Navigating the complexities of student loan repayment can feel overwhelming, especially when considering potential tax benefits. Understanding the student loan interest deduction is crucial for borrowers seeking to minimize their tax burden. This guide offers a comprehensive overview of eligibility requirements, calculation methods, and relevant tax forms, empowering you to confidently claim this valuable deduction.

We’ll delve into the intricacies of adjusted gross income (AGI) limitations, explore which loan types qualify, and provide clear examples to illustrate the deduction calculation process. Furthermore, we’ll compare the student loan interest deduction to other repayment assistance programs, helping you make informed decisions about your financial strategy. Finally, we’ll examine the impact of past and potential future tax law changes, ensuring you stay informed about this dynamic area of personal finance.

Eligibility Requirements for the Student Loan Interest Deduction

Claiming the student loan interest deduction can significantly reduce your tax burden, but it’s crucial to understand the eligibility criteria. This section details the requirements, ensuring you accurately determine your eligibility for this valuable tax benefit.

Adjusted Gross Income (AGI) Limitations

The amount of student loan interest you can deduct is limited based on your Modified Adjusted Gross Income (MAGI). For the 2023 tax year, the deduction is phased out for single filers with a MAGI exceeding $85,000, and for married couples filing jointly, the phaseout begins when MAGI surpasses $170,000. This means that as your income rises above these thresholds, the amount of your deduction will decrease until it reaches zero. For example, a single filer with a MAGI of $90,000 would likely not be able to claim the full deduction, if any. The exact reduction depends on a complex formula determined by the IRS. It’s advisable to use tax software or consult a tax professional for precise calculations.

Qualifying Student Loans

The student loan interest deduction applies only to loans taken out for educational expenses for yourself, your spouse, or your dependent. This includes federal student loans, such as those from the Federal Direct Loan Program, and private student loans. However, loans used for purposes other than education, such as personal loans or home loans, do not qualify. Furthermore, loans used to pay for room and board are generally considered educational expenses and qualify for the deduction. It’s important to note that the loan must be used to pay for higher education expenses at an eligible institution.

Determining Eligibility Based on Filing Status

Eligibility for the student loan interest deduction depends on your filing status and MAGI, as previously discussed. Here’s a step-by-step guide:

1. Determine your filing status: This could be single, married filing jointly, married filing separately, head of household, or qualifying surviving spouse.

2. Calculate your MAGI: This involves adjusting your gross income to account for certain deductions and adjustments. Consult IRS Publication 970 for detailed instructions.

3. Compare your MAGI to the applicable limits: As mentioned, the phaseout begins at $85,000 for single filers and $170,000 for married couples filing jointly.

4. Check if you meet all other requirements: Ensure the loan was taken out for educational expenses and that you paid interest on the loan during the tax year.

Student Loan Type Eligibility Comparison

| Loan Type | Eligibility | AGI Phaseout (Single) | AGI Phaseout (Married Filing Jointly) |

|---|---|---|---|

| Federal Direct Loan | Yes | >$85,000 | >$170,000 |

| Federal Stafford Loan | Yes | >$85,000 | >$170,000 |

| Federal Perkins Loan | Yes | >$85,000 | >$170,000 |

| Private Student Loan | Yes (if for educational expenses) | >$85,000 | >$170,000 |

Calculating the Deductible Amount

The student loan interest deduction allows you to deduct the actual amount of interest you paid on qualified student loans during the tax year. However, there are limits on how much you can deduct, based on your modified adjusted gross income (MAGI) and the total amount of interest paid. Understanding these limitations is crucial for accurately calculating your deduction.

The calculation itself is relatively straightforward. You begin with the total amount of student loan interest you paid during the tax year. This amount is reported on Form 1098-E, Student Loan Interest Statement. You then compare this amount to the maximum allowable deduction, which is determined by your MAGI. The lesser of these two amounts is your deductible amount.

Maximum Deductible Amount Based on MAGI

The maximum amount you can deduct depends on your modified adjusted gross income (MAGI). MAGI is your adjusted gross income (AGI) with certain deductions added back. For the 2023 tax year, the maximum deduction is as follows:

| MAGI | Maximum Deduction |

|---|---|

| $70,000 or less (single filer; $140,000 or less for married filing jointly) | $2,500 |

| Over $70,000 (single filer); over $140,000 (married filing jointly) | Deduction is gradually reduced. Completely phases out at $85,000 (single) and $170,000 (married filing jointly). |

It’s important to note that the phase-out is not a sudden cutoff. Instead, the deduction is reduced incrementally as your MAGI increases above the thresholds. The exact reduction amount depends on your specific MAGI. Tax software or a tax professional can assist with precise calculations during the phase-out range.

Examples of Student Loan Interest Deduction Calculations

Let’s illustrate with some examples:

- Example 1: John paid $1,800 in student loan interest and has a MAGI of $60,000. Since his MAGI is below $70,000, his maximum deduction is $2,500. Therefore, he can deduct the full $1,800 he paid.

- Example 2: Sarah paid $3,000 in student loan interest and has a MAGI of $80,000. Her MAGI is above $70,000 but below the phase-out limit, meaning her deduction will be partially reduced. The exact amount of the reduction would need to be calculated based on the specific phase-out rules, which can be complex and require tax software or professional assistance. It will be less than $2,500 but more than $0.

- Example 3: Maria paid $2,000 in student loan interest and has a MAGI of $90,000. Her MAGI exceeds the phase-out limit for single filers, so she cannot deduct any student loan interest.

Flowchart for Calculating the Student Loan Interest Deduction

The following flowchart visually represents the calculation process:

[A flowchart would be inserted here. The flowchart would start with a box labeled “Total Student Loan Interest Paid.” This would lead to a decision diamond asking “Is MAGI ≤ $70,000 (single) or ≤ $140,000 (married filing jointly)?” A ‘yes’ branch would lead to a box labeled “Deductible Amount = Total Interest Paid (up to $2,500).” A ‘no’ branch would lead to a decision diamond asking “Is MAGI within the phase-out range?” A ‘yes’ branch would lead to a box labeled “Deductible Amount = Reduced Amount (complex calculation required).” A ‘no’ branch would lead to a box labeled “Deductible Amount = $0”. All boxes would connect to a final box labeled “Report Deductible Amount on Tax Return.”]

The formula for the deduction is: Deductible Amount = min(Total Student Loan Interest Paid, Maximum Allowable Deduction based on MAGI)

Tax Form and Filing Procedures

Claiming the student loan interest deduction requires careful completion of the relevant tax forms and the submission of supporting documentation. Understanding this process is crucial to ensure a successful claim and avoid potential penalties. Incorrectly claiming the deduction can lead to delays in processing your return or even an audit.

Completing Form 1040, Schedule 1

To claim the student loan interest deduction, you’ll need to use Form 1040, Schedule 1 (Additional Income and Adjustments to Income). Specifically, you’ll report the deduction on line 21, “Student loan interest.” This line allows you to enter the total amount of student loan interest you paid during the tax year. Remember to accurately record the amount; discrepancies can trigger scrutiny from the IRS. The instructions accompanying Form 1040 and Schedule 1 provide detailed guidance on completing this section. It’s essential to carefully review these instructions to ensure you’re following all the relevant rules and regulations.

Required Supporting Documentation

When claiming the student loan interest deduction, it’s crucial to retain all supporting documentation. This typically includes Form 1098-E, “Student Loan Interest Statement,” which your lender is required to provide if you paid $600 or more in student loan interest during the year. This form details the amount of interest you paid. If you paid less than $600, you’ll still need to keep records of your payments, such as bank statements or canceled checks showing the payments made to your student loan lender. These documents serve as proof of your payments and are essential if the IRS requests verification. Maintaining organized records is vital for a smooth tax filing process.

Consequences of Incorrectly Claiming the Deduction

Claiming the student loan interest deduction incorrectly can have several negative consequences. The most common issue is an inaccurate calculation of the deductible amount, potentially resulting in an underpayment or overpayment of taxes. An underpayment could lead to penalties and interest charges, while an overpayment might delay your refund. More seriously, providing false information or intentionally misrepresenting the amount of interest paid could result in an audit and potentially severe penalties, including fines and even criminal charges. Accuracy is paramount when claiming this deduction. For instance, if you mistakenly claim a deduction for interest paid on a loan that doesn’t qualify, this could lead to a rejection of your claim.

Checklist for Accurate Tax Return Filing

Before filing your tax return, carefully review this checklist to ensure accuracy:

- Gather all necessary documentation, including Form 1098-E (if applicable) and bank statements or canceled checks.

- Accurately calculate the deductible amount of student loan interest, ensuring you meet all eligibility requirements.

- Complete Form 1040, Schedule 1, line 21, entering the correct amount of the student loan interest deduction.

- Review your completed tax return carefully before submitting it to ensure accuracy and completeness.

- Retain copies of your tax return and all supporting documentation for your records.

Following these steps will help ensure a smooth and accurate tax filing process when claiming the student loan interest deduction.

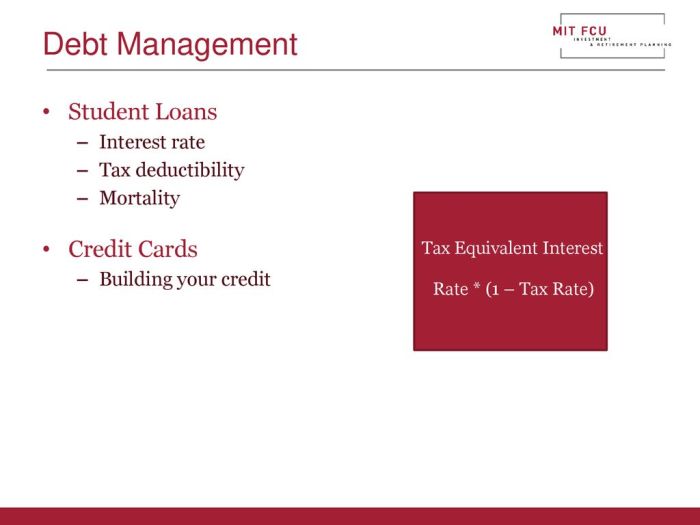

Comparison with Other Student Loan Repayment Assistance Programs

The student loan interest deduction, while beneficial, is just one piece of the puzzle when it comes to managing student loan debt. Several other federal and state programs offer different forms of assistance, each with its own set of eligibility criteria and benefits. Understanding these alternatives is crucial for borrowers to make informed decisions about managing their debt effectively. A comparative analysis allows borrowers to determine which program or combination of programs best suits their individual financial circumstances.

Understanding the nuances of various student loan repayment assistance programs is essential for effective debt management. Each program offers a unique approach to alleviate the burden of student loan repayment, catering to different borrower profiles and financial situations. By comparing the eligibility requirements, benefits, and limitations of each program, borrowers can optimize their repayment strategy and minimize their overall debt burden.

Comparison of Student Loan Repayment Assistance Programs

The following table compares three prominent student loan repayment assistance programs: the Student Loan Interest Deduction, Income-Driven Repayment (IDR) plans, and Public Service Loan Forgiveness (PSLF). These programs differ significantly in their eligibility requirements, the type of assistance provided, and the overall impact on borrowers’ long-term financial well-being.

| Program | Eligibility Requirements | Benefits | Disadvantages |

|---|---|---|---|

| Student Loan Interest Deduction | Must have paid interest on qualified student loans, meet adjusted gross income (AGI) limits, and file as an individual, head of household, qualifying surviving spouse, or married filing jointly. | Reduces taxable income, lowering your tax bill. | Limited by AGI limits and the amount of interest paid. Only reduces tax liability; it doesn’t directly reduce the loan principal. |

| Income-Driven Repayment (IDR) Plans | Vary by plan (e.g., ICR, PAYE, REPAYE,IBR). Generally require borrowers to demonstrate financial need based on income and family size. | Lower monthly payments based on income. Potential for loan forgiveness after 20-25 years (depending on the plan). | Lower monthly payments often result in a longer repayment period and potentially higher total interest paid over the life of the loan. Forgiveness may be subject to changes in program rules. |

| Public Service Loan Forgiveness (PSLF) | Requires employment in a qualifying public service job, repayment under an IDR plan, and 120 qualifying monthly payments. | Forgiveness of remaining federal student loan debt after 120 qualifying payments. | Strict eligibility requirements, including consistent employment in a qualifying public service job and adherence to an IDR plan. Long repayment period (10 years) before forgiveness is possible. |

Advantages and Disadvantages of Different Approaches

Choosing between the student loan interest deduction and other repayment assistance programs depends heavily on individual circumstances. For example, a high-income borrower might find the interest deduction less valuable than an IDR plan, which can significantly reduce monthly payments. Conversely, a borrower with a lower income might benefit more from the interest deduction, especially if they are not eligible for an IDR plan or PSLF. The PSLF program, while offering complete loan forgiveness, requires a significant commitment to public service and adherence to strict eligibility criteria. Carefully weighing these factors is crucial in selecting the most effective strategy.

Impact of Tax Law Changes on Student Loan Interest Deductibility

The student loan interest deduction, while seemingly straightforward, has been subject to various modifications throughout the years, significantly impacting borrowers’ tax liabilities and repayment strategies. These changes, often driven by broader economic policies and legislative priorities, highlight the dynamic nature of tax benefits and their potential for both advantageous and disadvantageous outcomes for students and recent graduates.

The deduction’s history reflects a fluctuating political landscape and shifting national priorities concerning higher education affordability and economic stimulus. Understanding these past shifts provides valuable context for predicting potential future alterations and their likely consequences.

Past Changes Affecting the Student Loan Interest Deduction

Numerous changes have impacted the student loan interest deduction since its inception. For instance, the maximum deduction amount has varied over time, sometimes being adjusted to account for inflation or economic conditions. Additionally, eligibility requirements, such as modified adjusted gross income (MAGI) limits, have undergone modifications, narrowing or broadening the pool of eligible borrowers. These changes have directly affected the number of individuals who could benefit from the deduction and the extent of the tax relief they could receive. For example, the 2017 Tax Cuts and Jobs Act temporarily increased the standard deduction, which, in some cases, rendered the student loan interest deduction less valuable to certain taxpayers as it pushed them into a higher tax bracket, reducing the overall benefit.

Potential Future Changes and Their Implications

Predicting future changes to the student loan interest deduction requires considering several factors. Potential changes could include adjustments to the MAGI limits, further alterations to the maximum deduction amount, or even the complete elimination of the deduction as part of broader tax reform efforts. Such alterations could significantly impact borrowers, potentially increasing their tax burdens and making loan repayment more challenging. For instance, a decrease in the maximum deduction or an increase in the MAGI limits could leave many borrowers ineligible for the benefit, or significantly reduce the amount they can deduct. Conversely, an increase in the maximum deduction or a decrease in the MAGI limits would benefit more borrowers. A complete elimination would leave borrowers with no federal tax benefit for their student loan interest payments.

Timeline of Significant Changes (Past Decade)

To illustrate the variability of the student loan interest deduction, a timeline highlighting key changes over the past decade is beneficial. While specific details regarding dollar amounts and income limits would require referencing IRS publications for each tax year, a general overview can highlight the shifting landscape.

| Year | Significant Change |

|---|---|

| 2013 | Potential changes related to the American Taxpayer Relief Act of 2012 might have impacted the deduction. |

| 2017 | The Tax Cuts and Jobs Act (TCJA) altered various tax provisions, including potentially influencing the student loan interest deduction through changes to standard deduction amounts and tax brackets. |

| 2018-2022 | The TCJA’s impact continued to be felt, and any further adjustments were largely based on its provisions. |

| 2023-Present | Ongoing discussions and potential legislative changes concerning student loan debt forgiveness and tax reform could affect the future of the student loan interest deduction. |

Note: This timeline provides a general overview. Specific details of changes in income limits, maximum deduction amounts, and other relevant parameters for each year should be verified through official IRS documentation.

Illustrative Examples of Student Loan Interest Deduction Scenarios

Understanding the student loan interest deduction requires examining various scenarios to grasp its application. The deduction’s value depends on factors like adjusted gross income (AGI), the amount of interest paid, and the borrower’s filing status. The following examples illustrate different situations a borrower might encounter.

Maximizing the Student Loan Interest Deduction

This scenario depicts a borrower who fully utilizes the deduction. Let’s consider Sarah, a single filer with an AGI of $65,000 and $2,500 in student loan interest payments. Because her AGI is below the phaseout limit (which varies yearly but is generally above $85,000 for single filers), she can deduct the full $2,500. This reduces her taxable income by that amount, resulting in a significant tax savings. This assumes she meets all other eligibility requirements, such as having paid the interest on a qualified student loan.

Scenario Where a Borrower Does Not Qualify for the Deduction

Conversely, consider John, a married taxpayer filing jointly with an AGI exceeding $170,000 (the approximate phaseout limit for married couples filing jointly). Even if he paid $3,000 in student loan interest, he wouldn’t qualify for the deduction because his AGI surpasses the threshold. The phaseout range means the deduction is gradually reduced as income increases until it disappears entirely. His high income prevents him from claiming this tax benefit.

Scenario Where a Borrower Partially Qualifies for the Deduction

David, a single filer, paid $1,800 in student loan interest. His AGI is $75,000, placing him within the phaseout range. The exact amount of his deduction would depend on the specific phaseout rules for the tax year, which involve a calculation based on his AGI and the applicable thresholds. He would be able to deduct a portion of the interest paid, but not the full amount. The IRS instructions for Form 8863 provide the details for calculating this reduced deduction.

Hypothetical Borrower: Eligibility and Deductible Amount

Let’s analyze the case of Emily, a head of household filer. In the tax year 2023, Emily paid $1,500 in student loan interest on qualified education loans. Her AGI was $60,000. Assuming the phaseout range for head of household filers in 2023 was between $70,000 and $85,000 (these values are for illustrative purposes and should be verified with current IRS guidelines), Emily’s AGI is below the phaseout range. Therefore, she is eligible for the full $1,500 student loan interest deduction. This deduction would reduce her taxable income and lower her overall tax liability. To claim this deduction, she would need to complete Form 8863 and file it along with her Form 1040.

Last Point

Successfully navigating the student loan interest deduction requires a thorough understanding of eligibility criteria and calculation methods. By carefully reviewing your loan details, AGI, and relevant tax forms, you can effectively leverage this valuable tax benefit. Remember to compare the deduction with other repayment assistance programs to optimize your overall student loan repayment strategy. Staying informed about potential tax law changes will ensure you remain prepared to maximize your savings in the years to come.

Common Queries

Can I deduct interest on private student loans?

Yes, provided you meet the eligibility requirements, including AGI limits, and the interest is paid on qualified education loans.

What if I paid off my student loans early? Can I still deduct the interest?

Yes, you can deduct the interest you paid during the tax year, even if you paid off the loan early.

What happens if I claim the deduction incorrectly?

Incorrectly claiming the deduction could lead to an audit and potential penalties, including interest and fines. Accurate record-keeping is essential.

Is there a limit to how much interest I can deduct?

Yes, the maximum deductible amount is capped annually. This amount may change based on tax law updates.

Where can I find the relevant tax form?

The relevant form is typically Form 1040, Schedule 1 (Additional Income and Adjustments to Income). Consult the IRS website or a tax professional for the most up-to-date information.