Navigating the complexities of higher education often involves the significant financial commitment of student loans. Understanding the historical trajectory of student loan interest rates is crucial for both current and prospective borrowers. This exploration delves into the evolution of these rates, examining key periods of fluctuation and the economic factors that have shaped them. We’ll uncover how these shifts have impacted borrowers and explore potential future trends.

From the initial establishment of federal student loan programs to the present day, interest rates have experienced periods of both stability and dramatic change. These fluctuations are intricately linked to broader economic conditions, government policies, and the overall health of the financial markets. This analysis aims to provide a comprehensive overview, equipping readers with the knowledge to better understand and navigate the landscape of student loan financing.

Introduction to Student Loan Interest Rates

Student loan interest rates in the United States have fluctuated significantly over time, impacting millions of borrowers. Understanding these rates is crucial for prospective and current students to make informed decisions about financing their education. The history of these rates reveals a complex interplay of government policy, economic conditions, and market forces.

The cost of borrowing for education has not remained static. Early student loan programs often featured lower, fixed interest rates, reflecting a different economic climate and a less developed market for student lending. However, the increasing reliance on student loans to finance higher education, coupled with fluctuating market conditions, has led to greater variability in interest rates. This variability has, at times, created challenges for borrowers trying to manage their debt.

Federal Student Loan Types and Interest Rates

Federal student loans are offered through various programs, each with its own interest rate structure. These rates are typically set annually and can vary depending on the loan type, the borrower’s creditworthiness (though generally not directly for federal loans), and the loan disbursement date. The interest rate is a significant factor influencing the total cost of the loan over its repayment period. Understanding these differences is key to selecting the most appropriate loan option.

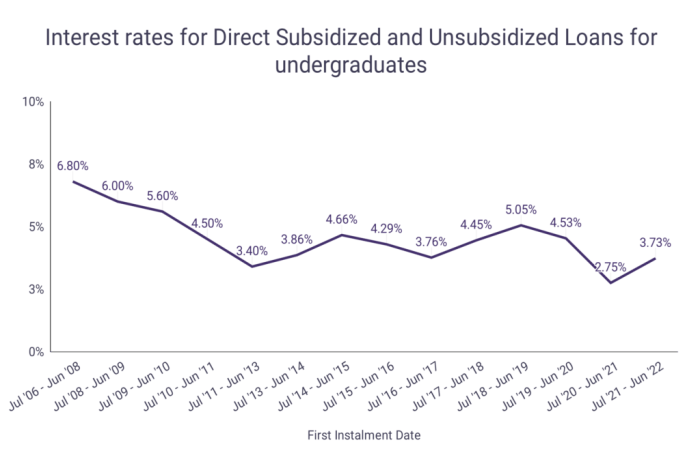

- Subsidized Federal Stafford Loans: These loans are awarded based on financial need and do not accrue interest while the student is enrolled at least half-time. Interest rates are set annually by Congress. For example, the rate for subsidized Stafford loans disbursed in the 2023-2024 academic year was 5.05% for undergraduates.

- Unsubsidized Federal Stafford Loans: These loans are available to undergraduate and graduate students regardless of financial need. Interest begins accruing immediately, even while the student is in school. The interest rate is set annually by Congress; for the same 2023-2024 period, the rate was 5.05% for undergraduates.

- Federal PLUS Loans: These loans are available to graduate students and parents of undergraduate students. Interest rates are typically higher than Stafford loans and accrue interest immediately. The interest rate is set annually by Congress. The rate for Grad PLUS loans in the 2023-2024 academic year was 7.54%.

Factors Influencing Student Loan Interest Rates

Several factors contribute to the determination of student loan interest rates. These factors influence both the initial interest rate offered and any subsequent changes to that rate. A clear understanding of these dynamics can help borrowers anticipate potential rate adjustments and plan their repayment strategies accordingly.

- Market Interest Rates: The overall state of the economy significantly influences interest rates. When interest rates are generally high, student loan rates tend to be higher as well, reflecting the increased cost of borrowing money for the government or lender. Conversely, during periods of low interest rates, student loan rates are typically lower.

- Government Policy: Congressional action directly sets the interest rates for federal student loans. Changes in government policy, budget considerations, and political priorities can significantly impact the rates borrowers face.

- Loan Type: As mentioned above, different types of federal student loans carry different interest rates. Subsidized loans often have lower rates than unsubsidized loans, reflecting the different risk profiles associated with each loan type. PLUS loans typically have higher rates, reflecting the higher risk associated with lending to graduate students or parents.

Historical Trends in Student Loan Interest Rates

Student loan interest rates have fluctuated significantly over the past half-century, impacting millions of borrowers. These fluctuations reflect broader economic conditions, government policies, and the evolving landscape of higher education financing. Understanding these historical trends is crucial for prospective and current borrowers to make informed decisions.

Analyzing historical interest rate data reveals distinct periods of increase and decrease, shaped by various economic and political factors. The following table provides a snapshot of major changes, highlighting key events influencing these shifts.

Timeline of Student Loan Interest Rate Changes

| Year | Loan Type | Interest Rate (Approximate) | Notable Events |

|---|---|---|---|

| 1970s | Various Federal Programs | Variable, generally low (e.g., 3-7%) | Limited federal student loan programs; rates generally reflected prevailing Treasury bond yields. |

| 1980s | Various Federal Programs | Variable, generally moderate (e.g., 7-12%) | Increased focus on federal student aid; rates influenced by rising inflation and interest rates. |

| 1990s | Stafford Loans (Subsidized and Unsubsidized) | Variable, generally moderate (e.g., 7-9%) | Introduction of the Stafford Loan program; rates still largely tied to Treasury bond yields. |

| 2000s | Stafford Loans (Subsidized and Unsubsidized) | Variable, generally moderate to high (e.g., 6-8% initially, rising to higher levels later) | Increased demand for higher education led to expansion of loan programs, with rates sometimes adjusted based on market conditions. |

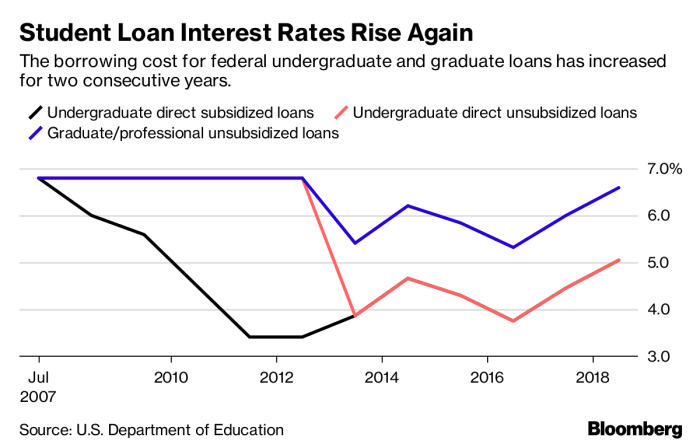

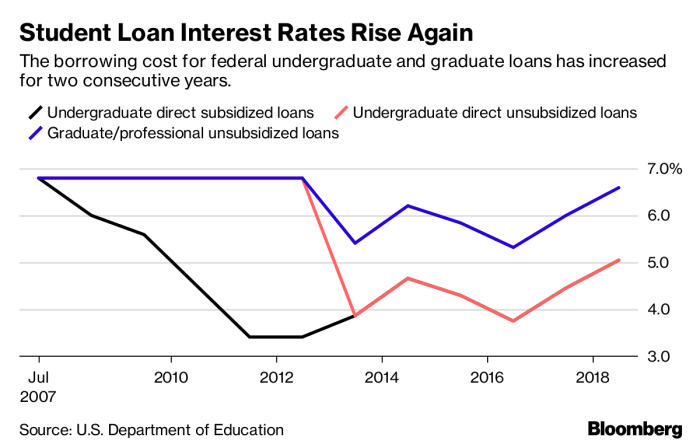

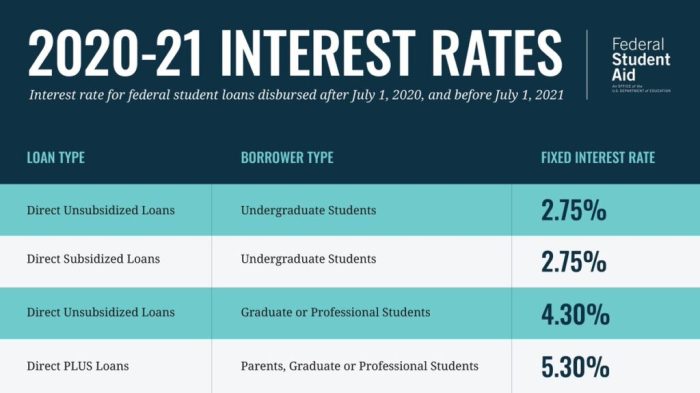

| 2010s | Stafford Loans (Subsidized and Unsubsidized), PLUS Loans | Variable, significant fluctuations (e.g., 3.4% to over 7% for subsidized loans; higher for unsubsidized and PLUS loans) | The 2008 financial crisis impacted rates; subsequent legislation introduced fixed rates for some loans, but rates continued to fluctuate based on government borrowing costs. |

| 2020s | Stafford Loans (Subsidized and Unsubsidized), PLUS Loans | Variable, but generally low in the early years, with potential future adjustments | COVID-19 pandemic led to temporary interest rate suspensions; subsequent years saw fluctuating rates reflecting broader economic conditions and government policy. |

Note: The interest rates provided are approximate averages and may not reflect the exact rate for every borrower. Actual rates varied depending on the specific loan program, creditworthiness, and other factors.

Periods of Significant Rate Changes and Their Causes

Periods of significant increases in student loan interest rates often coincided with periods of high inflation or increased government borrowing costs. For example, the rising rates of the late 1970s and early 1980s mirrored a broader period of high inflation across the US economy. Conversely, periods of lower rates, such as the early 2010s following the financial crisis, reflected low Treasury yields and government efforts to stimulate economic activity.

Comparison of Subsidized and Unsubsidized Loan Interest Rate Trends

Subsidized and unsubsidized loans have generally followed similar overall trends, but unsubsidized loans typically carried a slightly higher interest rate. This difference reflects the fact that the government pays the interest on subsidized loans while the borrower is in school (under certain conditions), reducing the overall cost of the loan. The absence of this government subsidy for unsubsidized loans translates to a higher interest rate to compensate for the added risk for lenders. This difference has remained relatively consistent over time, though the exact spread between subsidized and unsubsidized rates has fluctuated depending on prevailing economic conditions.

The Impact of Economic Factors on Interest Rates

Student loan interest rates, while seemingly independent, are intricately woven into the fabric of the broader economy. Several key economic factors exert significant influence, shaping the cost of borrowing for students and ultimately impacting their financial futures. Understanding these relationships is crucial for both borrowers and policymakers alike.

Inflation and the Federal Funds Rate are particularly impactful, along with government intervention through policy and legislation. These factors interact in complex ways, leading to fluctuations in student loan interest rates over time.

Inflation’s Influence on Student Loan Interest Rates

Inflation, the rate at which the general level of prices for goods and services is rising, and interest rates generally move in tandem. When inflation rises, lenders typically demand higher interest rates to compensate for the decreased purchasing power of future repayments. Conversely, periods of low inflation often correlate with lower interest rates. This is because lenders are less concerned about the erosion of the value of their money over time. For example, during periods of high inflation, such as the late 1970s and early 1980s in the United States, student loan interest rates were significantly higher than they were during periods of low inflation, like the early 2010s. The relationship isn’t always perfectly linear, however, as other economic factors can influence the final rate.

Federal Funds Rate’s Impact on Student Loan Interest Rates

The federal funds rate, the target rate set by the Federal Reserve (the central bank of the United States), serves as a benchmark for other interest rates in the economy. Changes to the federal funds rate ripple outwards, affecting various borrowing costs, including those for student loans. A decrease in the federal funds rate generally leads to lower interest rates across the board, including student loans, while an increase typically results in higher rates. This is because the federal funds rate influences the cost of borrowing for banks, which in turn impacts the rates they offer on loans, including student loans. For instance, the significant lowering of the federal funds rate in response to the 2008 financial crisis and the COVID-19 pandemic led to a temporary decrease in some student loan interest rates.

Government Policies and Legislation’s Role in Interest Rate Fluctuations

Government policies and legislation play a significant role in shaping student loan interest rates. The government can directly influence rates through subsidies, loan programs with fixed interest rates, or by setting caps on interest rates. Changes in these policies can lead to immediate and substantial shifts in the cost of borrowing for students. For example, the government’s decision to temporarily set student loan interest rates to 0% during the COVID-19 pandemic demonstrates the direct power of government intervention. Furthermore, legislative changes affecting the overall financial landscape, such as tax reforms or budget adjustments, can indirectly affect the availability of funds for student loan programs and subsequently influence interest rates. These government actions are often intended to either stimulate the economy or to address specific social or economic goals, impacting student loan rates as a consequence.

The Student Loan Interest Rate Calculation Process

Understanding how student loan interest is calculated is crucial for responsible financial planning. The process, while seemingly complex, is based on fundamental mathematical principles and depends heavily on the loan’s terms and the lender’s specific policies. This section details the methods employed, providing a clear picture of how interest accrues over the life of your loan.

Interest accrual on student loans typically follows a simple interest calculation, although the specifics can vary. The core principle involves applying a percentage (the interest rate) to the outstanding loan balance over a specific period. This accumulated interest is then added to the principal, creating a larger balance on which future interest is calculated – a process known as compounding.

Simple Interest Calculation

Simple interest is calculated using a straightforward formula: Interest = Principal x Rate x Time. The principal represents the initial loan amount, the rate is the annual interest rate (expressed as a decimal), and the time is the loan period in years. For example, a $10,000 loan with a 5% annual interest rate over one year would accrue $500 in interest ($10,000 x 0.05 x 1 = $500). However, this simple calculation rarely applies to student loans in practice, as most utilize compounding interest.

Compound Interest Calculation and Accrual

Most student loans use compound interest, meaning interest is calculated not only on the principal but also on the accumulated interest. This leads to exponential growth of the total debt over time. A step-by-step guide illustrates this:

- Determine the daily interest rate: The annual interest rate is divided by 365 (or 360, depending on the lender’s method) to find the daily rate. For example, a 6% annual rate becomes approximately 0.06/365 = 0.000164 daily rate.

- Calculate daily interest: The daily interest rate is multiplied by the outstanding loan balance. If the balance is $10,000, the daily interest is approximately $1.64 ($10,000 x 0.000164).

- Add daily interest to the principal: The daily interest is added to the principal balance. The new balance becomes $10,001.64.

- Repeat steps 2 and 3: This process repeats daily, with the interest calculated on the increasingly larger balance.

- Capitalization: At specific intervals (monthly, quarterly, or annually, depending on the loan terms), the accrued interest is added to the principal. This is called capitalization. The next interest calculation will then be based on this new, larger principal balance.

The longer the loan term, the more significant the impact of compounding. Over many years, the total interest paid can substantially exceed the initial loan amount.

Comparison of Interest Rate Calculation Methods

While most student loan lenders use compound interest, variations exist in the frequency of compounding (daily, monthly, etc.) and how capitalization is handled. Some lenders might offer different interest rate calculation methods for different loan types (e.g., subsidized vs. unsubsidized loans). A direct comparison requires examining individual loan agreements. For instance, a loan with daily compounding will accrue slightly more interest than one with monthly compounding over the same period, due to the more frequent addition of interest to the principal. It’s essential to carefully review the loan documents to understand the specific calculation method used by your lender.

Impact of Interest Rates on Student Borrowers

Student loan interest rates significantly influence the long-term financial health of borrowers. Understanding how these rates fluctuate and their impact on repayment is crucial for effective financial planning. Even seemingly small differences in interest rates can compound over the life of a loan, leading to substantial variations in the total amount repaid.

The total cost of a student loan is directly affected by the interest rate. Higher interest rates mean borrowers pay more in interest over the life of the loan, increasing the overall debt burden. Conversely, lower interest rates result in lower overall costs. This difference can amount to thousands of dollars, impacting a borrower’s ability to save for other financial goals like a down payment on a house or retirement. For example, a $50,000 loan at 5% interest will cost significantly less over the loan term than the same loan at 7% interest.

Repayment Plan Sensitivity to Interest Rate Changes

Different repayment plans react differently to interest rate changes. For instance, income-driven repayment (IDR) plans, which base monthly payments on income, will see fluctuations in the total amount repaid, but the monthly payment itself might be less impacted. Standard repayment plans, with fixed monthly payments, will maintain the same monthly payment amount, but the total amount paid in interest will increase with higher interest rates, extending the repayment period. This means borrowers on standard plans may pay significantly more in interest over the life of the loan compared to those on IDR plans if interest rates rise. A fixed-payment plan will result in a longer repayment period if interest rates increase, but a variable-payment plan will have more immediate impact to the monthly payment amount.

Strategies for Managing High Interest Rates

Understanding the impact of high interest rates is essential for effective management. Several strategies can help borrowers mitigate the financial burden.

The following strategies can help borrowers navigate high-interest rates:

- Refinance your loans: If interest rates fall, refinancing can lower your monthly payments and the total interest paid. This is particularly beneficial for borrowers with good credit scores.

- Make extra payments: Even small extra payments can significantly reduce the principal balance and the total interest paid over the life of the loan. This accelerates the repayment process and saves money in the long run. For example, paying an extra $100 per month on a $50,000 loan can significantly reduce the overall interest paid and shorten the repayment timeline.

- Explore income-driven repayment plans: IDR plans adjust monthly payments based on income, making them more manageable for borrowers facing financial hardship. While the total amount paid might be higher over the loan’s lifetime, the lower monthly payments can provide much-needed financial breathing room.

- Consolidate your loans: Consolidating multiple loans into a single loan can simplify repayment and potentially lower your interest rate, depending on the terms of the consolidation loan. However, it is crucial to carefully compare interest rates before consolidating.

Future Projections of Student Loan Interest Rates

Predicting future student loan interest rates requires considering a complex interplay of economic factors and government policies. While precise forecasting is impossible, analyzing current trends and potential scenarios allows for a reasoned assessment of likely future trajectories over the next decade. Several key factors will shape these rates, including inflation, economic growth, and the overall fiscal health of the nation.

Interest rates are fundamentally linked to inflation. High inflation generally leads to higher interest rates as lenders demand greater returns to compensate for the diminished purchasing power of their money. Conversely, low inflation or deflation may result in lower rates. Economic growth also plays a significant role. Strong economic growth often translates into higher interest rates due to increased demand for borrowing, while weak growth can suppress rates. Government policies, particularly those related to fiscal spending and monetary policy, exert considerable influence. For instance, increased government borrowing can drive up interest rates across the board, including those for student loans.

Scenarios Based on Economic Forecasts and Government Policies

Several plausible scenarios could unfold regarding student loan interest rates in the next decade. A positive scenario assumes sustained economic growth, controlled inflation, and responsible government fiscal management. Under this scenario, interest rates might remain relatively stable or even experience modest increases, potentially mirroring broader market trends. This would be similar to the period between 2010 and 2018 where rates saw gradual increases, largely reflecting broader economic improvements.

A more pessimistic scenario involves a period of prolonged economic stagnation or recession, coupled with high inflation. This could lead to significantly higher interest rates as lenders seek to protect against inflation and increased default risk. This situation might resemble the economic climate of the late 1970s and early 1980s, when high inflation and economic uncertainty led to dramatically increased borrowing costs. A third scenario, less likely but still possible, involves government intervention to artificially lower student loan interest rates, potentially through subsidies or direct rate setting. This might involve a policy shift to address the growing student loan debt crisis, similar to past government interventions in the mortgage market during the 2008 financial crisis.

Potential Impact of Future Interest Rate Changes on the Student Loan Debt Crisis

Changes in student loan interest rates will significantly impact the student loan debt crisis. Higher interest rates will exacerbate the problem by increasing the total amount borrowers owe, extending repayment periods, and potentially leading to higher default rates. This would put additional strain on borrowers’ finances and further burden the overall economy. Conversely, lower interest rates could offer some relief, making it easier for borrowers to manage their debt and potentially reducing the overall cost of higher education. The extent of the impact will depend on the magnitude and duration of the interest rate changes, as well as the effectiveness of government policies aimed at mitigating the crisis. For example, a sustained period of high interest rates could push millions of borrowers into long-term financial hardship, increasing the social and economic costs of the debt crisis. Conversely, a sustained period of low rates would help borrowers, though other factors affecting the debt crisis, like loan volume, would still require attention.

Visual Representation of Data

Data visualization is crucial for understanding the complex trends in student loan interest rates. Graphs provide a clear and concise way to interpret historical data and make comparisons across different loan types. Effective visualizations can highlight key patterns and inform decision-making for both borrowers and policymakers.

Line Graph of Historical Student Loan Interest Rates

A line graph effectively illustrates the historical trend of student loan interest rates. The horizontal (x) axis represents time, typically spanning several years or decades, with clearly marked intervals (e.g., yearly or quarterly). The vertical (y) axis represents the interest rate, expressed as a percentage, with a clearly defined scale. Each data point on the graph represents the average interest rate for a specific period. The line connecting these points visually demonstrates the fluctuation of interest rates over time, revealing periods of increase, decrease, and stability. For instance, a sharp upward trend might indicate a period of economic uncertainty or increased demand for loans, while a downward trend could reflect government intervention or a change in lending practices. Adding labels to significant economic events or policy changes can further enrich the graph’s power. A legend might clarify whether the data represents a specific type of loan (e.g., subsidized or unsubsidized federal loans) or an average across all loan types.

Bar Chart Comparing Average Interest Rates Across Loan Types

A bar chart is ideal for comparing average interest rates across different types of student loans over a specific time period (e.g., a single year or a five-year period). The horizontal (x) axis displays the different loan types (e.g., subsidized federal loans, unsubsidized federal loans, private loans). The vertical (y) axis represents the average interest rate for each loan type, again expressed as a percentage. Each bar represents a specific loan type, with its height corresponding to the average interest rate. Clear labels for each bar and the axes ensure easy interpretation. The chart could also include error bars to represent the variability in interest rates within each loan type. For example, a bar chart might show that private student loans consistently carry higher interest rates than federal subsidized loans, reflecting the higher risk associated with private lending. The use of different colors for each bar can improve visual clarity and make comparisons easier. A title clearly stating the time period covered by the data is crucial for proper context.

Summary

In conclusion, the history of student loan interest rates reveals a complex interplay of economic forces and government policy. Understanding this history is essential for making informed decisions about borrowing and repayment strategies. While predicting future trends remains challenging, by analyzing past patterns and current economic indicators, borrowers can better prepare for the financial realities of student loan debt. The ongoing debate surrounding student loan debt relief underscores the significant impact of these rates on individuals and the broader economy.

Question & Answer Hub

What is the difference between subsidized and unsubsidized loans?

Subsidized loans don’t accrue interest while the borrower is in school, during grace periods, or under certain deferment conditions. Unsubsidized loans accrue interest from the time the loan is disbursed.

How often do student loan interest rates change?

Federal student loan interest rates are typically set annually and can change each July 1st for new loans. Existing loans retain their original interest rate.

Can I refinance my student loans to get a lower interest rate?

Yes, refinancing may be an option, but it often involves private lenders and may have different terms and conditions. Carefully compare offers before refinancing.

What is the impact of inflation on student loan interest rates?

High inflation can lead to increased interest rates as lenders seek to protect their returns against the erosion of purchasing power.