Navigating the complexities of student loan repayment can feel overwhelming, but understanding the Income-Based Repayment (IBR) program is a crucial step towards financial freedom. This program offers a lifeline to borrowers struggling with high student loan debt, adjusting monthly payments based on income and family size. By exploring the eligibility criteria, payment calculations, and potential benefits, we aim to demystify this vital tool for responsible debt management.

This guide provides a detailed overview of the Student Loan IBR program, covering everything from eligibility requirements and payment calculations to the potential for loan forgiveness and the impact on your credit score. We’ll examine the program’s advantages and disadvantages, offering practical advice to help you make informed decisions about your repayment strategy.

Income-Based Repayment (IBR) Program Eligibility

The Income-Based Repayment (IBR) program offers a pathway to more manageable student loan payments for eligible borrowers. Understanding the eligibility requirements is crucial to determining if this program can provide financial relief. This section details the income limitations, eligible loan types, and the steps involved in confirming your eligibility.

Income Requirements for IBR Program Eligibility

Your adjusted gross income (AGI), as reported on your federal income tax return, plays a pivotal role in determining your IBR eligibility. The AGI is your gross income minus certain deductions. Generally, your AGI must be below a specific threshold relative to the poverty guideline for your family size and state of residence. The exact income limits are adjusted annually and are available on the official federal student aid website. Exceeding these limits will make you ineligible for IBR. It’s important to note that the income used for IBR calculation is your income at the time of application and will be re-evaluated periodically.

Eligible Federal Student Loans for IBR

Not all federal student loans qualify for IBR. Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans (for graduate or professional students), and Direct Consolidation Loans are typically eligible. However, Federal Family Education Loan (FFEL) Program loans generally are not eligible for IBR unless they have been consolidated into a Direct Consolidation Loan. It’s essential to check the specific loan type on your student loan statements to confirm eligibility.

Determining Eligibility for the IBR Program

Determining your eligibility involves a straightforward process:

1. Calculate your Adjusted Gross Income (AGI): Obtain your most recent federal income tax return (Form 1040) to find your AGI.

2. Determine your family size: This includes you, your spouse, and any dependents.

3. Locate the applicable poverty guideline: Consult the official federal poverty guidelines for your family size and state of residence. These guidelines are updated annually and can be found on the U.S. Department of Health and Human Services website.

4. Compare your AGI to the poverty guideline: Your AGI must be below a certain multiple of the poverty guideline to qualify for IBR. The specific multiple varies depending on the IBR plan (IBR, PAYE, REPAYE).

5. Check your loan type: Ensure your federal student loans are eligible for IBR, as explained in the previous section.

6. Apply for IBR: If you meet the income and loan type requirements, you can apply for IBR through the StudentAid.gov website.

Comparison of IBR Eligibility Criteria Across Federal Loan Programs

| Loan Program | Income Requirement | Eligible Loan Types | Application Process |

|---|---|---|---|

| IBR | AGI below a multiple of the federal poverty guideline (varies by plan) | Direct Subsidized, Unsubsidized, PLUS, and Consolidation Loans | StudentAid.gov |

| PAYE | AGI below a multiple of the federal poverty guideline | Direct Subsidized, Unsubsidized, PLUS, and Consolidation Loans | StudentAid.gov |

| REPAYE | AGI below a multiple of the federal poverty guideline | Direct Subsidized, Unsubsidized, PLUS, and Consolidation Loans | StudentAid.gov |

| ICRR | No specific income requirement; based on loan amount and repayment term | Direct Subsidized, Unsubsidized, PLUS, and Consolidation Loans | StudentAid.gov |

IBR Payment Calculation Methods

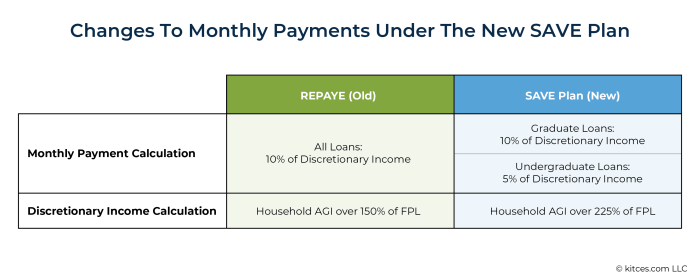

The Income-Based Repayment (IBR) program offers a flexible approach to student loan repayment, tailoring monthly payments to your income and family size. Understanding how these payments are calculated is crucial for effective financial planning. Several factors contribute to the final payment amount, and the specific formulas used can vary slightly depending on the specific IBR plan (IBR, PAYE, REPAYE).

IBR Payment Calculation Factors

Several key factors influence the calculation of your monthly IBR payment. These include your adjusted gross income (AGI), as reported on your federal tax return; your family size; the total amount of your eligible student loans; and the applicable interest rate for your loans. The formula takes into account your income relative to the poverty guideline for your family size and location. Essentially, the higher your income, the higher your payment will be, while a larger family size might lead to a slightly lower payment. The loan amount directly impacts the total payment; a larger loan balance generally translates to a higher payment, even if the income is relatively low. Furthermore, the interest rate on your loans affects the amount of interest that accrues over time, and the plan structure (IBR, PAYE, REPAYE) may also have slight variations in calculation methodology.

Comparison of IBR with Other Repayment Plans

IBR payments differ significantly from standard and graduated repayment plans. Standard repayment plans feature a fixed monthly payment over a 10-year period, regardless of income fluctuations. Graduated repayment plans start with lower payments that gradually increase over time, also spread across a 10-year period. In contrast, IBR payments are adjusted annually based on your income and family size, potentially resulting in lower payments, especially during periods of lower income. The repayment period for IBR plans is typically longer than 10 years (often 20 or 25 years), potentially leading to higher total interest paid over the life of the loan. This trade-off between lower monthly payments and potentially higher total interest is a key consideration when choosing a repayment plan.

Hypothetical IBR Payment Calculation

Let’s consider a hypothetical scenario: A borrower has $50,000 in eligible student loans with a 6% interest rate, a family size of two, and an adjusted gross income of $40,000. The exact calculation would depend on the specific IBR plan and the poverty guideline for their state. However, a simplified example might involve calculating a percentage of discretionary income (income above the poverty guideline) applied to the loan amount. For instance, if the formula indicates a 10% payment on discretionary income, and their discretionary income is $20,000 (after considering the poverty guideline for a family of two), their monthly payment could be calculated as follows: ($20,000/12 months) * 0.10 = approximately $167 per month. This is a simplified example; the actual calculation involves more complex factors and may vary based on the specific IBR plan used. Remember that this is a hypothetical scenario, and actual payments will vary depending on individual circumstances. The formula itself is complex and is not easily expressed as a single equation, as it involves multiple steps and calculations based on the federal poverty guidelines and the borrower’s specific financial information. The Department of Education’s website provides tools and resources for more accurate estimations based on individual circumstances.

IBR Program Benefits and Drawbacks

Income-Based Repayment (IBR) plans offer a potentially significant advantage to student loan borrowers, particularly those facing financial hardship. By tying monthly payments to a percentage of your discretionary income, IBR can make borrowing more manageable in the short term. However, it’s crucial to understand both the benefits and drawbacks before enrolling. Careful consideration of your individual financial circumstances is key to making an informed decision.

The primary benefit of IBR is the potential for lower monthly payments. This can be especially helpful for borrowers in lower-paying jobs or those experiencing unexpected financial setbacks. Lower monthly payments can free up funds for other essential expenses, improving overall financial stability. However, lower monthly payments often translate to a longer repayment period and potentially higher total interest paid over the life of the loan. This trade-off needs careful consideration.

IBR Program Advantages

IBR plans can provide significant relief for borrowers struggling to manage their student loan debt. Lower monthly payments can prevent delinquency and default, protecting credit scores and avoiding the serious financial consequences associated with loan default. Furthermore, some IBR plans offer loan forgiveness after a specified period of repayment, potentially eliminating a substantial portion or all of the remaining loan balance. This forgiveness aspect is particularly appealing to borrowers in public service or certain non-profit sectors.

IBR Program Disadvantages

While IBR offers significant advantages, it’s not without limitations. The most prominent disadvantage is the potential for significantly higher total interest paid over the life of the loan due to the extended repayment period. This can result in a much larger total cost compared to a standard repayment plan. Furthermore, the eligibility requirements and specific terms of IBR plans can be complex and vary depending on the type of loan and the lender. Navigating these complexities can be challenging for some borrowers. Finally, the process of obtaining loan forgiveness under IBR programs can be lengthy and requires strict adherence to specific requirements.

Examples of IBR Benefits and Detriments

Consider a recent graduate starting a career with a modest salary. An IBR plan could allow them to make manageable monthly payments, avoiding default while building their career and financial stability. However, a high-earning individual might find that an IBR plan extends their repayment unnecessarily, leading to significantly higher total interest costs. They might be better served by a standard repayment plan to pay off their debt faster. Similarly, a borrower facing a period of unemployment might find IBR a lifeline, allowing them to temporarily reduce their payments, while someone with a stable high income might not need the lower payment option and could end up paying more in interest over time.

Pros and Cons of IBR

The decision to enroll in an IBR plan should be carefully weighed based on individual circumstances.

- Pros: Lower monthly payments, improved affordability, potential for loan forgiveness, avoidance of default.

- Cons: Longer repayment period, higher total interest paid, complex eligibility requirements, lengthy loan forgiveness process.

IBR and Loan Forgiveness

The Income-Based Repayment (IBR) program offers a pathway to potential loan forgiveness for eligible borrowers. While not automatic, consistent payments under the IBR plan, coupled with meeting specific criteria, can lead to the cancellation of remaining loan balances after a set period. Understanding the requirements and potential impact of income fluctuations is crucial for borrowers aiming for loan forgiveness.

Loan Forgiveness Requirements and Timeline

Loan forgiveness under IBR is not guaranteed and depends on several factors. Generally, borrowers must make qualifying monthly payments for a specific period, typically 20 or 25 years, depending on the loan type and when the loan was originated. The exact number of payments needed may vary. For example, Direct Subsidized and Unsubsidized Loans, and Direct PLUS Loans, may require 25 years of qualifying payments for loan forgiveness. The timeline can be affected by several factors including changes in income, employment status, and adherence to program rules. Failure to make timely payments or provide accurate income information can significantly delay or prevent loan forgiveness. Borrowers should actively track their progress and maintain consistent communication with their loan servicer.

Impact of Income Changes on Loan Forgiveness Timeline

Changes in income directly affect IBR payments and consequently, the loan forgiveness timeline. A decrease in income will typically result in lower monthly payments, potentially extending the time it takes to reach the required payment threshold for forgiveness. Conversely, an increase in income may lead to higher payments, potentially shortening the timeline. The calculation of your monthly payment is based on your income and family size, so any changes in either will result in a recalculation. For example, a borrower experiencing a significant career change resulting in reduced income may find their payment significantly lowered, leading to a longer repayment period before loan forgiveness is achieved. Conversely, a promotion or salary increase would lead to higher payments, potentially speeding up the process. Regularly updating your income information with your loan servicer is essential to ensure your payments are accurately calculated and your forgiveness timeline is properly adjusted.

Visual Representation of the IBR Loan Forgiveness Process

A flowchart can visually represent the steps involved in pursuing loan forgiveness under IBR.

[Imagine a flowchart here. The flowchart would begin with “Apply for IBR,” leading to “Income Certification,” then “Payment Calculation,” followed by “Make Monthly Payments.” A decision point would branch from “Make Monthly Payments,” leading to “Qualifying Payments Made?” A “Yes” branch would lead to “Reach Payment Threshold?” A “Yes” branch from there would lead to “Loan Forgiveness,” while a “No” branch would loop back to “Make Monthly Payments.” A “No” branch from “Qualifying Payments Made?” would lead to “Review Payment History and Income.” A separate branch would show the impact of income changes on the timeline, potentially extending or shortening the path to loan forgiveness.]

The flowchart illustrates the iterative nature of the process, highlighting the importance of consistent payments and regular income updates for efficient progress toward loan forgiveness. Each step is crucial, and any deviation could significantly impact the overall timeline.

IBR Program Enrollment and Management

Successfully navigating the Income-Based Repayment (IBR) program requires understanding the enrollment process, managing your income updates, and maintaining consistent payments. This section details the key steps involved in managing your IBR plan effectively.

IBR Program Enrollment

To enroll in an IBR plan, you must first consolidate your federal student loans if you have multiple loans from different lenders. This combines your loans into a single loan with a single servicer. After consolidation, you can apply for IBR through your loan servicer’s website or by contacting them directly. You will need to provide your income and family size information to determine your monthly payment amount. The application process typically involves completing an online form and providing supporting documentation, such as tax returns or pay stubs. Once approved, your monthly payment will be recalculated based on your income and family size.

Updating Income Information

Your income information is crucial for accurate IBR payment calculations. It’s essential to update your loan servicer annually, or whenever your income changes significantly. This typically involves submitting updated tax returns or pay stubs through your online account or by mail. Failure to update your income information can result in overpayments or underpayments, potentially impacting your long-term repayment plan and eligibility for loan forgiveness. The specific documentation required and the process for submitting it may vary depending on your loan servicer.

Managing IBR Payments and Avoiding Delinquency

Maintaining consistent payments is key to avoiding delinquency and potential negative consequences, such as damage to your credit score and the loss of loan forgiveness benefits. Set up automatic payments through your bank account or use online bill pay to ensure timely payments. Regularly review your account statements to verify payment amounts and ensure that your payments are being properly credited. If you anticipate difficulty making a payment, contact your loan servicer immediately to explore options such as deferment or forbearance. Proactive communication can prevent delinquency and help you stay on track with your repayment plan.

Sample Communication from Loan Servicer

Subject: Important Update Regarding Your Income-Based Repayment (IBR) Plan

Dear [Borrower Name],

This letter is to inform you about important updates concerning your Income-Based Repayment (IBR) plan. As per your most recent income documentation, your monthly payment has been recalculated to $[New Monthly Payment Amount], effective [Effective Date]. This adjustment reflects changes in your reported income. Your new payment schedule is available for review on your online account at [Website Address].

Remember to update your income information annually, or whenever there is a significant change in your income, by [Date] to ensure your monthly payments accurately reflect your current financial situation. Failure to do so may result in inaccurate payment calculations.

If you have any questions or require further assistance, please do not hesitate to contact us at [Phone Number] or reply to this email.

Sincerely,

[Loan Servicer Name]

Impact of IBR on Credit Score

Income-Based Repayment (IBR) plans can significantly impact your credit score, both positively and negatively. Understanding these effects is crucial for making informed decisions about your repayment strategy. The key factor determining the impact is your consistent and timely payment behavior.

IBR, like other repayment plans, reports your payment activity to the credit bureaus. This means on-time payments contribute positively to your credit score, while late or missed payments negatively impact it. The magnitude of the impact depends on several factors, including your overall credit history, the severity of any delinquencies, and the proportion of your debt represented by your student loans. Generally, consistent on-time payments, regardless of the repayment plan, are vital for building and maintaining a strong credit score.

On-Time versus Late IBR Payments

Consistent on-time payments under an IBR plan will build your credit history in a positive way, much like any other loan repayment. This consistent positive reporting helps improve your credit utilization ratio (the amount of credit you use compared to your total available credit), and demonstrates responsible financial behavior. Conversely, late or missed payments will negatively affect your credit score. These late payments can lead to a lower credit score, making it more difficult to secure loans, credit cards, or even rent an apartment in the future. The severity of the negative impact is directly proportional to the number and duration of late payments. For example, consistently missing payments for several months can significantly lower your score, potentially impacting your ability to obtain favorable interest rates on future loans.

Comparison of IBR with Other Repayment Plans

The impact of IBR on your credit score is generally similar to other repayment plans, such as Standard Repayment or Graduated Repayment. The crucial element remains consistent on-time payments. However, the lower monthly payments offered by IBR might make it easier for some borrowers to consistently make on-time payments compared to plans with higher monthly payments. Conversely, some borrowers may find that the longer repayment period associated with IBR (and potentially the accumulation of interest) leads to more overall debt and a longer period of negative credit reporting related to the loan.

Long-Term Credit Score Effects of IBR

The long-term impact of IBR on your credit score depends heavily on responsible repayment behavior. If you consistently make on-time payments throughout the life of your loans, your credit score will likely benefit, especially if you start with a low credit score. On the other hand, if you struggle to make consistent payments, even with the lower monthly payments of IBR, the long-term effect on your credit score could be detrimental. It’s essential to remember that a good credit score is crucial for securing favorable terms on future financial products and opportunities. The prolonged repayment period under IBR, coupled with the accumulation of interest, might not show immediate benefits, but the consistent positive reporting of on-time payments will eventually improve your score over time. For example, a borrower who initially had a poor credit score and utilized IBR, making all payments on time, may see a significant increase in their score over a five to ten-year period, opening doors to better financial opportunities. Conversely, a borrower with a good credit score who repeatedly misses payments under IBR may see their score significantly decrease, potentially resulting in difficulties securing future loans.

IBR and Different Life Stages

Income-Based Repayment (IBR) plans are designed to be flexible and adapt to the ever-changing circumstances of borrowers’ lives. Understanding how IBR adjusts to different life stages is crucial for maximizing its benefits and avoiding potential pitfalls. This section explores how IBR handles significant life events and offers strategies for navigating financial challenges.

IBR’s adaptability to life changes is a key advantage. The program recalculates payments periodically, typically annually, based on your adjusted gross income (AGI) and family size. This means that if your income decreases, your payments will also decrease, providing crucial financial relief during difficult times. Conversely, if your income increases, your payments may increase, reflecting your improved financial capacity.

IBR and Job Loss or Unemployment

Facing job loss or unemployment can be incredibly stressful, and managing student loan payments adds another layer of difficulty. IBR provides a vital safety net during these periods. When your income drops significantly, your IBR payment will be recalculated to a lower amount, potentially reducing your monthly payment to a manageable level, or even to $0 in some cases, depending on your income and family size. This prevents borrowers from falling behind on their loans and allows them to focus on finding new employment. For example, a borrower making $60,000 annually might see their monthly payment significantly reduced if their income falls to $20,000 due to unemployment.

IBR and Marriage and Children

Major life events like marriage and having children often lead to significant changes in income and expenses. IBR acknowledges these changes by factoring in family size when calculating your payments. The addition of a spouse’s income (if applicable) and increased expenses associated with children will influence your payment amount. While the inclusion of a spouse’s income might lead to a higher payment, the program still provides a more manageable payment plan compared to a standard repayment plan. The increase in expenses related to childcare might offset any income increase, keeping the monthly payments relatively consistent.

IBR and Financial Hardship

IBR offers several options for borrowers facing financial hardship. Besides the automatic recalculation of payments based on income changes, borrowers may be able to request a forbearance or deferment. These options temporarily suspend or reduce payments, providing much-needed breathing room during periods of financial strain. However, it’s crucial to remember that interest may continue to accrue during forbearance or deferment, potentially increasing the total loan amount over time. It’s essential to carefully weigh the pros and cons of these options and explore them with your loan servicer.

Examples of IBR Benefits During Low Income or Unemployment

Let’s consider a few scenarios to illustrate IBR’s benefits:

* Scenario 1: A borrower earning $40,000 annually loses their job and experiences a period of unemployment. Their IBR payment could be significantly reduced, potentially to $0, allowing them to focus on finding new employment without the added pressure of student loan payments.

* Scenario 2: A borrower with a high-income job experiences a pay cut due to a company restructuring. Their IBR payment will adjust downwards to reflect their reduced income, preventing them from becoming overwhelmed by their loan payments.

* Scenario 3: A borrower has a child and experiences a decrease in available income due to childcare expenses. IBR will take the increase in family size into account, potentially lowering their monthly payment.

IBR Payment Changes at Different Life Stages

| Life Stage | Income | Family Size | Approximate Monthly IBR Payment |

|---|---|---|---|

| Single, Recent Graduate | $40,000 | 1 | $300 |

| Married, One Child | $60,000 (combined) | 3 | $400 |

| Job Loss, Unemployment | $15,000 | 1 | $50 |

| Return to Employment | $50,000 | 1 | $350 |

*Note: These are illustrative examples only. Actual payments will vary based on individual loan amounts, interest rates, and income verification processes.*

Last Recap

The Student Loan IBR program presents a powerful option for managing student loan debt, offering flexibility and potential long-term benefits. While it’s not a one-size-fits-all solution, understanding its intricacies empowers borrowers to make informed choices that align with their individual financial circumstances. By carefully considering eligibility, payment calculations, and potential consequences, you can harness the power of IBR to navigate your student loan journey effectively and responsibly.

Key Questions Answered

What happens if my income changes during the IBR repayment period?

You must update your income information with your loan servicer. Failure to do so could result in inaccurate payment calculations.

Can I switch from another repayment plan to IBR?

Yes, you can typically switch to IBR from other federal student loan repayment plans. Check with your loan servicer for specific procedures.

Does IBR affect my eligibility for other federal aid programs?

It may. IBR participation could impact your eligibility for certain other federal programs. Consult the relevant government websites for details.

What if I miss an IBR payment?

Missing payments can negatively impact your credit score and may lead to penalties or further collection actions. Contact your servicer immediately if you anticipate difficulties making a payment.