Navigating the complexities of student loan repayment can feel overwhelming, but understanding available tax benefits like the student loan interest deduction can significantly ease the financial burden. The 2024 student loan interest deduction offers a potential tax break for eligible borrowers, reducing their overall tax liability. This guide delves into the intricacies of this deduction, providing clarity on eligibility requirements, calculation methods, and essential record-keeping practices.

This resource aims to empower you with the knowledge needed to confidently determine your eligibility and maximize your potential tax savings. We will explore the nuances of the deduction, comparing it to other relevant tax benefits and examining the potential impact of future legislative changes. Through practical examples and illustrative scenarios, we’ll demystify the process, making it accessible and straightforward.

Eligibility Requirements for the Student Loan Interest Deduction in 2024

The student loan interest deduction allows taxpayers to deduct the amount they paid in student loan interest during the tax year. However, eligibility isn’t guaranteed and depends on several factors, primarily your modified adjusted gross income (MAGI) and filing status. Understanding these limitations is crucial for accurately claiming this deduction.

Modified Adjusted Gross Income (MAGI) Limits

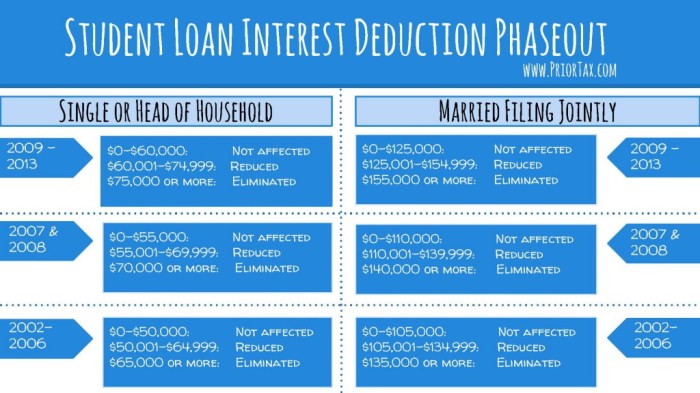

The student loan interest deduction is subject to income limits. Your modified adjusted gross income (MAGI) is used to determine your eligibility. MAGI is your adjusted gross income (AGI) with certain deductions added back in. For 2024, the MAGI limits are phased out, meaning the deduction is gradually reduced as your income increases until it becomes completely unavailable. This means that even if you are initially below the limit, you might not be able to deduct the full amount. The exact phaseout range is determined by your filing status. Exceeding the phaseout range will result in ineligibility for the deduction.

Filing Status and Eligibility

Your filing status significantly impacts your eligibility for the student loan interest deduction. The IRS considers several filing statuses, including single, married filing jointly, married filing separately, qualifying widow(er), and head of household. Each status has a specific MAGI limit. Filing jointly generally results in a higher MAGI limit compared to filing as single, increasing the chances of eligibility for couples. Conversely, filing separately often leads to lower MAGI limits, potentially reducing the likelihood of qualification.

Examples of Eligibility Based on Income and Filing Status

Let’s consider some examples to illustrate how income and filing status affect eligibility.

* Example 1: A single taxpayer with a MAGI of $70,000 in 2024 would likely be ineligible for the student loan interest deduction because this is likely above the MAGI limit for single filers.

* Example 2: A married couple filing jointly with a combined MAGI of $140,000 might find themselves partially or fully ineligible depending on the exact phaseout range for that filing status. This is because this income is near the upper limit for married filing jointly.

* Example 3: A single taxpayer with a MAGI of $60,000 might be eligible for a portion or the full deduction, depending on the specific phaseout range.

* Example 4: A married couple filing separately, each with a MAGI below the limit for that status, would each be eligible to claim the deduction individually, assuming they meet all other requirements.

MAGI Limits and Eligibility Table

The following table summarizes the MAGI limits and eligibility status for different filing statuses. Please note that these are illustrative examples and the actual limits may vary slightly depending on the final IRS guidelines for 2024. It is always recommended to consult the official IRS publications for the most up-to-date information.

| Filing Status | MAGI Limit (Single) | MAGI Limit (Married Filing Jointly) | Eligibility Status (Yes/No) – *Illustrative Example Only* |

|---|---|---|---|

| Single | $75,000 (Illustrative) | N/A | No (if MAGI > $75,000) |

| Married Filing Jointly | N/A | $150,000 (Illustrative) | No (if MAGI > $150,000) |

| Married Filing Separately | $37,500 (Illustrative) | N/A | No (if MAGI > $37,500) |

| Head of Household | $90,000 (Illustrative) | N/A | No (if MAGI > $90,000) |

Calculating the Student Loan Interest Deduction

Determining your student loan interest deduction involves a straightforward calculation, but understanding your modified adjusted gross income (MAGI) is crucial. The deduction is limited, and the amount you can deduct depends on both the interest you paid and your income.

The student loan interest deduction allows you to deduct the actual amount of interest you paid on qualified student loans during the tax year, up to a maximum limit. This limit is adjusted annually for inflation. For 2024, you can deduct the amount of interest you paid, up to a maximum of $2,500. However, this maximum deduction is phased out for higher-income taxpayers. The phase-out range depends on your filing status and MAGI.

Maximum Deduction Limit and MAGI Phase-Out

The $2,500 maximum deduction is reduced for single filers with a MAGI above $70,000 and married couples filing jointly with a MAGI above $140,000. The phase-out is not a sudden drop to zero; it’s a gradual reduction. For example, if your MAGI exceeds the threshold by a small amount, you may still be able to deduct a portion of your student loan interest. The exact reduction depends on how much your MAGI exceeds the threshold. Specific phase-out ranges should be verified with the most up-to-date IRS publications.

Examples of Student Loan Interest Deduction Calculations

Let’s illustrate the calculation with a few examples:

Example 1: John is single, paid $1,500 in student loan interest, and has a MAGI of $60,000. Since his MAGI is below the phase-out threshold, he can deduct the full $1,500.

Example 2: Jane and her husband file jointly, paid $2,200 in student loan interest, and have a MAGI of $150,000. Their MAGI exceeds the phase-out threshold for joint filers. The exact amount of their deduction will be reduced, and the calculation requires referring to the IRS guidelines for the specific phase-out reduction at their income level. They will not be able to deduct the full $2,200.

Example 3: Sarah is single, paid $3,000 in student loan interest, and has a MAGI of $80,000. Because she exceeded the MAGI threshold, her deduction will be reduced. The exact amount would be determined based on the IRS phase-out rules for single filers. She will not be able to deduct the full $3,000.

Step-by-Step Guide to Reporting the Deduction

To accurately report the student loan interest deduction, follow these steps:

- Gather your documentation: Collect Form 1098-E, which shows the amount of student loan interest you paid. If you don’t receive a 1098-E, you’ll need to gather your loan statements.

- Determine your MAGI: Calculate your modified adjusted gross income (MAGI). This involves adjusting your adjusted gross income (AGI) by adding back certain deductions and subtractions.

- Calculate your deduction: Determine the amount of interest you can deduct, keeping in mind the $2,500 maximum and the MAGI phase-out rules.

- Complete Form 1040: Report the student loan interest deduction on Schedule 1 (Additional Income and Adjustments to Income) of Form 1040.

- File your return: Submit your completed tax return to the IRS.

Flowchart Illustrating the Calculation Process

The following describes a flowchart illustrating the calculation. Imagine a flowchart with boxes and arrows.

Start:

Box 1: Determine amount of student loan interest paid.

Arrow: Points to Box 2

Box 2: Determine MAGI.

Arrow: Points to Box 3

Box 3: Is MAGI below the phase-out threshold for your filing status? (Yes/No)

Arrow (Yes): Points to Box 4

Arrow (No): Points to Box 5

Box 4: Deduction = Lesser of student loan interest paid or $2,500.

Arrow: Points to End

Box 5: Calculate the reduced deduction based on the IRS phase-out rules for your MAGI and filing status.

Arrow: Points to End

End:

Documentation and Record Keeping for the Student Loan Interest Deduction

Proper documentation is crucial for successfully claiming the student loan interest deduction. Maintaining organized records not only simplifies tax preparation but also provides essential support in the event of an IRS audit. Failing to keep adequate records can lead to delays in processing your return or, worse, disallowance of the deduction.

The IRS requires taxpayers to substantiate all deductions claimed. For the student loan interest deduction, this means having readily available proof of both the payments made and the eligibility requirements being met. Careful record-keeping significantly reduces the risk of complications during tax season and protects your right to the deduction.

Necessary Documentation for an Audit

Supporting documentation should demonstrate that you made eligible student loan interest payments and meet all the criteria for the deduction. This includes proof of your identity, your student loan details, and evidence of the interest payments themselves. The IRS may request any or all of this documentation during an audit.

Examples of Acceptable Documentation

Several documents serve as strong evidence of your student loan interest payments. These documents provide verifiable proof of the amounts paid and the dates of payment, essential for supporting your deduction claim.

- Form 1098-E, Student Loan Interest Statement: This form, issued by your lender, summarizes the total amount of student loan interest you paid during the tax year. It’s the most important piece of documentation. Carefully review this form for accuracy before filing your tax return.

- Bank Statements: Bank statements showing payments made to your student loan lender(s) provide corroborating evidence. They should clearly indicate the date, amount, and payee of each transaction. If you use online banking, printed or downloaded statements are acceptable.

- Canceled Checks or Payment Confirmation Emails: If you paid by check, canceled checks serve as proof of payment. Similarly, emails confirming online payments from your lender can be useful supporting documentation.

- Student Loan Promissory Notes: While not always necessary, having a copy of your student loan promissory note can be helpful, particularly if there’s a question about the type of loan or the interest rate.

Best Practices for Organizing and Storing Records

Maintaining a well-organized system for your student loan interest payment records is key to efficient tax preparation and easy access during an audit. Consider these methods to ensure your records remain secure and readily available.

- Dedicated File: Create a dedicated physical or digital file specifically for your student loan interest records. This keeps all related documents together, simplifying retrieval.

- Digital Organization: Scan all physical documents and store them digitally in a secure, password-protected folder. Cloud storage services offer additional protection and accessibility.

- Chronological Ordering: Organize documents chronologically by tax year, making it easy to locate records for a specific year.

- Regular Backups: Regularly back up your digital records to prevent data loss due to hardware failure or other unforeseen events.

Recommended Methods for Securely Storing Financial Records

Protecting your financial records from loss or theft is paramount. These methods offer various levels of security and convenience.

- Fireproof Safe: A fireproof safe provides protection against fire and theft, ideal for storing original physical documents.

- Secure Cloud Storage: Reputable cloud storage services offer encryption and data backups, safeguarding your digital records.

- Password-Protected Computer Files: Store digital files on a password-protected computer and regularly back them up to an external hard drive or cloud service.

Comparing the Student Loan Interest Deduction to Other Tax Benefits

The student loan interest deduction is a valuable tax break, but it’s crucial to understand how it stacks up against other potential tax advantages available to students and recent graduates. Choosing the most beneficial option depends heavily on individual circumstances, such as income level, type of education, and overall financial situation. A thorough comparison is necessary to make an informed decision.

The student loan interest deduction isn’t the only tax benefit available to help manage the financial burden of higher education. Other options, like the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), offer different approaches to reducing your tax liability. Understanding the nuances of each can significantly impact your tax return.

Comparison of Tax Benefits for Higher Education Expenses

This section compares the student loan interest deduction with the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Each offers a unique path to tax relief, and the optimal choice depends on individual eligibility and circumstances.

| Tax Benefit | Eligibility Criteria | Maximum Potential Savings | Key Differences |

|---|---|---|---|

| Student Loan Interest Deduction | Must have paid interest on qualified student loans; modified adjusted gross income (MAGI) limitations apply. | Up to $2,500 in deductible interest (depending on income). | Deduction from gross income; available for interest payments only; income limitations apply. |

| American Opportunity Tax Credit (AOTC) | Student must be pursuing a degree or other credential at an eligible educational institution; must be enrolled at least half-time; cannot have completed the first four years of higher education; income limitations apply. | Up to $2,500 per student (100% of the first $2,000 in qualified education expenses and 25% of the next $2,000). | Credit against tax liability; applies to qualified education expenses (tuition, fees, books); income limitations and other restrictions apply. |

| Lifetime Learning Credit (LLC) | Student can be pursuing a degree or other credential at an eligible educational institution; no limit on years of study; income limitations apply. | Up to $2,000 per tax return (20% of the first $10,000 in qualified education expenses). | Credit against tax liability; applies to qualified education expenses (tuition, fees); no limit on years of study; income limitations apply. |

Situations Favoring Specific Tax Benefits

The best tax benefit often depends on individual circumstances. For example, a high-income student with significant student loan debt might find the student loan interest deduction more beneficial than the AOTC or LLC, even if the latter are technically available. Conversely, a low-income student with relatively little student loan debt might benefit more from the AOTC or LLC to offset tuition and fees directly. A student pursuing a graduate degree might find the LLC more advantageous than the AOTC, as the AOTC has limitations on the number of years of eligibility.

Impact of Tax Law Changes on the Student Loan Interest Deduction

The student loan interest deduction, while offering valuable tax relief, remains susceptible to changes in federal tax legislation. Understanding these potential shifts is crucial for individuals managing student loan debt and planning their long-term financial strategies. The deduction’s future hinges on evolving political priorities and economic conditions, making proactive monitoring essential.

The student loan interest deduction’s future is uncertain, dependent on various factors influencing federal tax policy. Potential changes could impact both eligibility criteria and the maximum deduction amount. For example, adjustments to income thresholds, modifications to the definition of “qualified education expenses,” or even the complete elimination of the deduction are possibilities that taxpayers should be aware of. These shifts could significantly affect the amount of tax savings individuals can claim.

Potential Future Changes and Their Effects

Several legislative trends could alter the student loan interest deduction. Increased pressure to reduce the national debt might lead to the elimination or reduction of tax deductions like this one, deemed by some to be a benefit primarily for higher-income individuals. Conversely, growing concerns about student loan debt burdens could prompt expansions to the deduction, potentially raising the income limits or increasing the maximum deductible amount. Proposals for broader student loan forgiveness programs could also indirectly impact the deduction’s relevance, as forgiven debt would render the deduction unnecessary.

Examples of Past Changes and Their Impact

The student loan interest deduction has experienced modifications throughout its history. For instance, the maximum amount deductible has changed over time, reflecting adjustments to inflation and broader tax reform efforts. Changes to adjusted gross income (AGI) thresholds have also affected the number of taxpayers eligible for the deduction. In the past, higher income limits have resulted in a greater number of people qualifying for the deduction, while lower limits have had the opposite effect. For example, a hypothetical taxpayer with $70,000 AGI might have qualified for the full deduction under one set of rules but only a partial deduction or none at all under revised guidelines. These changes directly impact the amount of tax savings taxpayers receive.

Implications for Long-Term Financial Planning

The uncertainty surrounding the student loan interest deduction necessitates proactive financial planning. Individuals should account for the potential elimination or modification of the deduction when budgeting for student loan repayment and projecting future tax liabilities. Developing a diversified financial strategy that is not overly reliant on the continued existence of this tax break is a prudent approach. This could involve exploring other avenues for tax savings or adjusting repayment strategies to accommodate potential changes in the deduction. For instance, someone heavily reliant on the deduction might accelerate their loan repayments to minimize the financial impact of any future legislative changes. Alternatively, they might explore refinancing options to secure a lower interest rate and reduce their overall debt burden.

Illustrative Scenarios and Case Studies

Understanding the student loan interest deduction requires examining its application in real-world situations. The following case studies illustrate how different factors affect the deduction amount and overall tax liability. Each scenario uses simplified figures for clarity.

Case Study 1: Single Filer with Moderate Income and Loan Interest

Sarah is a single filer with an adjusted gross income (AGI) of $60,000. She paid $2,500 in student loan interest during the tax year. Since her AGI is below the phaseout threshold (which varies yearly, consult the IRS website for the most up-to-date information), she can deduct the full $2,500. This reduces her taxable income by $2,500, resulting in a lower tax liability. The exact tax savings will depend on her applicable tax bracket. Assuming a 22% marginal tax bracket, her tax savings would be approximately $550 ($2,500 x 0.22).

Case Study 2: Married Filing Jointly with High Income and Maximum Deduction

John and Mary are married and file jointly. Their combined AGI is $180,000. They paid a total of $3,000 in student loan interest. Their AGI exceeds the phaseout range for married filing jointly, meaning the deduction may be limited or completely phased out depending on the exact AGI and the applicable phaseout range for that year. For illustrative purposes, let’s assume that due to their high AGI, they only qualify for a partial deduction of $1,500. This reduces their taxable income by $1,500, resulting in a lower tax liability. Their tax savings would be lower than if they could deduct the full amount. The actual savings will depend on their marginal tax bracket. Let’s assume a 24% marginal tax bracket; their tax savings would be approximately $360 ($1,500 x 0.24).

Case Study 3: Married Filing Separately with Low Income and Partial Loan Payment

David and Emily are separated and file their taxes separately. David’s AGI is $35,000, and he paid $1,000 in student loan interest. Emily’s AGI is $20,000, and she paid $500 in student loan interest. Both are below the AGI phaseout threshold for their filing status. Therefore, David can deduct the full $1,000, while Emily can deduct the full $500. The tax savings for each will depend on their individual marginal tax brackets. Assuming David is in the 12% bracket and Emily is in the 10% bracket, David’s tax savings would be approximately $120 ($1,000 x 0.12), and Emily’s would be approximately $50 ($500 x 0.10). It’s important to note that even though they are married, their deductions are calculated separately due to their filing status.

Ultimate Conclusion

Successfully claiming the student loan interest deduction requires careful attention to detail and a thorough understanding of the eligibility criteria and calculation methods. By diligently maintaining accurate records and familiarizing yourself with the relevant tax forms, you can confidently navigate the process and potentially reduce your tax burden. Remember to consult with a qualified tax professional for personalized advice tailored to your specific circumstances. Understanding this deduction is a crucial step in effectively managing your student loan debt and achieving long-term financial well-being.

Expert Answers

Can I claim the deduction if I’m a dependent on someone else’s tax return?

No, you must be able to file as an independent taxpayer to claim the deduction.

What if I paid more interest than the deduction limit allows?

You can only deduct up to the maximum allowable amount, even if you paid more.

Where can I find Form 1098-E?

Your lender should provide you with Form 1098-E, which reports the interest you paid during the year.

What happens if I don’t have all the necessary documentation?

The IRS may disallow the deduction, so maintaining accurate records is crucial.

Does the deduction affect my eligibility for other student loan repayment programs?

Generally, no. The deduction is a tax benefit separate from repayment programs.