Navigating the complexities of student loan repayment can feel overwhelming, but understanding income-based repayment (IBR) plans can significantly alleviate the burden. This guide provides a comprehensive overview of the student loan income-based repayment application process, from eligibility criteria and application procedures to long-term implications and potential challenges. We’ll explore various IBR plan options, demystify income verification, and offer practical strategies for effective plan management.

Whether you’re a recent graduate facing daunting loan payments or a seasoned borrower seeking a more manageable repayment strategy, this resource is designed to empower you with the knowledge and tools necessary to make informed decisions about your financial future. We’ll delve into the intricacies of each IBR plan, providing clear explanations and real-world examples to illustrate how these plans work in practice. Understanding the application process, income verification requirements, and potential long-term effects will enable you to confidently navigate the system and achieve financial stability.

Understanding Income-Based Repayment (IBR) Plans

Income-Based Repayment (IBR) plans offer a lifeline to student loan borrowers struggling with high monthly payments. These plans tie your monthly payment to your income and family size, making repayment more manageable. Understanding the nuances of different IBR plans is crucial for choosing the most suitable option.

Types of IBR Plans

Several income-driven repayment (IDR) plans are available, each with its own eligibility requirements and payment calculation methods. While specific plan names and details may vary over time, common types include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE). These plans share similarities but have key differences in eligibility and payment calculations.

IBR Plan Eligibility Criteria

Eligibility for IBR plans generally requires borrowers to have federal student loans and to meet specific income thresholds. The exact requirements vary depending on the specific IBR plan and the lender. Generally, borrowers must be unable to afford their standard repayment plan payments. Specific income limits and loan types may be considered. It’s essential to check the current eligibility criteria with your loan servicer.

Determining Your Eligible Payment Amount

Calculating your IBR payment involves several steps. First, you’ll need to determine your Adjusted Gross Income (AGI) from your most recent tax return. This is your gross income minus certain deductions. Next, your family size is considered. The formula used to calculate your monthly payment incorporates your AGI, family size, and the total amount of your eligible federal student loans. The formula itself is complex and varies by plan, but the basic principle is that a lower income and larger family size result in a lower monthly payment. Your loan servicer will perform this calculation once you apply.

Impact of Income and Family Size on IBR Payments

A borrower with a lower income will typically have a lower monthly payment than a borrower with a higher income, all other factors being equal. Similarly, a borrower with a larger family size will generally have a lower monthly payment than a borrower with a smaller family size, reflecting the increased financial burden of supporting a larger household. For example, a single borrower earning $30,000 annually might have a significantly lower monthly payment than a borrower earning $80,000 annually, even with the same loan amount. Adding dependents further reduces the monthly payment.

Comparison of IBR Plan Features

| Feature | IBR | PAYE | REPAYE |

|---|---|---|---|

| Payment Calculation | Based on AGI, family size, and loan amount | Based on AGI, family size, and loan amount | Based on AGI, family size, and loan amount |

| Maximum Repayment Period | 25 years | 20 years | 20 years |

| Loan Forgiveness | Possible after 25 years of payments | Possible after 20 years of payments | Possible after 20 years of payments |

| Eligibility | Specific income and loan type requirements | Specific income and loan type requirements | Specific income and loan type requirements |

The Application Process for IBR

Applying for an Income-Based Repayment (IBR) plan involves several steps and requires careful attention to detail. The process aims to match your monthly student loan payments to your income, making repayment more manageable. Understanding the requirements and timeline is crucial for a smooth application.

Required Documentation for IBR Application

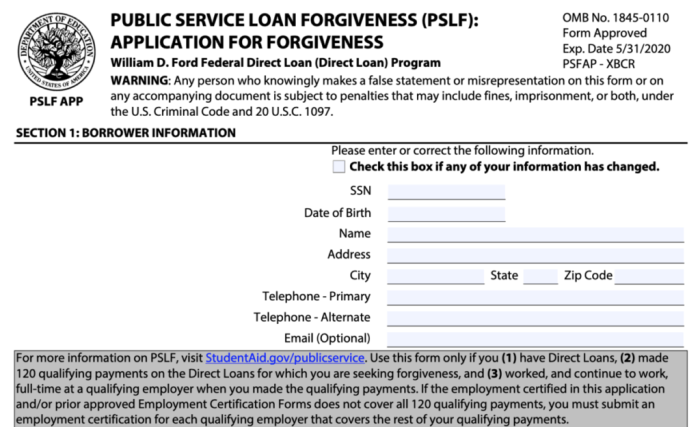

Gathering the necessary documentation is the first and arguably most important step in the IBR application process. Incomplete applications often lead to delays. You will generally need proof of income, such as tax returns (Form 1040), W-2s, or pay stubs from the most recent tax year. Additionally, you’ll need your federal student loan information, including your loan servicer’s contact details and your loan identifiers (like your loan numbers). Depending on your specific circumstances, additional documentation might be requested, such as proof of family size or documentation of unusual financial circumstances.

Steps Involved in Submitting the IBR Application

The application process typically begins online through your student loan servicer’s website. First, you’ll need to locate your servicer’s website and log into your account. Next, you’ll search for the IBR application, which may be found under sections such as “Repayment Plans,” “Manage My Loans,” or “Payment Options.” Once located, complete the application form accurately and thoroughly, providing all requested information. After completing the form, upload or submit the required documentation as specified by the instructions. Finally, review your submission for accuracy before confirming.

Timeline for Application Processing and Approval

Processing times for IBR applications can vary, depending on factors such as the completeness of your application and the workload of your loan servicer. Generally, you can expect a decision within 30-60 days from the date of submission. However, it’s not uncommon for the process to take longer, especially if additional information is requested. You can monitor the status of your application online through your servicer’s website. They often provide updates and estimated timelines, but it’s advisable to allow sufficient time for processing. For example, if you submit your application in January, it might be approved and effective in April or May, depending on your servicer’s processing times.

Checklist of Tasks Before, During, and After Application

Careful planning and organization are essential for a successful IBR application.

- Before Application: Gather all required documentation (tax returns, W-2s, pay stubs, loan information); Review the IBR plan details to ensure it’s the right fit for your financial situation; Create a checklist to track your progress.

- During Application: Complete the application form accurately; Double-check all provided information for accuracy; Upload all required documents; Confirm submission.

- After Application: Track the status of your application online; Contact your loan servicer if you have any questions or if the processing time exceeds expectations; Understand your new monthly payment amount and payment schedule.

Income Verification and Documentation

Securing an income-based repayment (IBR) plan requires you to accurately demonstrate your income. This process involves verifying your income through various methods and providing supporting documentation. Understanding this process is crucial for a smooth and successful application.

The lender will use several methods to verify your income. The specific methods employed may vary depending on the lender and your individual circumstances. However, the goal remains consistent: to confirm the accuracy of the income information you provided in your application.

Methods of Income Verification

Lenders typically employ a combination of methods to verify income, prioritizing those that provide the most reliable and up-to-date information. These methods may include:

- Tax Returns: Your most recent federal tax return (Form 1040) is a primary source of income verification. This document provides a comprehensive overview of your income for the previous tax year.

- Pay Stubs: Recent pay stubs (typically from the last three months) are another common method of verification. These show your gross pay, deductions, and net pay, providing a current snapshot of your income.

- W-2 Forms: These forms summarize your wages and other compensation from your employer for the previous tax year. They are often used in conjunction with tax returns.

- Self-Employment Documentation: For self-employed individuals, documentation might include profit and loss statements, bank statements, and tax returns (Schedule C or equivalent).

- Employer Verification: In some cases, the lender may directly contact your employer to verify your income and employment status. This often involves a simple phone call or a written request for verification.

Acceptable Income Documentation

The specific documents accepted vary by lender, but the examples above represent the most commonly used forms of income verification. It’s crucial to provide clear, legible copies of all requested documents. Incomplete or illegible documents can delay the processing of your application.

Consequences of Inaccurate Income Information

Providing inaccurate income information can have serious consequences. This could result in the rejection of your IBR application, potential penalties, and even legal action. It’s essential to be completely truthful and accurate when reporting your income.

Tips for Accurate and Timely Income Verification

To ensure a smooth and timely application process, follow these tips:

- Gather all necessary documents in advance: This will streamline the application process and prevent delays.

- Double-check all information for accuracy: Carefully review all documents for any errors or discrepancies before submitting your application.

- Keep copies of all submitted documents: This will be helpful in case of any questions or issues later on.

- Respond promptly to lender requests: If the lender requests additional documentation, respond promptly to avoid delays.

Sample Income Verification Form

While the specific format of an income verification form may vary, the following example illustrates the key information typically requested:

| Applicant Name: | ____________________________ |

|---|---|

| Social Security Number: | ____________________________ |

| Employer Name: | ____________________________ |

| Employer Address: | ____________________________ |

| Your Position: | ____________________________ |

| Gross Annual Income: | ____________________________ |

| Date of Employment: | ____________________________ |

| Signature: | ____________________________ |

| Date: | ____________________________ |

Managing Your IBR Plan

Successfully navigating an Income-Based Repayment (IBR) plan requires understanding how it works and proactively managing your payments. This section will cover key aspects of managing your IBR plan, ensuring you stay on track and avoid potential pitfalls.

IBR Payment Calculation

Your IBR payment is calculated based on your adjusted gross income (AGI), family size, and the outstanding loan balance. The formula used varies slightly depending on the specific IBR plan (IBR, PAYE, REPAYE), but generally involves a percentage of your discretionary income. Discretionary income is your AGI minus 150% of the poverty guideline for your family size. This amount is then divided by 10, and the result is multiplied by the total loan amount. For example, if your discretionary income is $20,000 and your total loan balance is $50,000, your annual payment would be ($20,000/10)*$50,000 = $100,000. This annual amount is then divided by 12 to determine your monthly payment. It’s crucial to note that the actual calculation may be more complex, and it’s advisable to use the official government calculators or consult your loan servicer for the precise calculation for your specific circumstances.

Updating Income Information

Your income information is central to your IBR plan. Annual updates are typically required, and you’ll need to provide documentation, such as your tax return, to verify your income. The process for updating your information varies by loan servicer, but generally involves submitting the required documentation through their online portal or by mail. Failing to update your income information accurately and timely can lead to incorrect payment amounts, potentially resulting in overpayment or underpayment. It’s vital to update your information promptly when there’s a significant change in your income, such as a job change, promotion, or a significant decrease in earnings.

Consequences of Missed IBR Payments

Missing IBR payments has serious consequences. Late payments can damage your credit score, making it harder to obtain loans or credit cards in the future. Furthermore, missed payments can lead to your loan going into default. Defaulting on your student loans can result in wage garnishment, tax refund offset, and even legal action. It’s essential to contact your loan servicer immediately if you anticipate difficulty making a payment to explore options like forbearance or deferment before default occurs.

Strategies for Effective IBR Plan Management

Effective management of your IBR plan involves proactive planning and communication. Creating a realistic budget that incorporates your IBR payment is crucial. Regularly reviewing your budget and adjusting it as needed will help you stay on track. Maintain open communication with your loan servicer; address any questions or concerns promptly. Consider setting up automatic payments to avoid missed payments. Explore options like refinancing if you qualify for lower interest rates to reduce your overall payment. Seeking financial counseling can provide valuable guidance and support in managing your student loan debt effectively.

Sample Monthly Budget Incorporating IBR Payments

The following is a sample budget; your actual budget will vary based on your individual circumstances.

| Income | Amount |

|---|---|

| Net Monthly Salary | $3,000 |

| Expenses | Amount |

| Rent/Mortgage | $1,000 |

| Utilities | $200 |

| Groceries | $300 |

| Transportation | $150 |

| IBR Payment | $250 |

| Other Expenses | $100 |

| Savings | $0 |

This example shows a tight budget with limited savings. It highlights the importance of careful budgeting when managing IBR payments. Ideally, individuals should aim to allocate a portion of their income towards savings to build a financial safety net.

Potential Challenges and Solutions

Income-Based Repayment (IBR) plans offer significant benefits to student loan borrowers, but navigating them can present certain challenges. Understanding these potential hurdles and their solutions is crucial for maximizing the advantages of IBR and avoiding potential pitfalls. This section will explore common difficulties, offer practical solutions, and compare IBR to alternative repayment strategies.

Common Challenges with IBR Plans

IBR plans, while helpful, aren’t without their complexities. One common issue is the fluctuation of income. Changes in employment, salary, or family status can impact your payment amount, potentially leading to adjustments and recalculations. Another challenge involves accurately documenting income, particularly for self-employed individuals or those with irregular income streams. Finally, the long repayment period inherent in IBR plans can lead to the accumulation of significant interest, ultimately increasing the total amount repaid.

Solutions to Address IBR Challenges

Careful planning and proactive communication are key to mitigating the challenges associated with IBR. For fluctuating income, maintaining open communication with your loan servicer is vital. Regularly updating your income information ensures your payments accurately reflect your current financial situation. For self-employed individuals, meticulous record-keeping and clear documentation of income are essential for a smooth verification process. To minimize interest accrual, consider making additional payments whenever possible, even small amounts can make a significant difference over time. Exploring options like refinancing, if eligible, might reduce your interest rate and shorten the repayment term.

Situations Where IBR May Not Be Ideal

While IBR plans are beneficial for many, they might not be the best option for everyone. For high earners, the potential for lower monthly payments might not outweigh the longer repayment period and increased total interest paid. Borrowers with relatively small loan balances might find that standard repayment plans offer a faster route to loan payoff with less overall interest. Similarly, individuals with predictable and stable income might prefer the simplicity and predictability of a fixed repayment plan.

Comparison of IBR with Other Repayment Options

IBR plans differ significantly from other repayment options like Standard Repayment, Graduated Repayment, and Extended Repayment. Standard Repayment involves fixed monthly payments over a 10-year period, while Graduated Repayment starts with lower payments that gradually increase. Extended Repayment offers a longer repayment period (up to 25 years) but with higher total interest. IBR plans, however, adjust payments based on income, offering flexibility but potentially leading to longer repayment terms and higher overall costs. The best option depends on individual circumstances and financial goals.

Navigating Common IBR Application and Repayment Issues

During the application process, ensure all documentation is accurate and complete. Errors or omissions can lead to delays. If you encounter difficulties, contact your loan servicer immediately. During the repayment phase, regularly review your payment statements and account details to ensure accuracy. If you experience a change in income or family circumstances, promptly notify your servicer to initiate the necessary adjustments. Keep records of all communications and documentation related to your IBR plan. Proactive communication and careful record-keeping are your best defenses against potential issues.

Long-Term Implications of IBR

Choosing an Income-Based Repayment (IBR) plan significantly impacts your financial future. Understanding the long-term effects on loan forgiveness, credit scores, and taxes is crucial for making informed decisions. This section explores these key implications, providing a realistic example to illustrate the potential outcomes.

Loan Forgiveness Under IBR

IBR plans offer the possibility of loan forgiveness after a specified period of qualifying payments, typically 20 or 25 years, depending on the specific plan and loan type. However, the amount forgiven is considered taxable income in the year of forgiveness. This means you’ll owe taxes on the forgiven amount, potentially resulting in a significant tax bill. The exact amount forgiven depends on your income and payment history throughout the repayment period. Factors like missed payments or periods of deferment can affect the eligibility for forgiveness. Careful planning and understanding the tax implications are essential.

Impact of IBR on Credit Scores

While IBR plans can help manage monthly payments, consistently making smaller payments over an extended period may not always improve your credit score as quickly as a higher payment plan. Late payments, even on an IBR plan, can negatively impact your credit score. It’s important to maintain consistent on-time payments, even if they are smaller, to mitigate any negative impact on your creditworthiness. Credit reporting agencies assess various factors, and a longer repayment timeline under IBR may not be viewed as favorably as a shorter repayment period with higher payments.

Tax Implications of IBR

As mentioned previously, any loan forgiveness received under an IBR plan is considered taxable income. This means you will need to report the forgiven amount on your tax return for the year you receive the forgiveness. This can result in a substantial tax liability, depending on your tax bracket. It’s crucial to consult a tax professional to understand the potential tax implications and plan accordingly. They can help you estimate your tax liability and explore strategies for managing the potential tax burden.

Example IBR Repayment Scenario

Let’s consider a hypothetical scenario: Sarah has $50,000 in student loans with an initial interest rate of 6%. Under her IBR plan, her monthly payments are $300. Over 25 years, she makes 300 monthly payments, totaling $90,000. After 25 years, the remaining balance of $20,000 is forgiven. However, Sarah will owe taxes on this $20,000, which could significantly reduce her net savings. This example highlights the importance of considering the long-term costs, including taxes on forgiven amounts.

Visual Representation of Long-Term IBR Impact

Imagine a graph with “Years” on the x-axis and “Loan Balance” on the y-axis. The line representing a standard repayment plan would show a steep downward slope, reaching zero relatively quickly. In contrast, the line representing an IBR plan would show a much gentler slope, extending over 20-25 years. While the monthly payments are lower, the total amount paid over time (including the tax liability on forgiven amounts) is potentially higher. The graph would visually demonstrate the trade-off between lower monthly payments and a longer repayment period with a potentially higher overall cost.

Last Recap

Successfully navigating the student loan income-based repayment application process requires careful planning and attention to detail. By understanding the various IBR plans, meticulously documenting your income, and proactively managing your repayment strategy, you can significantly reduce your monthly payments and work towards a debt-free future. Remember to regularly review your plan and adjust as needed to reflect changes in your financial circumstances. Proactive planning and a thorough understanding of the system are key to long-term success in managing your student loan debt.

Question Bank

What happens if my income changes during the repayment period?

You must update your income information with your loan servicer. Failure to do so could result in inaccurate payments and potential issues down the line.

Can I switch from one IBR plan to another?

Generally, yes, but there are specific timelines and requirements. Consult your loan servicer for details.

What if I miss an IBR payment?

Missing payments can negatively impact your credit score and potentially lead to loan default. Contact your servicer immediately if you anticipate difficulty making a payment.

Are there any fees associated with IBR plans?

While there are no application fees for IBR, standard interest still accrues on your loan balance.