Navigating the complexities of student loan repayment often leaves borrowers questioning the intricacies of tax implications. Understanding Form 1098-E, the document reporting your student loan interest payments, is crucial for accurately filing your taxes and potentially claiming valuable deductions. This guide unravels the mysteries surrounding student loan interest, the 1098-E form, and how it impacts your financial well-being.

From deciphering the information on your 1098-E to maximizing the student loan interest deduction, we’ll cover key aspects like repayment strategies, refinancing implications, and essential record-keeping practices. By the end, you’ll be equipped with the knowledge to confidently manage your student loan debt and optimize your tax returns.

Understanding Form 1098-E

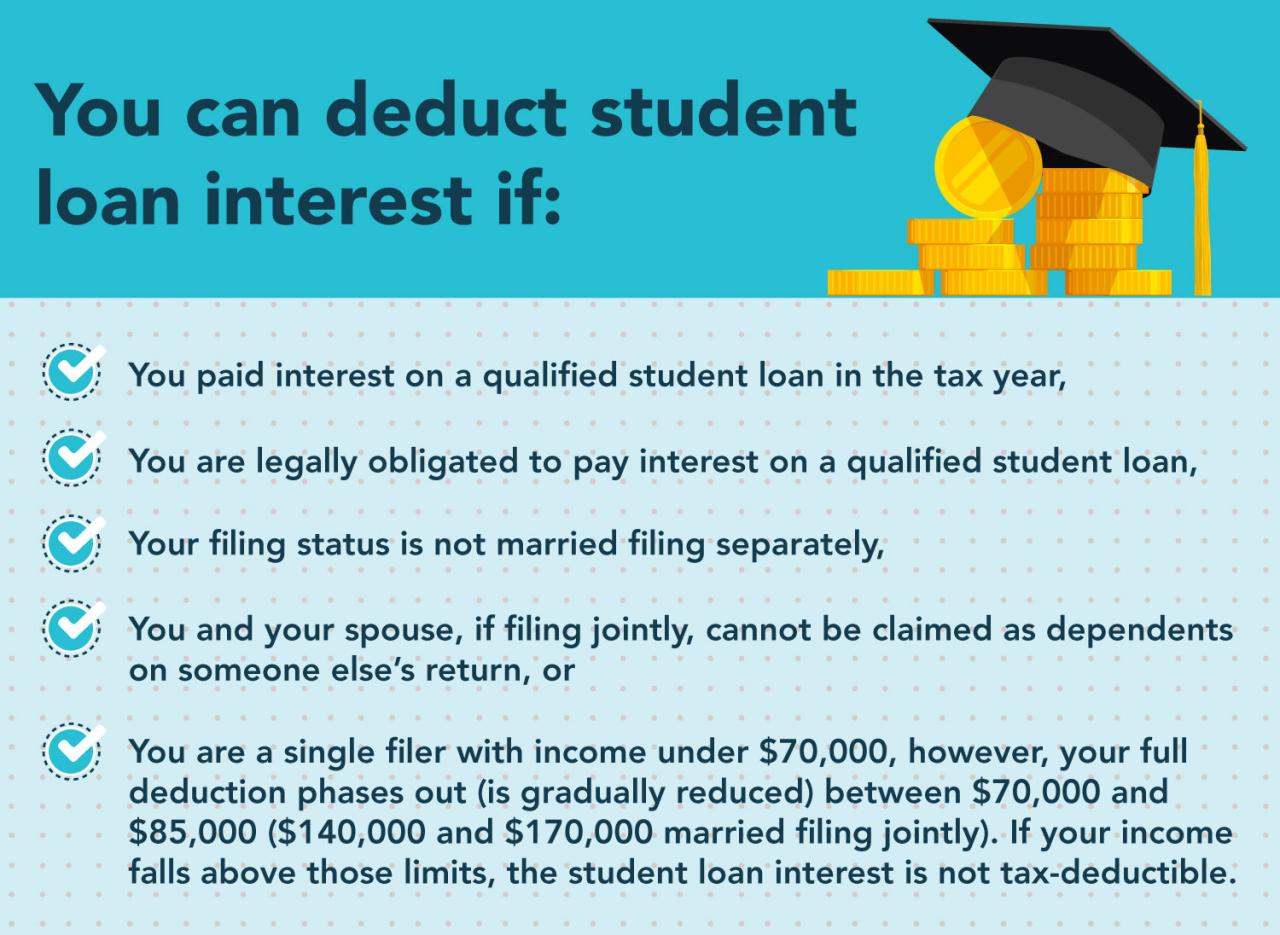

Form 1098-E, Student Loan Interest Statement, is a crucial document for anyone who paid interest on student loans during the tax year. This form provides the information you need to accurately report your student loan interest payments on your federal income tax return, potentially leading to a valuable tax deduction.

Form 1098-E reports the total amount of interest you paid on qualified education loans during the tax year. Understanding this form is essential for correctly filing your taxes and claiming any applicable deductions.

Information Reported on Form 1098-E

The 1098-E form includes key information necessary for tax reporting. This includes the payer’s name (the lender who issued the student loan), the borrower’s name (your name), and the total amount of interest paid during the tax year. Additional information may be included, such as the loan’s origination date and the borrower’s tax identification number (TIN). Accurate completion of this form is vital for avoiding errors on your tax return.

Examples of Situations Requiring a 1098-E Form

Several situations may result in a borrower receiving a 1098-E form. For example, if you made interest-only payments on a federal student loan, you would receive a 1098-E. Similarly, if you paid interest on a private student loan, and the lender is required to report it, you will also receive this form. Even if you made payments on a loan that includes both principal and interest, the portion dedicated to interest will be reported. It is important to note that the lender is only required to send a 1098-E if you paid $600 or more in student loan interest during the year.

Scenarios and Corresponding 1098-E Entries

The following table illustrates different scenarios and how they would be reflected on a 1098-E form. Remember that the actual form may contain additional details.

| Scenario | Payer Name | Borrower Name | Interest Paid |

|---|---|---|---|

| Federal Student Loan Interest Only Payments | Department of Education | Jane Doe | $1,200 |

| Private Student Loan Interest and Principal Payments | Private Lender X | John Smith | $750 |

| Consolidated Federal Student Loans, Interest Only | Department of Education | Sarah Jones | $500 |

| No Interest Paid on Student Loans | N/A | N/A | $0 |

Student Loan Interest Deduction

The student loan interest deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. This can significantly reduce your taxable income and, consequently, your tax liability. Understanding the rules and limitations surrounding this deduction is crucial for maximizing your tax benefits.

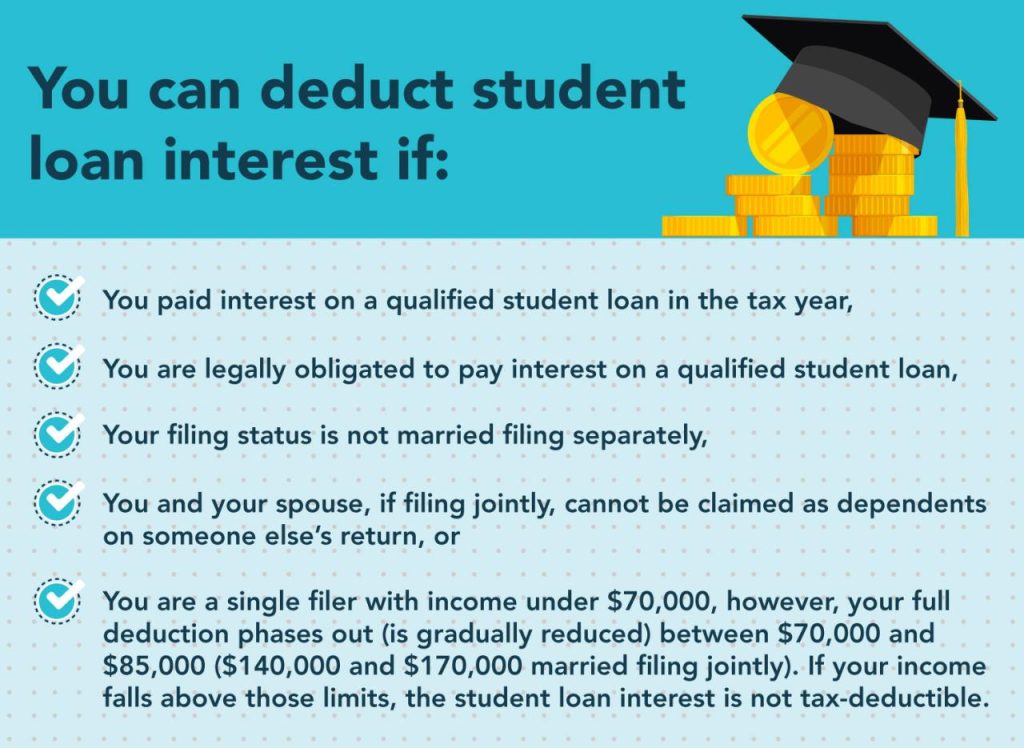

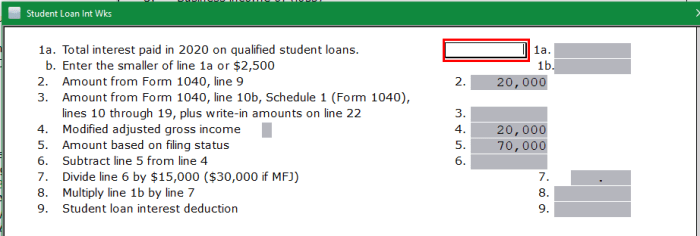

Eligibility Requirements for the Student Loan Interest Deduction

To claim the student loan interest deduction, you must meet several criteria. Firstly, the loan must be taken out for your education, or the education of your spouse or dependent. The loan must be used to pay for qualified education expenses, such as tuition, fees, room and board, and other necessary educational costs. You must also be legally obligated to repay the loan, and the interest paid must be for a qualified education loan. Finally, your modified adjusted gross income (MAGI) must be below a certain threshold, which varies depending on your filing status and the tax year. For example, in 2023, the limit was $85,000 for those married filing jointly, $65,000 for those filing as head of household, and $40,000 for single filers. Exceeding this threshold would disqualify you from claiming the deduction.

Limitations and Restrictions on the Student Loan Interest Deduction

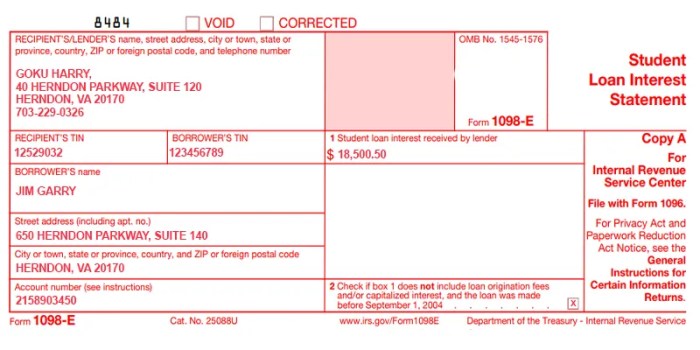

The student loan interest deduction is limited to the actual amount of interest you paid during the year, up to a maximum deduction of $2,500. This means even if you paid more than $2,500 in student loan interest, you can only deduct $2,500. Furthermore, the deduction is an above-the-line deduction, meaning it is deducted from your gross income before calculating your adjusted gross income (AGI). This makes it particularly beneficial as it can reduce your taxable income regardless of other deductions you may claim. It’s also important to note that you cannot deduct interest paid on loans used for purposes other than education, such as personal loans or loans used to purchase a home.

Comparison with Other Education Tax Benefits

The student loan interest deduction is distinct from other education tax benefits, such as the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC). The AOTC and LLC are tax credits, which directly reduce your tax liability, while the student loan interest deduction reduces your taxable income. Tax credits generally offer a larger tax benefit than deductions. The AOTC and LLC are generally for students currently enrolled in college, while the student loan interest deduction is available for those repaying their student loans. Therefore, a taxpayer may be eligible for both a student loan interest deduction and a credit for their education, or their dependents’ education. A taxpayer should carefully evaluate their eligibility for all available education tax benefits.

Flowchart for Determining Eligibility for the Student Loan Interest Deduction

The following flowchart Artikels the steps to determine eligibility:

[A textual description of a flowchart follows. Visual representation is not possible within this text-based format. The flowchart would have a series of decision points (diamonds) and processing steps (rectangles). It would start with “Loan taken out for education?” (Yes/No). A “Yes” branch would lead to “Used for qualified education expenses?” (Yes/No). A “Yes” here would go to “Legally obligated to repay?” (Yes/No). A “Yes” here would go to “MAGI below the limit?” (Yes/No). A “Yes” here would lead to “Eligible for Deduction”. All “No” branches would lead to “Not Eligible for Deduction”.]

Impact of Interest on Loan Repayment

Understanding how student loan interest affects your repayment is crucial for effective financial planning. The interest accrued on your loans significantly impacts the total amount you ultimately repay, potentially extending the repayment period and increasing your overall cost. This section will explore different repayment plans, strategies for minimizing interest, and the long-term financial implications of various approaches.

Student Loan Repayment Plans and Their Impact on Total Interest Paid

Different repayment plans offer varying monthly payments and repayment timelines, directly influencing the total interest paid. A standard repayment plan typically involves fixed monthly payments over a 10-year period. However, longer repayment periods, such as those offered by extended repayment plans (up to 25 years), result in lower monthly payments but significantly higher total interest paid due to the extended accrual period. Income-driven repayment plans, which adjust monthly payments based on income and family size, offer lower monthly payments in the short term but may extend the repayment period considerably, leading to potentially higher overall interest costs. For example, a $50,000 loan with a 6% interest rate repaid over 10 years under a standard plan might result in approximately $13,000 in interest, while the same loan repaid over 25 years could accumulate more than $30,000 in interest.

Strategies to Minimize Student Loan Interest

Several strategies can help borrowers minimize the amount of interest paid on their student loans. Making extra principal payments reduces the loan’s principal balance faster, leading to less interest accruing over time. Refinancing your loans with a lower interest rate can also substantially reduce the total interest paid over the life of the loan. Consolidating multiple loans into a single loan with a lower interest rate can streamline payments and potentially lower overall interest costs. Careful budgeting and prioritizing loan repayment can accelerate the repayment process, minimizing interest accrual. For instance, an extra $100 payment per month on a $50,000 loan can significantly shorten the repayment period and reduce total interest paid.

Comparison of Long-Term Costs of Different Loan Repayment Strategies

The following table illustrates the long-term cost differences between various repayment strategies for a hypothetical $50,000 student loan with a 6% interest rate. These figures are illustrative and actual amounts may vary based on individual loan terms and payment schedules.

| Repayment Plan | Repayment Period (Years) | Approximate Monthly Payment | Approximate Total Interest Paid |

|---|---|---|---|

| Standard Repayment | 10 | $550 | $13,000 |

| Extended Repayment | 25 | $250 | $30,000 |

| Income-Driven Repayment (Example) | 20 | Variable (e.g., $300 – $450) | $25,000 – $35,000 |

Effect of Interest Capitalization on Total Loan Repayment Amount

Interest capitalization occurs when unpaid interest is added to the principal loan balance, increasing the amount on which future interest is calculated. This significantly increases the total amount repaid. For example, consider a $10,000 loan with a 5% interest rate. If interest is capitalized annually for three years and no payments are made, the principal will increase substantially. After the first year, the unpaid interest would be $500. After capitalization, the new principal becomes $10,500. The second year’s interest calculation is based on this higher amount, resulting in even more interest capitalization the following year. This compounding effect leads to a much larger total repayment amount than if the interest were not capitalized. This process illustrates the significant impact of interest capitalization, making timely payments crucial to avoid substantial increases in the total repayment amount.

Tax Implications of Refinancing

Refinancing student loans can significantly impact your tax situation, primarily by altering the amount of student loan interest you can deduct. Understanding these implications is crucial for making informed financial decisions. The key factor is the change in your loan terms, specifically the interest rate and the lender.

Refinancing often involves replacing your existing federal student loans with a new private loan. This change affects your eligibility for the student loan interest deduction because private loans generally don’t qualify for the deduction under current IRS guidelines. The implications are directly tied to the tax benefits you previously received, or could have received, from the deduction.

Impact of Refinancing on Form 1098-E

Form 1098-E reports the amount of student loan interest you paid during the tax year. If you refinance your federal student loans with a private lender, you’ll likely no longer receive a 1098-E form, as private lenders aren’t obligated to provide it. This means the interest you pay on your refinanced loan won’t be reported on this form, and you will lose the ability to claim the student loan interest deduction on your federal tax return, regardless of the amount of interest paid. Conversely, if you refinance your federal loans with another federal loan program, you might continue to receive a 1098-E form, depending on the specifics of the new loan program. However, the amount reported could change due to differences in interest rates or loan balances.

For example, let’s say you paid $2,000 in interest on your federal student loans in 2023 and received a 1098-E reflecting this amount. If you refinance those loans in 2024 with a private lender and pay $1,500 in interest that year, you won’t receive a 1098-E, and you won’t be able to deduct the $1,500. In contrast, if you refinanced with another federal loan program and paid $1,800 in interest, you *might* receive a 1098-E showing that amount, allowing you to claim the deduction (subject to other eligibility requirements).

Potential Benefits and Drawbacks of Refinancing from a Tax Perspective

The primary drawback of refinancing from a tax perspective is the potential loss of the student loan interest deduction. This deduction can provide significant tax savings, especially for individuals in lower tax brackets. However, refinancing can offer non-tax benefits, such as a lower interest rate, leading to lower overall loan repayment costs. The decision to refinance should weigh these non-tax benefits against the loss of the deduction. A lower interest rate might lead to substantial savings over the life of the loan, even if it means foregoing the deduction. It’s a financial trade-off requiring careful consideration.

Key Tax Considerations When Refinancing Student Loans

Before refinancing, consider these crucial tax implications:

- Loss of Student Loan Interest Deduction: Refinancing with a private lender eliminates your eligibility for this deduction.

- Impact on Adjusted Gross Income (AGI): The student loan interest deduction is an above-the-line deduction, impacting your AGI. Losing this deduction will increase your AGI, potentially affecting other tax benefits tied to AGI thresholds.

- Tax Implications of Loan Forgiveness Programs: If your refinanced loan is eligible for loan forgiveness programs, the forgiven amount may be considered taxable income in the future. This is a complex area and requires careful consideration.

- State Tax Implications: Some states offer their own student loan interest deductions. Refinancing might affect your eligibility for these state-level benefits as well.

Record Keeping and Tax Preparation

Accurate record-keeping is crucial for successfully claiming the student loan interest deduction. Maintaining detailed records not only ensures you receive the correct tax benefit but also protects you from potential IRS inquiries and penalties. Failing to keep proper records can lead to missed deductions or even accusations of tax fraud. This section will guide you through best practices for documenting your student loan interest payments and accurately reporting them on your tax return.

Importance of Accurate Record Keeping for Student Loan Interest Payments

Meticulous record-keeping is paramount when claiming the student loan interest deduction. The IRS requires substantiation for all deductions claimed, and failing to provide sufficient documentation can result in the disallowance of your deduction. This means keeping copies of all relevant documents, including your 1098-E form (if received), payment confirmations from your lender, and any other documentation that verifies the amount of interest you paid during the tax year. This comprehensive approach protects your right to claim the deduction and minimizes the risk of an audit. Consider using a dedicated file or folder to store these documents, both physical and digital copies.

Reporting Student Loan Interest on Tax Returns

Accurately reporting student loan interest on your tax return involves a straightforward process. First, gather all necessary documents, including your 1098-E form and any additional records showing interest paid. Next, complete the relevant sections of Form 1040, specifically Schedule 1 (Additional Income and Adjustments to Income). On Schedule 1, you’ll find a line dedicated to student loan interest. Enter the amount of interest paid as shown on your 1098-E or your records, whichever is more accurate. If you paid more interest than reported on the 1098-E, you can still deduct the full amount, but be prepared to provide supporting documentation to the IRS if requested. Remember to double-check your entries for accuracy before filing your return. If you are unsure about any aspect of the process, consulting a tax professional is always advisable.

Organizing Financial Documents Related to Student Loan Interest Payments

Effective organization is key to simplifying the tax preparation process. Consider using a dedicated filing system, either physical or digital, to store all documents related to your student loan interest payments. This could include a labeled folder, a dedicated section in your accounting software, or a cloud-based storage system. Regardless of the method, ensure that your system allows for easy retrieval of documents when needed. A good practice is to label documents clearly with the tax year and the relevant information. For example, you might label a document as “2023 Student Loan Interest Payment – Bank of America.” Regularly reviewing and updating your files will prevent disorganization and ensure you have the necessary information readily available when filing your taxes.

Consequences of Incorrectly Reporting Student Loan Interest

Incorrectly reporting student loan interest can have significant consequences. The most common consequence is the disallowance of the deduction, meaning you won’t receive the tax benefit you were entitled to. In more severe cases, inaccurate reporting can lead to penalties and interest charges from the IRS. Furthermore, repeated instances of incorrect reporting can damage your tax credibility and may subject you to further scrutiny in future tax audits. In extreme cases, deliberate misreporting of student loan interest can be considered tax fraud, which carries severe legal and financial repercussions. Therefore, accuracy and meticulous record-keeping are essential to avoid any negative consequences.

Summary

Successfully managing student loan debt requires a multifaceted approach, encompassing informed repayment strategies and a thorough understanding of tax implications. Mastering the nuances of Form 1098-E and the student loan interest deduction empowers you to make well-informed decisions, minimize interest costs, and maximize your tax benefits. Remember, accurate record-keeping is paramount, and seeking professional tax advice when needed can provide invaluable support in navigating this complex landscape.

FAQ Explained

What if I don’t receive a 1098-E form?

If you paid over $600 in student loan interest and haven’t received a 1098-E, contact your lender. You can still deduct the interest using your payment records.

Can I deduct student loan interest if I’m not itemizing?

No, the student loan interest deduction is an itemized deduction. You must itemize your deductions on Schedule A to claim it.

What happens if I make a mistake on my tax return related to student loan interest?

Errors can lead to adjustments, penalties, or even audits. It’s crucial to maintain accurate records and consider seeking professional tax assistance if needed.

Is there a limit to how much student loan interest I can deduct?

Yes, the deduction is limited to the actual amount of interest you paid during the year, up to a maximum amount (this amount can change annually, so check the current IRS guidelines).