Navigating the complex world of student loans can feel overwhelming, but understanding the various options available is crucial for your financial future. This guide provides clear examples of federal and private student loans, outlining their differences in interest rates, eligibility, and repayment plans. We’ll explore various repayment strategies, including standard, graduated, and income-driven plans, demonstrating their long-term impact on your finances. By examining real-world scenarios, we aim to equip you with the knowledge to make informed decisions and successfully manage your student loan debt.

We’ll delve into the intricacies of loan terms, highlighting key aspects such as grace periods, deferment, and forbearance, and outlining the potential consequences of default. Furthermore, we’ll offer practical advice on budgeting, debt repayment strategies, and navigating unexpected challenges that may arise during repayment. This guide is designed to empower you to take control of your student loan journey.

Types of Student Loans

Navigating the world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. This section will Artikel the key distinctions between federal and private student loans, along with the benefits of loan consolidation programs. Choosing the right loan type significantly impacts your borrowing costs and repayment strategy.

Federal Student Loans

Federal student loans are offered by the U.S. government and generally offer more favorable terms than private loans. They come with various protections and repayment options designed to help borrowers manage their debt. The following table summarizes three common types:

| Loan Type | Interest Rate Information | Eligibility Requirements | Repayment Options |

|---|---|---|---|

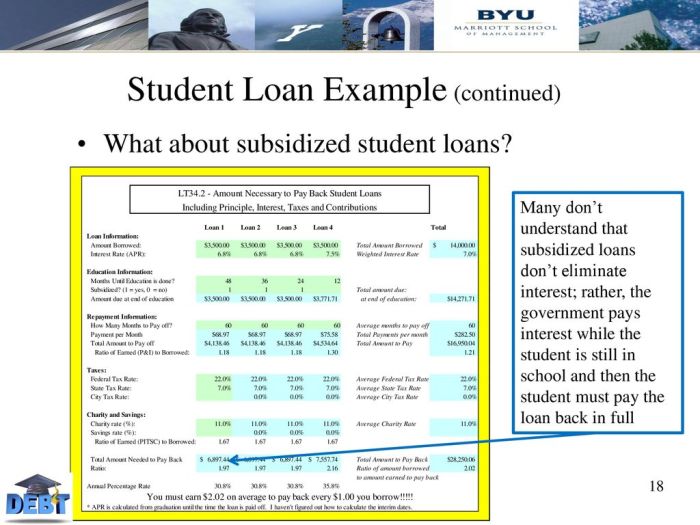

| Subsidized Loan | Interest rates are set annually by the government and are typically lower than unsubsidized loans. The government pays the interest while the borrower is in school at least half-time, during grace periods, and during deferment. | Demonstrated financial need, enrollment at least half-time in an eligible program. | Standard repayment, income-driven repayment plans, extended repayment, graduated repayment. |

| Unsubsidized Loan | Interest rates are set annually by the government. Interest accrues from the time the loan is disbursed, even while the borrower is in school. | Enrollment at least half-time in an eligible program. | Standard repayment, income-driven repayment plans, extended repayment, graduated repayment. |

| PLUS Loans (Parent PLUS and Graduate PLUS) | Interest rates are set annually by the government. Interest accrues from the time the loan is disbursed. | Credit check required; parents must meet minimum credit standards for Parent PLUS loans; graduate students must meet minimum credit standards for Graduate PLUS loans. | Standard repayment, extended repayment. |

Private Student Loans

Private student loans are offered by banks, credit unions, and other financial institutions. Unlike federal loans, these loans are not backed by the government. This key difference leads to several variations in terms and conditions.

The following bullet points highlight key differences between federal and private student loans:

- Interest Rates: Private loan interest rates are typically higher than federal loan interest rates and are often variable, meaning they can change over the life of the loan.

- Eligibility Requirements: Private loans often have stricter eligibility requirements, including credit checks and co-signers.

- Repayment Options: Private loans may offer fewer repayment options compared to federal loans. Income-driven repayment plans are generally not available.

- Borrower Protections: Federal loans offer various borrower protections, such as deferment and forbearance options, which are often less flexible or unavailable with private loans.

- Loan Forgiveness Programs: Federal loans may be eligible for loan forgiveness programs based on certain careers or circumstances; this is typically not the case with private loans.

Loan Consolidation Programs

Loan consolidation programs combine multiple student loans into a single loan with a new interest rate and repayment schedule. This can simplify repayment and potentially reduce monthly payments.

Potential benefits of loan consolidation include:

- Simplified repayment with a single monthly payment.

- Potentially lower monthly payments (though this depends on the new interest rate and repayment term).

- A fixed interest rate (depending on the program).

- Access to different repayment plans.

Student Loan Repayment Plans

Choosing the right student loan repayment plan is crucial for managing your debt effectively and minimizing long-term costs. Different plans offer varying payment amounts and repayment periods, impacting your budget and the total interest you’ll pay over the life of the loan. Understanding the options available is essential for making an informed decision.

Understanding the nuances of each repayment plan is vital for effective debt management. Factors such as income, loan amount, and long-term financial goals should be considered when making a selection. Failing to do so could result in unnecessary financial strain or significantly increased interest payments.

Student Loan Repayment Plan Comparison

The following table compares common student loan repayment plans. Remember that specific eligibility criteria and plan details can vary depending on your lender and loan type.

| Plan Name | Payment Calculation Method | Eligibility Criteria | Advantages and Disadvantages |

|---|---|---|---|

| Standard Repayment Plan | Fixed monthly payments over 10 years. | Generally available to all federal student loan borrowers. | Advantages: Predictable payments, shortest repayment period. Disadvantages: Higher monthly payments, potential for financial strain. |

| Graduated Repayment Plan | Payments start low and gradually increase every two years over a 10-year period. | Generally available to all federal student loan borrowers. | Advantages: Lower initial payments, easing initial financial burden. Disadvantages: Payments significantly increase over time, potentially leading to financial difficulty later. |

| Extended Repayment Plan | Fixed monthly payments over a longer period (up to 25 years). | Generally available to all federal student loan borrowers with a loan balance exceeding $30,000. | Advantages: Lower monthly payments. Disadvantages: Significantly higher total interest paid over the life of the loan, longer repayment period. |

| Income-Driven Repayment Plan (IDR) | Monthly payments are calculated based on your discretionary income and family size. Several plans exist (e.g., ICR, PAYE, REPAYE,IBR). | Generally available to all federal student loan borrowers. Specific eligibility criteria vary by plan. | Advantages: Affordable monthly payments, potential for loan forgiveness after 20-25 years depending on the plan. Disadvantages: Longer repayment periods, potential for higher total interest paid. |

Implications of Choosing a Repayment Plan

The choice of repayment plan significantly impacts long-term costs. Consider these scenarios:

- Choosing a Standard Repayment Plan results in higher monthly payments but significantly less interest paid overall due to the shorter repayment period.

- Opting for an Extended Repayment Plan lowers monthly payments but dramatically increases the total interest paid due to the extended repayment period.

- An Income-Driven Repayment Plan provides lower monthly payments based on income, but the extended repayment period may lead to higher total interest paid and potential for loan forgiveness after a long period of repayment.

- A Graduated Repayment Plan offers manageable initial payments, but the increasing payments could create financial strain later in the repayment period.

Hypothetical Repayment Schedule ($50,000 Loan)

This is a simplified example and does not account for potential changes in interest rates or income. Actual payments will vary.

| Month | Standard Plan Payment (10 years) | Graduated Plan Payment (10 years) | Income-Driven Plan Payment (Example: $300/month) |

|---|---|---|---|

| 1 | $550 | $350 | $300 |

| 12 | $550 | $380 | $300 |

| 24 | $550 | $420 | $300 |

| 60 | $550 | $550 | $300 |

| 120 | $550 | $700 | $300 |

| *Total Interest Paid (Estimate)* | $15,000 | $20,000 | $36,000 |

Understanding Loan Terms and Conditions

Navigating the world of student loans requires a thorough understanding of the terms and conditions Artikeld in your loan agreement. These details significantly impact your repayment responsibilities and overall financial health. Failing to grasp these key aspects can lead to unforeseen difficulties and financial strain. This section will clarify essential terms and potential consequences.

Key Loan Terms and Conditions

Understanding the specific terms of your student loan is crucial for responsible borrowing and repayment. The following terms frequently appear in loan agreements and directly affect your financial obligations.

- Interest Rates: This is the percentage charged on the principal loan amount. Lower interest rates mean lower overall costs.

- Fees: These are additional charges associated with the loan, such as origination fees or late payment fees. These fees can add significantly to the total cost.

- Grace Periods: This is the period after graduation or leaving school before loan repayment begins. The length varies depending on the loan type.

- Deferment: This allows temporary postponement of loan payments under specific circumstances, such as returning to school or experiencing unemployment. Specific eligibility criteria usually apply.

- Forbearance: Similar to deferment, this allows for temporary suspension of payments, but often without the same strict eligibility requirements. Interest may still accrue during forbearance.

Consequences of Student Loan Default

Defaulting on a student loan—failing to make payments according to the loan agreement—has severe consequences that can significantly impact your credit and financial future. These repercussions extend beyond simply damaging your credit score.

- Damaged Credit Score: A default will drastically lower your credit score, making it difficult to obtain loans, credit cards, or even rent an apartment in the future.

- Wage Garnishment: The lender can garnish your wages, meaning a portion of your paycheck will be directly seized to repay the debt.

- Tax Refund Offset: Your federal and state tax refunds can be seized to repay the debt.

- Difficulty Obtaining Future Loans: A default makes it extremely challenging to secure future loans, including mortgages and auto loans.

- Collection Agency Involvement: Your loan may be sold to a collection agency, which can aggressively pursue repayment through various means.

Comparison of Federal and Private Student Loans

Federal and private student loans differ significantly in their terms and conditions. Understanding these differences is essential for making informed borrowing decisions.

| Feature | Federal Loan | Private Loan | Key Differences |

|---|---|---|---|

| Interest Rates | Generally lower and fixed | Generally higher and can be variable or fixed | Federal loans typically offer more favorable interest rates. |

| Fees | Typically lower or nonexistent | Can be higher, including origination fees and prepayment penalties | Private loans often have higher fees. |

| Repayment Plans | Offers various income-driven repayment plans | Fewer repayment options available; typically standard repayment plans | Federal loans provide greater flexibility in repayment. |

| Deferment/Forbearance | More readily available and often easier to qualify for | Less common and more restrictive eligibility criteria | Federal loans offer more robust deferment and forbearance options. |

| Default Consequences | Subject to federal regulations with specific protections | Subject to state and private collection laws; potentially harsher consequences | Federal loans generally have more defined and regulated default procedures. |

Managing Student Loan Debt

Effectively managing student loan debt requires a proactive approach encompassing budgeting, strategic repayment methods, and understanding available repayment plans. Failing to plan can lead to increased interest payments and prolonged repayment periods. This section provides practical strategies to navigate the complexities of student loan repayment.

Sample Student Loan Budget

Creating a realistic budget is crucial for successful student loan repayment. This involves identifying all monthly income and expenses, allocating funds for loan payments, and ensuring sufficient funds for essential living expenses. A well-structured budget provides a clear picture of your financial situation, enabling informed decision-making.

- Income: $3,000 (monthly net income after taxes)

- Expenses:

- Rent: $1,000

- Groceries: $300

- Utilities: $150

- Transportation: $200

- Student Loan Payment: $500

- Other Expenses (Entertainment, Savings, etc.): $350

- Total Expenses: $2,500

- Remaining Funds: $500 (This can be used for additional loan payments, building an emergency fund, or other savings goals.)

Strategies for Faster Student Loan Repayment

Several strategies can accelerate student loan repayment, potentially saving significant amounts on interest. These strategies require discipline and commitment, but the long-term benefits are substantial. Choosing the right approach depends on individual financial circumstances and risk tolerance.

- Debt Avalanche Method: This method prioritizes paying off the loan with the highest interest rate first. By focusing on high-interest loans, you minimize the total interest paid over the life of your loans. For example, if you have a loan with 7% interest and another with 4%, you would focus on paying off the 7% loan first.

- Debt Snowball Method: This method focuses on paying off the smallest loan first, regardless of interest rate. The psychological benefit of quickly eliminating a loan can provide motivation to continue with the repayment process. This method is often preferred for its motivational aspect, even if it doesn’t save as much on interest in the long run.

- Extra Payments: Making even small extra payments each month can significantly reduce the loan’s principal balance and shorten the repayment period. For instance, an extra $50 per month can make a substantial difference over time.

- Refinance Your Loans: Refinancing can consolidate multiple loans into one with a lower interest rate, potentially saving money on interest payments. However, it’s essential to carefully compare offers from different lenders and understand the terms and conditions before refinancing.

Applying for Income-Driven Repayment Plans

Income-driven repayment (IDR) plans adjust your monthly payment based on your income and family size. These plans can make student loan repayment more manageable, especially during periods of lower income. However, it’s crucial to understand that IDR plans typically extend the repayment period, leading to higher total interest paid over the life of the loan.

- Gather Necessary Information: Collect your tax returns, pay stubs, and other documentation demonstrating your income and family size.

- Choose an IDR Plan: Research the different IDR plans available (e.g., ICR, PAYE, REPAYE,IBR) and select the one that best suits your financial situation.

- Complete the Application: Submit the application through the appropriate government website (StudentAid.gov in the US).

- Provide Required Documentation: Upload the necessary documents supporting your income and family size.

- Review and Submit: Carefully review your application before submitting it to ensure accuracy.

- Monitor Your Account: Regularly check your student loan account to ensure your payments are correctly processed and that your plan is up-to-date.

Illustrative Scenarios

Understanding how student loan management can impact your financial future is best illustrated through real-world examples. These scenarios highlight both successful navigation and the challenges that can arise, emphasizing the importance of proactive planning and resourcefulness.

Successful Student Loan Management Leading to Debt-Free Graduation

Maria, a diligent pre-med student, meticulously planned her finances throughout her undergraduate career. Before starting college, she researched various scholarship opportunities and secured several grants, significantly reducing her reliance on loans. She also opted for part-time employment during her semesters, strategically allocating her earnings towards tuition and living expenses. This proactive approach allowed her to minimize the amount she needed to borrow. Furthermore, Maria maintained a detailed budget, tracking her income and expenses meticulously. This enabled her to identify areas where she could cut back and prioritize loan repayments. Upon graduation, Maria had successfully paid off all her student loans, a testament to her financial discipline and planning. Her strategic approach, combining scholarship applications, part-time work, and disciplined budgeting, resulted in a debt-free graduation.

Struggling with Loan Repayment Due to Unexpected Circumstances

David, an aspiring software engineer, faced unforeseen challenges after graduation. He secured a job but, six months later, was laid off due to company restructuring. This sudden job loss significantly impacted his ability to meet his monthly loan payments. The added stress of unemployment, coupled with the pressure of mounting debt, led to significant financial strain. However, David proactively sought help. He contacted his loan servicer to explore options like forbearance or deferment, temporarily suspending or reducing his payments. He also actively searched for new employment and enrolled in job retraining programs to enhance his skillset and improve his job prospects. Additionally, David explored options for financial assistance, such as unemployment benefits and community support programs. While challenging, David’s proactive approach to seeking assistance and actively working towards regaining financial stability provided him with the necessary time and resources to navigate this difficult period.

Comparison of Student Loan Management Scenarios

| Scenario | Financial Situation | Challenges Faced | Solutions Implemented |

|---|---|---|---|

| Maria (Successful Management) | Secured scholarships and grants; part-time employment; meticulous budgeting; minimized loan borrowing. | Maintaining a balance between studies, work, and financial planning. | Proactive financial planning; disciplined budgeting; utilizing scholarships and grants; strategic part-time work. |

| David (Struggling with Repayment) | Job loss; inability to meet loan payments; financial stress. | Unexpected job loss; mounting debt; financial insecurity. | Contacting loan servicer for forbearance/deferment; active job searching; skill enhancement; exploring financial assistance programs. |

Final Wrap-Up

Successfully managing student loan debt requires careful planning, understanding, and proactive strategies. From choosing the right repayment plan to implementing effective budgeting techniques, this guide has provided a framework for navigating the complexities of student loans. Remember, seeking professional financial advice tailored to your individual circumstances can be invaluable. By understanding the options available and proactively managing your debt, you can pave the way for a financially secure future.

Frequently Asked Questions

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in default, impacting your ability to obtain credit in the future.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it often involves consolidating federal and private loans into a new private loan, potentially losing federal loan benefits.

What is loan forgiveness?

Loan forgiveness programs, typically for specific professions or through public service, can eliminate a portion or all of your student loan debt after meeting certain requirements. Eligibility varies greatly.

How do I consolidate my student loans?

You can consolidate federal student loans through the government’s Direct Consolidation Loan program. Private loans generally cannot be consolidated with federal loans.