Navigating the complexities of homeownership as a student loan borrower can feel daunting. Understanding the intricacies of FHA loan eligibility, particularly how your student loan debt impacts the process, is crucial for a successful home purchase. This guide provides a clear overview of FHA guidelines specifically tailored to students, addressing key aspects from eligibility requirements to managing existing student loan debt and exploring loan consolidation options. We’ll demystify the process, empowering you to make informed decisions and achieve your homeownership goals.

This comprehensive resource will equip you with the knowledge to confidently approach the FHA loan application process, considering the unique challenges and opportunities presented by student loan debt. We’ll delve into practical strategies for improving your eligibility, exploring various scenarios, and providing actionable steps to increase your chances of approval. By the end, you’ll have a clear understanding of how to leverage your financial situation to secure an FHA loan.

FHA Loan Eligibility for Students

Securing a home loan as a student can seem daunting, but the Federal Housing Administration (FHA) offers a pathway to homeownership even with limited credit history and income. FHA loans are government-insured mortgages designed to make homeownership more accessible to a wider range of borrowers, including students. Understanding the eligibility requirements is key to successfully navigating the application process.

Basic FHA Loan Eligibility Requirements for Students

To qualify for an FHA loan, students must meet several criteria, similar to other borrowers, but with some nuances relevant to their financial situation. These include demonstrating a stable income source, even if it’s part-time employment alongside studies, providing proof of identity and citizenship, and having a credit history that meets FHA standards. A strong application will showcase responsible financial management, despite potentially limited income or credit history. Furthermore, the property being purchased must meet FHA appraisal standards and be deemed suitable for occupancy.

Minimum Credit Score and Debt-to-Income Ratio Requirements

While there isn’t a specific “student” credit score requirement, FHA loans generally have lower credit score requirements than conventional loans. A credit score of 500 or higher is typically required, although a higher score (often 580) may be needed to secure a lower down payment. The debt-to-income ratio (DTI), which compares your monthly debt payments to your gross monthly income, is another crucial factor. FHA loans typically allow for higher DTI ratios than conventional loans, making them more accessible to students who may have student loan debt. A DTI ratio of 43% is often acceptable, but lenders may have stricter internal guidelines. Careful budgeting and responsible debt management are crucial to improve your chances of approval.

Prequalifying for an FHA Loan: A Step-by-Step Guide

Prequalification is a crucial first step in the home-buying process for students. It helps you understand how much you can borrow and gives you a competitive edge when making an offer on a home. Here’s a step-by-step guide:

1. Gather your financial documents: This includes pay stubs, bank statements, tax returns, and student loan repayment information.

2. Check your credit report: Review your credit report for any errors and take steps to improve your credit score if necessary.

3. Contact multiple FHA-approved lenders: Shop around and compare rates and fees from different lenders. Each lender may have slightly different requirements.

4. Complete a prequalification application: Provide the lender with the necessary financial information.

5. Receive your prequalification letter: This letter confirms the loan amount you’re pre-approved for and helps strengthen your offer when buying a home.

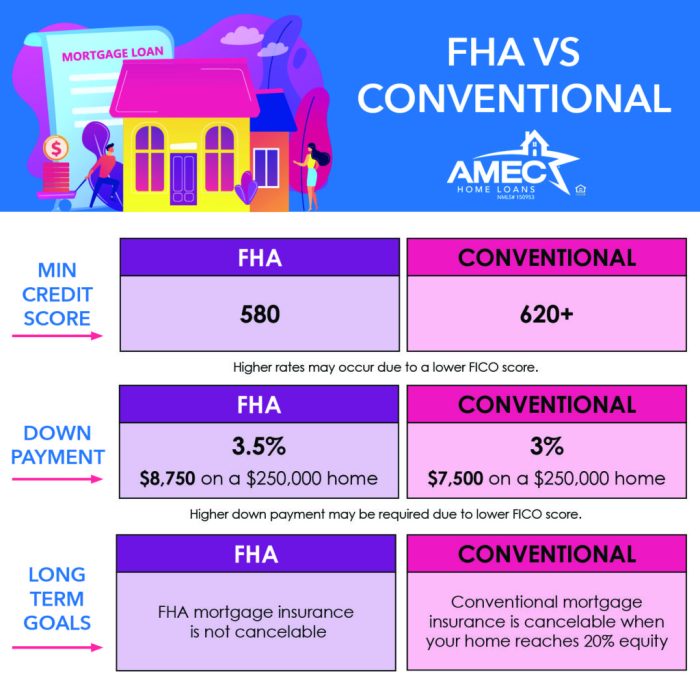

Comparison of FHA and Conventional Loan Requirements for Students

| Requirement | FHA Loan | Conventional Loan |

|---|---|---|

| Minimum Credit Score | Typically 500 (higher score may be needed for lower down payment) | Usually 620 or higher |

| Down Payment | As low as 3.5% | Typically 5% or more |

| Debt-to-Income Ratio (DTI) | Generally higher tolerance (often up to 43%) | Usually lower tolerance (often below 43%, sometimes stricter) |

| Mortgage Insurance | Required | May be required depending on down payment |

Using Student Loan Debt in FHA Loan Calculations

Understanding how your student loan debt impacts your FHA loan application is crucial. Lenders assess your debt-to-income ratio (DTI) to determine your ability to repay a mortgage. Student loan payments, like other recurring debts, are a significant factor in this calculation.

Student Loan Debt and Debt-to-Income Ratio

The FHA uses your DTI to evaluate your risk as a borrower. Your DTI is calculated by dividing your total monthly debt payments (including student loans, credit cards, car payments, etc.) by your gross monthly income. A lower DTI generally indicates a lower risk to the lender, increasing your chances of approval. Student loan payments are included in the numerator (total monthly debt payments) of this calculation. For example, if your total monthly debt payments are $2,000 and your gross monthly income is $6,000, your DTI is 33.33%. FHA guidelines typically prefer a DTI below 43%, although exceptions may be made depending on the overall financial profile of the borrower.

Impact of Different Repayment Plans

The type of student loan repayment plan you’re on significantly influences your DTI. Standard repayment plans typically have higher monthly payments compared to income-driven repayment (IDR) plans. IDRs adjust your monthly payment based on your income, resulting in lower payments, but potentially extending the loan term and accumulating more interest over time. When calculating your DTI, lenders will use the actual monthly payment amount shown on your loan statement. Using an IDR plan might lower your DTI, making you a more attractive candidate for an FHA loan. However, the lender will consider the total loan amount and the longer repayment period when assessing the risk.

Strategies for Managing Student Loan Debt to Improve FHA Loan Eligibility

Several strategies can help improve your FHA loan eligibility by reducing your DTI:

- Consolidate your loans: Consolidating multiple student loans into one loan can simplify payments and potentially lower your monthly payment amount, thus reducing your DTI.

- Refinance your loans: Refinancing your student loans might lead to a lower interest rate, resulting in smaller monthly payments. However, be aware that refinancing might affect your loan term.

- Increase your income: A higher income will lower your DTI, making it easier to qualify for an FHA loan. Consider seeking a promotion, taking on additional work, or improving your skills to increase your earning potential.

- Reduce other debts: Paying down other debts, such as credit cards or car loans, can significantly reduce your total monthly debt payments and improve your DTI.

Debt-to-Income Ratio Calculation Flowchart

This flowchart illustrates the process of calculating the DTI for an FHA loan application, including student loan debt:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Gather Financial Information” which would branch to boxes for “Gross Monthly Income,” “Student Loan Monthly Payment,” “Other Monthly Debt Payments.” These would all converge into a box labeled “Calculate Total Monthly Debt Payments.” This would then connect to a box labeled “Calculate Debt-to-Income Ratio (Total Monthly Debt Payments / Gross Monthly Income).” Finally, this would lead to a box labeled “Analyze DTI and Proceed with FHA Loan Application.” Arrows would connect all the boxes indicating the flow of the calculation.]

FHA Loan Options for Student Loan Consolidation

Consolidating multiple student loans before applying for an FHA loan can significantly impact your eligibility. This process involves combining several student loans into a single, new loan with potentially more favorable terms. Understanding the implications of consolidation within the context of an FHA loan application is crucial for prospective homebuyers.

The possibility of using an FHA loan after student loan consolidation is entirely dependent on the borrower’s overall financial picture post-consolidation. The FHA focuses on the borrower’s debt-to-income ratio (DTI), credit score, and overall financial stability. Consolidation can positively or negatively affect these factors, influencing the likelihood of FHA loan approval.

Advantages and Disadvantages of Consolidating Student Loans Before Applying for an FHA Loan

Consolidating student loans prior to applying for an FHA loan presents both benefits and drawbacks. A well-executed consolidation can simplify repayment, potentially lower monthly payments, and improve your credit score, all of which can boost your FHA loan application. Conversely, poorly planned consolidation could lead to a higher overall interest rate, extending the repayment period and ultimately increasing the total cost. It’s crucial to weigh these factors carefully.

Scenarios Where Consolidating Student Loans Improves FHA Loan Eligibility

Several scenarios highlight how consolidating student loans can improve FHA loan eligibility. For instance, a borrower with multiple high-interest student loans might find that consolidation into a single, lower-interest loan significantly reduces their monthly debt payments. This reduction in monthly payments directly improves their DTI, making them a more attractive candidate for an FHA loan. Another scenario involves a borrower with a history of late payments on multiple student loans. Consolidation can streamline payments and improve their payment history, positively impacting their credit score and increasing their chances of FHA loan approval.

Comparison of Different Student Loan Consolidation Options and Their Impact on FHA Loan Applications

Choosing the right consolidation option is vital. Different options have varying impacts on your FHA loan application. Consider the following:

| Consolidation Option | Interest Rate | Repayment Term | Impact on FHA Loan Application |

|---|---|---|---|

| Federal Direct Consolidation Loan | Weighted average of existing loans (potentially lower) | Variable, up to 30 years | Can improve DTI if interest rate is lower; simplifies repayment history |

| Private Student Loan Consolidation | Variable, often higher than federal options | Variable, typically shorter than federal options | May not improve DTI; could negatively impact application if interest rate is significantly higher |

| Income-Driven Repayment Plans (IDRs) | Not a consolidation itself, but alters payment amount | Variable, potentially extended | Can improve affordability and DTI in the short-term, but potentially increases total interest paid over the life of the loan |

| No Consolidation | Existing loan terms remain unchanged | Existing loan terms remain unchanged | DTI may be negatively impacted if multiple high-interest loans are present |

Impact of Student Loan Forgiveness Programs on FHA Loans

Student loan forgiveness programs, such as the Public Service Loan Forgiveness (PSLF) program and Income-Driven Repayment (IDR) plans, can significantly impact an individual’s ability to secure and maintain an FHA loan. The complexities arise from how these programs affect a borrower’s debt-to-income ratio (DTI) and overall financial picture, both at the time of application and throughout the loan’s lifespan. Understanding these implications is crucial for both borrowers and lenders.

The primary way student loan forgiveness programs affect FHA loan applications is through their influence on the borrower’s DTI. Lenders use DTI to assess a borrower’s ability to repay the loan. A lower DTI generally increases the likelihood of loan approval. While student loan forgiveness programs ultimately reduce debt, the process is gradual. During the application process, the lender will consider the full amount of the student loan debt, not the potentially forgiven portion. This can temporarily lower the applicant’s chances of approval or necessitate a larger down payment to compensate for a higher DTI. However, once forgiveness is granted, the borrower’s DTI will improve, potentially leading to better financial health.

Effect of Student Loan Forgiveness on Long-Term FHA Loan Affordability

The long-term affordability of an FHA loan is directly impacted by the timing and amount of student loan forgiveness. For example, a borrower might initially struggle with monthly payments due to high student loan debt and mortgage payments. However, after receiving forgiveness, their monthly expenses decrease substantially, making the FHA loan more manageable. Conversely, if forgiveness is delayed or partial, the borrower may continue to face financial strain. The improved financial situation post-forgiveness can also allow for easier refinancing or other financial maneuvers, strengthening the long-term affordability of the FHA loan. A successful PSLF program participant, for instance, might find themselves in a significantly improved financial position after 10 years of qualifying payments, enhancing their ability to manage their FHA mortgage.

Challenges and Opportunities in Combining FHA Loans and Student Loan Forgiveness

Using an FHA loan while participating in student loan forgiveness programs presents both challenges and opportunities. A significant challenge lies in the uncertainty surrounding the forgiveness timeline. Lenders prefer predictability, and the fluctuating nature of student loan debt can make it difficult to assess a borrower’s long-term financial stability. Opportunities arise from the potential for improved credit scores and lower DTI post-forgiveness. This could open doors to better interest rates or refinancing options in the future. Furthermore, the reduction in monthly expenses following forgiveness could allow borrowers to allocate more funds towards additional savings or investments.

Key Considerations for Borrowers in Student Loan Forgiveness Programs Applying for FHA Loans

Understanding the nuances of combining FHA loans and student loan forgiveness programs is crucial. It’s essential to consider the following:

- Current DTI: Calculate your DTI, including your full student loan debt, before applying for an FHA loan. A lower DTI significantly increases your chances of approval.

- Forgiveness Timeline: Understand the projected timeline for your student loan forgiveness. This will help you demonstrate long-term financial stability to lenders.

- Documentation: Gather all necessary documentation related to your student loan forgiveness program, including payment history and program participation verification.

- Financial Planning: Develop a robust financial plan that accounts for both your FHA loan payments and your student loan payments, considering the potential impact of forgiveness.

- Lender Communication: Be transparent with your lender about your participation in a student loan forgiveness program and provide all relevant documentation.

Finding FHA-Approved Lenders for Student Loan Borrowers

Securing an FHA loan with student loan debt can seem daunting, but finding the right lender significantly impacts your chances of approval and the terms you receive. Choosing wisely involves understanding lender characteristics, comparing services, and asking the right questions. This section guides you through the process of identifying and selecting an FHA-approved lender best suited to your needs as a student loan borrower.

Characteristics of FHA-Approved Lenders Specializing in Student Loan Borrowers

Understanding the specific characteristics of lenders who are experienced with student loan borrowers is crucial. These lenders often have streamlined processes and a deeper understanding of the complexities involved in assessing borrowers’ financial situations, including student loan debt. Look for lenders with demonstrable experience in handling student loan debt as part of the loan application process, a reputation for clear communication and responsive customer service, and a transparent fee structure. Lenders who actively market their services to student loan borrowers are more likely to be knowledgeable and efficient in handling such cases.

Comparison of Services Offered by Different Lender Types

Banks, credit unions, and online lenders all offer FHA loans, but their services and approaches differ. Banks typically offer a wide range of financial products but might have more stringent lending criteria. Credit unions, often member-owned, may offer more personalized service and potentially more competitive rates, but their loan products might be more limited. Online lenders provide convenience and potentially faster processing times, but may lack the personal touch of traditional lenders. Each type of lender has its strengths and weaknesses; the best choice depends on individual preferences and circumstances. For example, a borrower prioritizing a personal relationship might favor a credit union, while someone seeking speed and efficiency might prefer an online lender.

Comparing Interest Rates and Fees from Different FHA Lenders

Directly comparing interest rates and fees is vital for securing the best possible loan terms. Interest rates are often expressed as an Annual Percentage Rate (APR), which includes the interest rate plus any other fees. To effectively compare, gather quotes from multiple lenders, ensuring you’re comparing apples to apples – using the same loan amount, term length, and other relevant factors. Pay close attention to closing costs, origination fees, and any other charges that might add to the overall cost of the loan. A lower APR doesn’t automatically mean a better deal; consider the total cost of the loan over its lifetime. For example, a lender with a slightly higher APR but lower fees could end up being more cost-effective in the long run.

Checklist of Questions to Ask Potential FHA Lenders

Before committing to a lender, prepare a list of specific questions to ensure they meet your needs and understand your financial situation. Ask about their experience working with borrowers who have student loan debt, their process for evaluating student loan repayment plans, the specific fees and closing costs associated with the loan, and their customer service responsiveness. Inquire about their loan processing timeframes and their willingness to explain the details of the loan agreement clearly and concisely. Understanding their approach to underwriting student loan debt and their flexibility in accommodating various repayment plans is crucial for a smooth and successful loan application. Finally, ask about any available programs or initiatives specifically designed to support student loan borrowers.

Illustrative Examples of Student Loan and FHA Loan Scenarios

Understanding how student loan debt impacts FHA loan eligibility requires examining real-world scenarios. These examples illustrate both successful qualification and instances where high debt prevents approval, along with a comparison of FHA and conventional loan costs.

Successful FHA Loan Qualification with Student Loan Debt

This scenario depicts a recent graduate, Sarah, successfully securing an FHA loan. Sarah earns an annual salary of $60,000, with a stable job history of two years. Her total monthly student loan payments are $700. She has a credit score of 720 and a down payment of 3.5% for a $250,000 home. Her other monthly debt payments (car loan, credit cards) total $300. The FHA loan application considers her debt-to-income ratio (DTI), which is calculated as total monthly debt divided by gross monthly income. In Sarah’s case, her total monthly debt is $1000 ($700 student loans + $300 other debt), and her gross monthly income is $5000 ($60,000 annual salary / 12 months). Her DTI is 20%, well below the typical FHA limit of 43%. The lender approves her FHA loan application, considering her stable income, manageable debt, and good credit score, demonstrating that responsible management of student loan debt can facilitate homeownership.

FHA Loan Denial Due to High Student Loan Debt

Conversely, consider David, another recent graduate. David earns $45,000 annually, with a credit score of 680. However, he has significant student loan debt resulting in monthly payments of $1200. He also has $400 in other monthly debt payments. Aiming for a $200,000 home, he needs a $7,000 down payment. His total monthly debt is $1600, and his gross monthly income is $3750. His DTI is approximately 43%, nearing the maximum FHA limit, potentially pushing him above the threshold for approval in many cases. Furthermore, his lower credit score could also contribute to a denial. Lenders might deny his application due to a high DTI and credit score, making it difficult to secure an FHA loan. Alternative solutions for David could include exploring loan consolidation to lower monthly payments, improving his credit score, or saving for a larger down payment to reduce the loan amount needed. He could also consider renting for a period to reduce his debt and improve his financial standing before applying again.

Comparison of FHA and Conventional Loan Costs for Student Borrowers

The following table illustrates the potential differences in monthly payments and overall costs between an FHA loan and a conventional loan for a student borrower with similar financial circumstances to Sarah and David. Note that these are illustrative examples and actual costs will vary depending on individual circumstances, interest rates, and loan terms.

| Loan Type | Loan Amount | Interest Rate | Monthly Payment (Principal & Interest) |

|---|---|---|---|

| FHA Loan (Sarah’s scenario) | $250,000 | 4.5% (example) | $1300 (approx.) |

| Conventional Loan (Sarah’s scenario, assuming eligibility) | $250,000 | 4.0% (example) | $1200 (approx.) |

| FHA Loan (David’s scenario, assuming approval) | $200,000 | 5.0% (example) | $1100 (approx.) |

| Conventional Loan (David’s scenario, assuming approval) | $200,000 | 4.5% (example) | $1000 (approx.) |

Last Recap

Securing an FHA loan with student loan debt requires careful planning and a thorough understanding of the guidelines. By strategically managing your debt, understanding the impact of different repayment plans, and choosing the right lender, you can significantly increase your chances of approval. This guide has provided a roadmap for navigating this process, equipping you with the knowledge and tools to confidently pursue homeownership. Remember to consult with a financial advisor and lender for personalized guidance tailored to your specific circumstances.

FAQ Insights

What if I’m still in school and don’t have a steady income?

FHA loans typically require a stable income history. However, you might be able to qualify if you have co-borrowers with sufficient income or can demonstrate future income potential.

Can I use an FHA loan to refinance my student loans?

No, FHA loans are primarily for purchasing or refinancing a home, not for consolidating student loans directly. However, consolidating your student loans *before* applying for an FHA loan might improve your debt-to-income ratio.

How long does the FHA loan approval process take?

The timeframe varies, but generally expect it to take several weeks to a few months, depending on factors such as your credit score, debt-to-income ratio, and the lender’s processing time.

What is the difference between an FHA loan and a conventional loan for students?

FHA loans typically require lower credit scores and down payments than conventional loans, making them more accessible to students. However, they usually involve mortgage insurance premiums.