Navigating the complex world of student loans requires a firm understanding of interest rates. These rates significantly impact the total cost of your education and your long-term financial well-being. This guide delves into the intricacies of average student loan interest rates, exploring various loan types, repayment strategies, and the factors influencing these crucial numbers. We’ll break down the calculations, compare federal and private loans, and equip you with the knowledge to make informed decisions about your financial future.

Understanding how interest rates affect your repayment plan is paramount. Whether you’re choosing between fixed or variable rates, or grappling with the implications of compounding interest, this guide offers clarity and actionable insights. By exploring real-world scenarios and providing practical tips, we aim to empower you to manage your student loan debt effectively.

Current Average Student Loan Interest Rates

Understanding current average student loan interest rates is crucial for prospective and current borrowers. These rates significantly impact the overall cost of a college education and the repayment burden faced by graduates. Fluctuations in these rates are influenced by various economic factors, making it essential to stay informed.

The following table presents average interest rates for federal and private student loans over the past five years. It’s important to note that these are averages and individual rates can vary based on creditworthiness, loan type, and the lender’s policies. Precise figures are subject to change, and it’s recommended to consult official sources for the most up-to-date information.

Average Student Loan Interest Rates (2019-2023)

| Loan Type | Year | Average Interest Rate (%) | Notes |

|---|---|---|---|

| Federal Undergraduate | 2019 | 4.53 | Data from the National Center for Education Statistics (NCES) |

| Federal Undergraduate | 2020 | 4.25 | Data from the NCES |

| Federal Undergraduate | 2021 | 3.73 | Data from the NCES |

| Federal Undergraduate | 2022 | 4.99 | Data from the NCES |

| Federal Undergraduate | 2023 | 5.25 | Estimate based on current trends; subject to change. |

| Federal Graduate | 2019 | 6.08 | Data from the NCES |

| Federal Graduate | 2020 | 5.81 | Data from the NCES |

| Federal Graduate | 2021 | 5.31 | Data from the NCES |

| Federal Graduate | 2022 | 6.54 | Data from the NCES |

| Federal Graduate | 2023 | 6.78 | Estimate based on current trends; subject to change. |

| Federal PLUS | 2019 | 7.60 | Data from the NCES |

| Federal PLUS | 2020 | 7.08 | Data from the NCES |

| Federal PLUS | 2021 | 6.59 | Data from the NCES |

| Federal PLUS | 2022 | 8.01 | Data from the NCES |

| Federal PLUS | 2023 | 8.29 | Estimate based on current trends; subject to change. |

| Private | 2019 | 8.00 – 14.00 | Wide range reflects varying creditworthiness and lender policies. |

| Private | 2020 | 7.50 – 13.00 | Wide range reflects varying creditworthiness and lender policies. |

| Private | 2021 | 7.00 – 12.00 | Wide range reflects varying creditworthiness and lender policies. |

| Private | 2022 | 8.50 – 14.50 | Wide range reflects varying creditworthiness and lender policies. |

| Private | 2023 | 9.00 – 15.00 | Estimate based on current trends; wide range reflects varying creditworthiness and lender policies. |

Factors Influencing Interest Rate Fluctuation

Several key factors contribute to the fluctuations observed in average student loan interest rates over the past five years. These include changes in the overall economic climate, such as inflation and Federal Reserve interest rate adjustments. Government policies, including changes to federal student loan programs and subsidies, also play a significant role. Finally, the performance of the overall financial market and credit conditions influence the pricing strategies of private lenders. For example, the COVID-19 pandemic significantly impacted the market, leading to temporary rate reductions in some sectors followed by subsequent increases.

Fixed Versus Variable Interest Rates

Student loans are typically offered with either fixed or variable interest rates. A fixed interest rate remains constant throughout the loan’s repayment period, providing predictable monthly payments. A variable interest rate, however, fluctuates based on a benchmark index, such as the prime rate or LIBOR. This means monthly payments could increase or decrease over time, depending on market conditions. While variable rates may start lower, the potential for increased payments makes fixed rates a more predictable and potentially less risky option for many borrowers. The choice between fixed and variable rates involves a trade-off between potential savings and the stability of predictable monthly payments. Borrowers should carefully consider their individual financial circumstances and risk tolerance when making this decision.

Impact of Interest Rates on Repayment

Student loan interest rates significantly influence the total cost of repayment. Even seemingly small differences in interest rates can lead to substantial variations in the amount borrowers ultimately pay back. Understanding this impact is crucial for effective financial planning and minimizing long-term debt.

Loan Repayment Scenarios: 5% vs. 7% Interest

The following table illustrates the difference in total repayment costs for a $50,000 loan with a 5% interest rate compared to a 7% interest rate, over both 10-year and 20-year repayment plans. These calculations assume a simple, fixed-rate loan with consistent monthly payments. Actual repayment amounts may vary slightly based on the specific loan terms and calculation methods used by lenders.

| Interest Rate | Repayment Term (Years) | Approximate Monthly Payment | Total Repayment Cost |

|---|---|---|---|

| 5% | 10 | $536.82 | $64,418.40 |

| 7% | 10 | $570.26 | $68,431.20 |

| 5% | 20 | $360.28 | $86,467.20 |

| 7% | 20 | $408.14 | $97,953.60 |

Repayment Strategies to Minimize Interest Impact

Several strategies can help borrowers mitigate the effects of high interest rates. Making extra payments, even small ones, significantly reduces the principal balance faster, leading to lower overall interest charges. Refinancing to a lower interest rate loan, when possible, is another effective approach. Exploring income-driven repayment plans, which adjust monthly payments based on income, can provide short-term relief, though it often extends the repayment period and increases total interest paid. Consolidation loans can simplify repayment by combining multiple loans, potentially leading to a lower interest rate if a better rate is secured.

Interest Capitalization: Implications for Loan Costs

Interest capitalization occurs when accrued interest is added to the principal loan balance. This increases the total amount owed, leading to higher interest payments over the life of the loan. For example, if interest is capitalized annually on a loan, the interest accumulated during the year becomes part of the principal balance in the next year, and subsequently earns interest itself. This compounding effect can substantially inflate the final cost of the loan. Understanding capitalization schedules and making proactive repayment efforts to avoid or minimize it is crucial for efficient debt management.

Federal vs. Private Student Loan Interest Rates

Choosing between federal and private student loans is a crucial decision impacting your long-term financial health. Understanding the differences in interest rates, repayment terms, and eligibility requirements is vital for making an informed choice. This section will compare and contrast these two loan types to help you navigate this important process.

Federal and private student loans differ significantly in several key aspects. These differences can have a substantial impact on the overall cost of your education and your ability to manage repayment.

Interest Rate Comparison

Interest rates on federal and private student loans vary considerably. Federal student loan interest rates are generally lower than those for private loans. The rates for federal loans are set by the government and are often subsidized, meaning the government pays the interest while you’re in school (under certain circumstances). Private loan interest rates, however, are determined by the lender and are based on your creditworthiness, income, and other factors. This means that borrowers with poor credit histories or low incomes will face significantly higher interest rates on private loans.

- Federal Loans: Typically offer lower, fixed interest rates, and are often subsidized.

- Private Loans: Interest rates are variable or fixed, and generally higher than federal loan rates. Rates are influenced by credit score and income.

Repayment Terms and Eligibility

Repayment terms and eligibility criteria also differ substantially between federal and private student loans. Federal loans usually provide various repayment plans to suit different financial situations, including income-driven repayment options. Private loan repayment terms are typically less flexible, often with shorter repayment periods and fewer options for modification. Eligibility for federal loans is generally based on enrollment status and financial need, while private loan eligibility hinges primarily on credit history, income, and the presence of a co-signer.

- Federal Loans: Offer various repayment plans, including income-driven repayment options; eligibility based on enrollment and financial need.

- Private Loans: Repayment terms are generally less flexible; eligibility primarily based on credit history, income, and potentially a co-signer.

Advantages and Disadvantages of Each Loan Type

Weighing the advantages and disadvantages of each loan type is crucial for making an informed decision. While federal loans offer lower interest rates and more flexible repayment options, private loans may be necessary to cover funding gaps not met by federal aid.

- Federal Loan Advantages: Lower interest rates, flexible repayment options, government protections (like deferment and forbearance).

- Federal Loan Disadvantages: May not cover the full cost of education; eligibility requirements.

- Private Loan Advantages: Can fill funding gaps not covered by federal loans; potentially higher loan amounts.

- Private Loan Disadvantages: Higher interest rates, less flexible repayment options, reliance on creditworthiness.

Impact of Credit Scores and Income on Private Student Loan Interest Rates

Credit scores and income significantly influence the interest rates offered on private student loans. Lenders use these factors to assess your creditworthiness and risk. A higher credit score typically translates to a lower interest rate, reflecting a lower perceived risk to the lender. Similarly, a higher income often indicates a greater capacity to repay the loan, leading to a potentially more favorable interest rate. Borrowers with limited or no credit history or low incomes may face significantly higher interest rates or may need a co-signer to secure a loan.

For example, a borrower with an excellent credit score (750 or above) might qualify for a private student loan with an interest rate of 6%, while a borrower with a poor credit score (below 600) might face an interest rate of 12% or higher. This substantial difference highlights the importance of maintaining good credit and securing a stable income before applying for private student loans.

Understanding Interest Rate Calculations

Understanding how student loan interest is calculated is crucial for effective financial planning. This section will break down the process, explaining both simple and compound interest and demonstrating how to calculate your monthly payment.

Student loan interest accrues over time, increasing the total amount you owe. The calculation method depends on whether your loan uses simple or compound interest. Simple interest is calculated only on the principal loan amount, while compound interest is calculated on the principal plus any accumulated interest. Most student loans use compound interest, meaning your interest grows exponentially over time.

Simple Interest Calculation

Simple interest is calculated using a straightforward formula: Interest = Principal x Rate x Time. The principal is the original loan amount, the rate is the annual interest rate (expressed as a decimal), and the time is the loan term in years. For example, a $10,000 loan with a 5% annual interest rate over 10 years would accrue $5,000 in simple interest ($10,000 x 0.05 x 10 = $5,000). The total amount owed after 10 years would be $15,000. This method is rarely used for student loans.

Compound Interest Calculation

Compound interest is more complex. Interest is calculated not only on the principal but also on the accumulated interest from previous periods. The formula is more intricate and often requires iterative calculations or specialized financial calculators/software. A common approach involves calculating the interest accrued each period (e.g., monthly) and adding it to the principal before calculating the interest for the next period. The more frequent the compounding (daily, monthly, quarterly), the faster the loan balance grows.

Monthly Payment Calculation

Calculating the monthly payment on a student loan involves using the following formula, which incorporates the loan amount (P), the monthly interest rate (r), and the loan term in months (n):

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

* M = Monthly Payment

* P = Principal Loan Amount

* i = Monthly Interest Rate (Annual Interest Rate / 12)

* n = Number of Months (Loan Term in Years * 12)

Let’s illustrate with an example: A $20,000 loan with a 7% annual interest rate over 10 years (120 months).

1. Calculate the monthly interest rate: 7% / 12 = 0.005833

2. Calculate the number of months: 10 years * 12 months/year = 120 months

3. Apply the formula: M = 20000 [ 0.005833(1 + 0.005833)^120 ] / [ (1 + 0.005833)^120 – 1]

4. Solve: The monthly payment would be approximately $232. Note: This calculation is simplified and does not include any fees. Actual calculations might vary slightly depending on the lender’s methods.

Simple vs. Compound Interest Example

Consider a $10,000 student loan with a 6% annual interest rate over 5 years.

* Simple Interest: Total interest after 5 years would be $3,000 ($10,000 x 0.06 x 5). The total amount owed would be $13,000.

* Compound Interest (assuming annual compounding): The calculation is more complex. After year 1, the interest is $600 ($10,000 x 0.06). The balance becomes $10,600. In year 2, the interest is calculated on $10,600, and so on. The total interest accumulated after 5 years using compound interest would be significantly higher than $3,000, resulting in a larger total amount owed. The exact amount would need to be calculated using the compound interest formula or a financial calculator. This difference highlights the significant impact of compound interest on the total cost of a student loan.

Resources for Finding Current Interest Rate Information

Securing the best possible interest rate on your student loans is crucial for minimizing your overall repayment burden. Understanding where to find reliable and up-to-date information is the first step in this process. This section Artikels key resources and strategies for researching student loan interest rates effectively.

Finding accurate and current information on student loan interest rates requires diligence. Several reputable sources offer this data, but it’s important to understand what information to look for and how to compare rates effectively to make informed decisions.

Reliable Sources for Student Loan Interest Rate Information

Several government agencies and reputable financial websites provide current information on student loan interest rates. Accessing this information empowers you to compare rates and make informed borrowing choices.

- Federal Student Aid (FSA): The official U.S. Department of Education website provides comprehensive details on federal student loan interest rates. This is a primary source for understanding rates for federal loans, including subsidized and unsubsidized loans. You’ll find information on fixed versus variable rates, and how rates are determined each year.

- National Education Association (NEA): While not solely focused on interest rates, the NEA often publishes articles and resources related to student loan debt and financing, including information on current rates and trends.

- Consumer Financial Protection Bureau (CFPB): The CFPB provides resources to help consumers understand financial products and services, including student loans. Their website offers information on interest rates and other aspects of student loan borrowing.

- Major Financial Websites: Reputable financial websites, such as Bankrate, NerdWallet, and others, frequently publish articles and comparisons of student loan interest rates from various lenders. However, always verify the information with the lender’s official website.

Key Information to Seek When Researching Student Loan Interest Rates

When comparing student loan interest rates, several key pieces of information are crucial for a thorough analysis. Failing to consider these factors could lead to an unfavorable loan choice.

- Interest Rate Type (Fixed vs. Variable): Fixed interest rates remain constant throughout the loan’s term, while variable rates fluctuate based on market conditions. Understanding the implications of each type is vital for long-term financial planning.

- Annual Percentage Rate (APR): The APR represents the total cost of borrowing, including interest and fees. It provides a more complete picture than the interest rate alone.

- Fees: Origination fees, late payment fees, and other charges can significantly impact the overall cost of the loan. Compare the total cost, not just the interest rate.

- Repayment Terms: Longer repayment terms generally result in lower monthly payments but higher total interest paid. Shorter terms lead to higher monthly payments but less total interest.

- Loan Deferment and Forbearance Options: Understanding the terms and conditions for pausing or reducing payments during financial hardship is important.

The Importance of Comparing Interest Rates from Multiple Lenders

Comparing interest rates from multiple lenders before selecting a student loan is paramount to securing the most favorable terms. This practice ensures you’re not overpaying on interest and helps you choose a loan that aligns with your financial goals.

Choosing a student loan based solely on the first offer received can be a costly mistake. Thorough comparison shopping can save you thousands of dollars in interest payments over the life of the loan.

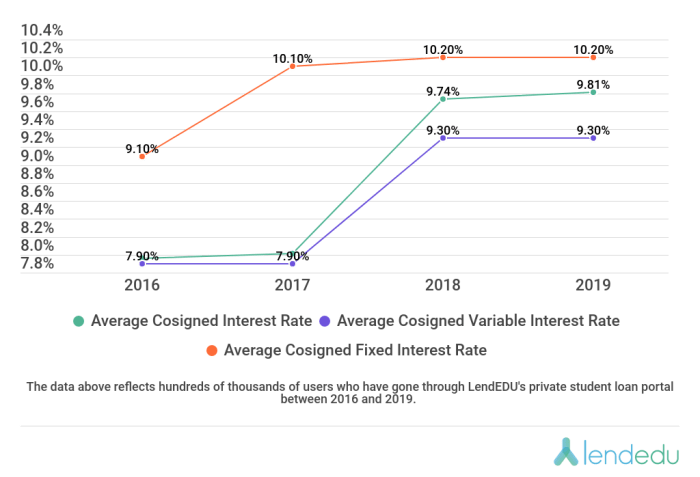

Visual Representation of Interest Rate Trends

Understanding the historical trends of student loan interest rates provides valuable context for current rates and helps borrowers anticipate future changes. Visual representations, such as graphs and charts, are effective tools for interpreting this complex data.

A line graph depicting average student loan interest rates over the past two decades would reveal a fluctuating pattern. The graph’s y-axis would represent the interest rate percentage, and the x-axis would represent the years, from, for example, 2004 to 2024. The line itself would illustrate the highs and lows, showing periods of relatively high rates, potentially peaking around certain economic events like the 2008 financial crisis, followed by periods of lower rates, possibly influenced by government intervention or shifts in monetary policy. Significant dips might be observed during periods of economic recession when the Federal Reserve lowered interest rates broadly, indirectly impacting student loan rates. Conversely, periods of economic expansion could be reflected in a gradual upward trend of the line. Specific data points could be highlighted to illustrate notable changes, for example, marking the years when specific legislative changes were enacted that impacted rates.

Average Interest Rates for Various Student Loan Types

A bar chart offers a clear comparison of average interest rates across different student loan types in a given year. Each bar would represent a specific loan type (e.g., subsidized federal loans, unsubsidized federal loans, private loans from various lenders). The height of each bar would correspond to the average interest rate for that loan type. The chart would visually highlight the differences in interest rates between federal and private loans, demonstrating that private loans typically carry higher interest rates than federal loans. This difference is often attributed to the lower risk associated with federally backed loans. The chart could also show variations in interest rates within the same loan type depending on the borrower’s creditworthiness or other factors. For example, a borrower with excellent credit might secure a lower interest rate on a private loan compared to a borrower with a lower credit score. The visual contrast in bar heights would effectively communicate the range of interest rates available to students and the importance of comparing options before borrowing.

Epilogue

Successfully managing student loan debt hinges on a thorough understanding of interest rates. This guide has provided a comprehensive overview of average student loan interest rates, encompassing the various factors that influence them, the differences between loan types, and effective repayment strategies. Armed with this knowledge, you can navigate the complexities of student loan repayment and make informed decisions to minimize your long-term financial burden. Remember to always compare rates from multiple lenders and utilize available resources to stay informed about current market trends.

FAQ Resource

What is the difference between a fixed and variable interest rate?

A fixed interest rate remains constant throughout the loan term, while a variable rate fluctuates based on market conditions. Fixed rates offer predictability, while variable rates might initially be lower but carry the risk of increasing.

How often is interest calculated on student loans?

Interest on federal student loans is typically calculated daily and capitalized (added to the principal) periodically, often annually. Private loan interest calculation methods may vary; check your loan agreement.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing may lower your interest rate, but it often involves switching to a private lender. Carefully weigh the pros and cons before refinancing, as it might affect your eligibility for federal repayment programs.

What happens if I don’t make my student loan payments?

Failure to make payments can lead to delinquency, negatively impacting your credit score and potentially resulting in wage garnishment or tax refund offset. Contact your lender immediately if you anticipate difficulties making payments.