Navigating the complexities of student loan repayment can feel overwhelming, particularly when understanding the role of interest rates. This exploration delves into the historical context of student loan interest limits, examining how these limits have evolved, their impact on borrowers, and the government’s role in shaping these policies. We’ll compare federal and private loan options, highlighting key differences and considerations for borrowers seeking financial clarity.

Understanding student loan interest limits is crucial for responsible financial planning. This guide provides a comprehensive overview of the current interest rate structure, the factors influencing these rates, and the various repayment plans available to help manage debt. By examining real-world scenarios and hypothetical examples, we aim to demystify the process of interest accrual and empower borrowers to make informed decisions.

Historical Context of Student Loan Interest Limits

The evolution of student loan interest rate regulations in the United States reflects a complex interplay of economic conditions, political priorities, and societal concerns about access to higher education. Understanding this history is crucial to appreciating the current landscape of student loan debt and the ongoing debate surrounding its management. The system hasn’t always included the interest rate caps and subsidies we see today; rather, it’s evolved significantly over several decades.

The history of student loan interest rate regulation is marked by periods of both high and relatively low rates, influenced by broader economic trends and specific legislative actions. Early student loan programs often lacked the comprehensive regulatory frameworks present today, resulting in fluctuating interest rates that were sometimes significantly higher than those available for other types of borrowing. Subsequent legislation aimed to make higher education more accessible and affordable by introducing interest rate caps and subsidies, although the effectiveness and equity of these measures have been subjects of ongoing discussion.

Evolution of Student Loan Interest Rate Regulations

Prior to the 1960s, student loan programs were largely fragmented and lacked consistent federal oversight. Interest rates varied considerably depending on the lender and the specific program. The Higher Education Act of 1965 marked a turning point, establishing the Guaranteed Student Loan (GSL) program, which provided federal guarantees to lenders, thereby expanding access to credit for students. However, interest rates remained market-driven, fluctuating with broader economic conditions. The subsequent decades witnessed several legislative amendments modifying aspects of the GSL program, including some attempts to regulate interest rates, but these were often insufficient to fully address concerns about affordability. The shift to the Federal Stafford Loan Program in the 1980s brought more direct federal involvement in loan disbursement and interest rate setting, albeit still with some market influences. The introduction of subsidized and unsubsidized loans further complicated the interest rate structure.

Interest Rate Comparisons Across Eras and Loan Programs

Comparing interest rates across different eras requires careful consideration of the economic context. For example, during periods of high inflation, nominal interest rates on student loans were also higher. However, adjusting for inflation reveals a different picture. While exact figures vary depending on the specific loan program and year, it’s generally observed that interest rates on federal student loans were significantly higher in the 1970s and 1980s compared to later periods, even after accounting for inflation. The introduction of subsidized loans, where the government pays the interest while the student is in school, also significantly impacted the effective cost of borrowing. Unsubsidized loans, on the other hand, accrued interest from the moment the loan was disbursed, regardless of the student’s enrollment status. This difference in interest accrual significantly affects the total cost of borrowing over the loan repayment period.

Impact of Significant Legislative Changes on Interest Rates

Several key legislative changes directly impacted student loan interest rates. The Higher Education Act of 1965, as mentioned, laid the groundwork for federal involvement. Subsequent amendments and the creation of the Stafford Loan program introduced more direct federal control over interest rates, although the level of control varied over time. The Health Care and Education Reconciliation Act of 2010, for example, temporarily lowered interest rates on subsidized Stafford Loans. However, these temporary adjustments often led to subsequent rate increases, highlighting the ongoing tension between political expediency and long-term financial stability of the student loan system. The fluctuating nature of these rates has resulted in periods of uncertainty for borrowers and has frequently been a subject of political debate.

Timeline of Key Milestones in Student Loan Interest Rate History

| Year | Legislation/Event | Interest Rate Changes |

|---|---|---|

| 1965 | Higher Education Act | Establishment of Guaranteed Student Loan (GSL) program; market-driven interest rates. |

| 1970s-1980s | Various amendments to Higher Education Act | Fluctuating interest rates, generally high compared to later periods. |

| 1980s | Shift to Federal Stafford Loan Program | Increased federal involvement in interest rate setting, but still some market influence. |

| 2010 | Health Care and Education Reconciliation Act | Temporary reduction in interest rates on subsidized Stafford Loans. |

| 2013-Present | Ongoing legislative debates and adjustments | Continued fluctuations and efforts to address affordability concerns. |

Current Student Loan Interest Rate Structure

Understanding the interest rate structure for federal student loans is crucial for borrowers to effectively manage their debt. These rates, while subject to change annually, are generally fixed for the life of the loan, meaning your monthly payment amount remains consistent (excluding potential changes due to capitalization of interest). However, understanding the different loan types and their associated rates is essential for informed borrowing decisions.

Federal student loan interest rates are determined by a complex interplay of factors, primarily the type of loan and the date the loan is disbursed. The government sets a fixed interest rate for each loan program each year. Unlike private loans, credit history typically does not directly impact the interest rate on federal student loans. However, the type of loan, whether subsidized or unsubsidized, significantly affects the interest rate. Graduate PLUS loans, for example, generally carry higher interest rates than undergraduate loans.

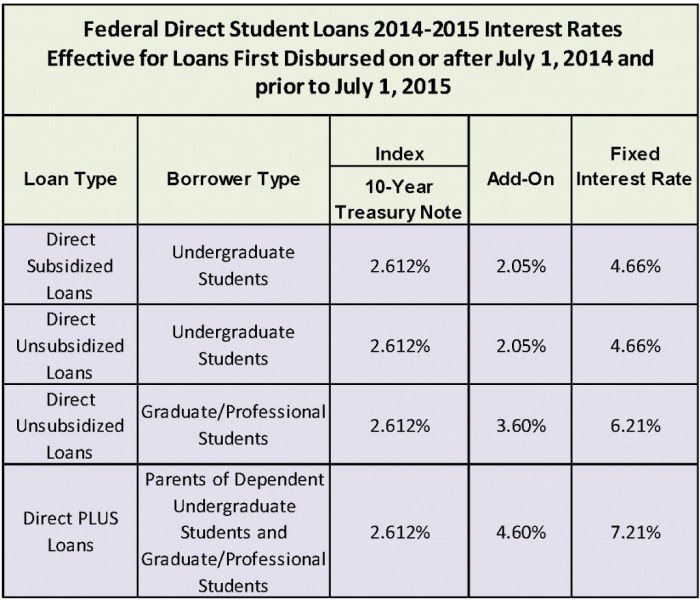

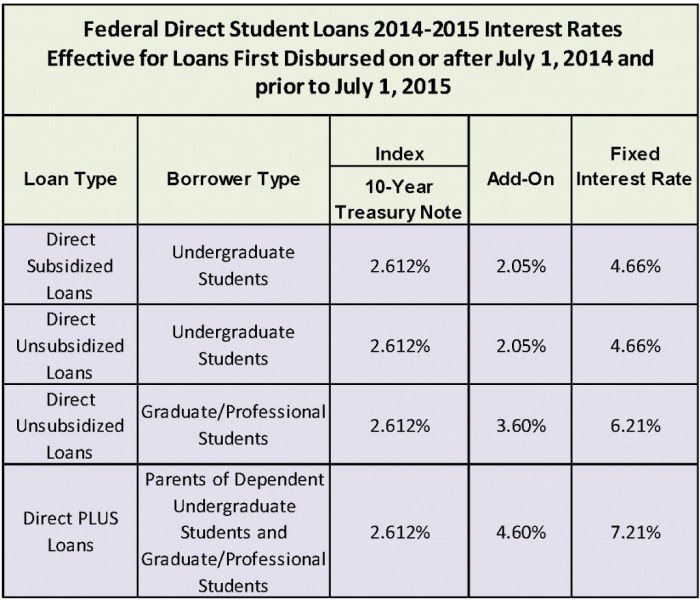

Federal Student Loan Interest Rate Details

The following table provides a comparison of current interest rates for various federal student loan programs. Note that these rates are subject to change annually and are based on the fiscal year (July 1st to June 30th) in which the loan is disbursed. Always consult the official Federal Student Aid website for the most up-to-date information.

| Loan Type | Interest Rate (Example Fiscal Year – Adjust for Current Year) | Subsidized/Unsubsidized |

|---|---|---|

| Direct Subsidized Loan (Undergraduate) | 4.99% | Subsidized |

| Direct Unsubsidized Loan (Undergraduate) | 6.54% | Unsubsidized |

| Direct Subsidized Loan (Graduate/Professional) | 6.54% | Subsidized |

| Direct Unsubsidized Loan (Graduate/Professional) | 7.04% | Unsubsidized |

| Direct PLUS Loan (Graduate/Professional) | 7.54% | N/A |

| Direct PLUS Loan (Parent) | 7.54% | N/A |

It’s important to remember that the example interest rates provided in the table are illustrative and subject to annual changes. The actual interest rate applied to your loan will depend on the loan type and the fiscal year in which your loan is disbursed. For instance, a student receiving a Direct Subsidized Loan in the 2023-2024 fiscal year would have a different interest rate than a student receiving the same loan type in the 2024-2025 fiscal year.

Factors Influencing Interest Rate Calculations

While credit history doesn’t directly affect federal student loan interest rates, other factors play a significant role. The primary factor is the type of loan. Subsidized loans typically have lower interest rates than unsubsidized loans because the government pays the interest while the student is in school (under certain conditions). Graduate and professional loans generally command higher rates than undergraduate loans, reflecting the higher loan amounts often involved. The disbursement date of the loan, specifically the fiscal year, also determines the interest rate applied to that loan.

Impact of Interest Limits on Borrowers

Interest rate caps on student loans significantly influence the overall cost of borrowing and the long-term financial health of borrowers. Understanding how these limits affect debt accumulation, monthly payments, and total repayment costs is crucial for prospective and current student loan borrowers. This section explores these impacts in detail.

Interest Rate Caps and Debt Accumulation

Interest rate caps directly affect the total amount of interest accrued over the life of a loan. Lower interest rates, naturally, lead to lower overall interest payments, resulting in less accumulated debt. Conversely, higher rates, even if capped, can substantially increase the total amount owed, potentially delaying debt repayment and impacting long-term financial planning. This effect is amplified by the compounding nature of interest; interest is calculated not only on the principal loan amount but also on previously accrued interest.

Effect of Interest Rate Fluctuations on Monthly Payments

Fluctuations in interest rates, even within a capped range, impact monthly payments. A rise in the interest rate, while remaining within the cap, will generally increase the monthly payment amount, requiring borrowers to allocate more of their income towards loan repayment. Conversely, a decrease in the rate will usually result in lower monthly payments. This variability can make budgeting and financial planning challenging for borrowers, as their monthly obligations may not remain consistent throughout the loan repayment period. Accurate budgeting and financial planning necessitate considering a range of potential interest rate scenarios within the established cap.

Long-Term Financial Implications of Different Interest Rate Scenarios

The long-term financial implications of different interest rate scenarios are substantial. Borrowers with loans subject to lower interest rates will generally pay significantly less in total interest over the life of the loan, leading to earlier debt repayment and greater financial flexibility in the future. Conversely, higher interest rates, even within a capped range, can lead to significantly higher total repayment costs, potentially delaying major life goals such as homeownership or starting a family. This long-term impact underscores the importance of carefully considering interest rate scenarios when choosing a student loan and developing a repayment strategy.

Hypothetical Example of Total Repayment Costs

To illustrate the impact of varying interest rates, consider a hypothetical $50,000 student loan with a 10-year repayment period:

The following bullet points demonstrate the total repayment costs under different interest rate scenarios:

- Scenario 1: 4% Interest Rate: Total repayment cost (principal + interest): Approximately $60,850

- Scenario 2: 6% Interest Rate: Total repayment cost (principal + interest): Approximately $67,750

- Scenario 3: 8% Interest Rate: Total repayment cost (principal + interest): Approximately $75,450

This example clearly demonstrates how even seemingly small differences in interest rates can lead to substantial differences in the total amount repaid over the life of the loan. A 4% interest rate results in approximately $14,600 less in total repayment costs compared to an 8% rate.

Interest Rate Subsidies and Repayment Plans

Understanding federal student loan repayment plans and the impact of interest rate subsidies is crucial for borrowers navigating the complexities of loan repayment. These plans offer varying approaches to managing debt, and subsidies can significantly influence the total amount repaid.

Federal student loan interest subsidies and repayment plans are designed to make student loan repayment more manageable for borrowers. Interest subsidies essentially cover the interest that accrues on certain loans while the borrower is in school or during periods of deferment or forbearance. Repayment plans, on the other hand, offer different schedules and payment amounts to suit individual financial situations.

Federal Student Loan Repayment Plans

Several federal student loan repayment plans are available, each with its own structure and benefits. The choice of plan significantly impacts monthly payments and the total amount paid over the life of the loan. Careful consideration of individual financial circumstances is necessary to select the most appropriate option.

The most common repayment plans include:

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s the default plan for most federal student loans.

- Graduated Repayment Plan: Payments start low and gradually increase over a 10-year period. This option may be appealing initially but leads to higher payments later in the repayment term.

- Extended Repayment Plan: This plan extends the repayment period beyond 10 years, resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment (IDR) Plans: These plans base monthly payments on income and family size. They offer lower monthly payments than other plans, potentially resulting in loan forgiveness after 20 or 25 years, depending on the specific plan.

Impact of Interest Subsidies on Repayment Obligations

Interest subsidies directly reduce the total amount borrowers repay. During periods when subsidies apply (e.g., in-school, deferment), the government pays the accruing interest. This means the principal loan balance remains unchanged, leading to lower overall repayment costs compared to situations where interest accrues and capitalizes (adds to the principal). For example, a borrower with a $10,000 loan and a 5% interest rate who receives a subsidy during their studies will owe less than a borrower without a subsidy. The latter would see their debt grow before repayment even begins.

Income-Driven Repayment Plan Eligibility

Eligibility for income-driven repayment plans typically requires borrowers to have federal student loans and to meet certain income requirements. The specific income thresholds and documentation requirements vary depending on the plan. Generally, borrowers must demonstrate their income and family size through tax returns or other verifiable documentation. The Department of Education provides detailed eligibility guidelines for each plan.

Comparison of Income-Driven Repayment Plans

Several income-driven repayment plans exist, each with distinct features. Choosing the best plan depends on individual financial circumstances and long-term goals.

| Plan Name | Payment Calculation | Forgiveness Period | Key Features |

|---|---|---|---|

| Income-Based Repayment (IBR) | Based on discretionary income and family size. | 20 or 25 years | Available for both undergraduate and graduate loans. |

| Pay As You Earn (PAYE) | 10% of discretionary income. | 20 years | Available for loans disbursed after June 30, 2007. |

| Revised Pay As You Earn (REPAYE) | 10% of discretionary income. | 20 or 25 years | Covers both undergraduate and graduate loans, including Perkins loans. |

| Income-Contingent Repayment (ICR) | Based on income and loan amount. | 25 years | Payments are recalculated annually. |

The Role of Government in Managing Interest Rates

The government plays a significant role in the student loan market, influencing borrowing costs and overall debt levels through its policies on interest rates. This influence stems from the government’s involvement in guaranteeing and often directly lending funds for student education. Understanding the government’s role is crucial for analyzing the complexities of student loan debt and its impact on borrowers and the economy.

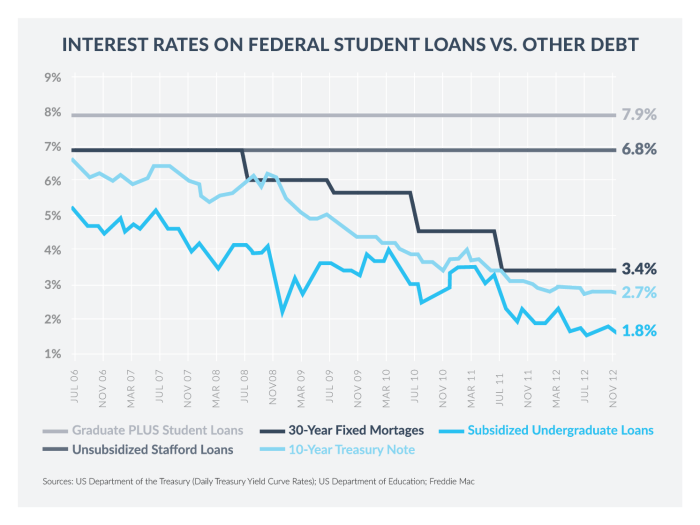

The government’s primary role is setting and regulating the interest rates applied to federal student loans. This involves determining the base interest rate, which is often tied to market indices like the 10-year Treasury note, and adding a fixed or variable margin to account for administrative costs and potential risks. Regulations also govern the terms and conditions of loan repayment, including grace periods, deferment options, and income-driven repayment plans. These regulations aim to balance the need to ensure access to education financing with the need to manage the risks associated with government-backed lending.

Economic Factors Influencing Government Decisions on Interest Rate Policies

Government decisions regarding student loan interest rates are influenced by a complex interplay of economic factors. Inflation rates are a key consideration, as high inflation can erode the real value of loan repayments, impacting both borrowers and the government’s financial position. The overall economic climate, including interest rates on other forms of borrowing, also plays a role. If market interest rates rise generally, the government may adjust student loan rates to remain competitive, potentially attracting more borrowers but also increasing the overall cost of the loan program. Fiscal policy considerations, including the government’s budget deficit and overall spending priorities, also affect the affordability and sustainability of government-subsidized student loan programs. Furthermore, political considerations and public opinion on student loan debt can also significantly influence government policy decisions.

Potential Consequences of Different Government Policies on Student Loan Debt

Different government policies on student loan interest rates have far-reaching consequences. For example, maintaining artificially low interest rates can encourage increased borrowing, potentially leading to higher levels of student loan debt and a greater burden on borrowers. However, this can also increase access to higher education, which can benefit both individuals and the broader economy. Conversely, significantly raising interest rates might curb borrowing and reduce the overall level of student debt, but it could also limit access to education, particularly for low-income students. A balanced approach that considers both affordability and the potential for unsustainable debt levels is crucial for responsible policymaking. The long-term economic impact, including the potential effect on economic growth and inequality, must be carefully weighed.

Scenario: Impact of Sudden Interest Rate Changes on the Student Loan Market

Consider a scenario where there’s a sudden and significant increase or decrease in student loan interest rates.

- Sudden Increase: A sharp increase in interest rates would immediately increase the monthly payments for current borrowers, potentially leading to higher rates of loan defaults and delinquencies. New borrowers would face higher costs of education, potentially discouraging enrollment in higher education. The overall demand for student loans could decrease, impacting the lending institutions and potentially slowing down economic growth. This scenario mirrors the challenges faced by borrowers during periods of high inflation and increased market interest rates.

- Sudden Decrease: Conversely, a sudden decrease in interest rates would lower monthly payments for current borrowers, providing immediate relief. This could stimulate demand for student loans, leading to increased enrollment in higher education. However, the government may face increased financial strain if the decreased interest rates are not offset by other measures, such as increased fees or reduced subsidies. This scenario could lead to a short-term boost in economic activity but also potentially increase the overall level of student loan debt in the long term, requiring careful management to prevent future financial instability.

Comparison with Private Student Loans

Choosing between federal and private student loans is a crucial decision for students and their families, significantly impacting their financial future. Understanding the differences in interest rates, repayment terms, and borrower protections is essential for making an informed choice. This section will compare and contrast these loan types, highlighting their advantages and disadvantages to help you navigate this important decision.

Federal student loans, offered by the U.S. government, generally offer more borrower protections and flexible repayment options compared to private student loans. However, private loans may sometimes offer lower interest rates depending on the borrower’s creditworthiness. The optimal choice depends on individual circumstances and financial profiles.

Interest Rates and Terms

Federal student loans offer fixed interest rates that are set annually by the government. These rates are generally lower than those offered by private lenders, especially for undergraduate students. Private student loans, on the other hand, offer variable or fixed interest rates that are determined by the lender based on the borrower’s credit history, income, and co-signer (if applicable). This means that interest rates on private loans can fluctuate, potentially leading to higher overall borrowing costs. Repayment terms for federal loans are typically longer, offering more flexibility, while private loan terms can vary widely depending on the lender and the borrower’s profile.

Advantages and Disadvantages of Federal Student Loans

Federal student loans provide several advantages, including fixed interest rates, income-driven repayment plans, and loan forgiveness programs for certain professions. However, they might have higher interest rates compared to private loans for borrowers with excellent credit. The availability of federal loans also depends on factors such as enrollment status and financial need.

Advantages and Disadvantages of Private Student Loans

Private student loans can sometimes offer lower interest rates than federal loans for borrowers with strong credit scores. They may also offer more flexible repayment options in certain cases. However, they often lack the borrower protections afforded by federal loans, and may include higher fees. Defaulting on a private loan can have severe consequences, such as damaging credit scores and potential legal action.

Factors to Consider When Choosing Between Loan Types

Several key factors should be considered when deciding between federal and private student loans. These include credit history (crucial for private loans), the amount of financial aid already received, the borrower’s financial situation and future earning potential, and the overall cost of the education. Borrowers should carefully weigh the potential benefits and drawbacks of each loan type before making a decision.

Comparison Table: Federal vs. Private Student Loans

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Interest Rates | Fixed, generally lower; set annually by the government. | Variable or fixed; determined by borrower’s creditworthiness. Can be higher or lower than federal rates. |

| Repayment Options | Multiple options available, including income-driven repayment plans. | Options vary by lender; generally less flexible than federal options. |

| Borrower Protections | Strong borrower protections, including deferment and forbearance options. | Fewer borrower protections; default can have severe consequences. |

| Credit Check | Generally not required for subsidized loans; unsubsidized loans may require a credit check for higher loan amounts. | Credit check always required; credit score significantly impacts interest rates and loan approval. |

| Loan Forgiveness Programs | Available for certain professions and circumstances. | Generally not available. |

Visual Representation of Interest Accrual

Understanding how interest accrues on student loans is crucial for effective financial planning. The process, while seemingly simple, can significantly impact the total repayment amount over the loan’s lifespan. This section will illustrate the mechanics of interest accrual and its compounding effect.

Interest accrual on student loans generally follows a simple interest calculation initially, but it quickly transitions to compound interest. Simple interest is calculated only on the principal loan amount. However, with most student loans, the interest is compounded, meaning that interest is added to the principal balance, and subsequent interest calculations include this added interest. This snowball effect is what causes the loan balance to grow exponentially over time.

Compound Interest Calculation

The core concept behind compound interest is that interest earned in one period becomes part of the principal for the next period. This continuous addition of interest to the principal leads to faster growth of the total debt. The formula for compound interest is: A = P (1 + r/n)^(nt), where: A = the future value of the investment/loan, including interest; P = the principal investment amount (the initial deposit or loan amount); r = the annual interest rate (decimal); n = the number of times that interest is compounded per year; and t = the number of years the money is invested or borrowed for.

Let’s illustrate this with a textual example. Consider a $10,000 student loan with a fixed annual interest rate of 5%, compounded annually.

- Year 1: Interest accrued: $10,000 * 0.05 = $500. New balance: $10,000 + $500 = $10,500.

- Year 2: Interest accrued: $10,500 * 0.05 = $525. New balance: $10,500 + $525 = $11,025.

- Year 3: Interest accrued: $11,025 * 0.05 = $551.25. New balance: $11,025 + $551.25 = $11,576.25.

- Year 4: Interest accrued: $11,576.25 * 0.05 = $578.81. New balance: $11,576.25 + $578.81 = $12,155.06.

- Year 5: Interest accrued: $12,155.06 * 0.05 = $607.75. New balance: $12,155.06 + $607.75 = $12,762.81.

As you can see, even with a seemingly modest interest rate, the compounding effect leads to a substantial increase in the total loan balance over just five years. The interest paid increases each year because it is calculated on a progressively larger principal amount. This example demonstrates the importance of understanding compound interest and its impact on long-term debt.

Conclusion

Successfully managing student loan debt requires a thorough understanding of interest rates and repayment options. This overview of student loan interest limits provides a framework for navigating the complexities of federal and private loans. By understanding the historical context, current structures, and the government’s influence, borrowers can develop effective strategies for repayment and long-term financial well-being. Remember to explore all available repayment plans and seek professional advice when necessary to tailor a repayment plan that suits your individual circumstances.

FAQ

What happens if I don’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset.

Can I refinance my student loans to lower my interest rate?

Yes, refinancing is an option, but it often involves switching from federal to private loans, potentially losing federal protections like income-driven repayment plans.

How often are student loan interest rates adjusted?

Federal student loan interest rates are generally fixed for the life of the loan, though the initial rate depends on the loan type and the year it was disbursed. Private loan rates can vary.

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while you’re in school (under certain conditions), whereas unsubsidized loans accrue interest from disbursement.