Navigating the complexities of student loan repayment can feel overwhelming, but understanding income-contingent repayment plans offers a potential pathway to manageable debt. These plans tailor monthly payments to your income, providing crucial flexibility for borrowers facing financial uncertainties. This exploration delves into the intricacies of these plans, outlining eligibility, payment calculations, and the potential for loan forgiveness.

From understanding the eligibility criteria and the process of application to grasping the impact of income fluctuations on monthly payments, this guide aims to empower you with the knowledge needed to make informed decisions about your student loan repayment strategy. We will also examine the potential tax implications of loan forgiveness and compare income-contingent plans with other repayment options available.

Eligibility Criteria for Income-Contingent Repayment Plans

Income-contingent repayment (ICR) plans offer a lifeline to student loan borrowers struggling with repayment. These plans adjust your monthly payments based on your discretionary income and family size, potentially lowering your payments significantly. However, understanding the eligibility criteria is crucial before applying. Eligibility varies depending on the specific ICR plan and your loan type.

Income thresholds and other requirements for qualifying for an income-contingent repayment plan are primarily determined by your adjusted gross income (AGI) and family size. Generally, you must have federal student loans, and your AGI must fall below a specific threshold. The exact threshold varies by plan and is adjusted annually to reflect changes in the cost of living. Additionally, some plans may require you to have a certain amount of outstanding student loan debt. The process of applying and being approved involves completing an application form, providing documentation of your income and family size, and undergoing a verification process by your loan servicer.

Income Thresholds and AGI Calculations

Determining your eligibility hinges on accurately calculating your adjusted gross income (AGI). This is your gross income minus certain deductions allowed by the IRS. Your AGI, combined with your family size, determines whether you fall below the income threshold for the specific ICR plan. For example, a single borrower might need an AGI below $60,000 to qualify, while a borrower with a family of four might have a higher threshold, perhaps $100,000. These numbers are illustrative and subject to change based on the specific plan and year. It’s vital to consult the official guidelines for the most up-to-date information. Many federal student loan servicers offer online calculators to help determine your AGI and potential eligibility.

Application Process and Approval

Applying for an ICR plan typically involves completing a form available through your loan servicer’s website or by contacting them directly. You will need to provide documentation verifying your income and family size, such as tax returns or pay stubs. The servicer will then review your application and determine your eligibility. If approved, your monthly payments will be recalculated based on your income and family size. The approval process can take several weeks, and it’s important to be prepared for a potential waiting period. Regular communication with your loan servicer is key to ensuring a smooth process.

Comparison of Eligibility Requirements Across Different ICR Plans

Different lenders and government programs offer variations of ICR plans, each with its own nuances in eligibility requirements. For example, some plans may prioritize borrowers with specific loan types (e.g., Federal Stafford Loans, Federal Grad PLUS Loans), while others might have stricter income thresholds. It is essential to carefully compare the eligibility criteria of different plans to find the most suitable option. The official websites of the lenders or government agencies offering these plans are the best resources for detailed information on their specific eligibility requirements. The information provided by the lender or agency will supersede any general information provided elsewhere.

Step-by-Step Guide to Determine Eligibility

1. Identify your federal student loans: Make a list of all your federal student loans and their balances.

2. Calculate your Adjusted Gross Income (AGI): Use your most recent tax return or consult an IRS publication to determine your AGI.

3. Determine your family size: Include yourself and any dependents you claim on your taxes.

4. Research ICR plan eligibility requirements: Visit the websites of your loan servicers or the federal student aid website to find the specific income thresholds for each available plan.

5. Compare your AGI and family size to the plan requirements: Determine if your AGI and family size meet the criteria for any ICR plan.

6. Complete the application: If eligible, complete the application through your loan servicer’s website or by contacting them directly.

7. Provide necessary documentation: Submit the required documentation, such as tax returns and pay stubs.

8. Monitor your application status: Stay in contact with your loan servicer to check on the progress of your application.

Calculation of Monthly Payments

Understanding how your monthly student loan payment is calculated under an income-contingent repayment (ICR) plan is crucial. The process considers your adjusted gross income (AGI), family size, and the loan’s outstanding principal balance. The goal is to create manageable monthly payments that are proportionate to your earnings.

The precise formula for calculating monthly payments under an ICR plan isn’t publicly available as a single, universally applicable equation. The calculation is complex and varies slightly depending on the specific loan servicer and program. However, the core principle involves determining your disposable income and applying a payment ratio based on that income and family size. The payment is generally capped at a percentage of your disposable income, ensuring affordability while still working towards loan repayment.

Disposable Income Determination

Determining your disposable income is a key step in the calculation. This isn’t simply your gross income; it’s your income after certain deductions. Typically, deductions include federal income tax, state income tax, and Social Security and Medicare taxes. Some programs may also allow for additional deductions based on factors such as childcare expenses or the number of dependents. The exact deductions allowed will depend on the specific loan program and the servicer’s guidelines. It’s important to consult your loan servicer’s documentation for precise details.

Income Level and Family Size Impact on Payments

Different income levels and family sizes significantly affect monthly payments under an ICR plan. Higher incomes generally result in higher monthly payments, while larger family sizes may result in lower payments (due to the higher number of dependents considered in the disposable income calculation). For example, a single borrower with a high income will likely have a substantially higher monthly payment than a borrower with a low income and a large family. The payment is designed to be affordable, but it will always be tied to income. It’s important to note that these calculations are dynamic; your payment may adjust as your income or family size changes.

Example Payment Calculations

The following table illustrates how different income levels and family sizes can influence monthly payments. These are illustrative examples and should not be considered precise representations of any specific program’s calculations. Actual payments will vary depending on the specific loan program, loan balance, and individual circumstances.

| Annual Income | Family Size | Calculated Monthly Payment (Example) |

|---|---|---|

| $30,000 | 1 | $150 |

| $60,000 | 1 | $300 |

| $30,000 | 4 | $100 |

| $60,000 | 4 | $200 |

Impact of Income Changes on Repayment

Income-contingent repayment (ICR) plans are designed to adjust your monthly student loan payments based on your income and family size. This means that your payments will fluctuate as your financial situation changes. Understanding how these changes impact your payments is crucial for effective loan management.

Income changes, whether increases or decreases, directly influence your monthly payment amount under an ICR plan. The plan is recalculated periodically, usually annually, to reflect your updated income and family size. This ensures your payments remain manageable while still working towards loan repayment. Failing to report changes can lead to overpayment or underpayment, potentially impacting your loan forgiveness eligibility if applicable.

Reporting Income Changes to the Lender

It’s essential to promptly notify your loan servicer of any significant changes in your income or family size. This typically involves submitting updated tax information, such as your most recent tax return or a pay stub, along with a formal notification. The specific process varies slightly depending on your loan servicer, but generally involves logging into your online account, completing a form, or contacting customer service. Delays in reporting can result in inaccurate payment calculations and potentially affect your long-term repayment strategy.

Examples of Payment Adjustments Based on Income Fluctuations

Let’s consider two scenarios to illustrate how income changes affect ICR payments.

Scenario 1: Income Increase. Suppose a borrower’s annual income increases from $40,000 to $60,000. Assuming a constant family size and loan balance, their monthly payment will likely increase because a higher income allows for a larger monthly payment. The exact increase will depend on the specific ICR plan formula used by the lender. For instance, if the initial monthly payment was $200, it might increase to $300, reflecting the 50% income increase.

Scenario 2: Income Decrease. Conversely, if a borrower’s annual income drops from $50,000 to $30,000, their monthly payment will likely decrease. This protects borrowers during periods of financial hardship. Using the same hypothetical example, if the initial monthly payment was $250, it might decrease to $150, mitigating the financial burden during a period of reduced income.

Flowchart: Reporting Income Changes and Subsequent Payment Adjustments

The following describes a flowchart illustrating the process. Imagine a rectangular box representing each step. Arrows connect the boxes, showing the flow of the process.

Box 1: “Income Change Occurs” (e.g., new job, job loss, salary increase). An arrow points to Box 2.

Box 2: “Notify Loan Servicer” (within the timeframe specified by the servicer). An arrow points to Box 3.

Box 3: “Submit Required Documentation” (tax returns, pay stubs, etc.). An arrow points to Box 4.

Box 4: “Loan Servicer Reviews Documentation”. An arrow points to Box 5.

Box 5: “Loan Servicer Recalculates Payment”. An arrow points to Box 6.

Box 6: “Updated Payment Amount Communicated to Borrower”. An arrow points to Box 7.

Box 7: “Borrower Makes Payments Based on New Amount”.

Forgiveness and Loan Discharge

Income-contingent repayment (ICR) plans offer the possibility of student loan forgiveness after a specific period of qualifying payments. This forgiveness isn’t automatic; it hinges on meeting several criteria and completing the necessary application procedures. Understanding these requirements is crucial for borrowers aiming to eliminate their student loan debt through an ICR plan.

The conditions for student loan forgiveness under an ICR plan vary depending on the specific program and the type of loan. Generally, forgiveness is granted after making a certain number of qualifying monthly payments, typically 20 or 25 years, depending on the loan type and when the loan was disbursed. The remaining balance is then discharged. It’s important to note that the forgiven amount is considered taxable income in most cases.

Conditions for Loan Forgiveness

Forgiveness under an ICR plan requires consistent on-time payments for the specified period. Payments must be calculated according to the income-contingent formula, reflecting the borrower’s income and family size. Any missed or late payments can delay or prevent forgiveness. Furthermore, the type of loan significantly impacts the forgiveness timeline and eligibility. For example, Direct Subsidized and Unsubsidized Loans might have different forgiveness periods than Federal Family Education Loans (FFEL). Finally, maintaining employment and accurately reporting income are crucial for continued eligibility.

Applying for Loan Forgiveness

The application process typically involves monitoring your payment progress through your loan servicer’s online portal. Once you approach the end of your qualifying payment period, your servicer will typically notify you about the steps to take. This may involve submitting updated income documentation and confirming your employment status. Failure to respond promptly to these requests could delay the forgiveness process. The exact steps and deadlines will vary depending on your loan servicer and the specific ICR plan you’re enrolled in. It’s vital to keep your contact information updated with your loan servicer.

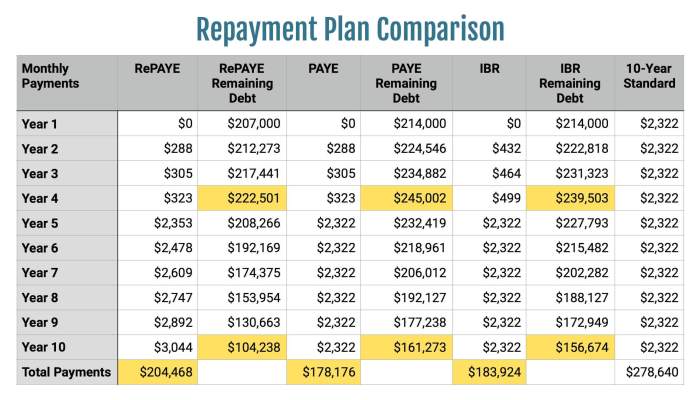

Comparison of Forgiveness Provisions Across ICR Plans

Different income-contingent repayment plans may have slightly varying forgiveness periods and eligibility requirements. For instance, the exact number of qualifying payments required for forgiveness may differ between the ICR plan and other income-driven repayment (IDR) plans like the Revised Pay As You Earn (REPAYE) or Income-Based Repayment (IBR) plans. The key difference often lies in the calculation of the monthly payment and the length of the repayment period. Understanding these nuances is essential for choosing the most suitable plan. Consult the Department of Education’s website or your loan servicer for the most up-to-date and accurate information.

Eligibility Criteria and Required Steps for Loan Forgiveness

Before attempting to apply for loan forgiveness, borrowers should understand the eligibility criteria and the necessary steps. The process isn’t automatic and requires proactive engagement.

- Eligibility Criteria: Consistent on-time payments for the required period (typically 20 or 25 years), accurate income reporting, and maintaining employment throughout the repayment period.

- Required Steps: Enroll in an eligible ICR plan, make consistent monthly payments as calculated by the plan, and actively monitor payment progress through your loan servicer’s online portal. Respond promptly to requests for updated information from your loan servicer, and be prepared to provide documentation supporting your income and employment status when requested.

Tax Implications of Income-Contingent Repayment

Income-contingent repayment (ICR) plans offer a flexible approach to student loan repayment, adjusting monthly payments based on income. However, a crucial aspect often overlooked is the tax implication of any loan forgiveness that may occur under these plans. Understanding these potential tax consequences is vital for effective financial planning.

Forgiven student loan debt under an ICR plan is generally considered taxable income in the year the debt is forgiven. This means the forgiven amount will be added to your gross income, potentially increasing your tax liability for that year. The IRS treats this as income because the loan forgiveness is essentially a benefit received. This can significantly impact your tax bracket and overall tax burden, especially if a substantial amount of debt is forgiven.

Tax Treatment of Forgiven Student Loan Debt

The Internal Revenue Service (IRS) classifies forgiven student loan debt under an ICR plan as income, subject to federal income tax. This applies regardless of whether the loan was originally subsidized or unsubsidized. The amount forgiven is reported on Form 1099-C, Cancellation of Debt, which you will receive from your loan servicer. You are then required to include this amount in your gross income when filing your federal income tax return. This can lead to a higher tax bill in the year of forgiveness.

Examples of Tax Consequences in Different Income Scenarios

Let’s consider a few scenarios to illustrate the potential tax implications.

Scenario 1: Low Income. Imagine someone with an annual income of $30,000 who has $10,000 in student loan debt forgiven. While the forgiven amount is significant relative to their income, their overall tax bracket might be low enough that the additional tax burden is manageable. They may only see a modest increase in their tax liability.

Scenario 2: Moderate Income. Someone earning $60,000 annually with $20,000 in forgiven debt will likely face a more substantial tax increase. The forgiven amount pushes them further into a higher tax bracket, resulting in a larger tax liability compared to Scenario 1. The impact is more pronounced due to the progressive nature of the tax system.

Scenario 3: High Income. An individual earning $120,000 a year with $30,000 in forgiven debt will experience the most significant tax consequences. The additional income from the forgiven debt pushes them significantly into a higher tax bracket, leading to a substantial increase in their tax liability. This highlights the importance of proactive financial planning in anticipation of potential tax obligations.

Potential Tax Implications Based on Income and Forgiven Debt Amount

The following table illustrates potential tax implications. Note that this is a simplified example and does not account for all potential tax deductions or credits. Actual tax liability will depend on individual circumstances and applicable tax laws. It’s always advisable to consult a tax professional for personalized guidance.

| Annual Income | Forgiven Debt Amount | Approximate Taxable Income Increase | Estimated Additional Tax Liability (Illustrative, varies by state and filing status) |

|---|---|---|---|

| $30,000 | $10,000 | $10,000 | $1,000 – $2,000 |

| $60,000 | $20,000 | $20,000 | $4,000 – $6,000 |

| $120,000 | $30,000 | $30,000 | $8,000 – $12,000 |

Comparison with Other Repayment Plans

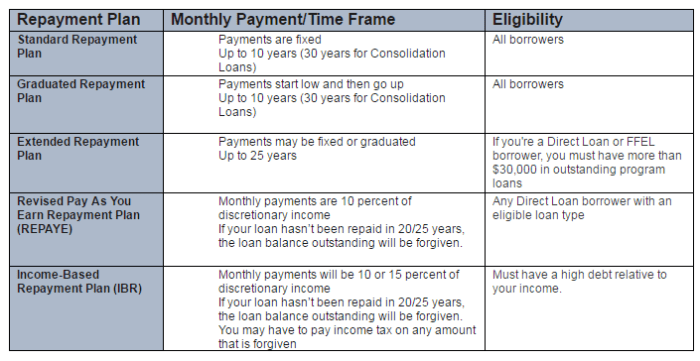

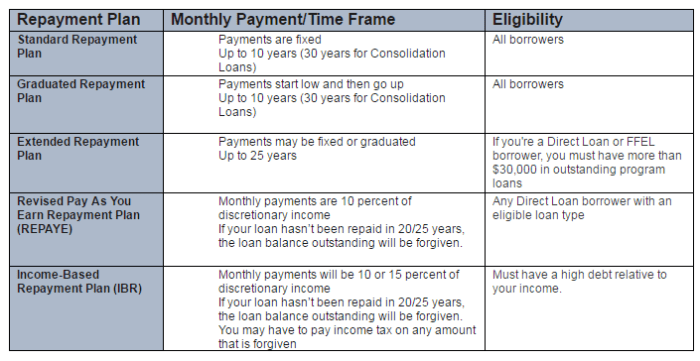

Choosing the right student loan repayment plan is crucial for managing debt effectively. Understanding the differences between various plans is essential to making an informed decision that aligns with your financial situation and long-term goals. This section compares and contrasts income-contingent repayment (ICR) plans with standard, extended, and graduated repayment plans, highlighting key differences in payment amounts, loan forgiveness, and eligibility requirements.

The primary distinction between these plans lies in how your monthly payment is calculated and the length of the repayment period. While ICR bases payments on your income and family size, the others utilize a fixed or graduated schedule irrespective of your financial circumstances. This impacts not only the monthly burden but also the total interest paid over the life of the loan and the potential for loan forgiveness.

Key Differences Between Repayment Plans

The following table summarizes the key differences between income-contingent, standard, extended, and graduated repayment plans. Note that specific details and eligibility criteria may vary depending on the lender and the type of federal student loan.

| Feature | Income-Contingent Repayment (ICR) | Standard Repayment | Extended Repayment | Graduated Repayment |

|---|---|---|---|---|

| Payment Calculation | Based on discretionary income and family size | Fixed monthly payment over 10 years | Fixed monthly payment over 25 years | Payments start low and gradually increase over 10 years |

| Loan Term | Up to 25 years, potentially longer depending on income | 10 years | Up to 25 years | 10 years |

| Monthly Payment | Varies with income; potentially lower than other plans, especially in early years | Higher initially, but consistent | Lower initially than standard, but consistent | Low initially, increasing each year |

| Loan Forgiveness | Possible after 20-25 years, depending on income and loan type; remaining balance may be forgiven | No loan forgiveness | No loan forgiveness | No loan forgiveness |

| Eligibility | Specific eligibility criteria apply, typically based on income and loan type | Generally available for all federal student loans | Generally available for all federal student loans; higher loan balances often required | Generally available for all federal student loans |

| Advantages | Lower monthly payments, potential for loan forgiveness | Shorter repayment period, lower total interest paid | Lower monthly payments than standard | Lower initial payments, easier to manage early in career |

| Disadvantages | Longer repayment period, potential for higher total interest paid if income remains low | Higher monthly payments | Longer repayment period, higher total interest paid | Higher payments later in repayment term |

Advantages and Disadvantages Summary

While ICR offers potentially lower monthly payments and loan forgiveness, it comes with a longer repayment period, leading to potentially higher overall interest costs. Standard repayment, though demanding higher initial payments, results in a shorter repayment period and lower total interest. Extended repayment offers lower monthly payments but significantly extends the repayment period, increasing overall interest paid. Graduated repayment provides manageable initial payments, but the increasing payments might become challenging later. The best choice depends heavily on individual financial circumstances and long-term financial goals. Careful consideration of all factors is crucial before selecting a repayment plan.

Potential Challenges and Pitfalls

Navigating an income-contingent repayment (ICR) plan for student loans can present several challenges. Understanding these potential difficulties and implementing proactive strategies is crucial for successful repayment and avoiding negative consequences. This section Artikels common pitfalls and offers guidance on mitigating them.

Inaccurate Income Reporting

Inaccurate income reporting is a significant risk for borrowers on ICR plans. The monthly payment amount is directly tied to your reported income. Underreporting your income leads to lower payments, but it also delays loan repayment and could result in penalties or even loan default. Conversely, overreporting can lead to unnecessarily high payments, straining your budget. Accurate and consistent reporting is paramount. Using the most recent tax return information is generally recommended, as it is the most accurate reflection of your income. If your income fluctuates significantly throughout the year (for example, if you are a freelancer or seasonal worker), you might need to adjust your reported income more frequently than annually to avoid discrepancies.

Failure to Update Income Changes

Many borrowers’ financial situations change over time – job changes, promotions, or even periods of unemployment. Failing to promptly update the loan servicer with these income changes is a common mistake. Continuing to pay based on outdated income information can lead to either underpayment or overpayment, both with significant consequences. Consistent communication with your loan servicer regarding any income fluctuations is crucial. They may require supporting documentation, such as pay stubs or tax returns, to verify the changes. Regularly reviewing your repayment plan and your income is a proactive way to avoid issues.

Consequences of Non-Compliance

Failure to comply with the terms of an ICR plan, including accurate income reporting and timely payments, can lead to several negative consequences. These can range from increased interest accrual to late payment fees, and ultimately, loan default. Defaulting on your student loans has severe implications, including damage to your credit score, wage garnishment, and potential tax penalties. Furthermore, default can prevent you from accessing future loans or credit opportunities. Maintaining open communication with your loan servicer and promptly addressing any payment issues is vital to avoid these serious consequences.

Strategies for Successful Navigation

Successfully navigating an ICR plan requires proactive planning and consistent effort. Maintaining meticulous records of income, expenses, and loan payments is essential. Regularly review your payment schedule and your income, comparing them to ensure accuracy. If your income changes, contact your loan servicer immediately to update your information. Explore options for budgeting and financial planning to ensure you can afford your monthly payments. Consider seeking professional financial advice to create a personalized repayment strategy that aligns with your financial situation. Proactive communication and careful monitoring are key to successfully managing your ICR plan and avoiding potential pitfalls.

Last Word

Successfully managing student loan debt often requires a strategic approach, and income-contingent repayment plans can be a valuable tool. By carefully considering your eligibility, understanding the payment calculation methods, and preparing for potential income fluctuations, you can navigate the complexities of repayment and potentially achieve loan forgiveness. Remember to thoroughly research the specific terms and conditions of your plan and consult with a financial advisor for personalized guidance.

FAQ Compilation

What happens if I lose my job while on an income-contingent repayment plan?

Most plans offer options for temporarily reducing or suspending payments during periods of unemployment or financial hardship. Contact your loan servicer immediately to discuss your options and explore available deferment or forbearance programs.

How long does it typically take to have my student loans forgiven under an income-contingent plan?

The timeframe for loan forgiveness varies greatly depending on the specific plan, your income, and the amount of your loan. Some plans may offer forgiveness after 20-25 years of payments, while others may have different timelines. Check your plan’s specific terms for details.

Can I refinance my student loans if I’m already enrolled in an income-contingent repayment plan?

Refinancing your student loans might eliminate your eligibility for income-contingent repayment and any associated benefits like potential loan forgiveness. Carefully weigh the pros and cons before refinancing.

Are there any credit implications for being on an income-contingent repayment plan?

Generally, being on an income-contingent repayment plan itself doesn’t negatively impact your credit score, as long as you make the payments as agreed. However, consistent late or missed payments will negatively affect your credit score.