Securing suitable housing during your studies can be a significant hurdle, often complicated by financial constraints. This guide delves into the intricacies of student loans specifically designed for housing, offering a practical roadmap for navigating the process. We’ll explore eligibility criteria, loan types, budgeting strategies, and potential risks, empowering you to make informed decisions about your housing finances.

From understanding the various types of loans available – federal versus private – to mastering budgeting techniques and exploring alternative housing options, we aim to provide a comprehensive resource that addresses the unique challenges students face when securing housing.

Eligibility Criteria for Student Housing Loans

Securing a student housing loan can significantly ease the financial burden of finding suitable accommodation during your studies. Understanding the eligibility criteria is crucial for a successful application. This section details the typical requirements you’ll encounter when applying for such loans.

Income Requirements for Student Housing Loan Applicants

Lenders typically assess the applicant’s income, or the income of their co-signer, to determine their ability to repay the loan. This assessment considers factors beyond just the gross annual income. For example, lenders may scrutinize the applicant’s debt-to-income ratio (DTI), which compares monthly debt payments to monthly gross income. A lower DTI generally indicates a greater capacity for repayment. Specific income thresholds vary significantly between lenders, but generally, a consistent and demonstrable income stream is required, often verified through pay stubs or tax returns. Some lenders may also consider part-time income or parental support in assessing income sufficiency.

Credit Score Thresholds and Impact on Loan Approval

A good credit score is often a critical factor in loan approval. Lenders use credit scores to gauge the applicant’s creditworthiness and risk of default. While the specific credit score thresholds differ across lenders, a higher score generally translates to more favorable loan terms, including lower interest rates. Applicants with lower credit scores may still qualify, but they may face higher interest rates or stricter loan conditions. Building and maintaining a strong credit history is, therefore, highly beneficial for securing favorable student housing loan terms. For example, a credit score above 700 might be considered excellent, potentially leading to lower interest rates and easier approval, whereas a score below 600 might be seen as high-risk, potentially resulting in rejection or higher interest rates.

Required Documentation for Applying for a Student Housing Loan

The application process requires providing comprehensive documentation to verify your identity, income, and creditworthiness. This typically includes:

- Proof of identity (e.g., passport, driver’s license)

- Proof of enrollment (e.g., acceptance letter, student ID)

- Income verification (e.g., pay stubs, tax returns, bank statements)

- Credit report

- Details of the proposed housing (e.g., lease agreement, rental application)

The specific documents required may vary depending on the lender and the applicant’s individual circumstances. It is advisable to contact the lender directly to clarify the specific requirements.

Comparison of Eligibility Criteria Across Different Lending Institutions

Eligibility criteria for student housing loans can vary significantly among different lending institutions. Some lenders may be more lenient with credit score requirements or income thresholds than others. Some may offer specialized programs catering to specific student populations. Comparing offers from multiple lenders is essential to secure the most favorable terms. For instance, one lender might prioritize a low DTI ratio while another might focus more on the applicant’s credit history and length of employment. It is strongly recommended to shop around and compare offers before committing to a loan.

Summary of Eligibility Requirements

| Requirement | Description | Impact on Approval | Where to Find Information |

|---|---|---|---|

| Income | Sufficient and verifiable income, often assessed through pay stubs, tax returns, or bank statements. Debt-to-income ratio is also considered. | Essential for demonstrating repayment ability. Insufficient income may lead to rejection. | Lender’s website, application materials |

| Credit Score | A numerical representation of creditworthiness. Higher scores generally indicate lower risk. | Significantly impacts interest rates and approval chances. Low scores may result in higher rates or rejection. | Credit report from a credit bureau (e.g., Equifax, Experian, TransUnion) |

| Documentation | Proof of identity, enrollment, income, credit history, and housing details. | Essential for verifying the information provided in the application. Incomplete documentation may delay or prevent approval. | Lender’s website, application materials |

| Enrollment Status | Proof of current or accepted enrollment in an eligible educational institution. | Necessary to confirm eligibility for the student housing loan. Lack of proof of enrollment leads to immediate rejection. | Acceptance letter, student ID, transcript |

Types of Student Housing Loans

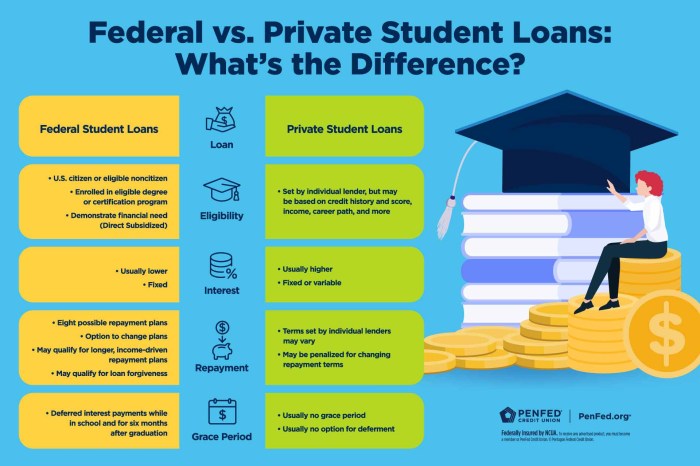

Securing funding for student housing can be a significant step in the higher education journey. Understanding the different loan options available is crucial for making an informed decision that aligns with your financial situation and repayment capabilities. This section will Artikel the key distinctions between federal and private student housing loans, highlighting their advantages, disadvantages, interest rates, and repayment terms.

Federal Student Housing Loans

Federal student loans are offered by the government and typically come with more favorable terms than private loans. These loans often have lower interest rates, flexible repayment plans, and various borrower protections. However, eligibility is determined by factors such as financial need and enrollment status.

Advantages and Disadvantages of Federal Student Housing Loans

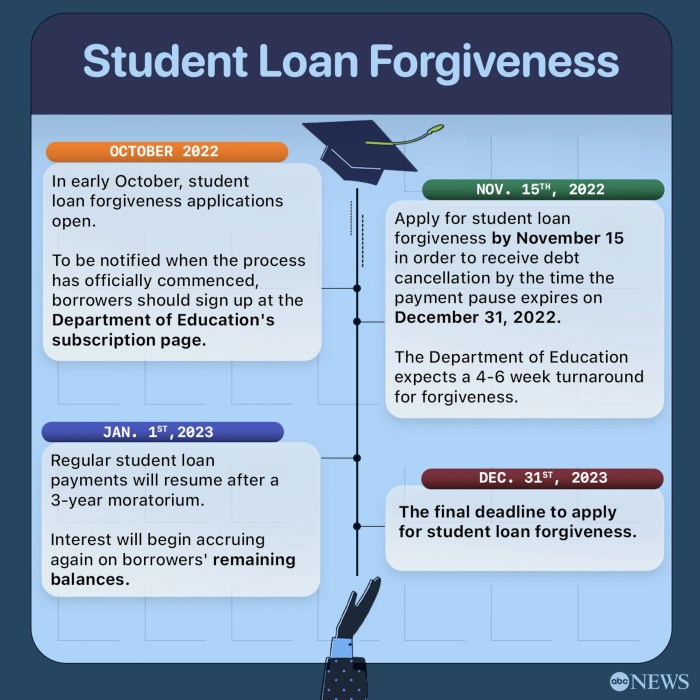

Federal student loans generally offer several advantages. They often have lower interest rates compared to private loans, making them more affordable in the long run. Furthermore, they usually provide more flexible repayment options, including income-driven repayment plans that adjust payments based on your income and family size. Deferred interest periods might be available, meaning you don’t have to start making payments while still in school. Finally, robust borrower protections exist, such as loan forgiveness programs under certain circumstances.

However, the application process can be somewhat complex and may require completing the Free Application for Federal Student Aid (FAFSA). The amount you can borrow is often capped, meaning you might need to explore private loans to cover the remaining housing costs. Lastly, federal loans are subject to changes in government policies and regulations.

Private Student Housing Loans

Private student loans are offered by banks, credit unions, and other financial institutions. They are not subject to the same regulations as federal loans and therefore offer more varied terms and conditions. Eligibility is generally based on creditworthiness and income, meaning students with poor credit history or limited income might face higher interest rates or loan denial.

Advantages and Disadvantages of Private Student Housing Loans

Private student loans can be more readily available than federal loans, particularly for students who don’t qualify for federal aid. They may offer larger loan amounts than federal loans, potentially covering all housing expenses. The application process is typically simpler and faster than the federal loan process.

However, private loans usually carry higher interest rates than federal loans, leading to higher overall borrowing costs. Repayment terms might be less flexible, and borrower protections are often limited compared to federal loans. The interest rates are often variable, meaning they can fluctuate over the life of the loan, potentially increasing your monthly payments.

Interest Rates and Repayment Terms Comparison

A direct comparison of interest rates and repayment terms is difficult without specifying the exact loan programs and individual creditworthiness. However, a general comparison illustrates the typical differences.

| Loan Type | Interest Rate (Example) | Repayment Period (Example) | Eligibility Requirements |

|---|---|---|---|

| Federal Subsidized Loan | 3-5% (Variable, dependent on market conditions) | 10-20 years | US Citizenship, enrollment in eligible program, demonstrated financial need |

| Federal Unsubsidized Loan | 4-6% (Variable, dependent on market conditions) | 10-20 years | US Citizenship, enrollment in eligible program |

| Private Student Loan | 6-12% (Variable, dependent on credit score and market conditions) | 5-15 years | Creditworthiness, income verification, co-signer may be required |

Affordability and Budgeting for Student Housing Loans

Securing student housing often necessitates a loan, making careful budgeting crucial for successful repayment. Understanding the true cost of borrowing and developing effective financial strategies are essential to avoid overwhelming debt and maintain financial stability throughout your studies and beyond. This section will guide you through creating a realistic budget, exploring debt minimization techniques, and utilizing available resources.

Sample Student Housing Budget

Creating a comprehensive budget is the cornerstone of responsible financial management. This involves carefully tracking income and expenses to ensure loan repayments and living costs are manageable. The following example demonstrates a possible budget for a student, but remember to tailor it to your specific circumstances.

| Income | Amount |

|---|---|

| Part-time Job Earnings | $500 |

| Parental Support | $200 |

| Scholarship/Grant | $300 |

| Total Monthly Income | $1000 |

| Expenses | Amount |

|---|---|

| Student Housing Loan Payment | $250 |

| Rent | $400 |

| Utilities (Electricity, Water, Internet) | $100 |

| Groceries | $150 |

| Transportation | $50 |

| Books and Supplies | $50 |

| Personal Expenses | $100 |

| Total Monthly Expenses | $1100 |

This budget shows a slight shortfall, highlighting the need for careful expense management or potential adjustments to income sources. Students should regularly review and adjust their budgets to reflect changing circumstances.

Strategies for Minimizing Student Housing Loan Debt

Several strategies can significantly reduce the overall debt burden associated with student housing loans. Prioritizing these methods can lead to substantial long-term savings.

- Explore Loan Repayment Options: Investigate different repayment plans offered by lenders, such as income-driven repayment or extended repayment periods. These options can lower monthly payments, although they may increase the total interest paid over time. Carefully weigh the pros and cons of each option.

- Increase Income: Seeking additional income sources through part-time jobs, freelance work, or internships can help accelerate loan repayment. Even small increases in income can make a substantial difference over time.

- Reduce Expenses: Careful budgeting and identifying areas where expenses can be reduced (e.g., cooking at home more often, utilizing cheaper transportation options) can free up funds for loan repayment.

- Seek Refinancing Opportunities: Once your credit score improves, consider refinancing your student loan at a lower interest rate. This can potentially save a significant amount of money over the life of the loan. However, thoroughly research refinancing options before committing.

Budgeting Tools and Resources

Numerous budgeting tools and resources are available to assist students in managing their finances effectively. Utilizing these resources can significantly improve financial literacy and aid in responsible debt management.

- Spreadsheet Software: Programs like Microsoft Excel or Google Sheets allow for the creation of customized budgets, tracking income and expenses, and forecasting future financial needs.

- Budgeting Apps: Many mobile apps (e.g., Mint, YNAB, Personal Capital) offer features such as automated expense tracking, budgeting tools, and financial goal setting.

- University Financial Aid Offices: University financial aid offices often provide budgeting workshops, financial counseling, and access to resources that can help students manage their finances.

- Online Financial Literacy Resources: Numerous websites and online resources (e.g., the Consumer Financial Protection Bureau, the National Foundation for Credit Counseling) offer valuable information and tools related to budgeting, debt management, and financial planning.

Calculating Total Cost of a Student Housing Loan

The total cost of a student housing loan encompasses the principal amount borrowed plus the accumulated interest over the repayment period. This calculation is crucial for understanding the true cost of borrowing.

The total cost = Principal amount + (Principal amount x Interest rate x Loan term)

For example, a $10,000 loan with a 5% annual interest rate over a 5-year repayment period would have a total cost of approximately $12,763. This calculation, however, is a simplification. Amortization schedules provide a more precise calculation, showing the breakdown of principal and interest payments over time. Many online loan calculators can help with these calculations.

The Application Process for Student Housing Loans

Securing a student housing loan involves several key steps. Understanding this process will help you navigate it efficiently and increase your chances of approval. Careful preparation and attention to detail are crucial throughout the application.

The application process typically involves submitting a comprehensive application form along with supporting documentation. Lenders will carefully review your financial situation, credit history (if applicable), and the details of your housing needs to assess your eligibility. The entire process can take several weeks, depending on the lender and the volume of applications they are processing.

Application Steps

The following steps Artikel a typical student housing loan application process. While specific requirements may vary between lenders, these steps provide a general framework.

- Pre-qualification: Before formally applying, many lenders offer pre-qualification. This allows you to get an estimate of how much you might be able to borrow without impacting your credit score. This helps you understand your borrowing power and plan your budget accordingly.

- Gather Necessary Documents: This is a crucial step. You will typically need proof of enrollment (acceptance letter or transcript), identification documents (passport or driver’s license), income verification (pay stubs or tax returns, if applicable), and details of the housing you intend to secure (lease agreement or property details).

- Complete the Application Form: Fill out the application form accurately and completely. Inaccurate or incomplete information can delay the process or lead to rejection. Double-check all information before submitting.

- Submit the Application: Submit your completed application form and all supporting documents as required by the lender. You may do this online, via mail, or in person, depending on the lender’s procedures.

- Credit Check and Verification: The lender will conduct a credit check (if applicable) and verify the information you provided. This step is essential to assess your creditworthiness and ensure the accuracy of your application.

- Loan Approval or Denial: Once the lender completes its review, you will receive notification of approval or denial. If approved, you will receive details about the loan terms, interest rates, and repayment schedule.

- Loan Disbursement: After accepting the loan terms, the lender will disburse the funds according to the agreed-upon schedule, often directly to the landlord or property owner.

The Role of Co-signers

A co-signer is an individual who agrees to be jointly responsible for repaying the loan if the primary borrower (the student) fails to do so. Co-signers typically need to have good credit and a stable income. Their inclusion significantly strengthens the loan application, especially for students with limited or no credit history. The lender will assess both the student’s and co-signer’s financial standing before making a decision.

Tips for an Efficient Application Process

To streamline the application process, ensure you organize all your documents in advance. Read the lender’s requirements carefully and address any questions proactively. Maintain open communication with the lender throughout the process. Applying early, especially if the housing requires a deposit, can avoid last-minute stress. Comparing loan offers from multiple lenders can help you secure the most favorable terms.

Potential Risks and Challenges of Student Housing Loans

Securing a student housing loan can significantly ease the financial burden of finding suitable accommodation during your studies. However, it’s crucial to understand the potential risks and challenges involved before committing to such a loan. Failing to do so could lead to unforeseen financial difficulties. Careful planning and understanding of the loan terms are essential to avoid negative consequences.

Student housing loans, while beneficial, present several financial risks. Understanding these risks and implementing appropriate mitigation strategies is vital for responsible borrowing. Defaulting on a loan can have severe repercussions, impacting your credit score and future financial opportunities.

Risks Associated with Student Housing Loans

Taking out a student housing loan involves several potential risks. These include the possibility of accumulating significant debt, facing interest rate fluctuations, and experiencing difficulties in repayment should unforeseen circumstances arise. For example, a sudden loss of income due to illness or unexpected job loss could make repayments challenging. Furthermore, the total cost of the loan, including interest, may exceed initial expectations, especially if the repayment period is extended. Proper budgeting and financial planning are crucial to mitigate these risks.

Strategies for Mitigating Risks

Several strategies can help mitigate the risks associated with student housing loans. Thoroughly researching different loan options and comparing interest rates and repayment terms is crucial. This allows you to choose the most suitable and affordable loan. Creating a realistic budget that accounts for all living expenses, including loan repayments, is also essential. This helps ensure that repayments are manageable throughout the loan term. Additionally, exploring alternative housing options, such as shared accommodation or living at home, can help reduce the overall loan amount needed. Finally, maintaining open communication with the lender and seeking assistance if facing financial difficulties can prevent default.

Consequences of Defaulting on a Student Housing Loan

Defaulting on a student housing loan can have severe and long-lasting consequences. Your credit score will be negatively impacted, making it difficult to secure loans or credit in the future. This can affect your ability to rent an apartment, buy a car, or even obtain a mortgage. The lender may also pursue legal action to recover the outstanding debt, potentially leading to wage garnishment or legal judgments. These actions can have a significant and lasting impact on your financial well-being.

Potential Financial Challenges Associated with Student Housing Loans

Understanding the potential financial challenges is crucial for responsible borrowing. The following points highlight some key areas to consider:

- High interest rates leading to increased overall loan cost.

- Unexpected expenses such as repairs or maintenance costs for the housing.

- Difficulty in managing repayments alongside other financial commitments such as tuition fees and living expenses.

- Potential for loan amounts to exceed initial budgeting estimates due to unforeseen circumstances.

- Impact on credit score and future borrowing capabilities in case of default.

Alternatives to Student Housing Loans

Securing affordable housing is a significant concern for students, and while student loans can seem like a necessary solution, exploring alternatives can lead to significant long-term financial benefits. This section Artikels various housing options that minimize or eliminate the need for loans, comparing their cost-effectiveness and highlighting their respective advantages and disadvantages.

Comparison of Alternative Housing Options

Choosing the right housing option depends heavily on individual circumstances, such as budget, location preferences, and desired level of independence. The following table summarizes key aspects of several alternatives to student loans for housing. Note that costs are estimates and can vary widely based on location and specific circumstances.

| Housing Option | Cost | Pros | Cons |

|---|---|---|---|

| Living with Family/Guardians | Potentially free or significantly reduced cost (depending on arrangements) | Significant cost savings, emotional support, familiar environment. | Limited independence, potential for conflict, may not be geographically convenient for the university. |

| On-Campus Housing (Dormitories) | Varies widely by institution; often includes meal plans. | Convenience, built-in social network, access to campus resources, often included in tuition or financial aid packages. | Can be expensive, limited space, shared living arrangements, less privacy. |

| Shared Housing (with roommates) | Rent is split amongst multiple occupants, significantly reducing individual costs. | Cost-effective, opportunity to build friendships, shared responsibilities. | Potential for roommate conflicts, need to coordinate schedules and living styles, less privacy. |

| Homestays | Varies depending on location and host family; usually includes meals. | Immersive cultural experience, home-cooked meals, potential for language learning, often a supportive environment. | Less privacy than other options, potential for cultural adjustment challenges, may require adherence to host family’s rules. |

| Subletting or renting a room | Rent varies depending on location and size of the room. | More privacy than shared housing, potential for greater flexibility. | May require finding reliable landlords or subletters, responsibility for utilities and maintenance. |

Cost-Effectiveness Considerations

The cost-effectiveness of each option is relative. For instance, living with family is generally the most affordable, while on-campus housing can be surprisingly expensive, sometimes rivaling or exceeding off-campus options. Shared housing offers a good balance between cost and independence, while homestays and subletting provide different levels of privacy and independence at varying costs. Careful budgeting and comparison-shopping are crucial regardless of the chosen option. Factors such as utilities, transportation, and food costs should all be factored into the total cost.

Government Programs and Resources for Student Housing

Securing affordable housing is a significant challenge for many students, but various government programs and resources exist to help alleviate this burden. These initiatives aim to provide financial assistance, housing options, or both, depending on individual circumstances and eligibility. Understanding these programs is crucial for students navigating the complexities of higher education and independent living.

Federal Housing Assistance Programs

Several federal programs offer housing assistance to students who meet specific eligibility requirements. These programs often focus on low-income individuals and families, but some may have provisions for students facing financial hardship. Eligibility is typically determined by factors such as income, family size, and citizenship status. The application process usually involves completing forms and providing documentation to prove eligibility. Benefits may include direct rental subsidies or assistance with down payments on housing. Limitations may include long waitlists, strict income limits, and location restrictions. Examples of such programs may include those administered through the Department of Housing and Urban Development (HUD), though specific programs and their availability vary by location and may change. It’s essential to check the HUD website or contact local housing authorities for the most up-to-date information.

State and Local Housing Assistance Programs

In addition to federal programs, many states and localities offer their own housing assistance programs tailored to the needs of their residents. These programs can vary significantly in their eligibility criteria, benefits, and application processes. Some states may prioritize students or young adults in their allocation of housing assistance. Others may offer programs specifically designed for students attending in-state colleges or universities. To find relevant programs, students should research the housing assistance resources available in their specific state and locality, often through the state’s housing authority or local government websites. Benefits can range from rental assistance vouchers to subsidized housing units. Limitations often include limited funding, competitive application processes, and specific residency requirements.

Campus-Based Housing Resources

Many colleges and universities offer on-campus housing options, often with varying costs and amenities. While not strictly government programs, these resources play a vital role in providing housing for students. Eligibility typically depends on factors such as enrollment status, academic standing, and sometimes lottery systems. Benefits include convenience, built-in community, and often access to campus resources. Limitations can include limited availability, higher costs compared to off-campus housing, and restrictions on who can live on campus (e.g., first-year students only). It’s crucial for students to investigate the housing options provided by their institution early in their academic planning.

Scholarships and Grants for Housing

While not direct housing assistance, some scholarships and grants specifically target students facing housing insecurity. These awards can provide financial aid that can be used towards rent, utilities, or other housing-related expenses. Eligibility requirements vary widely depending on the specific scholarship or grant, but often include academic merit, financial need, or involvement in specific programs. Students should research scholarships and grants offered by their university, private organizations, and government agencies. The application processes typically involve submitting applications and supporting documentation, which can include essays, transcripts, and financial statements. Benefits include direct financial assistance, which can alleviate some of the financial burden of housing costs. Limitations include limited availability and highly competitive application processes.

Summary

Successfully navigating the world of student housing loans requires careful planning and a thorough understanding of the available options. By carefully weighing the advantages and disadvantages of different loan types, creating a realistic budget, and understanding the potential risks involved, students can secure safe and affordable housing while minimizing long-term financial burdens. Remember to explore all available resources and seek professional advice when needed.

Clarifying Questions

What happens if I can’t repay my student housing loan?

Defaulting on a student loan can have severe consequences, including damage to your credit score, wage garnishment, and potential legal action. Contact your lender immediately if you anticipate difficulties making payments to explore options like repayment plans or deferment.

Can I use a student housing loan for utilities and other expenses?

Typically, student housing loans are specifically for the cost of housing, such as rent or mortgage payments. Utilities and other living expenses would need to be covered separately from your budget.

Are there any tax benefits associated with student housing loans?

Tax benefits related to student loans vary depending on your location and specific loan type. Consult a tax professional or refer to relevant government resources for accurate information.