The recent increase in student loan interest rates has sent ripples through the financial lives of millions. This shift impacts not only current borrowers facing immediate financial challenges but also future students considering higher education. Understanding the implications of this increase requires examining its multifaceted effects – from immediate repayment burdens to long-term financial planning and the broader economic consequences. This exploration will delve into the various aspects of this significant change, providing insights and strategies for navigating this complex landscape.

The increase in interest rates stems from a confluence of economic and political factors, with the government citing [insert specific government rationale here, e.g., budgetary constraints or inflation control] as the primary justification. However, this decision has sparked considerable debate, with critics arguing that the move disproportionately burdens vulnerable borrowers and potentially dampens future college enrollment. This analysis will weigh the arguments for and against the increase, considering both the short-term and long-term implications for individuals and the economy as a whole.

Impact of Increased Interest Rates on Student Loan Borrowers

The recent increase in student loan interest rates presents a significant financial challenge for millions of borrowers across the country. This rise directly impacts the overall cost of a student loan, affecting both immediate repayment burdens and long-term financial well-being. Understanding these consequences is crucial for borrowers to effectively manage their debt.

Increased interest rates translate to higher monthly payments and a greater total amount paid over the life of the loan. This immediate consequence can strain borrowers’ budgets, potentially forcing difficult choices between loan repayment and other essential expenses like housing, food, or healthcare. For borrowers already struggling with financial instability, this added burden can exacerbate existing challenges and potentially lead to delinquency or default.

Long-Term Effects of Increased Interest Rates

Higher interest rates significantly extend loan repayment timelines and inflate the total interest paid over the loan’s lifespan. Even a seemingly small percentage point increase can lead to thousands of dollars in additional interest accrued over the course of repayment. For example, a borrower with a $50,000 loan at 5% interest might pay significantly more than a borrower with the same loan at 4%. This increased cost can delay major life milestones such as homeownership, starting a family, or investing in retirement. The longer repayment period also means borrowers remain in debt for a longer time, limiting their financial flexibility.

Impact on Different Loan Types

The impact of increased interest rates varies depending on the type of student loan. Unsubsidized loans accrue interest throughout the entire loan period, even during grace periods or periods of deferment. Therefore, borrowers with unsubsidized loans will see a more immediate and substantial increase in their monthly payments and total interest paid compared to those with subsidized loans. Subsidized loans, on the other hand, do not accrue interest while the borrower is in school or during certain grace periods. However, once the grace period ends, the accrued interest is capitalized, meaning it is added to the principal loan balance, increasing the overall amount owed. This capitalization effect can still lead to a significant increase in total interest paid, although it may be less pronounced than for unsubsidized loans.

Projected Increase in Monthly Payments

The following table illustrates the projected increase in monthly payments for various loan amounts and interest rate changes, assuming a standard 10-year repayment plan. These figures are estimates and actual payments may vary based on individual loan terms and repayment plans.

| Loan Amount | Original Interest Rate (4%) | New Interest Rate (5%) | Monthly Payment Increase |

|---|---|---|---|

| $20,000 | $203 | $213 | $10 |

| $40,000 | $406 | $426 | $20 |

| $60,000 | $609 | $639 | $30 |

| $80,000 | $812 | $852 | $40 |

Government Policies and the Interest Rate Increase

The recent increase in student loan interest rates is a complex issue stemming from a confluence of government policy decisions, economic factors, and political considerations. Understanding the rationale behind this increase requires examining the interplay of these elements and their projected impact on both borrowers and the federal budget.

The government’s decision to raise interest rates is multifaceted. A primary driver is the need to manage the burgeoning national debt. Student loan programs represent a significant portion of federal spending, and increasing interest rates is one mechanism to reduce the overall cost of these programs to taxpayers. This approach, however, comes at a cost to borrowers.

Rationale for Interest Rate Increases

The primary rationale for increasing student loan interest rates is fiscal responsibility. The government aims to curtail the escalating cost of student loan programs, which have grown substantially in recent years. By increasing interest rates, the government seeks to reduce the overall amount of taxpayer money needed to subsidize these loans. This approach is often justified as a means of balancing the budget and controlling the national debt. The expectation is that higher interest rates will generate more revenue for the government, thereby offsetting some of the costs associated with loan repayment programs.

Political and Economic Factors Influencing the Decision

Several political and economic factors heavily influence decisions regarding student loan interest rates. Political considerations, including the desire to appeal to fiscally conservative voters, often play a significant role. Economic factors such as inflation and overall interest rate trends in the broader financial market also influence the decision-making process. For example, a period of high inflation might lead the government to raise interest rates on student loans in line with prevailing market rates to avoid further exacerbating inflationary pressures. Conversely, a period of economic slowdown might see the government opting for a more cautious approach to avoid increasing the financial burden on already struggling borrowers. The government might also be influenced by projections of future economic growth and the anticipated ability of borrowers to repay their loans under different interest rate scenarios.

Projected Impact on the Federal Budget

The projected impact of the interest rate increase on the federal budget is a reduction in the net cost of the student loan program. The government anticipates increased revenue from higher interest payments, thereby lessening the overall financial burden on taxpayers. The magnitude of this impact depends on several factors, including the size of the rate increase, the number of borrowers affected, and the overall repayment behavior of borrowers. For example, a 1% increase in interest rates across a $1 trillion student loan portfolio could generate tens of billions of dollars in additional revenue for the government over several years. However, this projection is sensitive to changes in default rates and the overall economic climate.

Alternative Policies to Mitigate Impact on Borrowers

Alternative policies exist to mitigate the impact of interest rate increases on student loan borrowers. These include targeted subsidies for low-income borrowers, income-driven repayment plans with more generous terms, and increased funding for student loan forgiveness programs. For example, the government could introduce a program providing interest rate subsidies for borrowers from low-income backgrounds, reducing their overall monthly payments and preventing them from falling into financial hardship. Similarly, expanding access to income-driven repayment plans could allow borrowers to tailor their monthly payments to their income levels, preventing them from becoming overwhelmed by their debt. Finally, increased funding for student loan forgiveness programs could provide relief to borrowers who have struggled to repay their loans, particularly those in public service or other critical professions.

Strategies for Managing Increased Student Loan Payments

Facing a student loan interest rate increase can feel overwhelming, but proactive strategies can help borrowers manage the added financial burden. Understanding your options and implementing a well-defined plan is crucial to avoid falling behind on payments and minimizing long-term financial strain. This section Artikels several approaches to effectively navigate this challenge.

Practical Strategies for Managing Higher Monthly Payments

Managing higher monthly payments requires a multi-pronged approach. Prioritizing budgeting, exploring repayment options, and seeking professional financial advice are key components of a successful strategy.

- Create a Detailed Budget: Thoroughly track all income and expenses to identify areas where spending can be reduced. This involves categorizing expenses, identifying non-essential spending, and prioritizing essential needs.

- Negotiate with Lenders: Contact your loan servicer to explore options like forbearance or deferment, which temporarily suspend or reduce payments. Understand the implications of these options, as they may lead to accrued interest.

- Increase Income: Explore opportunities to increase income through a second job, freelance work, or a promotion. Even a small increase in income can significantly impact your ability to manage higher payments.

- Seek Professional Financial Advice: A financial advisor can provide personalized guidance tailored to your specific financial situation and help you develop a comprehensive debt management plan.

- Refinance Your Loans: If possible, refinancing your loans at a lower interest rate can significantly reduce your monthly payments. However, carefully compare offers and consider the terms and conditions before making a decision.

Sample Budget Incorporating Increased Loan Payments

The following budget demonstrates how to incorporate increased loan payments into an existing financial plan. This is a simplified example and should be adapted to reflect individual circumstances.

| Category | Monthly Income | Monthly Expenses | |

|---|---|---|---|

| Salary | $3000 | Rent | $1000 |

| Side Hustle | $500 | Utilities | $200 |

| Total Income | $3500 | Groceries | $300 |

| Transportation | $150 | ||

| Student Loan Payment (Increased) | $500 | ||

| Other Expenses | $350 | ||

| Total Expenses | $2500 | ||

| Savings/Emergency Fund | $1000 |

This budget shows a $1000 surplus, allowing for savings and emergency fund contributions after accounting for increased loan payments. Remember, budgeting requires consistent monitoring and adjustments.

Comparison of Different Repayment Plans

Understanding the different repayment plans available is crucial for managing student loan debt effectively. Each plan has its own advantages and disadvantages.

- Standard Repayment Plan: This plan involves fixed monthly payments over a 10-year period. It’s the quickest way to pay off your loans but may result in higher monthly payments.

- Extended Repayment Plan: This plan stretches payments over a longer period (up to 25 years), resulting in lower monthly payments but higher overall interest paid.

- Income-Driven Repayment Plans (IDR): These plans base monthly payments on your income and family size. Payments are typically lower, but the repayment period is often longer, leading to higher overall interest costs. Examples include Income-Based Repayment (IBR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

Choosing the right repayment plan depends on individual financial circumstances and long-term goals. Carefully weigh the pros and cons of each option before making a decision.

Prioritized Strategies for Managing Increased Student Loan Payments

Based on effectiveness and feasibility, the following prioritization is suggested:

- Create a Detailed Budget and Identify Areas for Savings: This foundational step is essential for understanding your current financial situation and identifying areas for potential cost reduction.

- Explore Income-Driven Repayment Plans (IDR): These plans offer flexibility and lower monthly payments, providing immediate relief. It is important to understand the long-term implications of a longer repayment period and higher overall interest.

- Negotiate with Lenders for Temporary Relief: Forbearance or deferment can provide short-term relief, but it’s crucial to use these options strategically and understand the implications of accumulating interest.

- Refinance Your Loans (if applicable): Refinancing should be considered if a lower interest rate is attainable. Carefully evaluate the terms and conditions of any refinancing offer.

- Increase Income Through Additional Work or Promotion: Increasing income is a proactive long-term strategy that enhances your ability to manage debt and build financial stability.

The Psychological Impact of Increased Debt Burden

The rising cost of higher education, coupled with increased student loan interest rates, creates a significant financial burden for many borrowers. This increased debt can have profound and far-reaching psychological consequences, impacting borrowers’ mental health and overall well-being. The weight of substantial debt can lead to significant stress and anxiety, affecting not only financial stability but also personal relationships and overall life satisfaction.

The relationship between financial stress and mental health is well-documented. Studies consistently show a strong correlation between financial strain and increased rates of depression, anxiety, and even suicidal ideation. The constant worry about loan repayments, the fear of default, and the perceived inability to achieve financial goals can significantly impact a person’s mental and emotional state. This stress is not simply a matter of inconvenience; it’s a serious health concern with potentially devastating consequences.

Financial Stress and Mental Health Challenges

Financial hardship, particularly the pressure of mounting student loan debt, can exacerbate existing mental health conditions or trigger the onset of new ones. The inability to meet financial obligations, such as student loan repayments, can lead to feelings of hopelessness, helplessness, and a diminished sense of self-worth. This can manifest in various ways, including difficulty concentrating, sleep disturbances, irritability, and social withdrawal. The constant pressure to manage debt can also strain relationships with family and friends, further compounding the psychological burden. For example, a recent study by the American Psychological Association found that individuals with high levels of financial stress were significantly more likely to report symptoms of depression and anxiety compared to their less financially stressed counterparts. The long-term consequences of untreated financial stress can be severe, impacting physical health, career prospects, and overall quality of life.

Available Resources for Borrowers

Numerous resources are available to help borrowers cope with the psychological and financial challenges associated with student loan debt. Many universities and colleges offer counseling services that provide support and guidance for students and alumni struggling with financial stress. Non-profit organizations, such as the National Alliance on Mental Illness (NAMI) and the Jed Foundation, offer mental health resources and support groups specifically designed to address the mental health needs of individuals facing financial difficulties. Additionally, government agencies and private lenders often provide financial aid and loan repayment assistance programs to borrowers facing hardship. These programs may include income-driven repayment plans, deferments, and forbearances, which can provide temporary relief from loan payments. Furthermore, online resources and hotlines offer immediate support and guidance for individuals struggling with financial and mental health challenges. These resources can provide vital assistance in navigating the complexities of student loan debt and managing its psychological impact.

Coping Mechanisms for Managing Stress Related to Student Loan Debt

Understanding effective coping mechanisms is crucial for managing the stress associated with student loan debt. It’s important to remember that seeking help is a sign of strength, not weakness.

- Create a Realistic Budget: Developing a detailed budget that Artikels income and expenses can help you track your finances and identify areas where you can cut back. This can provide a sense of control and reduce anxiety about your financial situation.

- Seek Professional Financial Advice: A financial advisor can help you create a personalized repayment plan and explore options for debt consolidation or refinancing. This can provide peace of mind and a clear path forward.

- Prioritize Self-Care: Engage in activities that promote relaxation and well-being, such as exercise, meditation, or spending time in nature. These activities can help reduce stress and improve overall mental health.

- Connect with Support Systems: Talking to friends, family, or a therapist about your financial struggles can provide emotional support and reduce feelings of isolation.

- Practice Mindfulness and Stress Reduction Techniques: Techniques like deep breathing exercises, progressive muscle relaxation, and mindfulness meditation can help manage anxiety and improve overall well-being. These are readily available through online resources and apps.

- Explore Debt Management Programs: Consider enrolling in a debt management program offered by a credit counseling agency. These programs can help you create a manageable repayment plan and negotiate with your creditors.

Impact on Higher Education and Future Students

The recent increase in student loan interest rates presents a significant challenge to the future of higher education and the students who aspire to pursue it. This rise in borrowing costs will likely influence a range of decisions, from enrollment choices to career paths, with cascading effects on the economy and the nation’s workforce.

The increased cost of borrowing could deter prospective students from pursuing higher education altogether. The higher monthly payments associated with larger loan balances due to increased interest rates represent a substantial financial burden, particularly for students from low- and middle-income families who may already be facing financial constraints. This could lead to a decrease in college enrollment, potentially impacting the diversity of the student body and the overall quality of higher education institutions.

College Enrollment Rates and Economic Impacts

A decline in college enrollment due to higher interest rates would have significant economic consequences. Reduced enrollment translates to less revenue for colleges and universities, potentially leading to budget cuts, program reductions, and even closures in some cases. Furthermore, a less-educated workforce could hinder economic growth, as a skilled and educated workforce is a cornerstone of a thriving economy. For example, a study by the Georgetown University Center on Education and the Workforce projected that the economic return on investment for a college degree would be significantly lower for students burdened by higher interest rates, further dampening the incentive to pursue higher education. This reduced investment in human capital could have a long-term negative impact on productivity and innovation.

Changes in Borrowing Behaviors

Prospective students are likely to adjust their borrowing behaviors in response to higher interest rates. Some might opt for shorter, more intensive degree programs to minimize the total amount borrowed. Others might explore alternative financing options, such as scholarships, grants, and part-time employment, to reduce their reliance on loans. Some students might even delay their enrollment, opting to work and save money before starting their college education, potentially delaying their entry into the workforce. This shift in borrowing behavior could also lead to an increase in the demand for alternative financing options and a greater reliance on private loans, which often come with higher interest rates and less favorable terms than federal loans.

Long-Term Implications for the Future Workforce

The long-term impact on the future workforce is multifaceted. A decrease in college enrollment could lead to a shortage of skilled workers in various sectors, potentially hindering economic growth and technological advancement. Moreover, the increased debt burden on graduates could affect their career choices, with some potentially opting for lower-paying jobs with better job security to manage their debt more effectively. This could lead to a less mobile and less adaptable workforce, hindering innovation and economic dynamism. The increased debt could also delay major life decisions, such as homeownership and starting a family, further impacting economic activity and societal well-being. The long-term consequences of these shifts could be far-reaching and require careful consideration by policymakers and educational institutions alike.

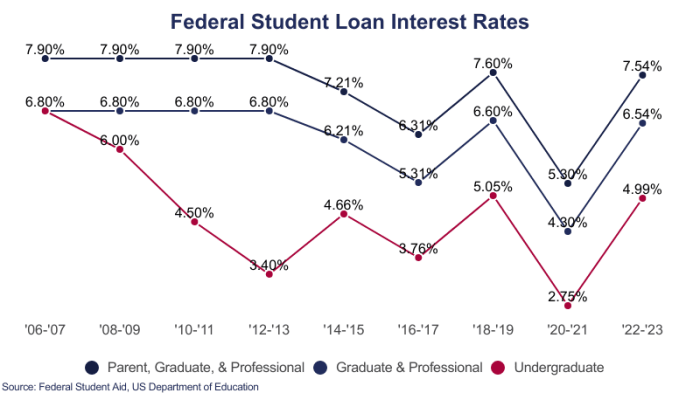

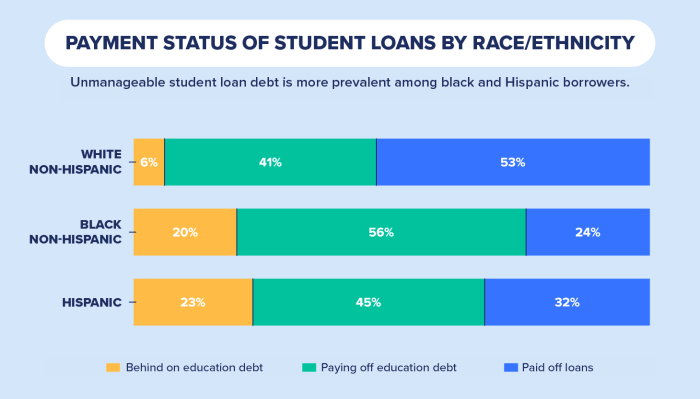

Visual Representation of Interest Rate Impact

Understanding the impact of student loan interest rate increases requires visualizing the data. Graphs and infographics can effectively communicate the complex relationship between interest rates, loan amounts, and repayment costs. This section details two visual representations that illustrate this impact.

A graph illustrating the relationship between interest rate increases and total loan repayment costs would typically show interest rate percentage on the x-axis and total repayment cost on the y-axis. For example, consider a $50,000 loan with a 10-year repayment plan. If the interest rate is 5%, the total repayment cost might be approximately $61,000. Increasing the interest rate to 7% could increase the total repayment cost to roughly $67,000, while a 9% interest rate might result in a total repayment cost nearing $73,000. The graph would visually demonstrate this exponential increase in total cost as the interest rate rises. Each data point would represent a specific interest rate and its corresponding total repayment cost, clearly showing the significant financial burden imposed by even small interest rate hikes. The graph could also include separate lines for different loan amounts to highlight the effect of loan size on the overall impact.

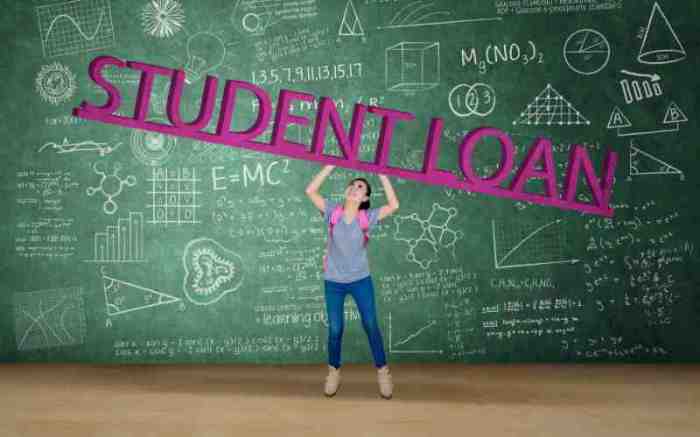

Student Loan Debt Breakdown by Demographics

An infographic illustrating the breakdown of student loan debt across different demographics would be highly effective in showcasing the disproportionate impact of interest rate increases. The infographic could use a segmented bar chart or a pie chart to visually represent the percentage of total student loan debt held by various demographic groups, such as age, race, gender, and level of education attained. For example, it might show that borrowers aged 25-34 hold a larger percentage of the total debt than any other age group. Similarly, it could highlight potential disparities in debt levels between different racial or ethnic groups, reflecting existing socioeconomic inequalities. Accompanying text would provide specific percentages and context for each segment, explaining the significance of the data and its implications for policy and support strategies. For instance, if the infographic shows a higher percentage of debt held by minority groups, the accompanying text might discuss the need for targeted financial aid programs to address these disparities. The infographic could also include a map visualizing debt distribution across different states or regions to provide a more comprehensive overview.

Ultimate Conclusion

In conclusion, the student loan interest rate increase presents a significant challenge for borrowers, demanding proactive financial management and careful consideration of available resources. While the government’s rationale for the increase is understandable within the context of [insert relevant economic factors], the impact on individual borrowers cannot be ignored. Understanding the available repayment options, budgeting strategies, and mental health resources is crucial for mitigating the negative consequences. The long-term effects on higher education accessibility and the economy remain to be seen, highlighting the need for ongoing dialogue and potential policy adjustments to ensure equitable access to higher education and responsible debt management.

Frequently Asked Questions

What happens if I can’t afford my increased student loan payments?

Contact your loan servicer immediately. They can explain options like income-driven repayment plans, deferment, or forbearance, which may temporarily reduce or suspend your payments.

Will my credit score be affected by a student loan interest rate increase?

Not directly. However, consistently late or missed payments due to the increase *will* negatively impact your credit score. Maintaining timely payments, even if smaller, is crucial.

Are there any government programs to help with increased student loan payments?

Several programs exist, including income-driven repayment plans and potential loan forgiveness programs depending on your occupation and loan type. Check the Federal Student Aid website for details.

How can I refinance my student loans to get a lower interest rate?

Refinancing options exist through private lenders, but carefully compare rates and terms. Note that refinancing federal loans into private loans may mean losing federal protections.