Summer break shouldn’t mean putting your education on hold. Securing funding for summer courses or internships can be a crucial step towards academic and career success. This guide delves into the intricacies of student loans specifically designed for the summer 2024 semester, offering a comprehensive overview of eligibility, loan amounts, repayment plans, and associated costs. We aim to equip you with the knowledge necessary to make informed decisions about financing your summer learning experience.

Navigating the world of student loans can be daunting, but understanding the key aspects – from eligibility requirements and interest rates to repayment options and potential risks – empowers you to choose the best financial path for your summer studies. This guide breaks down the process step-by-step, offering practical advice and resources to help you manage your finances effectively.

Eligibility Criteria for Summer 2024 Student Loans

Securing a student loan for the summer of 2024 requires meeting specific eligibility criteria, which can vary depending on the lender. Understanding these requirements is crucial for a successful application process. This section details the general eligibility requirements and compares criteria across different loan providers.

General Eligibility Requirements for Summer 2024 Student Loans

Generally, eligibility for summer student loans hinges on factors such as enrollment status, credit history, and financial need. Most lenders require applicants to be enrolled at least half-time in a degree program at an eligible institution. Proof of enrollment, such as an acceptance letter or transcript, is typically needed. Additionally, applicants must demonstrate the ability to repay the loan, which is often assessed through credit history and income verification. Specific requirements regarding minimum credit scores or income levels vary significantly among lenders.

Comparison of Eligibility Criteria Across Different Loan Providers

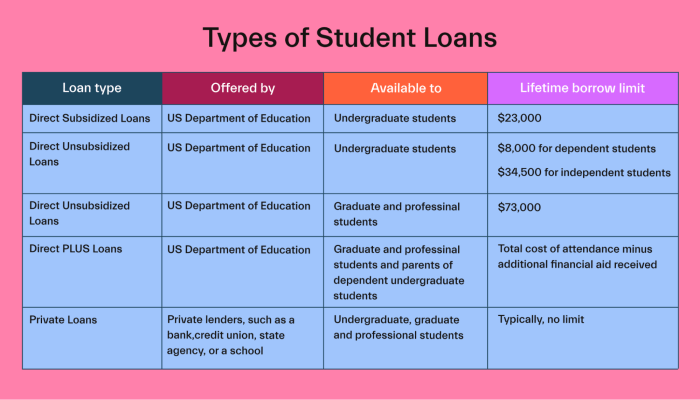

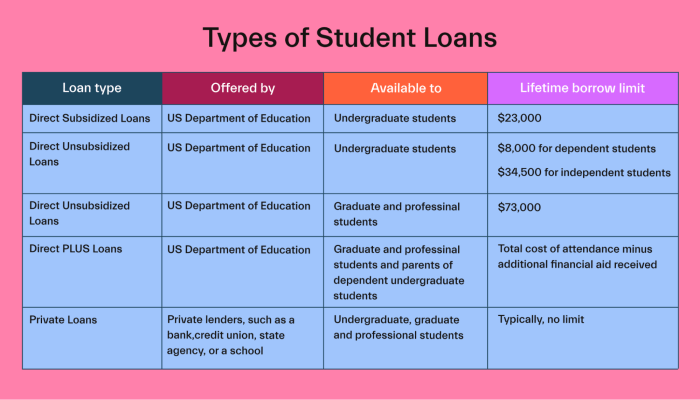

Eligibility criteria differ considerably across various student loan providers. Federal student loan programs, for example, often have less stringent credit requirements compared to private lenders. Federal loans typically prioritize financial need and enrollment status, while private lenders may place more emphasis on credit score, income, and co-signer availability. Some private lenders may offer loans to students with limited or no credit history, but these loans often come with higher interest rates. For instance, Sallie Mae might offer loans to students with lower credit scores than Discover Student Loans, but this may result in a higher interest rate for the Sallie Mae loan. It is crucial to compare offers from multiple lenders to find the most suitable option.

Impact of Credit History on Loan Approval for Summer 2024

A strong credit history significantly increases the likelihood of loan approval and can lead to more favorable loan terms, such as lower interest rates. Lenders use credit reports to assess the applicant’s creditworthiness and repayment ability. A good credit history demonstrates responsible financial behavior, making lenders more confident in the applicant’s ability to repay the loan. Conversely, a poor credit history or lack of credit history can make it difficult to secure a loan or result in higher interest rates and stricter terms. Students with limited or no credit history might need a co-signer with a strong credit history to improve their chances of approval. For example, a student with a credit score below 600 might struggle to secure a loan from a private lender, while a student with a score above 700 might qualify for more favorable terms.

Loan Eligibility Based on Age, Academic Status, and Credit Score

| Factor | Federal Loans | Private Lender A (e.g., Sallie Mae) | Private Lender B (e.g., Discover) |

|---|---|---|---|

| Age | Generally 18+ and enrolled | Generally 18+ and enrolled; may require co-signer under certain age or credit conditions. | Generally 18+ and enrolled; may require co-signer depending on credit history. |

| Academic Status | Enrolled at least half-time in an eligible program | Enrolled at least half-time in an eligible program | Enrolled at least half-time in an eligible program |

| Credit Score | Not a primary factor; financial need is considered | Good credit score (e.g., 670+) generally preferred; may consider lower scores with a co-signer. | Good credit score (e.g., 700+) often required; lower scores may be considered with higher interest rates. |

Loan Amounts and Repayment Plans for Summer 2024

Securing funding for your summer studies in 2024 involves understanding the available loan amounts and the various repayment options. This information is crucial for making informed financial decisions that align with your budget and long-term financial goals. Choosing the right repayment plan can significantly impact the total cost of your loan.

Loan amounts for summer study typically vary depending on several factors, including the lender, the student’s financial need, and the cost of tuition and other related expenses. Generally, summer loans are smaller than those for full academic years, often ranging from a few hundred dollars to several thousand. Specific amounts are determined on a case-by-case basis through the application process. It’s important to contact potential lenders directly to inquire about their specific loan limits for summer study.

Summer Loan Repayment Plan Options

Lenders offer a variety of repayment plans to accommodate different financial situations. The most common types include standard repayment, graduated repayment, extended repayment, and income-driven repayment. Understanding the differences between these plans is critical to selecting the option that best suits your post-graduation financial circumstances.

Standard Repayment Plan

This plan involves fixed monthly payments over a set period, typically 10 years. The payments remain consistent throughout the repayment term, making budgeting easier. However, the monthly payments might be higher than other plans, leading to faster repayment but potentially higher initial financial strain.

- Pros: Predictable monthly payments, faster loan payoff, lower total interest paid.

- Cons: Higher monthly payments, potentially challenging for recent graduates.

Graduated Repayment Plan

With a graduated repayment plan, monthly payments start low and gradually increase over time, usually over a 10-year period. This option can be more manageable initially for recent graduates with potentially lower incomes, but the monthly payments become progressively larger as your income hopefully grows.

- Pros: Lower initial payments, easier budgeting in early repayment years.

- Cons: Higher payments later in the repayment period, potentially higher total interest paid due to the longer repayment period.

Extended Repayment Plan

This plan stretches repayments over a longer period, often 25 years. This results in lower monthly payments, making it easier to manage in the short term. However, the total interest paid will significantly increase due to the extended repayment schedule.

- Pros: Lower monthly payments, easier short-term budgeting.

- Cons: Much higher total interest paid, longer repayment period.

Income-Driven Repayment Plans

Income-driven repayment plans link your monthly payments to your income and family size. Payments are typically recalculated annually, offering flexibility if your income changes. These plans often result in loan forgiveness after a certain number of years, but they usually involve higher total interest payments over the life of the loan. Specific forgiveness terms and eligibility criteria vary depending on the plan type and lender.

- Pros: Affordable monthly payments based on income, potential for loan forgiveness.

- Cons: Higher total interest paid over the life of the loan, longer repayment periods.

Implications of Choosing Different Repayment Plans

The choice of repayment plan significantly impacts the total interest paid. While a standard repayment plan leads to lower total interest due to faster repayment, it demands higher monthly payments. Conversely, extended and income-driven repayment plans offer lower monthly payments but result in significantly higher total interest paid over the loan’s lifetime. For example, a $5,000 loan at 5% interest repaid over 10 years (standard) might accrue $1,000 in interest, while the same loan repaid over 25 years (extended) could accrue $3,000 or more in interest. Careful consideration of your financial situation and long-term goals is essential in making this decision.

Interest Rates and Fees Associated with Summer 2024 Loans

Securing funding for your summer studies requires understanding the financial implications. This section details the interest rates and fees associated with summer 2024 student loans, helping you make informed borrowing decisions. We’ll explore the factors influencing interest rates, common fees, and a comparison of rates across different lenders.

Factors Influencing Interest Rates

Several factors contribute to the interest rate you’ll receive on a summer 2024 student loan. These include your credit history (if applicable, as some lenders may require a credit check for larger loan amounts), your chosen repayment plan, the loan amount, and the lender’s current market conditions. Lenders assess risk; a stronger credit history and a shorter repayment term may lead to a lower interest rate. Conversely, a larger loan amount or a longer repayment period may result in a higher rate, reflecting the increased risk for the lender. Additionally, prevailing interest rates in the broader financial market significantly impact the rates offered by lenders.

Common Fees Associated with Student Loans

Beyond interest, various fees can be associated with student loans. These may include origination fees (a percentage of the loan amount charged by the lender to process your application), late payment fees (penalties for missed or late payments), and potentially early repayment fees (though these are less common). It’s crucial to carefully review the loan agreement to understand all applicable fees before accepting the loan. These fees can add to the overall cost of borrowing, so comparing the total cost of the loan, including fees, is essential when choosing a lender.

Interest Rate and Fee Comparison Across Lenders

The following table compares interest rates and common fees from various hypothetical lenders for summer 2024 student loans. Remember that these are examples and actual rates and fees may vary depending on individual circumstances and lender policies. Always check with the lender directly for the most up-to-date information.

| Lender | Interest Rate (APR) | Origination Fee | Late Payment Fee |

|---|---|---|---|

| Lender A | 7.5% | 1% of loan amount | $25 |

| Lender B | 8.0% | 0% | $30 |

| Lender C | 6.8% | 0.5% of loan amount | $20 |

| Lender D | 9.2% | 1.5% of loan amount | $35 |

Application Process and Required Documentation for Summer 2024 Loans

Applying for a student loan for the summer of 2024 involves a straightforward process, but careful attention to detail is crucial to ensure a smooth and timely application. This section Artikels the necessary steps, required documentation, and typical processing times to help you navigate the application process effectively. Remember to check with your specific lender for any variations in their procedures.

The application process typically involves completing an online application form, gathering required documents, and submitting the completed application package. Processing times vary depending on the lender and the completeness of your application. Providing all necessary documentation upfront will significantly expedite the process.

Steps Involved in the Summer 2024 Student Loan Application Process

The application process is designed to be user-friendly, however, careful attention to detail is vital. Following these steps will ensure a smooth and efficient application.

- Locate and Access the Application Portal: Begin by visiting the website of your chosen lender or the designated student loan portal for your institution. You will typically find a clear link to the student loan application. Look for a section dedicated to summer loans or short-term loans.

- Create an Account or Log In: If you are a returning applicant, log in using your existing credentials. First-time applicants will need to create an account, typically requiring an email address and password. Securely store this information.

- Complete the Online Application Form: The application form will require detailed personal information, including your name, address, social security number, date of birth, and contact information. You will also need to provide details about your educational institution, course of study, and anticipated loan amount. Accuracy is paramount at this stage.

- Gather Required Documentation: Before proceeding, collect all necessary documents. This will streamline the process and prevent delays. (See the section below for a detailed list.)

- Upload Required Documents: Once you have gathered all necessary documents, upload them securely through the online portal. Ensure the documents are clear, legible, and in the required format.

- Review and Submit Your Application: Carefully review your completed application and uploaded documents for accuracy. Once you are satisfied, submit your application electronically. You will typically receive a confirmation number.

- Track Your Application Status: Most lenders provide online tools to track the progress of your application. Regularly check for updates and respond promptly to any requests for additional information.

Required Documentation for Summer 2024 Student Loan Applications

Providing complete and accurate documentation is crucial for a swift loan approval. Missing or incomplete documents can significantly delay the process.

- Completed Loan Application Form: This is the cornerstone of your application, containing all your personal and educational details.

- Proof of Enrollment: This typically involves an official acceptance letter or enrollment confirmation from your educational institution, clearly stating your summer courses and anticipated completion date.

- Government-Issued Photo Identification: A valid driver’s license, passport, or other government-issued photo ID is usually required for verification purposes.

- Social Security Number (SSN): Your SSN is necessary for verification and processing of your loan application.

- Bank Account Information: You will need to provide your bank account details for loan disbursement. This may involve providing account numbers and routing numbers.

- Financial Aid Award Letter (if applicable): If you are receiving financial aid, an award letter from your institution may be required to demonstrate your financial need and aid eligibility.

- Parent’s Tax Information (if applicable): For dependent students, parental tax information may be required as part of the application process. This is typically used to assess financial need.

Typical Processing Time for Summer 2024 Loan Applications

The processing time for student loan applications varies depending on several factors, including the lender, the completeness of your application, and the volume of applications being processed. While some lenders may process applications within a few days, others may take several weeks. For example, a lender with a robust online system and streamlined application process might approve loans within 7-10 business days, whereas a lender processing a high volume of applications manually could take 3-4 weeks or longer. It’s advisable to apply well in advance of your expected need for the funds.

Financial Aid Options Alongside Summer Loans

Securing funding for your summer studies shouldn’t rely solely on loans. Exploring a range of financial aid options can significantly reduce your reliance on borrowed funds and improve your overall financial health. This section details alternative funding sources and provides guidance on effective budget management incorporating various financial aid streams.

Summer loans offer immediate access to funds, but they come with the responsibility of repayment. Other financial aid options, such as grants and scholarships, represent non-repayable funds, making them highly desirable. A balanced approach, combining both loan and non-loan aid, can optimize your summer funding strategy.

Comparison of Summer Loans and Other Financial Aid Options

Summer loans provide readily available funds for tuition, living expenses, and other summer-related costs. However, they accrue interest, increasing the overall cost. Grants and scholarships, on the other hand, are typically awarded based on merit or financial need and do not require repayment. This makes them a significantly more advantageous option. Federal grants, such as Pell Grants, are often need-based, while scholarships can be merit-based, awarded for academic achievement, athletic prowess, or community involvement. The key difference lies in the repayment obligation; loans require repayment with interest, while grants and scholarships do not.

Budgeting with Summer Loans and Other Financial Resources

Creating a comprehensive budget is crucial for managing your summer finances effectively. Start by listing all your expected income sources, including summer loan disbursement, scholarship awards, and any part-time job earnings. Then, itemize all your expenses, categorizing them into essential (tuition, housing, food) and non-essential (entertainment, travel) categories. Subtract your total expenses from your total income. If your expenses exceed your income, you’ll need to re-evaluate your budget, potentially reducing non-essential spending or seeking additional funding sources. For example, if your summer loan covers tuition, you might need to find a part-time job to cover living expenses, or explore additional scholarship opportunities.

Different Financial Aid Options and Their Requirements

| Financial Aid Option | Requirements | Advantages |

|---|---|---|

| Summer Loans (Federal/Private) | Enrollment in eligible programs, credit check (for private loans), FAFSA completion (for federal loans) | Immediate access to funds, flexible repayment options (depending on the lender) |

| Federal Grants (e.g., Pell Grant) | Demonstrated financial need, enrollment in eligible programs, FAFSA completion | No repayment required, funds directly applied to tuition and fees |

| Scholarships (Merit-based/Need-based) | Vary widely depending on the scholarship; may involve academic achievements, extracurricular activities, essays, or financial need documentation | No repayment required, can significantly reduce overall education costs |

| Work-Study Programs | Enrollment in eligible programs, FAFSA completion, meeting eligibility requirements set by the institution | Earn money while studying, helps manage expenses, builds work experience |

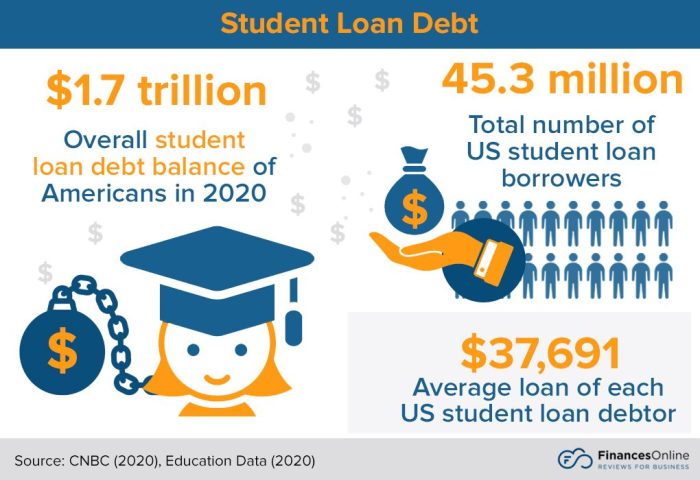

Managing Student Loan Debt After Summer 2024

Successfully navigating student loan repayment requires proactive planning and consistent effort. The summer term often marks a transition point, as students may be entering the workforce or continuing their education. Understanding your repayment options and developing sound financial habits now will significantly impact your long-term financial well-being.

Effective management of student loan debt hinges on a comprehensive understanding of your repayment options and the development of a robust financial plan. This includes budgeting carefully to allocate funds for loan repayment while also covering essential living expenses. Failing to plan effectively can lead to missed payments, accruing interest, and potentially damaging your credit score. A proactive approach, however, can lead to timely repayment and a healthier financial future.

Budgeting and Financial Planning for Loan Repayment

Creating a realistic budget is paramount to successful loan repayment. This involves meticulously tracking income and expenses to identify areas where savings can be maximized. Consider using budgeting apps or spreadsheets to categorize expenses and monitor progress. Allocate a specific amount each month towards loan repayment, treating it as a non-negotiable expense similar to rent or utilities. Regularly review and adjust your budget as needed to account for unexpected expenses or changes in income. For example, a student might allocate 20% of their post-graduation salary to loan repayment, while simultaneously tracking spending on groceries, transportation, and entertainment to ensure they remain within their allocated budget. This proactive approach helps prevent overspending and ensures consistent loan payments.

Examples of Budgeting Techniques

Several budgeting techniques can aid in effective student loan debt management. The 50/30/20 rule is a popular method, allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. Another approach is the zero-based budget, where every dollar is assigned a purpose, ensuring all income is accounted for. Zero-based budgeting helps to visualize spending habits and identify areas for potential savings. For instance, meticulously tracking every expense and then allocating the remaining income towards loan repayment can be a powerful tool for those seeking to accelerate debt reduction. Combining this with the 50/30/20 rule can provide a comprehensive approach to financial management.

Resources for Managing Student Loan Debt

It is crucial to leverage the many resources available to assist in navigating student loan repayment.

- Your Loan Servicer: Your loan servicer is your primary point of contact for all things related to your loans. They can provide information on repayment plans, deferment options, and forbearance programs.

- National Student Loan Data System (NSLDS): This website allows you to access your federal student loan information, including loan balances and repayment schedules.

- Financial Aid Office at Your Institution: Your college or university’s financial aid office often provides counseling and resources to help graduates manage their loans.

- Nonprofit Credit Counseling Agencies: These agencies offer free or low-cost credit counseling and can help you develop a debt management plan.

- Government Websites: Websites like studentaid.gov provide comprehensive information on federal student loan programs and repayment options.

Potential Risks and Considerations for Summer Loans

Taking out a student loan, even for a short summer session, involves financial risks that require careful consideration. Understanding the terms, potential consequences, and long-term impact is crucial to making an informed decision and avoiding future financial hardship. Borrowing responsibly requires a clear understanding of your repayment capabilities and the potential consequences of default.

Understanding Loan Terms and Conditions

Before signing any loan agreement, thoroughly review all terms and conditions. Pay close attention to the interest rate, repayment schedule, fees (originination fees, late payment fees), and any grace periods offered. A seemingly small difference in interest rates can significantly impact the total amount you repay over the life of the loan. For example, a 1% higher interest rate on a $2,000 loan could add hundreds of dollars to your total repayment cost. Understanding the repayment schedule—whether it’s fixed monthly payments or interest-only payments initially—will help you budget effectively and avoid late payments.

Consequences of Defaulting on Student Loans

Defaulting on a student loan has severe consequences. This occurs when you fail to make payments for a specified period (usually 90 days). The consequences can include damaged credit score, wage garnishment (a portion of your wages being seized to repay the loan), tax refund offset (your tax refund being used to repay the loan), and difficulty obtaining future loans or credit. In some cases, the defaulted loan can be sent to collections, leading to further fees and negative impacts on your credit history. This can make it harder to rent an apartment, buy a car, or even secure a job in certain fields.

Long-Term Financial Impact of Poor Loan Management

Imagine a scenario: A student borrows $3,000 for a summer course, expecting to easily repay it with summer employment. However, unexpected expenses arise, and repayments are missed. The illustration would depict two diverging paths. Path A (responsible management) shows steady repayment, leading to a clear financial future, possibly with early debt payoff and positive credit impact. Path B (poor management) shows the accumulation of interest and fees, resulting in a much larger debt burden. This leads to stress, limited financial options (difficulty saving for a down payment on a house, for example), and potentially impacts career choices due to the need to prioritize debt repayment. The illustration could use a simple line graph showing the growing debt in Path B compared to the decreasing debt in Path A, highlighting the significant difference in total repayment amounts over time. The visual would also incorporate icons representing positive (house, car, graduation) and negative (stress, debt collection) outcomes associated with each path, creating a clear contrast of the long-term financial impact of responsible versus irresponsible loan management. This visual representation emphasizes the importance of careful planning and responsible borrowing practices to avoid long-term financial strain.

Summary

Successfully securing funding for your summer 2024 studies can significantly impact your academic journey and future career prospects. By carefully considering eligibility criteria, loan amounts, repayment plans, and associated costs, you can make informed financial decisions that align with your educational goals. Remember to explore all available financial aid options and develop a robust budget to ensure responsible debt management. Planning ahead and understanding the implications of your choices will set you up for success both academically and financially.

FAQ Guide

What if I don’t have a strong credit history?

Many lenders offer student loans to those with limited or no credit history. However, you might qualify for smaller loan amounts or face higher interest rates. Consider a co-signer to improve your chances of approval.

Can I use a summer loan for living expenses?

While the primary purpose is for educational expenses, some lenders may allow a portion of the loan to cover living costs. Check the lender’s specific terms and conditions.

What happens if I can’t repay my loan?

Failure to repay your loan can result in negative impacts on your credit score, potential legal action, and difficulty obtaining future loans. Contact your lender immediately if you anticipate difficulties making payments.

Are there any grants or scholarships available for summer study?

Yes, many institutions and organizations offer grants and scholarships for summer study. Explore your college’s financial aid office and online scholarship databases for potential opportunities.