Navigating the complexities of student loan repayment can be daunting, especially during unforeseen financial hardships. This guide explores the crucial option of student loan hardship deferment, providing a comprehensive understanding of eligibility criteria, application processes, and potential long-term implications. We’ll delve into various deferment types, compare them to alternative repayment strategies, and address common challenges faced by borrowers.

Understanding your rights and options is paramount. Whether you’re facing temporary unemployment, medical emergencies, or other significant financial setbacks, this resource aims to empower you with the knowledge needed to make informed decisions about your student loan debt.

Eligibility Criteria for Student Loan Hardship Deferment

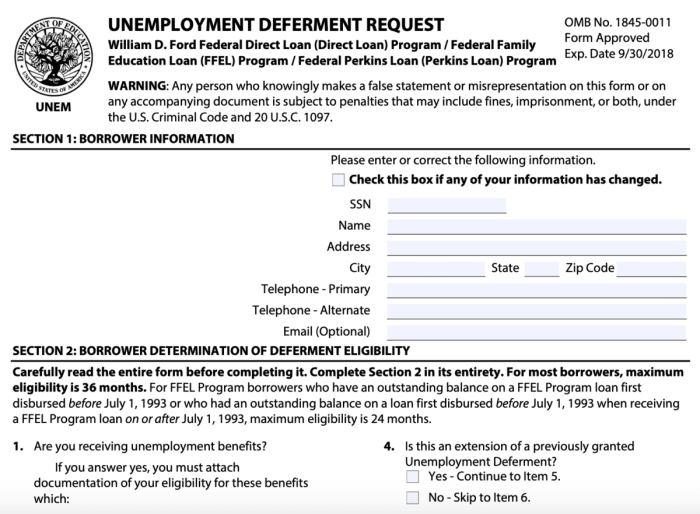

Securing a student loan deferment due to hardship requires meeting specific criteria. The process involves demonstrating a genuine financial difficulty that prevents timely loan repayment. The specific requirements vary depending on the type of loan and the lender.

General Requirements for Deferment

Generally, to qualify for a deferment, borrowers must demonstrate an inability to make their scheduled loan payments due to unforeseen circumstances. This typically involves providing documentation supporting a temporary financial hardship, such as unemployment, medical emergencies, or natural disasters. The specific documentation required may differ between lenders and loan programs. The length of the deferment period is also determined on a case-by-case basis and is often limited to a specific timeframe.

Income-Based Repayment Plan Eligibility Criteria

Income-driven repayment plans, while not strictly deferments, offer alternative payment options based on your income and family size. Eligibility for these plans usually requires completing a detailed application process, including providing tax returns and other financial documentation. These plans calculate your monthly payment based on a percentage of your discretionary income, meaning your payment is adjusted if your income changes significantly. If your income falls below a certain threshold, your monthly payment may be reduced to $0, effectively providing a form of temporary relief similar to a deferment.

Acceptable Documentation for Hardship Claims

Supporting documentation is crucial for a successful hardship deferment application. Examples of acceptable documentation include, but are not limited to: unemployment benefit statements, medical bills, proof of natural disaster damage (e.g., insurance claim documentation), pay stubs showing reduced income, and documentation of other significant financial setbacks. The lender will assess the provided documentation to determine the validity of the hardship claim.

Comparison of Deferment Eligibility Across Loan Programs

Federal student loan programs generally offer more generous hardship deferment options than private student loans. Federal loans often have established guidelines and specific hardship circumstances that qualify for deferment. Private lenders, however, may have stricter requirements and less flexible deferment policies. The availability and terms of deferment will depend on the specific lender and the terms of the individual loan agreement. It is vital to carefully review your loan documents to understand your rights and options.

Deferment Application Process Flowchart

The following describes a typical deferment application process. This is a general representation, and the specific steps may vary depending on the lender.

[A flowchart would be depicted here. The flowchart would begin with “Apply for Deferment,” branching to “Gather Required Documentation,” then “Submit Application and Documentation,” followed by “Lender Review,” leading to two possible outcomes: “Deferment Approved” or “Deferment Denied.” The “Deferment Denied” branch would lead to “Appeal Decision” or “Explore Alternative Options.”]

Types of Hardship Deferments Available

Student loan hardship deferments provide temporary relief from loan repayment obligations for borrowers facing significant financial challenges. Several types of deferments exist, each with specific eligibility requirements and durations. Understanding these differences is crucial for borrowers seeking this assistance.

Economic Hardship Deferment

Economic hardship deferments are granted to borrowers experiencing a significant, temporary reduction in income or an unexpected increase in expenses. This type of deferment recognizes that unforeseen circumstances can severely impact a borrower’s ability to meet their loan repayment obligations. To qualify, borrowers typically need to demonstrate a substantial change in their financial situation, such as job loss, reduced work hours, or a major medical expense. For example, a borrower who loses their job and is actively seeking employment could qualify for an economic hardship deferment. Similarly, a borrower facing unexpectedly high medical bills due to a serious illness or injury might also be eligible.

Total and Permanent Disability (TPD) Deferment

This deferment is available to borrowers who are deemed totally and permanently disabled. The definition of “totally and permanently disabled” varies depending on the lender, but generally refers to an inability to engage in any substantial gainful activity due to a medical condition. Documentation from a physician or other qualified medical professional is typically required to support the claim. For instance, a borrower diagnosed with a debilitating illness that prevents them from working could apply for a TPD deferment. The documentation would need to clearly establish the severity and permanence of the disability.

Cancer Treatment Deferment

Some lenders offer specific deferments for borrowers undergoing cancer treatment. This recognizes the significant financial burden and disruption caused by cancer diagnosis and treatment. The eligibility criteria typically involve providing documentation from a medical professional confirming the diagnosis and ongoing treatment. A borrower undergoing chemotherapy and radiation therapy, for example, could apply for this deferment to alleviate the financial strain during this challenging period.

| Deferment Type | Duration | Eligibility Requirements | Example |

|---|---|---|---|

| Economic Hardship | Varies, typically up to 12 months, potentially renewable | Significant reduction in income or unexpected increase in expenses; documentation may be required. | Job loss, significant medical expenses. |

| Total and Permanent Disability (TPD) | Potentially indefinite, depending on the lender and ongoing disability status. | Documentation of total and permanent disability from a qualified medical professional. | Debilitating illness preventing substantial gainful activity. |

| Cancer Treatment | Varies, often tied to the duration of treatment; check with your lender. | Documentation of cancer diagnosis and ongoing treatment from a medical professional. | Chemotherapy, radiation therapy, or other cancer treatments. |

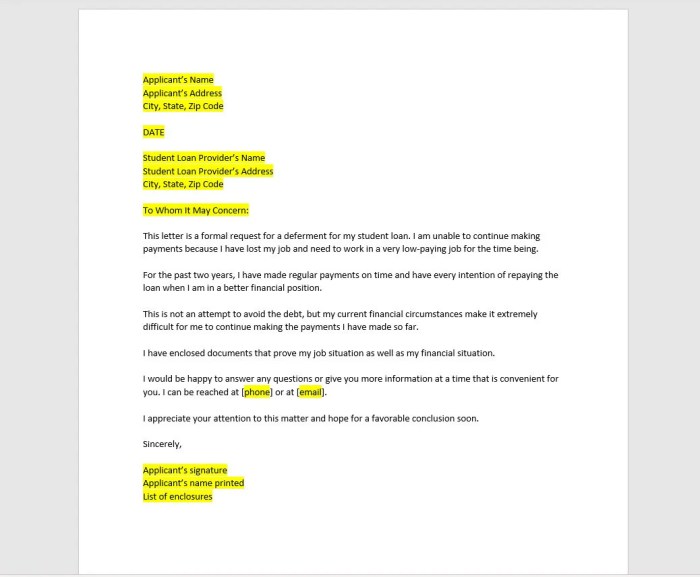

The Application Process for Deferment

Applying for a student loan hardship deferment involves several key steps. Understanding this process will help ensure a smooth and successful application. The specific requirements may vary slightly depending on your loan servicer, so it’s always best to check their website for the most up-to-date information.

Step-by-Step Application Guide

The application process generally follows a clear sequence. First, you’ll need to gather all necessary documentation. Next, you’ll complete the application form provided by your loan servicer. Finally, you’ll submit your completed application and supporting documents. Failure to provide complete documentation may result in delays or rejection of your application.

Required Documentation for Deferment

Supporting documentation is crucial for a successful application. This typically includes proof of your hardship, such as medical bills, unemployment documentation, or legal documents related to a disability. The specific documents required will depend on the type of hardship you are claiming. For instance, if claiming unemployment, you will need documentation from your state’s unemployment agency. If claiming a medical hardship, detailed medical bills and physician statements will be necessary. Always refer to your loan servicer’s specific requirements.

Application Checklist

Before beginning the application process, it’s advisable to prepare a checklist to ensure you have all the necessary materials. This will streamline the process and minimize potential delays.

- Completed application form from your loan servicer.

- Documentation proving your hardship (e.g., medical bills, unemployment documentation, legal documents).

- A copy of your government-issued photo ID.

- Your student loan account information (loan number, etc.).

- Contact information (phone number, email address).

Submitting the Application Electronically

Most loan servicers offer electronic application submission options for convenience. This typically involves uploading your completed application form and supporting documents through a secure online portal. Before submitting, carefully review all documents for accuracy and completeness. Once submitted, you will usually receive a confirmation number or email. Retain this confirmation as proof of submission. If you encounter any technical difficulties, contact your loan servicer’s customer support for assistance. Remember to keep copies of all submitted documents for your records.

Impact of Deferment on Student Loans

Deferring your student loan payments can offer temporary relief, but it’s crucial to understand the long-term financial implications. While it provides a break from monthly payments, deferment doesn’t erase the debt; instead, it significantly impacts interest accrual and ultimately, the total cost of your loan. Understanding these effects is vital for making informed financial decisions.

Deferment’s effect on your loan is primarily determined by the type of loan you have (federal or private) and the specific terms of your deferment plan. The key aspect to remember is that, for most federal student loans, interest continues to accrue during a deferment period. This means your loan balance will grow even though you aren’t making payments. Private loan deferment policies vary widely, so it’s crucial to review your loan agreement carefully.

Interest Accrual During Deferment

Interest continues to accrue on most federal student loans during a deferment period. This added interest is capitalized, meaning it’s added to your principal loan balance at the end of the deferment period. This increases the total amount you owe and subsequently, the amount of your future monthly payments. For example, if you defer a $20,000 loan for one year at a 5% interest rate, you’ll owe approximately $1,000 in additional interest by the end of that year. This $1,000 will then be added to your principal, increasing your total loan balance.

Impact of Deferment on Loan Repayment Terms

Deferment extends the overall repayment period of your student loan. Since interest continues to accrue, you’ll need to repay a larger principal amount once the deferment ends. This increased principal balance can lead to higher monthly payments, or an extended repayment timeline, even if you continue to make consistent payments after the deferment. For example, a deferment could add several years to your repayment plan, potentially pushing back your ability to achieve financial goals.

Examples of Deferment’s Effect on Long-Term Loan Costs

Let’s consider two scenarios: In scenario A, a borrower with a $30,000 loan at 6% interest repays the loan over 10 years without deferment. In scenario B, the same borrower takes a two-year deferment. Scenario B will result in a significantly higher total repayment amount due to capitalized interest accrued during the deferment period. The precise difference will depend on the interest rate and loan type, but the outcome will always be an increase in the overall cost of the loan. This increase can amount to thousands of dollars over the life of the loan.

Comparison with Alternative Repayment Options

Deferment should be compared with other repayment options, such as income-driven repayment plans or loan consolidation. Income-driven repayment plans adjust monthly payments based on income, while consolidation combines multiple loans into one with a potentially lower interest rate. These alternatives may offer better long-term financial outcomes compared to deferment, even if they require immediate payment adjustments. Choosing the best option depends on individual circumstances and financial goals.

Potential Benefits and Drawbacks of Deferment

It is important to weigh the potential benefits and drawbacks carefully before opting for a deferment.

- Benefits: Provides temporary relief from monthly payments, offering a breathing space during financial hardship.

- Drawbacks: Increased total loan cost due to capitalized interest, extended repayment period, potential impact on credit score (though this impact can vary and isn’t always negative).

Alternatives to Hardship Deferment

Facing financial hardship doesn’t automatically mean a deferment is the best solution for your student loans. Several alternative repayment options can provide more long-term financial stability, potentially avoiding the accumulation of interest during a deferment period. Exploring these alternatives is crucial to finding the most suitable path for your specific circumstances.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan payments more manageable by basing your monthly payment on your income and family size. These plans offer lower monthly payments than standard repayment plans, potentially making them more affordable during periods of financial strain. Several types of IDR plans exist, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR). Each plan has slightly different eligibility requirements and calculation methods, so it’s essential to research which one best suits your individual needs. The key benefit is that after a specific period of qualifying payments (usually 20 or 25 years), any remaining loan balance may be forgiven. This forgiveness is considered taxable income, however.

Examples of Situations Where Alternative Plans are More Suitable

IDR plans are particularly beneficial for borrowers experiencing job loss, reduced income, or unexpected medical expenses. For instance, a recent graduate struggling to find a high-paying job might find an IDR plan significantly more manageable than a standard repayment plan. Similarly, a borrower facing a prolonged period of unemployment due to illness or injury could greatly benefit from the reduced monthly payments offered by an IDR plan. In contrast, a deferment might temporarily alleviate payments but could lead to a larger overall loan balance due to accrued interest.

Comparison of Deferment, Forbearance, and Other Repayment Strategies

Deferment and forbearance both temporarily postpone student loan payments, but they differ significantly. Deferment typically involves specific eligibility requirements (like demonstrated financial hardship) and may or may not accrue interest depending on the loan type and deferment reason. Forbearance, on the other hand, is generally granted more easily but usually accrues interest, leading to a larger total loan amount over time. Other repayment strategies, like graduated repayment (payments increase over time) or extended repayment (longer repayment period), offer different payment structures to suit various financial situations. Each approach has its advantages and disadvantages, and choosing the right one depends on individual circumstances and long-term financial goals.

Summary of Repayment Options

| Repayment Option | Monthly Payment | Interest Accrual | Loan Forgiveness Potential |

|---|---|---|---|

| Standard Repayment | Fixed, typically higher | Yes | No |

| Graduated Repayment | Starts low, increases over time | Yes | No |

| Extended Repayment | Lower, longer repayment period | Yes | No |

| Income-Driven Repayment (IDR) | Based on income and family size | May or may not accrue, depending on plan | Potential for forgiveness after a set period |

| Deferment | Temporarily suspended | May or may not accrue, depending on loan type and reason | No |

| Forbearance | Temporarily suspended | Usually accrues | No |

Potential Challenges and Solutions

Navigating the student loan deferment process can present several hurdles for borrowers. Understanding these potential challenges and having strategies in place to address them is crucial for a smooth and successful application. This section Artikels common difficulties, solutions for rejected applications, financial management during deferment, long-term implications, and available resources.

Challenges During the Deferment Application Process

The application process itself can be complex and time-consuming. Borrowers may encounter difficulties gathering the necessary documentation to prove their eligibility for hardship deferment. Incomplete or inaccurate applications are a frequent cause of delays or rejections. Furthermore, understanding the specific requirements and nuances of different deferment programs can be overwhelming, leading to confusion and potential errors. Finally, communication delays with loan servicers can add further frustration to the process.

Addressing Rejected Deferment Applications

If a deferment application is rejected, borrowers should immediately request a detailed explanation from their loan servicer regarding the reason for the denial. This explanation will highlight areas where the application was lacking or where additional information is needed. The borrower can then re-submit a revised application with the necessary corrections and supporting documentation. If the second application is still rejected, it might be beneficial to seek assistance from a student loan counselor or advocate who can help navigate the appeals process and ensure the application meets all requirements.

Financial Management During Deferment

While deferment provides temporary relief from loan payments, it’s crucial to remember that interest continues to accrue on most federal student loans (unless it’s a subsidized loan). This means the total loan amount will increase over time. Therefore, borrowers should budget carefully during the deferment period, prioritizing essential expenses and creating a plan to repay the accumulated interest as soon as possible. Building an emergency fund is also vital to mitigate unexpected financial setbacks that could further complicate the situation. For example, setting aside a portion of income each month, even a small amount, can help create a buffer for unforeseen circumstances.

Long-Term Implications of Deferment

Relying extensively on deferment can have significant long-term financial implications. The accumulation of interest can substantially increase the total loan amount, leading to higher monthly payments and a longer repayment period. This can delay other financial goals, such as saving for a down payment on a house or investing for retirement. For instance, a $20,000 loan with a 6% interest rate deferred for three years could accrue over $3,600 in interest, significantly impacting the overall cost of the loan. Careful consideration of the long-term costs and alternatives is therefore essential.

Resources for Borrowers Seeking Financial Assistance

Several resources are available to help borrowers facing financial hardship. The National Foundation for Credit Counseling (NFCC) offers free or low-cost credit counseling services, including assistance with student loan management. Many universities and colleges also provide financial aid offices that can offer guidance and support. Additionally, the U.S. Department of Education website offers comprehensive information on student loan repayment options and available assistance programs. Finally, non-profit organizations focused on financial literacy can provide valuable resources and support to borrowers struggling to manage their student loans.

Illustrative Scenarios

Understanding the practical application of student loan hardship deferment is crucial. The following scenarios illustrate successful and unsuccessful applications, along with the long-term financial implications.

Successful Deferment Application

Sarah, a recent graduate with a degree in nursing, experienced unexpected medical expenses after a car accident. Her monthly student loan payments of $700 were proving impossible to manage alongside her medical bills and living expenses. She meticulously documented her medical bills, doctor’s notes, and her reduced income due to time off work. She applied for a hardship deferment based on documented financial hardship, providing all necessary documentation. After a thorough review, her application was approved, granting her a six-month deferment period. During this time, interest continued to accrue, but she avoided default and gained valuable time to manage her finances and resume payments.

Denied Deferment Application and Subsequent Actions

Mark, a freelance graphic designer, applied for a hardship deferment citing inconsistent income. While he provided some income documentation, it was incomplete and lacked sufficient evidence of consistent financial hardship. His application was denied. Understanding the reasons for the denial, Mark proactively explored alternative solutions. He contacted his loan servicer to discuss possible repayment plans, ultimately negotiating an income-driven repayment plan that reduced his monthly payments to a manageable level. He also sought financial counseling to improve his budgeting and financial management skills.

Long-Term Financial Impact of Deferment

Consider David, who obtained a three-year deferment on a $30,000 student loan with a 6% interest rate. While his monthly payments were paused, interest continued to accrue. Over three years, the accrued interest totaled approximately $5,400 (calculated using compound interest). At the end of the deferment period, David’s loan balance increased to $35,400. This resulted in a longer repayment period and higher overall interest payments compared to if he had continued making regular payments. For example, if his original repayment plan was 10 years, his new repayment plan might extend to 11 or 12 years, adding thousands more in interest over the life of the loan. This scenario highlights the importance of carefully considering the long-term financial implications before opting for a deferment.

Summary

Securing a student loan hardship deferment can offer vital breathing room during difficult financial times. However, it’s crucial to carefully weigh the short-term benefits against potential long-term consequences, such as increased interest accrual. By understanding the eligibility requirements, application process, and available alternatives, borrowers can navigate this complex landscape effectively and make the best choices for their individual circumstances. Remember to explore all available options and seek professional financial advice when necessary.

User Queries

What happens to my interest during a deferment?

Interest typically continues to accrue on subsidized and unsubsidized federal loans during a deferment period, increasing your overall loan balance.

Can I defer my private student loans?

The availability of deferment for private student loans varies greatly depending on your lender. Contact your lender directly to inquire about their hardship deferment policies.

How long can I defer my student loans?

The duration of a deferment depends on the type of hardship and the specific loan program. Some deferments may be limited to a specific timeframe, while others may be extended under certain circumstances.

What if my deferment application is denied?

If your application is denied, review the reasons provided and consider appealing the decision or exploring alternative repayment options like income-driven repayment plans.