Navigating the complexities of student loan repayment can feel overwhelming, especially when it comes to income-driven repayment (IDR) plans. Understanding the student loan income recertification process is crucial for borrowers to ensure they’re making the right payments and maximizing their potential for loan forgiveness. This guide provides a comprehensive overview of the recertification process, covering everything from documentation requirements to appealing a decision, ultimately empowering you to manage your student loans effectively.

This guide breaks down the often-confusing aspects of student loan income recertification into manageable steps, providing clear explanations and practical examples. We’ll explore the various IDR plans, the documents needed for recertification, the impact of income changes, and the procedures for different loan servicers. Whether you’re facing an income increase, decrease, or simply need to understand the process, this guide will help you navigate the complexities of recertification with confidence.

Understanding Income Recertification Requirements

Income recertification for student loans is a crucial process that ensures your monthly payment amount accurately reflects your current financial situation. Failing to recertify when required can result in higher payments than necessary or even default on your loans. This section details the process, the types of income considered, and provides a step-by-step guide.

The Student Loan Income Recertification Process

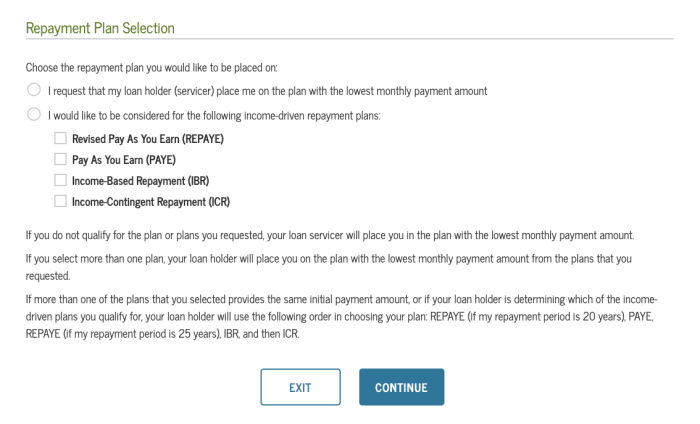

The income recertification process involves submitting updated financial information to your student loan servicer. This information is used to recalculate your monthly payment under your income-driven repayment (IDR) plan. The frequency of recertification varies depending on your specific plan and servicer, typically annually. The process usually involves completing an online form, providing documentation (like tax returns or pay stubs), and waiting for your servicer to process your information and adjust your payment.

Types of Income Considered for Recertification

Your student loan servicer will consider various sources of income when determining your eligibility for an IDR plan and calculating your monthly payment. This typically includes gross income from employment (salary, wages, bonuses, commissions), self-employment income (profit from a business), and any other significant sources of income, such as rental income or investment income. Generally, income from sources like alimony, child support, and Social Security benefits may also be included depending on your plan and servicer. It’s important to accurately report all income sources to avoid potential issues.

Step-by-Step Guide to Completing the Recertification Process

- Check your recertification deadline: Your servicer will notify you when it’s time to recertify your income. Pay close attention to these notices to avoid penalties.

- Gather necessary documentation: This typically includes your most recent tax returns (Form 1040 and supporting schedules), pay stubs, W-2 forms, and any other documentation that reflects your income from all sources.

- Complete the online recertification form: Your servicer will provide an online form to update your income information. Carefully review and accurately complete all fields.

- Upload supporting documentation: Follow your servicer’s instructions for uploading or submitting your supporting documentation. Ensure all documents are clear and legible.

- Submit your recertification: Once you’ve completed the form and uploaded all required documents, submit your recertification request.

- Monitor your account: After submitting your recertification, check your account regularly to track the status of your request and to confirm that your monthly payment has been adjusted accordingly.

Income-Driven Repayment (IDR) Plan Recertification Requirements Comparison

| Loan Servicer | Recertification Frequency | Required Documentation | Online Portal Availability |

|---|---|---|---|

| FedLoan Servicing (now Nelnet) | Annually | Tax returns, pay stubs | Yes |

| Navient | Annually | Tax returns, pay stubs | Yes |

| Great Lakes | Annually | Tax returns, pay stubs | Yes |

| Aidvantage | Annually | Tax returns, pay stubs | Yes |

Documentation Needed for Recertification

Successfully completing your income recertification requires submitting accurate and complete documentation. This process ensures your student loan repayment plan remains aligned with your current financial situation. Providing the necessary documents efficiently will expedite the review process.

To successfully recertify your income, you must provide documentation that verifies your income and household size. The specific documents required may vary slightly depending on your loan servicer and the type of repayment plan you are on, so always refer to your servicer’s specific instructions. However, the following list provides a general overview of commonly requested documents.

Required Documents

The following documents are typically required for income recertification. Ensure all documents are clear, legible, and complete. Incomplete or illegible documents may delay the processing of your recertification.

- Tax Return Transcripts: These official transcripts from the IRS provide a detailed record of your income and tax information. They are generally considered the most reliable form of income verification.

- Pay Stubs: Recent pay stubs (typically from the last three months) showing your gross pay, deductions, and net pay are often acceptable. Ensure these stubs clearly display your name, employer information, and pay period.

- W-2 Forms: Your W-2 form(s) from your employer(s) summarize your annual income and tax withholdings. These are particularly useful if you are recertifying near the end of the tax year.

- Self-Employment Documentation: If you are self-employed, you will need to provide documentation such as profit and loss statements, tax returns (Schedule C), or bank statements showing income and expenses. These should cover the relevant tax year.

- Proof of Household Size: This could include a copy of your driver’s license, marriage certificate, birth certificates for dependents, or other official documents that confirm the number of people in your household.

Acceptable Document Formats

Most loan servicers accept documents submitted electronically as scanned copies or digital photographs. However, ensure the quality is high enough to be easily legible. Physical copies sent via mail are also generally accepted, but electronic submission is often preferred for speed and convenience.

- Electronic Submissions: PDF, JPG, and PNG formats are commonly accepted. Ensure files are not excessively large to avoid upload issues.

- Physical Copies: If mailing documents, use a secure method of delivery, such as certified mail, and keep a copy of your submission for your records.

Common Documentation Issues and Resolutions

Several common issues can arise during the document submission process. Understanding these potential problems and their solutions can help ensure a smooth recertification.

- Issue: Blurry or illegible documents. Resolution: Resubmit clear, high-resolution copies. If originals are damaged, contact the issuing agency for replacements.

- Issue: Incomplete tax returns or pay stubs. Resolution: Obtain and submit the complete document. Contact your employer or the IRS for assistance if necessary.

- Issue: Documents with missing information (e.g., name, dates, employer information). Resolution: Contact the relevant party (employer, IRS) to obtain a corrected or complete document.

- Issue: Submitting documents outside the acceptable format. Resolution: Convert the document to an acceptable format (PDF, JPG, PNG) before resubmitting.

Recertification Checklist

Use this checklist to ensure you have all the necessary documents before submitting your income recertification.

| Document | Collected? | Notes |

|---|---|---|

| Tax Return Transcripts | ||

| Pay Stubs (Last 3 Months) | ||

| W-2 Forms | ||

| Self-Employment Documentation (if applicable) | ||

| Proof of Household Size |

Impact of Income Changes on Repayment Plans

Income-driven repayment (IDR) plans are designed to make student loan payments more manageable by basing your monthly payment on your income and family size. However, because your income fluctuates, it’s crucial to understand how these changes affect your payments and your overall repayment strategy. Regular income recertification ensures your payments remain aligned with your current financial situation.

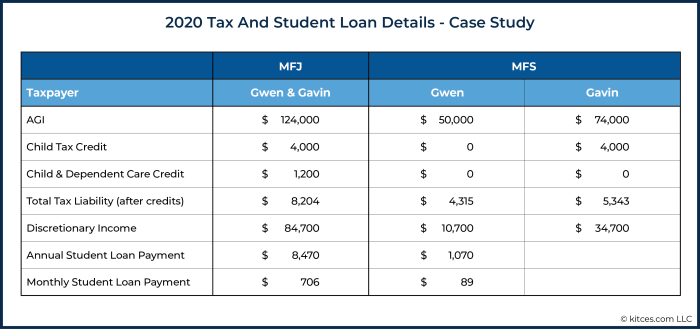

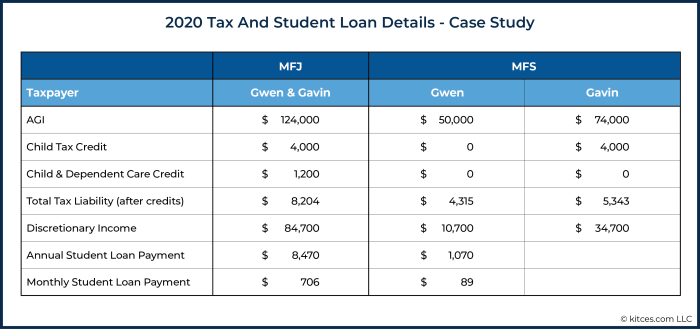

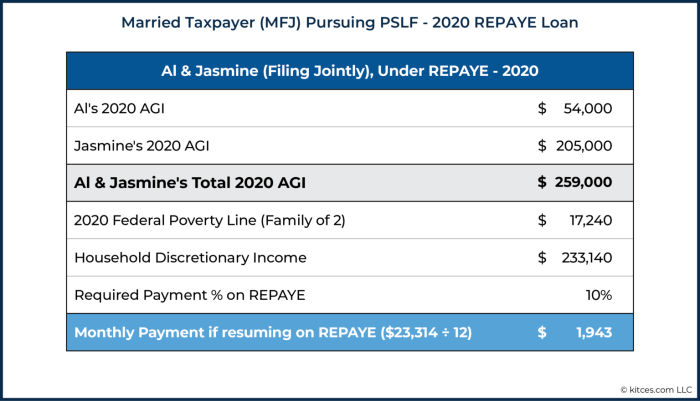

Changes in income directly impact your monthly student loan payment under an IDR plan. The calculation typically involves a formula that considers your discretionary income (income above a certain poverty guideline) and applies a payment percentage. An increase in income generally leads to higher monthly payments, while a decrease results in lower payments. Failure to accurately report income changes can lead to significant consequences.

Consequences of Inaccurate Income Recertification

Submitting inaccurate income information during recertification can have serious repercussions. You might face penalties, including: higher-than-necessary payments, extended repayment periods, or even the loss of IDR plan benefits altogether. In some cases, this could result in the accumulation of additional interest, potentially leading to a larger overall debt burden. The severity of the consequences depends on the nature and extent of the misrepresentation. Intentional misreporting is particularly problematic and could have legal ramifications.

Impact of Income Increases on Repayment Plans

When your income rises, your monthly payment under an IDR plan will usually increase proportionally. This is because a larger portion of your discretionary income is now available to contribute towards your student loans. For example, if your income increases by 15%, your monthly payment might also increase by a similar percentage, depending on the specific IDR plan’s formula. This ensures that you’re making a more substantial contribution towards repaying your debt while you earn more. This increase in payment, however, may reduce the overall time required to pay off the loan.

Impact of Income Decreases on Repayment Plans

Conversely, a decrease in income typically leads to a lower monthly payment. The IDR plan recalculates your payment based on your reduced discretionary income, making your monthly burden more manageable during times of financial hardship. For instance, if you experience a job loss or a significant pay cut, recertifying your income will result in a lower monthly payment, preventing you from falling behind on your payments. This adjustment helps to mitigate financial strain.

Examples of Income Change Scenarios

Let’s consider two scenarios. Scenario 1: Sarah earns $40,000 annually and her monthly payment is $200 under an IDR plan. If her income increases to $50,000, her payment might rise to $250. Scenario 2: John’s annual income drops from $60,000 to $45,000 due to a job change. His monthly payment might decrease from $300 to $225, providing him with much-needed financial relief. These are illustrative examples; the actual impact will depend on the specific IDR plan’s formula and other factors. It’s important to note that these are simplified examples and do not include potential changes in interest accrual or other factors that might affect the total amount paid.

Timing and Frequency of Recertification

Income-driven repayment (IDR) plans require periodic recertification of your income and family size to ensure your monthly payments accurately reflect your current financial situation. The frequency of these recertifications varies depending on the specific IDR plan you’ve chosen. Failing to recertify on time can lead to significant consequences, so understanding the process and deadlines is crucial.

Recertification frequency is determined by your chosen IDR plan and is usually an annual process. However, some plans may require more frequent updates, potentially every six months or even quarterly, depending on the lender and the specific terms of your loan. It’s essential to consult your loan servicer’s website or contact them directly to confirm your specific recertification schedule. They will provide the official documentation outlining your plan’s requirements.

Recertification Deadlines and Calculation

Determining your recertification deadline involves understanding your initial certification date and the required recertification frequency. For example, if your initial certification was on January 15th, 2024, and your plan requires annual recertification, your next deadline would be January 15th, 2025. If your plan requires semi-annual recertification, your deadlines would be January 15th, 2025 and July 15th, 2025. Always confirm these dates with your loan servicer to avoid any discrepancies. They typically send reminders, but proactive checking is advisable.

Consequences of Late Recertification

Submitting your recertification materials late can result in several penalties. Your loan servicer may temporarily revert your payments to the standard repayment plan, which could significantly increase your monthly payments. In some cases, late submission may also affect your eligibility for future income-driven repayment plans. Additionally, late fees may apply, adding extra costs to your already existing debt. The severity of the penalties can vary based on your lender and the terms of your loan agreement. For example, a lender might temporarily suspend your IDR plan benefits until the updated information is received and processed.

Recertification Process Timeline

The recertification process typically follows a structured timeline. This is a generalized example; specific timelines may vary depending on the loan servicer.

| Stage | Timeline (Example) | Description |

|---|---|---|

| Notification | 60 days before deadline | Loan servicer sends a reminder email or letter. |

| Gather Documents | 30 days before deadline | Collect required tax documents (W-2, 1099, etc.) and other income verification. |

| Complete Application | 15 days before deadline | Fill out and submit the recertification application online or by mail. |

| Confirmation | Within 7-10 business days of submission | Loan servicer confirms receipt and begins processing. |

| Processing | 15-30 days | Servicer reviews your documents and updates your payment plan. |

| Updated Payment Plan | Within 30-45 days of submission | New payment plan reflecting updated income is applied. |

Always prioritize timely submission to avoid penalties and ensure your payments remain manageable.

Navigating the Recertification Process with Different Loan Servicers

Recertifying your income for student loan repayment plans can vary significantly depending on your loan servicer. Understanding each servicer’s specific procedures is crucial for a smooth and timely process. Differences exist in online portals, required documentation, and communication methods. This section will highlight these differences and provide strategies to navigate them effectively.

Comparing Recertification Procedures Across Servicers

Different student loan servicers employ varying methods for income recertification. Some servicers may utilize entirely online portals with detailed instructions and progress tracking, while others might require more manual processes involving mailed documentation. The level of technological sophistication and user-friendliness can greatly impact the borrower’s experience. For example, one servicer might offer a streamlined online form, while another may require downloading, completing, and uploading multiple documents. This discrepancy necessitates a flexible approach from borrowers, requiring them to adapt to each servicer’s unique system.

Potential Challenges with Different Servicers

Borrowers might encounter various challenges depending on their servicer. These could include navigating complex online portals, experiencing delays in processing applications, or facing difficulties in contacting customer support. Some servicers may have limited online resources or less responsive customer service teams, potentially causing frustration and delays in the recertification process. Others might have stringent documentation requirements, leading to rejection of incomplete or improperly formatted applications. In some cases, technical glitches or system errors within the servicer’s online portal could further complicate the process.

Tips and Strategies for a Smooth Recertification Experience

Proactive planning and thorough preparation are key to a smooth recertification. Begin by carefully reviewing your servicer’s specific requirements well in advance of the deadline. Gather all necessary documentation—tax returns, pay stubs, W-2 forms—and organize them meticulously. Familiarize yourself with the online portal (if applicable) and ensure you have the necessary technical skills or support to complete the process successfully. Maintain detailed records of all communication with your servicer, including dates, times, and the names of representatives you speak with. If you anticipate challenges, consider contacting your servicer well in advance to clarify any uncertainties and potentially resolve potential issues proactively.

Contact Information and Online Resources for Major Student Loan Servicers

| Servicer Name | Phone Number | Website | Online Portal Access |

|---|---|---|---|

| Example Servicer 1 | (555) 123-4567 | www.exampleservicer1.com | [Link to online portal, if available] |

| Example Servicer 2 | (555) 987-6543 | www.exampleservicer2.com | [Link to online portal, if available] |

| Example Servicer 3 | (555) 246-8013 | www.exampleservicer3.com | [Link to online portal, if available] |

| Example Servicer 4 | (555) 135-7924 | www.exampleservicer4.com | [Link to online portal, if available] |

Appealing a Recertification Decision

Disagreements can arise regarding income recertification decisions. Borrowers who believe their income was misrepresented or that the decision was unfair have the right to appeal. The appeal process aims to ensure fairness and accuracy in determining repayment plan eligibility.

The process for appealing a recertification decision generally involves submitting a formal appeal to your loan servicer within a specified timeframe, usually Artikeld in your loan documents or on your servicer’s website. This timeframe is crucial; missing the deadline could jeopardize your appeal.

Appeal Process and Required Documentation

To file an appeal, you’ll need to gather supporting documentation that substantiates your claim. This typically includes a formal written request explaining why you disagree with the recertification decision, along with any evidence supporting your position. This might encompass updated tax returns, pay stubs reflecting a change in employment status or income, documentation of a significant medical expense, or other relevant financial records. The more comprehensive your documentation, the stronger your appeal will be. Failure to provide sufficient supporting documentation can weaken your case. Your loan servicer’s website or your loan documents will Artikel the specific requirements for your appeal.

Situations Warranting an Appeal

Several situations could justify an appeal. For instance, if your servicer mistakenly used outdated income information, or if a significant, unforeseen event such as job loss or a major medical expense impacted your income after the initial recertification but before the decision was made, an appeal would be appropriate. Another example would be if a clerical error led to an incorrect calculation of your income-driven repayment plan payment. If you believe your servicer failed to consider extenuating circumstances impacting your ability to repay your loans, an appeal is also recommended.

Potential Appeal Outcomes and Subsequent Steps

After submitting your appeal, your loan servicer will review the information you provided. There are three potential outcomes: your appeal could be granted, resulting in a revised repayment plan; it could be denied, leaving your original recertification decision in place; or, your servicer might request additional information before making a decision. If your appeal is denied, you may have the option to appeal the decision again, or you might explore other options such as contacting a consumer protection agency or seeking legal counsel. If your appeal is granted, your loan servicer will adjust your repayment plan accordingly. It is important to understand that the outcome of an appeal is not guaranteed.

Understanding the Long-Term Implications of Recertification

Accurate and timely income recertification significantly impacts your student loan repayment journey, influencing both the forgiveness timeline and your overall financial well-being. Understanding these long-term effects is crucial for effective financial planning.

Recertification plays a vital role in determining your eligibility for income-driven repayment (IDR) plans and potential loan forgiveness programs. These plans often tie your monthly payments to your income, meaning that consistent and accurate recertification ensures your payments reflect your current financial situation. This, in turn, can accelerate your progress toward loan forgiveness.

Impact on Loan Forgiveness

Accurate recertification is paramount for those aiming for loan forgiveness under programs like Public Service Loan Forgiveness (PSLF) or other IDR-based forgiveness options. A delay or inaccurate reporting of income can lead to missed payments, potentially extending the repayment period and delaying or even jeopardizing your eligibility for forgiveness. For example, if a borrower consistently underreports their income, their monthly payments might be lower than they should be. This could result in them not meeting the required payment count for forgiveness within the allotted timeframe. Conversely, accurately reporting a decrease in income could lead to reduced payments, enabling faster progress towards forgiveness.

Influence on Repayment Timeline

Recertification directly affects the length of your repayment period. Consistent and accurate reporting allows your repayment plan to adapt to changes in your income. If your income decreases, your monthly payment will likely decrease, potentially shortening the overall repayment timeline. Conversely, an increase in income might lead to higher payments, potentially accelerating the repayment process. Consider a scenario where a borrower’s income increases significantly after a few years. Accurate recertification will reflect this change, resulting in higher payments and potentially reducing the overall number of years required to repay the loans.

Financial Benefits of Consistent Recertification

The financial advantages of accurate and timely recertification are substantial. Lower monthly payments during periods of lower income provide immediate financial relief, allowing for better budgeting and reducing financial stress. This can also free up funds for other financial goals, such as saving for a down payment on a house or investing. In the long run, meeting the requirements for loan forgiveness due to consistent and accurate recertification can lead to significant savings over the life of the loan, avoiding potentially tens of thousands of dollars in interest payments.

Risks of Inaccurate or Incomplete Recertification

Inaccurate or incomplete recertification carries significant risks. Underreporting income could lead to accumulating unpaid interest, ultimately increasing the total amount owed. Conversely, overreporting income could lead to unnecessarily high payments, creating unnecessary financial strain. Furthermore, inaccurate information could jeopardize your eligibility for loan forgiveness programs, prolonging your repayment period and potentially leading to a much higher total repayment amount. For instance, a borrower who fails to report a significant change in their income might find themselves ineligible for loan forgiveness due to insufficient qualifying payments, even if they’ve been diligently making payments for years. This highlights the importance of accurate and timely updates.

End of Discussion

Successfully navigating student loan income recertification requires careful planning and attention to detail. By understanding the process, gathering the necessary documentation, and proactively addressing any potential challenges, you can ensure your payments are accurate and that you’re on track for potential loan forgiveness. Remember to keep your information updated with your loan servicer and don’t hesitate to reach out for assistance if needed. Proactive management of your student loans now will significantly impact your financial future.

Quick FAQs

What happens if I miss my recertification deadline?

Missing the deadline may result in your payments being recalculated based on your previous income, potentially leading to higher payments than necessary. You may also face penalties or delays in loan forgiveness.

Can I recertify my income more than once a year?

The frequency of recertification depends on your specific IDR plan. Some plans require annual recertification, while others may require it every two years. Check your loan servicer’s guidelines.

What if my income fluctuates throughout the year?

Most IDR plans use your income from the most recent tax year. Significant changes in income should be reported to your loan servicer as soon as possible, even if it’s outside the formal recertification period.

Where can I find my loan servicer’s contact information?

Your loan servicer’s contact information can usually be found on your loan statements or on the National Student Loan Data System (NSLDS) website.