Summer break shouldn’t mean putting your education on hold. Many students find themselves needing financial assistance to cover tuition, living expenses, or even summer internships. Securing a student loan specifically for the summer months can bridge that gap, but understanding the various loan types, application processes, and repayment options is crucial for making an informed decision. This guide navigates the complexities of summer student loans, offering a comprehensive overview to help you make the best choice for your financial needs.

From exploring different loan types and their associated interest rates to understanding the application process and available repayment plans, we’ll cover everything you need to know. We’ll also examine alternative funding sources and provide valuable financial literacy tips to ensure you manage your summer finances effectively. This information will empower you to approach summer funding strategically and responsibly.

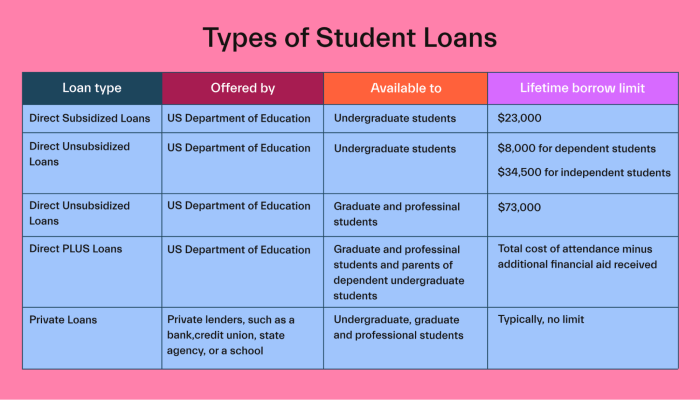

Types of Summer Student Loans

Securing funding for summer studies or related expenses can significantly impact a student’s academic journey. Summer student loans offer a flexible financing option, but understanding the various types available is crucial for making informed decisions. Different loan types cater to diverse needs and financial situations, each with its own set of eligibility requirements, interest rates, and repayment plans.

Federal Student Loans for Summer

Federal student loans, often preferred for their favorable terms, are available during the summer months. These loans are typically disbursed directly to the student’s institution to cover tuition, fees, and other educational expenses. Eligibility is generally based on financial need, demonstrated through the Free Application for Federal Student Aid (FAFSA). The types of federal loans available may include subsidized and unsubsidized Stafford Loans, and potentially PLUS loans for parents. Interest rates are set annually by the government and are generally lower than private loan options. Repayment typically begins six months after graduation or leaving school.

Private Student Loans for Summer

Private student loans, offered by banks and credit unions, provide an alternative funding source for summer expenses. These loans often have higher interest rates compared to federal loans and may require a co-signer, especially for students with limited or no credit history. Eligibility criteria vary significantly among lenders, with credit score, income, and debt-to-income ratio playing a key role. Repayment plans are typically fixed, with varying terms available depending on the lender. It is important to carefully compare interest rates, fees, and repayment options from multiple private lenders before committing to a loan.

Short-Term Loans for Summer Expenses

Short-term loans, such as payday loans or personal loans with shorter repayment periods, are sometimes used to cover immediate summer expenses. However, these options often come with high interest rates and fees, making them a less favorable choice compared to federal or private student loans. Eligibility typically hinges on the applicant’s creditworthiness and ability to repay the loan within the specified timeframe. These loans are generally not recommended for larger educational expenses due to their potentially exorbitant costs.

Comparison of Summer Student Loan Types

Understanding the differences between these loan types is crucial for informed decision-making. The following table summarizes key characteristics:

| Loan Type | Interest Rate | Repayment Period | Eligibility Requirements |

|---|---|---|---|

| Federal Subsidized/Unsubsidized Stafford Loans | Variable, set annually by the government (generally lower than private loans) | Begins six months after graduation or leaving school | Financial need (demonstrated through FAFSA), enrollment in eligible program |

| Federal PLUS Loans | Variable, set annually by the government | Begins within 60 days of disbursement | Credit check, enrollment in eligible program (parent or graduate student) |

| Private Student Loans | Variable, set by the lender (generally higher than federal loans) | Varies depending on the lender | Credit history, income, debt-to-income ratio, co-signer may be required |

| Short-Term Loans (Payday Loans, etc.) | Very high, often with significant fees | Short-term, typically a few weeks to a few months | Creditworthiness, ability to repay within the short timeframe |

Accessing Summer Student Loans

Securing funding for your summer studies requires navigating the application process for student loans. This process can vary depending on the lender and the specific loan program, but understanding the general steps and required documentation will streamline the process significantly. This section Artikels a typical application process and highlights key considerations.

The Application Process for Summer Student Loans

The application process for summer student loans generally follows a similar pattern across various programs. While specific requirements may differ, the core steps remain consistent. Careful attention to detail and timely submission of all required documents are crucial for a smooth application process.

- Pre-application Research: Before beginning the formal application, research available loan options. Consider interest rates, repayment terms, and eligibility criteria. Compare offers from different lenders to find the most suitable option for your financial needs and academic goals.

- Complete the Application Form: Most lenders provide online application forms. Accurately fill out all sections, providing complete and truthful information. Any inaccuracies can lead to delays or rejection of your application.

- Gather Required Documentation: Prepare all necessary supporting documents. This typically includes proof of enrollment (acceptance letter or current transcript), financial aid award letter (if applicable), and personal identification. Some lenders may also request tax returns or proof of income.

- Submit the Application and Documentation: Submit your completed application form and all supporting documentation electronically or via mail, as instructed by the lender. Keep copies of all submitted materials for your records.

- Loan Processing and Approval: The lender will review your application and supporting documents. This process may take several weeks. You will be notified of the lender’s decision via email or mail.

- Loan Disbursement: Upon approval, the loan funds will be disbursed according to the lender’s schedule. This is usually directly deposited into your bank account.

Required Documentation for Summer Student Loan Applications

Lenders require various documents to verify your identity, enrollment, and financial need. Providing accurate and complete documentation is crucial for a timely application process. Failure to submit required documents can result in delays or rejection of your application.

- Proof of Enrollment: This typically includes an acceptance letter from your educational institution or a current transcript showing your enrollment status for the summer term.

- Financial Aid Award Letter (if applicable): If you’ve received any financial aid, such as grants or scholarships, submit your award letter to demonstrate your financial need.

- Personal Identification: Provide a valid government-issued ID, such as a driver’s license or passport.

- Tax Returns (sometimes required): Some lenders may request copies of your tax returns to verify your income and financial situation.

- Proof of Income (sometimes required): Depending on the lender and loan type, you may need to provide proof of income, such as pay stubs or W-2 forms.

Examples of Required Documentation

To illustrate, consider a scenario where a student is applying for a summer student loan. They would need to provide a copy of their summer course schedule from their university, their acceptance letter, a copy of their driver’s license, and possibly their most recent tax return depending on the lender’s requirements. Another example could be a student applying for a private loan, where the lender might require additional documentation such as bank statements or proof of employment.

Summer Loan Amounts and Repayment

Securing a summer student loan involves understanding the factors that determine the loan amount and the various repayment options available. This section will detail these aspects, providing clarity on how loan amounts are calculated and how repayment schedules are structured. We will also explore examples to illustrate the impact of different interest rates and loan amounts on monthly payments.

Factors Influencing Summer Loan Amounts

Several factors influence the amount of a summer student loan a student can receive. These include the student’s credit history (if applicable), their academic standing, the cost of attendance for the summer term, and the availability of other financial aid. Lenders often assess a student’s demonstrated financial need, comparing the cost of tuition, fees, and living expenses to their available resources. A strong academic record can also positively impact loan approval and amount. The specific requirements and considerations will vary among lenders.

Summer Student Loan Repayment Plans

Summer student loans typically offer several repayment plan options. These may include standard repayment plans, which spread payments over a fixed period (e.g., 5-10 years), or income-driven repayment plans, where monthly payments are tied to the borrower’s income. Some lenders may offer graduated repayment plans, starting with smaller payments and gradually increasing them over time. The best repayment plan depends on the individual’s financial situation and long-term goals. It’s crucial to carefully review the terms and conditions of each plan before making a decision.

Calculating Monthly Loan Payments

Calculating monthly loan payments involves using a formula that considers the loan amount, interest rate, and loan term. A common formula used is:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

M = Monthly Payment

P = Principal Loan Amount

i = Monthly Interest Rate (Annual Interest Rate / 12)

n = Number of Months (Loan Term in Years * 12)

This formula can be complex to calculate manually. Many online loan calculators are readily available to simplify this process. Using these calculators allows for easy comparison of different loan amounts and interest rates and their effect on monthly payments.

Examples of Loan Amounts, Interest Rates, and Monthly Payments

The following table illustrates the impact of different loan amounts and interest rates on monthly payments, assuming a 5-year repayment term. Remember, these are examples and actual payments may vary depending on the lender and specific loan terms.

| Loan Amount | Annual Interest Rate | Monthly Interest Rate | Monthly Payment (approx.) |

|---|---|---|---|

| $2,000 | 5% | 0.00417 | $37.74 |

| $3,000 | 7% | 0.00583 | $58.31 |

| $4,000 | 6% | 0.005 | $76.39 |

| $5,000 | 8% | 0.00667 | $98.64 |

Summer Job Opportunities and Loan Repayment

Securing a summer job is a strategic move for students needing to manage their student loan debt. Summer employment offers the chance to earn money to directly contribute towards loan repayment, reducing the overall loan burden and potentially lowering interest accrued over time. The type of job, hours worked, and personal financial management all play crucial roles in effectively utilizing summer earnings to minimize loan debt.

Common Summer Job Types and Earning Potential

Summer employment options for students are diverse, ranging from entry-level positions to more specialized roles. The earning potential varies significantly based on factors such as location, experience, and the industry. Understanding these differences is essential for making informed decisions about job selection.

- Retail/Food Service: These jobs often offer flexible hours and are readily available, making them a popular choice for students. Hourly wages typically range from minimum wage to slightly above, depending on location and experience. A student working 20 hours a week at $15/hour could earn approximately $600 per week, or $2400 per month.

- Camp Counselor/Tutoring: These roles often require specific skills or certifications but offer higher pay and a more enriching experience. Hourly rates can range from $18-$30 or more, depending on qualifications and location. A camp counselor working a full-time summer position might earn $4000-$6000 or more.

- Internships: Internships can provide valuable work experience and often offer a stipend or hourly wage. While pay might be lower than some other summer jobs, the long-term career benefits can be substantial. Stipend amounts vary widely depending on the company and the student’s role. Some internships might offer a $1000-$2000 stipend for the summer, while others offer paid hourly wages at a rate comparable to entry-level positions.

Budgeting and Financial Management Strategies

Effective budgeting and financial management are critical for successfully using summer earnings to reduce student loan debt. A well-structured plan can ensure that funds are allocated efficiently towards loan repayment while still allowing for essential living expenses and some personal spending.

Creating a detailed budget is the first step. This involves listing all income sources (summer job earnings, financial aid, etc.) and expenses (rent, food, transportation, loan payments, etc.). Tracking spending habits through apps or spreadsheets provides valuable insights into spending patterns and helps identify areas for potential savings. Prioritizing loan repayment by allocating a significant portion of summer earnings towards principal payments can accelerate debt reduction. Setting up automatic loan payments can ensure consistent contributions, regardless of fluctuations in income. Exploring options for loan consolidation or refinancing can potentially reduce interest rates and monthly payments, further improving repayment efficiency.

Resources for Finding Summer Employment Opportunities

Finding suitable summer employment requires a proactive approach. Utilizing various resources increases the chances of securing a job that aligns with one’s skills and financial goals.

- Online Job Boards: Websites like Indeed, LinkedIn, and Monster list numerous summer job openings across various industries and locations.

- University Career Services: Many universities offer career services that provide guidance on job searching, resume writing, and interview skills. They often have dedicated sections for summer employment opportunities specifically for students.

- Networking: Talking to family, friends, and professors can uncover hidden job opportunities that might not be publicly advertised. Networking events and industry-specific conferences can also be beneficial.

- Local Businesses: Directly contacting local businesses, such as restaurants, retail stores, or recreational facilities, can lead to employment opportunities. Many businesses actively seek summer help.

Potential Risks and Benefits of Summer Loans

Taking out a summer student loan can be a helpful tool for managing educational expenses and living costs during the break, but it’s crucial to understand both the advantages and potential drawbacks before making a decision. Careful consideration of your financial situation and repayment capacity is essential to ensure a positive outcome.

Financial Risks Associated with Summer Loans

Summer loans, while convenient, carry inherent risks. High interest rates are a significant concern. Unlike some other loan types, summer loans often come with higher interest rates, meaning the total amount you repay will be considerably more than the initial loan amount. This can lead to a snowball effect, making it difficult to manage repayments, especially if you haven’t secured a summer job with sufficient income to cover the monthly payments. Furthermore, difficulty repaying the loan can negatively impact your credit score, potentially affecting your ability to secure loans or credit in the future, including more significant loans for tuition during the academic year. Unexpected circumstances, such as illness or job loss, can further exacerbate repayment difficulties.

Financial Benefits of Summer Loans

The primary benefit of a summer student loan is its ability to bridge the financial gap during the summer months. This funding can be used to cover essential educational expenses like textbooks, course materials, or technology upgrades. Additionally, it can help alleviate the burden of living costs, such as rent, utilities, and groceries, allowing students to focus on their studies or internships rather than worrying about immediate financial pressures. By utilizing a summer loan, students can potentially participate in enriching experiences, such as internships or summer courses, that may enhance their future career prospects and earning potential, thus offsetting the cost of the loan in the long run.

Long-Term Financial Implications

The long-term financial implications of a summer loan depend heavily on several factors. The interest rate, the loan amount, and the repayment plan all play crucial roles. Comparing this option to other funding sources, such as part-time summer employment or savings, is vital. For instance, if a student can secure a summer job that earns enough to cover their expenses, taking out a loan might be unnecessary and increase their long-term debt. However, if part-time work isn’t sufficient, a summer loan might be a more practical choice, provided the repayment plan is manageable and the interest rate is reasonable. A realistic budget and a clear understanding of the loan terms are crucial for making an informed decision. Failing to repay the loan promptly can result in significant financial repercussions, including penalties and damage to credit history.

Pros and Cons of Summer Student Loans

It’s important to weigh the advantages and disadvantages carefully before deciding whether a summer loan is the right choice.

- Pros: Provides immediate access to funds for essential expenses; allows participation in valuable experiences like internships or summer courses; can alleviate financial stress during the summer months.

- Cons: High interest rates can significantly increase the total cost of the loan; difficulty repaying can negatively impact credit score; requires responsible budgeting and repayment planning.

Alternatives to Summer Student Loans

Securing funding for summer expenses doesn’t always necessitate taking out a student loan. Several viable alternatives exist, each with its own set of advantages and disadvantages. Carefully considering these options can lead to a more financially responsible approach to managing summer costs. Exploring these alternatives can help students avoid accumulating debt and potentially save money in the long run.

Many students successfully finance their summer needs through a combination of part-time employment, scholarships, and grants. The optimal strategy will depend on individual circumstances, including the student’s work availability, academic standing, and the specific expenses they need to cover. This section will examine several key alternatives and their associated benefits and drawbacks.

Part-Time Employment

Summer employment offers a direct and reliable method of earning money to cover summer expenses. Many students find part-time jobs in various sectors, from retail and hospitality to research and administrative roles. The income generated can be used to pay for tuition, housing, books, and other summer-related costs.

Advantages include building work experience, developing valuable skills, and earning money to offset expenses. Disadvantages might include limited availability of suitable positions, potential conflicts with academic commitments, and the time commitment required, which may impact leisure time or other activities.

Scholarships and Grants

Scholarships and grants provide non-repayable financial aid to students. They are often awarded based on academic merit, financial need, or specific criteria set by the awarding organization. Numerous organizations offer scholarships and grants specifically for summer programs or to support students during the summer months.

Examples of organizations offering such funding include the National Merit Scholarship Corporation, the Sallie Mae Foundation, and various privately funded scholarships offered by colleges, universities, and community organizations. These awards can significantly reduce or eliminate the need for a summer loan. The primary advantage is that these funds don’t need to be repaid. However, securing scholarships and grants can be competitive, requiring considerable time and effort in the application process. Eligibility criteria vary widely, and securing funding is not guaranteed.

Table of Alternatives

| Funding Option | Advantages | Disadvantages | Eligibility Criteria |

|---|---|---|---|

| Part-Time Job | Direct income, work experience, skill development | Limited availability, time commitment, potential conflict with studies | Minimum age, availability, relevant skills |

| Scholarships | Non-repayable funding, potential for significant financial assistance | Competitive application process, varying eligibility requirements, not guaranteed | Academic merit, financial need, specific criteria (varies by scholarship) |

| Grants | Non-repayable funding, often based on financial need | Competitive application process, limited availability, specific eligibility requirements | Financial need, specific criteria (varies by grant) |

Financial Literacy for Students

Navigating the financial aspects of summer, especially when dealing with student loans, requires a solid understanding of personal finance. This section will equip you with practical strategies for budgeting, managing credit, and tracking finances to make informed decisions about your summer spending and loan repayment.

Creating a Realistic Summer Budget

A well-structured budget is crucial for managing your summer finances effectively. It helps you allocate funds for essential expenses, avoid overspending, and ensure you have enough to cover loan repayments. Begin by listing all anticipated income sources, including your summer job earnings, any financial aid received, and any savings you may have. Then, meticulously list all your expected expenses, categorizing them into necessities (rent, groceries, utilities) and discretionary spending (entertainment, dining out). Consider using budgeting apps or spreadsheets to track your income and expenses. A simple method is to subtract your total expenses from your total income; a positive result indicates a surplus, while a negative result shows a deficit requiring adjustments to your spending habits. For example, if you expect to earn $3000 over the summer and have estimated expenses of $2500, you have a $500 surplus.

Understanding Credit Scores and Their Impact

Your credit score is a numerical representation of your creditworthiness, significantly influencing your ability to secure loans and obtain favorable interest rates. Lenders use credit scores to assess the risk associated with lending you money. A higher credit score generally translates to lower interest rates and better loan terms. Factors influencing your credit score include payment history, amounts owed, length of credit history, credit mix, and new credit. Building a positive credit history early is beneficial. Even small, responsible credit activities, like paying utility bills on time, can contribute to a healthy credit score. A poor credit score can result in higher interest rates on loans, making repayment more challenging. For instance, a student with a low credit score might face a significantly higher interest rate on a student loan compared to a student with a good credit score.

Tracking Income and Expenses

Regularly monitoring your income and expenses is essential for staying on top of your finances. Utilize budgeting apps, spreadsheets, or even a simple notebook to record all transactions. Categorize your expenses for better analysis. Compare your actual spending against your budgeted amounts to identify areas where you can potentially save money. For example, if you budgeted $200 for groceries but spent $250, you can analyze your spending habits and adjust your grocery list for the following week. This consistent tracking helps you understand your spending patterns and make necessary adjustments to align with your financial goals. Reviewing your finances weekly or bi-weekly can prevent unexpected financial surprises and help you manage your loan repayment effectively.

Resources for Improving Financial Literacy

Numerous resources are available to enhance your financial knowledge. Many universities offer workshops or online courses on personal finance. Government websites, such as the Consumer Financial Protection Bureau (CFPB) website, provide valuable information on credit scores, budgeting, and debt management. Numerous reputable personal finance websites and blogs offer budgeting templates, financial advice, and educational materials. Utilizing these resources will provide you with the tools and knowledge needed to make informed financial decisions throughout your studies and beyond.

Ending Remarks

Navigating the world of summer student loans requires careful planning and a thorough understanding of your options. By weighing the benefits and risks, exploring alternative funding sources, and prioritizing financial literacy, you can make informed decisions that align with your academic and financial goals. Remember, responsible borrowing is key to ensuring a successful and financially sound summer experience. Careful consideration of your needs and a proactive approach to repayment will set you up for success, both academically and financially.

Question Bank

What happens if I can’t repay my summer loan?

Contact your lender immediately. They may offer options like deferment or forbearance to temporarily postpone payments. Failing to communicate can lead to serious consequences, so proactive communication is key.

Can I use a summer loan for things other than tuition?

Depending on the loan type and lender, you may be able to use the funds for living expenses, books, or other educational-related costs. Check your loan agreement for specifics.

What’s the difference between a subsidized and unsubsidized summer loan?

Subsidized loans don’t accrue interest while you’re in school, whereas unsubsidized loans do. Understand the implications of interest accumulation before choosing a loan type.

How does my credit score affect my loan application?

A good credit score improves your chances of approval and can result in a lower interest rate. If you lack a credit history, a co-signer may be necessary.