Navigating the complexities of student loan repayment can feel overwhelming, but understanding Income-Driven Repayment (IDR) plans is crucial for borrowers seeking manageable monthly payments and potential loan forgiveness. This guide delves into the intricacies of various IDR plans, offering a clear path to financial stability and long-term debt management. We’ll explore eligibility criteria, payment calculations, forgiveness options, and potential impacts on your credit score, empowering you to make informed decisions about your student loan repayment journey.

From understanding the differences between ICR, PAYE, REPAYE, and IBR plans to calculating your monthly payments and assessing the long-term implications, this resource provides a comprehensive overview. We’ll equip you with the knowledge needed to select the plan that best aligns with your financial situation and long-term goals, ultimately paving the way for a more secure financial future.

Income-Driven Repayment (IDR) Plan Eligibility

Securing an Income-Driven Repayment (IDR) plan can significantly ease the burden of student loan debt. These plans base your monthly payments on your income and family size, offering potentially lower payments than standard repayment plans. However, eligibility requirements vary depending on the specific IDR plan and your individual circumstances. Understanding these requirements is crucial before applying.

Eligibility for IDR plans hinges primarily on your income and the type of federal student loans you possess. Generally, you must have federal student loans (not private loans) to qualify. The specific income thresholds and application processes differ slightly between the various IDR plans, including Income-Based Repayment (IBR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Contingent Repayment (ICR).

Income Requirements for Various IDR Plans

The income requirements for IDR plans are not fixed amounts; they are calculated based on your Adjusted Gross Income (AGI) as reported on your federal tax return. The AGI is your gross income less certain deductions. Each plan has its own formula for determining your monthly payment, but all consider your AGI, family size, and loan balance. While precise thresholds aren’t universally stated, a lower AGI generally results in a lower monthly payment. For example, a single borrower with a low AGI and significant student loan debt might qualify for a significantly reduced monthly payment compared to a higher-earning individual with the same loan balance. The Department of Education’s website provides the most up-to-date calculation formulas for each plan.

Applying for an IDR Plan

The application process generally involves completing a new application through the StudentAid.gov website. You’ll need to provide information about your income, family size, and your federal student loans. This usually involves linking your Federal Student Aid account and providing your tax information. The Department of Education will then verify your information and determine your eligibility for an IDR plan and calculate your monthly payment. You may be required to recertify your income annually or every two years, depending on the specific plan. Failing to recertify your income could lead to increased payments or loss of IDR benefits.

Determining Eligibility: A Step-by-Step Guide

- Check your loan type: Ensure your loans are federal student loans. Private loans are not eligible for IDR plans.

- Gather necessary documents: You will need your most recent federal tax return and information about your federal student loans (loan amounts, servicers, etc.).

- Visit StudentAid.gov: Access the website and log in to your account.

- Complete the application: Provide accurate information about your income, family size, and loans.

- Review and submit: Carefully review your application before submitting it. Incorrect information can delay the process or lead to ineligibility.

- Monitor your account: Track the status of your application and wait for notification of approval or denial.

Comparison of Eligibility Criteria Across Different IDR Plans

While all IDR plans consider income and loan balance, the specific formulas and eligibility requirements vary slightly. For instance, REPAYE is generally considered more generous than IBR, offering lower monthly payments for some borrowers. ICR has a different calculation formula that may result in higher payments for some borrowers compared to PAYE or REPAYE. The best plan for you will depend on your individual circumstances and financial situation. Careful comparison of the payment calculation formulas for each plan is recommended before making a decision.

Types of IDR Plans

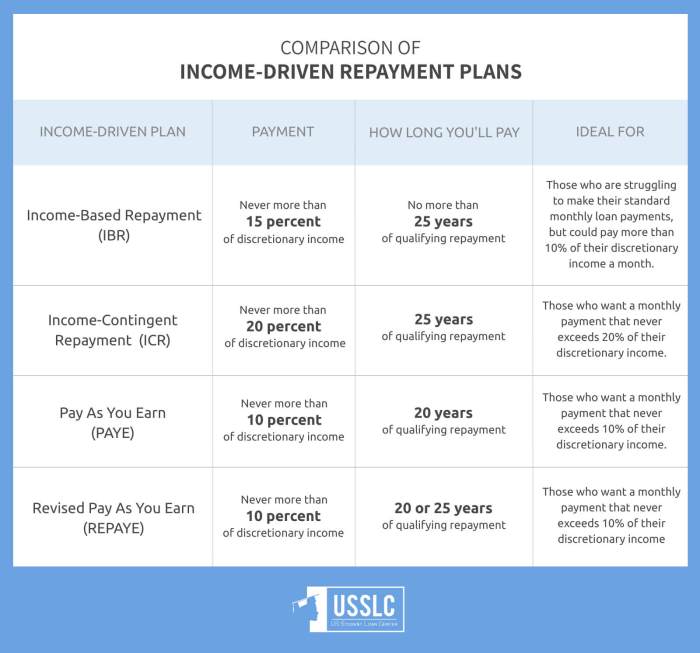

Choosing the right Income-Driven Repayment (IDR) plan is crucial for managing your student loan debt effectively. Different plans offer varying payment calculations, repayment periods, and forgiveness eligibility, impacting your long-term financial picture. Understanding these nuances is key to making an informed decision.

IDR Plan Comparison

The following table summarizes the key features of four common IDR plans: Income-Contingent Repayment (ICR), Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR). Remember that eligibility criteria and specific plan details can change, so it’s essential to check the official Federal Student Aid website for the most up-to-date information.

| Plan Name | Payment Calculation Method | Maximum Repayment Period | Forgiveness Eligibility |

|---|---|---|---|

| Income-Contingent Repayment (ICR) | Based on your discretionary income and loan amount; lower payment than standard repayment. | 25 years | Remaining balance forgiven after 25 years; tax implications apply. |

| Pay As You Earn (PAYE) | 10% of discretionary income; lower payment than standard repayment. | 20 years | Remaining balance forgiven after 20 years; tax implications apply. |

| Revised Pay As You Earn (REPAYE) | 10% of discretionary income; lower payment than standard repayment. Includes both undergraduate and graduate loans. | 20 or 25 years (depending on loan type) | Remaining balance forgiven after 20 or 25 years (depending on loan type); tax implications apply. |

| Income-Based Repayment (IBR) | 10% or 15% of discretionary income (depending on loan origination date); lower payment than standard repayment. | 25 years | Remaining balance forgiven after 25 years; tax implications apply. |

Advantages and Disadvantages of Each Plan

Each IDR plan presents a unique set of advantages and disadvantages. Carefully weighing these factors is crucial for selecting the plan that best aligns with your individual financial situation.

Income-Contingent Repayment (ICR)

Advantages: Potentially lower monthly payments than standard repayment plans.

Disadvantages: Longer repayment period (25 years), potentially leading to higher overall interest paid. Forgiveness eligibility may result in a large tax liability.

Pay As You Earn (PAYE)

Advantages: Relatively straightforward payment calculation (10% of discretionary income).

Disadvantages: Limited to loans originated after October 1, 2007. Forgiveness eligibility may result in a large tax liability.

Revised Pay As You Earn (REPAYE)

Advantages: Includes both undergraduate and graduate loans in the calculation. Potentially lower payments than other IDR plans, especially in the early years.

Disadvantages: Forgiveness eligibility may result in a large tax liability. Repayment period can be 20 or 25 years depending on loan type.

Income-Based Repayment (IBR)

Advantages: Offers flexibility with payment calculations (10% or 15% depending on loan origination date).

Disadvantages: Longer repayment period (25 years), potentially resulting in higher overall interest paid. Forgiveness eligibility may result in a large tax liability.

Long-Term Impact on Loan Repayment

The choice of IDR plan significantly impacts the long-term cost of your student loans. While lower monthly payments offer short-term relief, longer repayment periods can lead to substantially higher interest accumulation over time. For example, a borrower with a $50,000 loan might pay significantly more in total interest under a 25-year plan compared to a 10-year standard repayment plan. Furthermore, the tax implications of loan forgiveness should be carefully considered, as this can represent a substantial tax liability upon forgiveness. It’s advisable to consult with a financial advisor to project the total repayment cost under each plan and to understand the tax implications of loan forgiveness.

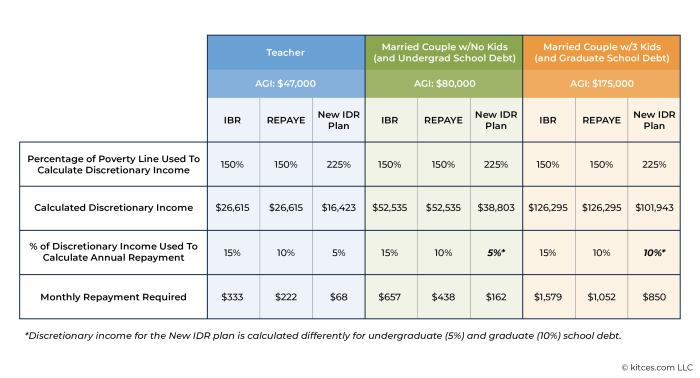

Calculating Monthly Payments Under IDR Plans

Calculating your monthly student loan payment under an Income-Driven Repayment (IDR) plan can seem complex, but understanding the underlying principles simplifies the process. Each IDR plan uses a different formula to determine your payment, based on your adjusted gross income (AGI) and your total student loan debt. The key is to accurately determine your AGI and then apply the appropriate formula for your chosen plan. Remember, these calculations are estimates, and your actual payment may vary slightly based on factors like your loan servicer and any changes to your income.

Income-Driven Repayment (IDR) Plan Payment Calculation Methods

Each IDR plan employs a unique calculation method. While the specifics vary, they generally involve comparing your AGI to a specific percentage of the poverty guideline for your family size and location. The resulting number determines your payment, often capped at a minimum or maximum amount. It’s crucial to consult the official guidelines for each plan, as these can be subject to change. These calculations are often performed by your loan servicer, but understanding the basics empowers you to verify the accuracy of your payment.

Calculating Payments: Examples Using Hypothetical Data

Let’s illustrate payment calculations using hypothetical scenarios for three common IDR plans: Revised Pay As You Earn (REPAYE), Income-Based Repayment (IBR), and Pay As You Earn (PAYE). Note that these are simplified examples and do not account for all potential factors affecting actual payments. Actual calculations involve more complex formulas and may include additional variables.

- Scenario 1: Low Income Assume an individual with $20,000 in annual AGI and $30,000 in student loan debt. Under REPAYE, IBR, and PAYE, their monthly payments would likely be significantly reduced or potentially even $0, depending on the specific plan guidelines and the poverty guideline threshold for their family size and location. The exact amount would depend on the specific formulas used by the loan servicer, taking into account factors like loan interest rates and the poverty guideline.

- Scenario 2: Moderate Income Consider an individual with $50,000 in annual AGI and $50,000 in student loan debt. Their monthly payments would be higher than in Scenario 1, but still significantly lower than a standard repayment plan. Again, the precise amount would vary based on the chosen IDR plan, the applicable formula, and the poverty guideline threshold. For example, under REPAYE, a portion of the interest may be subsidized, affecting the final payment amount.

- Scenario 3: High Income Suppose an individual with $100,000 in annual AGI and $75,000 in student loan debt. Their monthly payments under an IDR plan would likely be considerably higher than in the previous scenarios. However, even with a high income, the payment would still be calculated based on the IDR plan’s formula and would be less than a standard repayment plan’s payment. The calculation would still consider the poverty guideline threshold and the chosen plan’s specific formula, potentially leading to a payment less than what might be expected based solely on income.

Note: These examples are for illustrative purposes only. Actual payment calculations are more complex and depend on numerous factors, including the specific IDR plan, loan type, interest rate, and the individual’s AGI and family size. Always consult your loan servicer for accurate payment information.

Loan Forgiveness Under IDR Plans

Loan forgiveness under Income-Driven Repayment (IDR) plans offers the possibility of having your remaining student loan balance forgiven after a specified period of qualifying payments. However, it’s crucial to understand the requirements and potential tax implications before relying on this option. This section details the specifics of loan forgiveness under various IDR plans.

Requirements for Loan Forgiveness

Eligibility for loan forgiveness under IDR plans hinges on several factors. These include the type of loan, the specific IDR plan chosen, and consistent on-time payments for the required period. The length of the repayment period needed for forgiveness varies depending on the plan. Furthermore, income documentation must be submitted annually to certify continued eligibility. Failure to meet these requirements can result in the loss of forgiveness eligibility. For example, missing payments or providing inaccurate income information could delay or prevent forgiveness.

The Loan Forgiveness Application Process

Applying for loan forgiveness under an IDR plan usually involves a straightforward process, although the specific steps may vary slightly depending on your loan servicer. Generally, it requires submitting an application to your servicer once you’ve completed the required payment period. This application will likely involve verifying your income history and payment records. Your servicer will then review your application and notify you of the outcome. It is important to maintain meticulous records of your payments and income documentation throughout the entire repayment period to streamline the application process and minimize potential delays.

Tax Implications of Loan Forgiveness

A significant consideration is the tax implication of loan forgiveness. Currently, the amount of forgiven student loan debt is generally considered taxable income by the IRS. This means that you may be required to pay income taxes on the forgiven amount in the year it’s forgiven. However, there are exceptions and nuances, and it is advisable to consult a tax professional for personalized guidance. The tax implications can significantly impact your financial situation, so it’s vital to factor this into your long-term financial planning. For example, if $50,000 of your student loans are forgiven, you might owe taxes on that $50,000, which could amount to a substantial sum depending on your tax bracket.

IDR Plan Forgiveness Timelines

The following table summarizes the forgiveness timelines for several common IDR plans. It’s important to note that these timelines are subject to change, and it’s always best to consult the official Department of Education website for the most up-to-date information.

| Plan Name | Required Payment Period | Forgiveness Eligibility Requirements |

|---|---|---|

| Income-Based Repayment (IBR) | 20 or 25 years (depending on loan type and disbursement date) | Consistent on-time payments for the required period, annual income certification |

| Pay As You Earn (PAYE) | 20 years | Consistent on-time payments for the required period, annual income certification |

| Revised Pay As You Earn (REPAYE) | 20 or 25 years (depending on loan type and disbursement date) | Consistent on-time payments for the required period, annual income certification |

| Income-Contingent Repayment (ICR) | 25 years | Consistent on-time payments for the required period, annual income certification |

Impact of IDR Plans on Credit Score

Enrolling in an Income-Driven Repayment (IDR) plan can have a significant impact on your credit score, although the effect isn’t always negative. Understanding how your payment behavior interacts with your credit report is key to navigating this process successfully. Responsible management of your student loans under an IDR plan can help maintain or even improve your creditworthiness.

IDR plans report your payment activity to the credit bureaus, just like other loans. Consistent on-time payments will generally contribute positively to your credit score, while missed or late payments will negatively affect it. The impact depends on several factors, including your overall credit history, the severity and frequency of any missed payments, and the type of IDR plan you choose. Moreover, the specific reporting practices can vary slightly among different loan servicers.

Effect of Payment Behavior on Credit Ratings

Consistent on-time payments under an IDR plan demonstrate responsible financial behavior, which is a crucial factor in determining your credit score. These payments show lenders that you are managing your debt effectively, increasing your creditworthiness. Conversely, missed or late payments, even under an IDR plan, can severely damage your credit score. Late payments signal to lenders that you may be a higher-risk borrower, leading to lower credit scores and potentially higher interest rates on future loans. The severity of the negative impact depends on the frequency and duration of the missed payments. For example, consistently missing payments for several months can significantly lower your score, potentially making it difficult to obtain loans or rent an apartment in the future.

Scenario: Consistent vs. Missed Payments

Let’s consider two borrowers, both enrolled in an IDR plan for a $30,000 student loan. Borrower A makes every payment on time for three years. Their credit score remains stable or may even improve slightly due to the demonstration of responsible repayment behavior. Borrower B, however, misses three payments within the same three-year period. Their credit score will likely drop significantly, potentially impacting their ability to secure future credit. The magnitude of the score decrease would depend on their existing credit history and the credit scoring model used. For instance, a drop of 50-100 points is possible with multiple missed payments, significantly impacting their financial opportunities.

Recommendations for Maintaining a Good Credit Score

Maintaining a good credit score while on an IDR plan requires proactive management. First, understand your monthly payment amount and set up automatic payments to avoid missed payments. Second, regularly monitor your credit report for accuracy. Contact your loan servicer or credit bureau immediately if you notice any discrepancies. Third, communicate with your loan servicer if you anticipate any difficulty making payments. They may offer options to avoid delinquency, such as deferment or forbearance, though these options may have their own implications. Finally, consider building your credit score in other ways, such as obtaining a secured credit card and making responsible purchases. This diversified credit profile can help offset the impact of any potential negative marks associated with the student loan.

Potential Downsides and Considerations of IDR Plans

Income-Driven Repayment (IDR) plans offer significant benefits to borrowers struggling with student loan debt, but it’s crucial to understand their potential drawbacks before making a decision. While they lower monthly payments, this often comes at the cost of increased overall repayment time and higher total interest paid. A thorough understanding of these trade-offs is essential for making an informed choice.

While IDR plans can provide immediate relief from high monthly payments, several factors can negatively impact borrowers in the long run. These plans aren’t a one-size-fits-all solution, and their suitability depends heavily on individual circumstances and financial goals. Failing to fully consider these downsides can lead to unexpected financial burdens.

Higher Total Interest Paid

IDR plans typically extend the repayment period significantly. This longer repayment timeline, while beneficial for short-term affordability, results in substantially more interest accumulating over the life of the loan. For example, a $50,000 loan with a 6% interest rate might be paid off in 10 years under a standard repayment plan, accruing approximately $15,000 in interest. Under an IDR plan, the same loan might take 25 years to repay, resulting in potentially $35,000 or more in accumulated interest. This significant difference underscores the importance of carefully weighing the short-term benefits against the long-term cost.

Extended Repayment Period

The extended repayment period inherent in IDR plans can be both an advantage and a disadvantage. While lower monthly payments provide immediate relief, the longer repayment timeline means it will take considerably longer to become debt-free. This can have significant implications for long-term financial planning, such as delaying major purchases like a home or delaying retirement savings. Borrowers should carefully consider how a significantly extended repayment schedule will affect their overall financial goals.

Potential for Loan Forgiveness Complications

While loan forgiveness is a potential benefit of IDR plans, the process is complex and subject to change. Eligibility requirements can be stringent, and the forgiveness process itself can be lengthy and unpredictable. Furthermore, changes in government policy could impact the availability of forgiveness programs, leaving borrowers in uncertain situations after years of payments. The complexity and uncertainty surrounding loan forgiveness should be carefully considered.

Impact on Future Financial Planning

The prolonged debt burden associated with IDR plans can impact future financial planning. The lower monthly payments offer short-term relief, but the extended repayment period can hinder other financial goals. Borrowers need to account for the increased interest costs and the extended repayment timeline when making decisions about saving for retirement, purchasing a home, or other major financial goals. A realistic assessment of the long-term implications is crucial.

Situations Where IDR Plans May Not Be Optimal

IDR plans are not always the best option. For borrowers with higher incomes or the ability to make larger payments, a standard repayment plan might be more efficient, allowing for quicker debt elimination and significantly less interest paid overall. Similarly, individuals who anticipate substantial income growth in the near future might find a standard plan more advantageous, as they can accelerate repayment and minimize long-term interest costs. Careful consideration of individual circumstances is essential to determine the most suitable repayment strategy.

Resources and Further Information

Navigating the complexities of Income-Driven Repayment (IDR) plans can be challenging. Fortunately, numerous resources exist to help borrowers understand their options and manage their student loans effectively. This section provides a list of reliable sources and a visual guide to aid in the process.

Understanding the available resources and the application process is crucial for successfully managing your student loans under an IDR plan. The following information will help you find the assistance you need and navigate the steps involved.

Reliable Resources for IDR Plan Information

Several government agencies and non-profit organizations offer comprehensive information and support for borrowers seeking to enroll in or manage an IDR plan. These resources provide valuable tools and guidance to help make informed decisions about your student loan repayment.

- StudentAid.gov: The official website of the U.S. Department of Education’s Federal Student Aid, offering detailed information on all federal student loan programs, including IDR plans. This is the primary source for accurate and up-to-date information.

- Federal Student Aid’s IDR Comparison Tool: This online tool helps borrowers compare different IDR plans to determine which one best suits their financial situation. It provides personalized estimates of monthly payments and total repayment amounts.

- National Student Loan Data System (NSLDS): This system allows borrowers to access their federal student loan information, including loan balances, repayment history, and servicer contact information. It is essential for tracking your progress and managing your loans.

- Your Loan Servicer’s Website: Each loan servicer has its own website with specific information about managing your loans under an IDR plan. Contact information and helpful guides are typically available.

- Non-profit consumer credit counseling agencies: These agencies offer free or low-cost counseling services to help borrowers manage their debt, including student loans. They can provide guidance on choosing an IDR plan and navigating the repayment process.

Visual Representation of the IDR Plan Application and Management Process

The following describes a flowchart illustrating the steps involved in applying for and managing an IDR plan. This visual representation simplifies the process and highlights key stages.

The flowchart is rectangular, oriented vertically. It uses a light blue background with darker blue arrows connecting the steps. Each step is enclosed in a light green rectangle with a bold black title. The starting point, “Determine IDR Plan Eligibility,” is at the top. The next step, “Choose an IDR Plan,” branches into different paths representing the various IDR plan options (e.g., ICR, PAYE, REPAYE). Each plan option leads to “Complete the Application,” which is followed by “Submit Application to Loan Servicer.” A decision box, “Application Approved?”, branches into “Manage Payments Regularly” and “Appeal Denial.” “Manage Payments Regularly” leads to “Annual Re-certification,” which loops back to “Manage Payments Regularly.” “Appeal Denial” leads to “Resubmit Application or Explore Other Options.” The final step, “Potential Loan Forgiveness,” is at the bottom, indicating the possibility of loan forgiveness after making qualifying payments for a specified period. Key terms are highlighted in bold, and important deadlines are noted within each step’s description. The overall design is clean, concise, and easy to follow.

Last Point

Successfully managing student loan debt requires careful planning and a thorough understanding of available repayment options. By leveraging the information presented in this guide on student loan IDR plans, borrowers can confidently navigate the complexities of repayment, optimize their monthly payments, and potentially qualify for loan forgiveness. Remember to regularly review your plan and adjust as needed to ensure it remains aligned with your evolving financial circumstances. Proactive planning and informed decision-making are key to achieving long-term financial well-being.

FAQ Summary

What happens if my income changes while on an IDR plan?

You’ll need to recertify your income annually (or as required by your plan). A change in income will affect your monthly payment amount. Contact your loan servicer to update your information.

Can I switch from one IDR plan to another?

Generally, yes. However, there may be limitations and you should contact your loan servicer to understand the process and any potential implications. Switching plans might reset your repayment progress toward forgiveness.

What if I miss payments on my IDR plan?

Missing payments can negatively impact your credit score and potentially jeopardize your eligibility for loan forgiveness. Contact your loan servicer immediately if you anticipate difficulties making payments.

How long does it take to get loan forgiveness under an IDR plan?

The time required for loan forgiveness varies depending on the specific plan and your income. It typically ranges from 20 to 25 years of qualifying payments. The exact timeline is detailed in your plan documents.