Navigating the complexities of student loan repayment can feel overwhelming, especially when faced with financial hardship. Understanding the differences between forbearance and deferment is crucial for making informed decisions that protect your credit and long-term financial well-being. This guide provides a clear comparison of these two options, helping you determine which best suits your circumstances.

Both forbearance and deferment offer temporary pauses in student loan payments, but they operate differently regarding interest accrual and their impact on your credit score. Choosing the right path requires careful consideration of your individual financial situation and the potential long-term consequences. This in-depth analysis will equip you with the knowledge to make an educated choice.

Defining Forbearance and Deferment

Understanding the differences between student loan forbearance and deferment is crucial for borrowers navigating repayment challenges. Both offer temporary pauses in payments, but they differ significantly in their impact on interest and eligibility requirements. Choosing the right option can significantly affect the total cost of your loans over time.

Forbearance and Deferment Defined

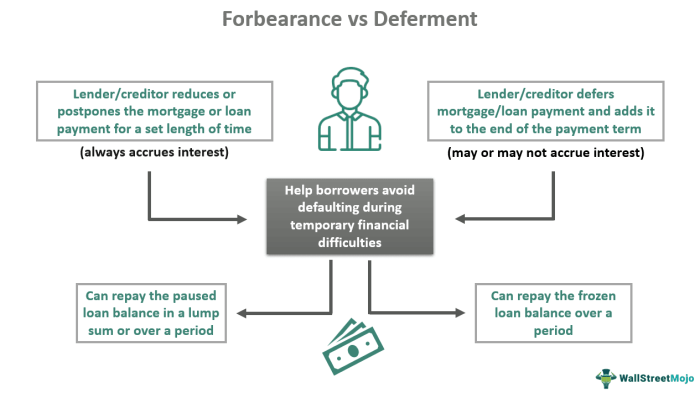

Forbearance and deferment are both temporary pauses in student loan payments, granted by your loan servicer. However, they differ substantially in how interest accrues and the criteria for eligibility. Forbearance is generally granted when a borrower experiences temporary financial hardship, while deferment is typically available for specific circumstances such as returning to school or experiencing unemployment.

Forbearance Eligibility Criteria

Eligibility for forbearance is typically based on demonstrated financial hardship. This could include unexpected job loss, medical emergencies, or other circumstances that prevent timely repayment. The specific requirements vary depending on the lender and the type of loan. Borrowers usually need to contact their loan servicer and provide documentation supporting their claim of hardship. The amount of forbearance granted also varies based on individual circumstances and lender policies.

Deferment Eligibility Criteria

Deferment eligibility is typically tied to specific life events. Common reasons for deferment include returning to school at least half-time, entering military service, or experiencing unemployment. Proof of enrollment in school, military service documentation, or unemployment verification may be required. The type of loan also impacts eligibility for deferment. For example, federal student loans generally offer more deferment options than private loans.

Comparison of Forbearance and Deferment

| Program Type | Interest Accrual | Payment Requirements | Eligibility Requirements | Length of Time Available |

|---|---|---|---|---|

| Forbearance | Usually accrues (except in certain limited circumstances) | Payments are temporarily suspended. | Demonstrated financial hardship. Documentation may be required. | Varies depending on lender and circumstances; often limited to a certain number of months. |

| Deferment | May or may not accrue depending on the loan type and deferment reason. Federal subsidized loans typically do not accrue interest during deferment. | Payments are temporarily suspended. | Specific qualifying life events (e.g., return to school, unemployment, military service). Documentation usually required. | Varies depending on the reason for deferment and loan type; potentially longer than forbearance. |

Interest Accrual and Capitalization

Understanding how interest accrues during forbearance and deferment is crucial for managing your student loan debt effectively. Both options temporarily suspend your required monthly payments, but they handle interest differently, significantly impacting your loan’s overall cost.

Interest accrual during forbearance and deferment operates differently. While you’re not making payments, interest continues to accumulate on your principal loan balance in most cases. The key distinction lies in how this accumulated interest is handled. In some forbearance plans, interest may be added to your principal balance at the end of the forbearance period, a process called capitalization. Deferment plans often have interest accruing, but capitalization may or may not occur, depending on the specific loan type and deferment program.

Interest Accrual During Forbearance and Deferment

During both forbearance and deferment, interest typically continues to accrue on your outstanding loan balance. This means that even though you are not making payments, the amount you owe is steadily increasing. The rate at which interest accrues depends on your loan’s interest rate. For example, a loan with a 7% interest rate will accrue interest at a faster pace than a loan with a 3% interest rate. The longer the forbearance or deferment period, the more interest will accumulate, leading to a larger total debt. The significant difference is how this accrued interest is treated once the forbearance or deferment period ends.

Impact of Interest Capitalization

Interest capitalization occurs when the accumulated interest during a forbearance or deferment period is added to the principal loan balance. This effectively increases the amount of principal on which future interest will accrue. This snowball effect can significantly increase the total amount you owe over the life of the loan. For example, if you have $10,000 in student loan debt with a 5% interest rate and a one-year deferment, the accumulated interest will be added to the principal after the deferment ends, increasing the total loan balance. Subsequent monthly payments will then be applied to a larger principal amount, leading to a longer repayment period and higher overall interest costs.

Hypothetical Scenario: Long-Term Financial Effects of Interest Capitalization

Let’s consider two scenarios to illustrate the impact of interest capitalization:

Scenario 1: Sarah has a $20,000 student loan with a 6% interest rate. She enters a one-year forbearance period where interest accrues and capitalizes. After one year, approximately $1,200 in interest will be added to her principal, increasing her balance to $21,200. This larger principal will result in higher monthly payments and a longer repayment period compared to if the interest had not capitalized.

Scenario 2: John has a similar $20,000 student loan with a 6% interest rate, but he utilizes a deferment plan where interest accrues but does not capitalize. After a one-year deferment, he still owes the original $20,000 principal plus the accumulated interest of approximately $1,200. However, this interest is not added to his principal balance. This means his monthly payments will be higher to cover the accumulated interest, but his principal balance remains unchanged, leading to a shorter repayment period than Sarah’s.

Impacts on Credit Score

Entering a forbearance or deferment plan for your student loans can significantly impact your credit score, although the extent of the impact varies depending on several factors, including your credit history, the length of the forbearance or deferment, and your overall credit management practices. Understanding these potential effects and implementing proactive strategies is crucial for minimizing negative consequences.

Forbearance and deferment are both temporary pauses in your student loan payments, but they’re reported differently to credit bureaus. While neither is ideal for your credit, deferment generally has a less severe impact than forbearance. This is primarily because, while both result in missed payments, deferment is often a pre-approved arrangement and may be viewed more favorably by lenders. Forbearance, on the other hand, is usually granted on a case-by-case basis and may be seen as a sign of greater financial difficulty. The missed payments associated with both, however, will negatively impact your credit score, potentially leading to a lower credit rating and making it harder to obtain loans or credit cards in the future. The longer the forbearance or deferment period, the more significant the negative impact.

Credit Score Impacts of Forbearance and Deferment

During a forbearance or deferment period, your student loan payments are temporarily suspended. This suspension is reported to the credit bureaus as a missed payment, negatively affecting your payment history, a critical component of your credit score. The impact can range from a modest decrease to a more substantial drop, depending on your existing credit profile and the length of the forbearance or deferment. For example, a borrower with a strong credit history might see a smaller drop than someone with a thin credit file or existing credit problems. The length of the forbearance or deferment is directly proportional to the negative impact; a six-month forbearance will likely cause a more significant drop than a one-month deferment. Furthermore, the frequency of forbearance or deferment usage is also considered; repeated instances can signal ongoing financial instability to lenders.

Mitigating Negative Credit Impacts

Several strategies can help minimize the negative effects on your credit score during forbearance or deferment. Maintaining good credit habits in other areas of your finances is crucial. This includes paying all other bills on time, keeping credit utilization low (the amount of credit you use compared to your total available credit), and avoiding opening new credit accounts unless absolutely necessary. Communicating with your loan servicer is also vital. Proactively discussing your financial situation and exploring options for repayment after the forbearance or deferment period can demonstrate responsibility and mitigate potential negative perceptions. Consider exploring options such as income-driven repayment plans if your financial circumstances are challenging, as these can help make your payments more manageable in the long term, preventing future forbearance or deferment needs.

Monitoring Credit Reports

Regularly monitoring your credit reports is essential during and after a forbearance or deferment period. You can obtain your free credit reports annually from AnnualCreditReport.com. Reviewing your reports allows you to verify that the forbearance or deferment is accurately reflected and identify any potential errors. If you discover inaccuracies, you can dispute them with the credit bureaus to ensure your credit score isn’t unfairly impacted. By tracking your credit score throughout the process, you can identify any significant changes and take appropriate action if necessary. This proactive monitoring allows you to address any issues promptly and prepare for the future. After the forbearance or deferment period ends, continued monitoring is important to observe the recovery of your credit score.

Types of Forbearance and Deferment Programs

Navigating the world of student loan repayment can be complex, especially when facing financial hardship. Understanding the different types of forbearance and deferment programs available is crucial for making informed decisions about your repayment strategy. These programs offer temporary pauses or modifications to your loan payments, but it’s important to weigh the potential benefits against any drawbacks.

The specific programs available to you will depend on your lender (federal or private) and your individual circumstances. Federal student loan programs generally offer a wider range of options than private lenders.

Federal Student Loan Forbearance Programs

Federal student loan forbearance is generally granted on a case-by-case basis and may require documentation of financial hardship. The length of forbearance can vary, but it typically lasts for a limited period. Different types of forbearance exist, each with its own criteria and implications. For example, there might be a forbearance for borrowers experiencing unemployment, or one designed for those facing other significant financial difficulties. The specific requirements and approval processes are Artikeld by the Department of Education.

Federal Student Loan Deferment Programs

Federal student loan deferment offers a temporary suspension of payments, often without requiring documentation of hardship, though certain conditions must be met. Several deferment options exist, depending on your circumstances. For instance, in-school deferment is available to students enrolled at least half-time in an eligible degree program, while unemployment deferment may be an option for those who have lost their job. Again, detailed eligibility criteria are available from the Department of Education.

Private Lender Forbearance and Deferment Programs

Private student loan lenders typically offer forbearance and deferment programs, but the terms and conditions can vary significantly from lender to lender. Unlike federal programs, there is no standardized set of options. Private lenders may require more stringent documentation of financial hardship and may impose stricter limits on the length of forbearance or deferment. It is crucial to carefully review the terms of your private student loan agreement and contact your lender directly to understand your available options. These programs often have a more limited scope than federal programs.

Comparison of Federal and Private Programs

The key difference lies in the flexibility and availability of options. Federal programs generally offer a broader range of deferment and forbearance options and may be more lenient in their requirements. Private lenders, on the other hand, tend to have stricter criteria and less flexibility. The potential impact on your credit score is another important consideration. While both types of programs can negatively affect your credit score if payments are missed, the impact might vary depending on the lender and the specific program details.

Examples of Program Application

A borrower facing unemployment might apply for a federal unemployment deferment or forbearance, while a borrower returning to school might utilize a federal in-school deferment. A borrower with a private loan and temporary financial difficulties might contact their lender to explore options for forbearance. The specific situation and the terms of the loan will dictate the most appropriate program. It is essential to actively communicate with your lender to determine the best course of action.

Application Process and Documentation

Applying for student loan forbearance or deferment involves navigating the specific processes of your loan servicer. While the general steps are similar, the required documentation and online portals may vary. It’s crucial to carefully review your loan servicer’s website for the most accurate and up-to-date information.

The application process typically begins with accessing your loan servicer’s website. You will likely need to log in to your account using your username and password. Once logged in, you’ll find a section dedicated to managing your loans, where options for forbearance or deferment will be available. Following the online prompts, you will provide the necessary information and supporting documentation. The servicer will then review your application and notify you of their decision. Keep in mind that processing times can vary.

Forbearance Application Process

The forbearance application process generally involves completing an online form provided by your loan servicer. This form will request details about your current financial situation and the reason for requesting forbearance. You’ll need to select the type of forbearance you’re seeking (e.g., general forbearance, income-driven repayment forbearance). After submitting the form, you may be asked to provide supporting documentation to substantiate your claim.

Deferment Application Process

Similar to forbearance, the deferment application process often begins with an online form through your loan servicer. However, for deferment, you will need to provide documentation proving your eligibility, such as proof of enrollment in school or evidence of unemployment. The servicer will review the application and supporting documents to determine your eligibility for a deferment.

Required Documentation

The specific documents needed will vary depending on the type of forbearance or deferment you’re applying for and your loan servicer’s requirements. However, common documentation includes:

Checklist of Documents

- Completed Forbearance or Deferment Application Form (obtained from your loan servicer’s website).

- Proof of Identity (e.g., driver’s license, passport).

- Social Security Number.

- For Forbearance: Documentation supporting your claim for hardship (e.g., medical bills, proof of job loss, bank statements demonstrating financial difficulty). The specifics will depend on the type of hardship claimed.

- For Deferment: Documentation proving eligibility (e.g., enrollment verification from your school, unemployment verification letter).

- Loan Account Information (loan numbers, etc.).

It’s highly recommended to keep copies of all submitted documents for your records.

Repayment Options After Forbearance or Deferment

Exiting a forbearance or deferment period requires careful consideration of your repayment options. The best choice depends on your financial situation, income, and the total amount of your loan. Understanding the available plans and their implications is crucial for successful repayment and avoiding future financial strain.

Standard Repayment Plan

The standard repayment plan is the most common option. It typically involves fixed monthly payments over a 10-year period. This plan offers predictable payments, but the monthly amount might be higher compared to other options, leading to quicker debt payoff but potentially higher monthly expenses. The advantage is the simplicity and predictable budget. The disadvantage is the higher monthly payments. For example, a $30,000 loan might result in monthly payments around $350, depending on the interest rate.

Extended Repayment Plan

An extended repayment plan stretches the repayment period to up to 25 years. This lowers monthly payments, making them more manageable for borrowers with limited income. However, the extended repayment period results in significantly higher total interest paid over the life of the loan. The advantage is lower monthly payments, easing short-term financial burdens. The disadvantage is significantly higher total interest paid over the loan’s lifetime. A $30,000 loan on this plan could result in monthly payments closer to $150, but the total interest paid could easily exceed $20,000.

Graduated Repayment Plan

The graduated repayment plan starts with lower monthly payments that gradually increase over time. This option is beneficial for borrowers anticipating income growth. The lower initial payments provide relief in the early stages of repayment, but payments increase substantially later on. The advantage is manageable starting payments, easing the initial financial burden. The disadvantage is the substantial increase in payments later, potentially leading to difficulties if income growth doesn’t match the payment increases. The initial payments might be around $100, increasing to over $400 in later years for a $30,000 loan.

Income-Driven Repayment Plans (IDR)

Income-driven repayment plans tie monthly payments to your income and family size. Several IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Driven Repayment (IDR). These plans generally result in lower monthly payments than standard plans, but they often extend the repayment period, leading to higher total interest paid. The advantage is lower monthly payments based on income, making repayment more affordable. The disadvantage is a longer repayment period and potentially significantly higher total interest paid over the life of the loan. The exact payment amount will vary greatly depending on individual income and family size.

Choosing the Right Repayment Plan

Selecting the appropriate repayment plan requires a thorough assessment of your financial circumstances. Consider your current income, anticipated future income, expenses, and your overall financial goals. It’s advisable to use online repayment calculators provided by your loan servicer to compare different plan options and estimate the total cost of each. Seeking guidance from a financial advisor can also provide valuable insights and support in making an informed decision. Careful planning and consideration are crucial for ensuring a successful and manageable repayment strategy after a forbearance or deferment period.

Potential Long-Term Financial Consequences

Choosing between student loan forbearance and deferment may seem like a minor decision in the short term, but the long-term financial implications can be significant. Understanding these differences is crucial for maintaining good financial health and avoiding potentially crippling debt. The primary difference lies in how interest accrues and capitalizes, directly impacting your total loan balance and future repayment obligations.

The most impactful long-term consequence of both forbearance and deferment is the accumulation of interest. While deferment may pause your payments, interest continues to accrue on most federal loans, adding to your principal balance. Forbearance, while offering a temporary reprieve from payments, typically also allows interest to accrue. This compounding interest can drastically increase your total loan amount over time, leading to significantly higher repayment costs and extending the repayment period. This means you’ll end up paying considerably more than your original loan amount. For example, a $30,000 loan with a 5% interest rate could balloon to over $40,000 after several years of forbearance or deferment, depending on the length and interest capitalization policies.

Impact on Future Borrowing Capabilities

The accumulation of unpaid interest and increased loan balance resulting from forbearance or deferment can negatively affect your credit score. A lower credit score makes it more difficult to secure loans in the future, whether for a car, a house, or even a small business. Lenders view borrowers with high debt-to-income ratios and a history of missed or delayed payments (even if those delays were due to forbearance) as higher risk. This translates to higher interest rates on future loans, making borrowing more expensive. Consider a scenario where a borrower has successfully navigated their student loans but then needs a mortgage. A lower credit score from past forbearance could result in a higher interest rate on their mortgage, potentially costing tens of thousands of dollars over the life of the loan.

Responsible Borrowing and Repayment Planning

Proactive planning and responsible borrowing are key to mitigating the long-term financial risks associated with forbearance and deferment. This includes creating a realistic budget that incorporates loan repayment, exploring options for income-driven repayment plans, and actively seeking advice from financial aid counselors or credit counselors. It’s also crucial to understand the terms and conditions of your specific loan program and to communicate openly with your loan servicer. Regularly reviewing your loan status, understanding the interest accrual, and making informed decisions about repayment strategies are essential for long-term financial well-being. Failing to plan adequately can lead to a cycle of debt that is difficult to escape. Prioritizing loan repayment, even with small, consistent payments, can prevent the accumulation of substantial interest and protect your credit score.

Final Conclusion

Ultimately, the decision between student loan forbearance and deferment hinges on a careful assessment of your immediate financial needs and your long-term financial goals. While both offer temporary relief from payments, understanding the nuances of interest accrual, credit score impact, and repayment options is paramount. By thoughtfully weighing the pros and cons of each, you can navigate this challenging period with greater confidence and minimize the potential negative consequences on your financial future.

FAQ Insights

What happens to my loan if I choose forbearance or deferment?

Forbearance temporarily suspends your payments, but interest usually continues to accrue. Deferment temporarily suspends both payments and interest accrual (for eligible federal loans).

Can I switch between forbearance and deferment?

It depends on your loan servicer and the specific circumstances. Some servicers may allow switching, while others may not. Contact your servicer to discuss your options.

How long can I have a forbearance or deferment?

The maximum length varies depending on the program and your loan type. Federal loans often have limits, while private loan terms may differ.

Will forbearance or deferment affect my eligibility for future loans?

Extended periods of forbearance or deferment can negatively impact your credit score, potentially affecting your eligibility for future loans. Lenders view consistent repayment as a positive indicator.