Navigating the complex landscape of student loan debt requires understanding the crucial role of interest rates. This exploration delves into the intricacies of student loan interest limitation, examining its historical context, impact on borrowers, and the government’s involvement. We’ll analyze various approaches to managing student loan debt and speculate on future trends in interest rate policies, offering a comprehensive perspective on this significant financial issue.

From the fluctuating rates of the past fifty years to the current debates surrounding affordability and accessibility of higher education, the discussion will illuminate the multifaceted challenges and potential solutions related to student loan interest. We will consider the economic factors driving policy decisions and examine the potential trade-offs between controlling interest rates and ensuring access to higher education for all.

Historical Context of Student Loan Interest Rates

The cost of higher education in the United States has risen dramatically over the past half-century, significantly impacting the role and evolution of student loan interest rates. Understanding this historical context is crucial for appreciating current debates and policies surrounding student loan debt. The fluctuating nature of these rates, influenced by economic conditions and legislative changes, has created a complex landscape for borrowers.

Interest rates on federal student loans haven’t remained static; they’ve been subject to considerable change over the past 50 years. Early student loan programs often featured fixed, relatively low interest rates, reflecting a different economic climate and a smaller scale of borrowing. However, as tuition costs escalated and student loan programs expanded, so did the complexity and variability of interest rates.

Legislative Changes Impacting Federal Student Loan Interest Rates

Significant legislative changes have directly shaped the interest rate landscape for federal student loans. The Higher Education Act of 1965 laid the groundwork for federal student aid, but subsequent amendments and new legislation have repeatedly altered interest rate structures. For instance, the creation of variable interest rates tied to market indices introduced a new element of uncertainty for borrowers. Later legislation, such as the 2007 College Cost Reduction and Access Act, aimed to provide some stability by establishing fixed rates for certain loan types for specific periods. The subsequent years have seen further adjustments, often driven by budget considerations and political priorities. These shifts highlight the dynamic interplay between government policy and the cost of higher education.

Interest Rate Comparisons Across Federal Student Loan Types

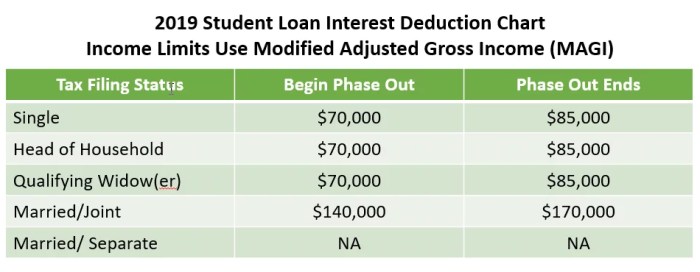

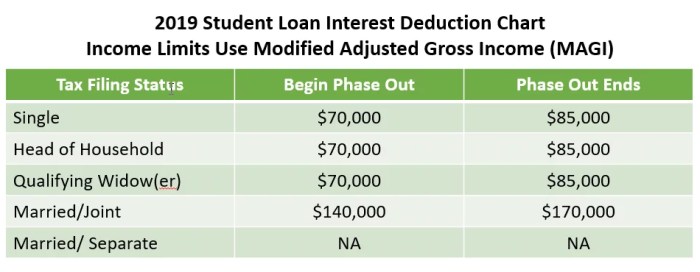

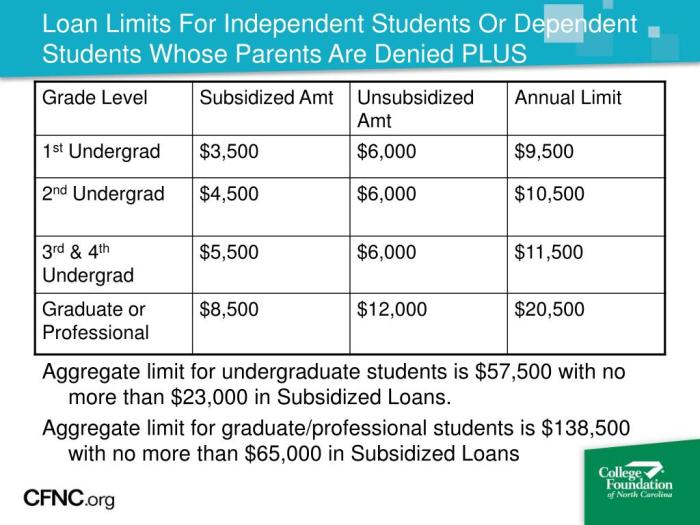

Federal student loans are not a monolithic entity; different loan types carry different interest rates. Subsidized Stafford Loans, for example, typically have lower interest rates than unsubsidized Stafford Loans because the government pays the interest while the student is in school. Unsubsidized loans accrue interest from the moment they are disbursed, leading to a higher total repayment amount. Parent PLUS loans and Graduate PLUS loans generally carry higher interest rates than undergraduate loans, reflecting the increased risk associated with larger loan amounts and the borrowers’ potentially higher earning potential. These variations reflect a risk-based pricing model, with higher-risk loans commanding higher rates.

Timeline of Key Events and Changes in Student Loan Interest Rate Policies

A chronological overview helps to illustrate the evolution of student loan interest rate policies. While precise dates and specifics may vary depending on the loan type and program, a generalized timeline provides context.

| Year (Approximate) | Key Event or Policy Change |

|---|---|

| 1970s-1980s | Generally lower, fixed interest rates on federal student loans; relatively smaller loan amounts. |

| 1990s | Introduction of variable interest rates linked to market indices; increased emphasis on risk-based pricing. |

| 2000s | Several legislative acts aimed at reducing student loan costs and improving access to higher education, often including temporary interest rate adjustments. |

| 2010s – Present | Continued adjustments to interest rates, influenced by economic conditions and political considerations; ongoing debates about affordability and debt relief. |

Impact of Interest Rate Limitations on Borrowers

Interest rate limitations on student loans significantly impact the total cost of borrowing for students, influencing both short-term repayment burdens and long-term financial health. These limitations, often implemented through government programs or legislative actions, aim to make borrowing more affordable and accessible, but their effects can be complex and vary depending on individual circumstances.

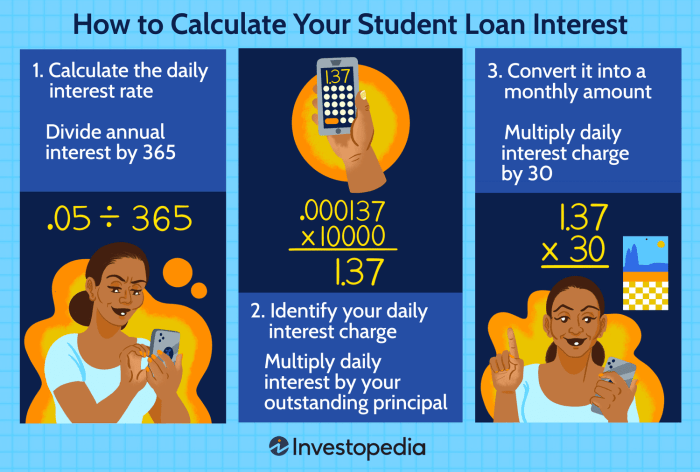

Interest rate caps directly reduce the amount borrowers pay in interest over the life of the loan. This translates to lower monthly payments and a smaller overall debt burden. Conversely, if interest rates are allowed to fluctuate freely, borrowers may face unexpectedly high interest costs, especially during periods of economic instability or high inflation. The impact of these fluctuations can be substantial, potentially delaying debt repayment and impacting other financial goals.

Effects of Interest Rate Caps on Total Borrowing Costs

Interest rate limitations directly affect the total cost of a student loan. Lower interest rates mean lower overall interest payments, reducing the total amount repaid. For example, a borrower with a $50,000 loan at a 5% fixed interest rate will pay significantly less in interest over the life of the loan than a borrower with the same loan amount at a 10% fixed interest rate. The difference can amount to thousands of dollars, impacting the borrower’s ability to save, invest, or purchase a home.

Examples of Beneficial and Detrimental Scenarios

Consider two borrowers, both with $30,000 in federal student loans. Borrower A benefits from a government-imposed interest rate cap of 4% during their borrowing period. Borrower B, however, took out private loans with variable interest rates that climbed to 8% during periods of economic uncertainty. Borrower A enjoys significantly lower total repayment costs compared to Borrower B. This illustrates how interest rate caps can protect borrowers from volatile interest rate environments. Conversely, scenarios where interest rate caps are unexpectedly lowered might benefit new borrowers but potentially leave those already in repayment with higher rates at a disadvantage.

Long-Term Financial Implications

The long-term financial implications of different interest rate scenarios are substantial. Lower interest rates free up more disposable income for borrowers, allowing them to save, invest, and build wealth faster. This can lead to earlier homeownership, retirement planning, and improved financial security. Conversely, high interest rates can hinder financial progress, leading to delayed financial goals and potentially impacting credit scores. This can create a cycle of debt, making it harder to achieve financial stability.

Comparison of Total Repayment Amounts Under Different Interest Rate Scenarios

| Loan Amount | Interest Rate | Loan Term (Years) | Total Repayment Amount |

|---|---|---|---|

| $20,000 | 4% | 10 | $23,660 |

| $20,000 | 6% | 10 | $25,500 |

| $40,000 | 4% | 15 | $54,300 |

| $40,000 | 7% | 15 | $66,000 |

The Role of Government in Setting Interest Rate Limits

Governments play a significant role in shaping the student loan landscape, and their decisions regarding interest rate limitations are driven by a complex interplay of social, economic, and political considerations. The rationale behind setting these limits is multifaceted, aiming to balance the needs of borrowers with the fiscal realities of government spending and the overall health of the financial system.

The government’s primary motivation for capping student loan interest rates is to promote access to higher education and alleviate the burden of student debt. High interest rates can act as a significant barrier to entry for many prospective students, particularly those from lower-income backgrounds. By limiting interest rates, governments aim to make higher education more affordable and accessible, fostering a more skilled and productive workforce.

Economic Factors Influencing Government Decisions

Several key economic factors influence government decisions regarding student loan interest rate limitations. These include inflation rates, prevailing market interest rates, the overall state of the economy, and the projected growth of the student loan market. For example, during periods of high inflation, the government might be more inclined to adjust interest rate caps to reflect the increased cost of borrowing. Conversely, during economic downturns, the government may opt for lower caps to stimulate demand for higher education and support economic recovery. Government budgetary constraints also play a crucial role; if government spending is tight, the ability to subsidize lower interest rates might be limited. A significant increase in student loan defaults could also trigger a review of interest rate policies.

Comparison of US and Other Developed Nations’ Approaches

The United States’ approach to student loan interest rate regulation differs significantly from that of other developed nations. While the US has historically employed a mix of fixed and variable interest rates, often tied to market indices with government subsidies, many other countries, such as Canada and Australia, often offer more heavily subsidized loans with fixed, lower interest rates throughout the loan term. Some European nations provide interest-free or extremely low-interest student loans, often funded through grants and government allocations. These variations reflect differing priorities in national education policy, levels of government investment in higher education, and the overall structure of their higher education funding systems. For example, Germany’s relatively low tuition fees and comprehensive government-funded scholarship programs minimize the need for large-scale student loan programs and thus, extensive interest rate regulation.

Trade-offs Between Interest Rate Control and Access to Higher Education

Controlling interest rates on student loans creates a delicate balance. While lower interest rates make higher education more accessible, they can also strain government budgets and potentially lead to increased government debt. Conversely, allowing market rates to dictate interest rates might make borrowing prohibitively expensive for many, thus limiting access to higher education and potentially exacerbating social inequalities. The government must carefully weigh these competing factors, considering the long-term societal benefits of a highly educated workforce against the immediate fiscal challenges of subsidizing student loans. The optimal balance often involves a combination of interest rate caps, income-driven repayment plans, and targeted financial aid programs to ensure both affordability and access to higher education.

Alternative Approaches to Managing Student Loan Debt

Managing student loan debt effectively requires a multifaceted approach that extends beyond simply limiting interest rates. While interest rate caps provide crucial relief, other strategies play a vital role in helping borrowers navigate their repayment journey and achieve financial stability. These strategies include exploring different repayment plans, understanding loan forgiveness programs, and employing effective personal financial management techniques.

Income-Driven Repayment Plans

Income-driven repayment (IDR) plans offer a flexible approach to student loan repayment by basing monthly payments on a borrower’s discretionary income and family size. Several IDR plans exist, each with slightly different eligibility requirements and calculation methods. These plans generally extend the repayment period, leading to lower monthly payments but potentially higher total interest paid over the life of the loan.

The advantages of IDR plans include reduced monthly payments, making repayment more manageable for borrowers facing financial hardship. They also offer the potential for loan forgiveness after a specified period of repayment, typically 20 or 25 years, depending on the plan. However, the disadvantages include significantly longer repayment periods, resulting in a substantially higher total interest paid over the loan’s lifetime. Furthermore, the eligibility criteria and complex calculations can be challenging for borrowers to navigate. For example, a borrower earning a modest income might find their monthly payment significantly reduced under an IDR plan, but they will likely pay significantly more in interest over the long repayment term.

Loan Forgiveness Programs

Loan forgiveness programs offer the potential for partial or complete cancellation of student loan debt under specific circumstances. These programs often target borrowers in public service professions, those working in low-income areas, or those who have made consistent payments for a prolonged period under an IDR plan.

The mechanics of loan forgiveness typically involve meeting specific eligibility requirements, such as working for a qualifying employer for a certain number of years or making consistent payments under an IDR plan for a designated period. Once these requirements are met, the remaining loan balance may be forgiven. The impact on borrowers is significant, potentially providing financial relief and improving long-term financial stability. However, the impact on the government involves a considerable financial outlay, reducing available funds for other government programs. The Public Service Loan Forgiveness (PSLF) program, for example, has faced challenges due to strict eligibility criteria and administrative complexities, leading to lower-than-anticipated forgiveness rates.

Strategies for Effective Student Loan Debt Management

Effective student loan debt management requires a proactive and strategic approach. Several strategies can significantly impact a borrower’s ability to repay their loans successfully and minimize the long-term financial burden.

- Create a Budget: Tracking income and expenses helps identify areas where spending can be reduced to allocate more funds towards loan repayment.

- Prioritize High-Interest Loans: Focusing on repaying loans with the highest interest rates first can minimize the total interest paid over the loan’s life.

- Explore Refinance Options: Refinancing loans at a lower interest rate can reduce monthly payments and the overall cost of borrowing.

- Consider an IDR Plan: If facing financial hardship, an income-driven repayment plan can provide temporary relief by lowering monthly payments.

- Automate Payments: Setting up automatic payments ensures consistent repayment and avoids late payment fees.

- Communicate with Lenders: Open communication with lenders can help negotiate repayment plans or address unforeseen financial difficulties.

The Future of Student Loan Interest Rate Policies

The landscape of student loan interest rate policies is dynamic, influenced by economic conditions, political priorities, and evolving societal expectations regarding higher education affordability. Predicting the future with certainty is impossible, but analyzing current trends and potential scenarios allows for a reasoned assessment of likely developments. This section explores potential future trends, the long-term sustainability of current programs, potential reforms, and the impact of economic fluctuations.

Potential Future Trends in Student Loan Interest Rate Policies

Several factors will likely shape future student loan interest rate policies. Increased political pressure to address student debt burdens could lead to further interest rate caps or even interest-free periods for certain borrowers. Conversely, economic realities such as inflation and rising government borrowing costs may necessitate adjustments that increase rates or limit government subsidies. We might also see a shift towards more personalized interest rates, reflecting individual creditworthiness and risk profiles, potentially mirroring the mortgage market’s approach. The increasing use of income-driven repayment plans could also influence interest rate policies, as these plans inherently decouple interest accrual from the loan’s principal balance. For instance, a future policy might see a tiered system where lower interest rates are paired with stricter income verification requirements for income-driven repayment plans.

Long-Term Sustainability of Current Student Loan Programs

The long-term sustainability of current student loan programs is a significant concern. The ever-increasing volume of student loan debt presents a considerable financial burden for both borrowers and the government. The current system’s reliance on government subsidies raises questions about its long-term fiscal viability, especially given the potential for future economic downturns. Without significant reforms, the escalating cost of these programs could strain government budgets and potentially lead to reduced funding for other crucial social programs. The example of the 2008 financial crisis, which saw a sharp increase in loan defaults and government intervention, serves as a cautionary tale highlighting the vulnerability of the current system.

Potential Reforms to the Student Loan System

Addressing the affordability and accessibility of higher education requires comprehensive reforms to the student loan system. One potential reform is to increase funding for grant programs, reducing reliance on loans. Another is to streamline and simplify the application process, making it more accessible to potential borrowers. Furthermore, exploring alternative repayment models, such as income-based repayment plans with more generous terms or loan forgiveness programs targeted at specific fields (like teaching or public service), could alleviate the burden on borrowers. Finally, incentivizing institutions to control tuition costs could address the root cause of rising student debt. This could involve linking federal funding to tuition affordability metrics or creating transparent tuition pricing standards.

Impact of Economic Fluctuations on Student Loan Interest Rates and Repayment Plans

Economic fluctuations significantly impact student loan interest rates and repayment plans. During periods of economic expansion, lower interest rates are often possible due to increased government revenue and lower borrowing costs. Conversely, during economic downturns, interest rates may rise to reflect increased risk and the government’s need to manage its own finances.

Hypothetical Scenario: Significant Economic Downturn

Imagine a scenario where a significant economic downturn leads to widespread job losses and a sharp decline in government revenue. In this situation, the government might be forced to raise student loan interest rates to maintain the fiscal viability of the loan programs. This would increase the monthly payments for borrowers, potentially leading to a rise in loan defaults. The government might also be forced to reduce or eliminate certain loan forgiveness programs or tighten eligibility criteria for income-driven repayment plans to curb expenses. Borrowers already struggling with job losses and reduced income would face the added pressure of increased loan repayments, potentially exacerbating financial hardship and contributing to a further economic slowdown. This scenario highlights the interconnectedness of the economy and the student loan system, emphasizing the need for robust and adaptable policies.

Final Summary

Ultimately, understanding student loan interest limitations is paramount for both borrowers and policymakers. The future of student loan policies hinges on a balanced approach that addresses affordability concerns without jeopardizing access to higher education. By exploring historical trends, analyzing current approaches, and considering potential reforms, we can work towards a more sustainable and equitable system that empowers students to pursue their educational goals without facing insurmountable financial burdens.

Clarifying Questions

What is the difference between subsidized and unsubsidized student loans?

Subsidized loans don’t accrue interest while the borrower is in school, whereas unsubsidized loans do.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing can potentially lower your interest rate, but it often involves private lenders and may require good credit.

What are income-driven repayment plans?

These plans base your monthly payments on your income and family size, potentially leading to loan forgiveness after a set period.

How do economic downturns affect student loan interest rates?

Economic downturns can lead to lower interest rates as the government may try to stimulate borrowing, but it can also affect job prospects, making repayment more difficult.