Navigating the complexities of student loan repayment often leaves borrowers questioning the intricacies of interest accrual. Understanding whether interest is calculated monthly or yearly, and how this impacts the total repayment amount, is crucial for effective financial planning. This exploration delves into the mechanics of student loan interest calculations, examining the differences between simple and compound interest, the influence of loan type and repayment plans, and strategies for minimizing the overall cost of borrowing.

We will dissect the various factors affecting your monthly payments, providing clear examples and visualizations to illuminate the often-opaque world of student loan finance. From federal versus private loans to the impact of deferment, we aim to empower you with the knowledge needed to make informed decisions about your repayment strategy.

Understanding Interest Calculation Methods

Understanding how student loan interest is calculated is crucial for effective financial planning. Knowing the difference between simple and compound interest, and the factors influencing your monthly payments, empowers you to make informed decisions about repayment strategies. This section will clarify these aspects.

Simple Versus Compound Interest

Simple interest is calculated only on the principal amount of the loan. Compound interest, however, is calculated on the principal amount plus any accumulated interest. Student loans almost universally use compound interest, meaning the interest you owe grows over time. This can significantly increase the total amount you repay compared to simple interest. For example, a $10,000 loan with a 5% simple interest rate would accrue $500 in interest annually. However, with compound interest, the interest earned each year is added to the principal, resulting in higher interest charges in subsequent years.

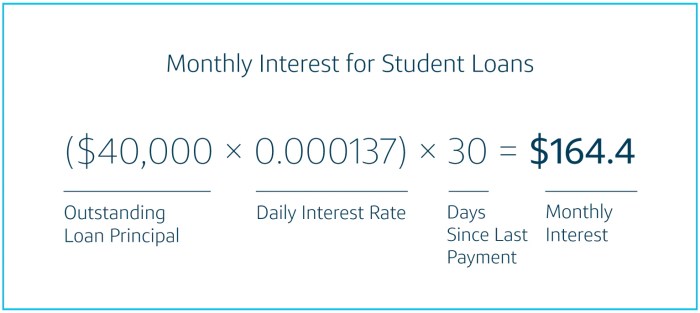

Factors Influencing Monthly Interest Calculation

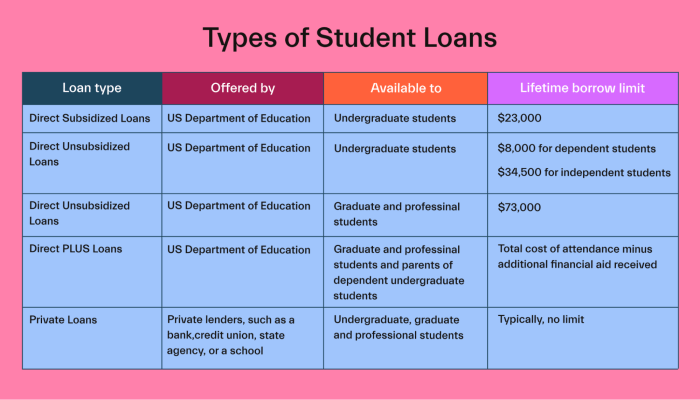

Several key factors determine the amount of interest accrued monthly on your student loan. These include the principal loan amount, the annual interest rate, and the type of loan.

The principal is the original amount borrowed. A larger principal leads to higher interest charges. The annual interest rate represents the percentage of the principal charged as interest annually. A higher interest rate will result in higher monthly interest payments. Finally, different loan types (e.g., federal subsidized, unsubsidized, private) may have varying interest rates and calculation methods. Federal subsidized loans, for instance, may not accrue interest during periods of deferment, unlike unsubsidized loans.

Calculating Monthly Interest Payments: A Step-by-Step Example

Let’s illustrate monthly interest calculation with a hypothetical example. Assume a $10,000 student loan with a 6% annual interest rate, compounded monthly. The monthly interest rate is calculated by dividing the annual rate by 12 (6%/12 = 0.5%). We’ll track the loan’s balance over a 12-month period, assuming a consistent monthly payment of $888.49 (calculated using a standard amortization schedule).

| Month | Beginning Balance | Interest Accrued | Payment Amount | Ending Balance |

|---|---|---|---|---|

| 1 | $10,000.00 | $50.00 | $888.49 | $9,161.51 |

| 2 | $9,161.51 | $45.81 | $888.49 | $8,318.83 |

| 3 | $8,318.83 | $41.59 | $888.49 | $7,471.93 |

| 4 | $7,471.93 | $37.36 | $888.49 | $6,620.80 |

| 5 | $6,620.80 | $33.10 | $888.49 | $5,765.41 |

| 6 | $5,765.41 | $28.83 | $888.49 | $4,905.75 |

| 7 | $4,905.75 | $24.53 | $888.49 | $4,041.79 |

| 8 | $4,041.79 | $20.21 | $888.49 | $3,173.51 |

| 9 | $3,173.51 | $15.87 | $888.49 | $2,299.89 |

| 10 | $2,299.89 | $11.50 | $888.49 | $1,422.90 |

| 11 | $1,422.90 | $7.11 | $888.49 | $541.52 |

| 12 | $541.52 | $2.71 | $544.23 | $0.00 |

Monthly Interest Accrued = (Annual Interest Rate / 12) * Beginning Balance

Impact of Loan Type on Interest Rates

Student loan interest rates are a crucial factor influencing the overall cost of higher education. Understanding the differences between federal and private loans, as well as the impact of various repayment plans and deferment options, is essential for responsible borrowing and financial planning. These factors significantly impact the total amount repaid over the loan’s lifespan.

Federal and private student loans differ significantly in their interest rates and repayment terms. These differences stem from the distinct sources of funding and risk assessments involved.

Federal and Private Loan Interest Rate Comparison

Federal student loans generally offer lower interest rates than private loans. This is because the federal government subsidizes these loans, reducing the risk for lenders. Interest rates on federal loans are also typically fixed, meaning they remain constant throughout the loan’s term. In contrast, private loan interest rates are often variable, fluctuating with market conditions, and tend to be higher to compensate for the increased risk assumed by private lenders. The specific interest rate offered will depend on several factors, including the borrower’s creditworthiness, the type of loan, and the prevailing market interest rates. For example, a federal subsidized loan might have a fixed rate of 5%, while a comparable private loan might carry a variable rate starting at 7%, potentially increasing over time. This difference in interest rates can translate to thousands of dollars in additional interest paid over the life of the loan.

Repayment Plan Impact on Monthly Interest Payments

The choice of repayment plan directly affects the monthly payment amount and the total interest paid. Standard repayment plans involve fixed monthly payments over a 10-year period. Graduated repayment plans start with lower monthly payments that gradually increase over time. Income-driven repayment plans (IDR) base monthly payments on a percentage of the borrower’s discretionary income, extending the repayment period. For instance, a standard repayment plan might result in higher monthly payments but less total interest paid compared to an IDR plan, which would have lower monthly payments but potentially much higher overall interest due to a longer repayment period. Choosing the appropriate plan requires careful consideration of one’s financial circumstances and long-term goals.

Impact of Loan Deferment or Forbearance on Total Interest

Deferment and forbearance temporarily postpone loan payments. While providing short-term relief, these options can significantly increase the total interest paid over the loan’s lifetime. During deferment or forbearance, interest may continue to accrue on subsidized federal loans, leading to a larger principal balance at the end of the deferment/forbearance period. For unsubsidized federal loans and private loans, interest accrues and is added to the principal balance during these periods, leading to a larger debt burden. For example, a borrower who defers their loan payments for two years might find their total interest paid increases substantially, even if their monthly payments remain the same after the deferment period ends. Careful consideration of the potential long-term cost of deferment or forbearance is crucial before utilizing these options.

Visualizing Interest Accrual

Understanding how interest accumulates on student loans can be challenging. Visual representations, such as graphs, offer a clear and concise way to grasp this concept, allowing for a better understanding of the long-term financial implications. This section will present two visual aids: a line graph illustrating monthly versus yearly interest accrual, and a bar chart comparing total interest paid at various interest rates.

Line Graph: Monthly vs. Yearly Interest Accrual

This line graph depicts the growth of interest on a $10,000 loan with a 5% annual interest rate over a 10-year period. The x-axis represents time in years, ranging from 0 to 10. The y-axis represents the total accumulated interest. Two lines are plotted: one showing the cumulative interest calculated monthly, and the other showing the cumulative interest calculated annually. The monthly interest line will show a steeper, more continuous upward curve reflecting the compounding effect of interest calculated and added more frequently. The yearly interest line will show a less steep, step-like increase, with a noticeable jump each year representing the annual interest calculation. The difference between the two lines will highlight the significant impact of compounding interest when calculated monthly. The graph clearly demonstrates that although the annual interest rate is the same, the total interest paid is substantially higher when interest is compounded monthly.

Bar Chart: Total Interest Paid at Varying Interest Rates

This bar chart compares the total interest paid over 10 years on a $10,000 loan at different interest rates: 4%, 6%, and 8%. The x-axis displays the interest rates (4%, 6%, 8%), and the y-axis represents the total interest paid in dollars over the 10-year period. Three bars will be presented, each corresponding to a specific interest rate. The height of each bar visually represents the total interest accumulated. The bar representing the 8% interest rate will be significantly taller than the 4% bar, clearly illustrating the substantial increase in total interest paid with a higher interest rate. This visual representation emphasizes the importance of securing a lower interest rate on student loans to minimize the overall cost of borrowing. The difference between the bars will highlight the considerable financial implications of even small percentage point variations in interest rates over the loan’s lifetime.

Strategies for Minimizing Interest Payments

Minimizing interest payments on student loans is crucial for reducing the overall cost of your education. Strategic planning and proactive actions can significantly lower the amount you ultimately pay back, freeing up resources for other financial goals. Understanding the various strategies available and their potential impact is key to effective debt management.

Several strategies can help borrowers minimize the total interest paid on their student loans. These range from simple adjustments to your repayment plan to more complex financial maneuvers. The effectiveness of each strategy depends on individual circumstances, loan terms, and financial capabilities. Careful consideration of both the advantages and disadvantages is crucial before implementation.

Aggressive Repayment Strategies

Making extra payments is arguably the most effective way to reduce interest accrued on student loans. Every extra payment reduces the principal balance, thus lowering the base upon which future interest is calculated. Even small, consistent extra payments can significantly shorten the repayment period and reduce overall interest paid. For example, consider a $30,000 loan at 6% interest with a 10-year repayment plan. Adding an extra $100 per month would save thousands of dollars in interest and pay off the loan years earlier. The disadvantage is the need for extra disposable income, which might not be feasible for all borrowers.

Refinancing Student Loans

Refinancing involves replacing your existing student loans with a new loan from a different lender, often at a lower interest rate. This can substantially reduce your monthly payments and the total interest paid over the life of the loan. However, refinancing might not always be beneficial. It could result in a longer repayment term, potentially increasing the total interest paid if you don’t secure a significantly lower interest rate. Additionally, refinancing federal student loans into private loans can lead to the loss of federal protections, such as income-driven repayment plans and loan forgiveness programs. Before refinancing, carefully compare interest rates, fees, and repayment terms from multiple lenders to ensure it’s a financially advantageous move.

Income-Driven Repayment Plans

Income-driven repayment plans (IDRs) adjust your monthly payments based on your income and family size. While they might result in a longer repayment period and higher overall interest paid, they offer lower monthly payments, making them manageable for borrowers with limited income. The advantage is affordability in the short term; however, the disadvantage is the potential for paying significantly more interest over the long term. Different IDR plans exist, each with its own eligibility requirements and repayment calculations. It’s crucial to research and choose the plan that best suits your individual financial situation.

Consolidation of Loans

Consolidating multiple student loans into a single loan can simplify repayment by reducing the number of payments you need to track. This can also potentially lower your monthly payment, although it might not necessarily reduce the total interest paid. The advantage is streamlined repayment; however, the disadvantage is that you may not achieve a significantly lower interest rate. Careful consideration of the interest rate offered by the consolidation loan is crucial. The new interest rate is usually a weighted average of the rates of your existing loans.

The Importance of Understanding the Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) is a crucial figure to understand when taking out student loans. It represents the true cost of borrowing, encompassing not only the interest rate but also various fees and charges associated with the loan. Failing to grasp the APR can lead to significant overestimation or underestimation of the total repayment amount, potentially impacting long-term financial planning.

The APR provides a comprehensive picture of the loan’s cost by incorporating all associated fees into the annual interest rate. This allows for a more accurate comparison between different loan offers, ensuring borrowers can make informed decisions. Understanding the APR is therefore vital for responsible borrowing and effective financial management.

APR Components and Calculation

The APR is calculated by taking the interest rate and adding any fees or charges associated with the loan. These fees can include origination fees, application fees, and any other costs imposed by the lender. The calculation then annualizes this combined cost, providing a single percentage that represents the total cost of borrowing over a year. A higher APR signifies a greater overall cost, while a lower APR indicates a lower cost. For instance, a loan with a 5% interest rate and a $100 origination fee will have a higher APR than a loan with a 5% interest rate and no origination fee. The exact calculation method can vary slightly depending on the lender and the loan type, but the underlying principle remains consistent: to provide a complete picture of the borrowing cost.

Impact of Higher APR on Total Interest Paid

A higher APR significantly increases the total interest paid over the life of the loan. Consider two hypothetical student loans: Loan A has a 5% APR, while Loan B has a 7% APR. Both loans are for $10,000 over 10 years. While the principal amount is the same, the total interest paid will differ substantially. Loan A, with the lower APR, will likely result in significantly less interest paid compared to Loan B over the ten-year repayment period. This difference can amount to thousands of dollars over the loan’s lifetime, highlighting the importance of choosing a loan with the lowest possible APR. For example, using a loan amortization calculator (easily found online), we can see that the total interest paid on Loan A might be approximately $2,500, whereas Loan B could easily exceed $3,500, a difference of $1,000. This difference underscores the long-term financial implications of even a seemingly small difference in APR.

Ending Remarks

Effectively managing student loan debt requires a thorough understanding of interest calculations and repayment options. By grasping the nuances of monthly versus yearly interest accrual, the influence of loan type and repayment plans, and proactive strategies for minimizing interest payments, borrowers can significantly reduce their overall financial burden. Remember, proactive planning and informed decision-making are key to successfully navigating the student loan repayment journey.

Detailed FAQs

What is the difference between simple and compound interest in the context of student loans?

Simple interest is calculated only on the principal loan amount, while compound interest is calculated on both the principal and accumulated interest. Compound interest results in significantly higher total interest paid over the life of the loan.

Can I pay off my student loans faster by making extra payments?

Yes, making extra payments reduces the principal balance faster, leading to lower overall interest payments and a shorter repayment period.

What happens if I defer or forbear my student loans?

Deferment and forbearance temporarily postpone your payments, but interest usually continues to accrue. This can lead to a larger overall loan balance.

How does my credit score affect my student loan interest rate?

A higher credit score typically qualifies you for lower interest rates on private student loans. Federal loan interest rates are generally not affected by credit score.

What is the best repayment plan for me?

The best repayment plan depends on your individual financial situation and income. Consider exploring standard, graduated, and income-driven repayment plans to determine which best suits your needs.