Navigating the complexities of student loan repayment can feel overwhelming, but understanding Income-Based Repayment (IBR) plans can significantly alleviate the burden. IBR plans offer a pathway to manageable monthly payments based on your income and family size, potentially leading to loan forgiveness after a set period. This guide delves into the intricacies of IBR, exploring eligibility criteria, calculation methods, tax implications, and long-term financial effects. We’ll compare IBR to other repayment options, address common challenges, and equip you with the knowledge to make informed decisions about your student loan debt.

From understanding the different types of IBR plans and their respective eligibility requirements to mastering the calculation of your monthly payment, this comprehensive resource will serve as your roadmap to successfully managing your student loan debt through an IBR plan. We will also explore the potential impact on your credit score and provide strategies for maintaining a healthy financial standing while on an IBR plan. The goal is to empower you to make the best choices for your unique financial situation.

Income-Based Repayment (IBR) Plan Eligibility

Income-Based Repayment (IBR) plans offer a pathway to more manageable student loan payments by basing your monthly payment on your income and family size. Eligibility depends on several factors, primarily your income and the type of federal student loans you hold. Understanding these factors is crucial before applying.

Income Requirements for IBR Plan Eligibility

To qualify for an IBR plan, your adjusted gross income (AGI) must be below a certain threshold. This threshold isn’t a fixed number; it varies based on the specific IBR plan and your family size. Generally, the lower your AGI relative to your loan amount and family size, the lower your monthly payment will be. Your AGI is calculated using your federal income tax return information. Specific income limits are published annually by the Department of Education and can be found on their website or through your loan servicer. It’s important to check the current guidelines as they may change from year to year.

Types of IBR Plans

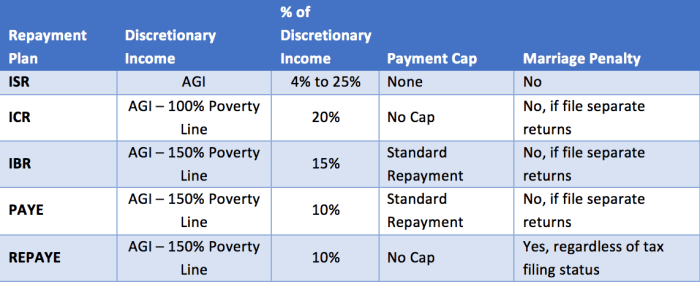

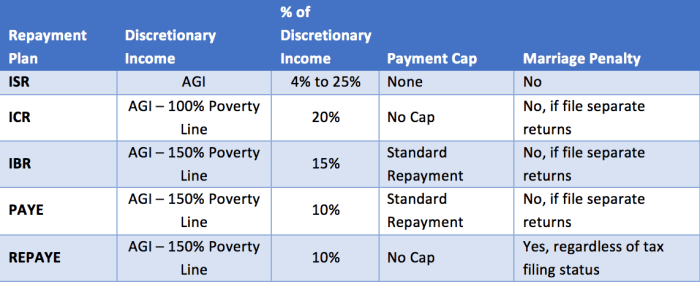

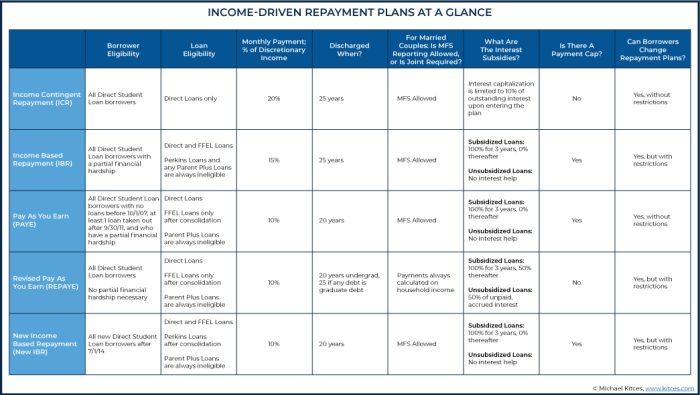

Several IBR plans exist, each with slightly different calculations and eligibility requirements. While the specific details can be complex, the most common plans are Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE). These plans share the common goal of making monthly payments more affordable, but the way they calculate those payments differs. The differences often relate to the income percentage used in the calculation and the loan repayment period.

Applying for an IBR Plan

Applying for an IBR plan is generally a straightforward process.

- Check Eligibility: First, confirm you meet the income and loan type requirements for the IBR plan you’re interested in. This often involves reviewing your loan details and calculating your AGI.

- Gather Documentation: You’ll need documentation proving your income and family size. This typically includes your most recent tax return.

- Submit Application: You can usually apply online through your student loan servicer’s website. The application process will involve providing the necessary documentation and verifying your information.

- Review Approval: Once your application is submitted, your servicer will review it and notify you of their decision. This process can take several weeks.

- Begin Payments: After approval, your monthly payment will be recalculated based on your income and family size. You’ll receive a new payment schedule.

Comparison of IBR Plan Features

The following table summarizes key features of common IBR plans. Remember that these are general comparisons, and specific details can vary based on the year and your individual circumstances. Always consult your loan servicer or the Department of Education for the most up-to-date information.

| Plan Name | Payment Calculation | Maximum Repayment Period | Eligibility Requirements |

|---|---|---|---|

| Income-Based Repayment (IBR) | Based on AGI and family size; typically 10-15% of discretionary income | 25 years | Specific loan types; AGI below a certain threshold |

| Income-Contingent Repayment (ICR) | Based on AGI, family size, and loan amount; payment can be lower than IBR | 25 years | Specific loan types; AGI below a certain threshold |

| Pay As You Earn (PAYE) | Based on AGI and family size; typically 10% of discretionary income | 20 years | Specific loan types; AGI below a certain threshold; loans disbursed after 2007 |

IBR Plan Calculation Methods

Understanding how your monthly IBR payment is calculated is crucial for effective student loan management. The calculation isn’t overly complex, but several factors interplay to determine your final payment amount. This section will detail the process and provide illustrative examples.

The IBR payment calculation aims to make your monthly payments affordable based on your discretionary income. This means it considers your income, family size, and loan amount, ultimately producing a payment that’s a manageable percentage of your income.

Factors Influencing IBR Payment Amount

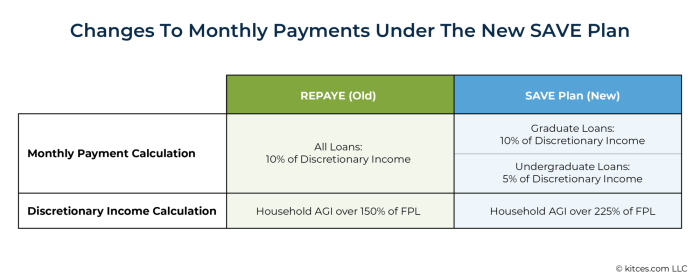

Several key factors significantly impact the calculated IBR payment. These include your adjusted gross income (AGI), family size (number of dependents), and the total amount of your eligible student loans. The specific formula used can vary slightly depending on the type of IBR plan (IBR, PAYE, REPAYE), and the government periodically adjusts the calculations. However, the core principles remain consistent. Higher income generally results in higher payments, while a larger family size usually leads to lower payments due to the increased expenses associated with a larger family. The total loan amount also directly affects the payment, with larger loan balances resulting in higher payments, all else being equal.

IBR Payment Calculation Steps

The calculation of your IBR payment involves several steps. While the exact formulas are complex and vary slightly depending on the specific plan, the general process can be summarized as follows:

- Determine Adjusted Gross Income (AGI): This is your gross income minus certain deductions as defined by the IRS. This is a crucial starting point for the calculation.

- Calculate Discretionary Income: Your discretionary income is your AGI minus 150% of the poverty guideline for your family size and state. This represents the income available for loan repayment after essential living expenses are considered.

- Determine the Payment Percentage: The percentage of discretionary income applied to your loan payment is fixed by the government and varies depending on the specific IBR plan. This percentage may change over time.

- Calculate the Annual Payment: Multiply your discretionary income by the payment percentage to find your annual payment amount.

- Calculate the Monthly Payment: Divide the annual payment by 12 to arrive at your monthly payment.

Examples of IBR Payment Calculations

Let’s illustrate with simplified examples. Note that these are for illustrative purposes only and do not reflect the precise calculations used by the government. Actual calculations are more complex and should be verified through official government resources.

| Scenario | AGI | Family Size | Discretionary Income (Simplified Example) | Payment Percentage (Example) | Annual Payment | Monthly Payment |

|---|---|---|---|---|---|---|

| Scenario 1: Low Income | $30,000 | 1 | $15,000 | 10% | $1,500 | $125 |

| Scenario 2: Moderate Income | $60,000 | 2 | $30,000 | 10% | $3,000 | $250 |

| Scenario 3: High Income | $100,000 | 1 | $60,000 | 10% | $6,000 | $500 |

Remember that these are simplified examples. The actual calculation involves more nuanced factors and specific formulas provided by the government. It is crucial to use official government resources or consult a financial advisor for accurate IBR payment calculations based on your individual circumstances.

IBR Plan and Loan Forgiveness

Income-Based Repayment (IBR) plans offer a pathway to potential loan forgiveness for eligible borrowers. Understanding the intricacies of this forgiveness is crucial for effective long-term financial planning. This section details the provisions, eligibility, and timeline associated with IBR loan forgiveness.

Loan Forgiveness Provisions Under IBR

IBR plans don’t automatically lead to loan forgiveness; instead, they offer the possibility of having the remaining loan balance forgiven after a specific number of qualifying payments. The exact number of payments required varies depending on the specific IBR plan type and loan origination date. Forgiveness is typically granted after 20 or 25 years of consistent on-time payments, though this can be shorter for borrowers with Public Service Loan Forgiveness (PSLF) eligibility. It’s important to note that the forgiven amount is considered taxable income.

Eligibility Requirements for Loan Forgiveness Under IBR

Several criteria must be met to be eligible for IBR loan forgiveness. Borrowers must maintain consistent, on-time payments under an IBR plan for the required duration. This means making payments based on your income and family size, as calculated by your loan servicer. The type of loan also plays a role; only eligible federal student loans qualify for IBR and subsequent forgiveness. Furthermore, the borrower must meet the income requirements for their chosen IBR plan throughout the repayment period. Failure to meet any of these conditions will jeopardize loan forgiveness.

Timeline for Achieving Loan Forgiveness Through IBR

The timeline for loan forgiveness under IBR is directly tied to the required number of qualifying payments. For example, a borrower with a 20-year repayment plan needs to make 240 qualifying monthly payments. This translates to a 20-year period of consistent, on-time payments. For those with 25-year plans, the timeline extends to 300 monthly payments, or 25 years. The process begins when the borrower enrolls in an IBR plan and begins making qualifying payments. The loan servicer tracks these payments, and after the required number of payments, borrowers can apply for loan forgiveness. It’s crucial to maintain accurate records of payments and communicate with the loan servicer regularly to ensure progress toward forgiveness.

IBR Loan Forgiveness Process Timeline

The following illustrates a simplified timeline. Actual timelines can vary depending on individual circumstances and loan servicer processing times.

| Stage | Description | Approximate Timeline |

|---|---|---|

| Enrollment | Apply for and enroll in an IBR plan. | Immediately |

| Qualifying Payments | Make consistent, on-time monthly payments based on income. | 20-25 years (depending on plan) |

| Application for Forgiveness | Submit the application for loan forgiveness to your loan servicer after completing the required number of payments. | After 20 or 25 years of payments |

| Processing and Review | The loan servicer reviews the application and verifies payment history. | Several months |

| Forgiveness Granted (or Denied) | Notification of loan forgiveness (or denial with reasons). | Following review |

IBR Plan and Tax Implications

Income-Based Repayment (IBR) plans can significantly impact your tax liability, both during the repayment period and upon potential loan forgiveness. Understanding these implications is crucial for effective financial planning. This section details how IBR payments and eventual loan forgiveness are treated for tax purposes.

IBR Payments and Tax Returns

IBR payments are generally considered interest payments for tax purposes. This means that the portion of your monthly payment applied to interest can be deducted from your taxable income. However, the portion applied to principal is not deductible. The exact breakdown between interest and principal will vary each month depending on your payment amount and the outstanding loan balance. To accurately track this, you should receive a 1098-E form from your loan servicer annually, summarizing the interest paid during the tax year. This form should be used when filing your federal income tax return. It’s important to note that state tax laws regarding deductibility may differ.

Tax Implications of Loan Forgiveness Under IBR

Under certain IBR plans, after a specified period of qualifying payments, the remaining loan balance may be forgiven. This forgiven amount is generally considered taxable income in the year it’s forgiven. This means you will need to report the forgiven amount on your tax return and pay taxes on it, potentially at your ordinary income tax rate. This can result in a significant tax liability, especially if a substantial loan balance is forgiven. For example, if $50,000 is forgiven, you would likely owe taxes on that full amount. Proper financial planning, including setting aside funds to cover this potential tax liability, is essential.

Examples of IBR’s Impact on Tax Liability

Let’s consider two scenarios. Scenario A: A borrower makes consistent IBR payments for 20 years, paying primarily interest in the early years and gradually more principal in later years. They receive a 1098-E form annually, deducting interest paid, reducing their taxable income each year. Scenario B: After 25 years of IBR payments, the borrower has $40,000 of their loan forgiven. In the year of forgiveness, they must report this $40,000 as income, potentially leading to a substantial tax bill. This underscores the importance of planning for this potential tax liability. The actual tax impact will depend on individual circumstances, including tax bracket and other income sources.

Flowchart Illustrating Tax Implications of IBR

[Diagram description: The flowchart would begin with a box labeled “Start: IBR Payments Begin.” An arrow would lead to a decision box: “Is the payment interest or principal?” If “Interest,” an arrow would lead to a box: “Deduct interest from taxable income (using 1098-E form).” If “Principal,” an arrow would lead to a box: “Principal is not tax deductible.” Both arrows would then converge into a box: “Continue IBR Payments.” After a certain period, an arrow would lead to a decision box: “Is loan forgiveness triggered?” If “Yes,” an arrow would lead to a box: “Report forgiven amount as income.” If “No,” an arrow would lead to a box: “Continue IBR Payments (or loan repayment).” Both arrows would then converge into a box labeled “End.”]

Comparing IBR with Other Repayment Plans

Choosing a student loan repayment plan is a crucial decision impacting your finances for years to come. While Income-Based Repayment (IBR) is a popular option, it’s essential to understand how it stacks up against other federal repayment plans to determine the best fit for your individual circumstances. This comparison will highlight the key differences and help you make an informed choice.

Several federal repayment plans are designed to help borrowers manage their student loan debt based on their income. Each plan has its own calculation method, payment amounts, and loan forgiveness provisions. Understanding these nuances is key to selecting the most advantageous plan.

IBR, PAYE, REPAYE, and ICR Plan Differences

The primary differences between IBR, PAYE (Pay As You Earn), REPAYE (Revised Pay As You Earn), and ICR (Income Contingent Repayment) lie in their eligibility requirements, payment calculations, and potential for loan forgiveness. While all four are income-driven repayment (IDR) plans, subtle variations can significantly affect your monthly payments and the amount of debt forgiven after a specified period.

| Feature | IBR | PAYE | REPAYE | ICR |

|---|---|---|---|---|

| Eligibility | Loans disbursed before 7/1/2014; some restrictions apply | Loans disbursed after 10/1/2007; some restrictions apply | Loans disbursed after 10/1/2014; some restrictions apply | Loans disbursed before 7/1/2014; some restrictions apply |

| Payment Calculation | 10-15% of discretionary income; specific calculation depends on loan disbursement date. | 10% of discretionary income | 10% of discretionary income; Higher payments than PAYE, but lower than IBR for some borrowers. | 20% of discretionary income |

| Loan Forgiveness | After 20 or 25 years of payments, depending on loan disbursement date. | After 20 years of payments. | After 20 or 25 years of payments, depending on loan type and disbursement date. | After 25 years of payments. |

| Interest Accrual | Accrued interest may be capitalized. | Accrued interest may be capitalized. | Subsidized loans do not accrue interest while in repayment; unsubsidized loans do. | Accrued interest may be capitalized. |

Advantages and Disadvantages of Choosing IBR

Choosing IBR over other plans presents both advantages and disadvantages. A key advantage is the potential for lower monthly payments, especially in the early years of repayment, making it manageable for borrowers with lower incomes. However, a disadvantage is the longer repayment period, potentially leading to more interest paid over the life of the loan and a larger total repayment amount. The potential for loan forgiveness is another advantage, though the lengthy timeframe should be considered. The specific terms and conditions, particularly concerning loan forgiveness, can differ significantly based on the disbursement date of your loans.

Impact of IBR on Credit Score

Choosing an Income-Based Repayment (IBR) plan can significantly impact your credit score, both positively and negatively. Understanding these potential effects is crucial for making informed financial decisions. While IBR offers flexibility in managing student loan debt, its influence on your credit report needs careful consideration.

On-time payments under an IBR plan are reported to the credit bureaus, just like payments on any other loan. Consistent, timely payments are a cornerstone of a healthy credit score. Conversely, missed or late payments, even if due to unforeseen circumstances, can negatively impact your creditworthiness. The severity of the impact depends on the frequency and duration of late payments.

On-Time Payments and Creditworthiness

Making on-time payments under an IBR plan is vital for maintaining a good credit score. Each on-time payment contributes to your payment history, a significant factor in credit scoring models. A consistent history of on-time payments demonstrates responsible borrowing behavior, leading to a higher credit score. Conversely, late or missed payments, even if the amount is small, negatively impact your credit score and can remain on your report for seven years. This can make it harder to secure loans, rent an apartment, or even get a job in the future. Therefore, prioritizing on-time payments, even if the monthly payment amount is low under IBR, is essential.

Strategies for Maintaining a Good Credit Score While on IBR

Maintaining a good credit score while on an IBR plan requires proactive financial management. Budgeting carefully to ensure consistent on-time payments is paramount. Consider setting up automatic payments to avoid accidental late payments. Monitoring your credit report regularly helps identify and address any errors promptly. A strong credit score is not only beneficial for future borrowing but also reflects responsible financial behavior. By diligently managing your IBR payments and practicing good credit habits, you can safeguard your creditworthiness.

IBR’s Effect on Credit Reports

IBR plans are reflected on your credit report as any other loan. The key information reported includes the loan amount, payment history (including any late payments), and account status (current, delinquent, or paid in full). The credit bureaus use this information to calculate your credit score. While the lower monthly payments of an IBR plan might seem beneficial, consistently making those payments on time is what truly matters. Late or missed payments, even under IBR, will negatively affect your credit score. Understanding how your IBR payments are reported and managing your finances accordingly is essential for maintaining a positive credit history.

Navigating Challenges with IBR

Income-Based Repayment (IBR) plans, while offering significant relief to borrowers struggling with student loan debt, are not without their challenges. Understanding these potential hurdles and developing strategies to overcome them is crucial for successfully managing your repayment journey. This section will explore common difficulties, solutions, and situations where IBR might not be the most suitable option.

Common Challenges Faced by IBR Borrowers

Many borrowers encounter difficulties navigating the complexities of IBR. These challenges often stem from fluctuating incomes, inconsistent documentation requirements, and the potential for unexpected changes in plan parameters. For example, self-employed individuals may face challenges accurately reporting their income, leading to inaccurate payment calculations. Similarly, changes in family size or employment status can impact eligibility and payment amounts, requiring timely updates to avoid penalties or accruing additional debt. Furthermore, understanding the intricacies of the forgiveness process can be daunting for many borrowers.

Strategies for Addressing IBR Difficulties

Proactive planning and meticulous record-keeping are essential for minimizing difficulties with IBR. Regularly reviewing your payment plan and ensuring your income information is accurate and up-to-date is crucial. Maintaining comprehensive records of all income documentation, payment confirmations, and communications with your loan servicer can prove invaluable in resolving any disputes or discrepancies. If you anticipate a significant change in your income, promptly notify your loan servicer to adjust your payment plan accordingly. Seeking professional guidance from a financial advisor or student loan counselor can also provide valuable support in navigating the complexities of IBR.

Situations Where IBR Might Not Be the Best Option

While IBR offers significant benefits, it’s not always the optimal repayment plan for every borrower. For example, high-income earners might find that other repayment plans, such as the Standard Repayment Plan, offer a faster path to loan repayment without the potential for higher long-term interest accrual associated with longer repayment periods. Similarly, borrowers with relatively small loan balances may find that other plans lead to faster debt elimination. Careful consideration of individual financial circumstances and long-term goals is crucial in determining the most suitable repayment strategy. A comprehensive comparison of different repayment plans, considering factors such as interest rates, loan balance, and income projections, is recommended before making a decision.

Resolving Issues with IBR Payments or Documentation

Addressing issues with IBR payments or documentation requires a systematic approach. Begin by thoroughly reviewing your loan documents and payment history to identify the specific problem. If you encounter discrepancies in your payment calculations, contact your loan servicer immediately to request a review and clarification. Provide all necessary documentation, such as tax returns and pay stubs, to support your claim. Maintain detailed records of all communications with your loan servicer, including dates, times, and the names of individuals you spoke with. If the issue remains unresolved, consider escalating the matter to the Department of Education’s Federal Student Aid office or seeking assistance from a consumer protection agency. Remember, persistence and thorough documentation are key to resolving payment or documentation issues effectively.

Long-Term Effects of IBR

Choosing an Income-Based Repayment (IBR) plan for student loans has significant long-term financial implications, impacting your overall financial health well beyond the repayment period. Understanding these effects is crucial for making informed decisions about your financial future. While IBR offers immediate relief by lowering monthly payments, it’s essential to consider the broader consequences.

The primary long-term effect of IBR is the extended repayment period. Lower monthly payments translate to a longer repayment timeline, potentially spanning 20 or even 25 years. This means you’ll pay significantly more in interest over the life of the loan compared to a standard repayment plan. The cumulative interest can substantially increase the total cost of your education. For example, a $50,000 loan with a 6% interest rate could cost significantly more under IBR than under a standard 10-year plan. This increased interest burden can affect your ability to save for retirement, purchase a home, or achieve other long-term financial goals.

Potential Benefits of Long-Term IBR

While the increased interest is a significant drawback, IBR can offer benefits for borrowers facing immediate financial hardship. The lower monthly payments can provide much-needed breathing room in a tight budget, allowing for better management of other expenses and potentially preventing defaults. This improved financial stability can lead to better credit scores in the long run, assuming responsible repayment behavior is maintained. For some borrowers, the potential for loan forgiveness after 20 or 25 years of qualifying payments might offset the increased interest costs. However, this forgiveness is contingent upon meeting stringent eligibility requirements, and changes in government policy could impact its availability.

Potential Drawbacks of Long-Term IBR

The extended repayment period and accrued interest are the most significant drawbacks. The cumulative interest paid can be substantial, impacting long-term savings and investment opportunities. For instance, the extra money paid towards interest under IBR could have been used for a down payment on a house or to start a retirement fund. Furthermore, the potential for loan forgiveness is not guaranteed. Changes in government policies or unexpected life events could prevent a borrower from reaching the required payment threshold for forgiveness. This uncertainty necessitates careful long-term financial planning.

Impact of IBR on Long-Term Financial Planning

IBR can significantly influence long-term financial planning. The extended repayment period needs to be factored into budgeting and savings goals. For example, a borrower planning for retirement should adjust their savings projections to account for the increased loan payments and interest. Furthermore, significant life events like marriage, starting a family, or purchasing a home will require careful consideration of the IBR plan’s impact on available funds. Financial advisors can help borrowers incorporate IBR into a comprehensive financial strategy, mitigating potential risks and maximizing long-term financial health.

Illustrative Representation of Long-Term IBR Effects

Imagine a bar graph. The X-axis represents time (in years), showing a standard repayment plan (10 years) and an IBR plan (25 years). The Y-axis represents total cost (principal + interest). The standard repayment plan bar would be shorter and thinner, representing a lower total cost. The IBR plan bar would be significantly taller and wider, reflecting a much higher total cost due to accumulated interest. However, a smaller bar alongside the IBR bar could represent the monthly payment amount, highlighting the immediate affordability of IBR despite its long-term cost implications. The graph visually emphasizes the trade-off between lower monthly payments and a higher overall cost.

Last Recap

Successfully managing student loan debt requires careful planning and a thorough understanding of available repayment options. Income-Based Repayment (IBR) plans provide a valuable tool for borrowers facing financial challenges, offering a path towards manageable monthly payments and potential loan forgiveness. While IBR offers significant benefits, it’s crucial to weigh its long-term implications and understand its potential impact on your credit score and tax liability. By carefully considering your individual circumstances and utilizing the information provided in this guide, you can confidently navigate the complexities of student loan repayment and chart a course towards a secure financial future.

Questions and Answers

What happens if my income changes while on an IBR plan?

You should update your income information with your loan servicer. Your monthly payment will be recalculated based on your new income.

Can I switch from one IBR plan to another?

Generally, yes. However, there may be limitations depending on your loan type and servicer. Contact your loan servicer for specifics.

What if I miss an IBR payment?

Missing payments can negatively impact your credit score and potentially lead to loan default. Contact your servicer immediately if you anticipate difficulty making a payment.

Does IBR apply to all federal student loans?

No, eligibility depends on the type of loan and when it was disbursed. Check with your loan servicer for details on your specific loans.