The pursuit of higher education often involves the significant financial hurdle of student loans. Understanding the FAFSA (Free Application for Federal Student Aid) process is crucial for securing the funding necessary to achieve academic goals. This guide delves into the intricacies of FAFSA, exploring various loan types, effective debt management strategies, and the long-term financial implications of student loan debt. We aim to equip students and their families with the knowledge to make informed decisions throughout their educational journey.

From completing the FAFSA application to navigating repayment options and maximizing financial aid opportunities, we’ll cover essential aspects of student financing. We will also address common misconceptions and provide practical advice to ensure a smoother and more financially responsible path towards academic success. This comprehensive guide aims to demystify the process, empowering you to take control of your financial future.

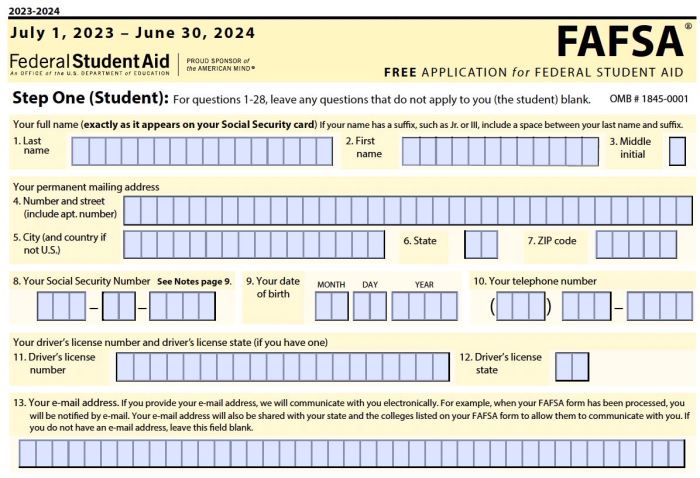

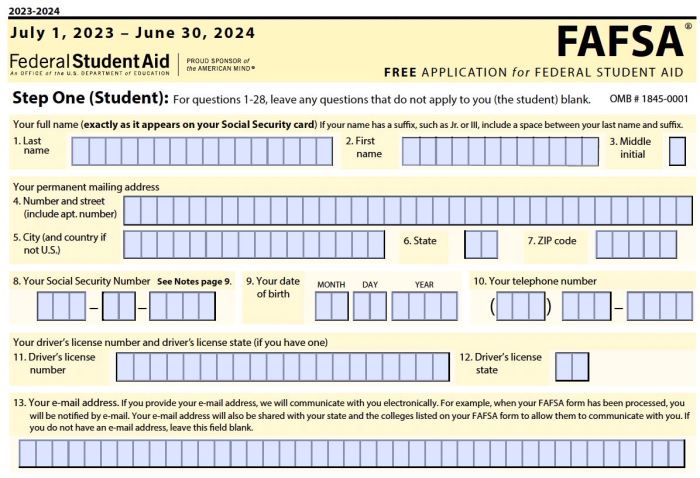

FAFSA Application Process

Completing the Free Application for Federal Student Aid (FAFSA) is a crucial step for students seeking financial assistance for higher education. The process, while potentially daunting at first, is straightforward when approached systematically. This section Artikels the steps involved, necessary documentation, potential pitfalls, and key differences between undergraduate and graduate applications.

Step-by-Step FAFSA Completion

The FAFSA application is completed online through the official website, studentaid.gov. The process generally involves creating an FSA ID, gathering required information, and accurately entering data into the form. Students should expect to spend approximately 30-60 minutes completing the application, depending on the complexity of their financial situation. The steps are generally: 1) Create an FSA ID; 2) Gather necessary tax information; 3) Complete the FAFSA form; 4) Review and submit the application; 5) Track your application status. Careful attention to detail is essential throughout this process.

Required Documentation

Accurate completion of the FAFSA hinges on having the necessary documentation readily available. This includes tax information (both yours and your parents’ if you are a dependent student), W-2s, social security numbers, and bank statements. Having this information organized beforehand significantly streamlines the application process and minimizes the risk of errors. Specific documents may vary depending on individual circumstances, but the core requirement remains consistent: accurate financial information.

Common Errors to Avoid

Several common mistakes can delay or even invalidate a FAFSA application. These include inaccurate reporting of income and assets, typos in social security numbers, and failing to properly complete all sections of the form. Double-checking all entered information is crucial, and utilizing the FAFSA’s online help features can address many potential problems proactively. Students should also be aware of deadlines and submit their application well in advance to allow for any necessary corrections.

FAFSA Application Process Comparison: Undergraduate vs. Graduate

| Feature | Undergraduate Student | Graduate Student | Notes |

|---|---|---|---|

| Applicant’s Tax Information | Student’s and parents’ tax information is generally required (depending on dependency status). | Primarily the student’s tax information is required. | Dependency status significantly impacts required information. |

| Financial Information Required | Comprehensive financial information for both student and parents (if dependent). | Primarily the student’s financial information. | Graduate students generally have more financial independence. |

| Expected Family Contribution (EFC) Calculation | EFC calculation considers both parental and student income and assets. | EFC calculation primarily considers the student’s income and assets. | EFC directly impacts the amount of financial aid offered. |

| Application Deadline | Varies by state and institution, generally in early Spring for the following academic year. | Varies by state and institution, generally similar to undergraduate deadlines. | Check specific school deadlines; some have earlier deadlines than others. |

Understanding Student Loan Types

Navigating the world of student loans can feel overwhelming, but understanding the different types available is crucial for making informed financial decisions. Federal student loans offer several options, each with its own set of benefits and drawbacks. Choosing the right loan type can significantly impact your repayment burden and overall financial health.

Federal Student Loan Types

The federal government offers several types of student loans. These loans generally have more borrower protections than private loans. Understanding the distinctions between these loan types is vital for responsible borrowing. The primary types include Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for parents and graduate students), and Direct Consolidation Loans.

Subsidized vs. Unsubsidized Loans

The key difference between subsidized and unsubsidized loans lies in interest accrual. With Direct Subsidized Loans, the government pays the interest while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized loans, however, accrue interest from the moment the loan is disbursed, regardless of your enrollment status. This means you’ll owe more at the end of your loan term if you don’t pay the accruing interest.

Interest Rates and Repayment Options

Interest rates for federal student loans are set annually by the government and are generally lower than private loan rates. The specific interest rate depends on the loan type and the year the loan was disbursed. Repayment options include standard repayment plans (fixed monthly payments over 10 years), extended repayment plans (longer repayment periods), graduated repayment plans (payments increase over time), and income-driven repayment plans (payments based on your income and family size). Income-driven repayment plans may lead to loan forgiveness after 20 or 25 years, depending on the plan.

Comparison of Student Loan Types

| Loan Type | Pros | Cons | Interest Rate (Example – Subject to Change) |

|---|---|---|---|

| Direct Subsidized Loan | Government pays interest while in school (at least half-time), during grace periods, and deferment; generally lower interest rates than unsubsidized loans. | Strict eligibility requirements (based on financial need); may not cover the full cost of education. | Variable; check the Federal Student Aid website for current rates. |

| Direct Unsubsidized Loan | No financial need requirement; can borrow more than with subsidized loans; available to undergraduate and graduate students. | Interest accrues from disbursement; can lead to a higher total repayment amount. | Variable; check the Federal Student Aid website for current rates. |

| Direct PLUS Loan (Parent/Graduate) | Available to parents of undergraduate students and graduate students; can help cover the full cost of education. | Higher interest rates than subsidized and unsubsidized loans; credit check required; parent borrower is responsible for repayment. | Variable; check the Federal Student Aid website for current rates. Generally higher than subsidized and unsubsidized loans. |

| Direct Consolidation Loan | Simplifies repayment by combining multiple federal student loans into one; potentially lower monthly payments (depending on repayment plan chosen). | May extend the repayment period and increase the total interest paid; does not lower the overall loan amount. | Variable; determined based on the weighted average of the interest rates of the consolidated loans. |

FAFSA and Financial Aid Eligibility

Securing financial aid for higher education often hinges on understanding FAFSA eligibility. The FAFSA (Free Application for Federal Student Aid) is the gateway to various federal, state, and institutional financial aid programs. Eligibility is determined by a complex formula considering several key factors, ultimately impacting the amount of aid a student receives.

Factors Influencing FAFSA Eligibility

Several factors significantly influence a student’s FAFSA eligibility. These include the student’s and their family’s financial information, such as income, assets, and tax filing status. Additionally, the student’s educational status, citizenship, and dependency status all play crucial roles. The FAFSA form collects detailed data on all these aspects to calculate the Expected Family Contribution (EFC). This EFC is a crucial number determining the amount of need-based financial aid a student is eligible to receive. Students should ensure the accuracy of the information provided, as any discrepancies can affect their eligibility.

Family Income and Assets’ Impact on Financial Aid Awards

Family income and assets directly influence the amount of financial aid a student receives. The FAFSA uses a complex formula to calculate the Expected Family Contribution (EFC), which considers both adjusted gross income (AGI) and untaxed income. Higher AGI and significant assets generally lead to a higher EFC, resulting in a lower amount of need-based financial aid. For example, a family with a high income and substantial savings might have a higher EFC, making them less eligible for grants and potentially impacting the amount of federal student loans they qualify for. Conversely, a family with a low income and limited assets will likely have a lower EFC, making them eligible for more need-based aid.

Appealing a Financial Aid Decision

Students who believe their financial aid award is inaccurate or unfair can appeal the decision. The appeals process typically involves submitting additional documentation supporting their claim, such as proof of significant changes in family circumstances, like unexpected job loss or medical expenses. Each institution has its own appeals process, so students should carefully review their school’s specific guidelines and deadlines. Successful appeals often require substantial evidence demonstrating a significant change in financial circumstances that wasn’t reflected in the initial FAFSA application. The process might involve providing updated tax returns, medical bills, or other relevant documents to support the appeal.

Scenario: Changes in Family Income Affecting Financial Aid

Consider a family whose adjusted gross income was $75,000 in the year preceding their child’s college application. Based on this income, they received a moderate amount of financial aid. However, due to an unforeseen job loss, their income drops to $40,000 the following year. If the student reapplies for financial aid, the reduced income will likely result in a lower EFC, making them eligible for a significantly larger amount of need-based financial aid, including grants and potentially more subsidized loans. This demonstrates how significant changes in family circumstances can directly affect financial aid eligibility and the overall financial aid package awarded.

FAFSA and Scholarships

Completing the Free Application for Federal Student Aid (FAFSA) is a crucial step in securing financial aid for college, but its benefits extend far beyond federal grants and loans. The information you provide on the FAFSA is often used by colleges and universities, as well as many external scholarship organizations, to determine your eligibility for additional financial assistance in the form of scholarships. Essentially, the FAFSA acts as a gateway to a wider range of funding opportunities.

The FAFSA simplifies the scholarship application process by providing a centralized source of your financial information. Many scholarship providers require applicants to submit their FAFSA data, streamlining the application process and reducing the need for repetitive paperwork. By completing the FAFSA, you make yourself eligible for scholarships that automatically consider your financial need, increasing your chances of securing funding. Furthermore, some scholarships specifically target students who have completed the FAFSA, highlighting its importance in expanding scholarship opportunities.

FAFSA Data and Scholarship Eligibility

Many scholarships require applicants to demonstrate financial need. The FAFSA provides a standardized measure of this need, making it a valuable tool for scholarship providers. Your Expected Family Contribution (EFC), calculated by the FAFSA, is a key factor in determining your eligibility for need-based scholarships. A lower EFC generally translates to greater eligibility for these types of awards. The FAFSA also provides information on your family size and other relevant factors that scholarship committees consider when evaluating applicants.

External Scholarship Databases and Resources

Several online resources can help you locate and apply for scholarships. These databases often allow you to filter search results based on criteria such as major, academic achievements, and financial need. Examples include Fastweb, Scholarships.com, and Peterson’s. These websites offer a vast selection of scholarships, ranging from national awards to smaller, local opportunities. Each database typically has its own search functionality and filtering options, allowing you to target scholarships that align with your specific profile. Utilizing multiple databases significantly increases your chances of finding suitable scholarship opportunities.

Maximizing Scholarship Opportunities with FAFSA

Completing the FAFSA early in the application process is critical. Many scholarships have early deadlines, so completing your FAFSA well in advance ensures you are eligible for as many opportunities as possible. Additionally, keep your FAFSA information updated, especially if your family’s financial circumstances change. This will ensure that your eligibility for need-based scholarships remains accurate. Finally, carefully review the eligibility requirements of each scholarship you apply for, ensuring you meet all the criteria before submitting your application. This proactive approach maximizes your chances of success in securing external scholarships.

Impact of Student Loans on Future Finances

Student loan debt can significantly impact your financial future, extending far beyond the repayment period. Understanding these long-term implications is crucial for responsible borrowing and financial planning. The decisions you make today regarding student loans will shape your financial well-being for years to come.

Long-Term Financial Implications of Student Loan Debt

Student loan debt can dramatically affect your ability to achieve major financial goals. The monthly payments represent a consistent outflow of funds that could otherwise be used for saving, investing, purchasing a home, or starting a family. For example, a graduate with $50,000 in student loan debt at a 6% interest rate could face monthly payments exceeding $500, significantly reducing disposable income and delaying major life purchases. This can lead to a longer timeline for achieving financial independence and security. High levels of debt can also create significant financial stress, impacting overall well-being.

Impact of Student Loans on Credit Scores and Future Borrowing Capacity

Your student loan repayment history directly influences your credit score. Consistent on-time payments contribute to a positive credit history, while missed or late payments can severely damage your credit score. A low credit score can limit your access to credit in the future, making it more difficult and expensive to obtain mortgages, auto loans, or even credit cards. This can have a ripple effect, hindering your ability to make large purchases or secure favorable loan terms. For instance, a low credit score might result in a higher interest rate on a mortgage, adding thousands of dollars to the overall cost of a home.

Importance of Financial Literacy for Managing Student Loan Debt

Financial literacy is paramount in effectively managing student loan debt. Understanding different repayment plans (standard, graduated, income-driven), interest capitalization, and the potential consequences of default is essential. Developing a realistic budget that incorporates loan payments is crucial for avoiding financial hardship. Seeking guidance from financial advisors or utilizing online resources can help borrowers navigate the complexities of loan repayment and make informed decisions about their financial future. Without a solid understanding of personal finance, borrowers may struggle to manage their debt effectively, leading to financial instability.

Hypothetical Scenario: Repayment Strategies and Long-Term Financial Health

Consider two recent graduates, both with $40,000 in student loan debt at a 5% interest rate. Graduate A chooses the standard repayment plan, making consistent monthly payments. Graduate B opts for an income-driven repayment plan, resulting in lower monthly payments initially but a longer repayment period and higher overall interest paid.

Graduate A: With consistent payments, Graduate A pays off their debt within 10 years, minimizing interest accrued. They are debt-free sooner, allowing them to save and invest more aggressively, potentially buying a house earlier and building wealth faster.

Graduate B: While enjoying lower initial payments, Graduate B’s debt extends for 20 years or more, resulting in significantly higher interest payments. While freeing up cash flow initially, this long-term debt could delay major financial goals, such as homeownership or retirement savings. This scenario illustrates how different repayment strategies can have vastly different long-term financial consequences.

Final Thoughts

Successfully navigating the student loan landscape requires careful planning, informed decision-making, and proactive financial management. By understanding the FAFSA process, exploring various loan options, and implementing effective debt management strategies, students can pave the way for a financially secure future. Remember that seeking guidance from financial aid advisors and utilizing available resources can significantly improve your overall experience and long-term financial well-being. The journey to higher education is an investment, and with careful planning, the rewards can far outweigh the challenges.

Essential FAQs

What happens if I make a mistake on my FAFSA application?

You can correct errors through the FAFSA website. Contact the Federal Student Aid office if you need assistance.

Can I get student loans without filling out the FAFSA?

While the FAFSA is the primary application for federal student aid, some private lenders may offer loans without requiring it. However, federal loans are generally more favorable in terms of interest rates and repayment options.

What if my family’s financial situation changes after I submit my FAFSA?

You can contact your financial aid office to update your information. They may be able to adjust your financial aid package based on the changes.

How long does it take to receive my financial aid after submitting the FAFSA?

Processing times vary, but generally, you can expect to hear back within a few weeks. Check with your school’s financial aid office for their specific timelines.