Navigating the complexities of student loan repayment can feel overwhelming, especially understanding the often-misunderstood grace period. This guide provides a clear and concise overview of the student loan grace period in 2024, addressing key changes, potential impacts, and strategies for successful management. We’ll explore both federal and private loan scenarios, equipping you with the knowledge to confidently handle this crucial phase of your loan journey.

Understanding your grace period is paramount to avoiding late payment fees and potential negative impacts on your credit score. This period offers a temporary reprieve before repayment begins, but it’s essential to know the rules and limitations to utilize it effectively. This guide will delve into the specifics of grace periods, offering practical advice and resources to help you plan for a smooth transition into repayment.

Definition and Explanation of Student Loan Grace Period

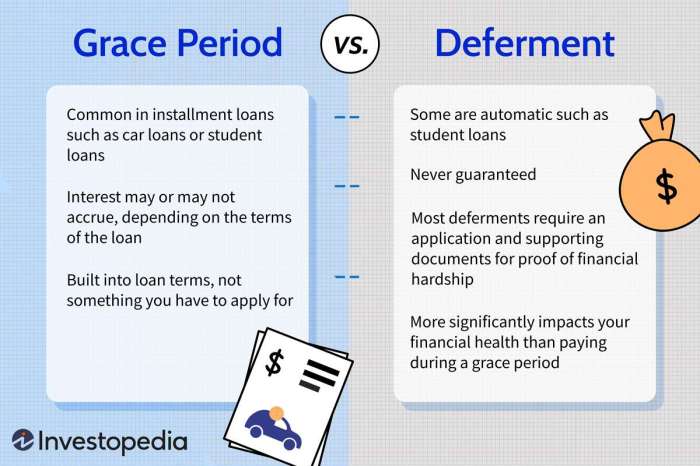

A student loan grace period is a temporary period after you graduate or leave school where you don’t have to make payments on your federal student loans. It’s a brief reprieve designed to give you time to find a job and get your finances in order before you start repaying your loans. Think of it as a short buffer zone before repayment officially begins.

The typical length of a grace period for federal student loans is six months. However, this isn’t a universal rule, and there are instances where this period might be altered. This grace period applies to most federal student loans, including subsidized and unsubsidized Stafford Loans, and PLUS loans. During this time, interest may or may not accrue depending on the loan type; for example, interest accrues on unsubsidized loans during the grace period, while it does not on subsidized loans.

Grace Period Length Variations

Several factors can influence the length of your grace period. For instance, if you’re enrolled at least half-time in a degree program at an eligible institution, your grace period is deferred. This means the clock stops until you are no longer enrolled at least half-time. Conversely, certain circumstances might lead to a shorter grace period, or even the elimination of a grace period altogether. For example, if you default on a loan, you will likely lose your grace period and repayment will begin immediately. Specific circumstances may also require immediate repayment. For example, a borrower enrolled in a program that is determined to be ineligible may have their grace period shortened or removed.

Federal vs. Private Student Loan Grace Periods

A key difference lies in the consistency of grace periods. Federal student loans generally offer a standardized grace period, typically six months. Private student loans, however, have vastly different grace periods. Some private lenders might offer a grace period, while others might not. The length of the grace period, if offered, can vary significantly depending on the lender and the terms of your loan agreement. It’s crucial to review your private loan documents carefully to understand your specific grace period terms. In short, you cannot assume a grace period exists for private loans; always check the loan agreement.

Student Loan Grace Period Changes in 2024

The year 2024 brought significant shifts in the landscape of student loan repayment, particularly concerning grace periods. While the standard grace period remained largely unchanged for many federal student loan borrowers, certain programs and policy adjustments introduced complexities that impacted repayment timelines and borrower responsibilities. Understanding these changes is crucial for effective financial planning.

The most significant change in 2024 regarding student loan grace periods stemmed from the ending of the COVID-19 pandemic-related payment pause. This pause, which significantly extended grace periods and suspended payments for many borrowers, concluded in late 2022 and early 2023. The resumption of regular payments meant a return to standard grace periods for most borrowers, although the transition wasn’t uniform and some borrowers faced challenges adjusting to the reinstated repayment schedules. This transition had a profound impact on borrowers, particularly those who had become accustomed to the extended forbearance.

Impact of Grace Period Changes on Borrowers

The end of the COVID-19 payment pause directly affected millions of borrowers. Many faced the immediate challenge of resuming payments after a period of suspended obligations. For some, this led to financial strain, requiring careful budgeting and potential adjustments to personal finances. Others benefited from the extended grace period offered during the pandemic, allowing them to better prepare for repayment. The overall impact varied significantly depending on individual financial situations and loan types. For example, borrowers with higher loan balances or lower incomes might have experienced a more pronounced impact than those with smaller loans and stable incomes. The abrupt return to standard repayment schedules also highlighted the need for better financial literacy and resources to assist borrowers in navigating the transition.

Reasons for Modifications to the Grace Period

The extension of grace periods during the COVID-19 pandemic was a direct response to the economic hardship experienced by many Americans. The pause was designed to provide temporary relief and prevent a wave of defaults. The subsequent return to standard grace periods reflected the government’s aim to restore the normal functioning of the student loan repayment system. This decision was also influenced by the need to manage the federal budget and ensure the long-term sustainability of the student loan program. While the extended grace periods offered vital support during a crisis, the long-term sustainability of such measures was a key factor in the eventual return to the pre-pandemic norms.

Resources for Updated Information on Grace Periods

Borrowers seeking the most up-to-date information on student loan grace periods should consult the official website of the U.S. Department of Education and the Federal Student Aid website (studentaid.gov). These sites provide comprehensive details on repayment plans, grace periods, and other relevant information. It’s also advisable to contact your loan servicer directly for personalized guidance and to clarify any uncertainties related to your specific loan terms and repayment schedule. Staying informed and proactive is key to navigating the complexities of student loan repayment effectively.

Impact of the Grace Period on Repayment

The grace period following student loan graduation or completion of studies significantly impacts when repayment begins and, consequently, the overall cost of borrowing. Understanding this period’s implications is crucial for effective financial planning and avoiding potential negative consequences. This section details how the grace period affects repayment start dates, the repercussions of missed payments, and the process of applying for extensions (where available).

The grace period postpones the start date of your student loan repayment. This delay provides a buffer period allowing borrowers time to secure employment, establish a budget, and prepare for the financial commitment of loan repayment. The length of the grace period varies depending on the loan type and lender, but it typically ranges from six months to one year. For example, a borrower graduating in May might have a grace period extending to May of the following year, before their first payment is due. However, it’s critical to note that interest may still accrue during this grace period, adding to the total loan amount.

Consequences of Missed Payments During the Grace Period

Failing to make payments during the grace period, even though payments aren’t technically due, has serious consequences. The most immediate impact is the accumulation of additional interest. This unpaid interest is capitalized, meaning it’s added to the principal loan balance. This increases the total amount owed, leading to higher monthly payments and a larger overall repayment burden. Furthermore, late payments during the grace period can negatively impact your credit score, making it harder to secure loans or credit cards in the future. In some cases, lenders may initiate collection actions, potentially leading to wage garnishment or legal action.

Applying for an Extended Grace Period

The possibility of obtaining an extended grace period depends entirely on the lender and the specific circumstances. There isn’t a universal standard for granting extensions. However, borrowers facing significant financial hardship, such as job loss or unexpected medical expenses, may be able to request an extension from their lender. This typically requires providing documentation supporting the hardship claim. The application process will vary by lender, often involving submitting forms and providing supporting financial documentation. It’s essential to contact your loan servicer directly to inquire about the possibility of an extended grace period and understand their specific requirements.

Comparison of Repayment Plans

The following table compares different repayment plans and their impact on borrowers during and after the grace period. These are illustrative examples, and actual amounts will vary depending on loan amount, interest rate, and individual circumstances.

| Plan Name | Monthly Payment (Example) | Total Interest Paid (Example) | Repayment Duration |

|---|---|---|---|

| Standard Repayment | $300 | $10,000 | 10 years |

| Graduated Repayment | $200 (increasing annually) | $12,000 | 10 years |

| Income-Driven Repayment (IDR) | Variable (based on income) | Potentially Higher | 20-25 years |

| Extended Repayment | Lower Monthly Payment | Potentially Higher | Up to 30 years |

Types of Student Loans and Their Grace Periods

Understanding the grace period for your student loans is crucial for managing your finances after graduation. The length of your grace period can significantly impact your repayment schedule and the total amount of interest you’ll pay. Different types of loans have different grace periods, and it’s essential to know the specifics of your loan(s).

The grace period is the time after you graduate or leave school before you’re required to begin making student loan repayments. During this period, interest may still accrue on your loan, depending on the loan type. Let’s explore the grace periods associated with various federal and private student loans.

Federal Student Loan Grace Periods

Federal student loans generally offer a standard grace period, although there are some exceptions depending on the loan type and program. Knowing your specific loan type is key to understanding your grace period.

- Direct Subsidized Loans: These loans typically have a six-month grace period after you leave school. During this grace period, the government pays the interest.

- Direct Unsubsidized Loans: These loans also typically have a six-month grace period after you leave school. However, unlike subsidized loans, interest accrues during the grace period and is added to the principal balance.

- Direct PLUS Loans (Graduate and Parent PLUS Loans): These loans generally have a six-month grace period after you leave school, and interest accrues during this time.

- Federal Perkins Loans: Grace periods for Perkins loans vary, typically ranging from nine months to a year. Interest accrues during the grace period.

Private Student Loan Grace Periods

Private student loans are offered by banks and credit unions, and their grace period policies vary significantly among lenders. Some may offer a grace period, while others may not. It is crucial to check your loan documents.

- Many Private Student Loans: Often have no grace period or a shorter grace period (e.g., 0-6 months). Interest usually accrues during this period, if any.

- Variable Grace Periods: The specific grace period offered is determined by the lender and the terms of the individual loan agreement.

- No Standardized Grace Period: Unlike federal loans, there’s no standard grace period across all private lenders. Review your loan documents carefully.

Comparison of Private Lender Grace Period Policies

Comparing grace period policies between private lenders requires reviewing each lender’s individual loan agreements. There’s no central database that consolidates this information. It’s crucial to contact each lender directly or thoroughly examine the loan documents before signing.

For example, Lender A might offer a three-month grace period, while Lender B might offer none. Lender C might offer a six-month grace period but with a higher interest rate to compensate.

Calculating Interest Accrued During the Grace Period

Calculating the interest accrued during the grace period involves a simple formula. The exact amount depends on the loan’s interest rate and the length of the grace period.

Example: Let’s say you have a $10,000 unsubsidized loan with a 5% annual interest rate. During the six-month grace period, the interest accrued would be calculated as follows:

Monthly Interest Rate = Annual Interest Rate / 12 = 5% / 12 = 0.004167

Interest Accrued in One Month = Loan Balance * Monthly Interest Rate = $10,000 * 0.004167 = $41.67

Total Interest Accrued During Six-Month Grace Period = $41.67 * 6 = $250.02

This is a simplified calculation; actual interest accrued might vary slightly depending on the method used by the lender to calculate daily interest.

Resources and Support for Borrowers

Navigating the complexities of student loan repayment can be challenging, especially during the grace period. Fortunately, numerous resources and support systems are available to help borrowers understand their options and manage their debt effectively. This section Artikels key resources, contact information, and practical steps borrowers can take to ensure a smooth transition into repayment.

Understanding the available support is crucial for borrowers to successfully manage their student loans. This includes knowing where to find reliable information, who to contact for assistance, and what steps to take when facing difficulties. Proactive engagement with these resources can significantly reduce stress and improve financial outcomes.

Government Agencies and Student Loan Servicers

Several government agencies and private student loan servicers provide essential information and assistance to borrowers. The U.S. Department of Education’s Federal Student Aid website (studentaid.gov) is a primary resource, offering comprehensive information on federal student loans, repayment plans, and debt management strategies. Borrowers can find their loan servicer’s contact information through this website. Direct contact with your loan servicer is crucial for addressing specific questions about your loan terms, repayment schedule, and available options. It is vital to note that contact information varies depending on the servicer and the type of loan. Always refer to your official loan documents or the Federal Student Aid website for the most up-to-date contact details.

Steps to Take When Facing Difficulty Managing Student Loans

If you’re struggling to manage your student loan payments, several steps can help you navigate the situation. First, contact your loan servicer immediately to discuss your circumstances. They may offer forbearance, deferment, or income-driven repayment plans to provide temporary relief or adjust your monthly payments to align with your financial capabilities. Explore options like income-driven repayment plans, which base your monthly payment on your income and family size. Consider seeking financial counseling from a reputable non-profit organization. These organizations offer free or low-cost guidance on budgeting, debt management, and financial planning strategies. They can help you create a personalized plan to manage your student loan debt effectively. Finally, thoroughly review all available options and choose the best path for your specific financial situation.

Tips for Successfully Navigating the Grace Period and Preparing for Repayment

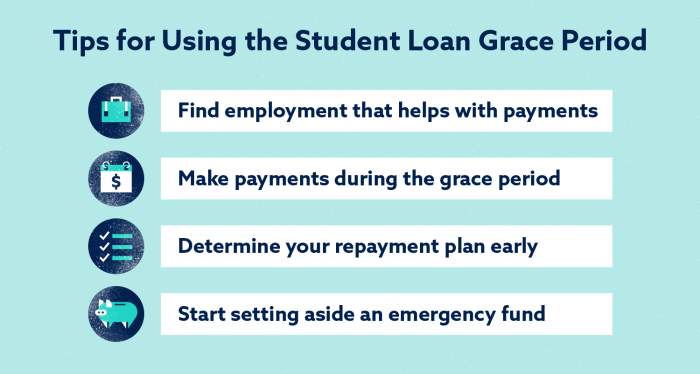

Preparing for repayment during the grace period is essential for avoiding future financial difficulties.

The following tips can help borrowers effectively manage their finances and transition smoothly into repayment:

- Understand your loan terms: Review your loan documents carefully to understand the interest rate, repayment period, and any applicable fees.

- Create a budget: Track your income and expenses to determine how much you can comfortably afford to pay each month.

- Explore repayment options: Research different repayment plans to find one that aligns with your financial situation.

- Set up automatic payments: Automate your payments to avoid late fees and ensure consistent repayments.

- Monitor your credit report: Regularly check your credit report to ensure your loan payments are accurately reflected.

- Seek professional help if needed: Don’t hesitate to contact a financial counselor or your loan servicer if you need assistance.

Helpful Websites and Organizations

Several websites and organizations provide valuable resources and support for student loan borrowers.

- Federal Student Aid (studentaid.gov): The official website of the U.S. Department of Education for federal student aid.

- National Foundation for Credit Counseling (NFCC): A non-profit organization offering credit counseling and debt management services.

- Consumer Financial Protection Bureau (CFPB): Provides resources and information on consumer financial issues, including student loans.

Illustrative Examples of Grace Period Scenarios

Understanding how a student loan grace period works is crucial for effective financial planning after graduation. The following scenarios illustrate various situations borrowers might encounter, highlighting both the benefits and potential pitfalls of this period.

Beneficial Standard Grace Period

Imagine Sarah, a recent graduate with federal student loans totaling $30,000. After completing her degree, she enters a standard six-month grace period. During this time, she secures a job in her field, begins building her credit history, and creates a detailed budget. This allows her to comfortably begin repayment once the grace period ends, avoiding late fees and negative impacts on her credit score. The grace period provided her with crucial time to transition from student life to financial independence.

Scenario Requiring an Extended Grace Period

Consider John, who graduated with significant student loan debt and experienced unexpected job market challenges after graduation. Finding employment proved difficult, and he faced financial hardship. An extended grace period, perhaps granted due to documented financial hardship or participation in an income-driven repayment plan, would have been beneficial. This would have given him breathing room to secure stable employment and develop a sustainable repayment strategy without facing immediate delinquency. The extended period provided a crucial buffer during a challenging period.

Negative Consequences from Misunderstanding the Grace Period

Maria, unaware of the specifics of her student loan grace period, assumed it was a year long instead of the standard six months. She didn’t start making payments until seven months after graduation, resulting in late fees and a negative mark on her credit report. This negatively impacted her ability to secure a loan for a car or apartment. This example underscores the importance of understanding the terms and conditions of your specific loan agreement.

Successful Management During and After the Grace Period

David meticulously planned for his post-graduation financial situation. He tracked his income and expenses during his grace period, researching various repayment options and selecting one that aligned with his budget. He also set up automatic payments to ensure timely repayments once the grace period concluded. His proactive approach allowed him to manage his debt effectively, maintain a good credit score, and achieve his financial goals. His disciplined approach demonstrates the positive impact of careful planning and proactive debt management.

Final Review

Successfully navigating the student loan grace period requires careful planning and a thorough understanding of the relevant regulations. By proactively managing your finances during this time and utilizing the resources available, you can effectively prepare for repayment and avoid potential pitfalls. Remember to stay informed about any updates to grace period policies and seek assistance if needed. Proactive engagement ensures a smoother transition into repayment and long-term financial stability.

FAQ Explained

What happens if I don’t make payments during my grace period?

While you don’t typically make payments during the grace period, failing to meet repayment obligations *after* the grace period ends will result in delinquency, negatively impacting your credit score and potentially leading to collection actions.

Can my grace period be extended?

In certain circumstances, such as documented hardship or enrollment in a qualifying program, an extension may be possible. Contact your loan servicer to explore options.

How do I find my loan servicer?

Your loan servicer information is typically available on your loan documents or through the National Student Loan Data System (NSLDS).

What if I’m unsure about my loan type and grace period?

Contact your loan servicer or refer to your loan documents for clarification on your specific loan type and applicable grace period.