Navigating the complexities of student loan repayment can be daunting, especially when dealing with a major servicer like ECSI. This guide provides a clear and concise overview of ECSI student loans, encompassing their various types, repayment options, and servicing practices. We’ll explore borrower experiences, strategies for effective loan management, and the role of ECSI in federal loan programs and income-driven repayment plans. Understanding these aspects is crucial for borrowers to make informed decisions and successfully manage their student loan debt.

From understanding the different loan types offered by ECSI to mastering effective repayment strategies and navigating potential challenges, this resource aims to empower you with the knowledge needed to confidently manage your financial future. We’ll delve into the details of ECSI’s services, compare them to other servicers, and offer practical advice to help you avoid pitfalls and achieve financial stability.

ECSI Student Loan Overview

ECSI (Education Credit Servicing, Inc.) is a major student loan servicer in the United States, managing federal student loans on behalf of the Department of Education. They handle various aspects of loan management, from processing payments to providing customer support. Understanding ECSI’s role and the services they offer is crucial for borrowers navigating their student loan repayment journey.

Types of Student Loans Serviced by ECSI

ECSI services a wide range of federal student loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for graduate students and parents), and Federal Stafford Loans. It’s important to note that ECSI does *not* originate these loans; they only service them after they’ve been disbursed by the lender. The specific type of loan a borrower has will influence their repayment plan options and interest rates.

ECSI Student Loan Repayment Options

Borrowers typically have several repayment options available to them, depending on their loan type and financial circumstances. These often include: Standard Repayment (fixed monthly payments over 10 years), Extended Repayment (longer repayment periods, leading to lower monthly payments), Graduated Repayment (payments increase over time), and Income-Driven Repayment (IDR) plans (payments are based on income and family size). Choosing the right repayment plan is a significant decision, impacting both the total interest paid and the monthly budget. Borrowers should carefully consider their individual circumstances and explore the available options to find the best fit.

ECSI Customer Service and Accessibility

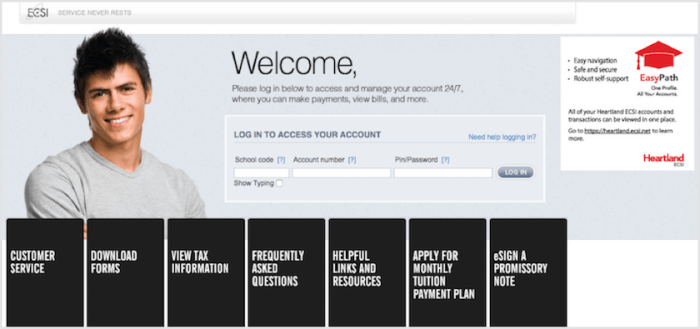

ECSI offers various customer service channels to assist borrowers. These include online account access through their website, where borrowers can view statements, make payments, and update contact information. They also provide phone support, allowing borrowers to speak directly with representatives. Additionally, ECSI typically offers resources and educational materials online, such as FAQs and guides to help borrowers understand their loan terms and repayment options. The accessibility of these resources varies; however, efforts are generally made to ensure information is available in various formats to accommodate diverse needs.

Key Features of ECSI Student Loans

| Feature | Description | Benefit | Consideration |

|---|---|---|---|

| Loan Types | Direct Subsidized, Unsubsidized, PLUS Loans, and Federal Stafford Loans | Variety of options to suit different educational needs and financial situations. | Interest rates and repayment terms vary by loan type. |

| Repayment Plans | Standard, Extended, Graduated, and Income-Driven Repayment plans | Flexibility to choose a plan that fits individual budgets and circumstances. | Carefully compare plans to minimize total interest paid. |

| Online Account Access | Secure online portal for managing loan accounts | Convenient and efficient way to monitor payments, view statements, and update information. | Requires internet access and familiarity with online banking. |

| Customer Support | Phone and online resources available | Multiple channels for assistance with loan-related questions and issues. | Wait times may vary depending on the time of day and volume of calls. |

ECSI Loan Servicing Practices

ECSI, as a student loan servicer, handles various aspects of loan management, from payment processing to default resolution. Understanding their practices is crucial for borrowers to effectively manage their student loan debt. This section details ECSI’s approach to loan servicing, offering a comparison to other major servicers and guidance for borrowers encountering difficulties.

ECSI Loan Payment Processing

ECSI offers several methods for borrowers to make their loan payments, including online payments through their website, automatic debit payments from a bank account, and payments by mail. Online payments generally provide immediate confirmation, while mailed payments may take several business days to process. Automatic debit payments offer convenience and help ensure timely payments, avoiding late fees. The specific payment options and associated fees are clearly Artikeld on ECSI’s website and in borrower communication materials. ECSI’s payment system is designed for efficiency and transparency, aiming to provide borrowers with clear and concise information regarding their payment status.

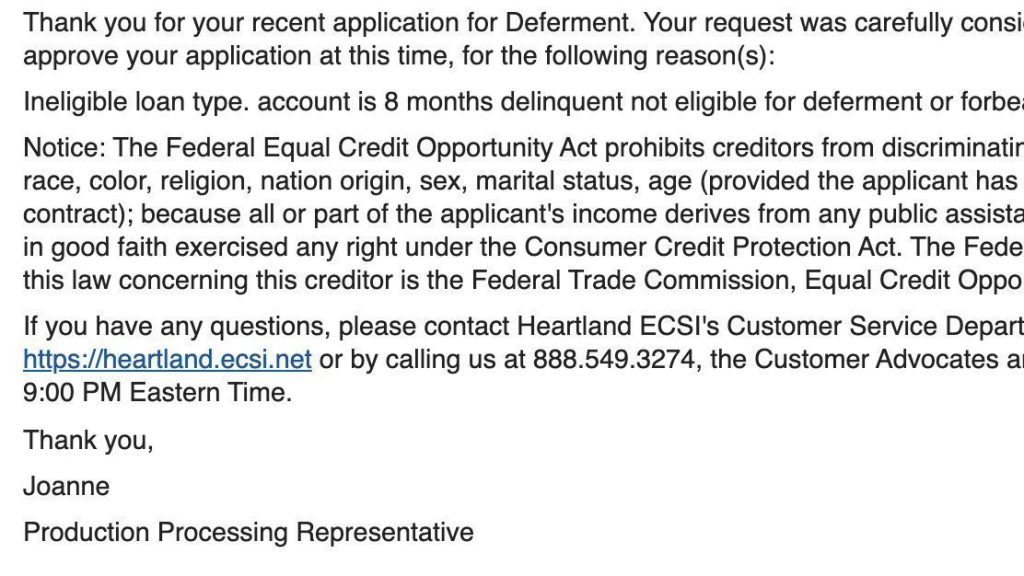

ECSI Loan Deferments and Forbearances

ECSI manages loan deferments and forbearances according to federal guidelines and the terms of individual loan agreements. A deferment temporarily suspends loan payments due to specific qualifying circumstances, such as unemployment or enrollment in school. A forbearance also suspends or reduces payments, but it’s typically granted for reasons not covered by deferment programs. Borrowers must apply for deferments or forbearances and provide supporting documentation to demonstrate eligibility. The approval process and associated terms vary depending on the specific type of loan and the borrower’s circumstances. Interest may accrue during deferments or forbearances, except in certain circumstances, adding to the total loan amount upon repayment resumption. ECSI provides detailed information about the deferment and forbearance process on its website and through direct communication with borrowers.

ECSI Loan Default Procedures

When a borrower defaults on their student loan, ECSI follows established procedures to attempt recovery of the outstanding debt. These procedures may include contacting the borrower directly, exploring repayment options, and potentially referring the account to a collection agency. The consequences of default can be severe, including damage to credit score, wage garnishment, and tax refund offset. ECSI is obligated to follow specific federal regulations regarding default management, ensuring fair and transparent treatment of borrowers. While ECSI aims to work with borrowers to avoid default, they also have a responsibility to recover the funds owed to the government or private lenders. The specific steps taken during the default process are Artikeld in ECSI’s communication with borrowers and on their website.

Comparison of ECSI Servicing Practices to Other Major Servicers

ECSI’s servicing practices are generally comparable to those of other major student loan servicers, such as Navient, Nelnet, and FedLoan Servicing. All servicers must adhere to federal regulations and guidelines regarding loan servicing. However, specific processes and customer service experiences may vary between servicers. Some borrowers may find one servicer more responsive or easier to work with than others, depending on individual circumstances and communication preferences. Factors such as website usability, payment options, and responsiveness to borrower inquiries can influence overall satisfaction with a particular servicer. Comparing servicers often requires researching individual experiences and reviewing independent reviews to assess their relative strengths and weaknesses.

Steps to Take When Encountering Problems with ECSI Loans

If a borrower encounters problems with their ECSI loan, they should take the following steps:

- Review loan documents and understand the terms and conditions.

- Contact ECSI customer service directly through phone, email, or their online portal to explain the issue.

- Document all communication with ECSI, including dates, times, and the names of individuals contacted.

- Explore available options, such as deferment, forbearance, or income-driven repayment plans.

- If the issue remains unresolved, consider seeking assistance from a student loan counselor or consumer protection agency.

Proactive communication and documentation are key to resolving issues effectively. Early intervention can often prevent more significant problems down the line.

ECSI and Federal Student Loan Programs

ECSI, or the Education Credit Management Corporation, plays a significant role in the servicing of federal student loans in the United States. Understanding its relationship with the federal government and the impact on borrowers is crucial for navigating the student loan repayment process. This section details ECSI’s involvement with various federal student loan programs and its adherence to federal regulations.

ECSI services a range of federal student loan programs, including those offered under the William D. Ford Federal Direct Loan Program. This encompasses Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans for parents and graduate students, and Direct Consolidation Loans. The specific programs ECSI services can vary over time, so it’s advisable to check ECSI’s website or your loan documents for the most up-to-date information.

ECSI’s Relationship with the Federal Government

ECSI operates as a third-party servicer under contract with the U.S. Department of Education. This means the federal government contracts with ECSI to manage certain aspects of federal student loan accounts, such as processing payments, responding to borrower inquiries, and managing loan deferments and forbearances. The Department of Education sets the standards and regulations that ECSI must follow, ensuring consistent treatment of borrowers across all servicers. This relationship ensures that ECSI’s practices align with federal guidelines and protect borrower rights. Failure to comply with these regulations can result in penalties for ECSI.

Impact of ECSI Servicing on Borrower Access to Federal Loan Programs

ECSI’s role as a loan servicer directly impacts borrowers’ experiences with federal student loan programs. Efficient and transparent servicing practices can facilitate access to important information and resources, making it easier for borrowers to manage their loans and avoid delinquency. Conversely, poor servicing practices can create barriers, leading to confusion, missed payments, and potential damage to credit scores. For example, timely and accurate communication regarding repayment options and available assistance programs is crucial for borrower success. Conversely, a lack of clear communication or delays in processing requests can negatively impact a borrower’s ability to navigate the repayment process.

Examples of ECSI’s Interaction with Federal Student Aid Regulations

ECSI’s operations are governed by numerous federal regulations, including those related to the Fair Credit Reporting Act (FCRA), the Truth in Lending Act (TILA), and the Higher Education Act (HEA). For example, ECSI must accurately report loan payment activity to credit bureaus in accordance with FCRA, ensuring that borrowers’ credit histories reflect their repayment performance accurately. Similarly, ECSI’s communication with borrowers regarding loan terms and repayment options must comply with TILA’s disclosure requirements. Compliance with HEA regulations ensures that ECSI follows established procedures for loan forgiveness, income-driven repayment plans, and other federal student aid programs.

Federal Student Loan Application Process Serviced by ECSI

The following flowchart illustrates a simplified representation of how a federal student loan application might be processed when ECSI is the designated servicer. This is a general illustration and specific steps may vary.

[Diagram Description: The flowchart would begin with “Student Completes FAFSA.” An arrow would point to “Application Received by Federal Student Aid (FSA).” Another arrow would lead to “FSA Approves Loan and Assigns Servicer (ECSI).” The next step would be “ECSI Notifies Borrower and Provides Loan Details.” An arrow then points to “Borrower Makes Payments to ECSI.” Finally, an arrow leads to “ECSI Reports Payment Activity to Credit Bureaus and FSA.” ]

Borrower Experiences with ECSI

Borrower experiences with ECSI, like any loan servicer, are varied. Some borrowers report positive interactions, while others express frustration. Understanding these diverse perspectives is crucial for prospective borrowers and current ECSI clients alike. This section will explore both positive and negative experiences, offering insights into common complaints and ECSI’s responses.

ECSI Borrower Testimonials

To illustrate the range of experiences, here are some fictionalized accounts reflecting common sentiments:

“ECSI’s online portal was easy to navigate, and I appreciated the automated payment reminders. Their customer service representatives were always helpful and responsive when I had questions about my repayment plan.” – Sarah J., former ECSI borrower.

“I found the communication from ECSI to be confusing and inconsistent. I had difficulty understanding my repayment options, and my calls to customer service often resulted in long wait times.” – David L., current ECSI borrower.

These examples highlight the need for clear, consistent communication and accessible online tools. The variability in experiences emphasizes the importance of proactive communication from borrowers to ensure a smoother repayment process.

Common Complaints and Positive Feedback

A common theme in negative feedback revolves around customer service responsiveness and clarity of communication. Borrowers frequently cite long wait times, difficulty reaching representatives, and confusing explanations of repayment options. Conversely, positive feedback often focuses on the user-friendliness of the online portal, the availability of automated payment options, and the helpfulness of specific customer service representatives when contact was successfully made.

ECSI’s Response to Borrower Concerns

ECSI actively attempts to address borrower concerns through various channels. They offer online resources, including FAQs and tutorials, to guide borrowers through the repayment process. They also provide phone and email support, though the effectiveness of this support varies based on individual experiences. ECSI also participates in federal programs designed to assist borrowers in distress, such as income-driven repayment plans.

Comparison with Other Loan Servicers

Comparing ECSI to other servicers requires acknowledging the diversity of experiences with each provider. While some borrowers may find ECSI’s customer service lacking, others may find it comparable to or even better than other servicers they’ve interacted with. For instance, a fictional borrower might find ECSI’s online portal more intuitive than that of another servicer, but less responsive customer service. Conversely, another borrower might prefer the personalized attention they received from a different servicer, even if that servicer’s online platform was less user-friendly. These variations underscore the subjective nature of these experiences.

Summary of Borrower Experiences

| Positive Experiences | Negative Experiences |

|---|---|

| Easy-to-use online portal | Long wait times for customer service |

| Helpful customer service representatives (in some cases) | Confusing communication regarding repayment options |

| Automated payment reminders | Difficulty reaching customer service representatives |

| Clear repayment plan information (in some cases) | Inconsistent communication |

Managing ECSI Student Loans Effectively

Effective management of your ECSI student loans is crucial for avoiding financial hardship and achieving timely repayment. This involves proactive planning, understanding your loan terms, and utilizing available resources. Failure to manage your loans effectively can lead to delinquency, default, and significant long-term financial consequences.

Understanding Loan Terms and Conditions

Thoroughly reviewing your ECSI loan documents is the first step towards effective loan management. This includes understanding your loan amount, interest rate, repayment plan, and any associated fees. Knowing your repayment schedule and the total amount you owe allows you to budget effectively and track your progress. Pay close attention to the details of your repayment plan, including the monthly payment amount, the length of the repayment period, and any potential penalties for late or missed payments. This knowledge empowers you to make informed financial decisions and avoid unexpected surprises.

Developing a Repayment Strategy

Creating a realistic repayment strategy is essential for avoiding loan default. This involves considering your income, expenses, and overall financial situation. Several repayment options are available, including standard, extended, graduated, and income-driven repayment plans. Choosing the right plan depends on your individual circumstances and financial goals. It’s advisable to explore all options and select the one that best aligns with your current and future financial capacity.

Budgeting and Financial Planning for Repayment

Effective budgeting is paramount to successful student loan repayment. Track your income and expenses meticulously to identify areas where you can reduce spending and allocate funds towards your loan payments. Consider creating a detailed budget that includes all your income sources and expenses, categorizing them to pinpoint areas for potential savings. Building an emergency fund is also crucial, providing a financial cushion to cover unexpected expenses and prevent missed loan payments. This financial buffer helps maintain consistent repayments even when facing unforeseen circumstances.

Repayment Strategies: Examples

The following table illustrates different repayment strategies for hypothetical loan amounts and interest rates. Remember, these are examples and your actual repayment plan will depend on your individual loan terms and financial situation.

| Repayment Plan | Loan Amount | Interest Rate | Monthly Payment (approx.) |

|---|---|---|---|

| Standard Repayment (10 years) | $30,000 | 6% | $330 |

| Extended Repayment (25 years) | $30,000 | 6% | $170 |

| Graduated Repayment (10 years) | $30,000 | 6% | Starts low, increases over time |

| Income-Driven Repayment (IBR) | $30,000 | 6% | Based on income, typically lower |

Avoiding Loan Default

Defaulting on your student loans has severe consequences, including damage to your credit score, wage garnishment, and potential legal action. To avoid default, make timely payments, communicate with ECSI if you anticipate difficulty making payments, and explore options such as deferment or forbearance if necessary. Proactive communication with your loan servicer is crucial. They may be able to offer solutions to help you manage your debt and avoid default. Remember that maintaining open communication is key to navigating potential repayment challenges.

ECSI and Income-Driven Repayment Plans

ECSI, as a student loan servicer, plays a crucial role in helping borrowers manage their federal student loans, including facilitating access to income-driven repayment (IDR) plans. These plans are designed to make monthly payments more manageable by basing them on your income and family size. Understanding how ECSI handles IDR plans is vital for borrowers seeking affordable repayment options.

ECSI’s role involves processing applications, verifying income information, and calculating monthly payments based on the chosen IDR plan. They also manage the account throughout the repayment period, ensuring accurate payment processing and providing necessary communication regarding plan updates and changes.

Applying for an Income-Driven Repayment Plan through ECSI

The application process for an IDR plan through ECSI typically begins on the Federal Student Aid website (studentaid.gov). Borrowers will need to create or log into their account, locate their ECSI-serviced loans, and select the desired IDR plan. This often involves submitting tax information (IRS tax transcripts are generally required) and documentation to verify income and family size. ECSI will then review the submitted information and determine eligibility. Once approved, the borrower’s monthly payment will be recalculated based on their income and family size, and this new payment amount will be reflected on their account. Regular updates regarding income and family size changes may be required periodically to maintain eligibility.

Types of Income-Driven Repayment Plans Offered through ECSI

ECSI administers several types of federal income-driven repayment plans. These plans may include, but are not limited to, Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has specific income and family size considerations for determining the monthly payment. The specific details of each plan, including eligibility requirements and payment calculation formulas, can be found on the Federal Student Aid website. The choice of plan depends on the borrower’s individual financial circumstances and long-term repayment goals.

Benefits and Drawbacks of Income-Driven Repayment Plans for ECSI Borrowers

Income-driven repayment plans offer significant benefits for borrowers struggling to manage high monthly payments. Lower monthly payments can provide immediate financial relief, making loan repayment more manageable. For some borrowers, these plans may even lead to loan forgiveness after a specified period of qualifying payments, effectively eliminating a portion or all of their student loan debt.

However, it’s important to acknowledge potential drawbacks. IDR plans typically extend the repayment period, leading to a higher total amount paid over the life of the loan due to accumulated interest. Also, maintaining eligibility requires annual or periodic recertification of income and family size. Failure to do so could result in a recalculation of monthly payments, potentially increasing the payment amount.

Key Requirements and Eligibility Criteria for Income-Driven Repayment Plans

Understanding the eligibility requirements is crucial before applying for an IDR plan. Below is a list of key factors:

- Federal Student Loans: Only federal student loans are eligible for IDR plans. Private student loans are not included.

- Income Documentation: Tax returns or other verifiable income documentation is required to determine eligibility and calculate monthly payments.

- Family Size: The number of individuals in the borrower’s household (including the borrower and any dependents) impacts the calculation of the monthly payment.

- Specific Plan Requirements: Each IDR plan has its own set of specific eligibility criteria and income limitations. These vary based on loan type and repayment plan selected.

- Loan Status: Loans must be in repayment status (i.e., grace period has ended) to be eligible for an IDR plan.

ECSI’s Role in Loan Consolidation

ECSI, or the Education Credit Servicing, Inc., doesn’t directly offer loan consolidation programs in the same way that the federal government does. However, ECSI plays a significant role in the process for borrowers whose federal student loans are assigned to them for servicing. Understanding ECSI’s involvement is crucial for borrowers considering consolidation.

ECSI’s primary role in loan consolidation is servicing consolidated loans. If you consolidate your federal student loans through the federal Direct Consolidation Loan program, your consolidated loan may be assigned to ECSI for servicing. This means ECSI will handle your monthly payments, manage your account information, and provide customer service related to your consolidated loan. They don’t initiate the consolidation; they manage the loan *after* it’s consolidated through the government’s program.

ECSI’s Servicing of Consolidated Loans

Once a borrower consolidates their federal student loans and ECSI is assigned as the servicer, they handle the day-to-day management of the loan. This includes processing payments, providing account statements, answering borrower inquiries, and managing changes to repayment plans. Borrowers should interact with ECSI for all matters related to their consolidated loan, such as updating contact information or exploring repayment options. The experience is similar to how ECSI manages other federal student loans, though the terms and conditions are set by the consolidation agreement.

Benefits and Drawbacks of Consolidating with ECSI (Indirectly)

Consolidating federal student loans, regardless of the servicer (including when ECSI becomes the servicer post-consolidation), offers potential benefits such as simplifying payments by combining multiple loans into one, potentially lowering monthly payments (by extending the repayment term), and possibly switching to an income-driven repayment plan. However, drawbacks include potentially extending the repayment period, which increases the total interest paid over the life of the loan, and the loss of any benefits tied to specific loan types, such as the potential for loan forgiveness programs linked to certain professions.

Steps Involved in Consolidating Federal Student Loans (with ECSI as a potential outcome)

The consolidation process begins with the borrower applying through the federal government’s website, not directly through ECSI. The application involves providing information about all federal student loans to be consolidated. After approval, the government issues a new consolidated loan, and a servicer, which *could* be ECSI, is assigned. The borrower will then receive notification of their assigned servicer and instructions on how to make payments.

Comparison of Consolidation Options

There are various options for managing student loan debt, including consolidation through the federal government, refinancing through private lenders, and managing loans individually. Each option has its own set of pros and cons.

| Consolidation Option | Pros | Cons | Servicer Role (ECSI’s potential involvement) |

|---|---|---|---|

| Federal Direct Consolidation Loan | Simplifies payments, potential for lower monthly payments, access to income-driven repayment plans | Potentially higher total interest paid, may lose benefits tied to specific loan types | ECSI may be assigned as the loan servicer after consolidation |

| Private Loan Refinancing | Potentially lower interest rates, shorter repayment terms | Loss of federal student loan benefits, may require good credit | ECSI plays no role; private lenders handle servicing |

| Managing Loans Individually | Maintains original loan terms and benefits | Complex payment management, higher administrative burden | ECSI might service individual loans, but consolidation is not involved. |

Closing Summary

Successfully managing your ECSI student loans requires a proactive approach and a thorough understanding of the available resources and options. By understanding the intricacies of ECSI’s servicing practices, utilizing effective repayment strategies, and proactively addressing any challenges, borrowers can navigate the repayment process with confidence and achieve long-term financial well-being. Remember to utilize the resources provided by ECSI and seek professional advice when needed to ensure a smooth and successful repayment journey. This comprehensive guide serves as a starting point for a more financially secure future.

FAQ Guide

What happens if I miss an ECSI loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default. Contact ECSI immediately to explore options like deferment or forbearance.

Can I refinance my ECSI student loans?

Yes, you can refinance your ECSI loans with a private lender. However, refinancing federal loans into private loans may eliminate federal protections and benefits.

How do I contact ECSI customer service?

ECSI provides various contact methods, including phone, email, and online account access. Their contact information is readily available on their website.

What are the eligibility requirements for income-driven repayment plans with ECSI?

Eligibility varies depending on the specific plan. Generally, you’ll need to demonstrate your income and family size. ECSI’s website details the requirements for each plan.