Navigating the complexities of student loan repayment can feel overwhelming, but understanding Income-Based Repayment (IBR) plans can significantly alleviate financial stress. This guide provides a comprehensive overview of the student loan IBR application process, from eligibility criteria and documentation requirements to managing your plan and exploring loan forgiveness options. We’ll break down the intricacies of different IBR plans, offering clear explanations and practical advice to empower you in making informed decisions about your student loan debt.

We aim to demystify the application process, addressing common challenges and providing solutions for potential roadblocks. Whether you’re just starting to explore IBR or already enrolled in a plan, this resource offers valuable insights to help you effectively manage your student loan repayment and work towards financial freedom.

Understanding Income-Based Repayment (IBR) Plans

Income-Based Repayment (IBR) plans offer a lifeline to student loan borrowers struggling to manage their monthly payments. These plans adjust your monthly payment based on your income and family size, making repayment more manageable. Understanding the nuances of each plan is crucial to selecting the best option for your individual circumstances.

IBR Plan Types and Eligibility

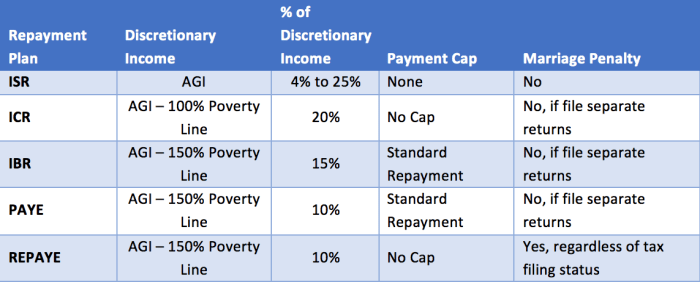

Several IBR plans exist, each with specific eligibility requirements. The most common are Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), and Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). Eligibility generally requires having federal student loans, not currently being in default, and meeting specific income thresholds. Specific eligibility criteria can vary depending on the plan and when the loans were disbursed. For instance, some plans may have stricter requirements based on the loan type or the year the loan was taken out. It’s crucial to check the Federal Student Aid website for the most up-to-date and accurate eligibility information.

Income Calculation for IBR

The calculation of your adjusted gross income (AGI) for IBR purposes is based on your tax return. The Department of Education typically uses your AGI from two years prior. For example, if you apply for IBR in 2024, your 2022 tax return will be used to determine your income. This AGI is then adjusted for family size using poverty guidelines. The resulting figure determines your monthly payment. For married couples filing jointly, both spouses’ incomes are considered. Self-employed individuals will need to provide documentation of their income, potentially including tax returns and financial statements. Specific calculations vary slightly depending on the IBR plan selected.

Benefits and Drawbacks of IBR Plans

IBR plans offer significant benefits, primarily the lower monthly payments, which can help borrowers avoid delinquency and default. Lower payments can also free up funds for other financial priorities. However, IBR plans often lead to longer repayment periods, potentially resulting in paying more interest over the life of the loan. Furthermore, the remaining loan balance after 20 or 25 years (depending on the plan) may be forgiven, but this forgiveness is considered taxable income. This means you’ll have to pay taxes on the forgiven amount in the year it’s forgiven. Careful consideration of these long-term implications is essential.

Comparison of IBR Plan Features

| Plan | Maximum Repayment Period | Income Calculation | Forgiveness After |

|---|---|---|---|

| IBR | 25 years | AGI from 2 years prior, adjusted for family size | 25 years |

| ICR | 25 years | AGI from 2 years prior, adjusted for family size | 25 years |

| PAYE | 20 years | AGI from 2 years prior, adjusted for family size | 20 years |

| REPAYE | 20 or 25 years | AGI from 2 years prior, adjusted for family size | 20 or 25 years (depending on loan type and disbursement date) |

The IBR Application Process

Applying for an Income-Based Repayment (IBR) plan can seem daunting, but understanding the process can significantly reduce stress. This section details the necessary steps, documents, and timeline involved in a successful IBR application. It aims to provide a clear and concise guide to navigate this crucial phase of student loan management.

Required Documents for IBR Application

Gathering the correct documentation is the first critical step. Incomplete applications often lead to delays. Ensuring you have all necessary materials upfront streamlines the process.

- Completed IBR Application Form: This form will request personal information, income details, and family size.

- Tax Returns (Most Recent): These are crucial for verifying your income and determining your repayment plan.

- W-2 Forms (Most Recent): These corroborate your income information provided on your tax returns.

- Pay Stubs (Recent): Pay stubs offer current income verification, especially useful if your income has fluctuated recently.

- Proof of Family Size: This may include birth certificates for dependents or marriage certificates.

- Student Loan Documentation: This includes your loan servicer’s name and your loan identification numbers.

Sample IBR Application Form

While the exact format varies by lender, a typical IBR application form would include sections for:

| Section | Information Required |

|---|---|

| Personal Information | Name, address, date of birth, social security number |

| Contact Information | Phone number, email address |

| Student Loan Details | Loan servicer name, loan ID numbers, loan balances |

| Income Information | Gross annual income, tax filing status, number of dependents |

| Supporting Documentation | Checkboxes or spaces to indicate attached documents |

| Signature | Space for applicant signature and date |

Online Application Process and Potential Challenges

Most IBR applications are submitted online through your student loan servicer’s website. The process usually involves creating an account (if you don’t already have one), completing the online form, and uploading supporting documents. Potential challenges include website navigation difficulties, technical glitches, and issues uploading large files. It’s important to allow ample time for the process and to have reliable internet access.

Submitting Supporting Documentation

After completing the online application form, you’ll need to upload or submit your supporting documents. Ensure all documents are clear, legible, and accurately reflect the information provided in the application. Many servicers offer online document upload portals; others may require mailed copies. Always keep copies of all submitted documents for your records.

IBR Application Timeline

The processing time for IBR applications varies depending on the servicer and the complexity of your application. However, a reasonable timeline to expect might be:

- Application Submission: The date you submit your completed application and supporting documents.

- Processing Time: This can range from a few weeks to several months. Expect delays if additional information is required.

- Approval/Denial Notification: You will receive official notification of your application’s status.

- Plan Implementation: Once approved, your new IBR plan will be implemented, and your monthly payments will be adjusted accordingly.

Income Verification and Documentation

Successfully navigating the income-based repayment (IBR) application process hinges on accurate and complete income verification. The lender will require documentation to confirm your reported income, ensuring your repayment plan aligns with your financial circumstances. Providing the necessary documentation correctly and efficiently is crucial for a smooth and timely approval.

Acceptable Income Documentation

Acceptable documentation varies depending on your employment status. For salaried employees, a W-2 form from your employer, covering the most recent tax year, is typically sufficient. Self-employed individuals, however, will need to provide more comprehensive documentation, such as Schedule C (Profit or Loss from Business) and Schedule SE (Self-Employment Tax) from their tax return. Other acceptable forms include pay stubs (at least three months’ worth), tax returns (federal and state), bank statements showing regular deposits consistent with reported income, and official employment letters specifying salary and employment dates. If you receive income from multiple sources, documentation from each source is required.

Handling Discrepancies in Income Reporting

Discrepancies between your reported income and the documentation provided can delay or even deny your application. If such discrepancies arise, immediately contact your loan servicer to explain the situation. Provide supporting documentation to clarify the differences, such as amended tax returns, corrected pay stubs, or letters of explanation from your employer addressing any inconsistencies. Proactive communication and thorough documentation are key to resolving these issues. For instance, if a pay stub shows a lower income than your tax return, a letter from your employer explaining a bonus payment reflected only on your tax return would help clarify the discrepancy.

Appealing an Income Verification Denial

If your IBR application is denied due to income verification issues, you have the right to appeal. The appeal process usually involves submitting additional documentation to support your income claim and clearly outlining why the initial verification was inaccurate. Carefully review the denial letter to understand the specific reasons for the denial and address them directly in your appeal. Including all relevant documentation and a detailed explanation of any errors will significantly improve the chances of a successful appeal. Remember to keep copies of all documentation submitted during the appeal process.

Accurately Reporting Self-Employment Income

Accurately reporting self-employment income requires careful attention to detail. Use your most recent tax return (including Schedules C and SE) as the primary source of information. Ensure all income and expenses are accurately reported, as these figures directly impact your calculated income for the IBR plan. If your income fluctuates significantly throughout the year, consider providing an average income calculation based on several years of tax returns or providing detailed financial statements showing a clear trend of income. Remember to maintain thorough records of your business income and expenses throughout the year to simplify the reporting process.

Common Income Verification Errors and How to Avoid Them

Preventing errors during the income verification process is vital for a smooth application. The following list highlights common mistakes and how to avoid them:

- Inconsistent Income Reporting: Ensure your reported income is consistent across all documentation (application, tax returns, pay stubs). Avoid discrepancies by carefully reviewing all documents before submission.

- Missing Documentation: Gather all required documents *before* submitting your application. Check the lender’s requirements to ensure you have everything needed.

- Incomplete or Unclear Documentation: Ensure all documents are legible, complete, and clearly show your name, income, and relevant dates. Avoid submitting blurry or partially filled-out documents.

- Incorrect Tax Year: Submit tax documentation for the correct tax year specified by the lender. Using outdated information can lead to rejection.

- Untimely Submission: Submit your application and documentation well in advance of deadlines to avoid delays caused by last-minute submissions.

Managing Your IBR Plan

Successfully navigating an Income-Based Repayment (IBR) plan requires proactive management and understanding of its intricacies. This section provides guidance on maintaining your plan, updating information, and understanding potential consequences of non-compliance. Remember, consistent monitoring and timely updates are key to maximizing the benefits of your IBR plan.

Maintaining Monthly Payments

Regularly reviewing your budget and ensuring sufficient funds are allocated for your monthly IBR payment is crucial. Unexpected expenses can impact your ability to make timely payments. Consider setting up automatic payments to avoid late fees and ensure consistent contributions. Budgeting tools and financial planning resources can assist in creating a sustainable payment plan that integrates your IBR obligation. Building a financial buffer can provide a safety net for unexpected circumstances, mitigating the risk of missed payments.

Updating Income Information

Your IBR payment is recalculated based on your income. It’s essential to update your income information annually, or whenever there’s a significant change (e.g., job change, promotion, or substantial decrease in income). The process typically involves completing an online form through your loan servicer’s website, providing supporting documentation such as tax returns or pay stubs. Failing to update your income information could result in overpayments or underpayments, potentially affecting your long-term repayment strategy. Contact your loan servicer directly for specific instructions and required documentation.

Scenarios Triggering Payment Recalculation

Several events can trigger a recalculation of your IBR payment. These include changes in your adjusted gross income (AGI) as reported on your tax return, changes in your family size (e.g., marriage, birth of a child, or divorce), and changes in your employment status (e.g., job loss, significant pay raise). Significant changes in your income or family circumstances should be reported to your loan servicer promptly to ensure your payments accurately reflect your current financial situation. A change in your loan servicer may also necessitate a payment recalculation to reflect their specific processes and procedures.

Impact of Job Changes or Family Size Changes

Job changes, particularly those resulting in a significant salary increase or decrease, directly impact your IBR payment. A higher income will likely lead to higher monthly payments, while a lower income may result in lower payments. Similarly, changes in family size influence your payment calculation, as IBR plans often consider the number of dependents. An increase in family size may lower your monthly payments, reflecting the increased financial burden. It’s important to promptly notify your loan servicer of any such changes to ensure your payments are adjusted accordingly.

Consequences of Non-Compliance

Non-compliance with IBR terms can have serious consequences. These consequences can include late payment fees, damage to your credit score, and ultimately, loan default. Defaulting on your student loans can lead to wage garnishment, tax refund offset, and difficulty obtaining future loans or credit. In some cases, the government may pursue legal action to recover the outstanding debt.

| Consequence | Severity | Impact | Potential Mitigation |

|---|---|---|---|

| Late Payment Fees | Low to Moderate | Additional charges added to your loan balance | Make timely payments; set up automatic payments |

| Negative Credit Report | Moderate to High | Damage to credit score; difficulty obtaining credit | Communicate with your servicer; explore repayment options |

| Loan Default | High | Wage garnishment; tax refund offset; legal action | Seek assistance through loan rehabilitation programs |

| Collection Agency Involvement | High | Aggressive debt collection tactics | Negotiate a repayment plan with the collection agency |

Forgiveness and Loan Discharge Under IBR

Income-Based Repayment (IBR) plans offer the possibility of loan forgiveness after a set number of qualifying payments. Understanding the requirements, application process, and tax implications is crucial for borrowers hoping to benefit from this program. This section details the process and associated considerations.

Loan Forgiveness Requirements Under IBR

Eligibility for loan forgiveness under IBR depends on several factors, primarily the type of federal student loan and the length of time you’ve made qualifying payments. Generally, you must make 240 qualifying monthly payments under an IBR plan (20 years) for undergraduate loans or 252 qualifying monthly payments (21 years) for graduate loans. The specific requirements can vary slightly depending on the type of IBR plan (IBR, PAYE, REPAYE) and when you entered repayment. Furthermore, the type of loan also impacts forgiveness – consolidation loans may be subject to different rules. It’s essential to check your specific loan servicer’s website or contact them directly for precise details about your loan’s forgiveness requirements.

The IBR Loan Forgiveness Application Process

Applying for loan forgiveness isn’t automatic. Once you’ve made the required number of qualifying payments, you must actively apply through your loan servicer. This typically involves submitting documentation proving your payment history and income. The application process can take several months, so it’s important to start the process well in advance of reaching the 240 or 252 payment milestone. Your servicer will review your application and determine your eligibility for forgiveness. If approved, the remaining balance on your eligible loans will be discharged.

Tax Implications of Loan Forgiveness

A significant consideration is the tax implications of loan forgiveness. Generally, the amount of forgiven student loan debt is considered taxable income. This means you will likely owe federal and potentially state income taxes on the forgiven amount. However, there are some exceptions, such as if the loan was discharged due to total and permanent disability or death. It’s highly recommended to consult with a tax professional to understand the potential tax implications specific to your situation and plan accordingly. For example, if $50,000 in student loan debt is forgiven, this $50,000 will be added to your taxable income for the year of forgiveness.

Examples of Loan Forgiveness Scenarios

Several scenarios can lead to loan forgiveness under IBR. For instance, a borrower with undergraduate loans who consistently makes qualifying monthly payments under an IBR plan for 20 years (240 payments) will typically be eligible for forgiveness. Similarly, a borrower with graduate loans making qualifying payments for 21 years (252 payments) would meet the requirements. However, if a borrower misses payments or doesn’t maintain an IBR plan for the entire duration, they might not qualify for forgiveness. It’s also important to note that only certain federal student loans qualify for IBR and subsequent forgiveness. Private student loans do not qualify for this program.

Calculating Remaining Loan Balance After IBR Payments

Calculating the remaining loan balance after a period of IBR payments requires knowing your initial loan balance, the interest rate, the monthly payment amount (which changes based on income), and the number of payments made. While this calculation can be complex and depends on the specific terms of your loan, you can utilize loan calculators available online or provided by your loan servicer. These tools often allow you to input your loan details and project your remaining balance over time. For example, if a borrower started with a $60,000 loan, made 120 qualifying payments under IBR, and the remaining balance after interest accrual is $30,000, then the remaining balance is $30,000. This is a simplified example; the actual calculation incorporates the fluctuating monthly payment amount and the interest accrual over the payment period.

Potential Issues and Troubleshooting

Navigating the Income-Based Repayment (IBR) application process can sometimes present challenges. Understanding common problems and their solutions can significantly streamline the process and minimize frustration. This section Artikels potential issues, offers solutions, and details strategies for effective communication with your loan servicer.

Common Application Errors

Errors during the IBR application process often stem from incomplete or inaccurate information. These errors can range from simple data entry mistakes to more complex issues related to income verification. For example, a mismatch between reported income and tax documentation can lead to application delays or rejection. Similarly, failing to provide all necessary documentation, such as W-2 forms or tax returns, can cause significant processing delays. Finally, submitting the application after the deadline will result in a rejected application.

Resolving Application Errors

If you encounter an error message during the online application process, carefully review the message for specific instructions. Most systems will highlight the problematic field or provide a contact number for assistance. If the error is due to incorrect information, correct the data and resubmit the application. If the error is related to missing documentation, gather the necessary documents and upload them through the portal. Contacting your loan servicer directly can be beneficial for more complex errors, especially if you need clarification on required documentation or have difficulty uploading files.

The Appeal Process for Denied Applications

If your IBR application is denied, you have the right to appeal the decision. The appeal process typically involves submitting a detailed explanation of why you believe the denial was unwarranted, along with any supporting documentation that may have been overlooked during the initial review. This documentation might include updated income verification, corrected tax information, or evidence of extenuating circumstances. It’s crucial to carefully review the denial letter to understand the specific reasons for the rejection and address those points directly in your appeal. The appeal process timeline and procedures vary depending on the loan servicer, so reviewing their specific guidelines is essential.

Communicating with Loan Servicers

Effective communication with your loan servicer is crucial throughout the IBR process. Keep records of all communication, including dates, times, and the names of individuals you spoke with. When contacting your servicer, clearly state your issue and provide all relevant information. Be polite and professional, even if you’re frustrated. If you have difficulty resolving an issue through phone calls or emails, consider sending a formal written letter. Always retain copies of all correspondence for your records.

Troubleshooting Flowchart

A flowchart visualizing the troubleshooting process could look like this:

[Imagine a flowchart here. The flowchart would start with a “Problem Encountered?” box. If yes, it would branch to “Identify Problem Type (Data Entry, Missing Documents, Denial, etc.)”. Each problem type would have its own branch leading to specific solutions, such as “Correct Data and Resubmit,” “Gather Missing Documents and Upload,” “Appeal Denial Following Servicer Guidelines,” or “Contact Servicer for Assistance”. If the problem is resolved, the flowchart ends with a “Problem Resolved” box. If not, it loops back to “Contact Servicer for Assistance”.]

Ending Remarks

Successfully navigating the student loan IBR application process requires careful planning and attention to detail. By understanding the eligibility requirements, gathering necessary documentation, and diligently managing your plan, you can significantly reduce your monthly payments and potentially qualify for loan forgiveness. Remember to proactively address any challenges and maintain open communication with your loan servicer. This guide serves as a valuable tool to help you achieve your financial goals and gain control over your student loan debt. Take charge of your financial future – your path to repayment starts here.

FAQ

What happens if my income changes after I apply for IBR?

You’ll need to update your income information with your loan servicer. Failure to do so may result in inaccurate payment calculations.

Can I switch from one IBR plan to another?

Generally, yes, but there may be restrictions depending on your specific loan and servicer. Contact your servicer to explore your options.

What if my IBR application is denied?

Understand the reasons for denial and appeal the decision if you believe it’s unwarranted. Provide any additional documentation that may support your claim.

How long does the IBR application process typically take?

Processing times vary, but it can take several weeks or even months. Be patient and follow up with your servicer if you haven’t received an update.