Navigating the complexities of student loan repayment can feel overwhelming, but understanding available tax benefits like the student loan interest deduction can significantly ease the financial burden. This guide provides a clear and concise overview of the eligibility requirements, calculation methods, and potential tax savings associated with this valuable deduction. We’ll explore how this deduction interacts with other student tax benefits and delve into potential future changes.

This exploration will equip you with the knowledge to confidently claim this deduction and maximize your tax savings. We’ll cover everything from determining your eligibility based on income and loan type to understanding the necessary documentation and completing the relevant tax forms. Real-world examples and visual aids will further clarify the process and its impact on your overall tax liability.

Eligibility Requirements for Student Loan Interest Deduction

Claiming the student loan interest deduction can provide significant tax relief for those repaying student loans. Understanding the eligibility requirements is crucial to ensure you can take advantage of this benefit. This section Artikels the criteria you must meet to claim the deduction.

Adjusted Gross Income (AGI) Limits

The amount you can deduct is dependent on your Modified Adjusted Gross Income (MAGI). The IRS sets annual limits on the MAGI. If your MAGI exceeds the limit, you may not be able to deduct the full amount, or you may not be eligible at all. These limits are adjusted annually for inflation, so it’s essential to consult the most current IRS guidelines for the tax year in question. For example, in 2023, a single filer could deduct the full amount if their MAGI was below a certain threshold; above that, the deduction might be phased out. It’s important to check the official IRS website for the most up-to-date information on AGI limits.

Qualifying Student Loans

The student loan interest deduction applies only to certain types of student loans. Specifically, the loan must be used to pay for qualified education expenses, such as tuition, fees, room and board, and other necessary educational costs. This excludes loans used for non-educational purposes. Federal student loans, as well as private student loans, generally qualify, provided they meet the other criteria. However, loans used for purposes other than education, such as personal expenses, are not eligible.

Determining Eligibility: A Step-by-Step Guide

To determine your eligibility, follow these steps:

1. Calculate your Modified Adjusted Gross Income (MAGI): This involves adjusting your gross income to account for certain deductions and additions as defined by the IRS. This is a crucial first step, as it directly impacts your eligibility.

2. Identify your student loan(s): Determine which loans were used to pay for qualified education expenses. Keep detailed records of loan payments and interest paid throughout the year.

3. Compare your MAGI to the IRS limits: Consult the current IRS publication for the applicable MAGI thresholds for your filing status (single, married filing jointly, etc.).

4. Determine your maximum deduction: Based on your MAGI and the amount of interest paid, calculate the maximum deductible amount. The maximum deduction is capped at a certain amount annually, which is subject to change.

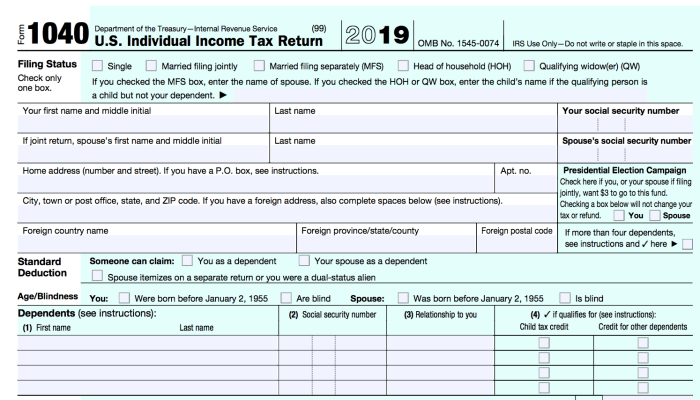

5. Claim the deduction on your tax return: Use the appropriate form (typically Form 1040, Schedule 1) to claim the deduction.

Eligibility Based on Income and Loan Type

The following table summarizes eligibility based on different AGI brackets and loan types. Note that this table provides a simplified example and actual limits and eligibility may vary based on the tax year and your specific circumstances. Always refer to the official IRS guidelines.

| AGI Bracket | Maximum Deduction | Loan Type | Eligibility Status |

|---|---|---|---|

| $70,000 – $85,000 (Single) | $2,500 | Federal Stafford Loan | Eligible (Partial Deduction Possible) |

| Below $70,000 (Single) | $2,500 | Federal Stafford Loan | Eligible (Full Deduction Possible) |

| Above $85,000 (Single) | $0 | Federal Stafford Loan | Not Eligible |

| $140,000 – $170,000 (Married Filing Jointly) | $2,500 | Private Student Loan (Qualified Expenses) | Eligible (Partial Deduction Possible) |

| Below $140,000 (Married Filing Jointly) | $2,500 | Private Student Loan (Qualified Expenses) | Eligible (Full Deduction Possible) |

| Above $170,000 (Married Filing Jointly) | $0 | Private Student Loan (Qualified Expenses) | Not Eligible |

Calculating the Deductible Amount

The student loan interest deduction allows you to deduct the actual amount of interest you paid on qualified student loans during the tax year, but with limitations. The maximum deduction is $2,500, and it’s phased out for higher adjusted gross incomes (AGI). This means the amount you can deduct might be less than the total interest you paid.

The calculation process involves determining your actual student loan interest paid, comparing it to the maximum deduction limit, and considering any AGI-based phaseout.

Maximum Deduction and AGI Phaseout

The student loan interest deduction is not unlimited. The maximum amount you can deduct is $2,500. However, this maximum is reduced (phased out) based on your modified adjusted gross income (MAGI). The phaseout ranges vary depending on your filing status. For the 2023 tax year, a single filer’s phaseout begins when their MAGI exceeds $70,000, while for married filing jointly, the phaseout begins when their MAGI exceeds $140,000. The exact phaseout range determines how much of the $2,500 maximum deduction you can claim. For example, if you are single and your MAGI is above $85,000, you may not be able to claim any student loan interest deduction. Consult the current IRS guidelines for the most up-to-date phaseout ranges.

Calculating the Deduction: A Hypothetical Example

Let’s illustrate the calculation with a hypothetical example. Suppose John paid $3,000 in student loan interest during the tax year and his modified adjusted gross income (MAGI) is $60,000. He is filing as single. Since his MAGI is below the $70,000 threshold for the phaseout range for single filers, he can deduct the full $2,500 (because his actual interest paid, $3000, exceeds the maximum allowable deduction of $2500).

Now, let’s consider another example. Suppose Mary paid $1,500 in student loan interest, and her MAGI is $80,000. She is also filing as single. Because her MAGI is below the phaseout range, she can deduct the full amount of interest she paid, which is $1,500.

Finally, let’s examine a case where the phaseout applies. Assume Sarah paid $2,000 in student loan interest and her MAGI is $90,000. She is single. In this scenario, because her MAGI exceeds the threshold for the phaseout range, she will not be able to deduct the full amount. The exact amount of the deduction would depend on the specific phaseout rules for her income level, as defined by the IRS. She would need to consult the IRS guidelines or tax software to determine the precise deductible amount.

Flowchart for Calculating the Student Loan Interest Deduction

The process can be visualized using a simple flowchart:

[Imagine a flowchart here. The flowchart would start with a box labeled “Determine Actual Student Loan Interest Paid.” An arrow would lead to a diamond-shaped decision box: “Is Interest Paid ≤ $2,500?”. If yes, an arrow would lead to a box labeled “Deductible Amount = Interest Paid.” If no, an arrow would lead to a box labeled “Deductible Amount = $2,500.” From both the “Deductible Amount” boxes, an arrow would lead to a diamond-shaped decision box: “Is MAGI within the Phaseout Range?”. If yes, an arrow would lead to a box labeled “Calculate Deduction based on Phaseout Rules (consult IRS guidelines).” If no, an arrow would lead to a box labeled “Deductible Amount = Result from previous step.” Finally, an arrow would lead from both “Deductible Amount” boxes to a terminal box labeled “Final Deductible Amount.”]

Documentation and Tax Form Requirements

Claiming the student loan interest deduction requires careful documentation to substantiate your claim and ensure a smooth tax filing process. Failing to provide sufficient documentation can result in delays or rejection of your deduction. This section details the necessary documentation and how to correctly complete the relevant tax form sections.

Accurate and complete documentation is crucial for successfully claiming the student loan interest deduction. The IRS requires specific information to verify your eligibility and the amount you can deduct. Submitting inaccurate or incomplete information can lead to delays in processing your return, requests for additional information, or even penalties. It’s essential to gather all necessary documents well in advance of tax season.

Required Documentation

To support your student loan interest deduction, you’ll need to gather several key documents. These documents serve as proof of your loan payments and the interest paid during the tax year. Keeping these records organized throughout the year will simplify the process significantly during tax time.

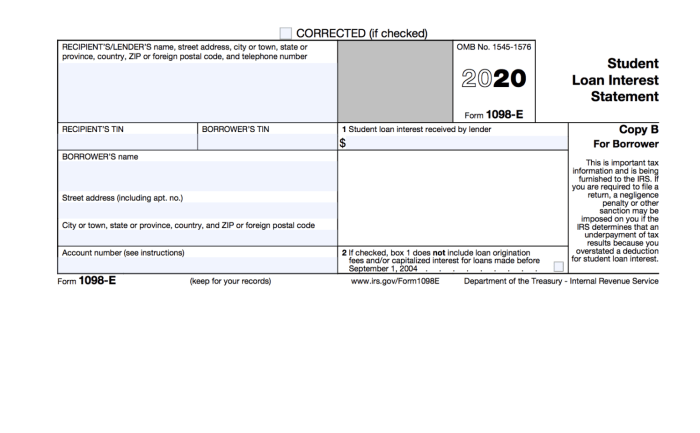

- Form 1098-E, Student Loan Interest Statement: This form is issued by your lender and reports the total amount of interest you paid during the tax year. This is the most crucial document for claiming the deduction.

- Loan Documents: Maintain copies of your loan agreements, promissory notes, and any other documentation that identifies your student loans and the interest rates. This can be helpful if the IRS requests additional verification.

- Payment Records: Keep records of all payments made towards your student loans during the tax year. This could include bank statements, cancelled checks, or online payment confirmations. These records should clearly show the date and amount of each payment, as well as the lender’s name.

Completing Form 1040 and Schedule 1

The student loan interest deduction is claimed on Schedule 1 (Additional Income and Adjustments to Income) of Form 1040, U.S. Individual Income Tax Return. Accurately completing this form is critical to ensure the IRS processes your deduction correctly.

You will enter the amount of student loan interest you paid during the year on line 21 of Schedule 1. This amount should match the amount reported on your Form 1098-E. It’s important to double-check this figure for accuracy. Incorrect entries can lead to delays or rejection of your claim. If you paid interest on more than one student loan, you should combine the total interest paid from all sources before entering it on Schedule 1.

Consequences of Inaccurate or Incomplete Documentation

Submitting inaccurate or incomplete documentation can have several negative consequences. The IRS may request additional information, delaying the processing of your tax return and potentially causing you to miss deadlines for amended returns. In some cases, the IRS might disallow the deduction entirely, resulting in a higher tax liability. In more serious instances, intentional misrepresentation could lead to penalties and interest charges.

Checklist of Required Documents and Tax Form Sections

To ensure a smooth and successful filing process, use this checklist to gather all necessary documents and verify completion of the relevant tax form sections.

| Document | Tax Form Section |

|---|---|

| Form 1098-E, Student Loan Interest Statement | Schedule 1 (Form 1040), Line 21 |

| Loan Documents (Agreements, Promissory Notes) | Keep for your records; may be requested by IRS |

| Payment Records (Bank Statements, Cancelled Checks, Online Payment Confirmations) | Keep for your records; may be requested by IRS |

Comparison with Other Tax Benefits for Students

Choosing the best tax strategy can significantly impact a student’s overall tax burden. While the student loan interest deduction offers relief on loan payments, other tax credits, like the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC), provide benefits related to educational expenses. Understanding the nuances of each can help students maximize their tax savings.

The student loan interest deduction, AOTC, and LLC all aim to alleviate the financial burden of higher education, but they do so in different ways and under varying circumstances. The student loan interest deduction focuses on reducing the tax liability based on the interest paid on student loans, while the AOTC and LLC directly reduce the amount of tax owed based on qualified education expenses. The most advantageous benefit depends heavily on the individual’s financial situation, the type of educational expenses incurred, and their income level.

American Opportunity Tax Credit (AOTC) versus Student Loan Interest Deduction

The AOTC is a credit for qualified education expenses paid for an eligible student during the first four years of higher education. It’s a more significant tax break than the student loan interest deduction for many students, potentially offering a larger reduction in tax liability. However, the AOTC is a credit, meaning it directly reduces the amount of tax owed, while the student loan interest deduction is an above-the-line deduction, which reduces taxable income. This difference affects how each benefit interacts with other aspects of a taxpayer’s tax situation. For instance, a taxpayer with a low tax liability might benefit more from a credit than a deduction.

Lifetime Learning Credit (LLC) versus Student Loan Interest Deduction

Unlike the AOTC, which is limited to the first four years of higher education, the LLC can be claimed for an unlimited number of years. This makes it a suitable option for students pursuing graduate degrees or continuing education. However, the maximum credit amount for the LLC is lower than the AOTC. Similar to the AOTC, the LLC is a tax credit, offering a more direct reduction in tax owed compared to the deduction for student loan interest. The choice between the LLC and the student loan interest deduction hinges on whether the student is paying significant interest on their loans and the amount of qualified education expenses.

Key Features Comparison

The following table summarizes the key features of the student loan interest deduction, AOTC, and LLC, allowing for a direct comparison to aid in determining which benefit is most suitable for a given situation.

| Feature | Student Loan Interest Deduction | American Opportunity Tax Credit (AOTC) | Lifetime Learning Credit (LLC) |

|---|---|---|---|

| Type of Benefit | Above-the-line deduction | Tax credit | Tax credit |

| Maximum Benefit | Up to $2,500 (2023) of interest paid | $2,500 (maximum credit) | $2,000 (maximum credit) |

| Eligibility Requirements | Must have student loan interest; meet modified adjusted gross income (MAGI) limits. | Student must be pursuing a degree or other credential at an eligible educational institution; meet MAGI limits; must not have completed the first four years of higher education. | Student must be pursuing a degree or other credential at an eligible educational institution; meet MAGI limits; no limit on years of higher education. |

| Limitations | Limited by the amount of interest paid and MAGI limits. | Limited to the first four years of higher education and MAGI limits. | Lower maximum credit amount than AOTC, and subject to MAGI limits. |

Impact of Student Loan Interest Deduction on Overall Tax Liability

The student loan interest deduction can significantly reduce a taxpayer’s overall tax liability by lowering their taxable income. This deduction allows eligible taxpayers to deduct the amount they paid in student loan interest during the tax year, resulting in a smaller tax bill. The amount of savings depends on several factors, including the taxpayer’s adjusted gross income (AGI), the amount of student loan interest paid, and their overall tax bracket.

The deduction directly impacts taxable income. By reducing taxable income, the overall tax liability is also reduced. This is because the tax owed is calculated based on a progressive tax system, where higher incomes are taxed at higher rates. Therefore, even a modest reduction in taxable income can lead to noticeable savings, especially for individuals in higher tax brackets.

Examples of Tax Savings with Varying Income Levels and Interest Amounts

The following examples illustrate the potential tax savings from the student loan interest deduction, assuming a standard deduction is not utilized to maximize the benefit of the deduction. These are simplified examples and do not account for all possible tax situations or deductions. Consult a tax professional for personalized advice.

| AGI | Student Loan Interest Paid | Tax Savings (Estimated, based on 2023 tax brackets)* |

|---|---|---|

| $60,000 | $1,500 | Approximately $225 |

| $80,000 | $2,000 | Approximately $400 |

| $100,000 | $2,500 | Approximately $625 |

*Tax savings are estimates and may vary based on individual circumstances and applicable tax laws.

Interaction Between the Deduction and Other Tax Credits or Deductions

The student loan interest deduction interacts with other tax benefits in several ways. It is an above-the-line deduction, meaning it is subtracted from gross income before calculating adjusted gross income (AGI). This is advantageous because it can reduce AGI, potentially making taxpayers eligible for other tax benefits that are based on AGI, such as certain tax credits or deductions. For example, a lower AGI could lead to a higher amount of the American Opportunity Tax Credit or Lifetime Learning Credit. However, it’s crucial to understand that the interaction can be complex, and the net effect will depend on the specific circumstances of the taxpayer.

Hypothetical Scenario Demonstrating Tax Reduction

Let’s consider a hypothetical scenario: Sarah, a single filer, has an AGI of $75,000 and paid $1,800 in student loan interest during the year. Assuming she itemizes her deductions (to maximize the benefit of the deduction), the $1,800 student loan interest deduction reduces her taxable income. Let’s assume, for simplicity, that this reduction results in a tax savings of approximately $300. This means her tax liability is reduced by $300 due to the deduction, effectively increasing her net income by that amount. This illustrates the tangible financial benefit of utilizing the student loan interest deduction.

Potential Changes to the Student Loan Interest Deduction

The student loan interest deduction, while currently available, faces an uncertain future. Its continued existence and the specifics of its parameters are subject to ongoing political and economic considerations. Understanding the potential for change is crucial for taxpayers currently utilizing or planning to utilize this deduction.

The student loan interest deduction’s future hinges on several key factors. These factors interact in complex ways, making precise predictions difficult, but analyzing them allows for a reasoned assessment of potential modifications.

Factors Influencing Potential Modifications

Several factors could lead to changes in the student loan interest deduction. Budgetary constraints often drive policy decisions, particularly regarding tax deductions. If the government seeks to reduce the national deficit, tax deductions, including the student loan interest deduction, may be targeted for modification or elimination. Furthermore, political priorities and shifts in the legislative landscape play a significant role. Changes in the composition of Congress or the administration can result in altered perspectives on the desirability and affordability of the deduction. Finally, economic conditions, such as periods of high inflation or recession, can influence the government’s willingness to maintain the deduction. For example, during economic downturns, there might be pressure to reduce spending on tax breaks to prioritize other social programs.

Historical Data on Changes to the Deduction

The student loan interest deduction has not remained static throughout its history. While the core concept has persisted, the specifics—such as the maximum deductible amount and the adjusted gross income (AGI) phaseout limits—have been adjusted over time. For example, the maximum amount that could be deducted has varied, and the AGI phaseout limits, which determine the eligibility based on income, have also been subject to change depending on the tax legislation in effect for each year. Analyzing past adjustments provides insight into the potential for future modifications. This historical data reveals a pattern of adjustments reflecting evolving economic and political priorities.

Possible Impact of Changes on Taxpayers

Potential changes to the student loan interest deduction could significantly impact taxpayers. A reduction in the maximum deductible amount would directly lower the tax savings for eligible borrowers. Similarly, tightening the AGI phaseout limits would reduce the number of taxpayers who qualify for the deduction, effectively excluding higher-income borrowers. In the most extreme scenario, complete elimination of the deduction would remove a valuable tax benefit for millions of students and recent graduates, increasing their overall tax liability. These changes could disproportionately affect lower- and middle-income borrowers who rely heavily on this deduction to offset the financial burden of student loans. For instance, a family relying on the deduction to manage their budget could face a significant financial hardship if the deduction were reduced or eliminated. Conversely, a complete removal of the deduction could lead to higher tax burdens, potentially hindering their ability to repay their student loans.

Illustrative Example

This section provides a visual representation of the potential tax savings achievable through the student loan interest deduction, demonstrating its impact across various income brackets. Understanding this impact is crucial for taxpayers to assess the potential benefit of claiming this deduction.

The following bar graph illustrates the estimated tax savings for individuals with different adjusted gross incomes (AGI) who are eligible for the maximum student loan interest deduction. The data is based on a hypothetical scenario assuming a standard deduction and a 22% marginal tax rate for illustrative purposes. Actual tax savings will vary depending on individual circumstances, including total income, other deductions, and the amount of student loan interest paid.

Tax Savings by Income Bracket

The bar graph below displays the estimated tax savings from the student loan interest deduction for individuals with different AGIs. The horizontal axis represents the AGI brackets, while the vertical axis represents the potential tax savings in US dollars. Each bar’s height corresponds to the estimated tax savings within that specific income bracket. The maximum deduction is assumed for all scenarios.

Imagine a bar graph. The horizontal axis is labeled “Adjusted Gross Income (AGI) Bracket” and is divided into segments representing income ranges: $0-$20,000, $20,001-$40,000, $40,001-$60,000, $60,001-$80,000, and $80,001+. The vertical axis is labeled “Tax Savings (USD)” and ranges from $0 to $2,500.

The bar representing the $0-$20,000 AGI bracket would be relatively short, perhaps around $500, reflecting a smaller tax savings due to the lower tax liability in this bracket. The bars gradually increase in height as the AGI bracket increases, with the $60,001-$80,000 bracket showing a significant increase, potentially around $1,500. The tallest bar would be for the $80,001+ bracket, reaching close to $2,000 or even slightly higher, representing the maximum potential tax savings given the assumed parameters. This illustrates that higher income earners, while paying more in taxes, potentially benefit more in absolute terms from the deduction, because the deduction is applied to their higher tax bracket.

Trends and Patterns in Tax Savings

The bar graph clearly demonstrates a positive correlation between AGI and the potential tax savings from the student loan interest deduction. Taxpayers with higher AGIs generally realize greater absolute tax savings because the deduction is applied to a larger tax liability. However, the *percentage* of tax savings relative to total income will decrease as AGI increases. For example, while a high-income earner might save $2000, that represents a smaller percentage of their overall income compared to a lower-income earner saving $500.

Implications for Taxpayers

The visual representation highlights the potential financial benefits of claiming the student loan interest deduction. It underscores the importance of understanding one’s AGI and accurately calculating the deductible amount to maximize tax savings. The graph also demonstrates that while the absolute tax savings increase with income, the *relative* benefit diminishes. Taxpayers should carefully consider the potential savings in relation to their overall financial situation and other tax planning strategies. This information can aid in making informed financial decisions regarding student loan repayment and overall tax planning.

Closure

Successfully navigating the student loan interest deduction can lead to substantial tax savings, making a considerable difference in your overall financial picture. By understanding the eligibility criteria, calculation methods, and supporting documentation, you can confidently claim this valuable deduction and reduce your tax burden. Remember to regularly review potential changes in legislation and consult with a tax professional if you have specific questions or complex situations.

User Queries

Can I deduct interest paid on private student loans?

Yes, provided you meet the income and other eligibility requirements. The type of loan (federal or private) does not automatically disqualify you.

What if I paid more interest than the maximum deduction allows?

You can only deduct up to the maximum allowed based on your adjusted gross income (AGI). You cannot carry forward the excess interest to a future tax year.

Where do I report the student loan interest deduction on my tax return?

The student loan interest deduction is reported on Schedule 1 (Additional Income and Adjustments to Income) of Form 1040.

What happens if I don’t have all the necessary documentation?

The IRS may disallow your deduction if you cannot provide sufficient proof of your interest payments. Keep all relevant loan statements and payment confirmations.

Does the student loan interest deduction affect my eligibility for other tax credits?

It may indirectly affect eligibility for some credits, depending on how the deduction impacts your overall taxable income. Consult a tax professional for personalized advice.