Navigating the complex landscape of student loans in the United States can feel overwhelming. Millions of Americans carry the burden of student loan debt, impacting their financial futures and overall well-being. This guide delves into the current state of student loan debt, exploring various repayment options, the long-term financial implications, and the role of government policies. We’ll examine the different types of loans available, strategies for effective repayment, and potential solutions for a more accessible and affordable higher education system.

From understanding federal versus private loans to exploring income-driven repayment plans and debt forgiveness programs, we aim to provide a clear and concise overview of the crucial aspects of student loan management. This comprehensive resource is designed to empower individuals to make informed decisions and navigate their financial journey with confidence.

The Current State of Student Loan Debt in the US

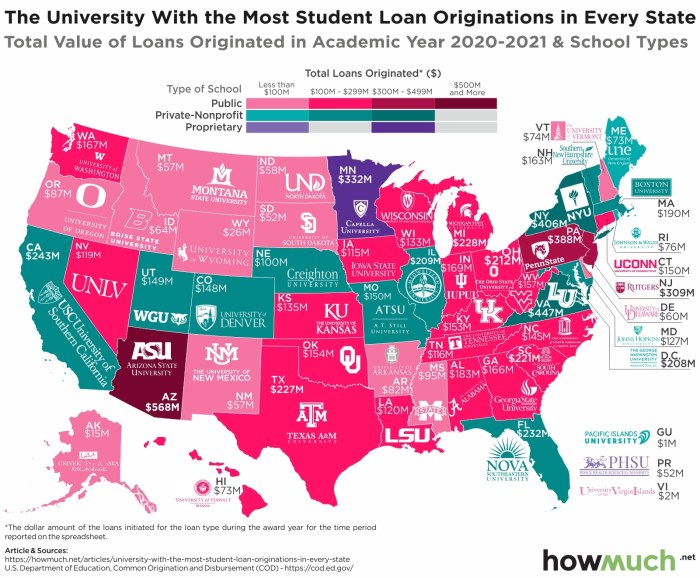

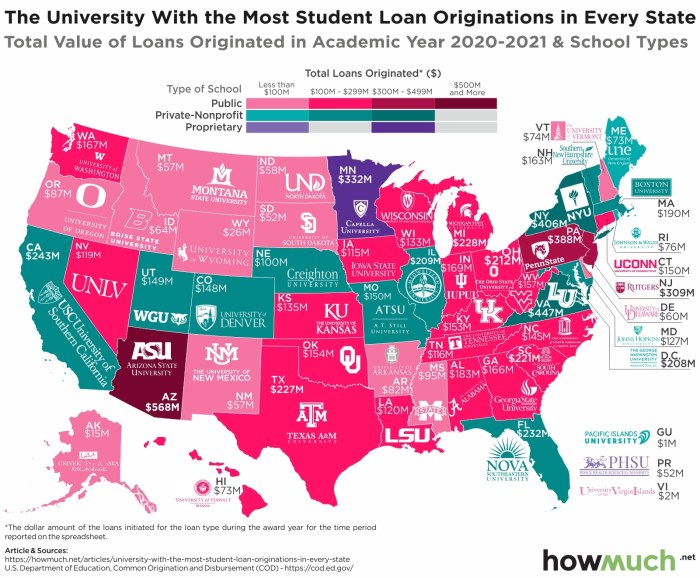

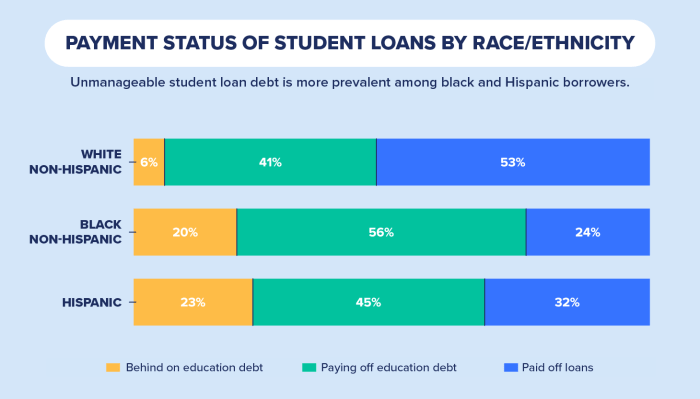

The United States grapples with a significant student loan debt crisis, impacting millions of borrowers and posing challenges to the national economy. Understanding the scope and distribution of this debt is crucial for developing effective solutions. This section provides an overview of the current situation, focusing on key statistics and demographic breakdowns.

Student Loan Debt Statistics

The total amount of student loan debt in the US is staggering. As of [Insert most recent data available from a reputable source like the Federal Reserve or the Department of Education], the total outstanding student loan debt exceeded [Insert total amount in trillions of dollars]. This represents a considerable burden on borrowers, with the average debt per borrower estimated at approximately [Insert average debt amount in dollars]. A significant percentage of borrowers, estimated at [Insert percentage] are experiencing difficulty in managing their loan repayments, often leading to delinquency and default. This high rate of delinquency contributes to the overall economic instability and impacts borrowers’ ability to achieve financial stability.

Distribution of Student Loan Debt Across Demographics

Student loan debt is not distributed evenly across the population. Significant disparities exist based on various demographic factors. The following table illustrates this distribution:

| Demographic | Age | Income Level | Education Level | Race/Ethnicity |

|---|---|---|---|---|

| Debt Amount (Average) | [Insert data on average debt by age group, e.g., 25-34, 35-44, etc. Source needed] | [Insert data on average debt by income bracket, e.g., <$30k, $30k-$50k, etc. Source needed] | [Insert data on average debt by education level attained, e.g., Bachelor’s, Master’s, etc. Source needed] | [Insert data on average debt by race/ethnicity, e.g., White, Black, Hispanic, etc. Source needed] |

| Percentage of Borrowers | [Insert data on percentage of borrowers in each age group. Source needed] | [Insert data on percentage of borrowers in each income bracket. Source needed] | [Insert data on percentage of borrowers with each education level. Source needed] | [Insert data on percentage of borrowers in each racial/ethnic group. Source needed] |

Note: Data sources for the table above should be cited (e.g., Federal Reserve, Department of Education, reputable research institutions). Replace bracketed information with actual data.

Types of Student Loans in the US

Understanding the different types of student loans is essential for borrowers to make informed decisions. Federal and private loans differ significantly in their terms, interest rates, and repayment options.

The key differences between federal and private student loans are summarized below:

- Federal Student Loans: These loans are offered by the U.S. government and generally offer more borrower protections, such as income-driven repayment plans and loan forgiveness programs. Interest rates are typically lower than private loans. Types include subsidized (interest does not accrue while the borrower is in school) and unsubsidized (interest accrues while the borrower is in school).

- Private Student Loans: These loans are offered by banks and other private lenders. They often have higher interest rates and less flexible repayment options compared to federal loans. Borrower protections are typically less extensive. Approval is based on creditworthiness.

Subsidized and unsubsidized federal loans differ in how interest is handled:

- Subsidized Loans: The government pays the interest while the borrower is in school (at least half-time) and during grace periods.

- Unsubsidized Loans: Interest accrues from the time the loan is disbursed, even while the borrower is in school. This accumulated interest is typically capitalized (added to the principal balance) upon entering repayment.

Repayment Plans and Options

Navigating the complexities of student loan repayment can feel overwhelming, but understanding the available options is crucial for managing your debt effectively. Federal student loan borrowers have access to a variety of repayment plans designed to fit different financial situations and income levels. Choosing the right plan can significantly impact your monthly payments and overall repayment timeline.

Income-Driven Repayment Plans

The federal government offers several income-driven repayment (IDR) plans, each with its own features and eligibility requirements. These plans calculate your monthly payment based on your income and family size, offering more manageable payments for borrowers facing financial hardship. However, it’s important to understand that while these plans reduce monthly payments, they often extend the repayment period, leading to potentially higher overall interest paid.

| Plan Name | Key Features | Eligibility Criteria |

|---|---|---|

| Income-Driven Repayment (IDR) | This is an umbrella term encompassing several plans; payment is based on income and family size. | Federal student loans; income below a certain threshold. |

| Income-Based Repayment (IBR) | Payment is 10-15% of discretionary income; remaining balance forgiven after 20 or 25 years. | Federal student loans; income below a certain threshold. |

| Pay As You Earn (PAYE) | Payment is 10% of discretionary income; remaining balance forgiven after 20 years. | Federal student loans disbursed after June 30, 2007; income below a certain threshold. |

| Revised Pay As You Earn (REPAYE) | Payment is 10% of discretionary income; remaining balance forgiven after 20 or 25 years, depending on loan type. | Federal student loans; income below a certain threshold. |

| Income-Contingent Repayment (ICR) | Payment is calculated based on a formula considering income, family size, and loan amount; remaining balance forgiven after 25 years. | Federal student loans; income below a certain threshold. |

Applying for Student Loan Forgiveness or Discharge

The process of applying for student loan forgiveness or discharge programs varies depending on the specific program. Generally, it involves demonstrating eligibility based on specific criteria, such as employment in public service or experiencing a total and permanent disability. This often requires gathering extensive documentation and submitting a comprehensive application.

Step-by-Step Guide to Applying for Student Loan Forgiveness or Discharge

- Identify the relevant program: Determine which forgiveness or discharge program you may qualify for based on your circumstances (e.g., Public Service Loan Forgiveness, Teacher Loan Forgiveness, Total and Permanent Disability Discharge).

- Gather necessary documentation: This might include tax returns, employment verification, disability documentation, and loan information.

- Complete the application: Submit the application through the appropriate channels, often online through the Federal Student Aid website.

- Monitor the status of your application: Track the progress of your application and respond to any requests for additional information.

- Understand the timelines: The processing time for these applications can vary significantly.

Comparison of Repayment Strategies

Borrowers can choose from several repayment strategies, each with its own advantages and disadvantages. Accelerated repayment involves making larger monthly payments to pay off the loan faster, minimizing interest paid but potentially straining the borrower’s budget. Standard repayment involves fixed monthly payments over a standard 10-year period. Extended repayment stretches payments over a longer period, reducing monthly payments but increasing the total interest paid.

The Impact of Student Loans on Personal Finance

Student loan debt can significantly impact borrowers’ financial well-being, extending far beyond the repayment period. The weight of these loans can affect various aspects of personal finance, from immediate spending habits to long-term financial goals like homeownership and retirement planning. Understanding these potential effects is crucial for responsible financial management.

The long-term effects of student loan debt can be substantial. High levels of debt can negatively influence credit scores, making it more difficult to secure loans for mortgages, cars, or even credit cards in the future. This can lead to higher interest rates on future borrowing, further compounding the financial burden. Moreover, the constant pressure of loan repayments can limit opportunities for saving and investing, hindering the accumulation of wealth and potentially delaying major life milestones such as purchasing a home or starting a family. The stress associated with managing significant debt can also negatively impact mental health and overall well-being.

Managing Student Loan Debt Through Budgeting and Financial Planning

Effective budgeting and financial planning are essential for individuals managing student loan debt. Creating a realistic budget that accounts for loan payments, living expenses, and other financial obligations is the first step towards responsible debt management. Careful planning helps borrowers prioritize debt repayment and allocate resources towards other financial goals.

- Create a detailed budget: Track all income and expenses to identify areas for potential savings.

- Prioritize loan repayment: Explore different repayment plans to find one that aligns with your income and financial goals. Consider prioritizing high-interest loans first.

- Automate payments: Set up automatic payments to avoid late fees and maintain a good payment history.

- Build an emergency fund: Aim to save 3-6 months’ worth of living expenses to handle unexpected events without further burdening your debt.

- Explore additional income streams: Consider a part-time job or freelance work to accelerate debt repayment.

Common Mistakes in Student Loan Management and How to Avoid Them

Many borrowers make mistakes when managing their student loans, often leading to increased financial stress and difficulties in repayment. Understanding these common pitfalls and implementing preventative measures can significantly improve the management of student loan debt.

- Ignoring loan details: Failing to understand the terms of your loan, including interest rates, repayment schedules, and potential fees, can lead to missed payments and increased debt. Regularly review your loan statements and understand the details of your repayment plan.

- Deferring or Forbearing without a Plan: While deferment or forbearance can provide temporary relief, they often lead to increased interest capitalization, resulting in a larger overall debt. Use these options strategically and only when absolutely necessary, coupled with a clear plan to resume payments as soon as possible.

- Not exploring repayment options: Failing to explore different repayment plans (such as income-driven repayment) can result in unaffordable monthly payments and potential default. Research and compare available options to find the best fit for your financial situation.

- Ignoring financial counseling: Many free or low-cost resources are available to help manage student loan debt. Take advantage of these resources to receive personalized guidance and support.

- Failing to consolidate loans: Consolidating multiple loans into a single loan can simplify repayment and potentially lower your interest rate. Explore this option to streamline your debt management.

The Role of Government Policies and Regulations

The US government’s involvement in student loan financing has a long and complex history, significantly shaping the current landscape of student debt. Early government programs focused primarily on providing access to higher education, but the scale and structure of these programs have evolved dramatically over time, leading to both positive and negative consequences. Understanding this evolution is crucial to evaluating the effectiveness of current policies and proposing potential solutions.

The history of federal student loan programs is marked by periods of expansion and contraction, reflecting shifting priorities in higher education and the broader economy. Initially, programs were relatively small and targeted specific populations. The post-World War II era saw a significant expansion of access to higher education, coupled with the growth of federal student aid programs. The creation of the Guaranteed Student Loan Program (GSLP) in 1965, for example, dramatically increased the availability of federal student loans, paving the way for the massive expansion of higher education participation. However, this expansion also laid the groundwork for the substantial accumulation of student loan debt we see today. Subsequent legislative changes, such as the Higher Education Act of 1965 and its subsequent reauthorizations, further expanded eligibility and increased loan amounts. The shift from a primarily subsidized loan system to one increasingly dominated by unsubsidized and private loans also played a significant role in escalating debt levels.

Effectiveness of Current Government Policies

Current government policies, while aiming to address the student loan debt crisis, have had mixed results. Income-driven repayment (IDR) plans, for example, offer lower monthly payments based on income, but often result in longer repayment periods and increased total interest paid. While providing short-term relief, IDR plans don’t fundamentally address the underlying issue of high student loan debt burdens. Similarly, programs like loan forgiveness for public service workers, while beneficial to those who qualify, are limited in scope and have not significantly reduced overall debt levels. The recent pause on student loan repayments, implemented during the COVID-19 pandemic, offered temporary relief but did not resolve the long-term problem. A comprehensive evaluation of these programs requires considering both their positive impacts on individual borrowers and their overall effectiveness in reducing the national student loan debt burden.

A Hypothetical Policy Proposal: Income-Based Tuition and Loan Forgiveness

One potential policy approach to address the student loan debt crisis is a combination of income-based tuition and targeted loan forgiveness. This proposal would tie tuition costs directly to a graduate’s post-graduation income. Students would pay a percentage of their income over a set period after graduation, with a cap on total repayment. This model, similar to income-based repayment plans, would ensure affordability while incentivizing graduates to pursue higher-paying careers. Furthermore, the proposal would include a loan forgiveness program focused on individuals pursuing careers in high-need sectors, such as education, healthcare, and public service. This targeted approach would incentivize graduates to enter fields that benefit society while addressing the issue of loan burden.

This policy has potential benefits, such as increased access to higher education for low- and middle-income students and a reduction in overall student loan debt. However, drawbacks include the complexity of implementing an income-based tuition system and the potential for administrative challenges. Determining the appropriate percentage of income for tuition payments and the criteria for loan forgiveness would require careful consideration. Furthermore, the cost of implementing such a program would need to be carefully assessed. A thorough cost-benefit analysis, considering both the short-term and long-term impacts, is essential before implementing this or any similar policy.

The Future of Student Loans in the US

The US student loan system faces a complex future, shaped by evolving economic conditions, technological advancements, and ongoing political debates. Predicting the precise trajectory is challenging, but several key trends and potential solutions are emerging that will significantly alter the landscape of higher education financing in the coming years. These trends will impact not only borrowers but also the institutions and government agencies involved.

The rising cost of higher education continues to outpace inflation, leading to predictions of further increases in student loan debt. While the recent pause on federal student loan payments offered temporary relief, the looming resumption of payments suggests a potential surge in delinquencies and defaults, particularly among borrowers struggling with economic hardship. The long-term effects of the pandemic, including its impact on employment and income levels, are still unfolding and will likely contribute to this trend. Furthermore, a potential recession could exacerbate existing financial challenges for borrowers.

Projected Trends in Student Loan Debt and Borrowing

Several factors suggest a continued increase in student loan debt, albeit potentially at a slower rate than in previous decades. Increased awareness of the burden of student loan debt might lead to more cautious borrowing behaviors among prospective students. However, the persistent gap between the rising cost of tuition and stagnant or slowly increasing financial aid packages will likely continue to drive demand for loans. For example, the rising popularity of expensive graduate programs in fields like healthcare and technology could further fuel the growth in student loan debt. Conversely, increased government regulation aimed at curbing predatory lending practices could potentially slow down the overall growth.

Technological Advancements and Their Impact

Technological advancements hold both promise and peril for the future of student loans. Online learning platforms offer a potentially more affordable alternative to traditional brick-and-mortar institutions, but questions remain regarding the quality and accreditation of these programs. The rise of AI-powered financial tools could improve the efficiency of loan servicing and repayment management, potentially helping borrowers better manage their debt. However, these same tools could also be used to target borrowers with high-interest loans or predatory financial products. For instance, AI algorithms might be used to personalize loan offers, but they could also exacerbate existing inequalities in access to affordable financing.

Potential Solutions for Increasing Affordability and Accessibility

Addressing the affordability and accessibility crisis in higher education requires a multi-pronged approach. Increased government funding for need-based financial aid, including grants and scholarships, is crucial. Reforms to the current student loan system, such as simplifying repayment plans and lowering interest rates, could also provide substantial relief to borrowers. Additionally, greater transparency in college pricing and financial aid packages could empower students to make more informed decisions about their educational investments. Further exploration of income-driven repayment models and loan forgiveness programs for public service workers are also potential avenues for improving affordability. Finally, investing in early childhood education and promoting greater access to affordable community college programs could help to prevent the accumulation of significant student loan debt in the first place.

Final Review

The student loan landscape in the US is constantly evolving, presenting both challenges and opportunities for borrowers. Understanding the various loan types, repayment plans, and potential pitfalls is crucial for long-term financial health. By proactively managing student loan debt and seeking available resources, individuals can mitigate the potential negative impacts and build a secure financial future. The information provided here serves as a starting point for a more informed approach to navigating this significant aspect of personal finance.

Questions and Answers

What happens if I can’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset. Contact your loan servicer immediately to explore options like deferment or forbearance.

Can I consolidate my student loans?

Yes, consolidating federal loans simplifies repayment by combining multiple loans into a single one with a potentially lower monthly payment. However, this may extend the repayment period and increase the total interest paid.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school, grace periods, and during certain deferment periods. Unsubsidized loans accrue interest from the time the loan is disbursed.

How do I find my student loan servicer?

You can usually find your servicer’s information on the National Student Loan Data System (NSLDS) website or through your loan documents.