Securing funding for a certificate program is a crucial step towards career advancement. This guide navigates the complexities of student loans specifically designed for certificate programs, offering insights into eligibility, application processes, repayment options, and potential return on investment. We’ll explore various program types, loan amounts, and the crucial decisions involved in financing your educational journey.

Understanding the financial landscape of certificate programs is key to making informed choices. This guide aims to empower prospective students with the knowledge necessary to confidently pursue their chosen field, while effectively managing the associated financial responsibilities. We will cover various funding options beyond just student loans, ensuring a holistic view of financing your education.

Loan Application Process and Requirements

Securing funding for your certificate program is a crucial step. Understanding the loan application process and the necessary requirements will help ensure a smooth and efficient application. This section Artikels the steps involved in applying for a student loan, specifically focusing on federal student aid options and the documentation needed for approval.

The process of applying for a student loan for a certificate program generally involves several key steps, from completing the FAFSA to submitting supporting documentation. Careful attention to detail at each stage is essential to maximize your chances of approval.

Completing the Free Application for Federal Student Aid (FAFSA)

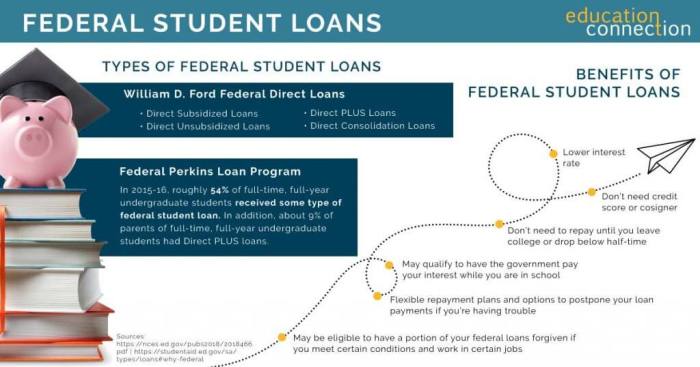

The FAFSA is the primary application for federal student aid, including loans. Completing it accurately and thoroughly is paramount. This application collects information about your financial situation to determine your eligibility for federal aid.

The FAFSA process is typically completed online through the official website. It requires detailed information about you, your parents (if you are a dependent student), and your income and assets. The information provided is used to calculate your Expected Family Contribution (EFC), which influences your eligibility for federal student aid.

- Step 1: Gather Necessary Information: Collect your Social Security number, federal tax returns (yours and your parents’), W-2s, and other relevant financial documents. This information will be required to accurately complete the application.

- Step 2: Create an FSA ID: You and your parents (if applicable) will need an FSA ID to access and sign the FAFSA. This is a username and password combination that provides secure access to your FAFSA information.

- Step 3: Complete the Application: Carefully and accurately complete all sections of the FAFSA online. Double-check all entries to ensure accuracy. Inaccurate information can delay or prevent approval.

- Step 4: Sign and Submit: Once completed, review the application thoroughly and then electronically sign it. Submit the completed FAFSA to the appropriate federal agency.

- Step 5: Track Your Application: After submission, monitor the status of your application online. You can usually check your FAFSA status and see when your information has been processed.

Required Documentation for Loan Approval

Beyond the FAFSA, several other documents may be required to finalize your student loan application. These documents verify your identity, enrollment, and financial information. Failure to provide the necessary documentation can delay or prevent loan approval.

The specific documentation requirements may vary depending on the lender and the type of loan. However, common requirements include:

- Proof of Enrollment: This typically includes an acceptance letter from your certificate program or a copy of your enrollment schedule.

- Transcript(s): Some lenders may request your academic transcripts to verify your academic standing and progress.

- Government-Issued Photo ID: A valid driver’s license or passport is usually required to verify your identity.

- Tax Information: Your tax returns and W-2 forms may be needed to verify your income and financial status. This helps determine your eligibility for federal aid.

- Bank Statements: In some cases, lenders may request bank statements to assess your financial stability.

Repayment Options and Strategies

Successfully completing your certificate program is a significant achievement, but understanding your student loan repayment options is equally crucial. Choosing the right repayment plan can significantly impact your finances and long-term financial well-being. This section Artikels various repayment plans and strategies to help you navigate this important phase.

Available Repayment Plans

Several repayment plans are available to help borrowers manage their student loan debt. The best plan for you will depend on your individual financial circumstances and income. Understanding the nuances of each plan is essential to making an informed decision.

- Standard Repayment Plan: This is the most basic plan, typically requiring fixed monthly payments over 10 years. It offers the shortest repayment period but results in higher monthly payments.

- Extended Repayment Plan: This plan extends the repayment period, lowering monthly payments but increasing the total interest paid over the life of the loan.

- Graduated Repayment Plan: Payments start low and gradually increase over time, making them more manageable initially but potentially higher later on.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payments on your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans typically offer lower monthly payments, but they may extend your repayment period significantly, leading to higher overall interest costs.

Advantages and Disadvantages of Repayment Plans

Each repayment plan has its own set of advantages and disadvantages. Carefully weigh these factors before making a decision.

| Repayment Plan | Advantages | Disadvantages |

|---|---|---|

| Standard | Shortest repayment period, lowest total interest paid | Highest monthly payments |

| Extended | Lower monthly payments | Longer repayment period, higher total interest paid |

| Graduated | Lower initial payments | Payments increase over time, potentially becoming unaffordable later |

| IDR Plans | Lowest monthly payments, potentially affordable based on income | Longest repayment period, highest total interest paid, potential for loan forgiveness after 20-25 years (depending on the plan and eligibility) |

Hypothetical Repayment Schedules

Let’s consider a $10,000 loan with two different repayment plans to illustrate the differences. These are simplified examples and do not account for potential changes in interest rates or other factors.

Scenario 1: Standard Repayment Plan (10-year term, 5% interest)

Using a loan calculator (many are available online), a $10,000 loan at 5% interest over 10 years would result in approximate monthly payments of $106.07. The total interest paid over the life of the loan would be approximately $2,728.40.

Scenario 2: Income-Driven Repayment Plan (20-year term, 5% interest, hypothetical income-based payment of $50/month)

With an IDR plan and a hypothetical $50 monthly payment, the repayment period would extend to approximately 20 years. The total interest paid would likely be significantly higher than the standard plan, potentially exceeding $6,000, due to the longer repayment period.

Calculating Monthly Payments

The formula for calculating monthly payments on a loan is complex, but online loan calculators simplify the process. These calculators typically require the loan amount, interest rate, and loan term (in years or months) as input.

The basic formula involves several factors: Principal (loan amount), interest rate (annual rate divided by 12), and the number of months in the loan term. The exact formula is beyond the scope of this brief overview, but readily available online calculators provide accurate results.

For example, changing the interest rate in Scenario 1 from 5% to 7% would increase the monthly payment. Similarly, extending the loan term in Scenario 1 from 10 years to 15 years would decrease the monthly payment but increase the total interest paid.

Potential Career Paths and Return on Investment

Choosing a certificate program is a significant investment of time and money. Understanding the potential career paths and the return on that investment is crucial for making an informed decision. This section will explore high-demand certificate programs, compare average graduate salaries, and analyze the potential return on investment (ROI) for specific examples.

Many certificate programs offer a direct route to in-demand jobs, providing a quicker and more affordable alternative to a four-year degree. The speed and focus of these programs allow students to gain specialized skills and enter the workforce relatively quickly, potentially leading to a faster return on their investment.

High-Demand Certificate Programs and Job Placement

Several certificate programs consistently show strong job placement rates. Examples include those in healthcare (e.g., medical assisting, phlebotomy), information technology (e.g., cybersecurity, network administration), and skilled trades (e.g., welding, HVAC). The specific demand varies by geographic location and economic conditions, but these fields generally offer a good balance of job availability and competitive salaries. Strong job placement is often facilitated through partnerships between educational institutions and employers, internships, and robust career services departments.

Salary Comparisons Across Certificate Programs

Average salaries for certificate program graduates vary significantly depending on the field, geographic location, and the specific skills acquired. For instance, graduates with certificates in specialized areas of IT, such as cybersecurity, often command higher salaries than those with certificates in less specialized fields. Similarly, healthcare certificate programs like surgical technology may offer higher earning potential than others. Data from the Bureau of Labor Statistics and other reputable sources can provide insights into average salaries for specific occupations. It’s important to note that these are averages, and individual salaries can vary widely based on experience, employer, and location.

Return on Investment (ROI) Analysis for Specific Certificate Programs

Calculating the ROI of a certificate program involves comparing the total cost (tuition, fees, materials) with the potential increase in earnings over a specific period. This calculation can be complex, as it requires estimating future earnings, which can be uncertain. However, a simplified approach can be useful for comparison. For example, consider a certificate program costing $10,000 with an average graduate salary of $50,000. If the graduate can pay off the loan within two years, the ROI is significant. However, a longer loan repayment period reduces the overall ROI.

ROI Projections for Three Certificate Programs

| Certificate Program | Projected Annual Salary | Total Program Cost | Estimated Loan Repayment Time (Years) |

|---|---|---|---|

| Medical Assisting | $38,000 | $8,000 | 1-2 |

| Network Administration | $60,000 | $12,000 | 2-3 |

| Welding | $45,000 | $6,000 | 1-2 |

Understanding Interest Rates and Fees

Securing a student loan to fund your certificate program requires a clear understanding of the associated costs. This section will detail the factors influencing interest rates and the various fees you might encounter, enabling you to make informed financial decisions.

Interest rates determine the cost of borrowing. A higher interest rate means you’ll pay more over the life of the loan. Understanding how these rates are set is crucial for budgeting and long-term financial planning.

Factors Influencing Student Loan Interest Rates

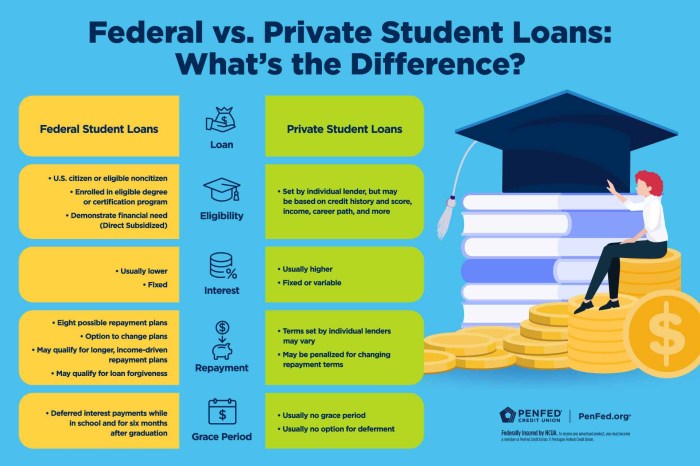

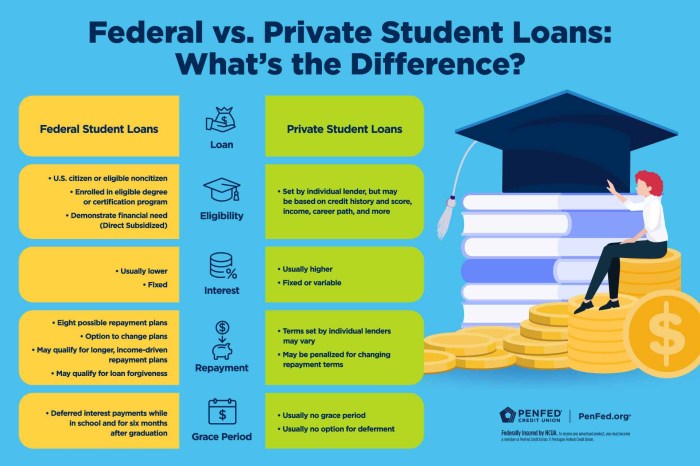

Several factors contribute to the interest rate you’ll receive on your student loan. These include your credit history (if applicable), the type of loan (federal or private), the loan’s repayment term, and the current economic climate. A strong credit history generally leads to lower rates, while longer repayment terms may result in higher rates due to increased risk for the lender. Similarly, prevailing interest rates in the broader financial market directly impact the rates offered on student loans.

Examples of Interest Rates and Their Impact

Let’s consider two scenarios. Scenario A: A student receives a federal student loan with a 5% fixed interest rate on a $10,000 loan over 10 years. Scenario B: The same student receives a private loan with a 7% fixed interest rate for the same amount and term. The difference in interest rates, seemingly small, significantly impacts the total repayment amount. In Scenario A, the total interest paid would be considerably less than in Scenario B, resulting in a lower overall cost of borrowing. Precise figures would depend on the amortization schedule, but the principle of higher interest rates leading to greater overall costs remains consistent.

Student Loan Fees

Understanding the various fees associated with student loans is equally important. These fees add to the overall cost of borrowing and should be factored into your budget.

- Origination Fees: These are one-time fees charged by the lender when the loan is disbursed. They are typically a percentage of the loan amount and can vary depending on the lender and loan type. For example, a 1% origination fee on a $10,000 loan would be $100.

- Late Payment Fees: These are penalties for missing loan payments. The amount varies depending on the lender, but it can significantly impact your overall cost if payments are consistently late. Late fees could range from $25 to $50 or more per missed payment.

- Prepayment Penalties: While less common with federal student loans, some private lenders may charge a penalty if you pay off your loan early. This penalty usually reduces as the loan approaches maturity.

- Default Fees: If you default on your loan (fail to make payments for an extended period), you will incur significant fees and potentially damage your credit score. These fees can be substantial, and collection agencies may pursue aggressive recovery measures.

Alternatives to Student Loans

Securing funding for a certificate program doesn’t always necessitate student loans. Several alternative financing options exist, each with its own set of advantages and disadvantages. Carefully considering these alternatives can significantly impact your overall financial burden and long-term well-being. This section explores viable options and strategies for securing funding without relying solely on loans.

Scholarships and Grants

Scholarships and grants represent non-repayable financial aid awarded based on merit, need, or specific criteria. Unlike loans, they don’t require repayment, making them highly desirable funding sources. Many organizations offer scholarships specifically for vocational training and certificate programs. These can be offered by professional associations, industry-specific foundations, community colleges, or even individual companies. A diligent search often yields substantial results.

Employer Tuition Reimbursement

Many employers offer tuition reimbursement programs as a benefit to their employees. These programs often cover a portion or all of the tuition costs for courses relevant to the employee’s current role or future career development within the company. Eligibility criteria vary widely, depending on factors such as length of employment, job performance, and the relevance of the course to the company’s needs. This is a particularly attractive option as it directly reduces the financial burden and can even enhance career prospects within the existing employment.

Strategies for Finding Scholarships and Grants

Finding suitable scholarships and grants requires proactive research and a strategic approach. Begin by exploring resources such as Fastweb, Scholarships.com, and the Peterson’s scholarship search engine. These websites allow you to filter searches based on criteria such as field of study, academic level, and demographic factors. Additionally, directly contacting professional associations related to your chosen certificate program can often uncover less widely publicized scholarship opportunities. Networking with your college’s financial aid office and career services department can also prove beneficial.

Comparison of Funding Options

| Funding Option | Eligibility Requirements | Application Process | Funding Amount |

|---|---|---|---|

| Scholarships (Example: Association of [Industry] Professionals Scholarship) | Membership in the association, academic standing, essay submission | Online application, essay submission, letter of recommendation | Varies, often $500-$5,000+ |

| Grants (Example: Pell Grant) | Demonstrated financial need, enrollment in an eligible program, US citizenship | FAFSA application | Varies, based on need and program costs |

| Employer Tuition Reimbursement (Example: Acme Corporation Tuition Assistance) | Employment at Acme Corporation for at least one year, job performance review, program relevance | Internal application, approval by supervisor and HR | Varies, can cover partial or full tuition |

Managing Student Loan Debt

Graduating with a certificate and student loan debt can feel daunting, but with a proactive approach, you can effectively manage your repayment and build a strong financial future. Understanding your loan terms, creating a realistic budget, and consistently prioritizing your payments are crucial steps towards successful debt management. This section Artikels strategies to navigate this process and avoid potential pitfalls.

Effective strategies for managing student loan debt hinge on proactive planning and consistent effort. Ignoring the debt won’t make it disappear; instead, it will likely grow and lead to serious financial consequences. Taking control of your finances early on is key to minimizing stress and maximizing your long-term financial well-being.

Budgeting and Financial Planning

Creating a detailed budget is fundamental to successful student loan repayment. This involves tracking your income and expenses to identify areas where you can save and allocate funds towards your loan payments. Consider using budgeting apps or spreadsheets to monitor your spending habits and ensure you stay within your financial limits. A realistic budget should account for essential expenses like rent, utilities, food, and transportation, as well as discretionary spending. Allocate a specific amount each month towards your student loan payments, treating it as a non-negotiable expense. Regularly reviewing and adjusting your budget as your financial circumstances change is essential for maintaining control of your finances. For example, if you receive a raise, you might allocate a larger portion towards your loan payments to accelerate repayment.

Avoiding Loan Default and Maintaining a Good Credit Score

Loan default occurs when you fail to make your loan payments for an extended period. This has severe consequences, including damage to your credit score, wage garnishment, and potential legal action. To avoid default, prioritize your loan payments, explore options for repayment plans if you encounter financial difficulties, and communicate proactively with your loan servicer if you anticipate any challenges. Maintaining a good credit score is vital for securing future loans, renting an apartment, and even getting a job in some fields. Regularly checking your credit report and addressing any errors can help you maintain a healthy credit score. Paying your bills on time, keeping your credit utilization low, and diversifying your credit accounts are key strategies for building and preserving a good credit score.

Consequences of Loan Default

The consequences of loan default are significant and far-reaching. A defaulted loan severely damages your credit score, making it difficult to obtain credit in the future. This can affect your ability to secure a mortgage, car loan, or even a credit card. Wage garnishment, where a portion of your earnings is automatically deducted to pay off your debt, is another potential consequence. This can significantly impact your monthly income and financial stability. Furthermore, loan default can lead to legal action, such as lawsuits and judgments, which can further complicate your financial situation. For instance, a defaulted student loan can result in a significant reduction in your credit score, making it harder to qualify for a mortgage and potentially costing you thousands of dollars in interest over the life of the loan.

Final Summary

Ultimately, financing a certificate program through student loans or alternative methods requires careful consideration of individual circumstances and long-term financial goals. By weighing the potential return on investment against the costs of borrowing and exploring diverse funding options, individuals can make well-informed decisions that align with their career aspirations and financial well-being. Remember to thoroughly research all options and seek professional financial advice when needed.

FAQ Guide

What if I don’t complete my certificate program?

Loan repayment terms vary depending on the lender and program, but you’ll generally still be responsible for the loan amount, even if you don’t finish the program. Contact your lender to discuss options.

Can I use a student loan for a certificate program at a private institution?

Yes, many private institutions are eligible for federal and private student loans. Eligibility depends on the institution’s accreditation and the program’s nature.

Are there any grants or scholarships specifically for certificate programs?

Yes, many scholarships and grants exist for vocational and certificate programs. Check with your institution’s financial aid office and online scholarship databases.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do. This impacts the overall loan cost.