Navigating the world of higher education in Spanish-speaking countries often involves understanding the intricacies of student loans. This guide delves into the diverse landscape of student financing across various Spanish-speaking nations, exploring everything from the nuances of terminology and loan types to government policies and the long-term implications of student debt. We’ll examine the cultural context surrounding student loans, highlighting regional differences and common challenges faced by students.

From comparing government-backed loans to private options, we’ll provide a practical overview of the application process, repayment plans, and available resources for those struggling with debt. Understanding the financial implications of higher education is crucial for informed decision-making, and this guide aims to equip students and families with the necessary knowledge to navigate this complex financial landscape.

Direct Translation and Nuances

The term “student loan” lacks a single, universally accepted translation across all Spanish-speaking regions. The best translation depends heavily on the specific context and the nuance one wishes to convey. Furthermore, the cultural understanding and perception of student loans vary significantly between countries, influencing the preferred terminology and associated implications.

The direct translation and its reception are shaped by the educational system, economic realities, and cultural attitudes toward debt in each region. A simple, literal translation might be understood, but it may not fully capture the subtleties embedded in the concept of a student loan within a specific Spanish-speaking community.

Regional Variations in Terminology for “Student Loan”

Several terms are used to describe student loans in different Spanish-speaking countries. While some are more formal than others, the choice often reflects both the specific type of loan and the cultural context. The lack of a standardized term highlights the diverse approaches to higher education financing across the Spanish-speaking world.

- Préstamo estudiantil: This is a widely understood and accepted term, essentially a direct translation of “student loan,” and is generally understood across most Spanish-speaking regions.

- Crédito educativo: This translates to “educational credit” and is often used in contexts where the loan is tied to a specific educational institution or program. It implies a more formal, institutionalized approach to financing education.

- Financiamiento para estudios: Meaning “financing for studies,” this is a broader term that encompasses various forms of financial aid, including loans, grants, and scholarships. It’s less specific than “préstamo estudiantil” but might be preferred in certain contexts.

- Ayuda financiera para estudiantes: Translating to “financial aid for students,” this term is even broader than “financiamiento para estudios” and often refers to a wider range of support mechanisms.

Cultural Connotations of Student Loans in Spanish-Speaking Countries

The cultural connotations associated with student loans vary considerably across Spanish-speaking nations. In some countries, accessing student loans is viewed as a normal and necessary step towards higher education, similar to the perception in the United States or the United Kingdom. However, in other countries, taking on debt for education may carry a stronger stigma, reflecting cultural values that prioritize avoiding debt at all costs.

Economic factors also play a crucial role. In countries with robust public education systems and generous government grants, the need for student loans might be less prevalent, and the social perception might be more neutral or even positive (as it signifies access to opportunity). Conversely, in countries with limited public funding for higher education, student loans may be perceived more negatively, reflecting the financial burden they impose on students and families.

Glossary of Student Loan Terms in Spanish

This glossary provides both formal and informal terms related to student loans, offering a more comprehensive understanding of the language used in different contexts.

| English | Formal Spanish | Informal Spanish |

|---|---|---|

| Student Loan | Préstamo estudiantil | Deuda de estudios |

| Loan Amount | Monto del préstamo | Plata prestada |

| Interest Rate | Tasa de interés | Intereses |

| Repayment Plan | Plan de pago | Plan de devolución |

| Default | Incumplimiento | Morosidad |

| Loan Forgiveness | Condonación del préstamo | Perdón de la deuda |

Loan Types and Repayment Options in Spanish

Securing funding for higher education in Spanish-speaking countries involves navigating a variety of loan options, each with its own set of terms and conditions. Understanding these differences is crucial for students to make informed decisions about their financing. This section details the common types of student loans available, their repayment structures, and the application processes in several countries.

Types of Student Loans in Spanish-Speaking Countries

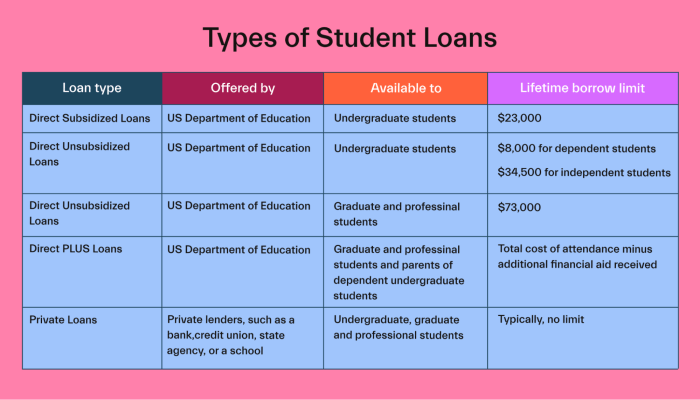

Student loan landscapes vary across Spanish-speaking nations. While government-backed loans are prevalent, private options also exist. The specific loan types, interest rates, and eligibility criteria differ significantly. The following table offers a generalized overview; it’s crucial to consult individual country and lender websites for precise details. Note that interest rates are subject to change and are presented as illustrative examples.

| Loan Type | Interest Rate (Example) | Repayment Period (Example) | Eligibility Requirements (Example) |

|---|---|---|---|

| Government-backed (e.g., Spain – Préstamos para Estudiantes) | Variable, typically lower than private loans (e.g., 2-4%) | Up to 15 years, depending on loan amount | Spanish citizenship or residency, enrollment in accredited institution, demonstrated financial need |

| Government-backed (e.g., Mexico – Crédito Educativo) | Fixed or variable, depending on the program (e.g., 4-8%) | Varies by program, typically 5-10 years | Mexican citizenship, enrollment in accredited institution, good academic standing |

| Private Student Loans (Various Countries) | Variable, generally higher than government-backed loans (e.g., 6-12%) | Typically 5-10 years | Credit history (often required for co-signer), enrollment in accredited institution |

| Scholarships and Grants (Various Countries) | 0% Interest | Non-repayable | Academic merit, financial need, specific program requirements |

Common Repayment Plans in Spanish-Speaking Countries

Once a student loan is disbursed, repayment begins after a grace period, typically six months to a year after graduation or program completion. Several repayment plans are available to accommodate varying financial situations. These plans often include:

Standard Repayment: This involves fixed monthly payments over a set period. The length of the repayment period influences the monthly payment amount. Shorter repayment periods mean higher monthly payments but less interest paid overall.

Graduated Repayment: Monthly payments start low and gradually increase over time, typically aligning with anticipated income growth. This offers lower initial payments but higher payments later in the repayment term.

Income-Driven Repayment (IDR): Monthly payments are calculated based on a percentage of discretionary income. This option is often available for government-backed loans and provides flexibility during periods of lower earnings. The remaining balance may be forgiven after a specified number of years.

Government-Backed vs. Private Student Loans: A Comparison

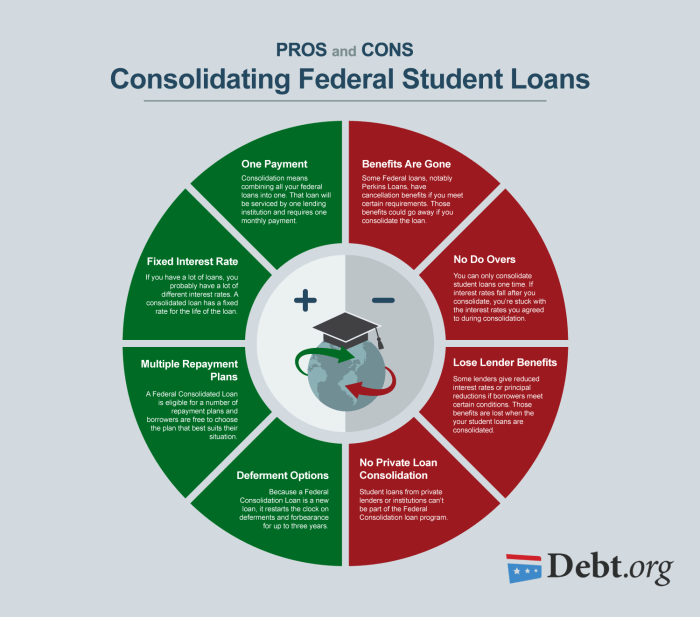

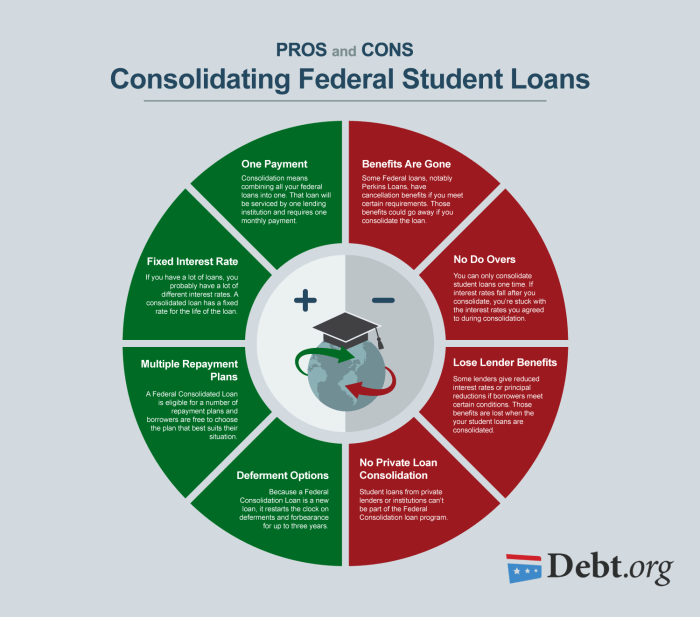

Government-backed loans generally offer lower interest rates and more flexible repayment options compared to private loans. However, eligibility requirements may be stricter, and the application process can be more complex. Private loans often have less stringent eligibility criteria but come with higher interest rates and potentially less favorable repayment terms.

| Feature | Government-Backed Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Typically lower | Typically higher |

| Repayment Options | More flexible, including IDR plans | Fewer options, typically standard repayment |

| Eligibility | Stricter requirements, often based on financial need | Less stringent, may require a co-signer |

| Application Process | Can be more complex and time-consuming | Generally simpler and faster |

Applying for Student Loans in Spanish-Speaking Countries

The application process varies across countries. Here’s a brief overview for three examples:

Spain: Students typically apply through the Ministry of Education or designated banks participating in government loan programs. The process involves submitting an application, providing documentation (academic transcripts, proof of income, etc.), and undergoing a credit assessment (if applicable).

Mexico: Applications for government-backed loans are often made through the National Fund for Higher Education (FONE). The process includes completing an online application, providing academic records, and demonstrating financial need.

Colombia: Students can explore options through government programs like ICETEX or private lenders. The application process usually involves completing an application form, providing financial information, and potentially obtaining a guarantor.

Student Loan Debt and its Impact

Student loan debt presents significant challenges for young people in Spanish-speaking countries, often hindering their ability to achieve financial stability and pursue their life goals. The weight of these loans can impact various aspects of their lives, from delaying major life decisions like homeownership and starting a family to limiting career choices and creating long-term financial stress. Understanding the scope of this issue is crucial for developing effective solutions and support systems.

The burden of student loan debt is particularly pronounced in countries where access to higher education is not universally subsidized and where private loan options may carry high interest rates. The lack of comprehensive financial literacy programs can exacerbate the problem, leaving students ill-equipped to manage their loans effectively.

Challenges Faced by Students with Student Loan Debt in Spanish-Speaking Countries

Students in Spanish-speaking countries grappling with student loan debt often face several interconnected challenges. High interest rates, coupled with potentially unstable employment markets after graduation, can lead to difficulty in making timely repayments. Furthermore, a lack of government support programs tailored to specific economic situations can leave borrowers feeling overwhelmed and vulnerable. The lack of clear and accessible information regarding loan terms and repayment options further complicates the situation. Many borrowers find themselves navigating a complex system without adequate guidance, potentially leading to missed payments and escalating debt.

Hypothetical Scenario Illustrating the Financial Burden of Student Loan Debt

Imagine Sofía, a recent graduate from a university in Mexico City with a degree in engineering. She took out a private student loan of 200,000 Mexican pesos (approximately USD $11,000 at the time of writing) to cover her tuition and living expenses. The loan has a 10% annual interest rate, and the repayment period is 10 years. Her monthly payments are approximately 2,500 Mexican pesos (approximately USD $140 at the time of writing), a significant portion of her starting salary as a junior engineer. If she experiences any unexpected financial setbacks, such as job loss or medical emergencies, meeting her loan obligations becomes exponentially more difficult. This scenario illustrates the significant financial pressure faced by many graduates in Spanish-speaking countries. The total cost of her loan, including interest, will likely exceed 300,000 Mexican pesos (approximately USD $17,000 at the time of writing) over the 10-year repayment period.

Resources Available to Students Struggling with Student Loan Repayment

Several resources exist to assist students struggling with student loan repayment across various Spanish-speaking countries. Many countries offer government-sponsored programs providing loan consolidation, deferment, or forbearance options. These programs often require borrowers to meet specific criteria related to income or employment status. Additionally, non-governmental organizations (NGOs) and financial literacy initiatives provide valuable counseling and support to help students manage their debt effectively. These resources may offer guidance on budgeting, debt management strategies, and exploring alternative repayment plans. For example, in Argentina, the government’s ANSES (Administración Nacional de la Seguridad Social) offers various programs to assist with student loan repayments.

Calculating the Total Cost of a Student Loan

Calculating the total cost of a student loan involves considering the principal amount borrowed and the accumulated interest over the repayment period. A simple example in Spanish:

Ejemplo: Un préstamo estudiantil de 10,000 dólares con una tasa de interés anual del 6% a pagar en 5 años. El interés simple anual sería de 600 dólares (10,000 x 0.06). El interés total a lo largo de 5 años sería de 3,000 dólares (600 x 5). El costo total del préstamo sería de 13,000 dólares (10,000 + 3,000).

This translates to: “Example: A student loan of $10,000 with an annual interest rate of 6% payable in 5 years. The simple annual interest would be $600 (10,000 x 0.06). The total interest over 5 years would be $3,000 (600 x 5). The total cost of the loan would be $13,000 (10,000 + 3,000).” Note that this is a simplified calculation using simple interest. Most student loans accrue compound interest, making the total cost higher.

Government Policies and Initiatives

Government involvement in student loan programs across Spanish-speaking countries varies significantly, reflecting differing economic priorities and social structures. While many nations prioritize access to higher education, the mechanisms for achieving this, and the level of government support, differ considerably. This section will examine specific policies and initiatives in two countries, highlighting the role of relevant agencies and comparing their approaches.

Government agencies play a crucial role in managing and regulating student loan programs. They are responsible for setting eligibility criteria, disbursing funds, collecting repayments, and enforcing regulations. These agencies often collaborate with educational institutions and private lenders to ensure the smooth functioning of the loan system. The specific structure and responsibilities of these agencies vary from country to country.

Student Loan Programs in Mexico

Mexico’s government, primarily through the Secretaría de Educación Pública (SEP), offers various student loan programs. These programs often target students from low-income backgrounds or those pursuing specific fields of study deemed crucial for national development. The programs usually involve a combination of grants and loans, with repayment terms tailored to the borrower’s financial circumstances. The SEP collaborates with various financial institutions to manage the disbursement and collection of these loans. One notable initiative is the Programa Nacional de Becas, which provides financial aid, including loans, to students meeting specific socioeconomic criteria. The program’s success is monitored through evaluation of graduation rates and employment outcomes of participating students.

Student Loan Programs in Spain

In Spain, the Ministry of Education and Vocational Training (Ministerio de Educación y Formación Profesional) plays a central role in managing student financial aid. The primary program is the Sistema Nacional de Garantía Juvenil (National Youth Guarantee System), which offers a combination of grants, loans, and training opportunities. The system is designed to support young people in accessing education and employment. Loans are offered through various banks and financial institutions, with the government often providing guarantees or subsidies to reduce the risk for lenders. The program is structured to be accessible to a broad range of students and is subject to regular reviews and adjustments based on economic conditions and employment market trends.

Comparison of Government Approaches

Mexico and Spain demonstrate contrasting approaches to student loan programs. While both countries aim to improve access to higher education, Mexico’s programs often focus more directly on need-based aid, targeting specific demographics and fields of study. Spain’s approach, through the National Youth Guarantee System, takes a broader approach, aiming to support young people in education and employment transitions. This reflects differences in social welfare systems and economic priorities between the two nations. Furthermore, the level of government direct involvement differs; Mexico often directly manages aspects of loan disbursement, while Spain relies more on partnerships with private lenders.

Visual Representation of Government Involvement

Imagine a flowchart. It begins with a student applying for a loan. This application moves to a government agency (e.g., SEP in Mexico or the Ministry of Education in Spain). The agency assesses the application based on pre-defined criteria. If approved, the agency either disburses funds directly or works with a financial institution to facilitate the loan. The student then attends university. After graduation, repayment begins, monitored and managed, either directly by the agency or through the partnered financial institution. The flowchart ends with the loan being fully repaid or potentially restructured based on the borrower’s circumstances. This visual representation highlights the central role of the government in overseeing the entire student loan lifecycle.

The Future of Student Loans in Spanish-Speaking Countries

The landscape of student loans in Spanish-speaking countries is undergoing a significant transformation, driven by evolving economic conditions, technological advancements, and shifting government priorities. Understanding these changes is crucial for both prospective students and policymakers aiming to ensure equitable access to higher education. This section will explore emerging trends, challenges, and potential future developments in this dynamic sector.

Emerging Trends in Student Loan Markets

Several key trends are shaping the future of student loans across Spanish-speaking nations. Increased access to online education is leading to a greater demand for flexible financing options. Simultaneously, a growing awareness of financial literacy is pushing for more transparent and accessible loan information. Furthermore, the rise of fintech companies is introducing innovative lending models, potentially increasing competition and offering more tailored solutions. For example, some companies are now using alternative credit scoring methods to evaluate loan applications from students with limited credit history, thereby expanding access to credit. This contrasts with traditional banking systems, which often have stricter requirements.

Potential Changes to Student Loan Policies and Programs

Governments in Spanish-speaking countries are increasingly recognizing the need for comprehensive reforms to their student loan systems. This includes exploring models that offer income-driven repayment plans, expanding loan forgiveness programs for specific professions (like healthcare or education), and implementing stricter regulations to prevent predatory lending practices. We are likely to see a greater emphasis on outcome-based financing, linking loan repayment to the student’s post-graduation earnings. Chile, for example, has been a pioneer in implementing such reforms, and its experience will likely inform policy decisions in other countries. This approach aims to balance the need for accessible financing with the responsibility of loan repayment.

Impact of Economic Factors on Student Loan Accessibility and Affordability

Economic fluctuations significantly influence the accessibility and affordability of student loans. Periods of economic growth often lead to increased government investment in education and more favorable lending conditions. Conversely, economic downturns can result in reduced government funding, tighter lending criteria, and higher interest rates, making it more difficult for students to access loans. The recent global economic uncertainty, for instance, has highlighted the vulnerability of student loan markets to external shocks. Countries heavily reliant on commodity exports, like some in South America, are particularly susceptible to these economic fluctuations. The impact on student debt levels is directly correlated to these economic shifts.

Predictions for the Future of Student Loan Debt in Spanish-Speaking Countries

Predicting the future of student loan debt requires considering various factors. Continued economic growth and robust government support could lead to manageable debt levels, particularly if accompanied by effective financial literacy programs. However, without sufficient reforms and proactive measures, we could see a rise in student loan defaults and a growing burden on borrowers. The potential for increased reliance on private lenders also poses risks, especially if regulations are not stringent enough to protect borrowers from predatory lending practices. Therefore, the future trajectory of student loan debt will depend heavily on the policy choices made by governments and the effectiveness of initiatives designed to promote financial responsibility and ensure fair access to higher education. Countries that proactively address these challenges are more likely to see sustainable and equitable student loan systems.

Outcome Summary

Securing a higher education is a significant investment, and understanding the intricacies of student loans in Spanish-speaking countries is paramount. This guide has explored the various facets of student financing, from the subtle differences in terminology across regions to the significant impact of government policies and economic factors. By understanding the diverse loan types, repayment options, and potential challenges associated with student debt, individuals can make informed choices and effectively manage their financial future. The information presented here serves as a valuable resource for navigating the complexities of student loans and achieving academic success.

Answers to Common Questions

What are the typical interest rates on student loans in Spain?

Interest rates on Spanish student loans vary depending on the lender (public or private) and the type of loan. It’s best to check with the specific lender for current rates.

Can I consolidate my student loans in Mexico?

Loan consolidation options in Mexico exist, but the specifics depend on the types of loans and lenders involved. Contacting the relevant government agencies or financial institutions is recommended.

What happens if I default on my student loan in Argentina?

Defaulting on a student loan in Argentina can lead to serious consequences, including damage to credit score and potential legal action. Contacting the lender to explore repayment options is crucial to avoid default.

Are there scholarships or grants available alongside student loans in Colombia?

Yes, many scholarships and grants are available in Colombia to supplement student loans. Researching government and private funding opportunities is recommended.