Navigating the complexities of student loan repayment can feel like traversing a minefield. Many borrowers assume that paying off their loans early will always be beneficial, but the reality is more nuanced. This exploration delves into the often-misunderstood world of student loan early payoff penalties, examining the potential pitfalls and rewards associated with accelerated repayment strategies. We’ll unravel the myths surrounding prepayment penalties, analyze the financial implications of various repayment approaches, and ultimately empower you to make informed decisions about your student loan debt.

We’ll explore different loan types, their associated interest rates, and how early repayment affects your overall cost. We’ll dissect loan agreements to identify clauses related to prepayment, comparing and contrasting loans with and without such penalties. Through illustrative scenarios and practical strategies, you’ll gain a clear understanding of how to optimize your repayment plan for maximum financial benefit.

Understanding Student Loan Structures

Navigating the world of student loans can be complex, especially with the various types and repayment options available. Understanding the fundamental differences between federal and private loans, along with their associated interest rates and repayment terms, is crucial for effective financial planning and responsible debt management. This section will clarify these key aspects.

Federal and Private Student Loan Types

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. Private student loans, on the other hand, are provided by banks, credit unions, and other private lenders. Federal loans typically include subsidized and unsubsidized loans for undergraduates and graduate students, as well as PLUS loans for parents and graduate students. Private loans encompass a wider range of loan products, often tailored to individual borrower needs and creditworthiness. The specific types available will vary depending on the lender.

Interest Rates and Repayment Terms

Interest rates for federal student loans are set by the government and are generally lower than those for private loans. The interest rate for a federal loan will depend on the loan type, the year the loan was disbursed, and the borrower’s credit history (for PLUS loans). Repayment terms for federal loans vary depending on the loan type and repayment plan selected, ranging from standard 10-year plans to income-driven repayment plans that adjust payments based on income and family size. Private loan interest rates are variable and determined by the lender based on the borrower’s creditworthiness and market conditions. Repayment terms are typically fixed, but can vary from 5 to 20 years, or even longer, depending on the loan amount and the lender.

Loan Amortization Schedules and Early Repayment

A loan amortization schedule details the breakdown of each payment towards principal and interest over the life of the loan. Early repayment significantly reduces the total interest paid over the life of the loan. For example, consider a $10,000 loan with a 5% interest rate over 10 years. The standard monthly payment would be approximately $106. If the borrower makes extra payments, or pays off the loan early, they will significantly reduce the total interest paid. Let’s say the borrower pays an additional $100 per month. This will shorten the loan term and reduce the total interest paid by hundreds, if not thousands, of dollars. A hypothetical example using a loan calculator would show this reduction in detail, but a visual representation would be difficult to convey in this format.

Comparison of Federal and Private Student Loan Features

| Feature | Federal Subsidized Loan | Federal Unsubsidized Loan | Private Student Loan |

|---|---|---|---|

| Interest Rate | Fixed, typically lower | Fixed, typically lower | Variable or Fixed, typically higher |

| Interest Accrual | No interest accrues while in school (under certain conditions) | Interest accrues while in school | Interest accrues while in school |

| Repayment Options | Multiple repayment plans available | Multiple repayment plans available | Fewer repayment options, often limited to standard plans |

| Borrower Protections | Strong borrower protections | Strong borrower protections | Fewer borrower protections |

Prepayment Penalties

Many students believe that paying off their student loans early will incur penalties. This is a common misconception, but the reality is more nuanced. While prepayment penalties are rare for federal student loans, they can exist in certain private loan agreements. Understanding the specifics of your loan is crucial to avoid unexpected fees.

Prepayment penalties are clauses in loan agreements that charge borrowers extra fees for paying off their loan before the scheduled maturity date. These penalties are designed to compensate the lender for lost interest income. However, the vast majority of federal student loan programs do not include such penalties, offering borrowers the flexibility to pay ahead without additional costs.

Loan Agreement Language Regarding Prepayment

Loan agreements often contain sections explicitly addressing prepayment. These sections might state that no prepayment penalty applies, or they may Artikel specific conditions under which a penalty might be assessed. Careful review of this language is essential. Look for phrases such as “no prepayment penalty,” “prepayment privilege,” or clauses that specify a fee based on a percentage of the outstanding balance or a fixed dollar amount. The absence of any mention of prepayment penalties usually implies that early repayment is permitted without additional charges. However, it is always best to confirm this directly with your lender.

Instances Where Prepayment Penalties Might Exist

Prepayment penalties are more commonly found in private student loans than in federal loans. Private lenders, unlike the federal government, operate under different financial models and may include these clauses to protect their profitability. The specific terms and conditions vary widely depending on the lender and the type of private loan. Some private loans might have a prepayment penalty for a specific period, perhaps the first few years of the loan term, after which the penalty is waived. Others may impose a penalty throughout the loan’s life. It’s crucial to thoroughly examine the loan documents before signing any private student loan agreement.

Comparison of Loans With and Without Prepayment Penalties

Loans without prepayment penalties offer significant financial flexibility. Borrowers can aggressively pay down their debt without incurring additional costs, potentially saving thousands of dollars in interest over the life of the loan. This allows for faster debt repayment and can lead to significant long-term financial benefits. Conversely, loans with prepayment penalties limit this flexibility. While the interest rate might appear lower initially, the potential penalty for early repayment could negate any interest savings achieved through a lower rate if the borrower plans to pay off the loan early. Therefore, a loan with a higher interest rate but no prepayment penalty might be more financially advantageous for borrowers aiming for rapid debt repayment. A thorough cost-benefit analysis, considering both interest rates and potential prepayment penalties, is essential when comparing loan options.

Financial Implications of Early Repayment

Paying off student loans early can significantly impact your financial future, offering substantial long-term benefits. While there are typically no prepayment penalties on federal student loans, the financial advantages are considerable when compared to making only minimum payments. This section will explore the quantifiable savings and illustrate the power of proactive repayment strategies.

Interest Savings Calculation

Let’s consider a scenario with a $30,000 federal student loan at a 6% annual interest rate, amortized over 10 years. The standard monthly payment would be approximately $330. Over the 10-year loan term, the total interest paid would be around $10,000. Now, let’s imagine paying off the loan in 5 years through accelerated payments. To achieve this, you would need to increase your monthly payment substantially. While the exact amount depends on the loan’s amortization schedule, you would likely need to pay significantly more each month, reducing the loan’s life to half its original term. This would dramatically reduce the total interest paid. In this example, paying off the loan in 5 years could reduce the total interest paid to approximately $4,000, resulting in a savings of $6,000. This illustrates the substantial interest savings possible through early repayment. The exact savings will vary depending on the loan’s interest rate, principal, and the chosen repayment strategy.

Long-Term Financial Benefits of Early Repayment

Paying off student loans early frees up significant cash flow. Consider the $330 monthly payment in our previous example. After 5 years of accelerated repayment, this money is available for other financial goals such as investing, saving for a down payment on a house, or paying off other debts. The compound interest earned on investments made with this freed-up cash flow over time can significantly outweigh the additional payments made to accelerate the loan payoff. Conversely, continuing to make only minimum payments for 10 years means that $330/month remains tied up in loan repayment, limiting the opportunity for other financial growth. This difference in available funds can create a substantial gap in net worth over the long term. For example, consistently investing that $330 monthly payment for 5 years at an average annual return of 7% could yield a substantial additional nest egg.

Comparison of Repayment Strategies

Several strategies can accelerate loan repayment. A lump-sum payment involves paying a large sum of money towards the principal, significantly reducing the remaining balance and interest accrued. Accelerated payments involve increasing the regular monthly payment amount, shortening the loan’s term. A hybrid approach combines both strategies, utilizing bonuses, tax refunds, or windfalls for lump-sum payments while maintaining consistently higher monthly payments.

Projected Savings Under Different Repayment Scenarios

| Repayment Strategy | Monthly Payment | Loan Payoff Time (Years) | Total Interest Paid |

|---|---|---|---|

| Minimum Payment | $330 | 10 | $10,000 (estimated) |

| Accelerated Payments | $500 | 5 | $4,000 (estimated) |

| Lump-Sum Payment ($10,000 upfront) + Minimum Payments | $330 | 7 | $6,000 (estimated) |

| Hybrid Approach (combination of lump-sum and accelerated payments) | $400 + occasional lump-sum payments | 6 | $5,000 (estimated) |

Strategies for Early Loan Repayment

Accelerating student loan repayment requires a proactive and strategic approach. By carefully managing your finances and exploring various options, you can significantly reduce the time and interest paid on your loans. This section Artikels several key strategies to help you achieve your early payoff goals.

Creating a Budget for Accelerated Loan Repayment

A detailed budget is crucial for identifying extra funds to allocate towards your student loans. Begin by meticulously tracking your income and expenses for at least one month. Categorize your spending to pinpoint areas where you can cut back. Consider using budgeting apps or spreadsheets to simplify this process. Once you have a clear picture of your financial situation, you can start allocating more money towards your loan payments. For example, if you identify $200 in discretionary spending each month, you can immediately increase your loan payment by that amount.

Identifying Additional Income Streams

Increasing your income allows for larger loan payments and faster payoff. Explore options like a part-time job, freelance work, or selling unused possessions. Consider your skills and interests when choosing an additional income stream. For instance, someone skilled in writing could offer freelance writing services, while someone with a car could utilize ride-sharing apps. Even small increases in income can make a significant difference over time. A part-time job earning $500 per month could reduce your loan payoff time by several years.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can significantly reduce your monthly payments and shorten your repayment timeline. Before refinancing, compare interest rates and terms from multiple lenders to find the best option. Carefully review the terms and conditions, ensuring you understand the implications before making a decision. For example, refinancing federal loans into private loans could mean losing access to federal repayment plans and protections.

Debt Avalanche and Debt Snowball Methods

The debt avalanche method prioritizes paying off the loan with the highest interest rate first, regardless of the balance. This minimizes the total interest paid over the life of the loans. The debt snowball method, conversely, focuses on paying off the smallest loan first, regardless of interest rate. This provides a sense of accomplishment and momentum, potentially improving motivation. For example, if you have a $5,000 loan at 7% interest and a $10,000 loan at 4%, the debt avalanche method would target the $5,000 loan first, while the debt snowball method would prioritize the $5,000 loan. The choice depends on individual preferences and financial psychology. The debt avalanche method is generally more financially efficient, while the debt snowball method may offer better psychological benefits.

Impact on Credit Score and Financial Health

Paying off student loans early can significantly impact your credit score and overall financial health, but the effects aren’t always straightforward. While aggressive repayment strategies offer substantial long-term benefits, they also present potential short-term drawbacks that need careful consideration. Understanding these nuances is crucial for making informed financial decisions.

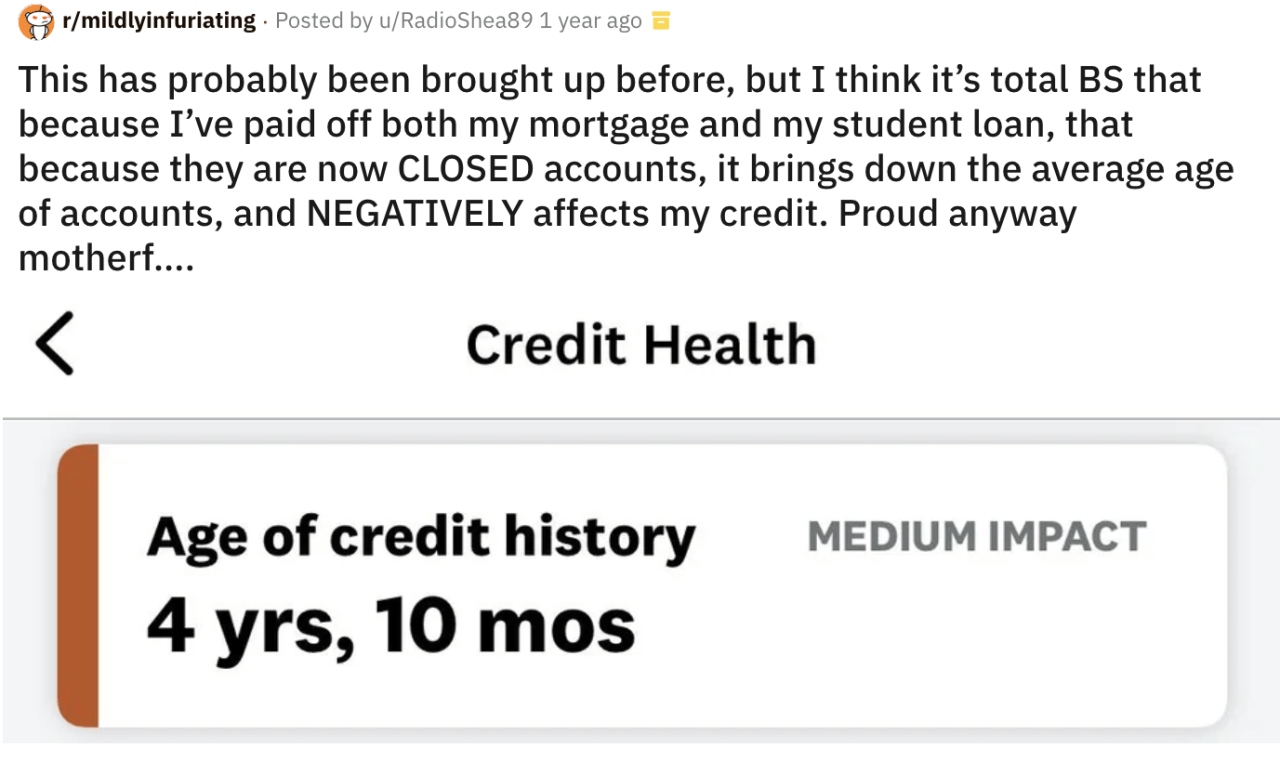

Early repayment primarily affects your credit score through its influence on your credit utilization ratio – the percentage of your available credit you’re currently using. Closing accounts associated with student loans can initially lower your available credit, potentially causing a temporary dip in your credit score, especially if you’ve had those accounts open for a long time. However, the positive effects of reducing your debt-to-income ratio and demonstrating responsible financial behavior generally outweigh this temporary dip. Furthermore, the consistent on-time payments made during the early repayment process contribute positively to your credit history, boosting your creditworthiness over time.

Credit Score Impacts

The impact of early student loan repayment on your credit score is multifaceted. While closing accounts might temporarily lower your available credit, leading to a higher credit utilization ratio (and potentially a slight score decrease), the long-term benefits of lower debt and consistent on-time payments generally lead to a higher credit score. For example, an individual with a high credit utilization ratio (say, above 30%) might see a temporary dip if they close a student loan account that constituted a significant portion of their available credit. However, this dip is usually short-lived, especially if the individual maintains responsible spending habits and other positive credit behaviors. Conversely, an individual with a low credit utilization ratio who aggressively pays down their student loans will likely see a positive impact on their credit score due to the decrease in their debt-to-income ratio. The sustained responsible financial behavior demonstrated through early repayment significantly contributes to long-term credit health.

Long-Term Financial Health Effects

Aggressive student loan repayment, while potentially impacting credit scores temporarily, greatly improves long-term financial health. By eliminating this significant debt burden sooner, individuals free up substantial monthly cash flow. This extra money can be redirected towards other crucial financial goals, such as building an emergency fund, investing for retirement, or saving for a down payment on a house. For instance, an individual paying off a $50,000 student loan five years early might free up hundreds of dollars each month. This extra cash flow can be used to accelerate savings for a down payment on a house, potentially saving thousands of dollars in interest payments over the life of the mortgage. Similarly, this extra money can be invested, generating potential returns that could significantly outpace the interest rate on the student loans.

Examples of Freed-Up Funds

Early repayment creates financial flexibility. Consider someone who aggressively pays off their $30,000 student loan three years ahead of schedule. This could free up $500-$1000 monthly, depending on the interest rate and repayment plan. This extra money could be used to:

- Maximize retirement savings contributions, potentially benefiting from employer matching and tax advantages.

- Build a robust emergency fund, providing a financial safety net for unexpected expenses.

- Invest in a diversified portfolio, building long-term wealth and potentially outpacing inflation.

- Save for a down payment on a house, reducing reliance on high-interest mortgages.

Benefits and Risks of Prioritizing Early Repayment

The decision to prioritize early student loan repayment involves weighing potential benefits against potential risks.

- Benefits: Reduced long-term interest payments, increased financial flexibility, improved debt-to-income ratio, potential positive impact on credit score (long-term), faster achievement of other financial goals.

- Risks: Potential temporary decrease in credit score (due to closed accounts and changes in credit utilization), reduced liquidity in the short-term, potential missed opportunities in other areas (e.g., lower-risk investments with potentially higher returns).

Illustrative Scenarios

Understanding whether early student loan repayment is beneficial depends heavily on individual circumstances. Factors such as interest rates, available investment opportunities, and overall financial health play crucial roles in determining the optimal strategy. Let’s examine scenarios where early repayment proves advantageous and others where it might not be the most prudent course of action.

Scenario: Early Repayment Highly Beneficial

Imagine Sarah, a recent graduate with a $30,000 federal student loan at a 7% interest rate. She has a stable job earning $60,000 annually, with relatively low expenses. After budgeting, she finds she can comfortably afford an extra $500 per month towards her loan. By aggressively repaying her loan, Sarah significantly reduces the total interest paid over the life of the loan. Instead of the standard 10-year repayment plan, she could potentially pay off the loan in approximately 4 years, saving thousands of dollars in interest. This early repayment frees up significant cash flow in the long run, allowing her to invest more aggressively, purchase a home sooner, or pursue other financial goals. The high interest rate and her ability to comfortably afford extra payments make early repayment a highly effective strategy in this case.

Scenario: Early Repayment Less Advantageous

Conversely, consider Mark, who has a $40,000 federal student loan at a 2% interest rate. He’s also earning $60,000 annually, but his expenses are higher due to a larger mortgage and family commitments. He has limited extra funds available for loan repayment. In Mark’s situation, the low interest rate minimizes the financial impact of a longer repayment period. He might find it more financially beneficial to invest his extra funds in higher-yielding investments (e.g., a retirement account with employer matching) that offer a potentially greater return than the relatively low interest he’s saving on his student loans. The opportunity cost of paying off his loans early outweighs the modest interest savings.

Hypothetical Individual’s Decision-Making Process

Let’s consider David, a software engineer earning $85,000 annually. His monthly expenses, including rent, transportation, and food, total $2,500. He has a $50,000 student loan with a 5% interest rate, requiring a minimum monthly payment of $500. After reviewing his budget, David determines he can comfortably afford an extra $300 per month towards his student loans. He carefully weighs the pros and cons of early repayment. He analyzes the potential interest savings from accelerating his loan repayment against the potential returns from investing the extra $300 in a diversified investment portfolio. Considering his risk tolerance and financial goals (purchasing a home in five years), he decides to allocate $200 towards extra loan repayment and $100 towards investments. This balanced approach allows him to reduce his loan burden while still pursuing long-term financial growth. This strategy represents a moderate approach that acknowledges both the benefits of debt reduction and the potential for investment returns.

Closure

Ultimately, the decision of whether or not to pay off your student loans early is a deeply personal one, heavily influenced by individual financial circumstances and risk tolerance. While the potential for significant interest savings is undeniable, a thorough understanding of your loan terms, a realistic assessment of your financial resources, and a well-defined repayment strategy are crucial. By carefully weighing the potential benefits against any potential penalties and long-term financial implications, you can confidently navigate the path to becoming debt-free.

Essential Questionnaire

What constitutes an “early” payoff?

There’s no universal definition. It generally refers to paying off your loan before the scheduled end of the repayment term, often involving extra payments beyond the minimum monthly amount.

Can I negotiate a lower interest rate if I pay early?

While unlikely with federal loans, some private lenders might be open to negotiation, particularly if you’re offering a significant lump-sum payment. It’s worth inquiring.

What happens to my credit score if I pay off my student loans early?

Paying off debt generally improves your credit score, but aggressively paying off loans might temporarily lower your credit utilization ratio (a factor in credit scoring) if you close the account immediately. The long-term benefit of reduced debt usually outweighs this temporary dip.

Are there tax implications for early loan repayment?

Generally, there are no direct tax implications for early repayment. However, depending on your individual tax situation, interest paid may be deductible, so you might want to consult a tax professional for specific guidance.