Application Number]

Dear [Loan Provider Contact Person or Department],

I am writing to inquire about the status of my student loan application, application number [Your Application Number]. The application was submitted on [Date of Application].

I would appreciate an update on the expected disbursement date or any information regarding the next steps in the process. Please let me know if any additional documentation is required.

Thank you for your time and assistance.

Sincerely,

[Your Name]

[Your Phone Number]

[Your Email Address]

Financial Aid Office Assistance

Your financial aid office serves as a vital resource for navigating the complexities of student loan disbursement. They act as a liaison between you and your loan providers, offering guidance and support throughout the loan process, particularly when encountering delays or issues. Understanding their role and how to effectively utilize their services can significantly alleviate stress and ensure a smoother path to accessing your funds.

The financial aid office plays a multifaceted role in assisting students with loan disbursement problems. Their responsibilities extend beyond simply processing applications; they actively work to resolve issues that prevent timely loan disbursement. This includes investigating delays, mediating with lenders, and providing students with the necessary information and resources to rectify any outstanding problems. They also help students understand their loan terms, repayment options, and overall financial planning.

Steps to Seek Assistance

To effectively utilize the services of your financial aid office, begin by gathering all relevant documentation, including your loan application, award letter, and any communication from your lender. Schedule an appointment or utilize their preferred communication method (email, phone, online portal) to explain your situation clearly and concisely. Be prepared to provide specific details about the delay, including dates, amounts, and any error messages received. Following up on your initial contact is crucial to ensure your concerns are addressed promptly.

Examples of Crucial Support

The financial aid office can provide invaluable support in a variety of situations. For instance, if your loan application is incomplete or contains errors, the office can help identify and correct these issues. If your loan is delayed due to a problem with your financial aid package, the office can work to resolve the underlying issue and expedite the disbursement. They can also provide guidance if you are facing unexpected financial hardship that impacts your ability to repay your loans. Finally, they can help you understand and navigate the appeals process should your loan application be denied.

Available Resources

Financial aid offices typically offer a range of resources to assist students. These might include online tutorials explaining the loan process, frequently asked questions (FAQs) documents addressing common issues, and contact information for relevant staff members. Many offices also host workshops or seminars to provide comprehensive financial literacy training, covering topics such as budgeting, loan repayment strategies, and credit management. They may also have access to external resources, such as debt counseling services or scholarship opportunities.

Effective Communication Strategies

When communicating with your financial aid office, maintain a professional and respectful tone. Clearly and concisely explain the problem you are experiencing, providing all relevant documentation to support your claim. Be patient and persistent in your follow-up, but avoid being demanding or accusatory. If you are unsatisfied with the response, be sure to follow their established procedure for appeals or escalation. Maintaining organized records of all communication (emails, letters, meeting notes) can prove invaluable should further action be needed.

Alternative Funding Options and Strategies

Delays in receiving student loan disbursements can create significant financial hardship. Fortunately, several alternative funding options and strategies can help students bridge the gap until their loans are processed. Understanding these alternatives and implementing effective budgeting techniques is crucial for maintaining financial stability during this period.

Students facing loan disbursement delays should explore a range of options to cover immediate expenses. These alternatives vary in accessibility, terms, and potential impact on long-term financial health. Careful consideration of both advantages and disadvantages is essential before committing to any particular funding source.

Alternative Funding Sources

Several sources can provide temporary financial relief while waiting for student loan funds. Each option presents a unique set of benefits and drawbacks that students should carefully weigh against their individual circumstances.

- Family and Friends: Borrowing from family or friends is often the most accessible option. This approach avoids interest charges and potentially burdensome repayment schedules. However, it’s crucial to establish clear repayment terms and maintain open communication to prevent strained relationships.

- Personal Savings: If available, using personal savings can provide a buffer against unexpected financial challenges. This strategy avoids accumulating debt, but it may deplete funds intended for other purposes. Careful consideration of the trade-offs is essential.

- Part-Time Employment: Securing part-time employment can provide immediate income to cover essential expenses. This approach offers financial independence but may require balancing work and academic commitments, potentially impacting academic performance.

- Short-Term Loans: Payday loans or other short-term loan options offer quick access to funds but often come with high interest rates and fees. These loans should be considered only as a last resort due to their potential for creating long-term financial difficulties.

Expense Management Strategies

Effective expense management is vital during periods of financial uncertainty. Prioritizing essential expenses and implementing budgeting techniques can help students navigate unexpected delays in loan disbursement.

- Create a Detailed Budget: Tracking income and expenses meticulously helps identify areas where spending can be reduced. This process involves listing all sources of income and categorizing expenses (housing, food, transportation, etc.).

- Prioritize Essential Expenses: Focus spending on necessities like rent, utilities, and groceries. Non-essential expenses (entertainment, dining out) should be minimized or eliminated temporarily.

- Negotiate with Creditors: If facing difficulty meeting payment deadlines, contact creditors to explore options like payment extensions or reduced payment plans. Open communication can prevent negative impacts on credit scores.

- Seek Financial Counseling: A financial counselor can provide personalized guidance on budgeting, debt management, and exploring additional financial aid options. Many colleges and universities offer free or low-cost financial counseling services.

Budgeting Techniques

Several budgeting techniques can help students manage their finances effectively during periods of financial stress. These methods provide a structured approach to tracking income and expenses, facilitating informed financial decisions.

- 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. This provides a framework for balancing essential expenses with discretionary spending and financial goals.

- Zero-Based Budgeting: Assign every dollar of income to a specific category, ensuring that total expenses equal total income. This method promotes mindful spending and prevents overspending.

- Envelope System: Allocate cash for specific expense categories into separate envelopes. Once the cash in an envelope is depleted, spending in that category ceases until the next allocation. This visual method helps track spending and avoid overspending.

Securing Alternative Funding

A systematic approach can increase the chances of securing alternative funding. Following a structured process improves the likelihood of obtaining necessary financial assistance during loan disbursement delays.

- Assess Financial Needs: Determine the exact amount needed to cover expenses until loan disbursement.

- Explore Funding Options: Research and compare different funding sources, considering their advantages and disadvantages.

- Prepare Necessary Documentation: Gather all required documents (bank statements, pay stubs, etc.) for loan applications or other funding requests.

- Submit Applications: Complete and submit applications promptly, following all instructions carefully.

- Maintain Open Communication: Regularly communicate with potential lenders or funding sources to update them on your progress and address any questions.

Impact of Delays on Students

Delayed disbursement of student loan funds can significantly impact a student’s academic progress and overall well-being, creating a cascade of challenges that extend beyond the immediate financial shortfall. The stress and uncertainty generated by these delays can affect students’ ability to focus on their studies and negatively impact their mental health.

The consequences of delayed loan disbursement can be far-reaching and affect various aspects of a student’s life. Students may find themselves unable to cover essential expenses such as tuition fees, housing, textbooks, and food, leading to a precarious financial situation. This can lead to increased stress and anxiety, impacting their academic performance and overall mental health. The lack of timely funding can also force students to make difficult choices, such as dropping out of school or taking on additional part-time work that interferes with their studies.

Financial Challenges Faced by Students

Delayed loan funds directly translate to immediate financial hardship. Students may face difficulty paying rent or mortgage, leading to potential eviction or foreclosure. They might struggle to purchase necessary textbooks and learning materials, hindering their academic performance. Moreover, the inability to meet basic living expenses, such as food and utilities, can severely compromise their physical and mental health. For example, a student relying on loan funds for housing might face eviction if the funds are delayed, forcing them to find alternative, often more expensive, housing arrangements, further exacerbating their financial difficulties. Another example is a student unable to purchase required textbooks, leading to missed assignments and lower grades, impacting their academic standing and future prospects.

Emotional and Psychological Stress

The uncertainty and stress associated with delayed loan disbursement can have a profound impact on a student’s mental health. The constant worry about meeting financial obligations can lead to anxiety, depression, and even feelings of hopelessness. This emotional toll can significantly affect their academic performance and overall well-being. For instance, a student grappling with the stress of delayed loan funds might experience difficulty concentrating in class, leading to decreased academic performance and potentially jeopardizing their academic standing. The pressure to find alternative solutions can also lead to increased stress and anxiety levels.

Available Support Systems

Several resources and support systems are available to students facing financial hardship due to delayed loan disbursements. Many universities have financial aid offices that can provide guidance and assistance in navigating financial challenges. They may offer emergency grants, short-term loans, or connect students with external resources. Additionally, many non-profit organizations and government programs provide financial assistance to students in need. Students should explore these options and seek help proactively to mitigate the impact of delayed funds. Furthermore, counseling services are often available on campus to address the emotional and psychological stress associated with financial difficulties.

Potential Consequences of Delayed Student Loan Funding

- Inability to pay tuition fees and other academic expenses.

- Difficulty in covering essential living expenses, such as housing, food, and utilities.

- Compromised academic performance due to stress and lack of resources.

- Increased risk of dropping out of school.

- Negative impact on mental health and overall well-being.

- Accumulation of debt from alternative borrowing sources.

- Delayed graduation and potential impact on future career prospects.

Closure

Navigating the complexities of student loan disbursement can be challenging, but proactive planning and clear communication are essential tools. By understanding the potential reasons for delays, ensuring your documentation is complete and accurate, and utilizing the resources available through your financial aid office and loan provider, you can significantly reduce the likelihood of facing financial setbacks. Remember, seeking help early is crucial. Don’t hesitate to reach out for assistance if you encounter delays—your academic success and financial well-being are worth it.

Questions and Answers

What happens if my student loan doesn’t arrive by the due date?

Contact your loan provider and financial aid office immediately. Explain the situation and inquire about the delay. They can investigate and provide solutions or alternative arrangements.

Can I appeal a loan denial?

Yes, most loan providers allow appeals. Carefully review the reason for denial and prepare a compelling case outlining why you believe the decision should be reconsidered. Provide any missing or corrected documentation.

What if I need funds urgently before my loan is processed?

Explore short-term solutions like emergency loans from family or friends, or consider temporary part-time employment. Contact your financial aid office to discuss potential short-term assistance programs.

Are there penalties for late loan repayment?

Yes, late payments typically incur interest charges and may negatively impact your credit score. Contact your lender immediately if you anticipate difficulty making a payment.