Navigating the complexities of student loan repayment can be daunting, especially when considering potential tax benefits. Understanding the student loan interest deduction and its associated income limits is crucial for maximizing your tax savings. This deduction offers a valuable opportunity to reduce your tax burden, but eligibility hinges on factors such as your modified adjusted gross income (MAGI) and filing status. This guide will clarify these complexities, empowering you to confidently navigate the process and potentially claim this beneficial deduction.

We’ll explore the current income limitations for various filing statuses, delve into the calculation of MAGI, and examine how changes in tax laws might impact your eligibility. Through illustrative scenarios and a clear explanation of the phaseout range, we aim to provide a comprehensive understanding of the student loan interest deduction’s income restrictions. This will equip you with the knowledge to accurately assess your eligibility and maximize your potential tax benefits.

Understanding the Student Loan Interest Deduction

The student loan interest deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year. This deduction can significantly reduce your taxable income and, consequently, your tax liability, providing much-needed financial relief to those burdened by student loan debt. It’s a valuable tool for many, but understanding the eligibility requirements and the process for claiming the deduction is crucial.

This deduction aims to lessen the financial strain of repaying student loans, encouraging individuals to pursue higher education. The benefit is directly tied to the amount of interest paid, offering a tangible reward for responsible loan repayment.

Eligibility Requirements for the Student Loan Interest Deduction

To claim the student loan interest deduction, you must meet several criteria. First, the student loans must be taken out for yourself, your spouse, or your dependent. The loans must be used to pay for qualified higher education expenses, such as tuition, fees, room and board, and other necessary educational costs. Importantly, you must be legally obligated to repay the loans, and the interest must be paid on a loan used to finance your education. Finally, your modified adjusted gross income (MAGI) must be below a certain threshold; this threshold varies annually and is adjusted for inflation. Exceeding this income limit will disqualify you from claiming the deduction.

Claiming the Student Loan Interest Deduction on Your Tax Return

Claiming the deduction is relatively straightforward. First, gather all your student loan interest statements from the year. These statements will clearly show the total amount of interest you paid. Next, you’ll need to complete Form 1098-E, which your lender provides, detailing the interest paid. This form provides the necessary information to accurately report your student loan interest payments. Finally, you’ll report the amount from Form 1098-E on Schedule 1 (Additional Income and Adjustments to Income) of Form 1040, your individual income tax return. The instructions for Form 1040 will guide you through the specific lines to use. Accurate record-keeping is essential to avoid errors and ensure you receive the full deduction you are entitled to.

Comparison of the Student Loan Interest Deduction with Other Education Tax Benefits

Several tax benefits exist to help with education costs. The student loan interest deduction is just one. Here’s a comparison:

| Tax Benefit | Description | Eligibility Requirements | Maximum Benefit |

|---|---|---|---|

| Student Loan Interest Deduction | Deduction for student loan interest paid | Income limits apply; loans must be for qualified education expenses | Up to $2,500 of interest paid (this amount may change yearly) |

| American Opportunity Tax Credit (AOTC) | Tax credit for qualified education expenses | Income limits apply; student must be pursuing a degree or other credential | Up to $2,500 per student |

| Lifetime Learning Credit (LLC) | Tax credit for qualified education expenses | No income limits; can be used for undergraduate or graduate courses | Up to $2,000 per tax return |

Income Limits for the Student Loan Interest Deduction

The student loan interest deduction allows taxpayers to deduct the amount they paid in student loan interest during the tax year. However, this deduction isn’t unlimited; it’s subject to income limitations that vary depending on your filing status. Understanding these limits is crucial for accurately calculating your tax liability.

The amount of the student loan interest deduction you can claim, if any, is directly impacted by your modified adjusted gross income (MAGI). This isn’t your standard adjusted gross income (AGI); it’s a slightly modified version used for various tax calculations, including this deduction. The deduction is phased out as your MAGI increases, meaning it gradually reduces until it disappears completely once you surpass a certain income threshold.

Modified Adjusted Gross Income (MAGI) Limits for the Student Loan Interest Deduction

The Internal Revenue Service (IRS) sets specific MAGI thresholds for claiming the student loan interest deduction. These limits are adjusted annually for inflation. For the 2023 tax year, the limits are as follows:

| Filing Status | MAGI Phaseout Begins | MAGI Phaseout Ends |

|---|---|---|

| Single | $70,000 | $85,000 |

| Married Filing Jointly | $140,000 | $170,000 |

| Head of Household | $95,000 | $115,000 |

Phaseout Range and Deduction Amount

The phaseout range isn’t a sudden cutoff. Instead, the deduction is gradually reduced as your MAGI rises within the specified range. The exact reduction depends on the specific amount of your MAGI within this range. For example, a single filer with a MAGI of $75,000 would see a partial reduction in their deduction compared to a single filer with a MAGI of $70,000. The reduction is calculated proportionally within the phaseout range. There is no deduction allowed once the upper limit of the phaseout range is exceeded.

Potential Impact of Changes in Tax Laws

The income limits for the student loan interest deduction are subject to change based on future tax legislation. Congress could adjust the phaseout ranges, either expanding or contracting them. For instance, in a future tax bill, the lower limits might be raised, making the deduction less accessible to higher-income individuals, or they might be lowered, making the deduction available to a wider range of taxpayers. Similarly, the upper limits could be adjusted, affecting the point at which the deduction is completely phased out. It’s important to stay updated on any changes to the tax code that may affect this deduction.

Determining Eligibility Based on Income: A Flowchart

The following flowchart illustrates the process of determining eligibility for the student loan interest deduction based on income:

[Imagine a flowchart here. The flowchart would begin with a box labeled “Calculate your Modified Adjusted Gross Income (MAGI).” This would lead to a series of decision boxes. The first would ask “Is your filing status Single?” If yes, it would lead to another decision box: “Is your MAGI less than $70,000?”. If yes, it would lead to a box indicating “Eligible for full deduction.” If no, it would go to another decision box “Is your MAGI less than $85,000?”. If yes, it would go to a box “Eligible for partial deduction (pro-rata reduction).” If no, it would lead to “Ineligible for deduction”. The flowchart would repeat this process for “Married Filing Jointly” and “Head of Household,” using their respective income thresholds. ]

Modified Adjusted Gross Income (MAGI) and its Role

Modified Adjusted Gross Income (MAGI) plays a crucial role in determining eligibility for the student loan interest deduction. Understanding MAGI is essential because it’s the income figure the IRS uses to see if you qualify for this tax break. It’s not simply your adjusted gross income (AGI); instead, it involves specific adjustments to your AGI, resulting in a potentially different number.

MAGI is a modified version of your Adjusted Gross Income (AGI), calculated by adding back certain deductions and subtracting others from your AGI. This adjusted figure is then used by the IRS to determine eligibility for various tax benefits and credits, including the student loan interest deduction. The key difference between AGI and MAGI lies in the inclusion and exclusion of specific items. The IRS uses MAGI to create a more accurate representation of a taxpayer’s financial situation for targeted tax benefits.

MAGI Components: Inclusion and Exclusion

The calculation of MAGI involves adding back certain deductions subtracted when calculating AGI and subtracting other adjustments. For example, the deduction for student loan interest is added back to AGI. Conversely, certain deductions, like those for IRA contributions or self-employment taxes, are not included in the MAGI calculation. The specific inclusions and exclusions can be complex, and it’s advisable to consult the IRS instructions or a tax professional for precise details. The goal is to arrive at a figure that more accurately reflects your income for purposes of determining eligibility for specific tax benefits.

MAGI Calculation Examples

Let’s illustrate MAGI calculation with a couple of scenarios.

Scenario 1: Assume John’s AGI is $60,000. He claimed a $2,000 student loan interest deduction and a $6,000 IRA deduction. To calculate his MAGI, we add back the student loan interest deduction ($2,000) but do not include the IRA deduction. Therefore, John’s MAGI is $60,000 + $2,000 = $62,000.

Scenario 2: Sarah’s AGI is $75,000. She itemized her deductions, claiming a $10,000 student loan interest deduction and a $5,000 charitable contribution deduction. Her MAGI would be calculated by adding back the student loan interest deduction: $75,000 + $10,000 = $85,000. The charitable contribution is irrelevant for this specific calculation.

These examples show how the student loan interest deduction directly impacts the MAGI calculation. Other deductions and adjustments, however, might not. The specific rules governing which items are included or excluded can change, so it is crucial to consult the most up-to-date IRS guidelines.

Common Deductions and Adjustments Affecting MAGI

Understanding which deductions and adjustments affect MAGI is vital for accurate calculation.

The following list provides some common items:

- Student Loan Interest Deduction: This deduction is *added back* to your AGI to calculate MAGI.

- IRA Deductions: These are generally *not* included in the MAGI calculation.

- Self-Employment Tax Deduction: This deduction is *not* included in the MAGI calculation.

- Health Savings Account (HSA) Deduction: This deduction is *not* included in the MAGI calculation.

- Alimony Payments (for divorces finalized before 2019): These are *not* included in the MAGI calculation. (Note: Alimony paid after 2018 is not deductible by the payer or included in the recipient’s gross income.)

Remember, this is not an exhaustive list. The specific inclusion or exclusion of items can be complex and depend on individual circumstances. It is always best to consult the IRS publications or a tax professional for the most accurate and up-to-date information.

Impact of Filing Status on Deduction Limits

The student loan interest deduction, while beneficial, has income limits that vary significantly depending on your filing status. Understanding these differences is crucial to determining your eligibility for the deduction and the potential amount you can claim. Your marital status and how you file your taxes directly influence the maximum modified adjusted gross income (MAGI) you can have and still claim the deduction.

The Internal Revenue Service (IRS) sets separate income limits for single filers, those married filing jointly, those married filing separately, and those filing as head of household. These limits change annually, so it’s essential to consult the most current IRS guidelines for the tax year in question. Exceeding these limits, regardless of your filing status, will render you ineligible for the deduction.

Income Limits by Filing Status

The following table summarizes the income limits for the student loan interest deduction for various filing statuses. Remember that these are examples and the actual limits may vary based on the tax year. Always refer to the official IRS publications for the most up-to-date information.

| Filing Status | Example Income Limit (Tax Year 2024 – Hypothetical) | Deduction Impact | Eligibility Determination |

|---|---|---|---|

| Single | $70,000 | A single filer with a MAGI below $70,000 may be able to deduct the full amount of their student loan interest paid. Above this limit, the deduction is phased out. | Calculate your MAGI. If it’s below the limit, you’re potentially eligible. If it’s above, you may still be partially eligible depending on the phase-out rules. |

| Married Filing Jointly | $140,000 | Couples filing jointly can have a higher combined income and still qualify for the deduction. | Calculate your combined MAGI. If it’s below the limit, you’re potentially eligible. If it’s above, the deduction may be reduced or eliminated. |

| Married Filing Separately | $35,000 | This filing status has the lowest income limit, significantly restricting eligibility. | Calculate your individual MAGI. If it’s below the limit, you’re potentially eligible. Exceeding the limit eliminates eligibility. |

| Head of Household | $90,000 | This status offers a higher income limit compared to single filers but lower than those married filing jointly. | Calculate your MAGI. If it’s below the limit, you’re potentially eligible. If it’s above, the deduction may be reduced or eliminated. |

It is important to note that these are hypothetical examples. The actual income limits are set annually by the IRS and can change. Therefore, always refer to the official IRS publications for the most accurate and up-to-date information regarding the student loan interest deduction and its income limits for the relevant tax year.

Tax Year and Deduction Limits

The student loan interest deduction, while offering valuable tax relief, is subject to annual adjustments in its income limitations. Understanding these changes and their impact is crucial for accurately calculating your tax liability. This section details how these limits fluctuate year to year and where to find the most current information.

The income limits for the student loan interest deduction are not static; they change annually. This means that the maximum modified adjusted gross income (MAGI) that qualifies you for the full or partial deduction is different each tax year. These adjustments reflect economic factors and potential legislative changes. Failing to account for these yearly modifications can lead to incorrect deductions and potential tax penalties.

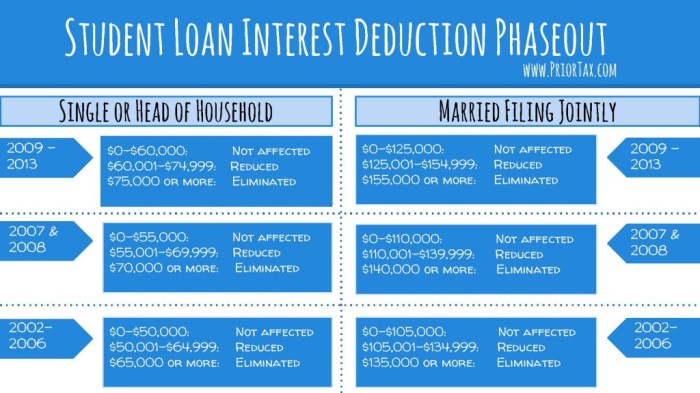

Historical Overview of Income Limits

The income thresholds for the student loan interest deduction have varied over the past decade. While precise figures require referencing IRS publications for each specific tax year, a general trend shows a gradual adjustment, sometimes upwards, sometimes remaining the same, depending on the prevailing economic climate and tax legislation. For example, the limits might have been relatively consistent for a few years, then increase significantly in response to economic changes or policy adjustments. To gain a complete picture of these yearly fluctuations, it’s essential to consult official IRS resources. These resources will provide precise data for each year, illustrating the changes over time. It’s also important to note that these limits may differ depending on filing status (single, married filing jointly, etc.), further complicating the need for accurate and up-to-date information.

Locating Up-to-Date Information on Income Limits

The most reliable source for the current year’s income limits for the student loan interest deduction is the official Internal Revenue Service (IRS) website. The IRS website provides detailed publications and instructions for completing Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), which includes the student loan interest deduction. Additionally, reputable tax preparation software and websites often include up-to-date information, drawing directly from IRS publications. Consulting a qualified tax professional can also ensure you are using the correct figures for your specific tax year and filing status. It’s always advisable to cross-reference information from multiple reliable sources to verify accuracy.

Implications of Not Meeting Income Requirements

Failing to meet the income requirements for the student loan interest deduction in a given tax year means you will not be able to claim this deduction. This directly impacts your taxable income, potentially resulting in a higher tax liability. The extent of this impact depends on your overall income and other deductions claimed. For instance, someone with a high income and few other deductions might see a more significant increase in their tax owed compared to someone with a lower income and more deductions. In essence, not meeting the income threshold eliminates a potential tax reduction, increasing the final tax amount due.

Illustrative Scenarios

Understanding the impact of income and filing status on student loan interest deduction eligibility requires examining specific examples. The following scenarios illustrate how different financial situations affect the deduction, using simplified examples for clarity. Remember that actual deduction amounts may vary based on individual circumstances and the latest IRS guidelines.

Scenario 1: Single Filer, Below Income Limit

This scenario depicts a single filer, Sarah, who paid $1,500 in student loan interest during the tax year. Her modified adjusted gross income (MAGI) is $60,000. The income limit for single filers is $85,000 for the relevant tax year (this limit can change annually, so always check the current IRS guidelines). Since Sarah’s MAGI is below the limit, she can deduct the full $1,500 in student loan interest.

Visual Representation: A simple bar graph showing Sarah’s MAGI ($60,000) well below the income limit ($85,000). Another bar represents her student loan interest deduction ($1,500).

Scenario 2: Married Filing Jointly, Above Income Limit

This scenario involves a married couple, John and Mary, filing jointly. They paid a combined $2,000 in student loan interest. Their combined MAGI is $170,000. The income limit for married couples filing jointly is $170,000 for this tax year. Because their MAGI exactly meets the limit, they can only deduct the full amount of student loan interest paid, if it is below the maximum amount that can be deducted.

Visual Representation: A bar graph showing John and Mary’s MAGI ($170,000) precisely at the income limit for married filing jointly. Another bar represents their student loan interest deduction ($2,000). A note should be added that in a real-life scenario, they might not be able to claim the full deduction if their MAGI exceeds the limit.

Scenario 3: Head of Household, Partial Deduction

David, a Head of Household filer, paid $1,200 in student loan interest. His MAGI is $95,000. The income limit for Head of Household filers is $130,000. However, the deduction is phased out above a certain threshold. Let’s assume for this scenario that the phase-out begins at $85,000 for Head of Household filers. Since his MAGI exceeds this threshold, he will not be able to deduct the full amount. The exact amount of the deduction will depend on the phase-out rules specified by the IRS for that particular tax year, which would need to be calculated using the specific IRS formula.

Visual Representation: A bar graph showing David’s MAGI ($95,000) exceeding the phase-out threshold (e.g., $85,000) but below the income limit ($130,000). A smaller bar represents his partial student loan interest deduction (a smaller amount than $1,200, the exact amount determined by the phase-out calculation). A clear label indicates that this is a partial deduction.

Tax Planning to Maximize Deduction

Taxpayers can maximize their student loan interest deduction by accurately tracking all interest payments throughout the year. Maintaining detailed records is crucial for accurate reporting. Furthermore, understanding the income limits for their filing status is essential. Careful financial planning, potentially adjusting income levels if feasible, could help taxpayers stay below the income limits to claim the full deduction. Consulting with a tax professional can provide personalized advice based on individual circumstances.

Last Word

Successfully navigating the student loan interest deduction requires a thorough understanding of income limitations and their implications. By carefully considering your modified adjusted gross income (MAGI), filing status, and the applicable tax year, you can accurately determine your eligibility and claim the maximum allowable deduction. Remember that tax laws are subject to change, so staying informed about updates is essential. Proactive planning and a clear grasp of these guidelines can significantly impact your tax liability and overall financial well-being.

FAQ Guide

What is Modified Adjusted Gross Income (MAGI)?

MAGI is a modified version of your adjusted gross income (AGI) used to determine eligibility for certain tax benefits, including the student loan interest deduction. It involves adding back certain deductions and adjustments to your AGI.

Can I still claim *some* of the deduction if my income exceeds the limit?

Yes, there’s a phaseout range. The deduction is gradually reduced as your income approaches and exceeds the limit, not immediately eliminated.

Where can I find the most up-to-date information on income limits?

Consult the official IRS website or a reputable tax professional for the most current information on income limits and eligibility requirements for the student loan interest deduction.

What happens if I claim the deduction incorrectly?

Incorrectly claiming the deduction could result in an amended tax return or penalties from the IRS. It’s best to seek professional advice if unsure.