Navigating the complexities of student loans can feel overwhelming, but understanding the guidelines is crucial for a successful academic journey and responsible financial future. This guide provides a clear and concise overview of the process, from eligibility and application to repayment and forgiveness options. We’ll demystify the various loan types, interest rates, and repayment plans, empowering you to make informed decisions about your education financing.

Whether you’re a prospective student planning your finances or a current borrower seeking clarity on repayment strategies, this resource offers practical advice and essential information to help you manage your student loan debt effectively. We’ll cover federal and private loan options, exploring the nuances of each and helping you determine the best path for your individual circumstances.

Eligibility Criteria for Student Loans

Securing funding for higher education often involves navigating the complexities of student loan eligibility. Understanding the requirements for both federal and private loans is crucial for prospective students and their families to make informed financial decisions. This section Artikels the key eligibility criteria to help you determine your options.

General Eligibility Requirements for Federal Student Loans

To be eligible for federal student loans, you generally need to be a U.S. citizen or eligible non-citizen. You must be enrolled or accepted for enrollment at least half-time in a degree or certificate program at an eligible institution (a school participating in federal student aid programs). You also need a valid Social Security number and must demonstrate financial need, although this requirement varies depending on the specific loan program. Finally, you must agree to complete a Master Promissory Note (MPN), a legally binding agreement outlining your responsibilities as a borrower.

Income Limitations and Parental Contribution Expectations

Federal student loan programs often consider the student’s and their family’s income when determining eligibility and the amount of financial aid awarded. The Free Application for Federal Student Aid (FAFSA) is used to gather this information. Based on the FAFSA data, the Department of Education calculates the Expected Family Contribution (EFC). This EFC represents the amount your family is expected to contribute towards your education costs. A lower EFC generally indicates greater eligibility for need-based federal student aid, including subsidized loans. There are no strict income limits for receiving federal student loans, but the amount of aid you receive is directly influenced by your EFC. For example, a family with a very high income may receive less in federal aid or only unsubsidized loans.

Comparison of Federal and Private Student Loan Eligibility

Federal student loans generally have more lenient eligibility requirements than private student loans. Federal loans prioritize access to education, often focusing on need and enrollment status. Private loans, on the other hand, typically require a credit check and a co-signer (often a parent with good credit) if the student lacks a sufficient credit history. Private loan lenders assess your creditworthiness and financial stability to determine your eligibility and interest rates. They often have stricter income requirements and may require higher credit scores than federal loan programs. For example, a student with a low credit score or limited income may find it difficult to secure a private loan without a co-signer, whereas federal loans may be more accessible.

Determining Eligibility for Specific Student Loan Programs

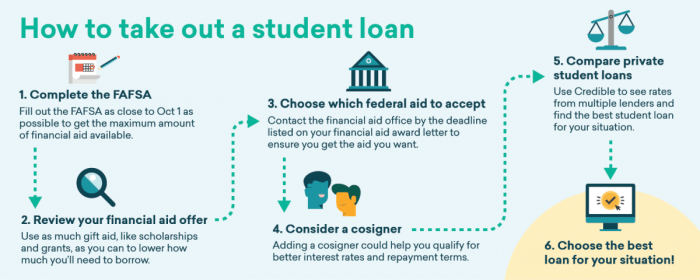

To determine your eligibility for specific federal student loan programs, follow these steps:

- Complete the FAFSA: This application gathers the necessary financial information to determine your eligibility for federal student aid.

- Review your Student Aid Report (SAR): The SAR summarizes your FAFSA information and provides an estimate of your EFC.

- Check your school’s financial aid award letter: This letter Artikels the types and amounts of financial aid you’ve been offered, including federal student loans.

- Understand the terms and conditions of each loan program: Carefully review the interest rates, repayment options, and other terms associated with each loan type before accepting.

- Compare federal and private loan options: Weigh the advantages and disadvantages of each loan type to make the best decision for your financial situation.

Types of Student Loans and Their Features

Choosing the right student loan is crucial for managing your educational expenses and future finances. Understanding the various types of loans available, their features, and their implications is essential for making informed decisions. This section will Artikel the key differences between federal and private student loans, and delve into the specifics of various federal loan programs.

Federal Student Loans

Federal student loans are offered by the U.S. government and generally offer more borrower protections than private loans. They are typically more favorable in terms of interest rates and repayment options. Several types of federal student loans exist, each designed to meet specific needs.

Subsidized and Unsubsidized Federal Stafford Loans

Subsidized Stafford Loans are need-based. The government pays the interest on these loans while you’re in school at least half-time, during grace periods, and during periods of deferment. Unsubsidized Stafford Loans are not need-based; interest accrues from the time the loan is disbursed, regardless of your enrollment status. Both loan types have variable interest rates set annually by the government, and repayment begins six months after graduation or leaving school.

Federal PLUS Loans

Federal PLUS Loans (Parent Loans for Undergraduate Students) are available to parents of dependent undergraduate students and to graduate students. These loans allow parents or graduate students to borrow the full cost of education minus other financial aid received. Interest rates are fixed for the life of the loan, and repayment begins within 60 days of the loan’s disbursement. Credit checks are required for PLUS loan applicants, and adverse credit history may result in loan denial or require an endorser.

Federal and Private Student Loan Comparison

Federal and private student loans differ significantly. Federal loans generally offer more flexible repayment options, including income-driven repayment plans that tie monthly payments to your income. They also provide borrower protections, such as deferment and forbearance options during financial hardship. Private loans, offered by banks and credit unions, often have higher interest rates and fewer repayment options. While private loans may offer larger loan amounts, they often require a creditworthy co-signer, especially for students with limited or no credit history. The lack of government oversight means less protection for borrowers in case of financial difficulties.

Student Loan Comparison Table

| Loan Type | Interest Rate (Example – rates vary annually) | Typical Repayment Period | Fees |

|---|---|---|---|

| Subsidized Stafford Loan | Variable, check the Federal Student Aid website for current rates | 10-20 years | Origination fee |

| Unsubsidized Stafford Loan | Variable, check the Federal Student Aid website for current rates | 10-20 years | Origination fee |

| Federal PLUS Loan | Fixed, check the Federal Student Aid website for current rates | 10-25 years | Origination fee |

| Private Student Loan | Variable or Fixed, varies widely by lender and borrower creditworthiness | Varies by lender, typically 5-20 years | Varies by lender, may include origination fees, prepayment penalties |

Loan Application and Approval Process

Securing student loans involves a multi-step process, beginning with the completion of necessary forms and culminating in loan approval or denial. Understanding this process is crucial for prospective students to navigate the financial aspects of higher education effectively. The following details the steps involved, required documentation, influencing factors, and potential reasons for denial.

Completing the FAFSA Form

The Free Application for Federal Student Aid (FAFSA) is the cornerstone of the federal student loan application process. This form collects vital information about the student and their family’s financial situation to determine eligibility for federal student aid, including grants, loans, and work-study programs. The FAFSA requires accurate and complete information, including Social Security numbers, tax returns, and bank statements. Submitting an inaccurate FAFSA can delay or prevent loan approval. The Department of Education uses the information provided to calculate the Expected Family Contribution (EFC), a key factor in determining financial aid eligibility.

Required Documentation for Student Loan Applications

Beyond the FAFSA, additional documentation may be required depending on the lender and the type of loan. Commonly requested documents include proof of enrollment (acceptance letter from the institution), transcripts (demonstrating academic progress), and government-issued photo identification. Some lenders may also require tax returns, bank statements, or proof of income for the student or their parents, particularly for private loans. It’s essential to carefully review the lender’s specific requirements to ensure a smooth application process.

Factors Influencing Loan Approval and Reasons for Denial

Several factors influence the approval of student loan applications. Credit history plays a significant role, especially for private loans. A strong credit history increases the likelihood of approval and may lead to more favorable interest rates. The applicant’s income, debt-to-income ratio, and the overall financial stability of the student and their co-signer (if applicable) are also carefully considered. Reasons for denial may include poor credit history, insufficient income, incomplete or inaccurate application information, or failure to meet the lender’s specific eligibility criteria. For federal loans, the primary factor is the student’s demonstrated financial need as calculated by the FAFSA.

Student Loan Application and Approval Process Flowchart

The following describes a flowchart illustrating the typical student loan application and approval process. The process begins with the completion of the FAFSA form. Following submission, the FAFSA data is processed, and the student receives a Student Aid Report (SAR). The SAR summarizes the information provided and calculates the EFC. Based on the EFC and other factors, the student is notified of their eligibility for federal student aid. If eligible, the student then completes the loan application, providing additional documentation as required by the lender. The lender reviews the application and supporting documents. If approved, the loan funds are disbursed to the educational institution. If denied, the student receives a notification explaining the reasons for denial and may have the opportunity to appeal or reapply. The process concludes with the disbursement of funds or denial notification.

Repayment Plans and Options

Choosing the right repayment plan for your federal student loans is crucial for managing your debt effectively and avoiding financial strain. Understanding the various options available and their implications is key to making an informed decision that aligns with your individual financial circumstances and goals. This section Artikels the different repayment plans offered for federal student loans and provides guidance on selecting the most appropriate option.

Federal student loan repayment plans offer flexibility to borrowers with varying income levels and financial situations. The best plan depends on factors such as your monthly income, loan amount, and financial goals. Careful consideration of these factors will help you select a plan that promotes timely repayment while minimizing financial hardship.

Standard Repayment Plan

The Standard Repayment Plan is the default plan for most federal student loans. It involves fixed monthly payments spread over a 10-year period. This plan provides a predictable payment schedule, allowing for consistent budgeting. However, the monthly payments may be higher than other plans, particularly for borrowers with substantial loan balances. The total interest paid over the life of the loan will be higher compared to longer repayment plans.

Graduated Repayment Plan

Unlike the Standard Repayment Plan, the Graduated Repayment Plan features payments that increase over time. Initially, the payments are lower, making them more manageable in the early years after graduation when income may be limited. However, payments gradually increase over the 10-year repayment period, potentially leading to higher payments in later years. This plan can provide short-term relief but may result in a higher total interest paid over the life of the loan.

Extended Repayment Plan

The Extended Repayment Plan offers a longer repayment period, typically up to 25 years, compared to the Standard and Graduated plans. This results in lower monthly payments, making it a suitable option for borrowers with significant loan balances or lower incomes. However, the longer repayment period translates to a significantly higher total interest paid over the loan’s lifetime. This plan is suitable for those prioritizing lower monthly payments, even at the cost of higher overall interest.

Income-Driven Repayment Plans

Income-driven repayment plans link your monthly payment amount to your income and family size. These plans are designed to make repayment more manageable for borrowers facing financial challenges. Eligibility requirements vary depending on the specific plan, but generally include having federal student loans and demonstrating financial need.

- Income-Driven Repayment (IDR) Plans: These plans include options like Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has its own specific formula for calculating monthly payments based on income and family size. Generally, payments are capped at a percentage of your discretionary income (income above a certain poverty level).

- Eligibility Requirements: Generally, borrowers must have federal student loans and complete an income verification process. Specific eligibility criteria may vary depending on the chosen plan and may include factors such as loan type and repayment history.

- Key Features: IDR plans often offer lower monthly payments compared to standard plans, potentially resulting in loan forgiveness after a certain number of years (usually 20-25) of qualifying payments. However, the total interest paid may be higher than with shorter repayment terms, and any forgiven amount may be considered taxable income.

Loan Forgiveness and Cancellation Programs

Navigating the complexities of student loan repayment can be daunting, but understanding the various forgiveness and cancellation programs available can significantly alleviate the burden. These programs offer opportunities to reduce or eliminate student loan debt under specific circumstances, providing relief for borrowers facing financial hardship or pursuing careers in public service. It’s crucial to understand the eligibility requirements and limitations of each program to determine if you qualify.

Public Service Loan Forgiveness (PSLF) Program

The Public Service Loan Forgiveness (PSLF) Program is designed to forgive the remaining balance on your Direct Loans after you’ve made 120 qualifying monthly payments under an income-driven repayment plan while working full-time for a qualifying government or non-profit organization. Eligibility requires employment by a qualifying employer and making consistent, on-time payments for the required 10 years. The program offers significant debt relief for those committed to public service, but it’s important to note that it requires careful planning and adherence to strict guidelines. Failure to meet the requirements, such as making non-qualifying payments or working for a non-qualifying employer, can lead to ineligibility for forgiveness. Examples of qualifying employers include government agencies at the federal, state, or local level, and non-profit organizations that provide public service.

Teacher Loan Forgiveness Program

This program offers forgiveness of up to $17,500 on eligible Direct Subsidized and Unsubsidized Loans or Federal Stafford Loans for teachers who have completed five years of full-time teaching in a low-income school or educational service agency. The program targets educators in underserved communities, aiming to incentivize and support teaching careers in these areas. Eligibility hinges on meeting the teaching requirements in a qualifying school, and the forgiveness amount is tied to the number of years of qualifying service. This program offers substantial benefits to educators committed to working in under-resourced schools, providing financial relief alongside their important work.

Income-Driven Repayment (IDR) Plans and Forgiveness

Several income-driven repayment (IDR) plans, such as the Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR) plans, can lead to loan forgiveness after a specific period (typically 20 or 25 years). These plans calculate your monthly payment based on your income and family size, making payments more manageable. After the forgiveness period, any remaining balance may be forgiven; however, the forgiven amount is considered taxable income. While these plans offer long-term relief, the potential for tax implications on forgiven debt should be carefully considered. The benefit is reduced monthly payments, but the drawback is that you will end up paying more in interest over the life of the loan.

Comparison of Loan Forgiveness Options

| Program | Eligibility Requirements | Benefits | Drawbacks |

|---|---|---|---|

| PSLF | 120 qualifying payments, full-time employment with qualifying employer | Complete loan forgiveness | Strict requirements, lengthy repayment period |

| Teacher Loan Forgiveness | 5 years of full-time teaching in low-income school | Forgiveness up to $17,500 | Limited to teachers in qualifying schools |

| IDR Plans | Income-based repayment plan | Lower monthly payments, potential forgiveness after 20-25 years | Forgiveness is taxable income, potential for higher overall interest paid |

Professions Eligible for Loan Forgiveness

Many professions beyond teaching qualify for loan forgiveness programs. Public service roles such as social work, nursing, law enforcement, and military service often have associated forgiveness programs. Additionally, some states offer their own loan forgiveness programs for specific professions deemed critical to the state’s needs. The specific requirements and eligibility criteria vary widely depending on the program and the profession. It’s important to research programs specific to your chosen career path to identify potential opportunities for loan forgiveness.

Managing Student Loan Debt

Successfully navigating student loan debt requires proactive planning and diligent management. Understanding your loan terms, creating a realistic budget, and consistently making payments are crucial steps toward becoming debt-free. Failing to do so can lead to serious financial consequences.

Effective Strategies for Budgeting and Managing Student Loan Debt

Budgeting is essential for successful student loan repayment. A well-structured budget allows you to allocate funds for loan payments while covering essential living expenses. This involves tracking income and expenses, identifying areas for potential savings, and prioritizing loan repayment within your financial plan. Prioritizing high-interest loans is a common strategy to minimize overall interest paid.

Understanding Loan Terms and Interest Rates

Understanding your loan terms, including interest rates, repayment periods, and any associated fees, is paramount. High interest rates significantly increase the total amount you’ll repay. Knowing your interest rate allows you to accurately estimate your total repayment cost and to compare different repayment options effectively. For example, a loan with a 7% interest rate will accrue significantly more interest over time compared to a loan with a 4% interest rate, even if the principal amounts are the same.

Consequences of Defaulting on Student Loans

Defaulting on student loans has severe consequences. These can include damaged credit scores, wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. Defaulting can make it extremely challenging to secure a mortgage, rent an apartment, or even obtain a car loan in the future. The long-term financial repercussions of default are substantial and far-reaching.

Sample Budget for Student Loan Repayment

This sample budget demonstrates how to allocate funds for student loan repayment. Remember, this is a template, and your specific budget will depend on your individual income, expenses, and loan amount.

| Income | Amount |

|---|---|

| Monthly Net Income | $3,000 |

| Expenses | Amount |

| Rent/Mortgage | $1,000 |

| Utilities | $200 |

| Groceries | $300 |

| Transportation | $150 |

| Student Loan Payment | $500 |

| Other Expenses (Entertainment, Savings, etc.) | $850 |

Note: This budget allocates a significant portion of the income to student loan repayment. Adjust the amounts based on your personal financial situation. Consider exploring options like budgeting apps to help track expenses and manage your finances effectively.

Understanding Interest Rates and Fees

Understanding the interest rates and fees associated with your student loans is crucial for effective financial planning. These factors significantly impact the total cost of your education and your long-term repayment strategy. Failing to grasp these concepts can lead to unexpected expenses and prolonged repayment periods.

Student loan interest rates are determined by several factors, including the type of loan (federal or private), the interest rate index used (e.g., Treasury bill rate), the lender’s risk assessment, and prevailing market conditions. Federal student loan interest rates are typically set by Congress and can vary depending on the loan program and the borrower’s creditworthiness. Private student loans, on the other hand, have interest rates determined by the lender based on a credit check and other financial factors. These rates tend to fluctuate more frequently than federal loan rates.

Student Loan Fees

Several fees can be associated with student loans. Origination fees, charged by the lender upon disbursement of the loan, are a common example. These fees are typically a percentage of the loan amount and cover the lender’s administrative costs. Late payment fees are incurred when payments are not made by the due date. These fees can add up significantly over time, increasing the overall cost of borrowing. Other potential fees include prepayment penalties (though less common with federal loans), and fees for certain loan modifications or deferments. It’s important to carefully review the loan documents to understand all associated fees before signing.

Interest Capitalization

Interest capitalization occurs when accrued interest is added to the principal loan balance. This means that future interest is calculated not only on the original loan amount but also on the accumulated interest. For example, if you have a $10,000 loan with a 5% interest rate, and you don’t make any payments for a year, the interest accrued ($500) will be added to your principal balance, increasing it to $10,500. The following year, the interest will be calculated on this higher amount, resulting in even greater total interest payments over the life of the loan. This process can dramatically increase the overall cost of the loan if not carefully managed. Understanding when and how capitalization occurs is essential to minimizing long-term expenses.

Impact of Different Interest Rates on Total Loan Repayment

Imagine two scenarios to illustrate the impact of interest rates:

Scenario A: A $10,000 loan with a 5% interest rate over 10 years.

Scenario B: A $10,000 loan with a 7% interest rate over 10 years.

Let’s represent this visually, although without an actual image. Imagine a simple bar graph. The horizontal axis represents the interest rate (5% and 7%). The vertical axis represents the total repayment amount over the 10-year period. The bar for Scenario A (5% interest) would be shorter than the bar for Scenario B (7% interest), clearly demonstrating how a higher interest rate leads to a significantly larger total repayment amount. The difference between the bar heights visually represents the additional cost incurred due to the higher interest rate. While precise figures would require loan amortization calculations, the visual representation effectively illustrates the principle. A higher interest rate translates to substantially higher total repayment costs.

Ultimate Conclusion

Successfully managing student loan debt requires proactive planning and a thorough understanding of the available resources. By carefully considering your eligibility, choosing the right loan type, and developing a robust repayment strategy, you can minimize the financial burden and pave the way for a bright future. Remember to utilize available resources and seek professional advice when needed to ensure you’re making informed decisions that align with your long-term financial goals. This guide serves as a starting point – continue your research and actively manage your loan journey for optimal success.

Detailed FAQs

What happens if I miss a student loan payment?

Missing payments can lead to late fees, damage your credit score, and potentially result in loan default, with serious financial consequences.

Can I refinance my student loans?

Yes, refinancing can potentially lower your interest rate and monthly payments, but it often involves switching from federal to private loans, which may eliminate certain benefits.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during deferment, while unsubsidized loans accrue interest from the time they’re disbursed.

How can I consolidate my student loans?

Consolidation combines multiple loans into a single loan, potentially simplifying repayment, but it may not always lower your interest rate.